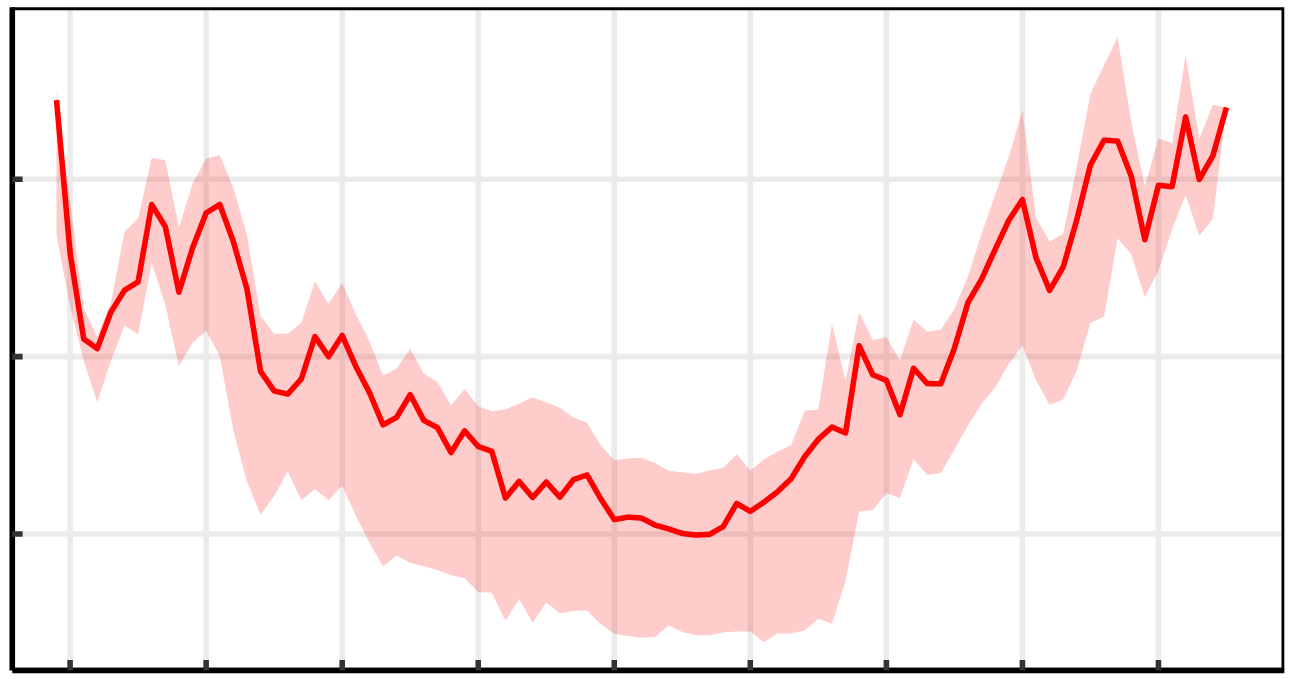

Abstract What accounts for the growth of US top income inequality? This paper proposes a hierarchical redistribution hypothesis. The idea is that US firms have systematically redistributed income to the top of the corporate hierarchy. I test this hypothesis using a large scale hierarchy model of the US private sector. My method is to vary […]

Continue ReadingFix, ‘Hierarchy and the power-law income distribution tail’

