Forum Replies Created

-

AuthorReplies

-

October 21, 2024 at 2:41 pm in reply to: The dark matter of CasP? What can’t we observe about capitalist power? #250161

First, what is the motivation to incorporate a physics metaphor into CasP theory? For example, if “the quantum of capital exists as finance, and only as finance,” why are you looking to physics–and not accounting– for answers? Every corporate entity (whether private, public, for profit, not for profit, law-abiding or criminal) must nominally follow the same accounting rules for tax purposes. Whether or not you can see what’s in the books of private entities, you know what the accounting rules are. So, why can’t you build testable models based on the accounting rules?

Second, if it is appropriate to borrow metaphors from physics, is “dark matter” the right metaphor to use? From what I can tell, things like dark matter and dark energy are posited because, empirically, their absence implies a violation of the conservation laws physics calls thermodynamics. CasP theory, however, is not premised on conservation laws, and the fact that CasP theory to date has focused almost exclusively on the market capitalizations of publicly traded firms does not mean you need a theory of “dark capital” to understand capital as power in privately held firms. Yes, the fact that privately held firms don’t have market capitalizations may obviate the universality of certain assertions made by CasP theory, but it doesn’t obviate all of them, which suggests that the publicly traded firm, not the privately held firm, is the special case.

In any event, accounting is a system of conservation laws. Mirowski even argues that principles of accounting may have inspired the development of thermodynamics (see, More Heat Than Light.) This is one more reason to look to accounting for answers, not physics.

- This reply was modified 8 months, 1 week ago by Scot Griffin.

September 30, 2023 at 12:25 pm in reply to: Mark, Engels, and Public/Private Credit as Power Index Precursor #249803Sterling non sequitur. A+++.

Have you considered undertaking a similar analysis of other economic data where a consensus number is tracked, like GDP, PMI, or something like that (if such historical data are available) ? See this economic calendar from NASDAQ, which shows several “consensus” numbers, some side-by-side with the actual numbers announced (especially for days before today, which is still being filled in).

I am just wondering how much of what we are seeing is the hype “signal” versus the macro “noise,” and, if the two are related, how much macro expectations influence earnings expectations.

Thanks for sharing.

When actual values are available, my calculation of hype is the natural log of the ratio of an estimate of earnings per share, made four quarters prior, to the actual earnings-per-share value. This is essentially the same thing as BN, but I am taking the log of the ratio to transform the distribution into a more Gaussian shape. Yet taking the log limits this analysis to measures of hype that are composed of two positive numbers. Such a limitation is not as severe as we might think. As I work through this research, I can’t conceptualize (or my math is not good enough) how a ratio with losses would work. Try, for example, to conceptualize what a measure hype would mean when the estimate is positive and the actual is negative, or when both values are negative. When both values are negative, the meaning of the ratio is reversed.

Using Excel or equivalent, you can apply if-then tests to convert negative values to absolute values, and you should be able to use if-then tests to write values that tells you whether each value of the numerator and denominator were negative (-1) and/or positive (+1) so you can compare the differences more accurately. At least I think I can imagine graphing that kind of data . . . (maybe using 4 different values mapping to 4 quadrants 1/1, 1/-1, -1/1, and -1/-1, then doing a separate graph that essentially does a quadrant count sorted by implied difference; I don’t know for sure.)

January 10, 2023 at 2:51 pm in reply to: What’s the breadth of “Breadth”? What’s the depth of “Depth”? #248838Apologies for the annoyance, Scot.

And the same to you, James.

January 10, 2023 at 2:15 pm in reply to: What’s the breadth of “Breadth”? What’s the depth of “Depth”? #248833Who is this “we” in this search for similarities and equivalencies? There are unstated premises in this argument about method and the promises of historical research, so I am not clear about the things I am guilty of not doing well or at all.

Apparently, the “we” is just Jordan and me.

Lastly, how useful might the internal/external, breadth/depth matrix be to understanding other modes of power I wonder?

So it seems there is some scope for concepts like breadth and depth to understand other modes of power, albeit in a less systematic way absent a CasP level model of that mode of power.

Or did my reading comprehension fail me this time?

Scot, I apologize if I came across as a hall monitor catching you breaking a school rule. I fully support any experimental modification to any method — I like to think that I have been able to make a few modifications myself — but the reference to a specific footnote about DA was a bit curious.

