Forum Replies Created

-

AuthorReplies

-

January 10, 2023 at 2:46 pm in reply to: What’s the breadth of “Breadth”? What’s the depth of “Depth”? #248836

In this particular instance, I think you’ve been a bit overzealous in your hall monitor role, but I am okay with that, if you don’t mind me being a little annoyed (which I am, but I will get over it).

Apologies for the annoyance, Scot.

January 10, 2023 at 12:44 pm in reply to: What’s the breadth of “Breadth”? What’s the depth of “Depth”? #248825If the goal is to search for analogs to CasP’s concepts of breadth and depth in other modes of power, insisting on using the precise metric with which CasP measures differential growth is unnecessarily limiting and, ultimately, misguided. You won’t be able to see anything because you’re wearing CasP blinders. We are searching for similarities and equivalencies, not identity, so it is better to abstract away some of the details to widen our field of view.

Who is this “we” in this search for similarities and equivalencies? There are unstated premises in this argument about method and the promises of historical research, so I am not clear about the things I am guilty of not doing well or at all.

Scot, I apologize if I came across as a hall monitor catching you breaking a school rule. I fully support any experimental modification to any method — I like to think that I have been able to make a few modifications myself — but the reference to a specific footnote about DA was a bit curious. If you think BN’s definition of differential growth is limiting, why must the abstraction come from a source that is constructed of variables you think are not helpful? Rather than interpret BN’s DA as really talking about differential growth in general, build a different pathway to your theory. To make BN’s version of DA function as a concept for all historical modes of power, you do have to empty it of all content. And then what is left? As you put it yourself, what in world would we be saying if we stated that a feudal lord or slave owner needed to differentially accumulate?

*** CasP analysis relies on macro level stock market and economic data that necessarily is incomplete: the data only reflect what is measured. So, the stock market measured the growth of retailers like Wal-Mart, Target, Borders Books, and Home Depot, but it did not measure the destruction of local retailers that fueled that growth. What is green-field to the stock market may be long-plowed, well-known ground to the market more broadly, just as North America was green-field to the Europeans but not to the indigenous peoples who had lived here for thousands of years.

I’m of the opinion that the incompleteness of differential measures of dominant capital makes it very easy for bad or lazy CasP research to be done. But that assumes the researcher is doing the bare minimum with a quantitative measure; and does the possibly for someone to do bad CasP research invalidate the method? I am not going to list all of the work I respect, but excellent CasP research knows that a measure of differential capitalization says, on its own, very little about how a firm or set of firms successfully differentially accumulated over a period of time. The harder job is to carefully demonstrate that relevant phenomena, including a qualitative history, corroborate a theory that financial measures are symbolic representations of power.

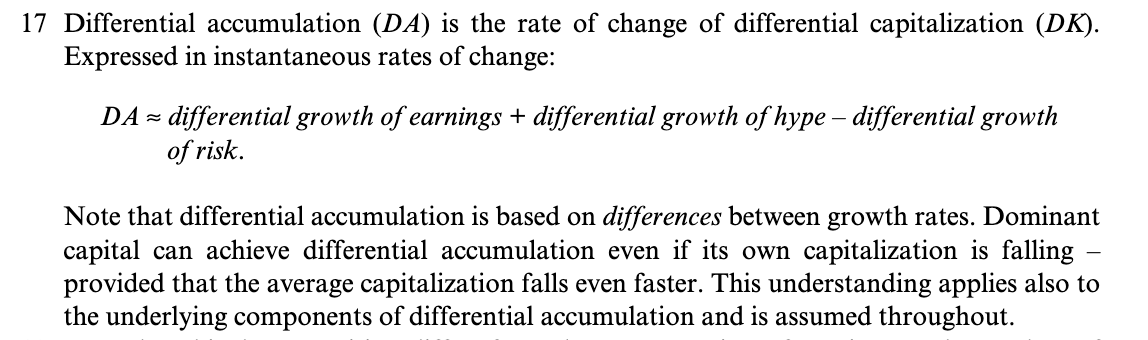

January 4, 2023 at 10:14 pm in reply to: What’s the breadth of “Breadth”? What’s the depth of “Depth”? #248815Remember that capitalism’s differential accumulation (DA) is determined by differential growth. See, Chapter 14, footnote 17 of Capital as Power (2009) at page 328.

