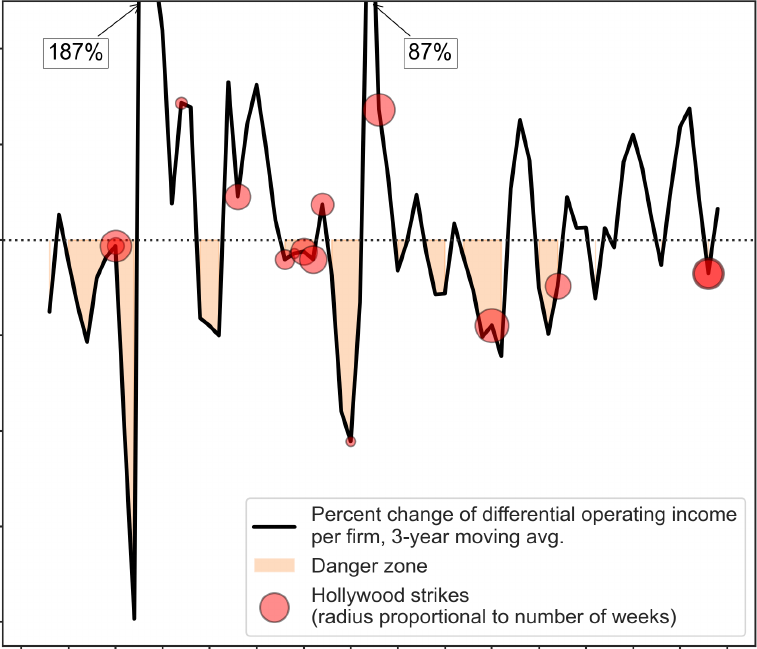

Abstract This paper investigates the timing of labour strikes in Hollywood. The occurrence of strikes, such as the WGA and SAG-AFTRA strikes in 2023, can make sense when we have the hindsight to piece together the historical details of what created rifts between labour and management. But why do strikes in Hollywood occur when they […]

Continue ReadingMouré, Gorsky, ‘No Place to Be Sick: Cooptation and Convergence in the US Hospital Care Sector’

Abstract This paper tries to answer the question: in what ways does the logic of capital accumulation shape the organization of hospital care in the US – a sector characterized by a preponderance of both public and private ‘not-for-profit’ institutions? Rather than taking different hospital ownership types as our analytical starting point, to answer this […]

Continue ReadingDillon, ‘Earning through Obsolescence’

Abstract This study examines the declining usage lifespan of household consumer durables in the United States between 1970 and 2018, situating the phenomenon within a heterodox political economy framework. While mainstream economic narratives attribute the rising rate of consumer durable waste over this time to “overconsumption” driven by consumer materialism, this study challenges that perspective […]

Continue ReadingBichler & Nitzan, ‘The Road to Gaza, Part II: The Capitalization of Everything’

Abstract Our recent article on ‘The Road to Gaza’ examined the history of the three supreme-God churches and the growing role of their militias in armed conflicts and wars around the world. The present paper situates these militia wars in the broader vista of the capitalist mode of power. Focusing specifically on the Middle East, […]