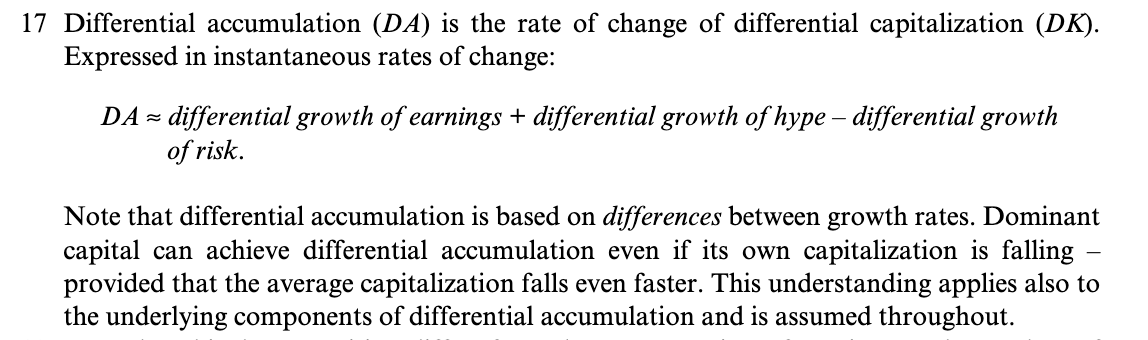

I referred to footnote 17 in a misguided attempt to avoid triggering a response like yours. I abstracted away the detail of growth rate and cited to the footnote to indicate (1) I was aware that within CasP it is growth rates that matter, and (2) provide the most simple and complete statement of differential accumulation/growth according to CasP, i.e., I was not hiding the ball, I was telling everyone exactly where to find it (and you did!).

If you think BN’s definition of differential growth is limiting, why must the abstraction come from a source that is constructed of variables you think are not helpful? Rather than interpret BN’s DA as really talking about differential growth in general, build a different pathway to your theory. To make BN’s version of DA function as a concept for all historical modes of power, you do have to empty it of all content. And then what is left? As you put it yourself, what in world would we be saying if we stated that a feudal lord or slave owner needed to differentially accumulate?

I was just trying to help Jordan think through the problem as he presented it (my response that referenced footnote 17 literally quoted the response in which Jordan referred to using CasP concepts to understand other modes of power, i.e., the second quote from Jordan, above).

Do I think BN’s definition of differential accumulation/growth is limiting? No, not in and of itself, and certainly not with respect to capitalism, but if, like Jordan, you are trying to extend the concept of differential accumulation to modes of power other than capitalism, you do have to “empty” at least some of CasP’s detail. Do you have to empty all of it? No, not if you free yourself of Marx’s framing of prior modes of production as stand-ins for prior modes of power and focus first on what makes those modes similar (compounding interest) before focusing on what makes them different. Then the central question becomes what is the difference that capital makes (my view: by cleaving the function of storing value from money itself and assigning it to finance, the innovation of capital eliminated the constraint that hoarding money placed on the economy and thus changed the nature of political economy from a zero-sum game to one that nominally permits perpetual growth). At least things seem that straightforward to me, but more work needs to be done, and I could be mistaken.

I’m of the opinion that the incompleteness of differential measures of dominant capital makes it very easy for bad or lazy CasP research to be done. But that assumes the researcher is doing the bare minimum with a quantitative measure; and does the possibly for someone to do bad CasP research invalidate the method? I am not going to list all of the work I respect, but excellent CasP research knows that a measure of differential capitalization says, on its own, very little about how a firm or set of firms successfully differentially accumulated over a period of time. The harder job is to carefully demonstrate that relevant phenomena, including a qualitative history, corroborate a theory that, even in empirical measures of the stock market, we are witnessing processes of power.

Again, I was not discussing CasP research. I was discussing whether and how CasP concepts can be applied to prior modes of power. As indicated by my quasi-footnote, however, I have seen instances where the concepts and terminology of differential accumulation regimes have been applied to the “strategy” of a single company, e.g., Walmart, and that is what I was objecting to as misguided, in part because the available data may not tell the whole story, i.e.:

In any event, breadth and depth are best viewed as regimes at a macro level (e.g., individual industries or dominant capital writ large) and should not be viewed as strategies undertaken by individual firms.

The written word is superior to the spoken word in many ways, but that does not negate the possibility of misunderstanding one another. I actually expect you and others here (looking at you, Jonathan) to act as “hall monitors,” especially if an interloper like me gets something obviously wrong. This is the CasP forum, not the Scot Griffin Pontification Channel. In this particular instance, I think you’ve been a bit overzealous in your hall monitor role, but I am okay with that, if you don’t mind me being a little annoyed (which I am, but I will get over it).

