Originally published at pluralistic.net Reproduced under a Creative Commons Attribution 4.0 license Cory Doctorow “Political economy” may sound like an obscure technical matter, but it’s a really very simple (and incredibly important) idea: That the economy is inevitably political, and there is no way to depoliticize economic theory. That is, every aspect of economics – […]

Continue ReadingMcMahon, ‘Star Power and Risk: A Political Economic Study of Casting Trends in Hollywood’

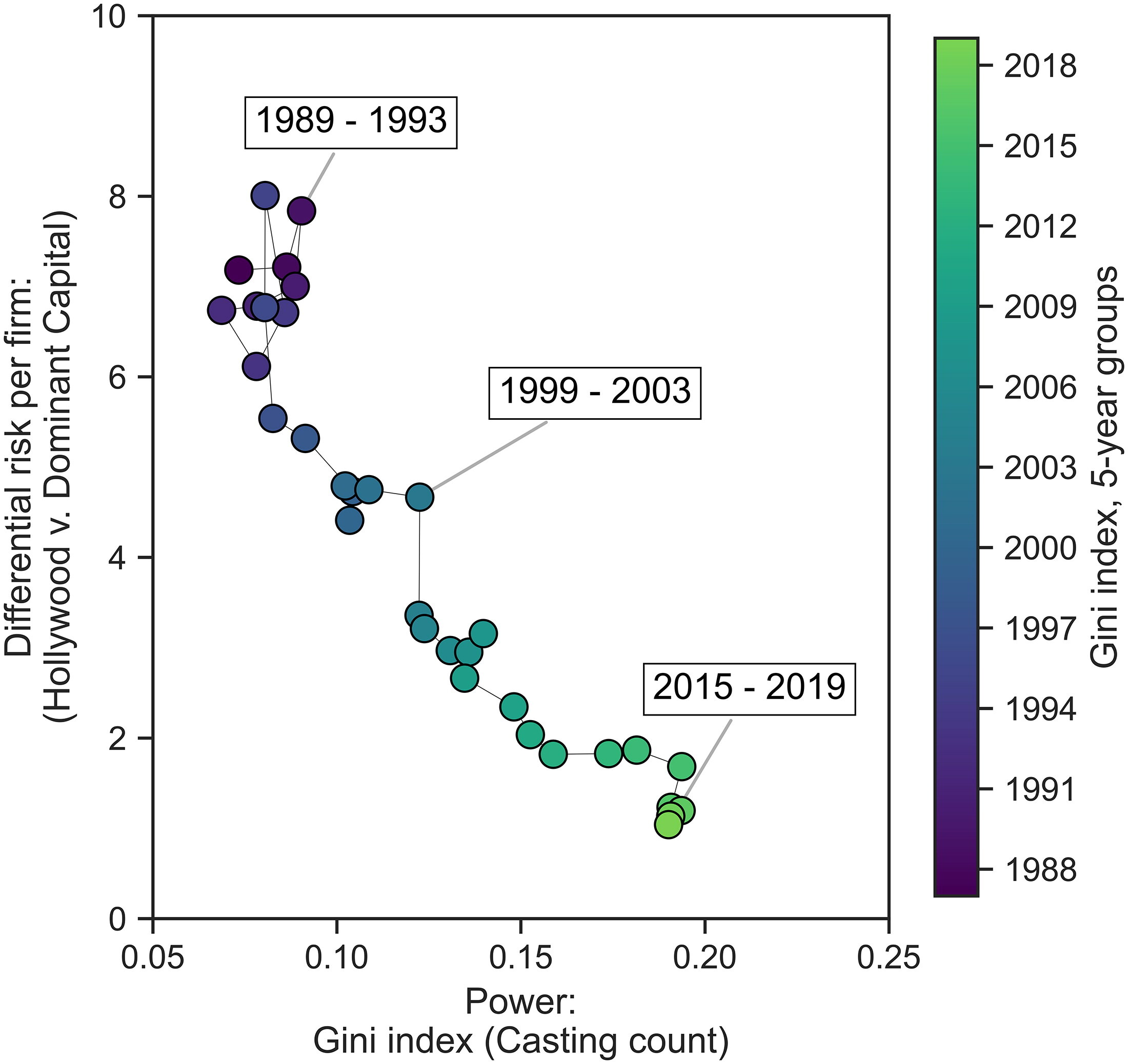

Abstract This paper builds an empirical and theoretical model to analyze how the financial goal of risk reduction changed the insides of Hollywood’s star system. For the moviegoer looking at Hollywood cinema from the outside, the function of the star system has remained the same since the 1920s: to have recognizable actors attract large audiences […]