Differential growth rates of earnings, hype and risk. These are not necessarily tied to growth of production, especially in terms of expanding with the building of new green-field technology.

S-curves and other business cycle theories tend to fall into a common problem: stagnation is the twilight of business enterprise, which makes the next wave of growth the logical transformation or rejuvenation of what stagnated. The breath and stagflation indices (see also the work of Joe Francis) do have periods and amplitudes, but these are observed empirically, rather than theorized as a mechanical motion of a capitalist engine. ***Edited add: (It’s easy for abstract theory to make a historical pattern or tendency seem overly structural. For a good example of someone trying to think of hype as a business cycle, but without going too far in terms of defining an inherent rule of capitalist development, see the creative work of Yuri Di Liberto).

January 1, 2023 at 10:32 am in reply to: CasP RG v. 1.00: Paul Feyerabend’s Against Method (Open Jan 01, 2023). #248793Discussion is open!

December 23, 2022 at 12:19 pm in reply to: Effective Discount Rate or the Reciprocal of the Trailing P/E #248783In any event, comparing price to EPS tells us nothing directly about discount rates or expected rates of return. Neither the Power Index nor the Systemic Fear Index tells us anything about discount rates or expected rates of return. I am happy that you found a way to talk about rates of return, but the discussion is a bit of a non sequitur (and it would have been a complete non-sequitur but for my inclusion of that one rhetorical question; you’re welcome).

What can you show us about rates of return? And if you lack the evidence, what do you need in order to show us? Aside from analytical proofs, which we are already debating in other threads, is there any empirical example that can help us the see problem that needs more investigation?

I’m starting to feel that you hope that CasP research gets redirected into what you call financial analysis, but the funny thing is, I don’t think anyone disagrees if the issue is that we, collectively, need to keep expanding CasP theory. Rather you (or someone) needs to give us an empirical example to collectively stew over.

PROFIT AND RATE OF RETURN

…

Not all discounting is capitalization, and I would argue that discounting within a single period, as I’ve done in my simplified model, is not capitalization, which requires discounting into perpetuity, not over a single period. Also, the capital outlays of a business are not the same as the capital outlays of shareholder in that business. The business and its shareholders are investing their capital in different things, at different times, in different markets, over different time periods, all interconnected by a chain of discounting operations assuming different rates of return.

Scot,

1. I have been trying to follow this discussion as closely as I can. I am a bit confused about how r functions in all of this argument. The general argument is that capitalists are discounting inputs with a future expectation of profit. But if different processes — which you say are not always capitalization, but discounting — how can they all use one value of r in the same point of time? If I’m following, the desire for a unified theory is also allowing for r to be anything, according to situation — the r in a forward-looking budget is not necessarily the r in capitalization. So why do they need to be both r?

2. Is there an issue of “revealed preferences” if wages are discounted future expectations? Unless we have independent confirmation of r before wages are paid, are we not left with wage cost + an implied discount, but which we don’t know?

- This reply was modified 2 years, 7 months ago by jmc.

Added two more:

R.M.N.; Cristian Mungiu; 2022; 125

This Is Not a Burial, It’s a Resurrection; Lemohang Jeremiah Mosese; 2019; 120And on the topic of films, Sight and Sound just released the 2022 version of its top 100 films of all time poll, which is only conducted every 10 years.

Lots of talk about Jeanne Dielman, 23, quai du Commerce, 1080 Bruxelles being voted #1.

- This reply was modified 2 years, 7 months ago by jmc.

