The Capital as Power Approach An Invited-then-Rejected Interview with Shimshon Bichler and Jonathan Nitzan SHIMSHON BICHLER and JONATHAN NITZAN September 2023 Keywords capital accumulation, capitalization, interview, Marxism, modes of power, stagflation, systemic fear, value theory Citation Bichler, Shimshon, and Nitzan, Jonathan. 2023. ‘The Capital as Power Approach: An Invited-then-Rejected Interview with Shimshon Bichler and Jonathan […]

Continue ReadingWith Great Power Comes Great Fear

Originally published at Economics from the Top Down Blair Fix Over the last year, I’ve watched with horror and amusement as health agencies around the world flip-flopped their advice on how to deal with COVID. My horror comes from knowing this flip-flopping breeds mistrust in science. But I am (morbidly) amused because I know that […]

Continue ReadingMcMahon, ‘Reconsidering Systemic Fear and the Stock Market’

Reconsidering Systemic Fear and the Stock Market A Reply to Baines and Hager JAMES MCMAHON August 2021 Abstract This article responds to Baines and Hager’s recent critique of the capital-as-power model of the stock market. Proposed by Bichler and Nitzan, this model seeks to explain how financial crises are tied to the concept of ‘systemic […]

Continue Reading2020/04: McMahon, ‘Reconsidering Systemic Fear and the Stock Market: A Reply to Baines and Hager’