Continue ReadingMcMahon, ‘The Political Economy of Hollywood’

Abstract In Hollywood, the goals of art and business are entangled. Directors, writers, actors, and idealistic producers aspire to make the best films possible. These aspirations often interact with the dominant firms that control Hollywood film distribution. This control of distribution is crucial as it enables the firms and other large businesses involved, such as […]

Continue Reading2022/01: McMahon, ‘Star power and risk: A political economic study of casting trends in Hollywood’

Abstract This paper builds an empirical and theoretical model to analyze how the financial goal of risk reduction changed the insides of Hollywood’s star system. For the moviegoer looking at Hollywood cinema from the outside, the function of the star system has remained the same since the 1920s: to have recognizable actors attract large audiences […]

Continue ReadingInequality Looks Very Different in Denmark and the US. Why?

Originally published at sbhager.com Sandy Brian Hager The following piece is based on my State of the Art article in Socio-Economic Review. It was originally published for The Conversation and the World Economic Forum Global Agenda. A Spanish translation can be found here. Why do the richest 1% of Americans take 20% of national income, […]

Continue ReadingKvachev, ‘Unflat Ontology: Essay on the Poverty of Democratic Materialism’

Abstract The paper is dedicated to the problem of flat ontology in philosophy and its relation to the practice in economy. The author argues that flat economy is based on a marginal utility theory of value and presents hierarchical value chains with concentration of power-capital as if they were flat and all the actors involved […]

Continue Reading2020/04: McMahon, ‘Reconsidering Systemic Fear and the Stock Market: A Reply to Baines and Hager’

Abstract A recent New Political Economy article by Baines and Hager (2020) critiqued Shimshon Bichler and Jonathan Nitzan’s capital-as-power (CasP) model of the stock market (Bichler & Nitzan, 2016). Bichler and Nitzan’s model of the stock market seeks to explain how financial crises are tied to the (upper) limits of redistributing income through power. Bichler […]

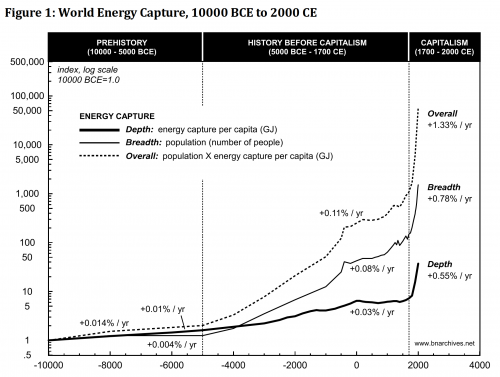

Continue ReadingBichler & Nitzan, ‘Growing through Sabotage: Energizing Hierarchical Power’

Abstract According to the theory of capital as power, capitalism, like any other mode of power, is born through sabotage and lives in chains – and yet everywhere we look we see it grow and expand. What explains this apparent puzzle of ‘growth in the midst of sabotage’? The answer, we argue, begins with the […]

Continue ReadingHager & Baines, ‘The Tax Advantage of Big Business’

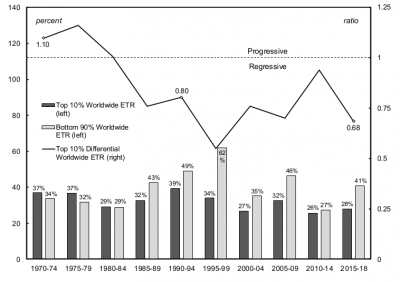

Abstract Corporate concentration in the United States has been on the rise in recent years, sparking a heated debate about its causes, consequences, and potential remedies. In this study, we examine a facet of public policy that has been largely neglected in current debates about concentration: corporate taxation. As part of our analysis we develop […]

