Abstract One of the most important and recurring debates in the field of International Political Economy and international affairs are the links between capitalism, fossil fuel energy and climate change. In these debates, the origins of our current climate emergency are rooted in how Britain became the first country to become reliant on mass production […]

Continue ReadingNoble, ‘Follow the Money: The Political Economy of Petrodollar Accumulation and Recycling’

Abstract This thesis makes two unique contributions to the International Political Economy literature. It presents the first comprehensive, empirical investigation of petrodollar accumulation and recycling spanning the period 1980-2021. It also corrects the misconception that petrodollar recycling in the 1970s and 1980s involved the extension of loans to developing countries using fractional reserve banking and […]

Continue ReadingBichler & Nitzan, ‘The Mismatch Thesis. Fiction and Reality in the Accumulation of Capital’

Abstract Political economists, both mainstream and Marxist, find it difficult to reconcile the «real» and «financial» appearances of capital. The conventional view is that «real» capital is an objective productive entity; that «finance» merely reflects this reality; and that, unfortunately, the reflection is often inaccurate, causing the two to «mismatch». This convention, we argue, is […]

Continue ReadingSuaste Cherizola, ‘El Capitalismo Contemporáneo y la Ontología de las Finanzas’

Abstract RESUMEN. Esta tesis es un esfuerzo por desentrañar el papel que juega el campo financiero dentro del proceso de acumulación de capital y la manera en que condiciona el desarrollo de la lucha entre las clases sociales por la distribución de la riqueza y el control político de la comunidad. El punto de partida […]

Continue ReadingDi Muzio & Dow, ‘Covid-19 and the Global Political Economy. Crises in the 21st Century’

Abstract Covid-19 and the Global Political Economy investigates and explores how far and in what ways the Covid-19 pandemic is challenging, restructuring, and perhaps remaking aspects of the global political economy. Since the 1970s, neoliberal capitalism has been the guiding principle of global development: fiscal discipline, privatisations, deregulation, the liberalisation of trade and investment regimes, […]

Continue ReadingDi Liberto, ‘Hype: The Capitalist Degree of Induced Participation’

Hype The Capitalist Degree of Induced Participation YURI DI LIBERTO April 2022 Abstract Power is usually considered as either a ‘positive’ or ‘negative’ construct, as in the power to force action versus the power to forbid it. This paper explores a hybridized approach to power based on the idea of ‘induced participation’. Building on Bichler […]

Continue ReadingNew Briefing – Drilling Down: UK Oil and Gas Financial Performance

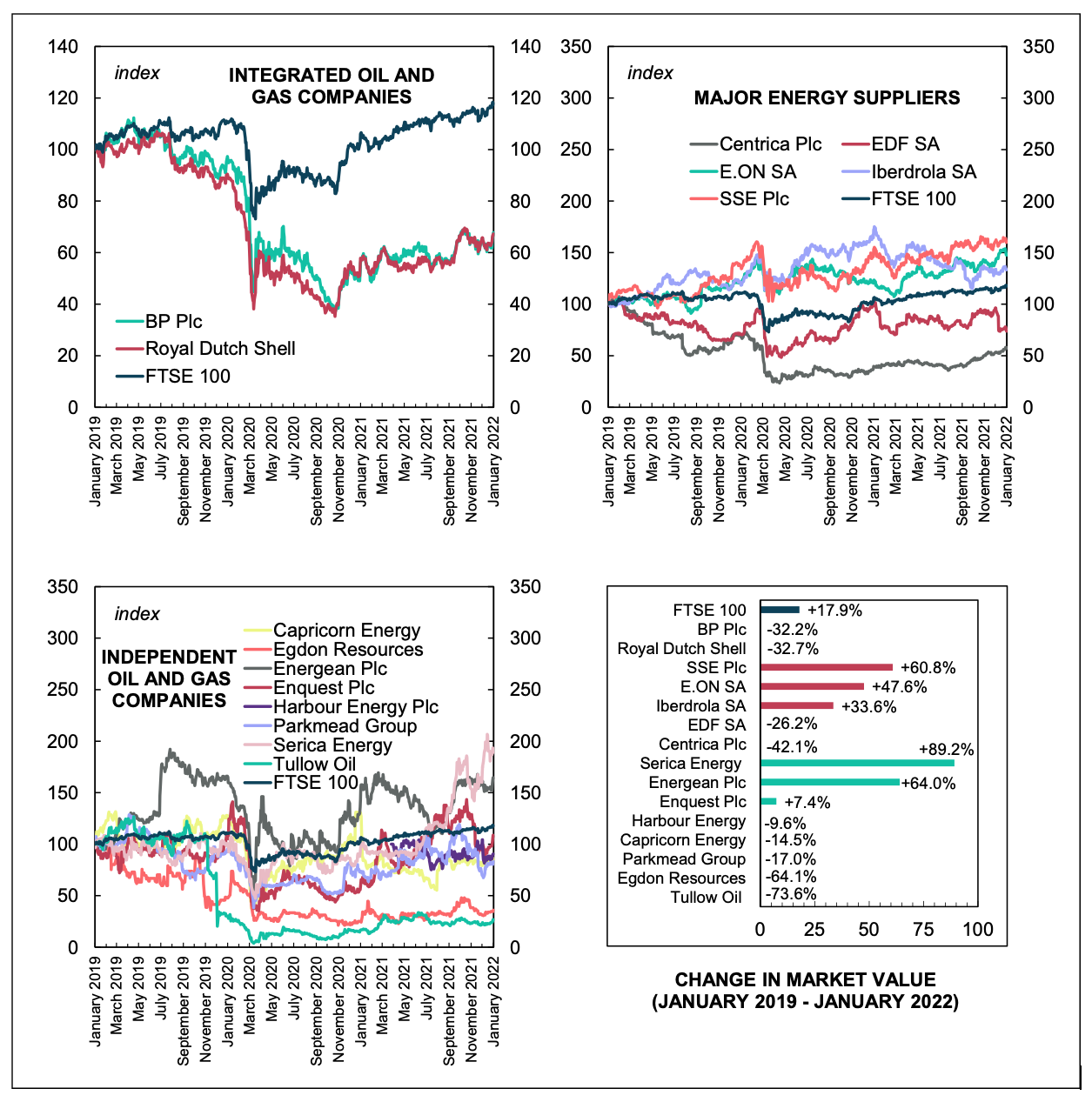

Originally published at sbhager.com Sandy Brian Hager Joseph Baines and I have a new briefing with Common Wealth examining the financial performance of UK oil and gas producers and energy suppliers. Some of the key findings include: The two UK-headquartered supermajors – BP and Royal Dutch Shell – have remained profitable over the past decade, […]

Continue ReadingThe rotten culture of the rich

Originally published at pluralistic.net Cory Doctorow In his 2019 book Dignity, Chris Arnade left his Wall Street job and traveled America, talking to poor, marginalized people, mostly at McDonald’s restaurants. Now, in a new essay for American Compass, Arnade delves into the “rotten culture of the rich.” https://americancompass.org/what-about-the-rotten-culture-of-the-rich/ Arnade starts with observations about how rich […]

Continue Reading