Forum Replies Created

-

AuthorReplies

-

Is it possible to make an extensive list of all the factors that affect capitalization. My google searches are inadequate, because i don’t know the correct search terms to look for.

You might find the following observations overly general, but it is useful to point them out.

1.

You can make a list, but it will include everything that capitalists believe affects earnings, hype, risk and the normal rate of return. In other words, it will include anything and everything that capitalist modellers (and now days, also their AI algorithms) manage to map — and then some (gut feelings, animal spirits, etc.). However, I don’t think this long list will get you anywhere.

In my view, the first step is to create not a list, but a theory/model that allows us to organize, interrelate and, most importantly, weigh the different forces that bear on differential capitalization. This is what CasP research proposes and tries to do, and it is anything but simple.

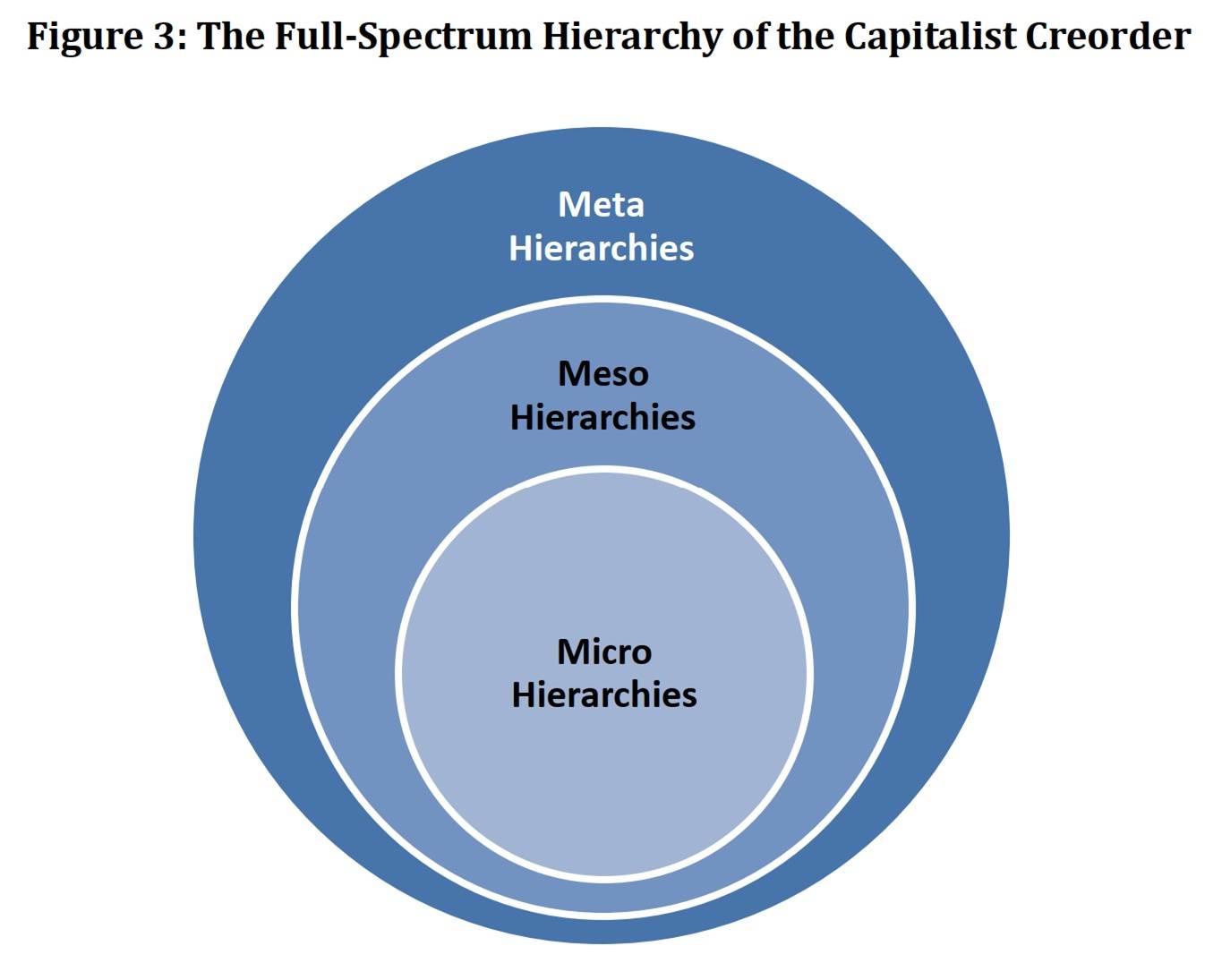

In our paper ‘Growing Through Sabotage’ (2020), we have a section on ‘Full-Spectrum Hierarchy’, where we write that:

[…] the capitalist creorder can be conceived of as a full-spectrum hierarchy, an ever-changing enfoldment of vertical structures nested within other vertical structures. Ranking the different hierarchies of capitalism from the most abstract down to the most concrete, we can say that the more concrete hierarchies are regulated by – and in this sense enfolded in – the more abstract ones. A simplified illustration of this enfoldment is shown in Figure 3: the lowest level of abstraction comprises micro hierarchies; the micro hierarchies are nested in meso hierarchies; and the meso hierarchies are themselves encompassed by the meta hierarchies.

What do the different levels consist of? Begin with the most abstract, meta hierarchies. The hubs of these hierarchies comprise the foundational institutions of capitalism, including, among others, the notion of ‘liberty’ (the differential Latin libertates fused into a universal notion of freedom), the concept of ‘private property’ (the negative Latin privatus inverted into a positive notion of possession), the idea of ‘investment’ (the feudal power of investiture reincarnated as a productive act) and the ritual of ‘capitalization’ (the ancient Mesopotamian caput, or head, made into a fractal-like algorithm of power) (Nitzan and Bichler 2009: 26, 227-228; Part III). The nodes of the meta hierarchies are the broad facets of society – the various dimensions of culture, ethnicity, religion and nationalism, among other things. And the links that tie the hubs to the nodes are the conduits through which the former gradually, and with plenty of setbacks and reversals, mould, leverage, internalize and encompass the latter. [Footnote: