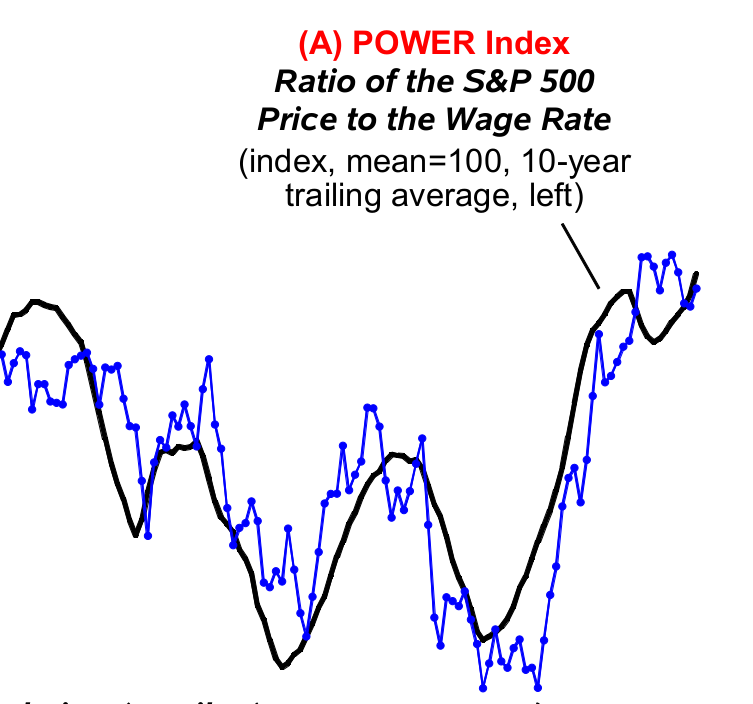

Abstract A recent New Political Economy article by Baines and Hager (2020) critiqued Shimshon Bichler and Jonathan Nitzan’s capital-as-power (CasP) model of the stock market (Bichler & Nitzan, 2016). Bichler and Nitzan’s model of the stock market seeks to explain how financial crises are tied to the (upper) limits of redistributing income through power. Bichler […]

Continue Reading2020/03: Bichler and Nitzan, ‘Manuscripts Don’t Burn’

Abstract The French Revolution changed the world. In the new order, the masters no longer need Monsieur Fouche and the thought police. They don’t need guillotines to clip brains and scissors to censor pamphlets. They don’t need strategic-studies institutes to manage oppression and navigate conflict. Instead, they prefer to subsidize ‘cultural pluralism’ and ‘critical studies’, […]

Continue Reading2020/02: Bichler and Nitzan, ‘The Capital as Power Approach. An Invited-then-Rejected Interview with Shimshon Bichler and Jonathan Nitzan’

Abstract This interview was commissioned in October 2019 for a special issue on ‘Accumulation and Politics: Approaches and Concepts’ to be published by the Revue de la régulation. We submitted the text in March 2020, only to learn two months later that it won’t be published. The problem, we were informed, wasn’t the content, which […]

Continue Reading2020/01: Fix, ‘Economic Development and the Death of the Free Market’