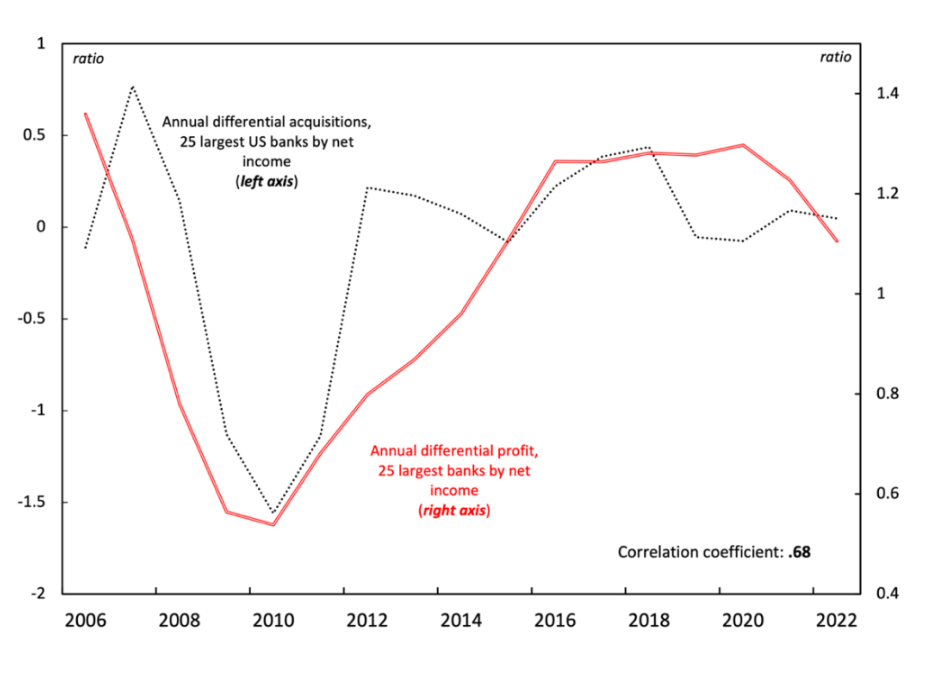

Continue ReadingMouré, ‘Consolidation and Crisis in the US Banking Sector 1980-2022’

Abstract Much of the economic analysis of banking crises focuses on the interplay between concentration and stability. A common theory is that concentration is associated with greater stability, whereas competition is associated with instability. In this view, there is a trade-off between, on the one hand, the higher prices and higher profits associated with a […]

Continue ReadingMouré, ‘A Critical Review of Sandy Brian Hager’s Public Debt, Inequality, and Power’

Abstract Hager’s project examines the historical development of US public debt ownership and its political implications. His main innovation is to approach the topic from the perspective of disaggregated social class and frame questions of public debt ownership in terms of social inequality and power. He tackles four questions: who are the owners of the […]

Continue ReadingBichler & Nitzan, ‘The Road to Gaza’

Abstract The war that started in 2023 between Hamas and Israel is driven by various long-lasting processes, but it also brings to the fore a new cause that hitherto seemed marginal: the armed militias of the Rabbinate and Islamic churches. The Rabbinate militias, embodied in Jewish settler organizations, have taken over not only Palestinian lands, […]

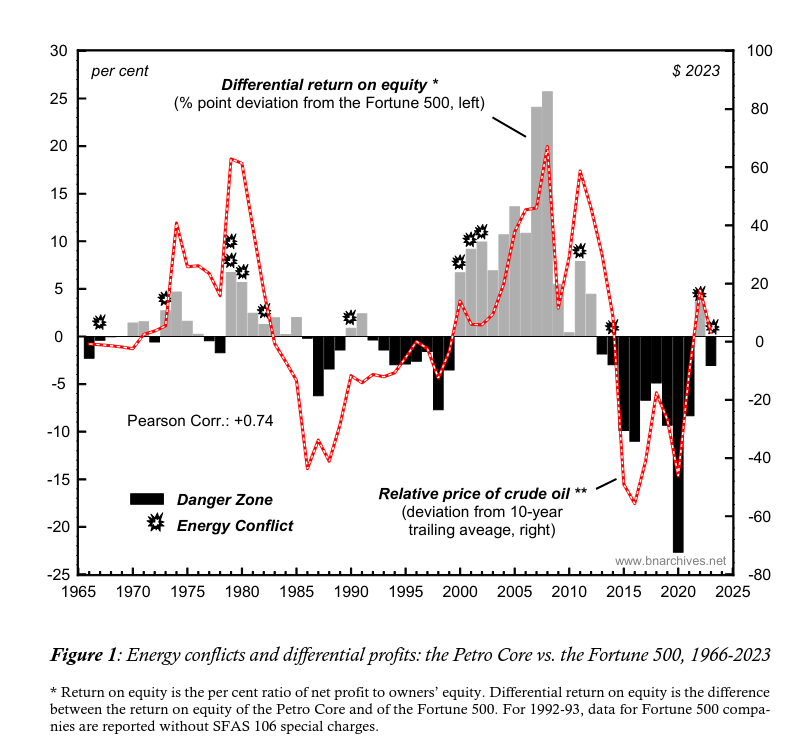

Continue ReadingBichler & Nitzan, ‘Blood and Oil in the Orient: A 2023 Update’

Abstract The 2023 war between Hamas and Israel elicits many different explanations. As with previous regional hostilities, here too, the pundits and commentators have numerous overlapping processes to draw on – from the struggle between the Zionist and Palestinian national movements, to the deep hostility between the Rabbinate and Islamic churches, to the many conflicts […]

