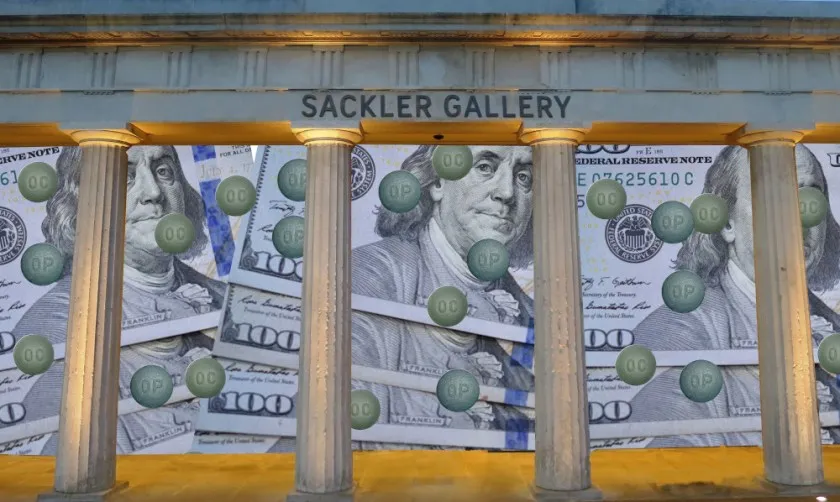

Originally published at pluralistic.net Cory Doctorow Two quotes to ponder as you read “Purdue’s Poison Pill,” Adam Levitin’s forthcoming Texas Law Review paper: “Some will rob you with a six-gun, And some with a fountain pen.” (W. Guthrie) “Behind every great fortune there is a great crime.” (H. Balzac) (paraphrase) Some background. Purdue was/is the […]

Continue ReadingMcMahon, ‘Why Scorsese is Right About Corporate Power’

Abstract In the March 2021 issue of Harper’s, Scorsese wrote an essay to pay tribute to Federico Fellini, the Italian director who directed such great films as La Strada, 8 1/2, La Dolce Vita, Nights of Cabiria and Satyricon. Scorsese writing on Fellini is definitely newsworthy for cinephiles who want to know about Fellini’s beginnings […]