Continue ReadingBaines & Hager, ‘Financial Crisis, Inequality, and Capitalist Diversity: A Critique of the Capital as Power Model of the Stock Market’

Abstract The relationship between inequality and financial instability has become a thriving topic of research in heterodox political economy. This article offers the first critical engagement with one framework within this wider literature: the Capital as Power (CasP) model of the stock market developed by Shimshon Bichler and Jonathan Nitzan. Specifically, we extend the CasP […]

Continue ReadingMartin, ‘The Autocatalytic Sprawl of Pseudorational Mastery ‘

Abstract Winner of the 2018 RECASP Essay Prize According to Jonathan Nitzan and Shimshon Bichler (2009), capital is not an economic quantity, but a mode of power. Their fundamental thesis could be summarized as follows: capital is power quantified in monetary terms. But what do we do when we quantify? What is the nature of […]

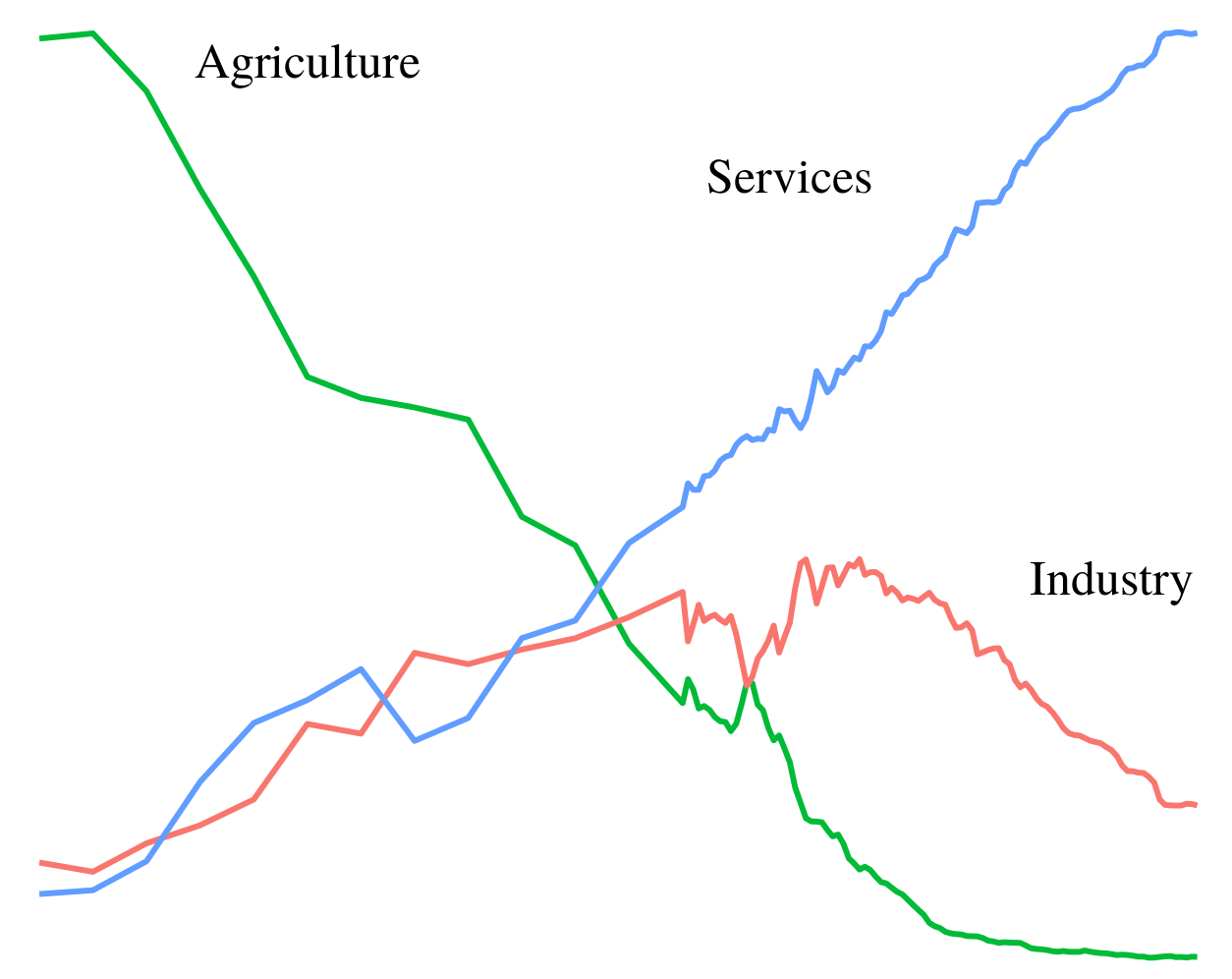

Continue ReadingFix, ‘Dematerialization Through Services: Evaluating the Evidence’

Abstract Dematerialization through services is a popular proposal for reducing environmental impact. The idea is that by shifting from the production of goods to the provision of services, a society can reduce its material demands. But do societies with a larger service sector actually dematerialize? I test the ‘dematerialization through services’ hypothesis with a focus […]

Continue Reading2019/01: Bichler & Nitzan, ‘CasP’s Differential Accumulation versus Veblen’s Differential Advantage (Revised and Expanded)’

Abstract This paper clarifies a common misrepresentation of our theory of capital as power, or CasP. Many observers tend to box CasP as an ‘institutionalist’ theory, tracing its central process of ‘differential accumulation’ to Thorstein Veblen’s notion of ‘differential advantage’. This view, we argue, betrays a misunderstanding of CasP, Veblen or both. First, we are […]

Continue ReadingCapitalism’s Deniers

Shimshon Bichler and Jonathan Nitzan Originally published at Real World Economics Review Blog. A new, capitalism-denying book is on the shelves, and it makes a stunning discovery: ‘Capitalism without competition is not capitalism’! Distortions: Capitalism Denied Capitalist crisis, like climate change, tends to breed ‘capitalism deniers’. The problem, argue the deniers, lies not in capitalism […]