Continue ReadingBichler & Nitzan, ‘Regime Change and Dominant Capital: Lessons from Israel’

Abstract Israel’s ongoing crisis – or ‘judicial coup’ in popular parlance – has elicited two opposite responses. The first comes from global rating agencies, economists and investment strategists who see Israel’s country risk rising. The opposite reaction, by Prime Minister Netanyahu and his acolytes, insists that the ‘coup’ is much ado about nothing, and that […]

Continue ReadingBichler & Nitzan, ‘Inflation as Redistribution: Creditors, Workers, Policymakers’

Abstract This paper is part of a dialogue with Blair Fix on how inflation redistributes income between creditors and workers and the way in which monetary policy affects this process. In his 2023 paper, ‘Inflation! The Battle Between Creditors and Workers’, Fix shows, first, that the impact of U.S. inflation on creditor-worker distribution has been […]

Continue ReadingBichler & Nitzan, ‘The Business of Strategic Sabotage’

Abstract Marxists love to hate the theory of capital as power, or CasP for short. And they have two good reasons. First, CasP criticizes the logical and empirical validity of the labour theory of value on which Marxism rests. And second, it offers the young at heart a radical, non-Marxist alternative with which to research, […]

Continue Reading2022/01: McMahon, ‘Star power and risk: A political economic study of casting trends in Hollywood’

Abstract This paper builds an empirical and theoretical model to analyze how the financial goal of risk reduction changed the insides of Hollywood’s star system. For the moviegoer looking at Hollywood cinema from the outside, the function of the star system has remained the same since the 1920s: to have recognizable actors attract large audiences […]

Continue Reading2021/07: Bichler & Nitzan, ‘Steve Keen’s The New Economics: A Manifesto’

Abstract Neoclassical economics is the official scientific underpinning of capitalism as well as its main ideological defence, and according to Keen, it fails in both tasks. Contrary to received opinion, neoclassicism cannot explain capitalism – either in detail or in the aggregate – and the policies it prescribes do not support but undermine the very […]

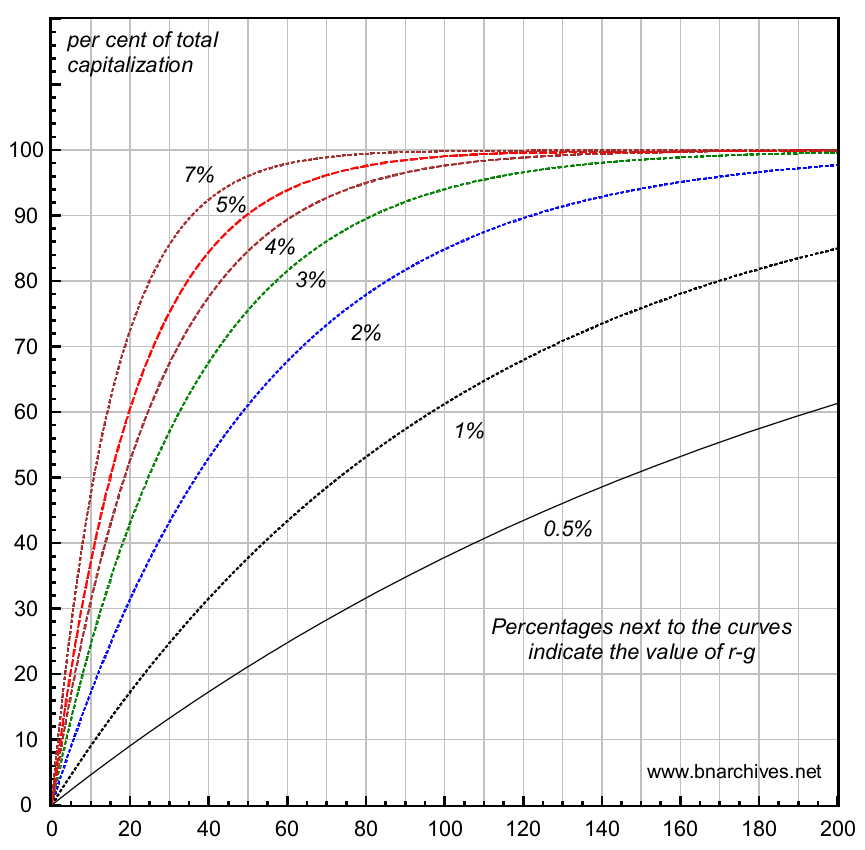

Continue Reading2021/06: Bichler & Nitzan, ‘The Capitalist Degree of Immortality’

