Forum Replies Created

-

AuthorReplies

-

You’re welcome! I love talking cinema and sharing recommendations.

I’ll add Lone Star to my need-to-watch list. Sayles’ Matewan, which is in Jonathan’s list, is a very good story of class war in a mining town. Sayles also wrote a book about the making of Matewan, called Thinking in Pictures.

I’ll see how many of those movies I can find on N. and S. Are there any services which might show other interesting cinema? Let’s say the films of Ingmar Bergman and Sergie Bondarchuk as examples.

N. and S.? Netflix and … ?

For me (in Canada) I have used Kanopy (which you can sync with a public library or university subscription) and the Criterion Channel (paid subscription, but worth it in my eyes). MUBI is CC’s closest alternative. One can assume there are still lots of streamers/torrents out there.

Bergman –> there is always this beast.

- This reply was modified 3 years, 7 months ago by jmc.

November 9, 2021 at 8:30 pm in reply to: Cleaning US trademark data to analyse trends in ownership #247153Cool, I’ll look into it. For now, chunking via pandas is working.

I’m not Jonathan, but I want to reply to this post’s intention. Don’t stress about asking for clarification because the forum is not a place for experts to gate-keep with prerequisites. Frankly, this site could use more readers like you. Questions drive conversation.

This is definitely worth expanding! Jonathan’s list of novels inspired me to build a list of films about a mode of power. What I have so far.

Title Director Year Runtime Ace in the Hole Billy Wilder 1951 111 Ali, Fear Eats the Soul Rainer Werner Fassbinder 1974 93 Army of Shadows Jean-Pierre Melville 1969 145 Badlands Terrence Malick 1973 93 Bamboozled Spike Lee 2000 135 Barton Fink Joel Coen 1991 117 Battle of Algiers, The Gillo Pontecorvo 1966 120 Beau Travail Claire Denis 1999 90 Belle de Jour Luis Buñuel 1967 101 Black Girl Ousmane Sembène 1966 55 Black Narcissus Michael Powell and Emeric Pressburger 1947 101 Blue Velvet David Lynch 1986 120 Caché Michael Haneke 2005 118 Canoa: A Shameful Memory Felipe Cazals 1976 115 Carlos Olivier Assayas 2010 338 Chinatown Roman Polanski 1974 131 Come and See Elem Klimov 1985 142 Daisies Věra Chytilová 1966 76 Death Race 2000 Paul Bertel 1975 82 Do The Right Thing Spike Lee 1989 120 Dogtooth Yorgos Lanthimos 2009 97 Dry White Season, A Euzhan Palcy 1989 107 EO Jerzy Skolimowski 2022 88 Eating Raoul Paul Bertel 1982 83 Executioner, The Luis García Berlanga 1963 90 Firemen’s Ball, The Miloš Forman 1967 73 Four Lions Chris Morris 2010 97 Friends of Eddie Coyle, The Peter Yates 1973 102 Germany, Year Zero Roberto Rossellini 1948 78 Godfather Part II, The Francis Ford Coppola 1974 200 Godfather, The Francis Ford Coppola 1972 177 Harakiri Masaki Kobayashi 1962 133 Heaven’s Gate Michael Cimino 1980 219 High and Low Akira Kurosawa 1963 143 Hunger Steve McQueen 2008 96 Investigation of a Citizen Above Suspicion Elio Petri 1970 115 Jeanne Dielman, 23, quai du Commerce, 1080 Bruxelles Chantal Akerman 1975 201 L’Argent Robert Bresson 1983 83 La Haine Mathieu Kassovitz 1995 98 Last Emperor, The Bernardo Bertolucci 1987 163 Leopard, The Luchino Visconti 1963 185 Magnificent Ambersons, The Orson Welles 1942 88 Man Push Cart Ramin Bahrani 2005 87 McCabe & Mrs. Miller Robert Altman 1971 121 Medium Cool Haskell Wexler 1969 110 Memories of Murder Bong Joon-ho 2003 131 Modern Times Charlie Chaplin 1936 87 My Beautiful Laundrette Stephen Frears 1985 97 Naked Mike Leigh 1993 131 New World, The Terrence Malick 2005 150 Night of the Hunter, The Charles Laughton 1955 92 Night of the Living Dead George A. Romero 1968 96 No Country for Old Men Joel Coen and Ethan Coen 2007 122 Parallax View, The Alan J. Pakula 1974 102 Parasite Bong Joon-ho 2019 132 Player, The Robert Altman 1992 124 R.M.N. Cristian Mungiu 2022 125 Repo Man Alex Cox 1984 92 Rome, Open City Roberto Rossellini 1945 105 Smooth Talk Joyce Chopra 1985 91 Soleil O Med Hondo 1970 98 Sullivan’s Travels Preston Sturges 1941 94 Sátántangó Bela Tarr 1994 439 There Will Be Blood Paul Thomas Anderson 2007 158 Thin Red Line, The Terrence Malick 1998 170 This Is Not a Burial, It’s a Resurrection Lemohang Jeremiah Mosese 2019 120 Touch of Sin Jia Zhangke 2013 130 Touki Bouki Djibril Diop Mambéty 1973 95 Tree of Life, The Terrence Malick 2011 139 Twin Peaks: Fire Walk with Me David Lynch 1992 134 Two Days, One Night Jean-Pierre Dardenne and Luc Dardenne 2014 95 Vagabond Agnès Varda 1985 105 Wages of Fear, The Henri-Georges Clouzot 1953 148 White Ribbon, The Michael Haneke 2009 144 Wind That Shakes the Barley, The Ken Loach 2006 126 Working Girls Lizzie Borden 1986 93 Z Costa-Gavras 1969 127 Zéro de conduite Jean Vigo 1933 44 - This reply was modified 3 years, 8 months ago by jmc. Reason: added films