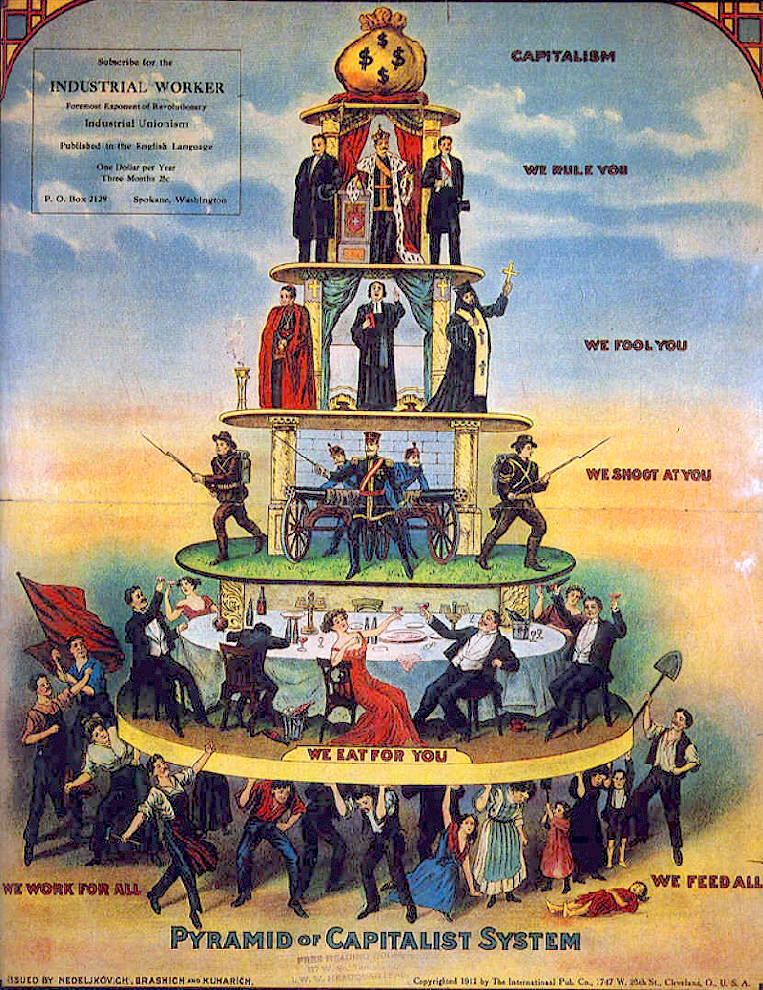

Abstract Free markets are, according to neoclassical economic theory, the most efficient way of organizing human activity. The claim is that individuals can benefit society by acting only in their self interest. In contrast, the evolutionary theory of multilevel selection proposes that groups must suppress the self interest of individuals. They often do so, the […]

Continue Reading2019/02.1: Fix, ‘How the Rich are Different: Hierarchical Power as the Basis of Income Size and Class’

Abstract This paper investigates a new approach to understanding personal and functional income distribution. I propose that hierarchical power — the command of subordinates in a hierarchy — is what distinguishes the rich from the poor and capitalists from workers. Specifically, I hypothesize that individual income increases with hierarchical power, as does the share of […]

Continue Reading2019/04: Hager and Baines, ‘Jurisdictional Tax Rates: How the Corporate Tax System Fuels Concentration and Inequality’

Abstract Corporate concentration in the United States has been on the rise in recent years, sparking a heated debate about its causes, consequences, and potential remedies. In this study, we examine a facet of public policy that has been largely neglected in current debates about concentration: corporate tax policy. As part of our analysis we […]

Continue Reading2019/03: McMahon, ‘Selling Hollywood to China’

Abstract From the 1980s to the present, Hollywood’s major distributors have been able to redistribute U.S. theatrical attendance to the advantage of their biggest blockbusters and franchises. At the global scale and during the same period, Hollywood has been leveraging U.S. foreign power to break ground in countries that have historically protected and supported their […]

Continue Reading2019/01: Bichler & Nitzan, ‘CasP’s Differential Accumulation versus Veblen’s Differential Advantage (Revised and Expanded)’

Abstract This paper clarifies a common misrepresentation of our theory of capital as power, or CasP. Many observers tend to box CasP as an ‘institutionalist’ theory, tracing its central process of ‘differential accumulation’ to Thorstein Veblen’s notion of ‘differential advantage’. This view, we argue, betrays a misunderstanding of CasP, Veblen or both. First, we are […]

