Abstract Israel’s ongoing crisis – or ‘judicial coup’ in popular parlance – has elicited two opposite responses. The first comes from global rating agencies, economists and investment strategists who see Israel’s country risk rising. The opposite reaction, by Prime Minister Netanyahu and his acolytes, insists that the ‘coup’ is much ado about nothing, and that […]

Continue ReadingBichler & Nitzan, ‘Regime Change and Dominant Capital: Lessons from Israel’

Abstract Israel’s ongoing crisis – or ‘judicial coup’ in popular parlance – has elicited two opposite responses. The first comes from global rating agencies, economists and investment strategists who see Israel’s country risk rising. The opposite reaction, by Prime Minister Netanyahu and his acolytes, insists that the ‘coup’ is much ado about nothing, and that […]

Continue ReadingWith Great Power Comes Great Fear

Originally published at Economics from the Top Down Blair Fix Over the last year, I’ve watched with horror and amusement as health agencies around the world flip-flopped their advice on how to deal with COVID. My horror comes from knowing this flip-flopping breeds mistrust in science. But I am (morbidly) amused because I know that […]

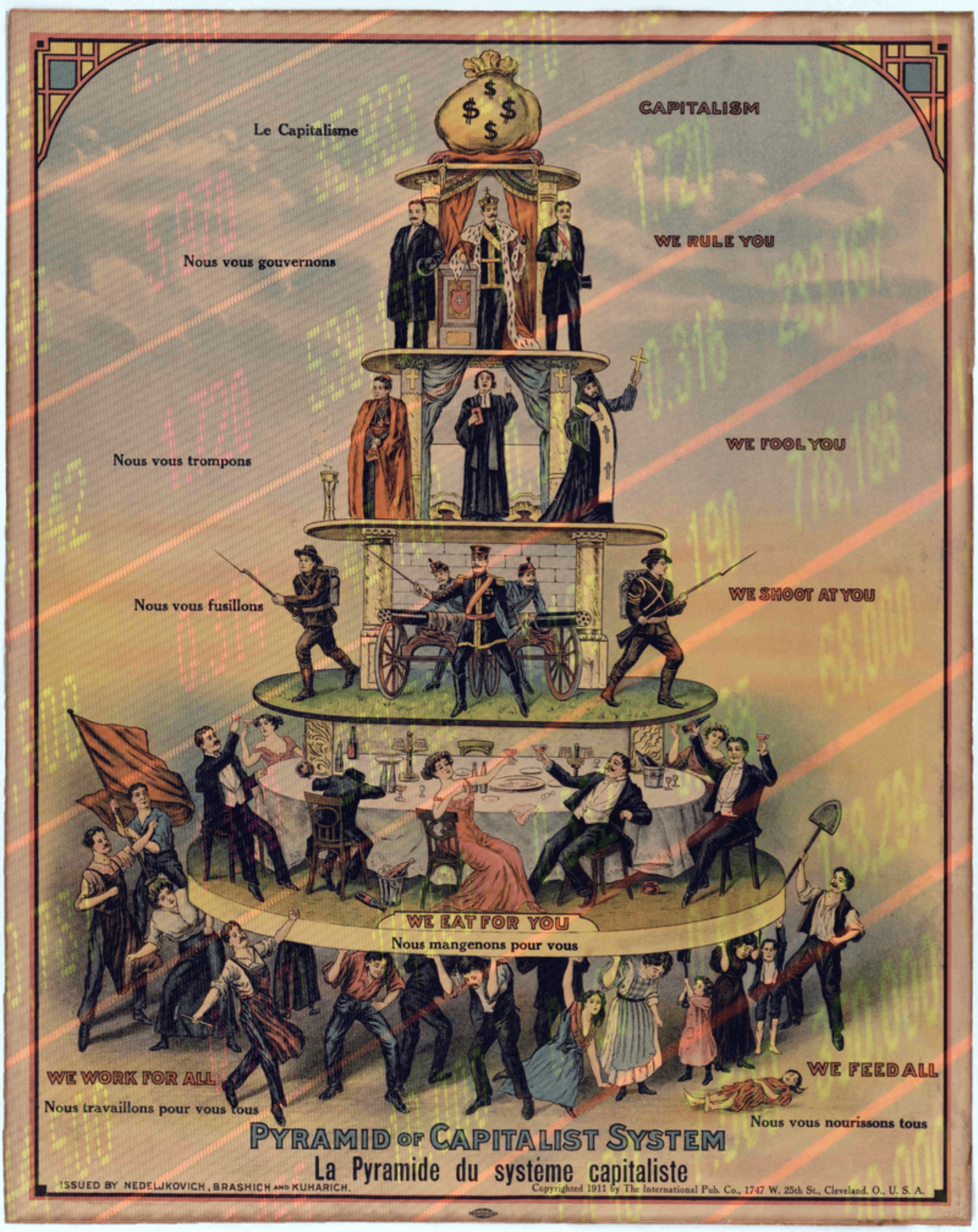

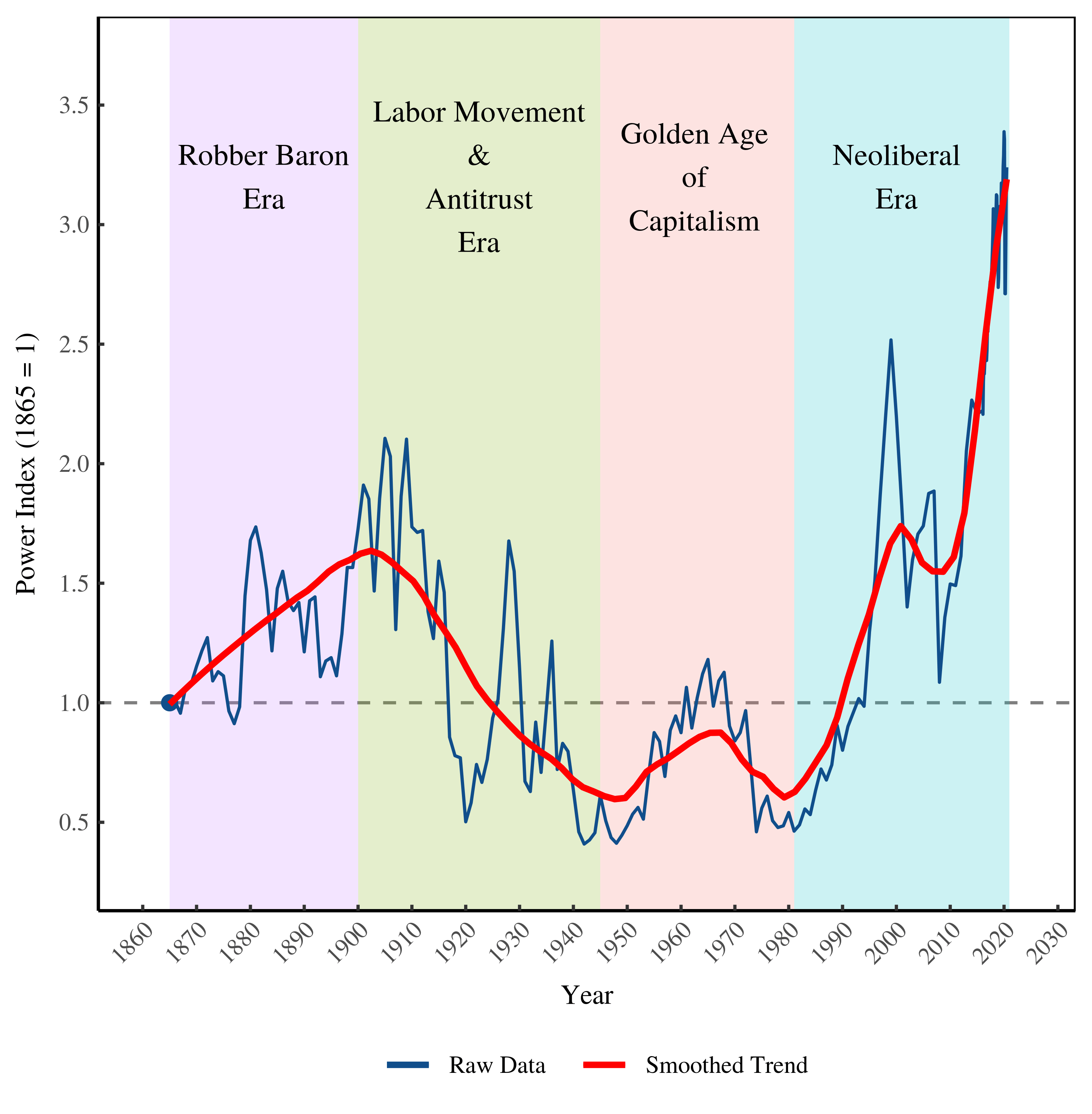

Continue ReadingHow the History of Class Struggle is Written on the Stock Market

Originally published on Economics from the Top Down Blair Fix It was a Thursday in August when all hell broke loose. The place was Logan County, West Virginia. The year was 1921. Over the next week, one million rounds of ammunition would be fired. Up to a hundred people were killed. All told, it was […]

Continue ReadingMcMahon, ‘Reconsidering Systemic Fear and the Stock Market’