- This reply was modified 3 years, 8 months ago by jmc. Reason: up to 50 films

- This reply was modified 3 years, 7 months ago by jmc. Reason: added more films

- This reply was modified 3 years, 7 months ago by jmc.

- This reply was modified 8 months ago by jmc. Reason: Added more films

November 3, 2021 at 11:49 am in reply to: Cleaning US trademark data to analyse trends in ownership #2470871. Memory load. Everything is re-merged and the fuzzy search is done one more time.

2. If you look at the names, some sectors def. rely on the number of trademarks they register. After seeing the results, it makes sense that MATTEL is the biggest. Hollywood is all over the top ranks. WWE is the largest wrestling league in the world. IGT is the biggest gambling, slot-machine company. ARISTOCRAT TECHNOLOGIES AUSTRALIA PTY LTD. is the second biggest.

November 2, 2021 at 7:28 pm in reply to: Cleaning US trademark data to analyse trends in ownership #247085This is really awesome James, thanks for sharing! In glancing through it, it is funny/interesting to see some firms so high up on the list (like WWE??). It also seems there are separate entries for Apple inc and Apple Computer inc., leading to a much lower rank for that company. I don’t know if you have read K Birch, D Cochrane, and C Ward’s article “Data as Asset?”, but I was fascinated by their finding that the big tech firms seem to hold significantly lower than average intangible assets, and at least for Google and Facebook, slightly higher than average tangible assets. Just goes to show the diversity in how intellectual property/intangible assets are capitalized/capitalized upon, and how little we actually know about the so-called new knowledge economy. Article: Birch K, Cochrane D, Ward C. Data as asset? The measurement, governance, and valuation of digital personal data by Big Tech. Big Data & Society. January 2021. doi:10.1177/20539517211017308

Thanks, Chris. The fine tuning of matching is something I will try to implement if/when I build another version. IMO, there is likely always going to be some manual grouping: e.g., counting Alphabet and Google as one.

The total counts are skewed by the number of years companies are alive. Tesla Motors has 55 trademarks and Ford Motor Company has thousands. If we look trademarks per year (registered minus cancelled), they might be closer in counts.

November 2, 2021 at 2:17 pm in reply to: Cleaning US trademark data to analyse trends in ownership #247080P.S. Different industry sectors have different approaches to trademarks. Some are very aggressive in applying for marks, and others don’t seem to care much beyond their corporate name. If you were able to add S&P GICS sector tags to the data (e.g., consumer discretionary for Mattel and IT for Apple), that would make the dataset more useful for intra-sector and cross-sector analysis.

100%. In another post about Moure’s paper, I found a Compustat application that counts patents per firm in the Compustat database. Funnily enough, they use fuzzy search to match the names — which is what I am using here. I have all the Compustat data, so I can try merging the two and see what happens.

- This reply was modified 3 years, 8 months ago by jmc.

November 2, 2021 at 2:15 pm in reply to: Cleaning US trademark data to analyse trends in ownership #247079Also, you might want to reach out to Thomas McCarthy, a former law professor at University of San Francisco who wrote the most widely known US TM law treatise. It looks like he is still around, and he might be interested in a clean and robust TM dataset (or even have access to one already). Links below: https://www.mofo.com/people/j-mccarthy.html https://www.mccarthyinstitute.com/

Thanks, I’ll look into it and send an FYI. I have some research questions of my own, but I am sharing my prep work for anyone that would want the results of cleaned names.

November 2, 2021 at 2:13 pm in reply to: Cleaning US trademark data to analyse trends in ownership #247078Do you distinguish between live and dead marks? Also, do the data allow you to distinguish between marks that are actually registered versus those that are only applications? A quick look at Mattel marks on TESS implies to me that some of the hits from my search are for intent to use applications that are not yet registered marks (and may never be).

I did not distinguish because filtering by live, dead, registered or applied is a step one would take later. The document and data are meant to prepare the dataset for all sorts of questions around onwership. The USPTO data schema helps explain the issue. The owner data is separated from the case file data, and TESS merges the data when a query is made.

- This reply was modified 3 years, 8 months ago by jmc.

My arithmetic was not meant to imply that reading novels was a chore. In fact, I have selected many novels from one of your older lists.

