Abstract This thesis makes two unique contributions to the International Political Economy literature. It presents the first comprehensive, empirical investigation of petrodollar accumulation and recycling spanning the period 1980-2021. It also corrects the misconception that petrodollar recycling in the 1970s and 1980s involved the extension of loans to developing countries using fractional reserve banking and […]

Continue ReadingMaxing out our global credit-card with authoritarian debt

Originally published at pluralistic.net Reproduced under a Creative Commons Attribution 4.0 license Cory Doctorow People who fret about the debt we’re taking on to deal with climate change are (half) right. Because there’s two ways of dealing with the climate emergency: either we can avert it, or we can seek high ground and erect high […]

Continue ReadingThe birth of capitalized credit money is inextricably bound with war

Jonathan Nitzan and Shimshon Bichler Originally published on Twitter During the twilight of feudalism, wars, whose cost soared in tandem with their material scope and unit price, were the most financially demanding expenses. Changing military technologies, beginning with the crusades and continuing with the Hundred Years War, made it increasingly necessary to rely on hired […]

Continue ReadingDoing Public Debt: A Praxeology for the Bondholding Class?

Originally published at sbhager.com Sandy Brian Hager Earlier this month in Berlin I participated in the third workshop of the “Doing Debt” research network. I received the invitation back in May and was asked by the organizers to present my research on ownership of the public debt and to think about how this research might […]

Continue ReadingWhy Isn’t Modern Monetary Theory Common Knowledge?

Originally published on Economics from the Top Down Blair Fix I’ve always been baffled why ‘modern monetary theory’ is called a theory. I don’t mean this in a disparaging way. As far as theories of money go, I think modern monetary theory (MMT for short) is the correct one. But having a correct theory of […]

Continue ReadingBaines & Hager, ‘The Great Debt Divergence and its Implications for the Covid-19 Crisis: Mapping Corporate Leverage as Power’

Abstract The COVID-19 pandemic has amplified longstanding concerns about mounting levels of corporate debt in the United States. This article places the current conjuncture in its historical context, analysing corporate indebtedness against the backdrop of increasing corporate concentration. Theorising leverage as a form of power, we find that the leverage of large non-financial firms increased […]

Continue ReadingDi Muzio & Robbins, ‘Capitalismo de deuda’

Abstract Capitalismo de deuda es un esfuerzo por descifrar cómo la tecnología de la deuda se ha convertido en uno de los mayores obstáculos para las aspiraciones democráticas y racionales de la sociedad moderna. Richard Robbins y Tim Di Muzio muestran que la deuda, entendida como una tecnología de poder, es un engranaje insertado en […]

