Forum Replies Created

-

AuthorReplies

-

February 15, 2021 at 9:11 pm in reply to: Questions Regarding Mumford’s Theory of the Mega-Machine #245345

Hi David,

Great to see that you registered and joined the forum. Please continue to ask questions like this.

I have not read Mumford in a while, but I have read two of his major works (Technics and Civilization, The Myth of the Machine vols. 1 and 2). In my mind, I categorize Mumford as a writer who distills ideas and arguments according to their dominant forms. In his analysis of the mega-machine a dominant characteristic is social coordination, which I think privileges images of everybody working together (in unequal societies and in the interest of power). The details are certainly much messier than this, but Mumford’s style tends to emphasize the ideologies that fuel this dominant characteristic.

And hats off to whoever came up with the idea for this forum! It’s such a fantastic initiative. I doubt my rash forays into CasP land would have ever got this far had it not been for this platform (and its helpful users). Cheers, Adam

The forum has been around in some form for almost a decade–and I also don’t know the history of its origins. But I wholeheartedly share your opinion of its usefulness. We welcome more questions of this sort, because the collective knowledge on this forum tends to hibernate and hide from view when posts are infrequent.

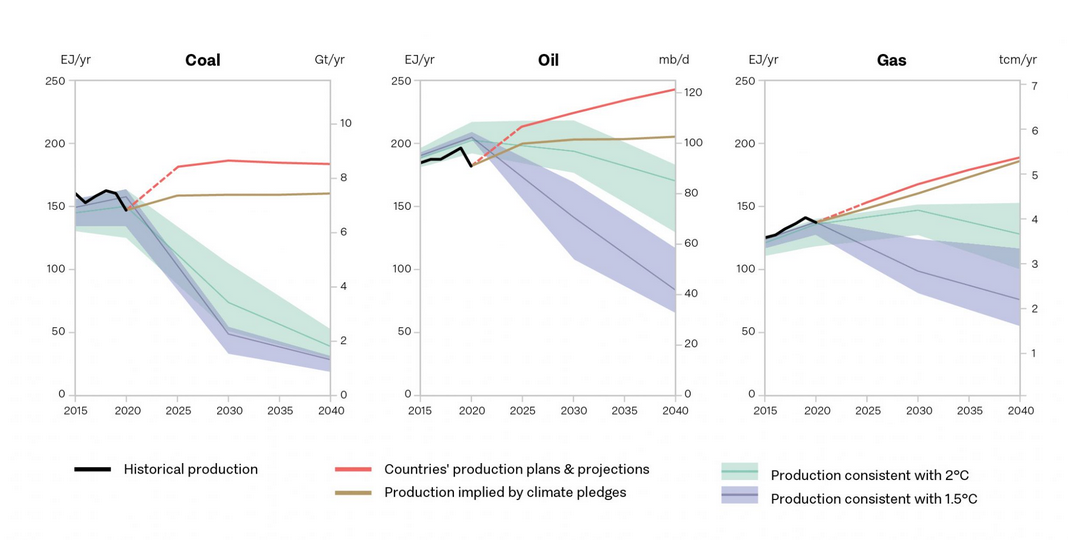

February 9, 2021 at 11:54 am in reply to: Links, tid-bits, or snippets of interesting research #245298The 2020 Production Gap Report addresses the planned bounce-back of fossil fuel production after COVID-19.

Looks very interesting! IMO the more you look at both figures, the more the difference between the two benchmarks is minimal. If I understand your interpretation, “beating” the average means the line going above 100. I think the better approach is to look at rising or falling differential capitalization. Your analysis of 2013 still stands and you avoid possible problems when the numerator is very small. For example, a small company could be rising in differential capitalization, but this rise could always be below 1 or 100. If the differential measure was re-indexed so a date equals 100, that is a good note to make in a footnote or below the graph.

- This reply was modified 5 years ago by jmc.

Thanks for the list, Jonathan. I have read Herman Wouk’s two-novel epic. The strength of that story, in my opinion, is how Wouk helps you imagine how big these “war machines” are. His description of Midway in unforgettable.

Sounds interesting, Jonathan. Off the top of my head I cannot remember if I have read a novel or book that focuses on the front-line experience.