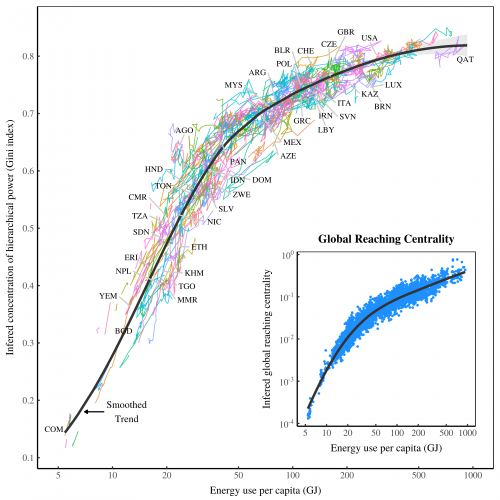

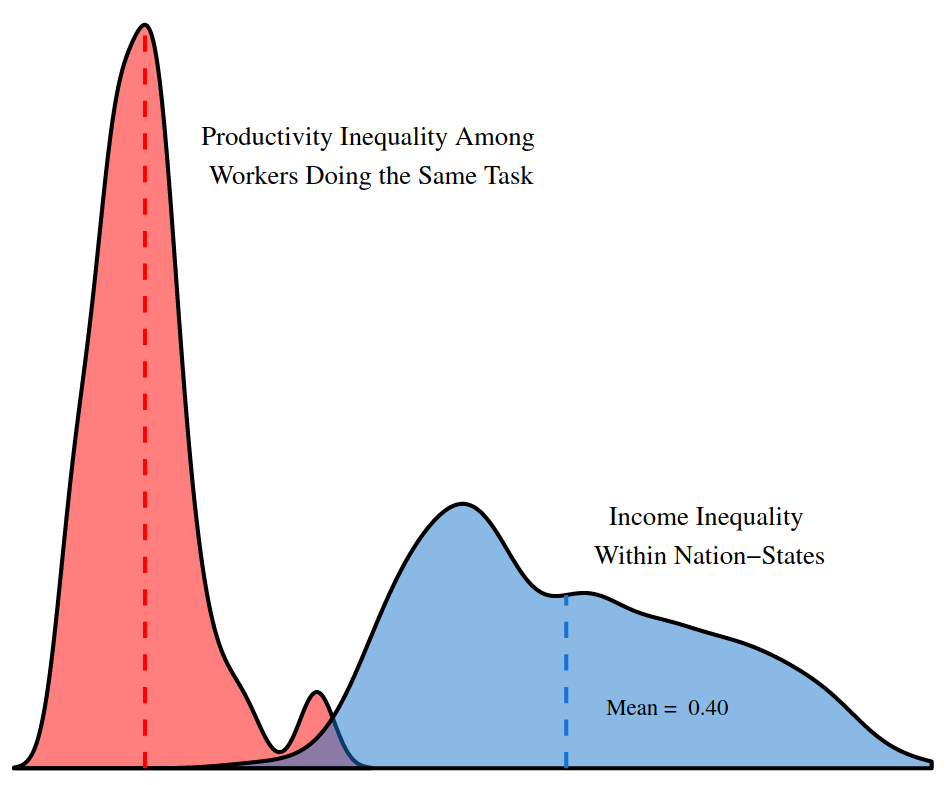

Continue Reading2018/09: Fix, ‘Energy, Hierarchy and the Origin of Inequality’

Abstract Where should we look to understand the origin of inequality? Most research focuses on three windows of evidence: (1) the archaeological record; (2) existing traditional societies; and (3) the historical record. I propose a fourth window of evidence — modern society itself. I hypothesize that we can infer the origin of inequality from the […]

Continue Reading2018/08: Bichler & Nitzan, ‘CasP’s Differential Accumulation versus Veblen’s Differential Advantage’

Abstract This paper clarifies a common misrepresentation of our theory of capital as power, or CasP. Many observers tend to box CasP as an ‘institutionalist’ theory, tracing its central process of ‘differential accumulation’ to Thorstein Veblen’s notion of ‘differential advantage’. This view, we argue, betrays a misunderstanding of CasP, Veblen or both. As we show, […]