November 18, 2022 at 5:57 pm in reply to: CasP Reading Group – Version 1 – Suggest Readings and Vote for ver. 1.00 #248603Hot dog, we have a wiener! The first CasP Reading Group reading will be …

… Against Method, Paul Feyerabend.

I’ll create and lock the thread for the discussion. Based on the pace of reading, let’s aim to have 100 pages read by January 1, 2023 — we may as well account for delays because of holidays and the end of the year. Don’t worry about posting ASAP, as the asynchronous format of this online discussion can handle staggered posting.

November 14, 2022 at 9:23 am in reply to: CasP Reading Group – Version 1 – Suggest Readings and Vote for ver. 1.00 #248595Added, and great to have you in the reading group, Tia.

Reminder that we have up to 5 votes. I was originally thinking of setting two readings, but the slow pace of the reading group gives us the flexibility to talk about the next reading in the new year. I don’t want people to feel that they cannot suggest readings for a long period of time, like 7 months.

Once we set the first reading, which is likely Against Method, currently a unanimous vote, I will strikethrough the readings that got no votes and create another sheet. Who knows, new suggestions might blossom from our discussion of Against Method.

November 11, 2022 at 9:49 am in reply to: CasP Reading Group – Version 1 – Suggest Readings and Vote for ver. 1.00 #248576One week left for adding reading suggestions and for voting! We have some great suggestions so far. As of today, here are the readings in the lead:

- Against Method, Paul Feyerabend, 2010, 4th Edition, Book, 287 p.

- Fascism and Big Business, Daniel Guerin, 1973, 2nd Edition, Book, 422 p.

- The Dawn of Everything, David Graeber and David Wengrow, 2021, Book, 704 p.

OK, we have something here! We have some advantages and disadvantages of working through a forum. Thank you for expressing interest and suggesting ways of operating. Here is my suggestion for version 1 of the reading group:

1. I create a post for reading group admin. The post can be to solicit readings and talk about difficulties of getting readings. I’ll create pinned posts in the community forum with information for all.

2. The upcoming reading group post will be made and have the first post explain tentative schedule, especially if a bigger reader needs to be paced. Our flexibility to read lots of pages will certainly vary. Let’s make it relatively easy going — something like 100 pages a month?*

3. The post will be locked for 1 month. The post will sit there to (a) give everyone time to get the reading and (b) remind everyone of an upcoming discussion. Once opened people can start posting, with the general assumption that people are following the suggested pace. Thus, if you finish a huge book in 1 month, still check the suggested reading schedule and focus your posts on the chapters or sections that would likely be covered by that point in time. Example: first 100 pages by month 1, first 150 pages by week 6, 200 pages by month 2, … If we read an article or chapter from an edited collection, we can just start posting with no restraint.

*The pace might seem slow to some, but posts on capitalaspower can be dense in a good way. We are not trying to finish these readings as fast as we can, so thoughtful reviewing is encouraged. CM’s recent post on the connections between Badiou and CasP is a great example of what we can do together.

4. Let’s get this going sooner than later. I know I’m creating a structure to the group on my own, but we can revisit the organization.

Great questions, Scot. I have thoughts on this and I hope others do as well.

A world without sabotage?

- This reply was modified 2 years, 8 months ago by jmc.

I read Villarreal’s critique of CasP as soon as I saw it. Before I raise issues with his model, I should say that I hope people use this forum for critiques of CasP. Certainly people can use their own blogs or Twitter feed, but the lack of critiques on this forum is not an editorial decision. We either get ignored or we hear that someone is trying to punch us from a distance. As long as one is not shitposting, sceptics of CasP are welcome here.