While cinema has an abundance of war films that are too glossy and entertaining for their subject matter, there are some that do a great job representing the horrors and other-worldliness of the front line. In the case of the Russian front, I can think of two; one I have seen and one is on my to-watch list.

Andrei Tarkovsky’s Ivan’s Childhood is a beautiful, poetic film about a Russian boy who, because of his age and presumed innocence, is able to go back and forth across German lines. He survives on the handouts of Russian soldiers who use him to relay intelligence.

Come and See, which I have yet to watch, has been getting a lot of attention since its restoration. It is the type of film that definitely critiques the argument that, by virtue of showing acts of war, all war films are anti-war films. This argument might come across as naive, but this is how Steven Speilberg argued that Saving Private Ryan was anti-war.

Currently working through:

Liking it so far. A sprawling, inter-generational novel set in what is now Zambia.

- This reply was modified 5 years, 1 month ago by jmc.

January 30, 2021 at 10:45 pm in reply to: GameStop, hedge funds, and the “reality” of the stock market #245241One aspect of the GameStop story is definitely relevant to the CasP approach: the question of what the high market value of GameStop is resting on. Can we say GameStop is overvalued but without falling into the trappings of the real-nominal dichotomy?

Hopefully we find a method to integrate the old forum with the new one. In the meantime, readers can see that this issue has come up before, in the context of speaking about ‘bubbles’ in the stock market.

- This reply was modified 5 years, 1 month ago by jmc.

January 29, 2021 at 6:07 pm in reply to: GameStop, hedge funds, and the “reality” of the stock market #245237Remember when BitCoin’s price soared? Everybody jumped on the story, and if you listened to the predictions of certain circles, we would all soon be buying groceries and paying rent with de-centralized currency.

That is what is striking me with the reporting on the GameStop price jump. I don’t have a clear answer right now, but it is wild to see what people are already saying about the effect of the event on the future of Wall Street or even of capitalism.

My thoughts that people are jumping feet first into the “rebelliousness” of reddit’s behavior were confirmed when YouTube recommended to me Joe Rogan’s thoughts about it on his podcast. Because that is what I was thinking: “What does Joe Rogan think about this mess?!?”

A long history of non-US market-cap data will be trickier. I might be able to help, but I would need to check what my remote access can get me.

In the meantime, I found stock price data going back to 2000. Available here and also attached: https://www.marketindex.com.au/asx/ajl

A measure of differential price is possible, but it does come with the caveat that you don’t know what is happening with Common Shares Outstanding (CSHO).

A quick route to S&P 500 historical data is from Schiller, which is also used in BN’s papers on systemic fear: http://bnarchives.yorku.ca/494/

Attachments:

You must be logged in to view attached files.January 1, 2021 at 9:34 pm in reply to: Do grumpy, cynical political economists wish each other Happy New Year? #245180December 31, 2020 at 1:59 pm in reply to: Do grumpy, cynical political economists wish each other Happy New Year? #245176I remember being overwhelmed while I was taking the course. My academic background made me a novice on multiple aspects of the research that was required. Keep fueling that curiosity to learn more–in whatever capacity–because who knows what can come from your explorations. After finally getting more comfortable with empirical work, I was energized from knowing that I had skills to see if evidence supported claims in political economy (to the best of my abilities and availability of data).

December 31, 2020 at 1:31 pm in reply to: Do grumpy, cynical political economists wish each other Happy New Year? #245174All the best to you as well, vbozic. If you don’t mind sharing, how did you find POLS 4292? I took Jonathan’s grad-level course years ago, but the 4th year course is very similar.

December 31, 2020 at 12:48 pm in reply to: Do grumpy, cynical political economists wish each other Happy New Year? #245170For safer browsing in 2021, uninstall Abobe Flash Player, as Adobe will not longer be updating for security. Adobe’s page. An updated browser (Firefox, Chrome, …) will also block Flash.

Ahh, memories of Flash. For those who know:

- This reply was modified 5 years, 2 months ago by jmc.