Abstract This note offers some speculative ideas worth considering. One of the key features of all hierarchical civilizations is their rulers’ fear of death. This fear was famously narrated in the ancient myth of Gilgamesh – the Sumerian king who realized that, like all other humans, he too was destined to die and embarked on […]

Continue Reading2021/05: Mouré, ‘Costly Efficiencies: Health Care Spending, COVID-19, and the Public/Private Health Care Debate’

Abstract The debate around public versus private health care often turns on cost – that is, on how to reduce costs, and particularly government expenditures, when it comes to health care. This paper examines the theoretical and empirical relationship between health costs and health outcomes in the context of the COVID-19 pandemic. It proposes an […]

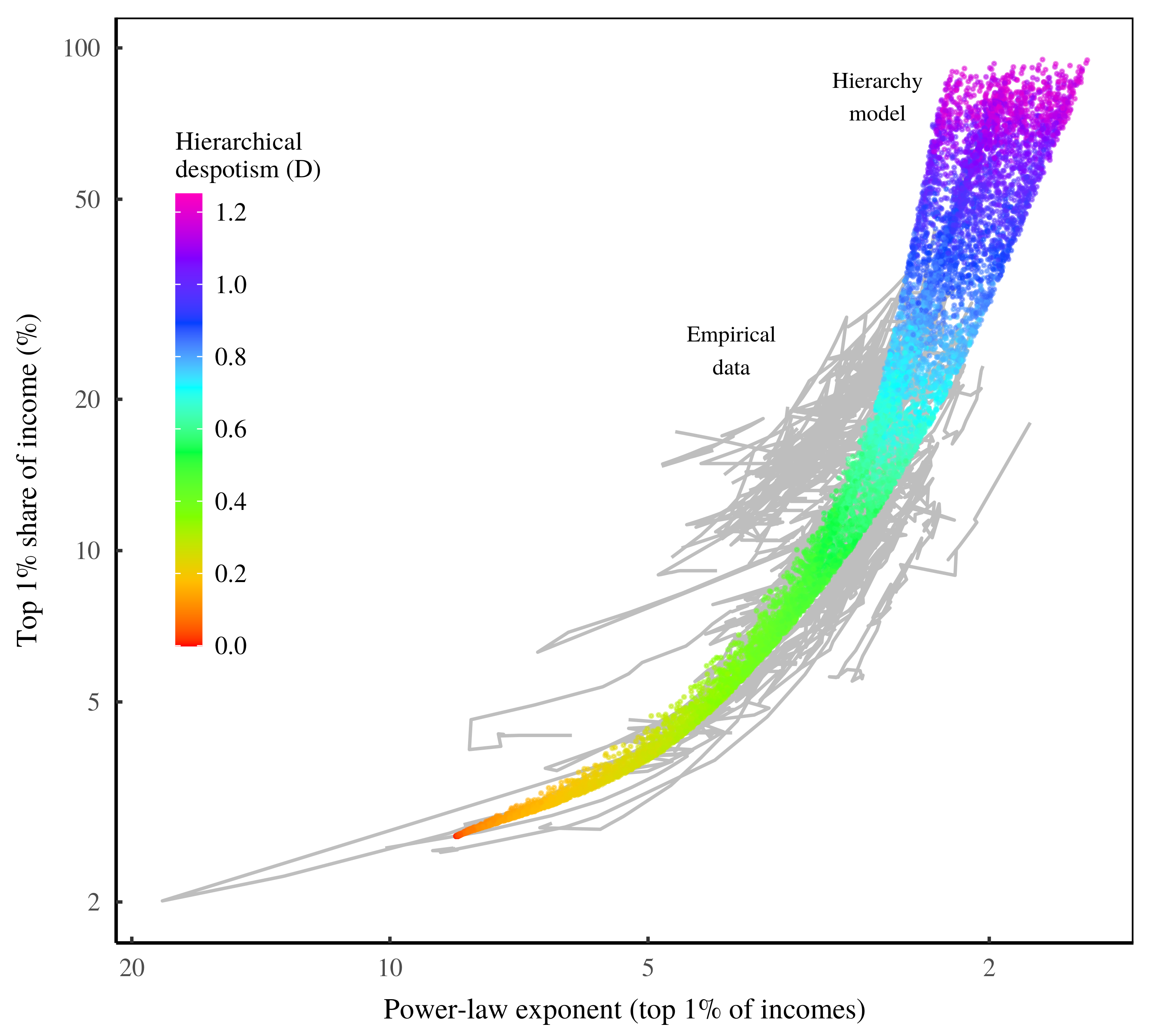

Continue Reading2021/04: Fix, ‘Redistributing Income Through Hierarchy’