Villarreal presents his model to corroborate his critique of BN’s model of strategic sabotage:

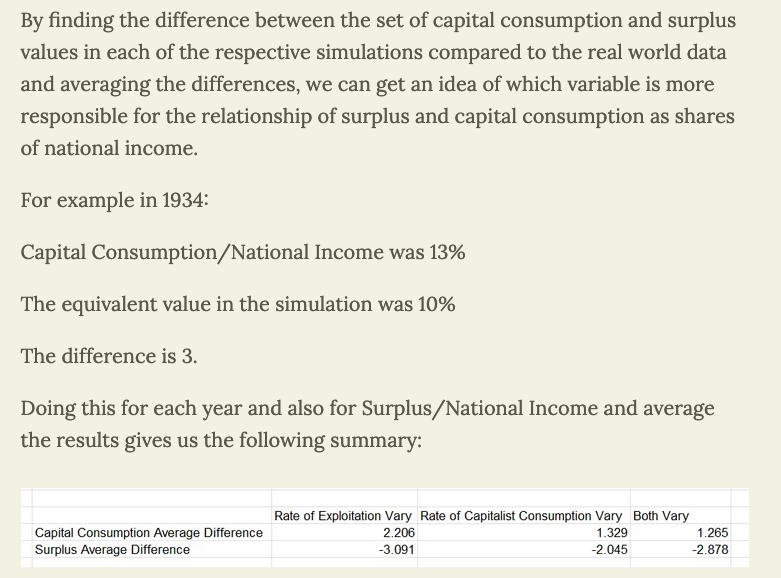

“As you can see, changes in the rate of capitalist consumption (or the rate of capitalist investment) produce outputs in the simulation 30-50% closer to reality than changes in the rate of exploitation. This indicates that capitalist consumption and investment is primarily responsible for driving the relationship between surplus and capital consumption (aka depreciation). It isn’t a pure struggle for power as financial accumulation which is determining profits, especially not through the labor market and strategic sabotage. Instead, it is the decisions regarding physical, real investment which determine profits, and it is this impact over the material world which actual class struggle is concerned with.”After downloading his model output and looking at his R code I want to raise three issues with Villarreal’s model of capital consumption and surplus.

1. I can’t understand how one uses model error, which he gets backwards, as it should be estimate minus actual, not the other way around, to establish the significance of a variable in producing an effect. Predictions are more accurate when error is low, but I am perplexed because you can have low model error on variables that are insignificant to an outcome. All it means is that your model correctly estimated the variable well — we still don’t know how important it is.

2. I looked at Villarreal’s comments on Twitter and he seems to have the drive to scrutinize CasP like a forensic accountant on payday. When he posts about his own model he is much more casual in the assessment of its results. Within the post that critiques CasP, his model will sometimes get an eyeball test. But there are curious qualities that one should put under the microscope.

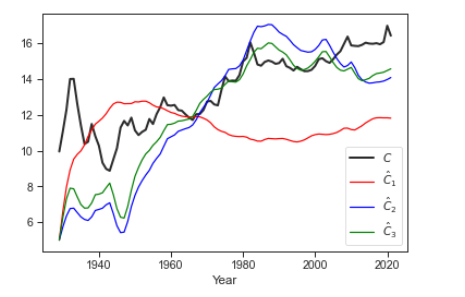

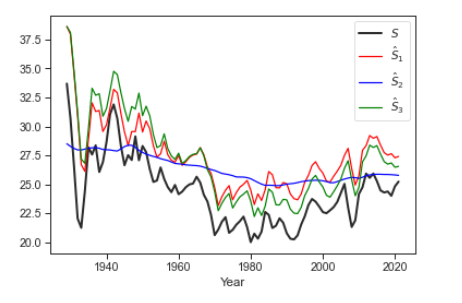

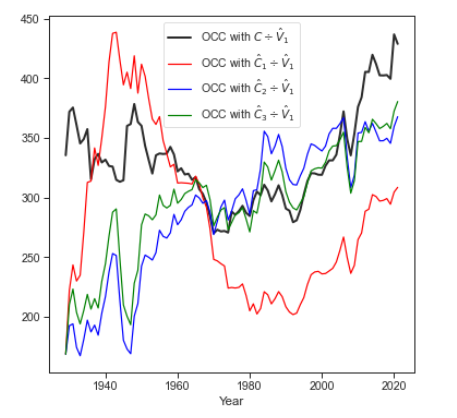

Here are two plots of the actual data from the national accounts and the three versions of his model (labelled 1,2,3 for convenience, but they are in the same order as his Excel sheet).