Apologies for the delay in my update. Below is a single image of the two plots above:

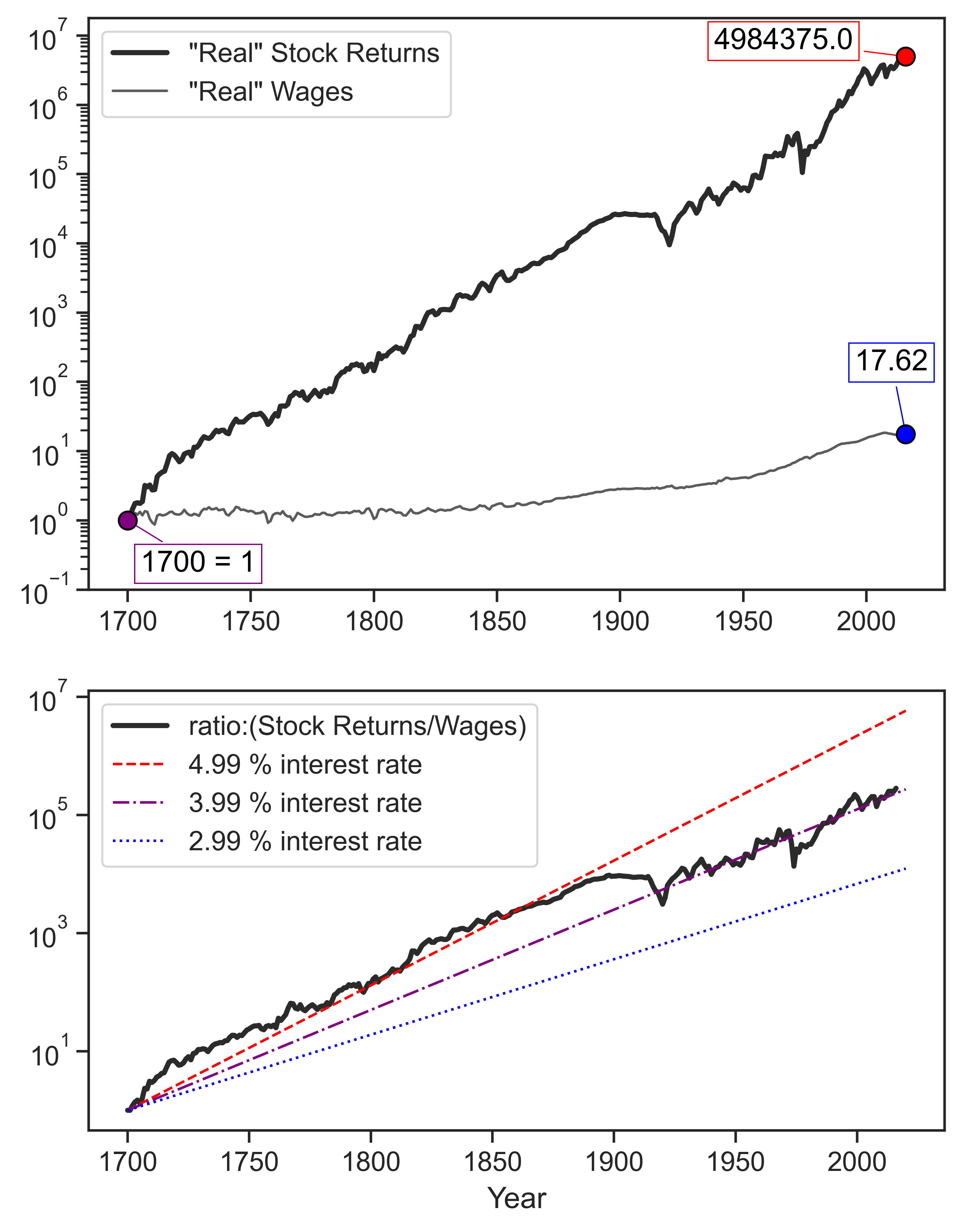

Sources: Global Financial Data, code _TFTASD for UK FTSE All-Share Return Index (w/GFD extension), 1694-2020. UK Composite Average Weekly Earnings series is from A47. Wages and Prices 1209-2016, A millennium of macroeconomic data for the UK, The Bank of England’s collection of historical macroeconomic and financial statistics. UK CPI is taken from A millennium of macroeconomic data for the UK.

I thought about Blair’s comment on runaway inequality. In this figure capital’s growth relative to labor is exponential and I think there is a simple reason why. The figure does not show what any real capitalist has earned because it spans hundreds of years. It is more of a symbolic representation of two types of life under capitalism. Say we have two families that in 1700 are at the same starting point. The “capital” family has bought into stock market and holds stock worth the return of 1. The “labour” family works for a living and also starts at 1. The huge growth of the “capital” family is a representation of someone buying stock in 1700 and holding up until the present.