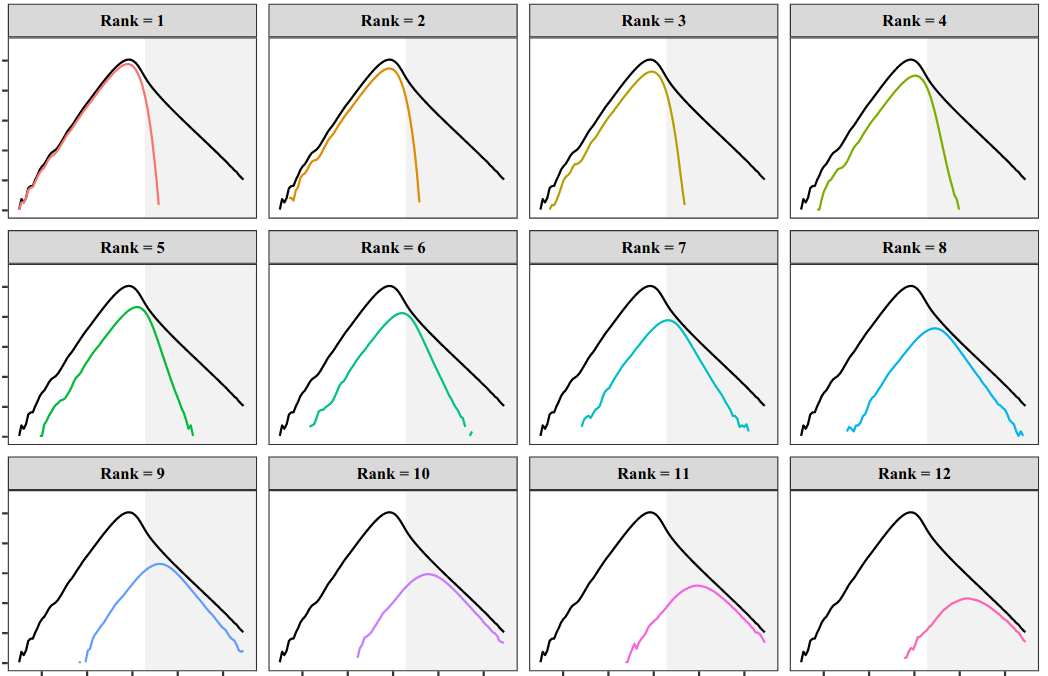

Abstract What explains the power-law distribution of top incomes? This paper tests the hypothesis that it is firm hierarchy that creates the power-law income distribution tail. Using the available case-study evidence on firm hierarchy, I create the first large-scale simulation of the hierarchical structure of the US private sector. Although not tuned to do so, […]

Continue Reading2018/02: Fix, ‘A Hierarchy Model of Income Distribution’

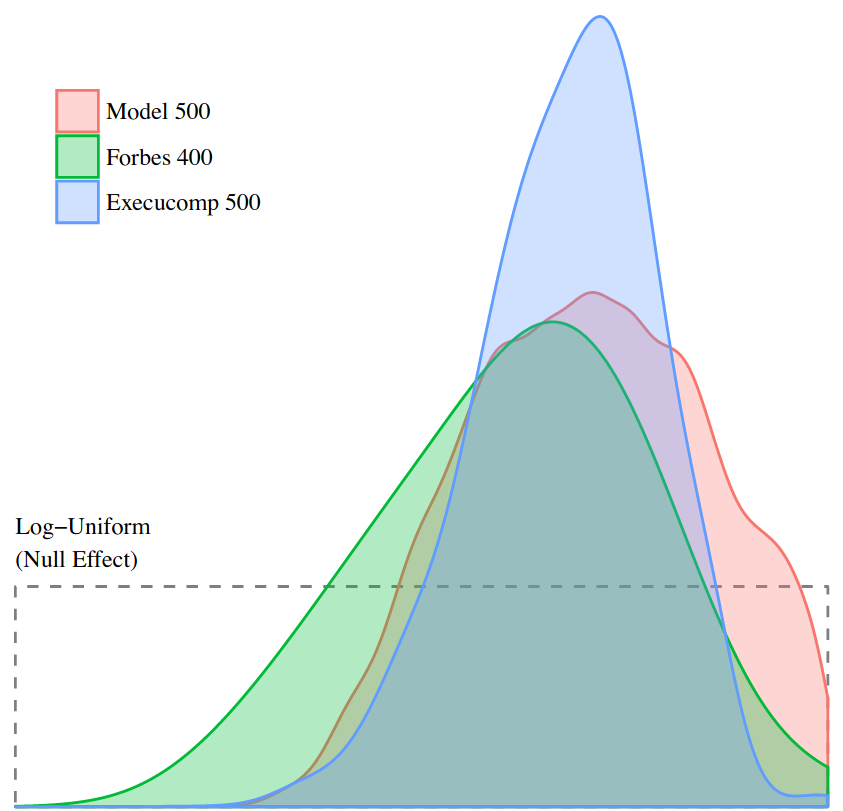

Abstract Based on worldly experience, most people would agree that firms are hierarchically organized, and that pay tends to increase as one moves up the hierarchy. But how this hierarchical structure affects income distribution has not been widely studied. To remedy this situation, this paper presents a new model of income distribution that explores the […]