Hi Scott, for reference, Marx’s Communist Manifesto and Capital Vol II and III are where he digs into his class analysis. Marx distinguishes between the bourgeoisie (Capitalist class capable of purchasing labour) Petit Bourgeousie (Wealthy people who do not purchase labour), Workers, and Lumpenproletariat (comprised of unemployed, disabled, homeless and outcast portions of society).

Thanks, Pieter. I have all those volumes and was able to refresh my basic understanding by re-reading the relevant section of the CM. Things seem more spread out in Capital, but I am enjoying the journey (unlike CM, which I read over a decade ago, I’ve only consulted Capital for specific topics, none of which were his class analysis).

I think that it would be highly reductive to limit class analysis to the rulers and the ruled, as this essentially ignores the fuzzy lines that are often drawn by the intersections of hierarchies that interact in different ways and different contexts. Hence me bringing up this subject in the first place.

Another way to frame the inquiry is whether the concept of class exists at all within the CasP framework. I think Bichler and Nitzan intend CasP to comprehend class, but are there bright line class divisions when everything is relative/differential? Lumpenproles, for example, have no power and simply do not exist within a mode of power but outside it. Under capitalism, almost every master is a servant, and almost every servant is a master.

Regarding the sole proprietor and the GS employee, isn’t the difference in mobilization due to the fact the sole proprietor mobilizes individuals while the GS employee mobilizes hierarchies of individuals?

If we limit our framework to viewing only the economic realm and the workplace, then this might fit, but in essence, the small business owner is limited to their employees and their small financial reach in the ability to exert their will, while the GS employee can mobilize the hierarchy beneath them, and has the fiscal means to mobilize much larger swathes of the population outside of the workplace.

As a major shareholder of many companies, even low level GS employees are capable of mobilizing hierarchies completely outside of GS. (I speak from experience; not fun) In corporate-speak, you might call this kind of relationship as major GS investments having a dotted line reporting relationship with GS.

CasP offers us the ability to look at how power is capitalized differentially at different intersections of hierarchical domination. Rather than simply looking at absolute wealth, or absolute relation to property, as the Marxist Class Analysis does, I think CasP offers us a more refined framework in which to approach Class Analysis. By looking at the Power of various hierarchies, from the business firm, to race relations, to governmental legal frameworks, to the various social phobias (homophobia, xenophobia, ageism, sexism) we can find the contexts of where these hierarchies intersect, and judge each individual’s relation to power, thereby introducing a highly granular and contextualized Class analysis.

That’s a novel and interesting insight. Again, I think reframing class in CasP terms may cause class to disappear because class defined in terms of differential power will be differential and, therefore, contextual. Still, it seems like a potentially fruitful area of inquiry.

One of the most prevailing ideas within Marx’s work, is the Class Analysis with class being determined in relation to the Means of Production. While the gist of class struggle tells a good rhetorical story, it feels like the MOP Class Analysis leaves much to be desired in the modern context. So I wonder if there is room for an improved class analysis from the CasP perspective with Class being determined by relation to Power rather than MOP Class, when viewed through the lens of power, instead of as a relation to production, is a kyriarchal power relation. The person working at Goldman Sachs as a mid-level employee earning a 7-figure salary annually has more power than the small business owner clearing 10K profit annually. When someone wishes to mobilize people to do their bidding, under capitalism, this means treating people’s labour like a commodity for sale. The 10k small capitalist can get a few people to do some things, while the Goldman Sachs employee can get a much larger group of people to do things. This is Power Over people. If we were to treat class as a relation to means of production. The Goldman Sachs employee would be working class, while the Small Business owner would qualify as petite bourgeoisie. Clearly, relation to Means of Production is not a good lens for viewing class. And I say it is Kyriarchal, because that Goldman Sachs worker might be a Black Trans Woman facing other forms of oppression, while one of their coworkers is a White male earning the same salary. Both of them might have the same capacity for exerting their will, but they do not have an equal confidence in the obedience of those they seek to mobilize to enact their will. Class should be viewed through this complex lens of Power relations that include matrices of intersectional domination.

Pieter,

First, I am not as familiar with Marx’s class analysis as I should be, so any pointers on what to review to deepen my understanding of it would be appreciated.

Second, doesn’t CasP already have some form of class analysis, i.e., the rulers and the ruled as mediated by the market and capital? Or does that just beg the question of how did the classes coalesce in the first place?