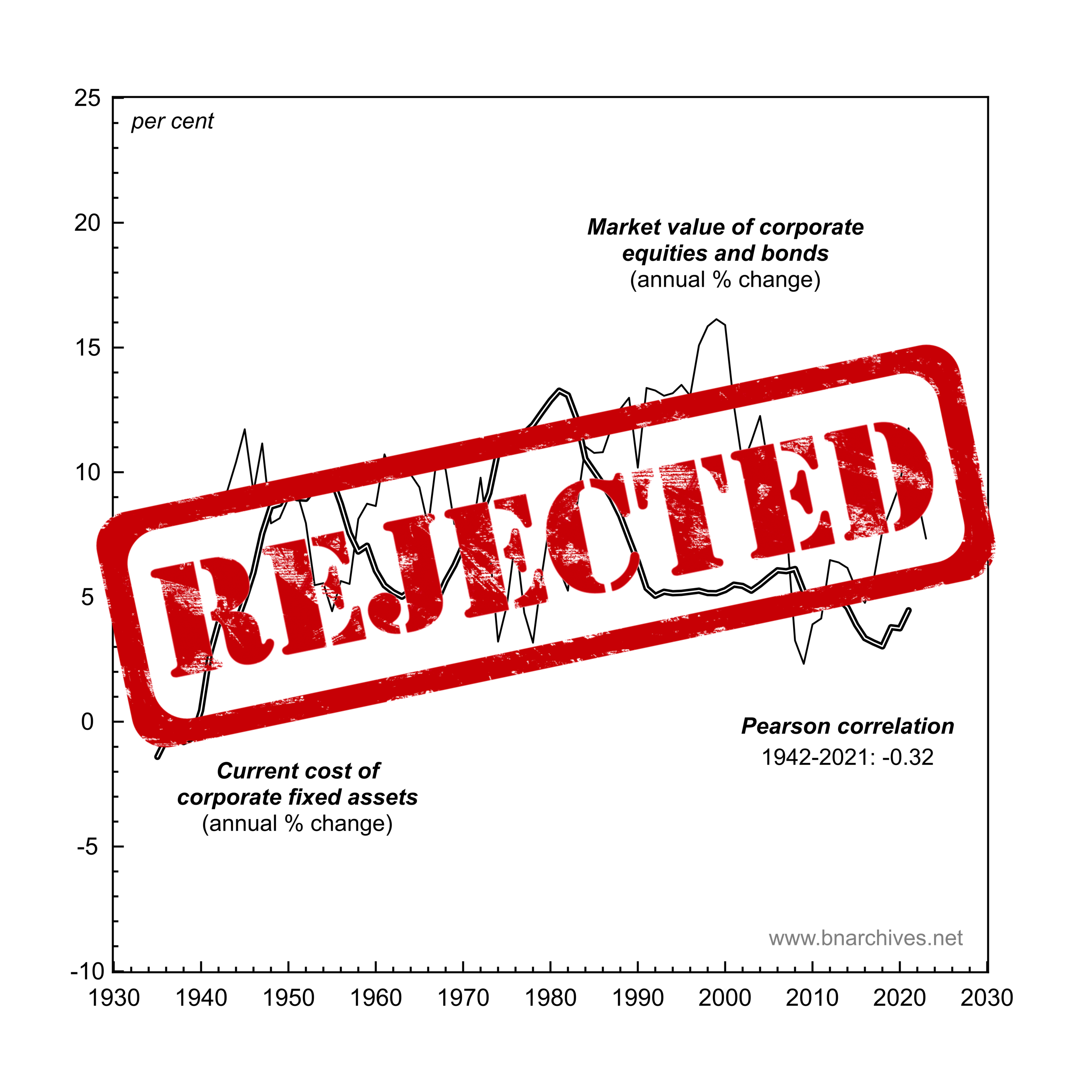

Abstract A recent New Political Economy article by Baines and Hager (2020) critiqued Shimshon Bichler and Jonathan Nitzan’s capital-as-power (CasP) model of the stock market (Bichler & Nitzan, 2016). Bichler and Nitzan’s model of the stock market seeks to explain how financial crises are tied to the (upper) limits of redistributing income through power. Bichler […]

Continue ReadingBaines & Hager, ‘Financial Crisis, Inequality, and Capitalist Diversity: A Critique of the Capital as Power Model of the Stock Market’