Continue Reading2018/07: Fix, ‘The Trouble with Human Capital Theory’

Abstract Human capital theory is the dominant approach for understanding personal income distribution. According to this theory, individual income is the result of ‘human capital’. The idea is that human capital makes people more productive, which leads to higher income. But is this really the case? This paper takes a critical look at human capital […]

Continue Reading2018/06: Fix, ‘Capitalist Income and Hierarchical Power: A Gradient Hypothesis’

Abstract This paper offers a new approach to the study of capitalist income. Building on the ‘capital as power’ framework, I propose that capitalists earn their income not from any productive asset, but from the legal right to command a corporate hierarchy. In short, I hypothesize that capitalist income stems from hierarchical power. Based on […]

Continue Reading2018/05: Fix, ‘The Growth of US Top Income Inequality: A Hierarchical Redistribution Hypothesis’

Abstract What accounts for the growth of US top income inequality? This paper proposes a hierarchical redistribution hypothesis. The idea is that US firms have systematically redistributed income to the top of the corporate hierarchy. I test this hypothesis using a large scale hierarchy model of the US private sector. My method is to vary […]

Continue Reading2018/04: Martin, ‘The Autocatalytic Sprawl of Pseudorational Mastery’

Abstract According to Shimshon Bichler and Jonathan Nitzan capital is not an economic quantity but a mode of power; it could be sumarized as: “Capital is power quantified in monetary terms”. So, what do we do when we “quantify”? What is the nature of “money” in a capitalist society? And, indeed, what is “power” in […]

Continue Reading2018/03: Fix, ‘The Aggregation Problem’

Abstract This article discusses the aggregation problem and its implications for ecological economics. The aggregation problem consists of a simple dilemma: when adding heterogeneous phenomena together, the observer must choose the unit of analysis. The dilemma is that this choice affects the resulting measurement. This means that aggregate measurements are dependent on one’s goals, and […]

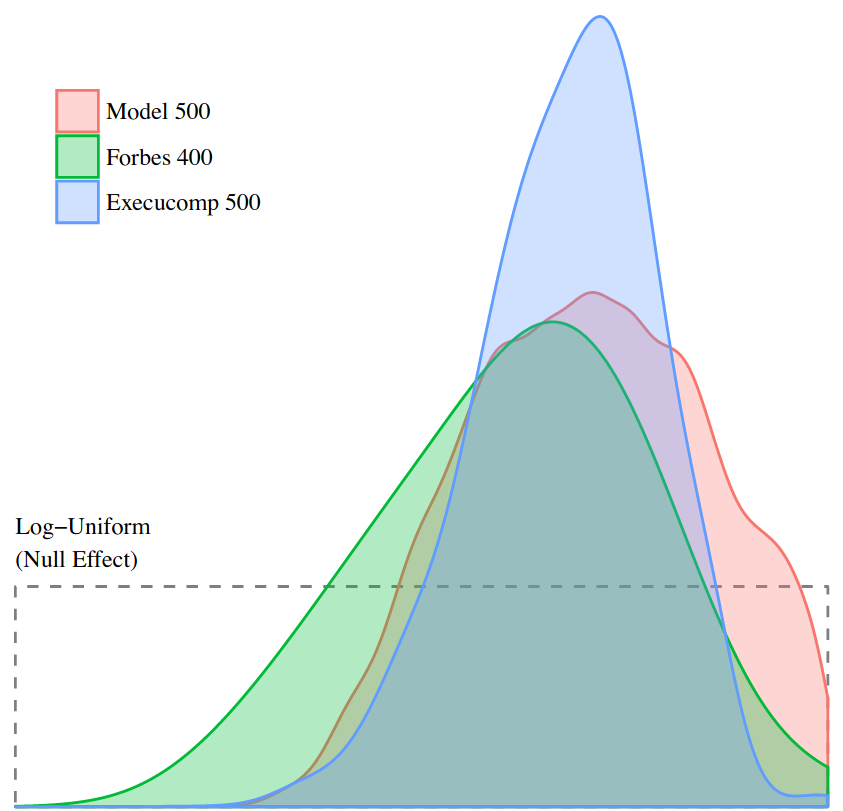

Continue Reading2018/02: Fix, ‘A Hierarchy Model of Income Distribution’