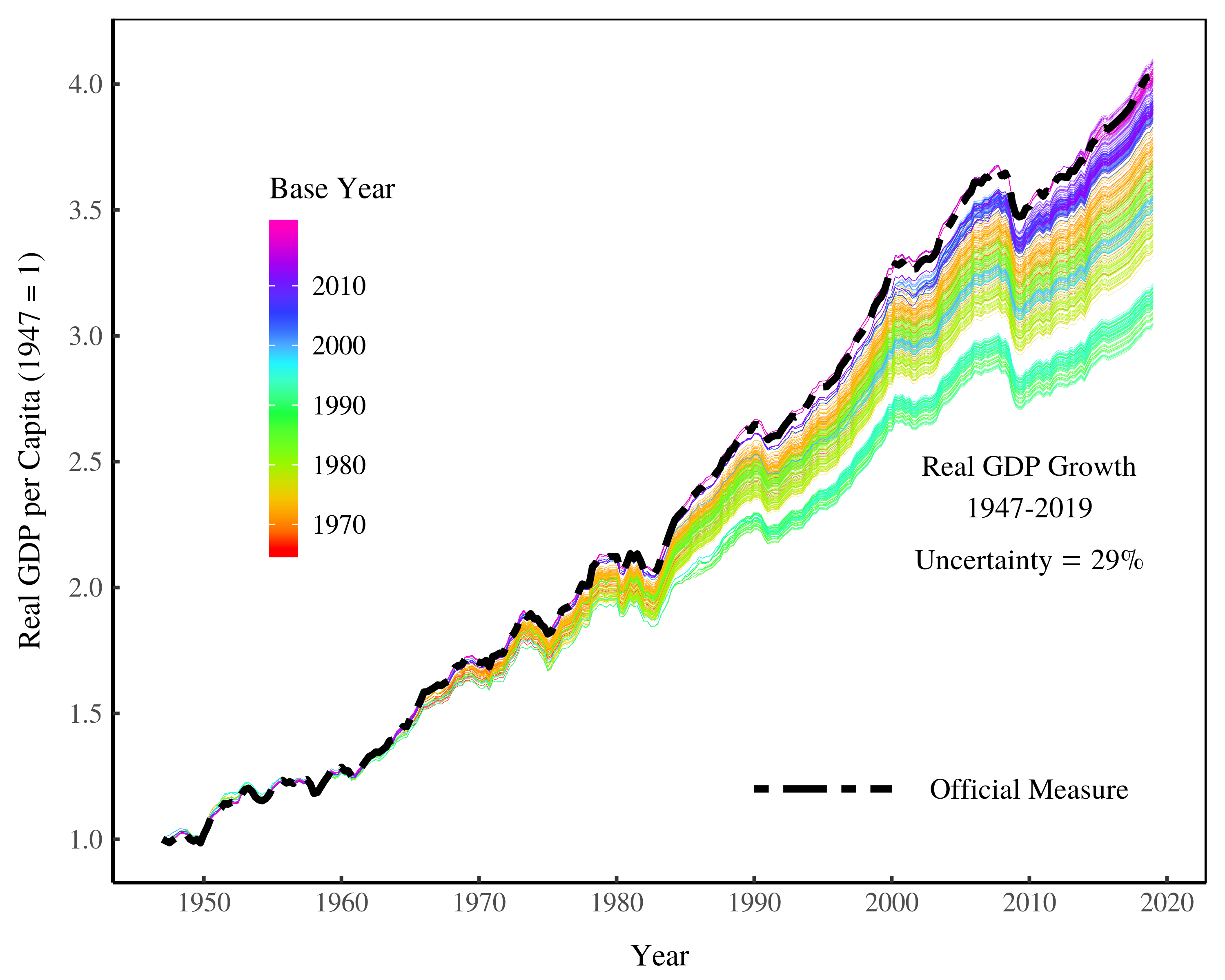

Continue ReadingFix, ‘The Aggregation Problem: Implications for Ecological and Biophysical Economics’

Abstract This paper discusses the dimension problem in economic aggregation, as it relates to ecological and biophysical economics. The dimension problem consists of a simple dilemma: when we aggregate, the observer must choose the dimension of analysis. The dilemma is that this choice affects the resulting measurement. This means that aggregate measurements are dependent on […]

Continue ReadingFix, ‘The Trouble With Human Capital Theory’

Abstract Human capital theory is the dominant approach for understanding personal income distribution. According to this theory, individual income is the result of ‘human capital’. The idea is that human capital makes people more productive, which leads to higher income. But is this really the case? This paper takes a critical look at human capital […]

Continue Reading2018/09: Fix, ‘Energy, Hierarchy and the Origin of Inequality’

Abstract Where should we look to understand the origin of inequality? Most research focuses on three windows of evidence: (1) the archaeological record; (2) existing traditional societies; and (3) the historical record. I propose a fourth window of evidence — modern society itself. I hypothesize that we can infer the origin of inequality from the […]