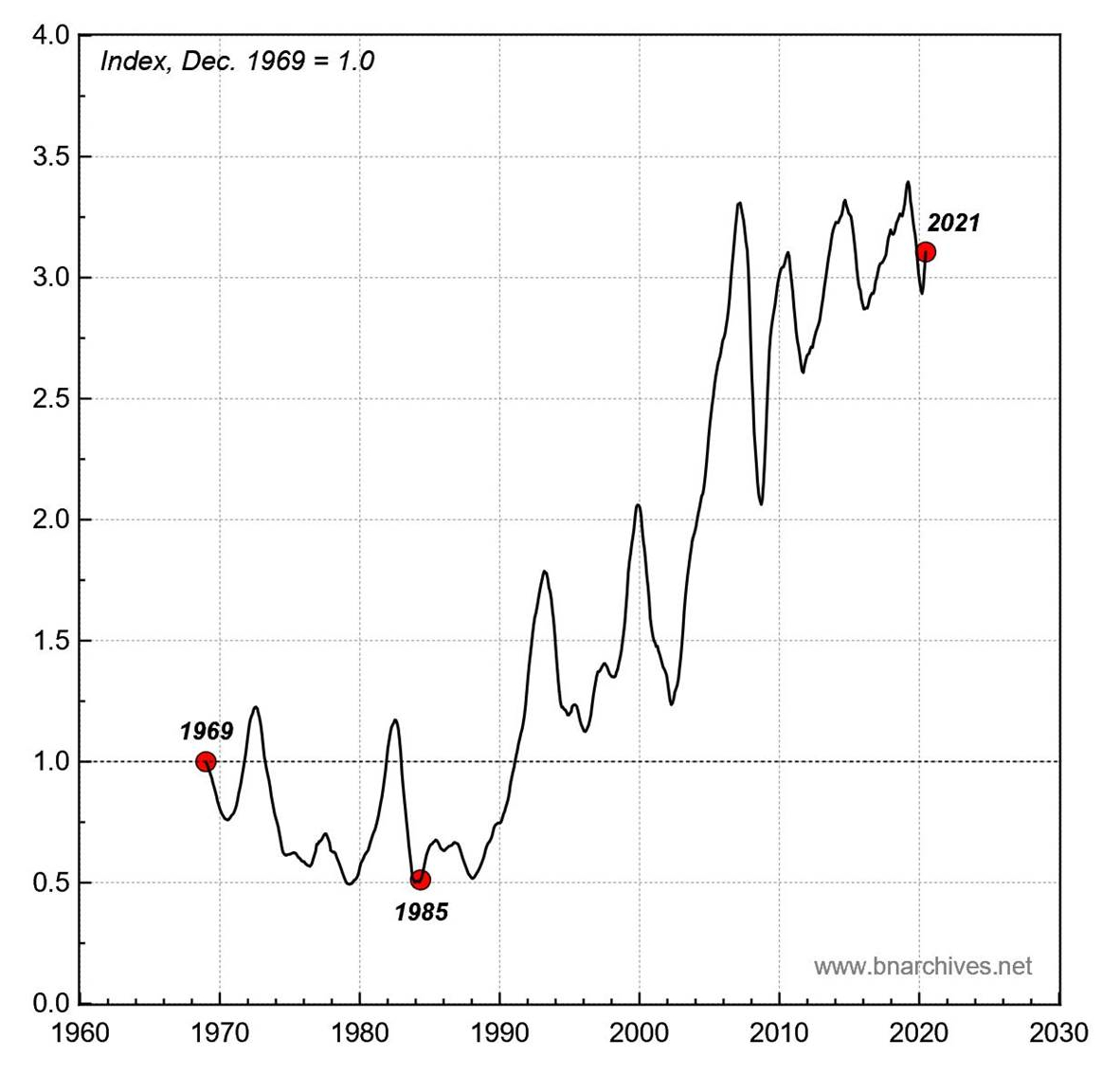

Reconsidering Systemic Fear and the Stock Market A Reply to Baines and Hager JAMES MCMAHON August 2021 Abstract This article responds to Baines and Hager’s recent critique of the capital-as-power model of the stock market. Proposed by Bichler and Nitzan, this model seeks to explain how financial crises are tied to the concept of ‘systemic […]

Continue ReadingStocks Are Up. Wages Are Down. What Does it Mean?