Think of how the fractal-like sprawl of concepts such as ‘financial accounting’, ‘investment’ and ‘capitalization’ penetrate and permeate all levels of business – from the small grocery store, family firm and largest conglomerate, to mutual, pension and sovereign wealth funds, to patents and copyrights – as well as other social institutions and organization, such as the military (the capitalized ‘quantity’ of the military arsenal and the ‘return on military assets’), organized religion (‘Islamic finance’ and ‘faith-based funds’), NGOs (‘cultural capital’ and ‘social capital’), workers (‘human capital’) and so on (Nitzan and Bichler 2009: Ch. 9).] At the meso level, the hubs are capitalist polities, corporations and NGOs, the nodes are individual subjects and the links are the capitalist institutions, patterns of thought and modes of behaviour that weave them into shifting hierarchies. And it is only at the lower, micro level of this full-spectrum enfoldment that we find the inner structures of formal organizations examined by Fix.

So if [Blair] Fix is right in arguing that greater energy capture per capita requires more hierarchical coordination, we can go even further: we can hypothesize that, as the capitalist mode of power deepens and globalizes, a significant – and perhaps growing – proportion of this hierarchical coordination will occur outside the boundaries of formal organizations. It will take place not only at the intestinal micro hierarchies of corporations and governments, but also – and increasingly so – at the meso and meta levels of scale-free networks: the hubs and nodes here are the foundational institutions of capitalism, the broad cultural and political facets of societies and their basic organizational units, while the connecting edges are trade, production and ownership ties, the various media of ideology, religion and education, the law and, ultimately, the threat of force and violence.

2.

No matter how successful the theory, it is at best an approximation anchored in its own time and history. Moreover, and crucially, CasP theorizes and researches capitalized power, not the undermining of capitalized power. It is a guide to what is, not to what can be made. This is a crucial distinction. In order to overturn capitalism, you need to understand it; but understanding of what currently exists is not enough. The reason is that every step of overturning capitalism, even the smallest, generates new formations whose structures and constellations are difficult and often impossible to foresee. It took capitalists half a millennium of turbulent, path-dependent trial and error to undo feudalism. There is no reason to think that autonomous formations can overturn capitalism on a preset list or even a theory, no matter how insightful. Theory-informed action is forever work in progress.