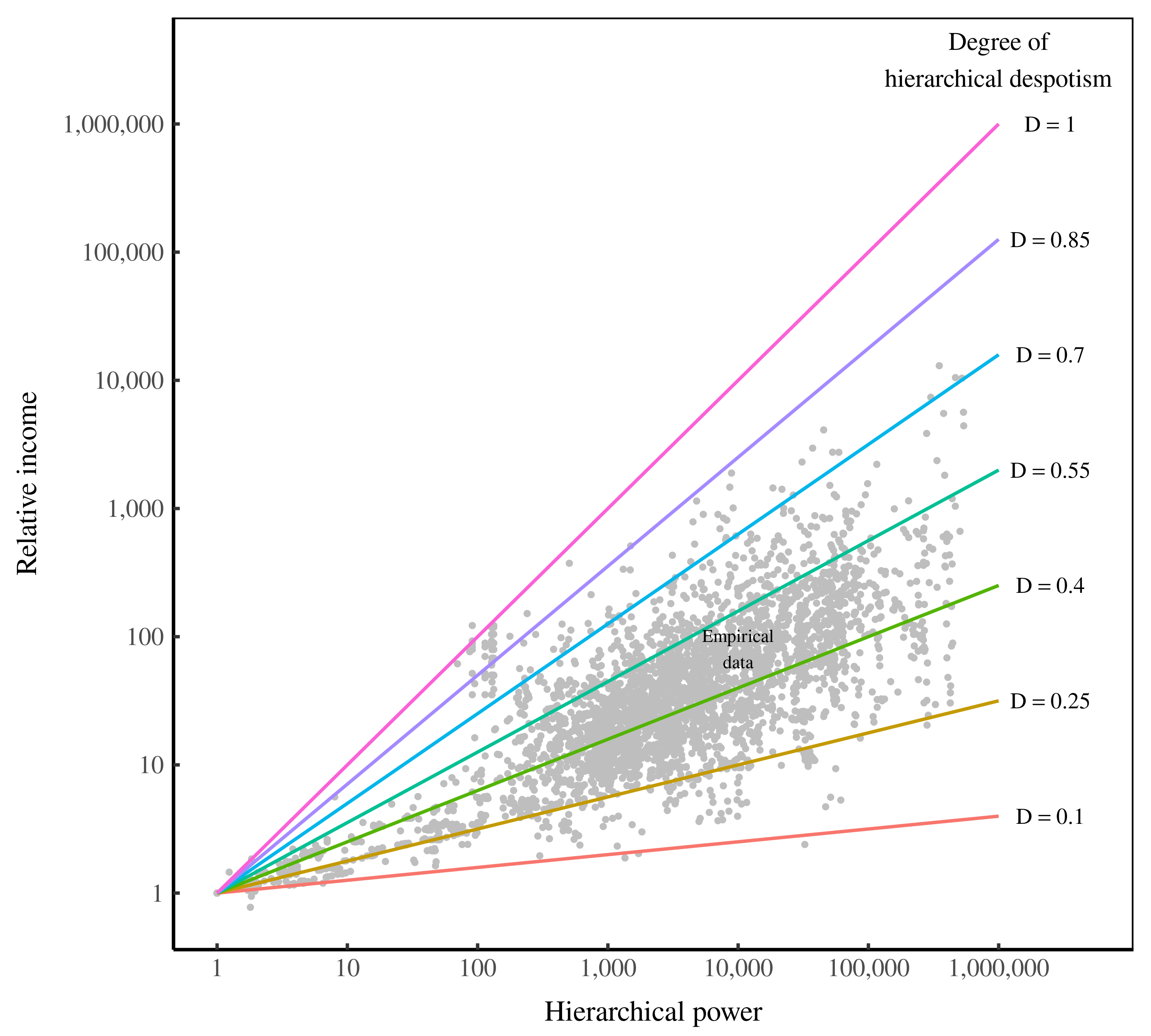

Abstract Although the determinants of income are complex, the results are surprisingly uniform. To a first approximation, top incomes follow a power-law distribution, and the redistribution of income corresponds to a change in the power-law exponent. Given the messiness of the struggle for resources, why is the outcome so simple? This paper explores the idea […]