Regarding the sole proprietor and the GS employee, isn’t the difference in mobilization due to the fact the sole proprietor mobilizes individuals while the GS employee mobilizes hierarchies of individuals? How should CasP’s class analysis account for hierarchically-induced dynamics, if at all? Hierarchies are built one master-servant relationship at a time, but what constitutes the master-servant relationship is often contextual (creditor-debtor, employer-employee, societal norms, etc.). Power is always personal, but it is most often projected through impersonal means. The more one must project power personally, the less power one has. Hierarchies provide leverage.

January 8, 2023 at 2:42 pm in reply to: What’s the breadth of “Breadth”? What’s the depth of “Depth”? #248821Remember that capitalism’s differential accumulation (DA) is determined by differential growth. See, Chapter 14, footnote 17 of Capital as Power (2009) at page 328.

Differential growth rates of earnings, hype and risk. These are not necessarily tied to growth of production, especially in terms of expanding with the building of new green-field technology.

Differential growth rates of earnings, hype and risk. These are not necessarily tied to growth of production, especially in terms of expanding with the building of new green-field technology.If the goal is to search for analogs to CasP’s concepts of breadth and depth in other modes of power, insisting on using the precise metric with which CasP measures differential growth is unnecessarily limiting and, ultimately, misguided. You won’t be able to see anything because you’re wearing CasP blinders. We are searching for similarities and equivalencies, not identity, so it is better to abstract away some of the details to widen our field of view.

S-curves and other business cycle theories tend to fall into a common problem: stagnation is the twilight of business enterprise, which makes the next wave of growth the logical transformation or rejuvenation of what stagnated. The breath and stagflation indices (see also the work of Joe Francis) do have periods and amplitudes, but these are observed empirically, rather than theorized as a mechanical motion of a capitalist engine. ***Edited add: (It’s easy for abstract theory to make a historical pattern or tendency seem overly structural. For a good example of someone trying to think of hype as a business cycle, but without going too far in terms of defining an inherent rule of capitalist development, see the creative work of Yuri Di Liberto).

I made no claims about the s-curve other than the one I made, which is that the relative maturity of an industry largely determines the regime of differential accumulation firms in that industry find themselves in at any given time. The s-curve asserts the growth rate of an industry changes over time, an assertion that would seem to have empirical support. If the goal of a capitalist firm is to beat the growth rate of a benchmark (“the average”), which CasP says it is, then the maturity of an industry has a large effect on which strategic choices are available to a firm competing in that industry.

In any event, breadth and depth are best viewed as regimes at a macro level (e.g., individual industries or dominant capital writ large) and should not be viewed as strategies undertaken by individual firms. “Green-field” is only available when an industry is emerging, for example. If a large incumbent firm seems to be engaging in green-field growth, it is more likely engaged in anti-competitive behavior. See, Microsoft v. Netscape, Wal-mart v. local general stores, and Borders Books v. local booksellers.*** On the other hand, no firm in an emerging industry will ever engage in a depth “strategy,” which would gift market share to its competitors and doom it to failure.

*** CasP analysis relies on macro level stock market and economic data that necessarily is incomplete: the data only reflect what is measured. So, the stock market measured the growth of retailers like Wal-Mart, Target, Borders Books, and Home Depot, but it did not measure the destruction of local retailers that fueled that growth. What is green-field to the stock market may be long-plowed, well-known ground to the market more broadly, just as North America was green-field to the Europeans but not to the indigenous peoples who had lived here for thousands of years.

January 4, 2023 at 5:59 pm in reply to: What’s the breadth of “Breadth”? What’s the depth of “Depth”? #248813Thanks for the reply Jonathan! That really clears things up about how and why breadth and depth is defined and used in CasP.

The reason we prioritize Equation 3 over other decompositions is theoretical. In our view, social power, including capitalized power, is exercised over people and by people. The exercise and impact of this power are multidimensional, of course, spanning much of what happens in society. But it is often useful to address this exercise/impact at two distinct levels, by looking at (1) direct power over the entity’s employees (breadth), and (2) indirect power, exercised through the activities of those employees on the rest of society (depth).

So it seems there is some scope for concepts like breadth and depth to understand other modes of power, albeit in a less systematic way absent a CasP level model of that mode of power. Perhaps something along the line of “(1) direct power over the entity’s [objects of domination] (breadth), and (2) indirect power, exercised through the activities of those [objects of domination] on the rest of [the broader social arena] (depth)” Whatever the case, this clarifies the CasP approach. Thanks!

Remember that capitalism’s differential accumulation (DA) is determined by differential growth. See, Chapter 14, footnote 17 of Capital as Power (2009) at page 328. Breadth and depth are just another way to say expansion and contraction (or consolidation), and which regime an industry finds itself in is largely determined by where it is on the so-called s-curve.

