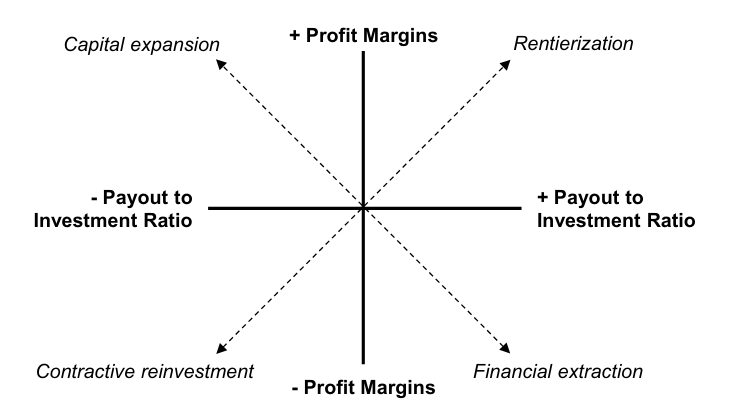

Abstract The concepts of rentiership and intellectual monopoly have gained increased prominence in discussions about the transformation of global capitalism in recent years. However, there have been few if any attempts to construct measures for rentiership and intellectual monopoly using firm-level financial data. The absence of such work, we argue, is symptomatic of conceptual challenges […]

Continue ReadingNew Briefing – Drilling Down: UK Oil and Gas Financial Performance

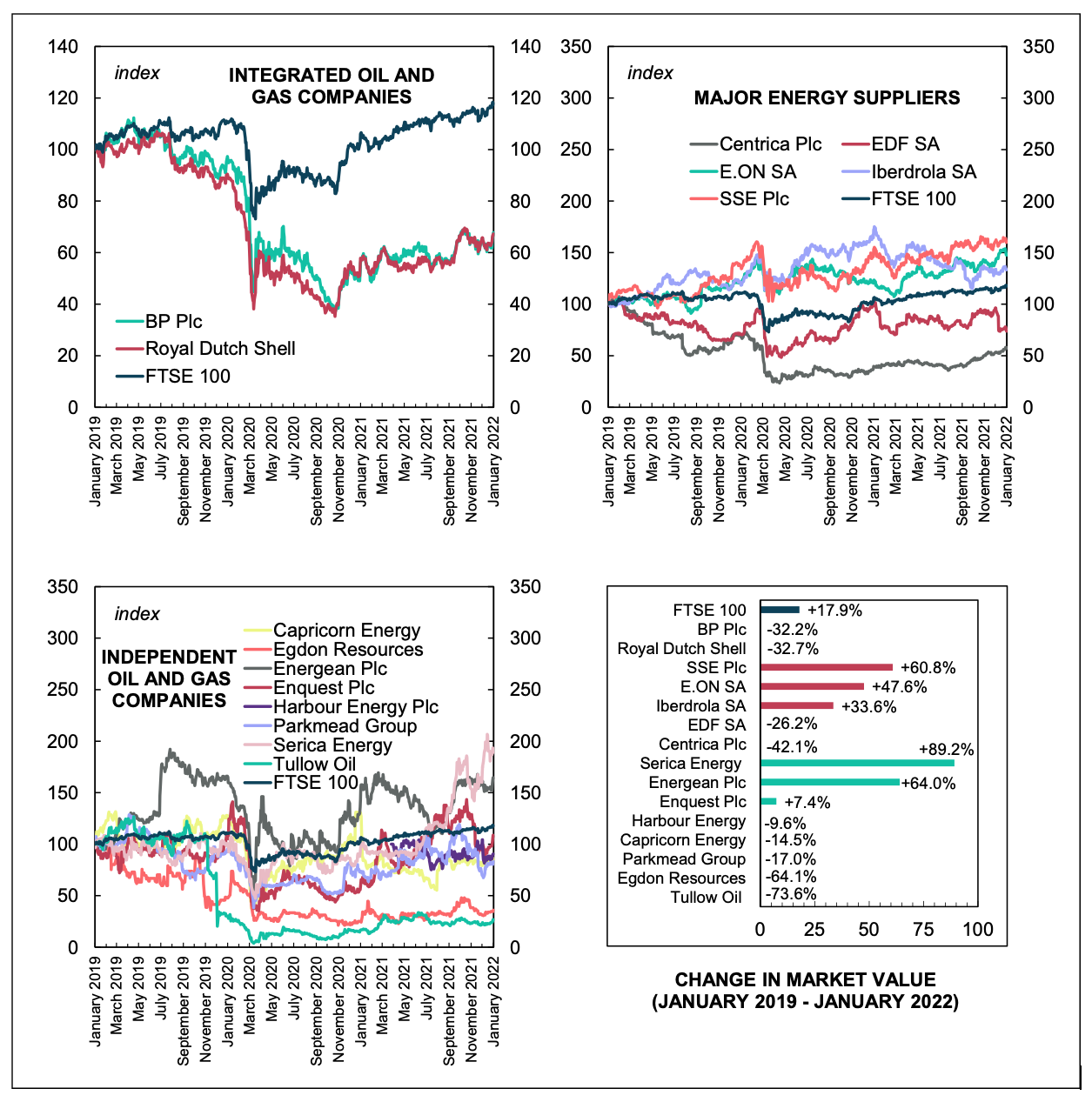

Originally published at sbhager.com Sandy Brian Hager Joseph Baines and I have a new briefing with Common Wealth examining the financial performance of UK oil and gas producers and energy suppliers. Some of the key findings include: The two UK-headquartered supermajors – BP and Royal Dutch Shell – have remained profitable over the past decade, […]