Continue ReadingBichler & Nitzan, ‘Arms and Oil in the Middle East: A Biography of Research’

Abstract This essay interweaves two stories—one theoretical and empirical, the other autobiographical. The first story embeds the Israeli-Palestinian conflict in the broader political economy of the Middle East and the global accumulation of “capital as power.” The second story narrates the authors’ personal journey to uncover, theorize, and research this enfoldment. The essay explores and […]

Continue Reading2018/08: Bichler & Nitzan, ‘CasP’s Differential Accumulation versus Veblen’s Differential Advantage’

Abstract This paper clarifies a common misrepresentation of our theory of capital as power, or CasP. Many observers tend to box CasP as an ‘institutionalist’ theory, tracing its central process of ‘differential accumulation’ to Thorstein Veblen’s notion of ‘differential advantage’. This view, we argue, betrays a misunderstanding of CasP, Veblen or both. As we show, […]

Continue ReadingBichler & Nitzan, ‘With Their Back to the Future: Will Past Earnings Trigger the Next Crisis?’

Abstract As these lines are being written (April 2018), the The U.S. stock market is again in turmoil. After a two-year bull run in which share prices soared by nearly 50 per cent, the market is suddenly dropping. Since the beginning of 2018, it lost nearly 10 per cent of its value, threatening investors with […]

Continue Reading