While differential growth likely is important to prior modes of power, the question is differential growth of what? I don’t think viewing feudalism and slavery as modes of power is useful in answering that question.

- This reply was modified 2 years, 5 months ago by Scot Griffin. Reason: Removed extraneous draft language

January 3, 2023 at 11:16 am in reply to: Is power a thing in itself or the space between things? #248805This is also why I continue to lean towards seeing power as denoting a relationship. To treat power as an attribute, something to accumulate (in absolute terms) or as a means to an end, risks making the same mistake as economists: claiming to have privileged insight into some underlying natural forces that can only be effected by power, rather than defined by it.

Capital is society’s debt to those who hold it, and debt is something that denotes both a relationship and a quantity.

In capitalism’s credit money system, money represents unpaid debts. When debts are paid, money is destroyed. Capitalists use capitalization– the process of arbitrating between present and future prices of the same thing via compounding/discounting– to capture money as profits, interest, etc., so that money cannot be used to pay off debts. This captured money accumulates as capital within the financial system. Hence, capital accumulation, at least as it relates to money capture, is the accumulation of unpaid debts. (Capital created through the appreciation of capital assets does not involve the capture of money.)

December 23, 2022 at 8:52 pm in reply to: Effective Discount Rate or the Reciprocal of the Trailing P/E #248788The effective discount rate is, indeed, the reciprocal of the trailing P/E ratio. There is nothing particularly inventive or insightful about it. For that reason alone, I question its value to CasP even pedagogically.

I’m not sure I follow this logic. Yes, what I call the ‘effective discount rate’, is the inverse of the trailing P/E ratio. But I don’t follow how this means there is nothing insightful about it. What is interesting is that capitalist agree to capitalize by relating prices to earnings. There is no objective reason they must do so. It is an ideological choice. Now, educated capitalists know that they should care about price-earnings ratios. So my analysis doesn’t tell them anything new. But that’s not the point. As I see it, what CasP does is similar to what anthropologists do when they study foreign cultures. These cultures clearly know what they believe — for example that a king’s power stems from god — but the anthropologist looks at this ideology from a structural perspective, rather than simply accepting it as ‘the way things are’.

If you avoid applying the reciprocal P/E ratio to individual stocks, there might still be value in it. The problem is CasP’s capitalization formula is simplified to such a great extent that it is best used making broad brush strokes. It is not suitable for filling in fine details. See my response to JCM as it relates to companies with similar P/E ratios and vastly different rates of return.

The problem with calling the reciprocal of the P/E ratio a discount rate in any situation is that it demonstrates complete ignorance of what the natives actually think and believe. They know what a discount rate is and how it is used, and they know the P/E ratio doesn’t tell you anything about it. If you want to use reciprocal P/E to make a point, call it something else

The effective discount rate has no value to CasP analytically because it cannot be correlated to the expected rates of return and, by definition, they must be identical. If they could be correlated, they would be correlated, but they have not been, and the data you adduce in 1. and 2. don’t contradict that conclusion (which is why I find them to be a non-responsive deflection).

I think the main argument, in CasP, is that capitalist claim to look to the future, but in practice, look to the past. So there is a herd behavior where capitalists agree — with varying degrees of uniformity — that future earnings will be similar to the recent past. Of course, this belief system is a rich topic for inquiry that needs a lot more research. For example, I’d like to see sociologists get involved and do qualitative analysis of capitalist’s actual expectations. It would be interesting to see how these beliefs relate to the things like the systemic fear index. My reading of your comments is that there is much more research to be done. If a capitalist claims to be using capitalization formula x, then we should take them at their word and study how this formula is applied. To wrap things up, I think what Jonathan is getting at is that capital as power research starts with a very general hypothesis (capitalization is an act of power), but then typically asks very specific empirical questions. Speaking for myself, I find your comments quite interesting. But perhaps you could simplify them into specific research questions that we might answer with data.

I understand that you believe the data you have seen show capitalists really look to the past, not to the future, but are there are other data out there that might lead you to change your opinion? For example, have you spent any time with actual free cash flow models and how they project future free cash flows and terminal values to determine the current intrinsic value of a stock based purely on those projected cash flows (other than using the free cash flow of the prior year as the baseline from which growth is projected)?

I spent time earlier this year tearing apart Stock-Analysis-on.net’s free cash flow analysis methodology, and I have their free cash flow models for several companies in Excel files. It shouldn’t take me along to finish the summary of method document, and I would be happy to share that and some of the data via Dropbox or Google Drive. (I will confirm with the owner of the site that he is okay with my sharing with researchers.) Just let me know.