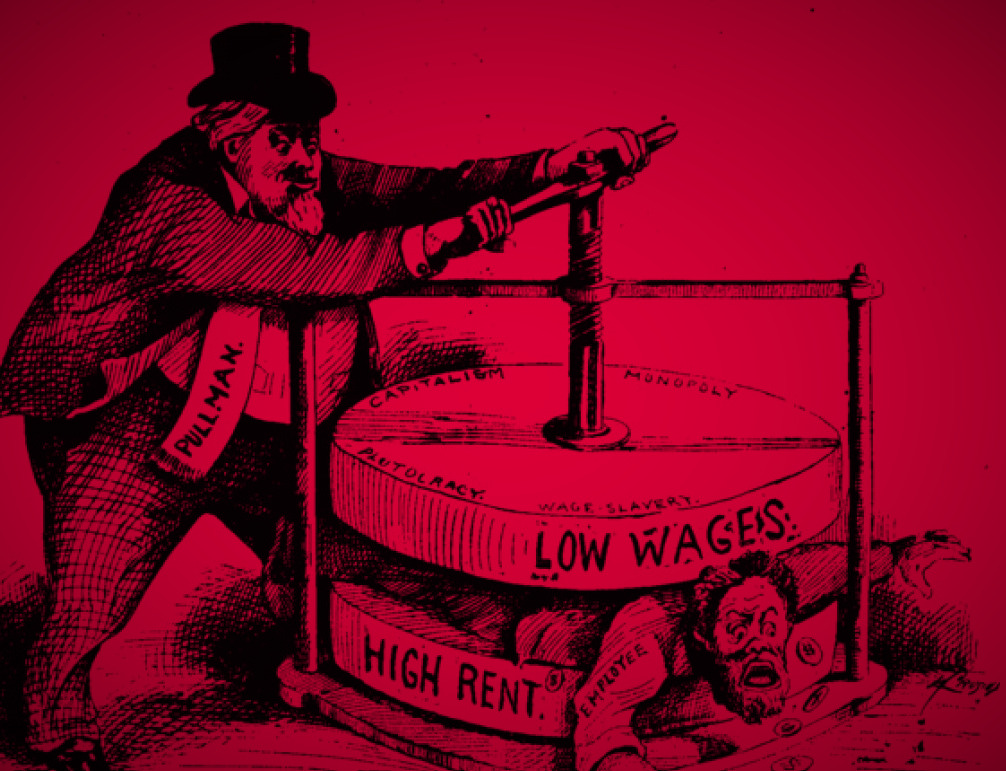

Continue ReadingEnd of the line for Reaganomics

Originally published at pluralistic.net Cory Doctorow Reagan turned the country upside-down, in a very bad way. The “Reagan revolution” was indeed revolutionary (or, rather, counter-revolutionary), reversing a half-century of progress on social safety nets, workers’ rights, and environmental protections. When we take stock of the Reagan years, we tend to focus on the actions that […]

Continue ReadingBaines & Hager, ‘The Great Debt Divergence and its Implications for the Covid-19 Crisis: Mapping Corporate Leverage as Power’

Abstract The COVID-19 pandemic has amplified longstanding concerns about mounting levels of corporate debt in the United States. This article places the current conjuncture in its historical context, analysing corporate indebtedness against the backdrop of increasing corporate concentration. Theorising leverage as a form of power, we find that the leverage of large non-financial firms increased […]

Continue ReadingMonaghan & Cochrane, ‘Fight to Win! Tools for Confronting Capital’

Abstract Anarchists have generally rejected the idea that there is or ought to be a pure or inherently revolutionary strategy or tactic. In this chapter we make use of the capital-as-power theory of value and capital in a way that informs and supports the ad hoc perspective on struggle and fighting to win. Our primary […]

Continue ReadingPropertization: The Process by which Financial Corporate Power has Risen and Collapsed

Propertization The Process by which Financial Corporate Power has Risen and Collapsed JONGCHUL KIM September 2018 Abstract Elsewhere I argue that the legal concept of property was created in the image of money in the late Roman Republic. Since then, the division of property and contract has been an underlying structure of Western law. The […]

Continue ReadingHager, ‘Public Debt, Inequality, and Power: The Making of a Modern Debt State’

Abstract Who are the dominant owners of US public debt? Is it widely held, or concentrated in the hands of a few? Does ownership of public debt give these bondholders power over our government? What do we make of the fact that foreign-owned debt has ballooned to nearly 50 percent today? Until now, we have […]

Continue ReadingHoward, ‘Concentration and Power in the Food System’

Abstract This book seeks to illuminate which firms have become the most dominant, and more importantly, how they shape and reshape society in their efforts to increase their control. These dynamics have received insufficient attention from academics and even critics of the current food system. The power of dominant firms extends far beyond narrow economic […]