I can think of some more great novels that aid the in the production of a hologramic view of society:

1. Achebe, Chinua. 1958. Things Fall Apart.

2. Egan, Jennifer. 2010. A Visit from the Goon Squad.

3. Farrell, J. G.. 1970. Troubles.

4. Krasznahorkai, László. 1985. [2012]. Sátántangó. Translated by George Szirtes.

5. McCoy, Horace. 1935. They Shoot Horses, Don’t They?

6. Toole, John Kennedy. 1980. A Confederacy of Dunces.Impressive list! At the rate of a novel a month, that’s around 17 years of reading.

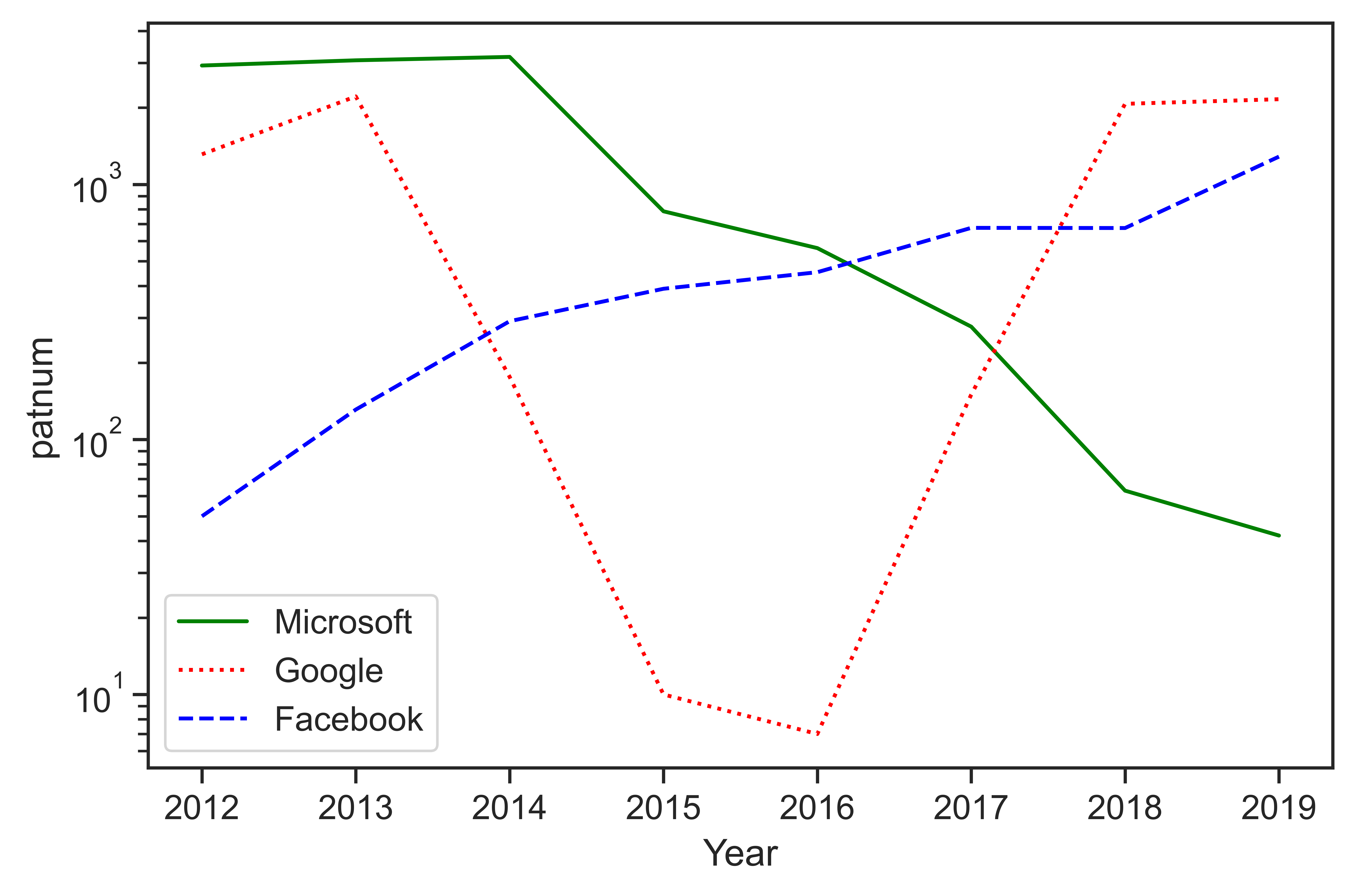

I also found a dataset that has yearly counts of patents by Compustat firm from 1980 to 2016. https://patents.darden.virginia.edu/get-data/

Note that the researchers ask for citation.

Hey Chris,

For now, I have no idea. The phrase “patents gained” is actually mine because the variable is a generic count of patents.

There would be ways around this problem, but a solution would likely involve digging into the details of a company.

Here, for example, are the number of patents gained per year for Microsoft, Google, and Facebook, from 2012 to 2019. Inspired by Chris Mouré’s new article for RECASP. Congrats, Chris!

-

AuthorReplies