- This reply was modified 3 years, 4 months ago by Jonathan Nitzan.

- This reply was modified 3 years, 4 months ago by Jonathan Nitzan.

Anything that affects future earnings, hype, risk and the normal rate of return impacts capitalization. But undermining these factors must be intertwined, or at least go hand in hand, with autonomous, non-capitalized form of organization to address the material needs and wellbeing of most people. Without these alternatives, the power logic of capitalization remains intact and its quantities will rebound.

It is important to distinguish between academia and science. They are often opposite to one another.

October 8, 2022 at 9:10 pm in reply to: Is Exchange Value Really Just Capitalized Use Value? #248404

October 8, 2022 at 9:10 pm in reply to: Is Exchange Value Really Just Capitalized Use Value? #2484041. I don’t understand the idea that capital discounts use value. The processes of power may or may not involve the creation of use value, but, in my view, capitalization is entirely independent of it.

2. In Sumer, wealth wasn’t thought of as Capital in the modern sense, let alone as discounted future earnings. Wealth was obtained by force, confiscation and royal/religious decree. There was no notion of “normal earnings” and “risk”. The future was deemed unknowable, subject to the whims of the gods. I don’t see the point of generalizing the modern ritual of orderly capitalization to pre-capitalist societies, let alone ancient ones.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

- This reply was modified 3 years, 4 months ago by Jonathan Nitzan.

October 7, 2022 at 5:41 pm in reply to: Is Exchange Value Really Just Capitalized Use Value? #248398If capitalization is the only pricing mechanism in capitalism, this would imply that what Marx calls exchange value is, in fact, just discounted use value, i.e., exchange value is capitalized use value.

Why do you say that discounting capitalizes use value (rather than power)?

Of course, wages and wage labor predate the emergence of capitalism by thousands of years, which implies that capitalization predates capitalism by thousands of years.

Capitalization was first used, embryonically, sometimes in the 14th century; was first formalized, if only tentatively, in the middle of the 19th century; and came into common use and full dominance in the second half of the 20th century. You can argue that capitalists were always forward-looking, and that the prices of their assets represented, or at least reflected, however unknowingly, future expectations. But I find it hard to think of the daily wage in Sumer as capitalizing something.

Within the nomos of the Market, it does not matter to a capitalist that Musk is more powerful than he/she because the capitalist owes Musk nothing.

1. It seems that we have a rather different notion of power. For us, power is a quantitative relationship between entities, which, in capitalism, takes the form of differential capitalization (and its differential elementary particles). If Musk’s capitalization is 1,000 times that of another capitalist, he is 1,000 more powerful.

2. Does it matter to other capitalists that Musk is stronger than they are? In our view, the answer is a definite yes. This is the crux of capital as power. Musk being stronger means he is able to creorder the world against the interests/opposition of other capitalists and in doing so retain and augment his differential capitalization. For those whose key purpose is more power, having less of it is the ultimate loss.

3. And in the capitalist mode of power, capitalists — regardless of what they think and feel — are compelled to seek differential capitalization, lest they be marginalized or weeded out altogether. And since, in capitalism, differential capitalization depends on and represents power, capitalism cannot be anything other than a mode of power.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

In capitalism, power is priced in and traded for $, and since in principle prices are the same for everyone, Musk and you will buy the same power for the same price.

But this universality does not imply that Musk and you have the same power. If Musk owns $232 billion and you own $232 million, he is 1,000 times more powerful than you — even though both of you face the same prices.

In general, capitalists grow more powerful not because they buy for less than others, but because they change the world in such a way that makes the price of what they own rise faster than other prices.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

1. Creorder means a (dynamic) process of creating a (static) structure (or a given pattern of change). In my view, the specific form of a given creorder is open ended.