Abstract Based on worldly experience, most people would agree that firms are hierarchically organized, and that pay tends to increase as one moves up the hierarchy. But how this hierarchical structure affects income distribution has not been widely studied. To remedy this situation, this paper presents a new model of income distribution that explores the […]

Continue Reading2018/01: Bichler & Nitzan, ‘With their Back to the Future: Will Past Earnings Trigger the Next Crisis?’

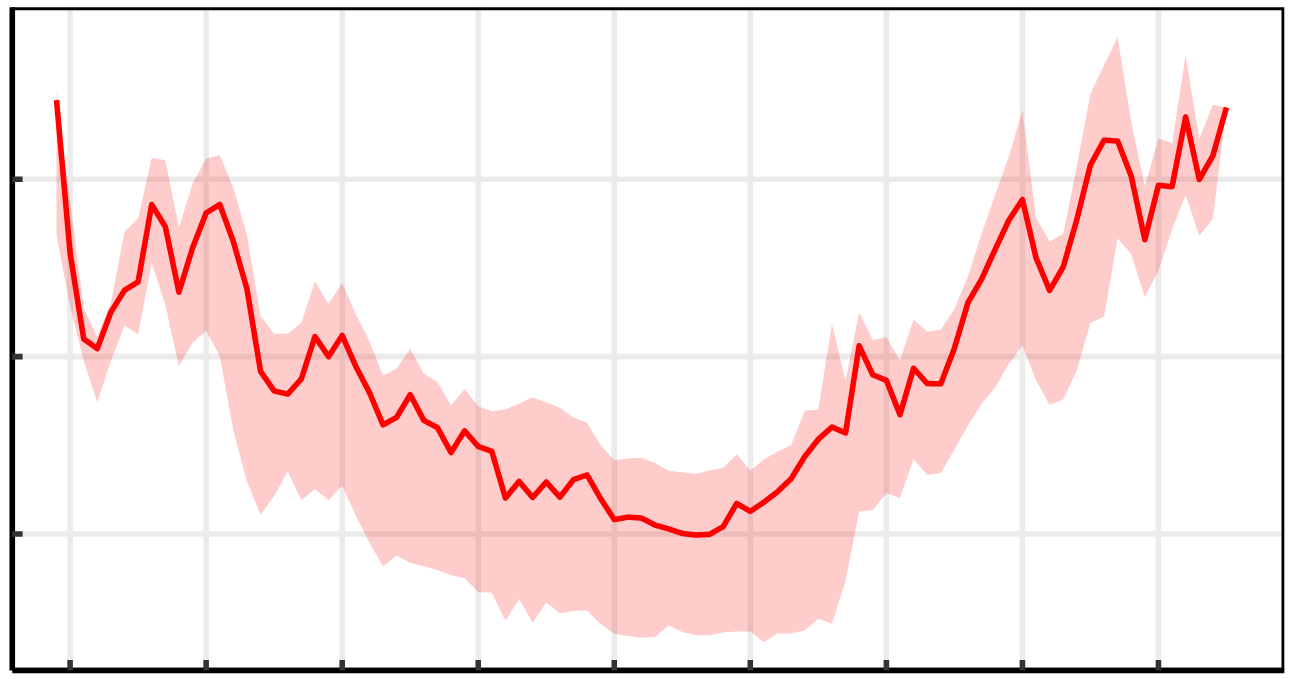

Abstract The U.S. stock market is again in turmoil. After a two-year bull run in which share prices soared by nearly 50 per cent, the market is suddenly dropping. Since the beginning of 2018, it lost nearly 10 per cent of its value, threatening investors with an official ‘correction’ or worse. As always, there is […]