December 23, 2022 at 8:29 pm in reply to: Effective Discount Rate or the Reciprocal of the Trailing P/E #248787What can you show us about rates of return? And if you lack the evidence, what do you need in order to show us?

Annualized rates of return are available for every publicly traded stock and the SP500, generally. See, for example, the SP500 website and click on any of the “1 Year”, “3 Year”, and “5 Year” tabs above the chart, for example. You can also go to a basic finance website and compare graphically relative rates of returns. Here is a 10 year chart at Yahoo Finance comparing nVidia and Walmart, two companies with similar P/E ratios, against the SP500.

Even if a particular stock does not have the annualized return readily available, it can be computed using annual price and dividend data, which is a subset of the information used in CAPM analysis to develop the target rate of return relative to the SP500. Such information has been available in 10-Ks for awhile now, as well, because companies compare their returns to their peers as part of the prep for annual shareholders meetings.

Aside from analytical proofs, which we are already debating in other threads, is there any empirical example that can help us the see problem that needs more investigation?

I think the Yahoo Finance link, above, illustrates my concern, but here is some potentially useful information:

As of today, NVIDIA has a trailing P/E of 40.78 and a market cap of $378.9M with estimated 2022 profits of $8.0B on $28.6B of revenue.

By comparison, Walmart has a trailing P/E of 44.24 and a market cap of $387B with estimated 2022 profits of $9.0B on $600B of revenue. (Yes, that is 1.125x NVIDIA’s profit with 20.979x NVIDIA’s revenue.)

According to Fortune magazine, the 2022, 5-year annualized, and 10-year annualized rates of return for NVIDA were 125.5%, 62%, and 57.3%, respectively. The same rates of return for Walmart were 1.9%, 18.3%, and 11.3%, respectively.

The effective discount rates of NVIDIA and Walmart are 2.45% and 2.26%, respectively. Leaving aside that the discount rate and rate of return for any given stock refer to the same quantity, the rates of return for the two companies are vastly dissimilar despite the fact their effective rates of return are nearly the same (they were closer a couple of days ago). It seems to me that, whatever the reciprocal of the P/E ratio shows us, it is not the rate of return (discount rate), effective or otherwise.

I suspect that there are at least two problems with using the reciprocal P/E as an indicator of discount rate. First, it does not account for different capital structures (the mix of debt and equity), which affects WACC, the discount rate used in free cash flow models. For example, Stock-Analysis -on.net has calculated the WACC of Walmart and NVIDIA to be 7.74% and 15.82%, respectively, using an expected rate of return of the market of 12.45% and a risk-free rate of 3.88%. Second, the reciprocal P/E provides no direct information of expected growth of future earnings. Stock-Analysis -on.net has calculated future earnings for NVIDIA and Walmart of $460B and $384B, respectively. Before accounting for debt obligations, a simple rollup of the next five years of cash flow plus terminal value was within $40B.

I’m starting to feel that you hope that CasP research gets redirected into what you call financial analysis, but the funny thing is, I don’t think anyone disagrees if the issue is that we, collectively, need to keep expanding CasP theory. Rather you (or someone) needs to give us an empirical example to collectively stew over.

I hope the above helps. There are at least three reasons why I think it would be useful for CasP researchers to be conversant with financial analysis and high finance thinking. First, if capital is finance, you need financial tools to study it. Second, CasP researchers need to be able to speak to financial types as they speak with each other, both to cultivate a valuable resource, and to avoid potential misunderstandings that might affect credibility. Finally, understanding how financial instruments are structured and measured by capitalists themselves ought to yield deeper insights and set CasP researchers on the path towards having policy discussions and making policy proposals. Proving yet again that capital is power can only get you so far.

Water is wet. Capital is power. Knowing those two things does not suggest that anything needs to be done–or can be done– about either of them.

December 23, 2022 at 12:57 am in reply to: Effective Discount Rate or the Reciprocal of the Trailing P/E #248779Scot, You ask many questions, but it isn’t always clear why.

Jonathan,

In this particular case, it is not because I was looking forward to a lazy, petulant insult or a lengthy, non-responsive, and deflectionary response, but I have come to expect such from time to time, and that is a price I am willing to pay to participate in this forum.