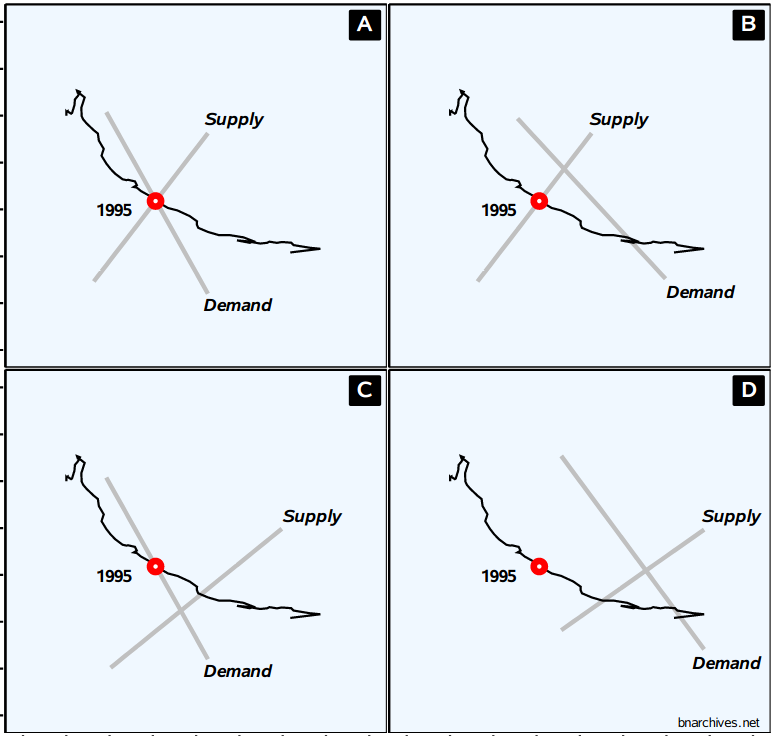

Continue Reading2021/03: Bichler and Nitzan, ‘The 1-2-3 Toolbox of Mainstream Economics: Promising Everything, Delivering Nothing’

Abstract We write this essay for both lay readers and scientists, though mainstream economists are welcome to enjoy it too. Our subject is the basic toolbox of mainstream economics. The most important tools in this box are demand, supply and equilibrium. All mainstream economists – as well as many heterodox ones – use these tools, […]

Continue Reading2021/02: Fix, ‘Living the good life in a non-growth world: Investigating the role of hierarchy’

Abstract Humanity’s most pressing need is to learn how to live within our planet’s boundaries — something that likely means doing without economic growth. How, then, can we create a non-growth society that is both just and equitable? I attempt to address this question by looking at an aspect of sustainability (and equity) that is […]