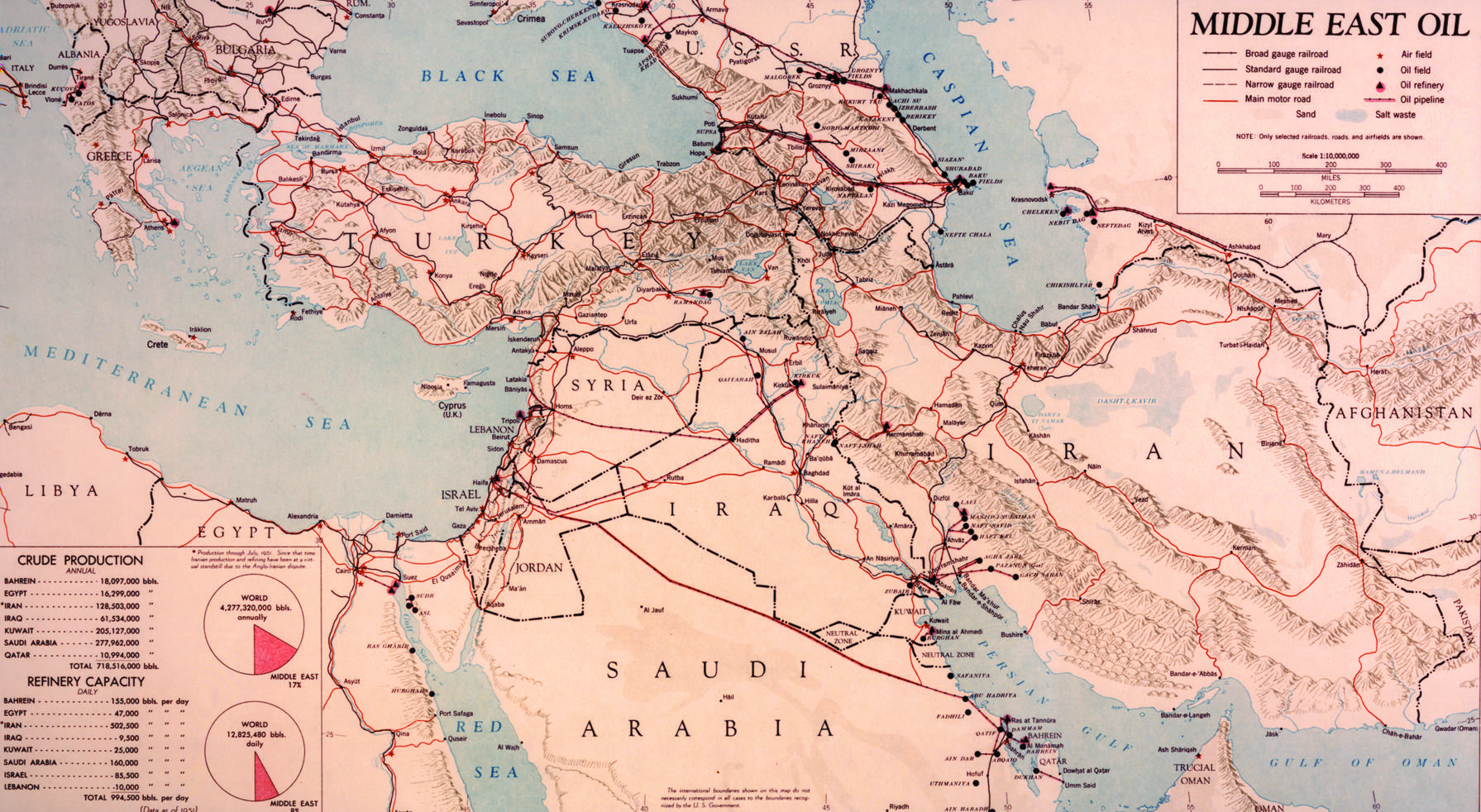

Continue ReadingNo. 2017/04: Bichler & Nitzan, ‘Arms and Oil in the Middle East: A Biography of Research’