Continue ReadingNo. 2017/03: Fix, ‘Evidence for a Power Theory of Personal Income Distribution’

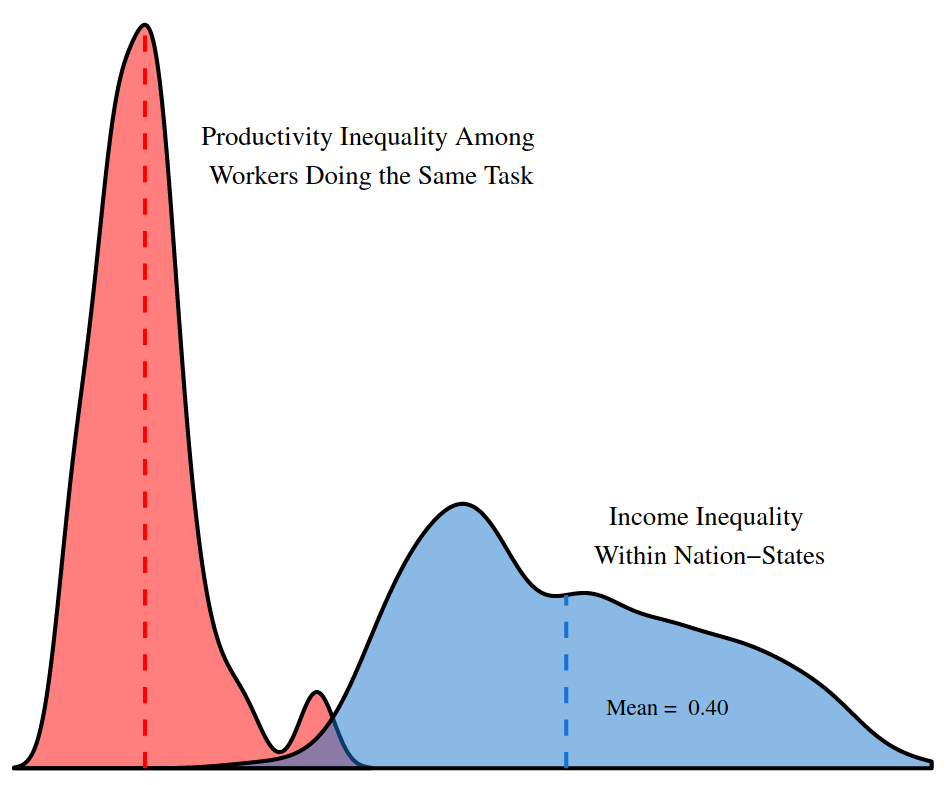

Abstract This paper proposes a new ‘power theory’ of personal income distribution. Contrary to the standard assumption that income is proportional to productivity, I hypothesize that income is most strongly determined by social power, as indicated by one’s position within an institutional hierarchy. While many theorists have proposed a connection between personal income and power, […]

Continue ReadingTrump, US Public Debt, and the Future of Global Financial Power

Sandy Hager The following post is based loosely on my presentation at the first annual Thammasat University-Conference for Asia Pacific Studies in Phuket, Thailand (8-9 December 2016). What a difference a few months makes. This past summer I published a piece in the European Journal of International Relations on the role of US Treasury securities […]