You are not the only person who reads or posts to the forum. I ask many questions, some of which are the same question phrased differently, with hopes of stimulating thought and engagement regardless of the reader’s background or view of CasP. In this particular case, I was also engaged in a bit of open brainstorming while attempting to hedge against potentially reflexive responses. Who knows, I might even have been successful in my hedging but for leaving in one rhetorical question, a total softball about capitalists being forward-looking, which it the only question you actually sought to answer (see your 3.)

Here is how I interpret your response:

- The effective discount rate is, indeed, the reciprocal of the trailing P/E ratio. There is nothing particularly inventive or insightful about it. For that reason alone, I question its value to CasP even pedagogically.

- The effective discount rate has no value to CasP analytically because it cannot be correlated to the expected rates of return and, by definition, they must be identical. If they could be correlated, they would be correlated, but they have not been, and the data you adduce in 1. and 2. don’t contradict that conclusion (which is why I find them to be a non-responsive deflection).

- The effective discount rate potentially undermines the validity of CasP itself because it seeks to do more than it is capable of doing, thereby creating a credible avenue for attacking CasP’s foundational explanation of capitalization. You shouldn’t make weak arguments if they undermine your stronger arguments. Your response in 1. and 2. lead me to believe that you have no particular desire to shore up the weakness of the effective discount rate, so I would just drop it and pretend it never happened.

Some direct responses to some of your enumerated points:

- It is no surprise that capitalization is correlated with current earnings because every free cash flow model starts with the previous quarter as the baseline for future growth. You know that, and using 12-month (4 quarter) trailing averages likely only enhances the correlation as models are adjusted on a quarterly basis (which you also know). In any event, comparing price to EPS tells us nothing directly about discount rates or expected rates of return.

- Neither the Power Index nor the Systemic Fear Index tells us anything about discount rates or expected rates of return.

- I am happy that you found a way to talk about rates of return, but the discussion is a bit of a non sequitur (and it would have been a complete non-sequitur but for my inclusion of that one rhetorical question; you’re welcome).

Unless CasP embraces, adapts, and enhances financial analytical tools to suit its needs, I don’t think it can evolve from the niche theorem/axiom it is today into a useful, explanatory theory. Endless, repetitive proofs that capital is power don’t advance anything, and it is not enough to go against the economic orthodoxy, you have to do the same against the financial orthodoxy, only more so.

Scot, 1. I have been trying to follow this discussion as closely as I can. I am a bit confused about how r functions in all of this argument. The general argument is that capitalists are discounting inputs with a future expectation of profit. But if different processes — which you say are not always capitalization, but discounting — how can they all use one value of r in the same point of time? If I’m following, the desire for a unified theory is also allowing for r to be anything, according to situation — the r in a forward-looking budget is not necessarily the r in capitalization. So why do they need to be both r? 2. Is there an issue of “revealed preferences” if wages are discounted future expectations? Unless we have independent confirmation of r before wages are paid, are we not left with wage cost + an implied discount, but which we don’t know?

James,

I am sorry if I have been as clear as mud. I am putting something together that I hope will clear things up (or prove that I am just plain wrong). In the meantime, here are some short-ish answers to your two questions.

1. There is no “one r to rule them all.”

The rate of return r is different for each discounting operation in a chain of discount operations, e.g.,

debt/credit money creation (bank, term of the loan) –> profit generation (firm, annual) –> market capitalization (investor, in perpetuity).

Every link in the chain applies its own discounting at its own rate of return (discount rate) r to ensure that, on paper and according to the formula (whether using compounding or discounting), the entity extending capital today gets back more capital in the future at the desired rate of return over the relevant term. Because these discounting operations are chained together, they necessarily affect each other, especially if expectations are not met, e.g., debt service related to a loan is considered in the profit generation and market capitalization links, affecting the discount rate applied differently.

NOTE: CasP’s discounting equation sacrifices detail for clarity and does not reflect how investors and analysts actually build free cash flow models to predict future earnings and the appropriate discount rate (which is usually the weighted average cost of capital, or WACC, of the firm being modeled). If everybody assumed or agreed that the present market capitalization is accurate, which the simplified equation 5 sort of implies, nobody would trade shares. Trading requires a disagreement in valuation, which creates a spread. Thus, every buyer goes long, and every seller goes short, at least relative to each other. I don’t think this reality makes the simplified equation 5 any less valid. In fact, I think it is a very powerful approach to teaching a fundamental truth.

2. At every link of the chain, there is no (and can be no) ex ante, independent confirmation that the extension of capital today will result in the expected and/or contracted rate of return in the future, not even in the case of a loan secured by collateral. Nevertheless, the logic of discounting is applied at each link of the chain, even if, in some cases, we habitually think of things like profits as involving addition of an arbitrary amount (or absconding with “surplus” labor) instead of compounding or discounting because we do not consider the passage of time, which accounting hides from view by commensurating past expenditures with present revenues and profits.