2. It is well known that Athenian democracy included only a fraction of the population, but its impulse was creating a society of citizens based on direct democracy (autonomy), philosophy (love of truth) and science (proof). All three components of this triangle assume and imply the absence of power. To me, articulating and fleshing out this triangle was a creorder.

3. The relationships among capitalists are very different. Their key ritual is differential accumulation – which implies not only controlling the rest of society, but also creating a power hierarchy of capitalists and corporations. In other words, their very purpose, even among themselves, is power.

September 30, 2022 at 6:06 pm in reply to: Inflation is always and everywhere a redistributional phenomenon #248364After decelerating for forty years, inflation is finally back, along with horror stories about capitalists who “use it” in order jack up their prices.

A recent paper in the Intercept bedevils a talkative executive who Has Been “Praying for Inflation” Because It’s an Excuse to Jack Up Prices. (Hat: https://twitter.com/HeavenlyPossum.)

Iron Mountain’s CEO, William Meaney, tells participants in an earnings call that “it’s kind of like a rain dance, I pray for inflation every day I come to work because … our top line is really driven by inflation. … Every point of inflation expands our margins.” And his CFO, one Barry A. Hytinen, can’t agree more: “we do have very strong pricing power” and for the company, inflation is “actually a net positive.”

And its not merely about raising prices. It is about raising them faster than others.

As Meaney explains, “where we’ve had inflation running at fairly rapid rates … we’re able to price ahead of inflation” — that is, increase its prices at a greater rate than the high recent rates of inflation. Raising prices, he says, “obviously covers our increased costs, but … a lot of that flows down to the bottom line.”

Everyone tries to beat the average: “People are seeing what FedEx, UPS, and others are having to do to actually manage their business and pass on that inflation.”

There is also a downside worth mentioning — namely, the differential loses of all those doomed subjects who forever trail the average. But this is just an unfortunate externality: “I wish I didn’t do such a good dance,” boasts Meaney, “but that’s more on a personal basis than on a business model.” According to Hytinen, “we feel for folks [but] we have a high gross margin business, so it naturally expands the margins of the business.”

***

Naturally, neither the executives nor the reporters consider the possibility that differential price increases and the differential profits that come with them are not the consequences of inflation, but its prime causes.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

September 28, 2022 at 12:03 am in reply to: Confidence in Obedience, or Confidence in Liquidity? #248359I appreciate our dialogue, always.

A few observations:

The Capital Asset Pricing Model (“CAPM”) […] is the basis of CasP’s insight regarding beating the average

I don’t think CasP derives anything from CAPM. In fact, in some sense, the two theories are opposite. CAPM is a neoclassical model that stipulates how passive investors (supposedly) pick the right combination of (presumably known) stock returns and risks. Our theory of differential accumulation tries to study how active capitalists change returns and risks (see Ch. 11 of Capital as Power).

I think the assessment that inflation is driven by the desire to raise prices faster than peers is overly simplistic and incorrect.

CasP does not say that capitalists “desire” to raise prices faster than average. Instead, it argues that capitalists seek to raise capitalized profit faster than average, and that, occasionally, when M&A decelerates, they are tempted to use stagflation to achieve it.

We need to think in terms of things like supply chains (or value chains) instead of just the prices end consumers see.

Correct. But this recommendation bursts into an open door.

September 25, 2022 at 8:09 pm in reply to: Confidence in Obedience, or Confidence in Liquidity? #248351Thank you for the comments, Scot.

Do you believe your Power Index directly measures confidence in obedience, or do you view it as merely indicative of it? I’ve gone back to the paper in which you first introduce the Power Index, but your assertions and reasoning are more logical than empirical.

Our logic goes as follows.

- We treat power as a quantitative relationship between entities. Our Power Index is the quantitative relationship between capitalists and workers, measured by the ratio of the S&P500 price and the average wage rate.

- The S&P price-to-wage ratio is set by capitalists (this ratio correlates almost perfectly with price and scarcely if at all with the wage rate), so in this sense it represents the confidence of capitalists: higher/lower confidence –> higher/lower price-to-wage ratio.