Originally published on Economics from the Top Down Blair Fix If you listen carefully, you can hear Jeff Bezos getting richer. There’s the sound again. Another billion in Bezos’ coffers. Let’s put some numbers to this sound of money. Since 2017, Bezos’ net worth has grown by about $4 million per hour — roughly 500,000 […]

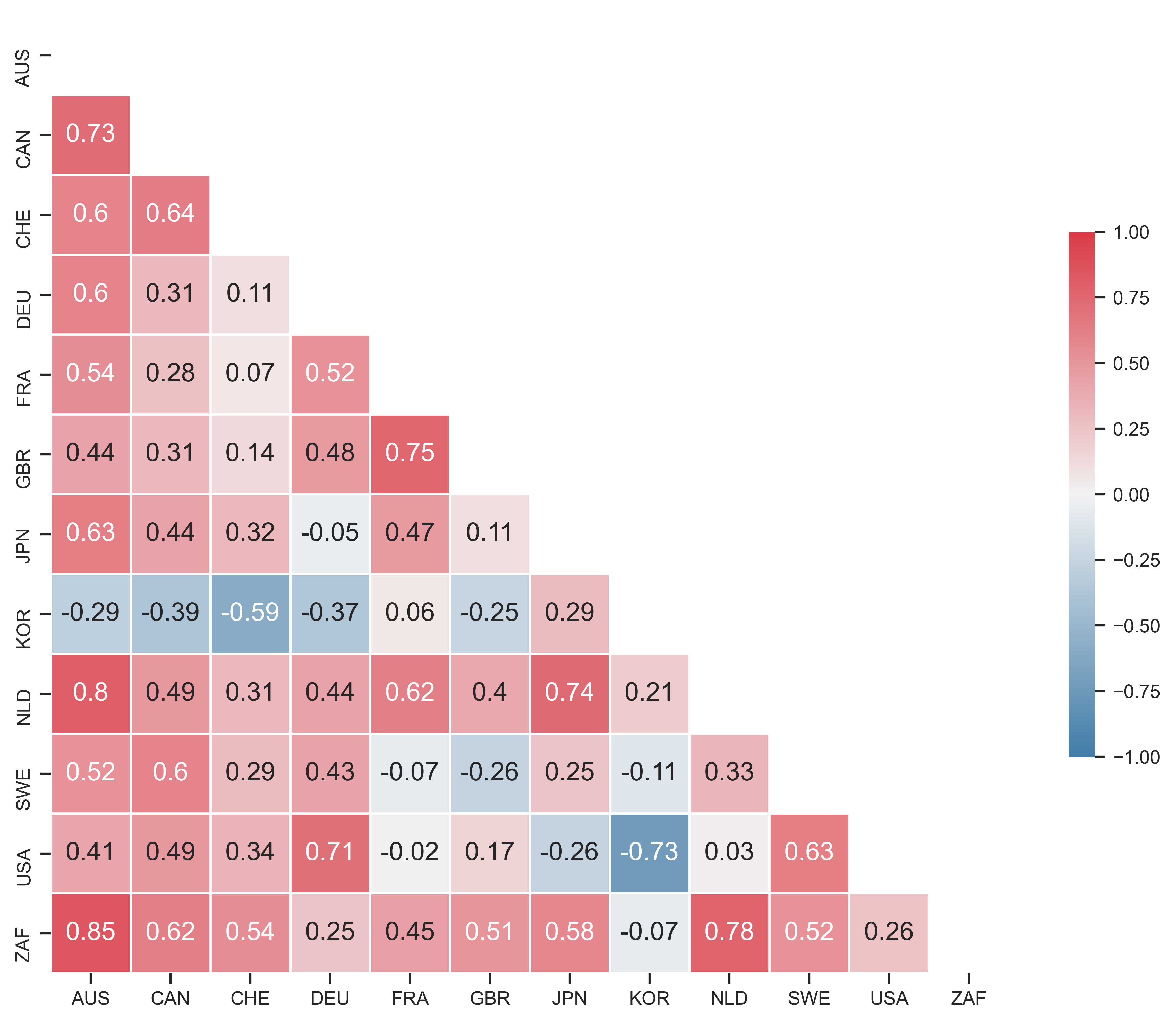

Continue ReadingBaines & Hager, ‘Financial Crisis, Inequality, and Capitalist Diversity: A Critique of the Capital as Power Model of the Stock Market’

Abstract The relationship between inequality and financial instability has become a thriving topic of research in heterodox political economy. This article offers the first critical engagement with one framework within this wider literature: the Capital as Power (CasP) model of the stock market developed by Shimshon Bichler and Jonathan Nitzan. Specifically, we extend the CasP […]

Continue Reading2018/01: Bichler & Nitzan, ‘With their Back to the Future: Will Past Earnings Trigger the Next Crisis?’

Abstract The U.S. stock market is again in turmoil. After a two-year bull run in which share prices soared by nearly 50 per cent, the market is suddenly dropping. Since the beginning of 2018, it lost nearly 10 per cent of its value, threatening investors with an official ‘correction’ or worse. As always, there is […]

Continue ReadingRadiolab: Nanoseconds on the Market

DT Cochrane The second part of this episode of Radiolab talks about the importance of nanoseconds when it comes to profitably making trades. The importance of this small difference led to a land grab as traders tried to get as close to the NYSE’s physical trading floor, since each foot of fiber optic cable between […]

Continue Reading