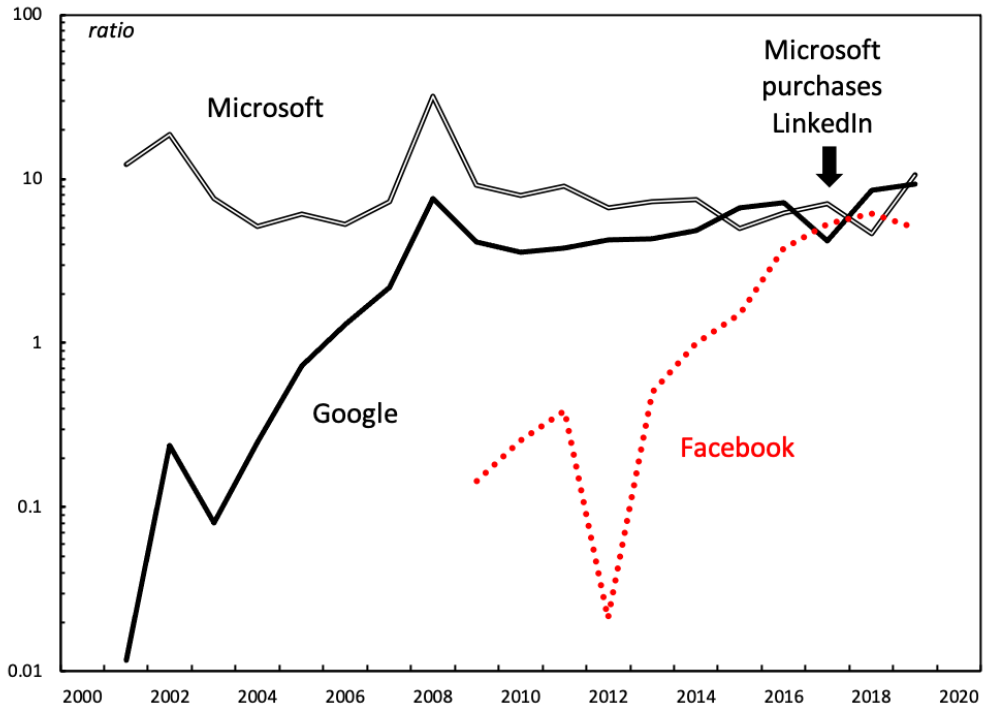

Continue Reading2021/01: Mouré, ‘Soft-wars: The Differential Trajectories of Google and Microsoft – a Capital as Power Analysis’

Abstract According to the capital as power framework, pecuniary earnings, or profits, are a symbolic representation of the struggle for power between different capitalist groups. In this struggle, capitalists measure their own power differentially – that is, relative to other capitalist entities. The focus on differential power, expressed in differential earnings, leads firms to try […]

Continue Reading2020/06: Bichler & Nitzan, ‘The Limits of Capitalized Power. A 2020 U.S. Update’

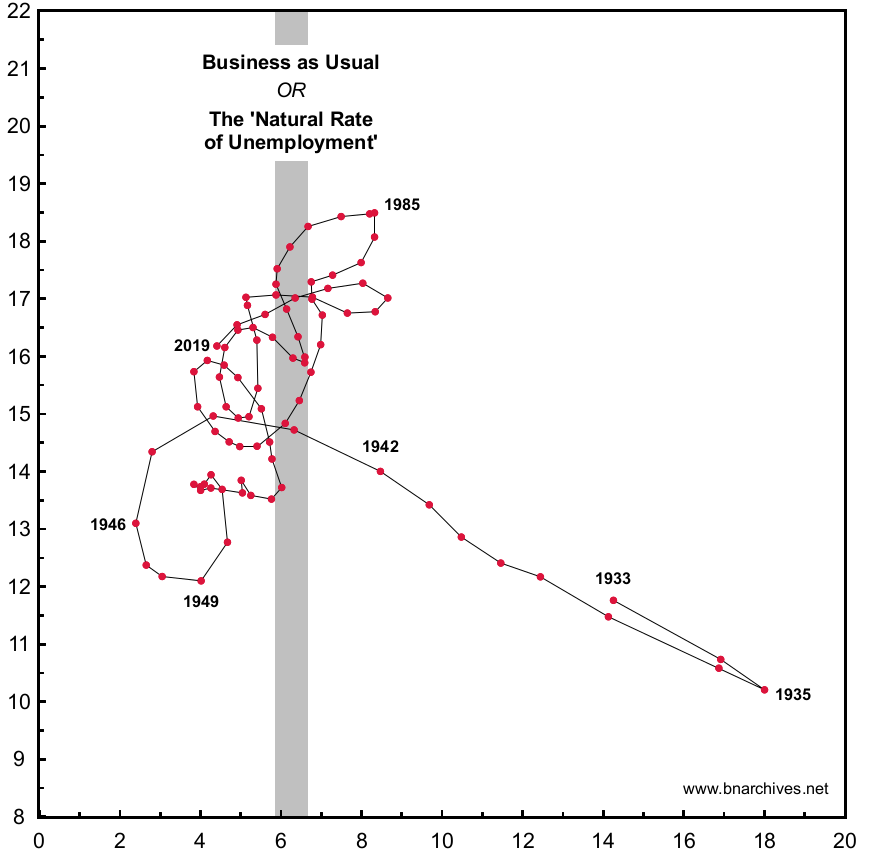

Abstract Until the late 2000s, our work focused primarily on why capitalism should be understood as a mode of power. We argued that capital itself is a form of organized power and researched how capitalists sustain, defend and augment their capitalized power. We called our approach ‘capital as power’ – or CasP, for short. But […]

Continue Reading