- We further assume that this confidence-read-price-to-wage-ratio represents the discounted value of future earnings capitalists expect to receive (relative to the wage rate). Since, in our view, these expected earnings depend wholly and only on society obeying the capitalists, it follows that the stock price/wage ratio represents the confidence capitalists have in the obedience of the those whom their rule (i.e., everyone/everything else).

- If our assumptions are incorrect, so is our interpretation.

- One can interpret our Power Index differently (as you do, when you call it “confidence in liquidity”), or devise other Power Indices.

Abstraction destroys the ability to study details that are ignored or eliminated for the sake of simplification. You can’t look at what you aren’t allowed to see.

I don’t think so. Your notion of “confidence in liquidity” is an abstraction. It does not prevent you from looking at the details being abstracted.

I think that theorizing a “State of Capital” does not go far enough, that it would be better simply to focus on understanding and studying the Market as sovereign and relegate the modern state to the Market’s subject, as we all are (including capitalists).

The study of the “state of capital” is in its infancy, and I doubt you can predict its potential reach and likely insights. Having said that, you are more than welcome to make the “Market” the supreme subject and see if it offers different/better insights.

And I’d prefer to jettison words like “ruler,” “ruled,” “citizen,” and “class” to focus entirely developing a new taxonomy based on differential power, which I think is more likely to lead to insights that eliminate such power altogether.

We scarcely refer to “citizens” and “classes”. I’m not sure, though, how one can speak of differential power without differentiating rulers from ruled.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

September 14, 2022 at 11:18 am in reply to: Confidence in Obedience, or Confidence in Liquidity? #248333I think “confidence in obedience” collapses too many disparate issues into a singularity, obliterating any opportunity to distinguish between those issues and understand their differences.

Yes, “confidence in obedience” is a way of describing the totalizing meaning of capitalized power (see Questions 15-16 in ‘The Capitalist as Power Approach’). I’m not sure, though, how the existence of this abstract notion is “obliterating any opportunity to distinguish between those issues and understand their differences.”

This where I think CASP’s outright rejection of the politics v. economics duality is problematic. I have always agreed with you that this dichotomy is a false one, that politics and economics are inseparable, but I also think we have to accept that this dichotomy, as false as it is, is a normative myth that has real power over people’s thinking and drives the formation of capitalist institutions. Whether we treat the state and Finance as separate entities or lump them together as “the state of capital,” the two operate in concert towards the same ends, but they operate differently and independently according to the normative myth and false dichotomy of politics v. economics.

I realize that we don’t share the same views on this matter, but I don’t think that we reject the politics-economics duality outright. Here is what we write on pp. 29-30 of Capital as Power:

To sum up, then, both neoclassicists and Marxists separate politics from economics, although for different reasons. The neoclassicists see the separation as desirable and, if handled properly, potentially beneficial. By contrast, Marxists view the distinction as contradictory and, in the final analysis, destructive for capitalism. Yet, both conclusions, although very different, are deeply problematic — and for much the same reason.

The difficulty lies less in the explanation of the duality and more in the widespread assumption that such a duality exists in the first place. Even E. P. Thompson, a brilliant historian who was otherwise critical of Marxist theoretical abstractions, seems unable to escape it. Writing on the development of British capitalism from the viewpoint of industrial workers, he describes the class socialization of workers as ‘subjected to an intensification of two intolerable forms of relationship: those of economic exploitation and of political oppression’ (1964: 198–99). In this dual world, the industrial labourer works for and is exploited by the factory owner — and when he organizes in opposition, in comes the policeman who breaks his bones, the sheriff who evicts him and the judge who jails him.

Now, this bifurcation is certainly relevant and meaningful — but only up to a point. From the everyday perspective of a worker, an unemployed person, a professional, even a small capitalist, economics and politics indeed seem distinct. As noted, most people tend to think of entities such as ‘factory’, ‘head office’, ‘pay cheque’ and ‘shopping’ differently from the way they think of ‘political party’, ‘taxation’, ‘police’, ‘military spending’ and ‘foreign policy’. Seen from below, the former belong to economics, the latter to politics.