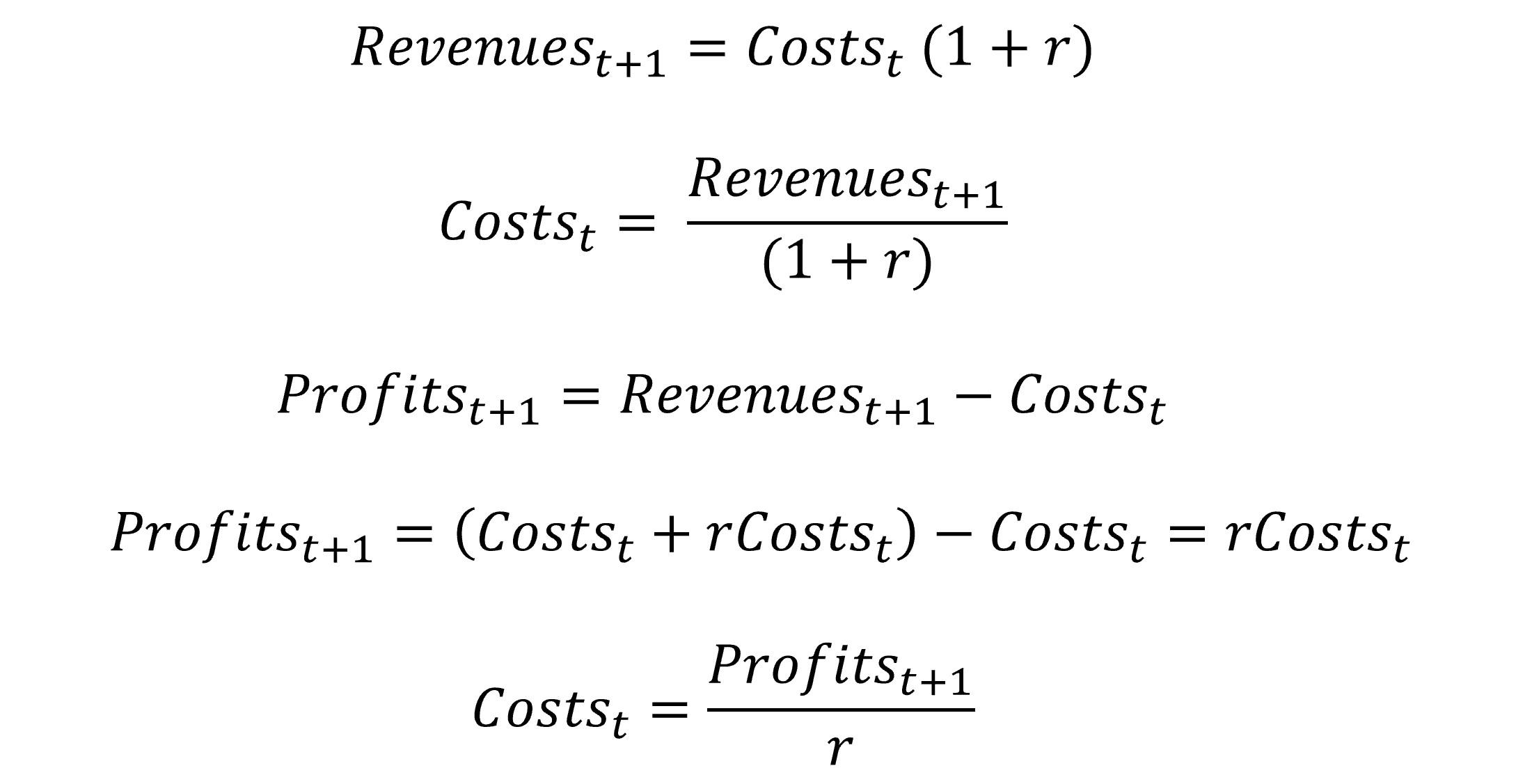

Basically, all I am arguing is that if you recognize input costs as being incurred before revenues and profits are received, it is appropriate to view input costs (including wages) as discounted revenues or profits, which occur later in time, where revenues are discounted by (1+r) and profits are discounted by r.

Again, for all intents and purposes, costs are capital outlays within the period of interest, regardless if “capital” remains on the balance sheets. Once you recognize capital expense on the income statement, it comes off the balance sheet.

-

AuthorReplies