Notice that it is much wilder at modelling capital consumption than it is at modelling surplus. The two stronger models of capital consumption (2,3) fail around the inflection point of this figure, which he states are two regimes of accumulation. The model that gets post-1980s “right” gets everything else wrong.

What about the seemingly perfect correlations between some of the surplus models and the surplus data? Well …

3. Villarreal is not simply explaining the relationships between columns in national accounts; he is claiming that the various concepts of Marxist economics (organic composition of capital, rate of exploitation) are “behind” ratios and variables we can download on a site like FRED.

For the sake of argument, let’s assume the past and present magnitudes of productive value are measurable as socially necessary abstract labour time, just as long as you have a good method to “see” them (because national accounts are in nominal dollars and cents).

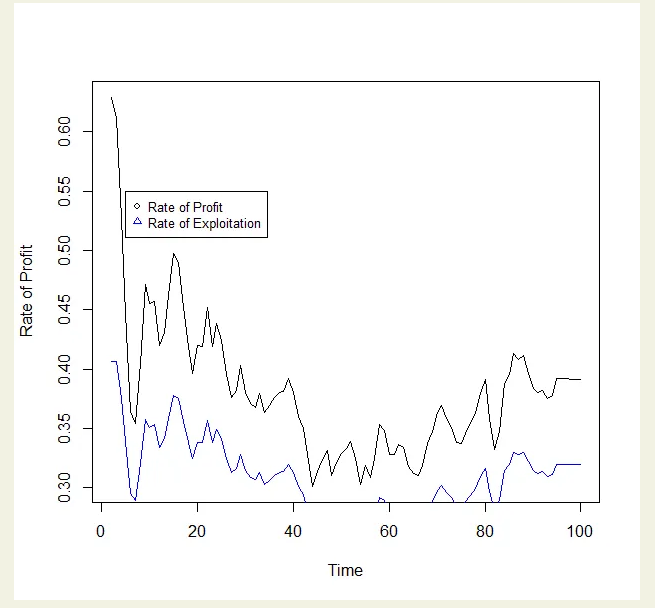

Villarreal’s model first looked odd to me when I saw a figure that he probably thinks is a good sign:

To me, this is an odd figure because, to the naked eye, it looks like an estimated rate of exploitation, which will not unite Marxists because many Marxists in fact have abandoned any hard quantitative version of the LToV, is simple to measure; it’s appearing to be just a constant share of the rate of profit, which we can calculate.

Villarreal will likely respond with a correction: he is deriving the rate of exploitation from the data on the rate of profit, not simply multiplying the latter by some constant (0.65, 1.1, etc.).

But when looking at his code, I am having a hard time untangling a puzzle: what is happening with all the V values? If you follow the R code, it appears that V is derived from external csv file that imports the rate of exploitation. There might be nothing inconsistent with the definitional relationships in Villarreal’s model, but we don’t get a picture of how the model predicts V, well or poorly.

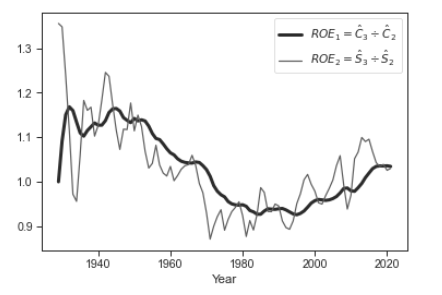

We can estimate the rate of exploitation with a ratio of two versions of the model: Model 3, where everything varies, and Model 2, where rate of exploitation is fixed.