Abstract During the late 1980s, we printed a series of working papers, offering a new approach to the political economy of Israel and wars in the Middle East. Our approach in these papers rested on three new concepts. It started by identifying the Weapondollar-Petrodollar Coalition – an alliance of armament firms, oil companies and financial […]

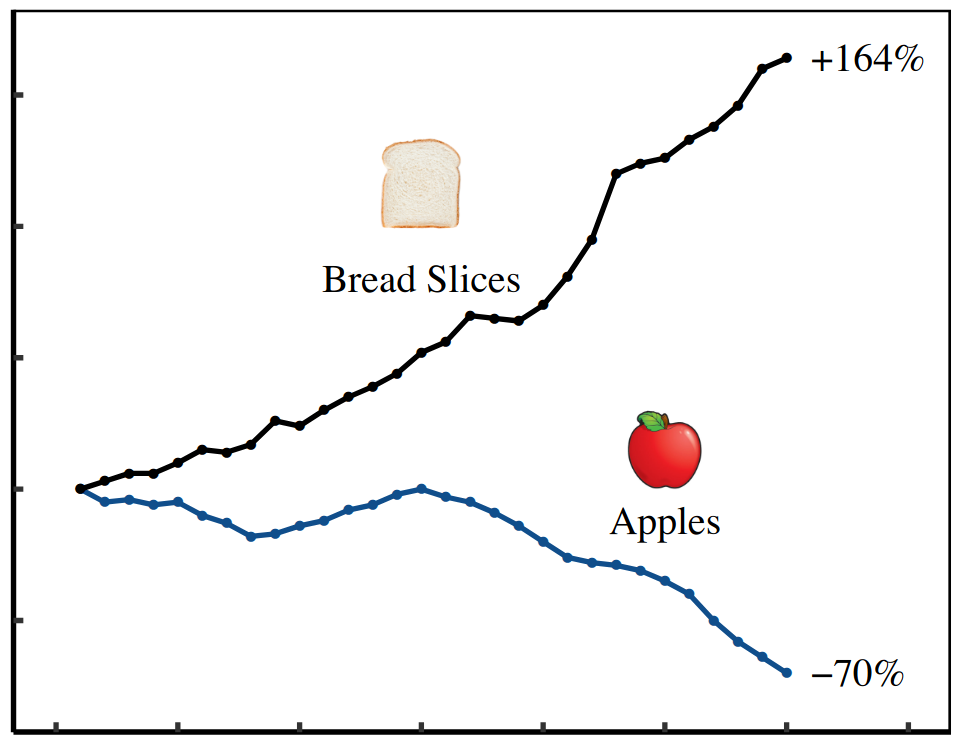

Continue ReadingNo. 2017/03: Fix, ‘Evidence for a Power Theory of Personal Income Distribution’

Abstract This paper proposes a new ‘power theory’ of personal income distribution. Contrary to the standard assumption that income is proportional to productivity, I hypothesize that income is most strongly determined by social power, as indicated by one’s position within an institutional hierarchy. While many theorists have proposed a connection between personal income and power, […]

Continue ReadingNo. 2017/02: Bichler & Nitzan, ‘Growing through Sabotage’

Abstract According to the theory of capital as power, capitalism, like any other mode of power, is born through sabotage and lives in chains – and yet everywhere we look we see it grow and expand. What explains this apparent puzzle of ‘growth in the midst of sabotage’? The answer, we argue, begins with the […]

Continue Reading