The difference between continuous exponential growth of stock returns and the U-shape of historical income inequality might have something to do with generational change. Fortunes from 1700 do not straightforwardly carry over into the present. So much can happen: inheritance tax, lost fortunes, individuals enter and leave the market through buying and selling.

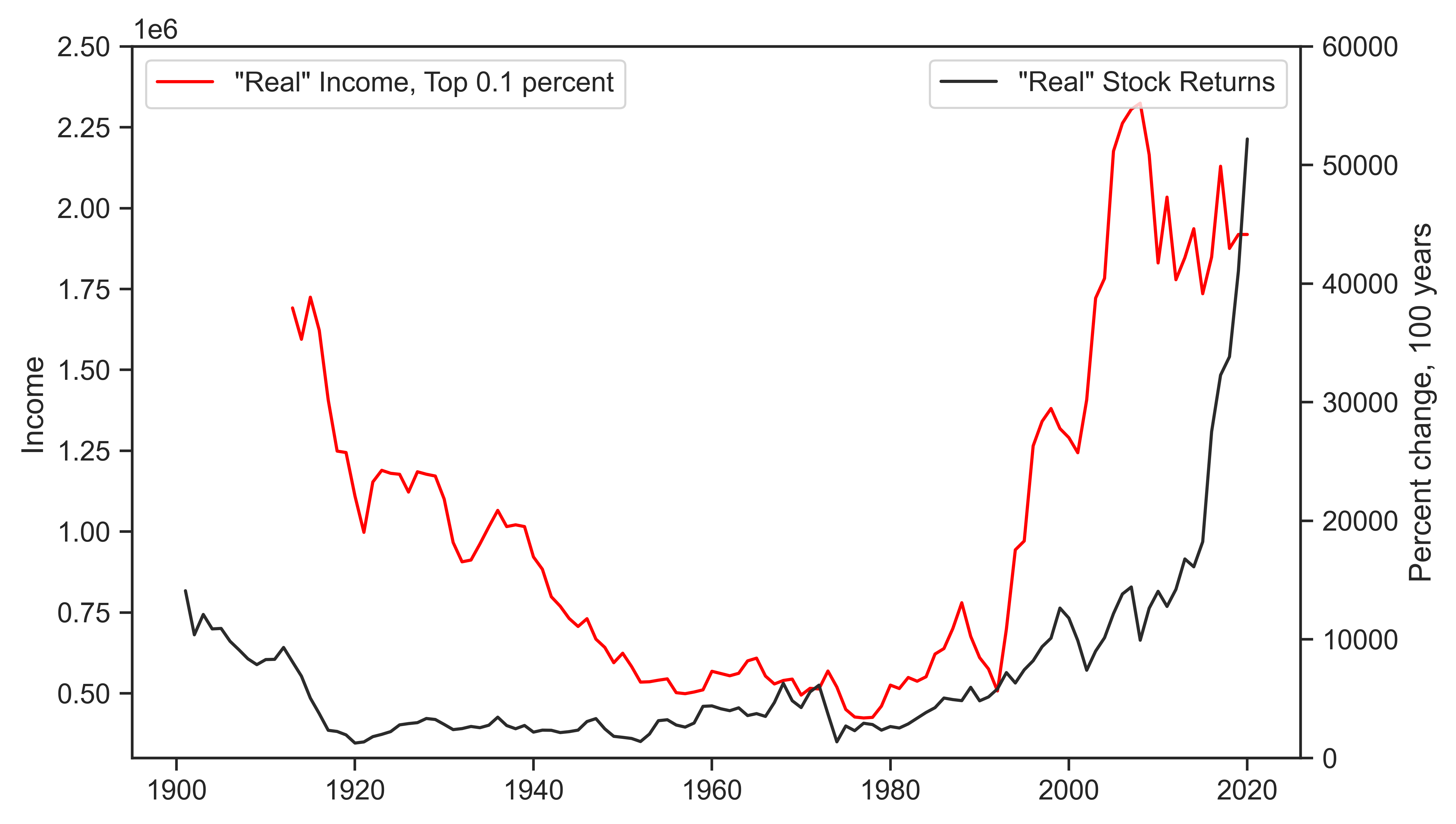

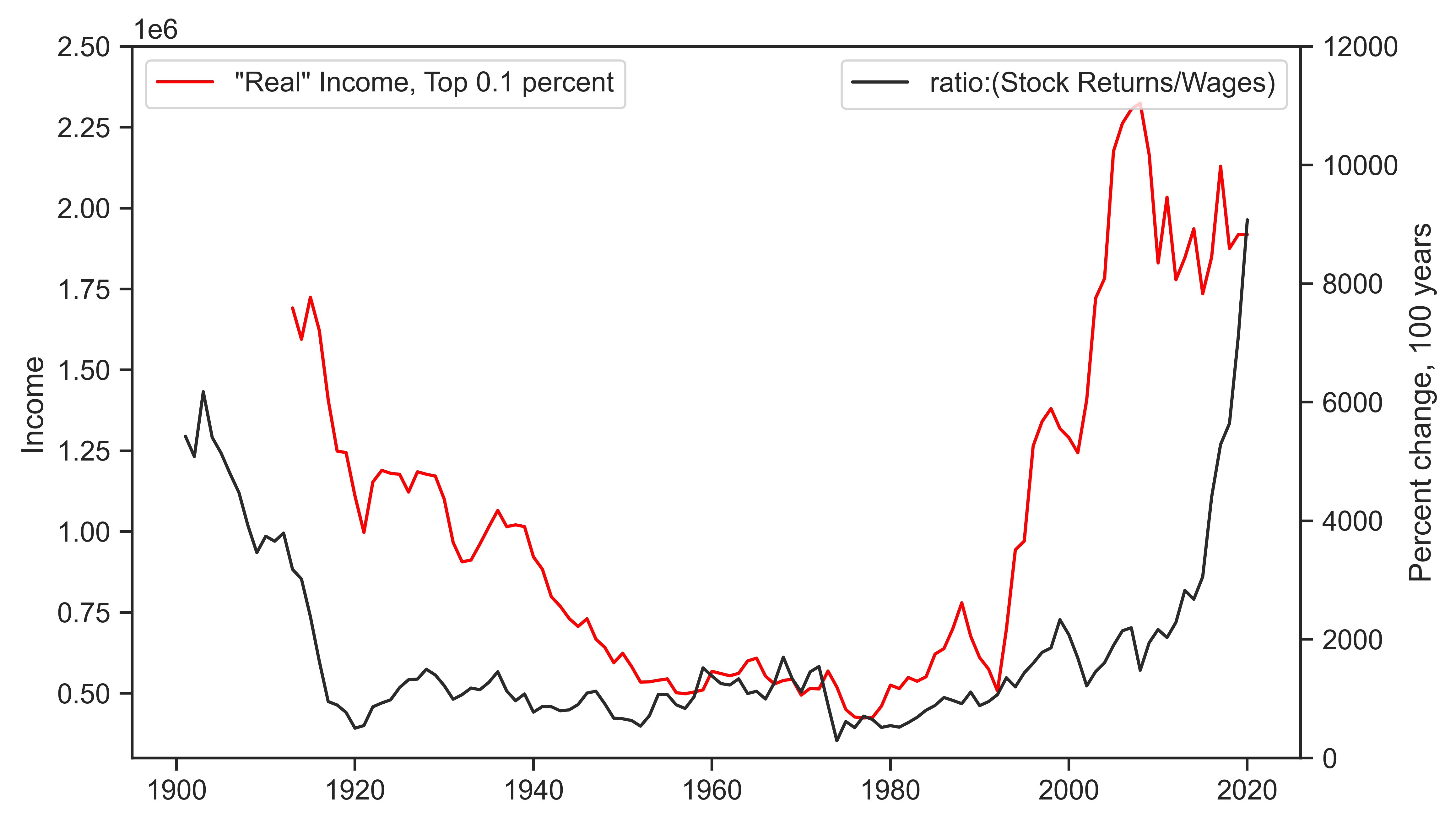

The following figures try to find the U-shape in the generational changes of stock returns and the stock/labor ratio. For comparison they are plotted against the .999 percent income of GBR, retrieved from WID.

- This reply was modified 5 years, 2 months ago by jmc.

-

AuthorReplies