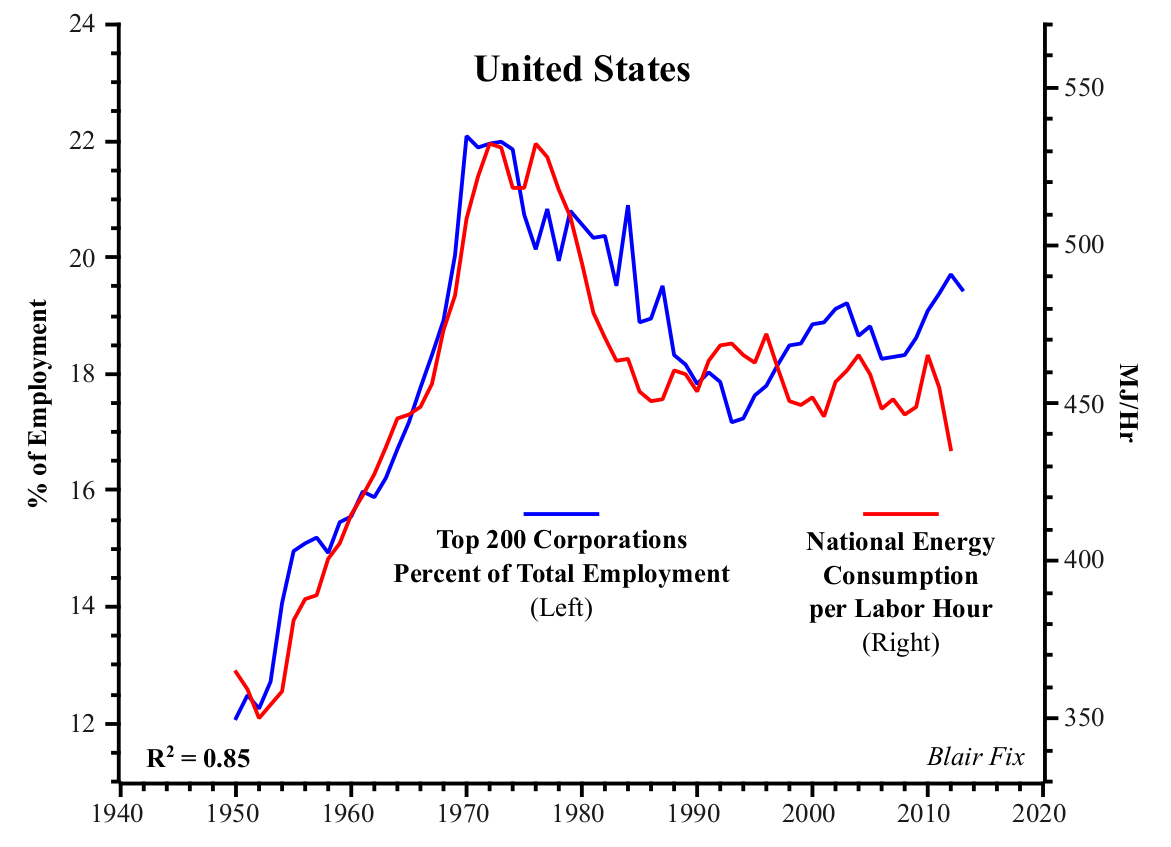

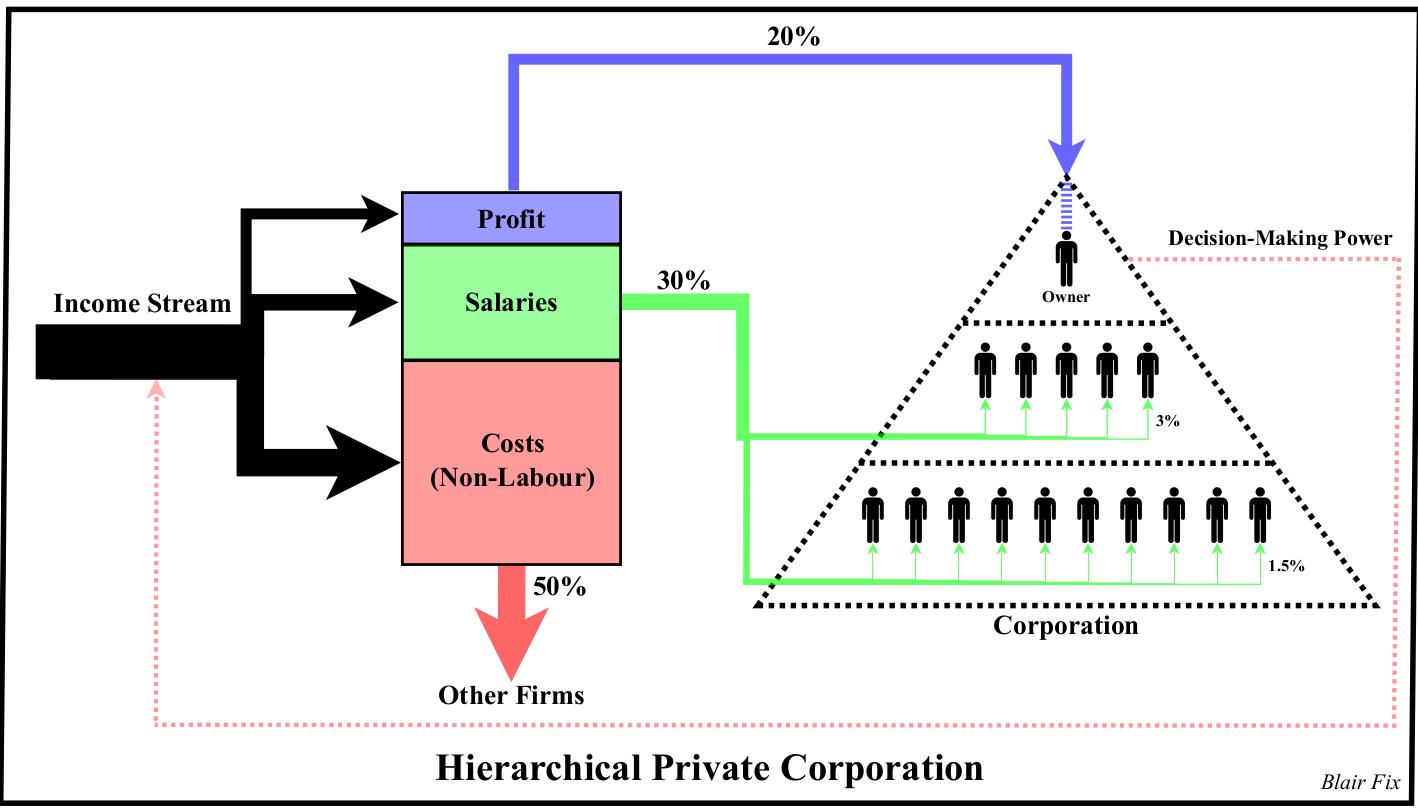

Continue ReadingPutting Power Back into Growth Theory

Putting Power Back Into Growth Theory BLAIR FIX June 2015 Abstract Neoclassical growth theory assumes that economic growth is an atomistic process in which changes in distribution play no role. Unfortunately, when this assumption is tested against real-world evidence, it is systematically violated. This paper argues that a reality-based growth theory must reject neoclassical principles […]

Continue ReadingWal-Mart’s Power Trajectory: A Contribution to the Political Economy of the Firm

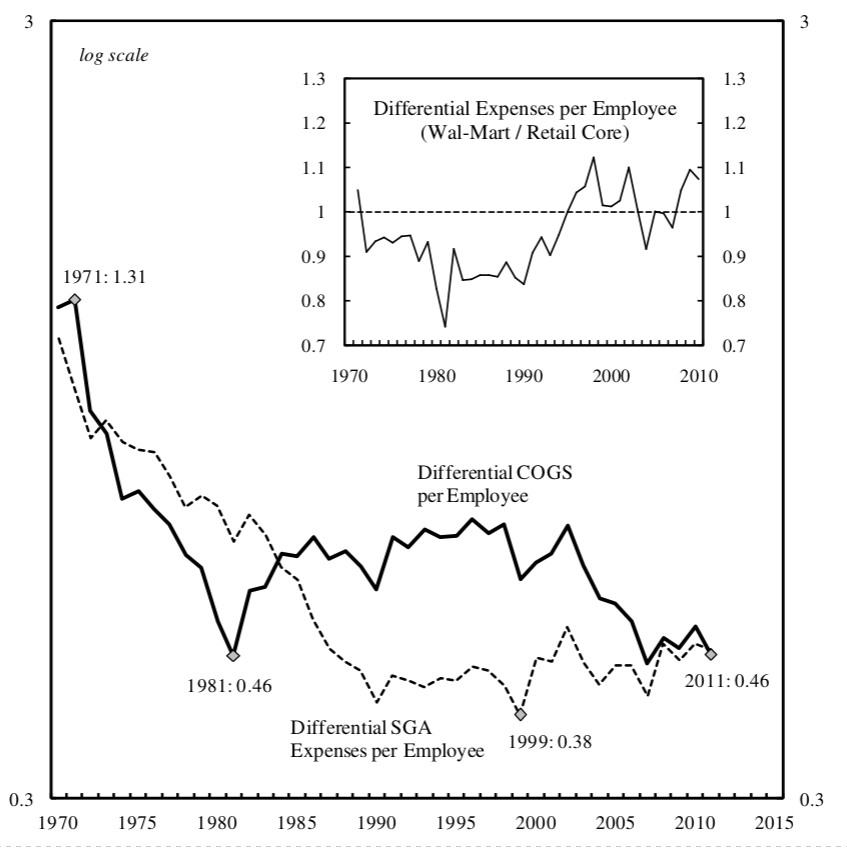

Wal-Mart’s Power Trajectory A Contribution to the Political Economy of the Firm JOSEPH BAINES March 2014 Abstract This article offers a power theory of value analysis of Wal-Mart’s contested expansion in the retail business. More specifically, it draws on, and develops, some aspects of the capital as power framework so as to provide the first […]

Continue ReadingNo. 2014/02: Fix, ‘Rethinking Profit: How Redistribution Drives Growth’

Abstract Using a combination of heterodox economics and biophysical analysis, this paper investigates the relationship between economic distribution and the growth of material throughput. Empirical results show that the growth of “useful work” correlates with redistribution towards profit. Furthermore, increases in energy consumption are correlated with increases in the largest corporations’ share of total employment. […]

Continue Reading