But that is not at all what capitalism looks like from above. It is not how the capitalist ruling class views capitalism, and it is not the most revealing way to understand the basic concepts and broader processes of capitalism. When we consider capitalist society as a whole, the separation of politics and economics becomes a pseudofact. Contrary to both neoclassicists and Marxists who see this duality as inherent in capitalism, in our view it is a theoretical impossibility, one that is precluded by the very nature of capitalism. To paraphrase David Bohm (1980), from this broader perspective, the politics–economics duality is not a useful division, but a misleading fragmentation. It cannot be shown to exist — and if it did exist, profit and accumulation would cease and capitalism would disappear.

The consequences of this entanglement for capital theory are dramatic. As we shall demonstrate, without an ‘economy’ clearly demarcated from ‘politics’ we can no longer speak of quantifiable utility and objective labour value; and with these measures gone, neoclassical and Marxian capital theories lose their basic building blocks. They can observe that Microsoft is worth $300 billion and that Toyota pays $2 billion for a new factory, but they cannot explain why.

You write that:

Next to the capitalists themselves, it is the states whose potential “disobedience” is most concerning to dominant capital.

Yes. Conflicts within dominant capital, which we think of as a complex network of big capitalists, large corporations, government organs and so-called policymakers, are crucial. But in our view, these inner-class conflicts are tied to and delineated by the conflict between the rulers and the ruled. If this latter conflict did not exist or was insignificant, the share of profit in national income would have been far higher, the laws would have been very different and potentially far harsher for the underlying population, violence would have been more extreme, etc.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

September 12, 2022 at 4:12 pm in reply to: Confidence in Obedience, or Confidence in Liquidity? #248330Thank you, Scot.

You define market liquidity as the existence of “potential buyers with money and a desire [to] spend it on capital assets.”

I agree that this is a precondition for the existence of asset markets – but so are enforceable laws, oxygen, food and human language, for that matter. What I’m unclear about, is what these general preconditions tell us about the direction of the stock market, let alone about capitalist power.

You are correct that, in the short run, investors seem concerned mostly with predicting the actions of other investors, or as Keynes famously put it in the General Theory:

. . . professional investment may be likened to those newspaper competitions in which the competitors have to pick out the six prettiest faces from a hundred photographs, the prize being awarded to the competitor whose choice most nearly corresponds to the average preferences of the competitors as a whole; so that each competitor has to pick, not those faces which he himself finds prettiest, but those which he thinks likeliest to catch the fancy of the other competitions, all of whom are looking at the problem from the same point of view. . . . We have reached the third degree where we devote our intelligence to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees. (Keynes 1936: 156)

But in the long run, the picture is very different. The chart below shows the price and earnings per share of the S&P 500 group of companies (rebased with 1871=100), and as you can see, the long-term correlation between these two series is nearly perfect (+0.97). To my mind, this tight correlation suggests that, over the long run, the desire of “potential buyers with money to spend on capital assets” – i.e., the market’s “liquidity” – reflects not what investors think about each other, but what they think about future profit.

And this is where CasP’s claims about power and confidence in obedience come in. To earn a profit, corporate owners must exert their power over society. And to provide the liquidity needed to price this power, they must be confident that society will continue to obey them – because if it doesn’t, future profits will falter along with prices.

I can go on to talk how risk and the normal rate of return are also anchored in power, but I think my point is clear.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

September 9, 2022 at 11:31 pm in reply to: Confidence in Obedience, or Confidence in Liquidity? #248323Thank you Scot.

Your claim, then, is that if, as a group, capitalists think that asset prices should be lower, they will likely go down — and if they think asset prices should be higher, they will likely rise. I believe we agree on this mechanism.

The interesting question is why. Why do capitalists. as a group, think that asset prices should be higher or lower — or, in your language, why should liquidity go up or down?

In my view, the answer has to do with what capitalists, as a group, think about future earnings, risk and the normal rate of return; and what they think about these three elementary particles hinges on power — that is, on the obedience of the system and people that they collectively rule (including policymakers, mind you).

Finally, if we agree that asset prices are set by the capitalists themselves, it follows that their capitalized power gauges their own confidence in this obedience.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

- This reply was modified 3 years, 5 months ago by Jonathan Nitzan.

-

AuthorReplies