Continue ReadingSome Important Limitations of Income Inequality Data

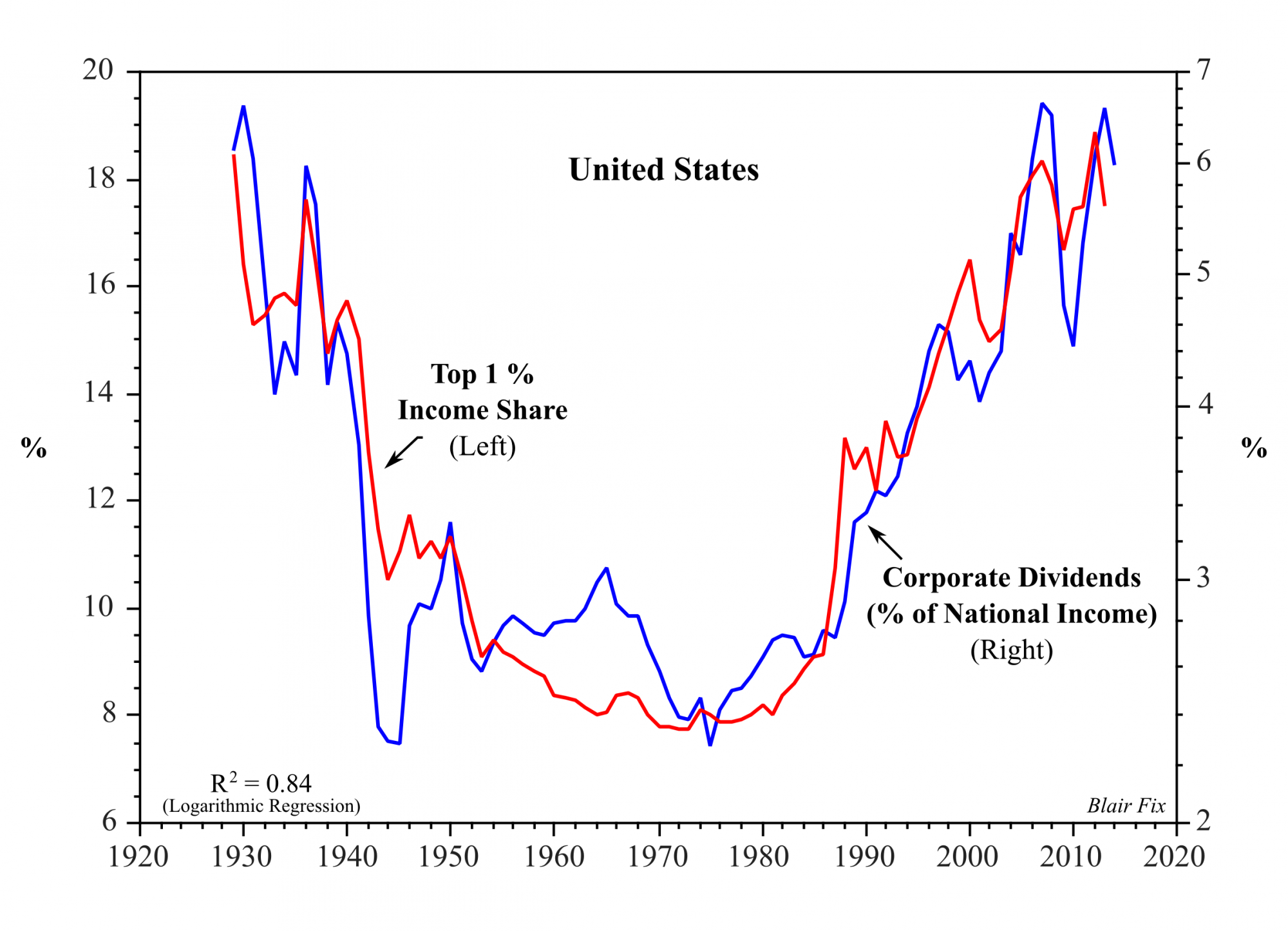

Jonathan Nitzan Blair Fix, a PhD student in the Faculty of Environmental Studies at York University in Toronto, points to some important limitations of income inequality data. In a recent posting on capitalaspower.com, Fix shows that, in the case of the U.S., the Top 1% income share correlates not with the share of capitalists in […]

Continue Reading