Continue ReadingNew Report – Power Ahead: An Energy System Fit For The Future

Originally published at sbhager.com Sandy Brian Hager In a new briefing with Common Wealth, Miriam Brett, Joseph Baines and I examine ownership and financial data for the “Big Six” UK energy companies: Centrica (British Gas), EDF Energy, E.ON UK, NPower, Scottish Power and SSE. We found that: Privatisation since the late-1980s transferred wealth from the […]

Continue Reading2020/04: McMahon, ‘Reconsidering Systemic Fear and the Stock Market: A Reply to Baines and Hager’

Abstract A recent New Political Economy article by Baines and Hager (2020) critiqued Shimshon Bichler and Jonathan Nitzan’s capital-as-power (CasP) model of the stock market (Bichler & Nitzan, 2016). Bichler and Nitzan’s model of the stock market seeks to explain how financial crises are tied to the (upper) limits of redistributing income through power. Bichler […]

Continue ReadingBaines, ‘Price and Income Dynamics in the Agri-Food System: A Disaggregate Perspective’

Abstract This dissertation seeks to illuminate contemporary processes of redistribution in the agri-food sector, with particular reference to the US. It addresses the following questions: How has the rapid rise in food price instability since the turn of the twenty-first century impacted income shifts within the agri-food system? Which groups within agriculture and agribusiness benefit […]

Continue ReadingBaines, ‘Wal-Mart’s Power Trajectory: A Contribution to the Political Economy of the Firm’

Abstract This article offers a power theory of value analysis of Wal-Mart’s contested expansion in the retail business. More specifically, it draws on, and develops, some aspects of the capital as power framework so as to provide the first clear quantitative explication of the company’s power trajectory to date. After rapid growth in the first […]

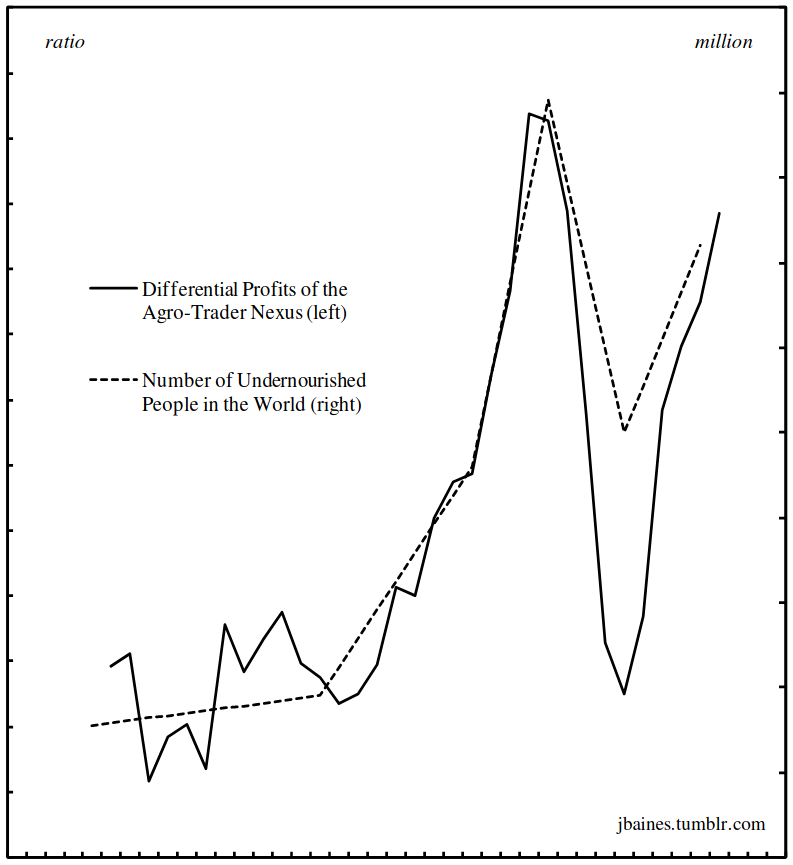

Continue ReadingBaines, ‘Food Price Inflation as Redistribution: Towards a New Analysis of Corporate Power in the World Food System’

Abstract This paper outlines the contours of a new research agenda for the analysis of food price crises. By weaving together a detailed quantitative examination of changes in corporate profit shares with a qualitative appraisal of the restructuring in business control over the organisation of society and nature, the paper points to the rapid ascendance […]

Continue Reading