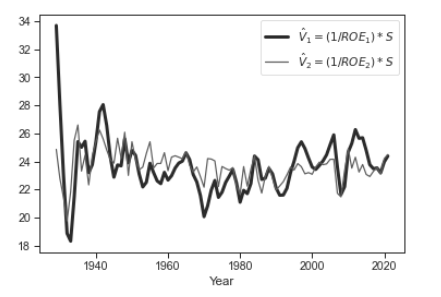

We can the derive an estimate of V with an inversion of the ROE multiplied by S, which would leave V.

I’m taking all these steps because it is not entirely clear what needs to be fixed or assumed to have the correlation between C and S have a clear Marxist explanation. Here for instance, are measures of the organic composition of capital, assuming the only issue is method (which is not the only issue). Just can Villarreal’s model has issues with predicting the bends and curves of C, the organic composition of capital (C/V) is just as wild.

Overall, I am having a hard time being convinced of the bigger claim, which is not simply that there is a relationship between C and S. For one, the C-S bend in the 1980s produces divisions in what model can explain what. Moreover, the same issues cascade with Marxist ratios like the organic composition of capital.

Coming from a Marxist political economy department, this exercise is reminding me of all the twists and turns that are necessary to show that Marx was right … all along. I have spent a few hours looking at Villarreal’s blog post and code, and my last recommendation is this: comment your code and help your readers see each step at each twist and each turn.

Here is the cleaned csv that I used. Villarreal’s excel sheet has different numbering formats per sheet (percentage / number), so I cleaned that and put it all on one.

- This reply was modified 2 years, 8 months ago by jmc.

- This reply was modified 2 years, 8 months ago by jmc.

Attachments:

You must be logged in to view attached files.Nice recommendations, Chris. I have a Pavlovian response to the cover for di Benedetto. Novels published by NYRB follow a style template, and I come across them all the time in used book stores like BMV in Toronto. As for Robinson, I have a long list of sci-fi to read, but adding one more won’t hurt.

The Leopard the film is so beautiful and it attempts capture the magnitudes of the noble lifestyles and the revolutionary change. In terms of being a history of Sicily at the time, I think the film is hard to follow. I’m discovering that this might reflect a theme in the book — the future will not include the Prince (played by Burt Lancaster in the film) and it does not entirely matter which party leads the unification of Italy.

James: I haven’t read the book but I watched Visconti’s The Leopard last winter. I thought the movie was really interesting, and visually stunning! My favourite fiction book this year has been The Silentiary, by Antonio di Benedetto. It’s a darkly comic story of a man’s existential struggle against the world and its noise. It’s also about writer’s block. I am looking forward to reading another from di Benedetto’s “Trilogy of Expectations” this fall, Zama.

I also enjoyed reading 2312 by Kim Stanley Robinson this summer. I think it qualifies as ‘hard’ sci-fi, meaning it spends a lot of time making the future ‘make sense’ in the context of our present – technologically as well as politically. It’s a bit more optimistic vision of the distant future than I would necessarily grant in that context, but that is part of what I liked about it – the writing is imbued with belief in and admiration for the creative powers of human society. It’s also a gripping adventure and a highly imaginative and rich exercise in world-building.

I also enjoyed reading 2312 by Kim Stanley Robinson this summer. I think it qualifies as ‘hard’ sci-fi, meaning it spends a lot of time making the future ‘make sense’ in the context of our present – technologically as well as politically. It’s a bit more optimistic vision of the distant future than I would necessarily grant in that context, but that is part of what I liked about it – the writing is imbued with belief in and admiration for the creative powers of human society. It’s also a gripping adventure and a highly imaginative and rich exercise in world-building.

Giuseppe Tomasi di Lampedusa’s The Leopard (translated from Italian).

This novel does not so much chronicle the unification of Italy, the Risorgimento, as it does the internal experiences of a noble family seeing their future irrelevancy written on the wall.

I’m reading it anticipation of re-watching Visconti’s film, The Leopard.

-

AuthorReplies