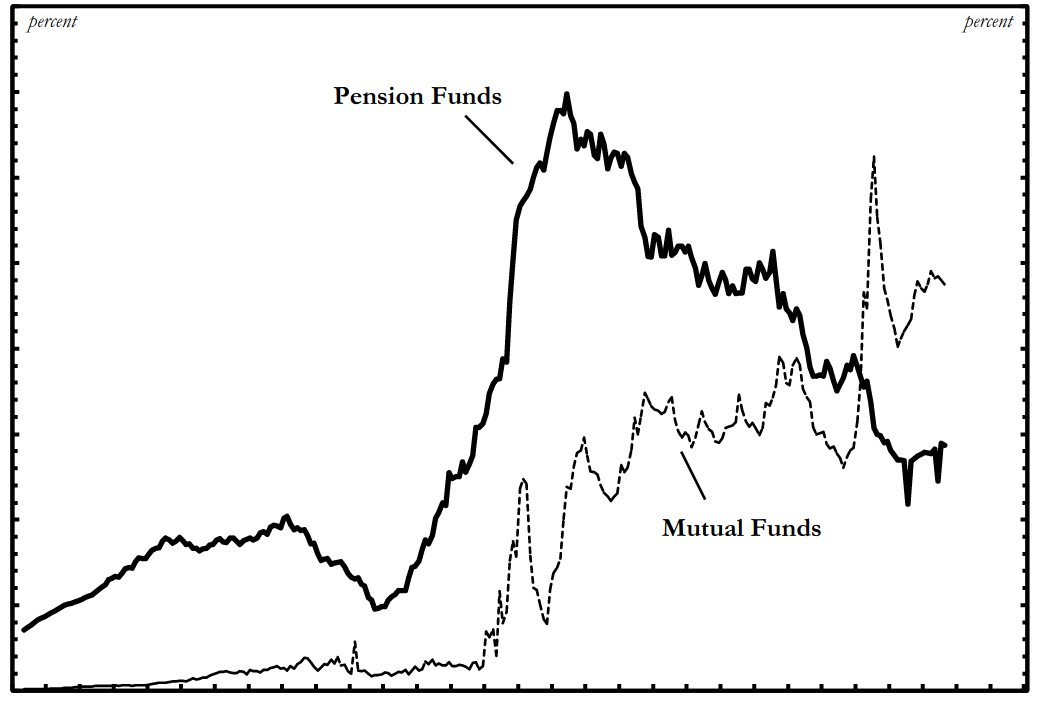

Continue ReadingHager, ‘Corporate Ownership of the Public Debt’

Abstract In various writings Karl Marx made references to an ‘aristocracy of finance’ in Western Europe and the United States that dominated ownership of the public debt. Drawing on original research, this article offers the first comprehensive analysis of public debt ownership within the US corporate sector. The research shows that over the past three […]

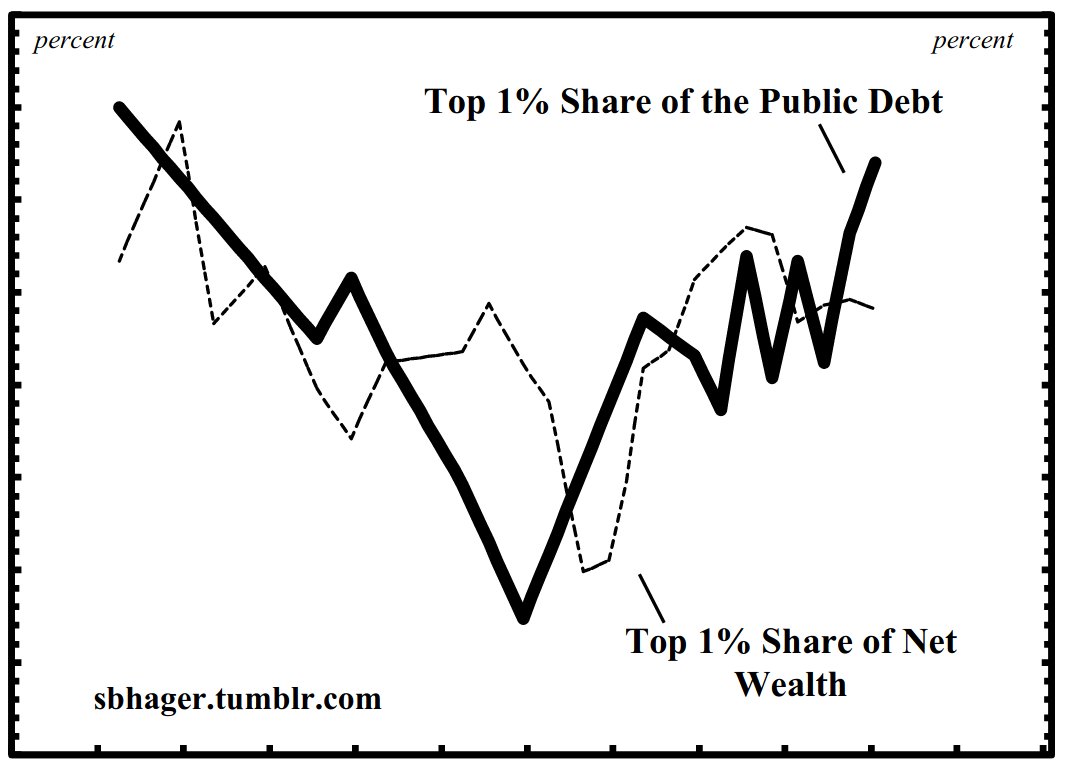

Continue ReadingHager, ‘What Happened to the Bondholding Class? Public Debt, Power and the Top One Per Cent’

Abstract In 1887 Henry Carter Adams produced a study demonstrating that the ownership of government bonds was heavily concentrated in the hands of a ‘bondholding class’ that lent to and, in Adams’s view, controlled the government like dominant shareholders control a corporation. The interests of this bondholding class clashed with the interests of the masses, […]

Continue Reading