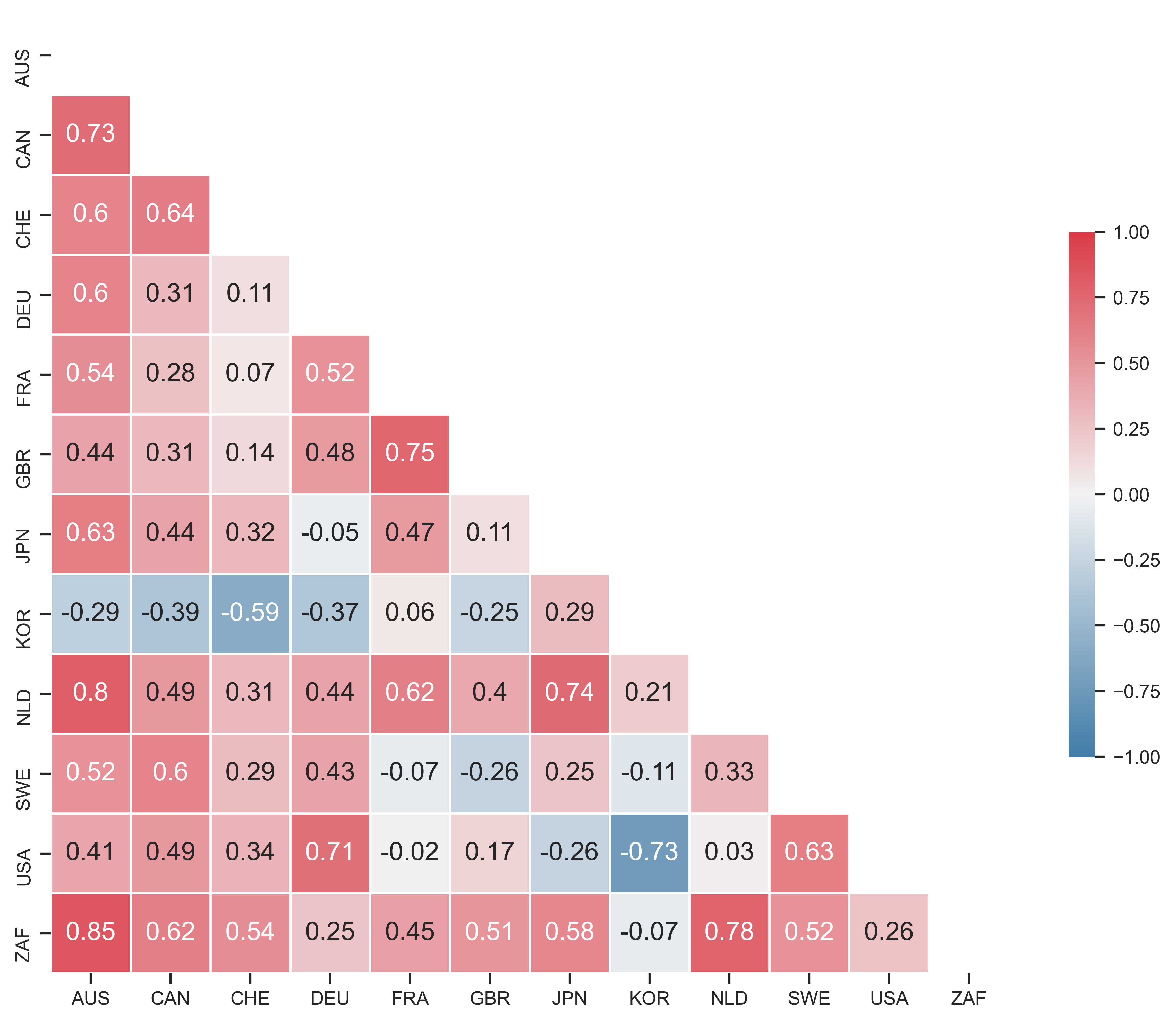

Abstract The relationship between inequality and financial instability has become a thriving topic of research in heterodox political economy. This article offers the first critical engagement with one framework within this wider literature: the Capital as Power (CasP) model of the stock market developed by Shimshon Bichler and Jonathan Nitzan. Specifically, we extend the CasP […]

Continue ReadingNo. 2016/07: Bichler & Nitzan, ‘A CasP Model of the Stock Market’

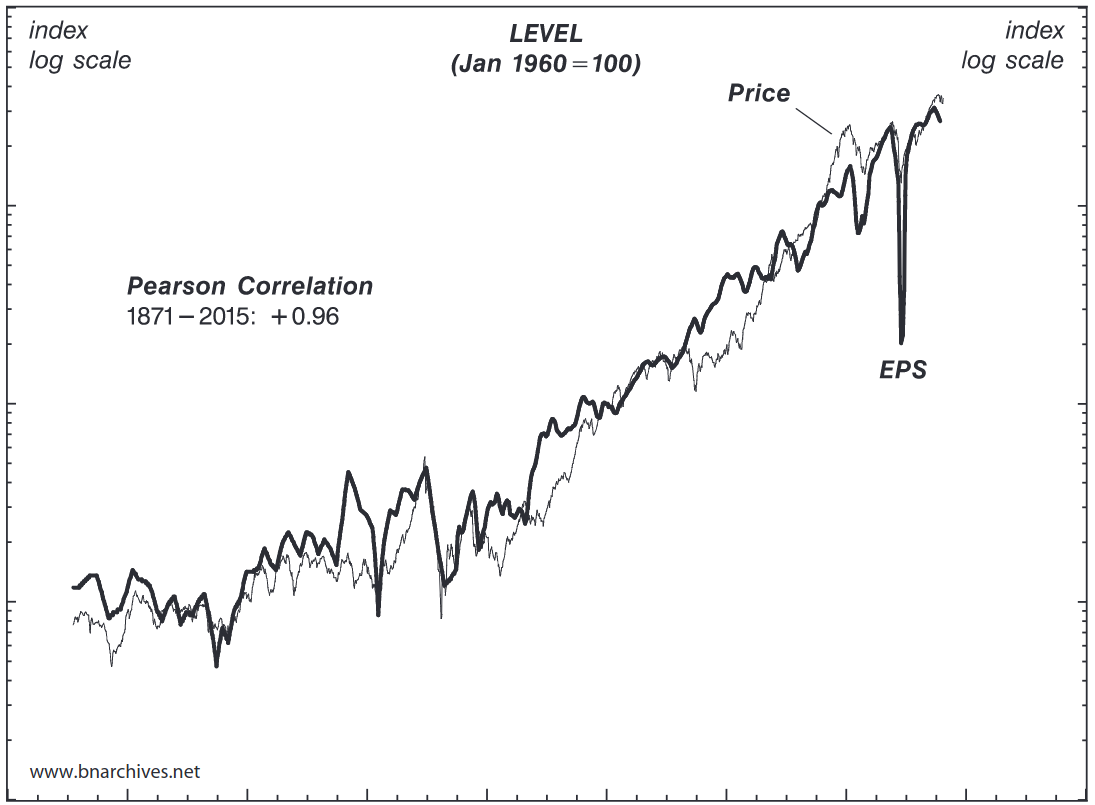

Abstract Most explanations of stock market booms and busts are based on contrasting the underlying ‘fundamental’ logic of the economy with the exogenous, non-economic factors that presumably distort it. Our paper offers a radically different model, examining the stock market not from the mechanical viewpoint of a distorted economy, but from the dialectical perspective of […]

Continue Reading