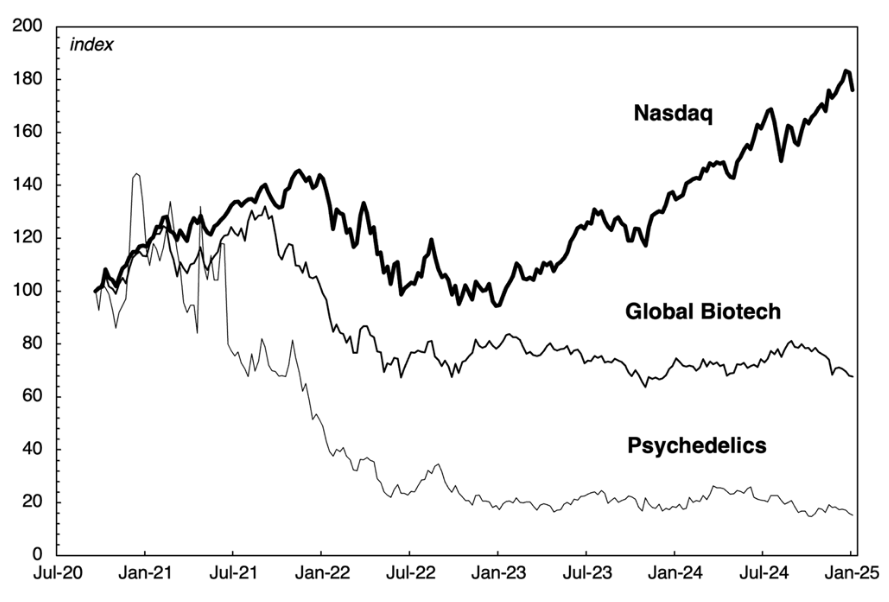

Abstract This article traces the shifting fortunes of for-profit psychedelic medicine through two phases: a boom from 2016 to late 2021, followed by a bust that continued through late 2024. It argues that the forces driving this cycle are best understood through the concept of capitalization, which links present valuations to investor expectations about future […]

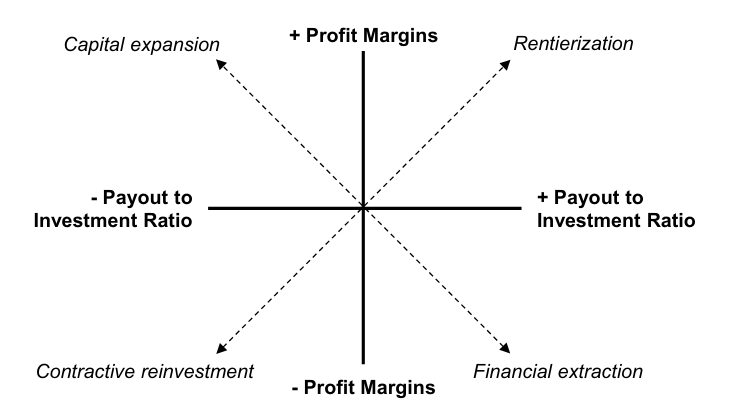

Continue ReadingBaines & Hager, ‘Rentiership and Intellectual Monopoly in Contemporary Capitalism’

Abstract The concepts of rentiership and intellectual monopoly have gained increased prominence in discussions about the transformation of global capitalism in recent years. However, there have been few if any attempts to construct measures for rentiership and intellectual monopoly using firm-level financial data. The absence of such work, we argue, is symptomatic of conceptual challenges […]

Continue ReadingLet them eat semaglutides

Originally published at sbhager.com Sandy Brian Hager Reading in the latest FT Weekend about NovoNordisk’s recent moves to corner the market for weight loss drugs, I was reminded of an eye-opening article from Rana Foroohar late last year. In that piece, the always-sharp Foroohar discusses the emergence of new blockbuster drugs known as semaglutides. These […]

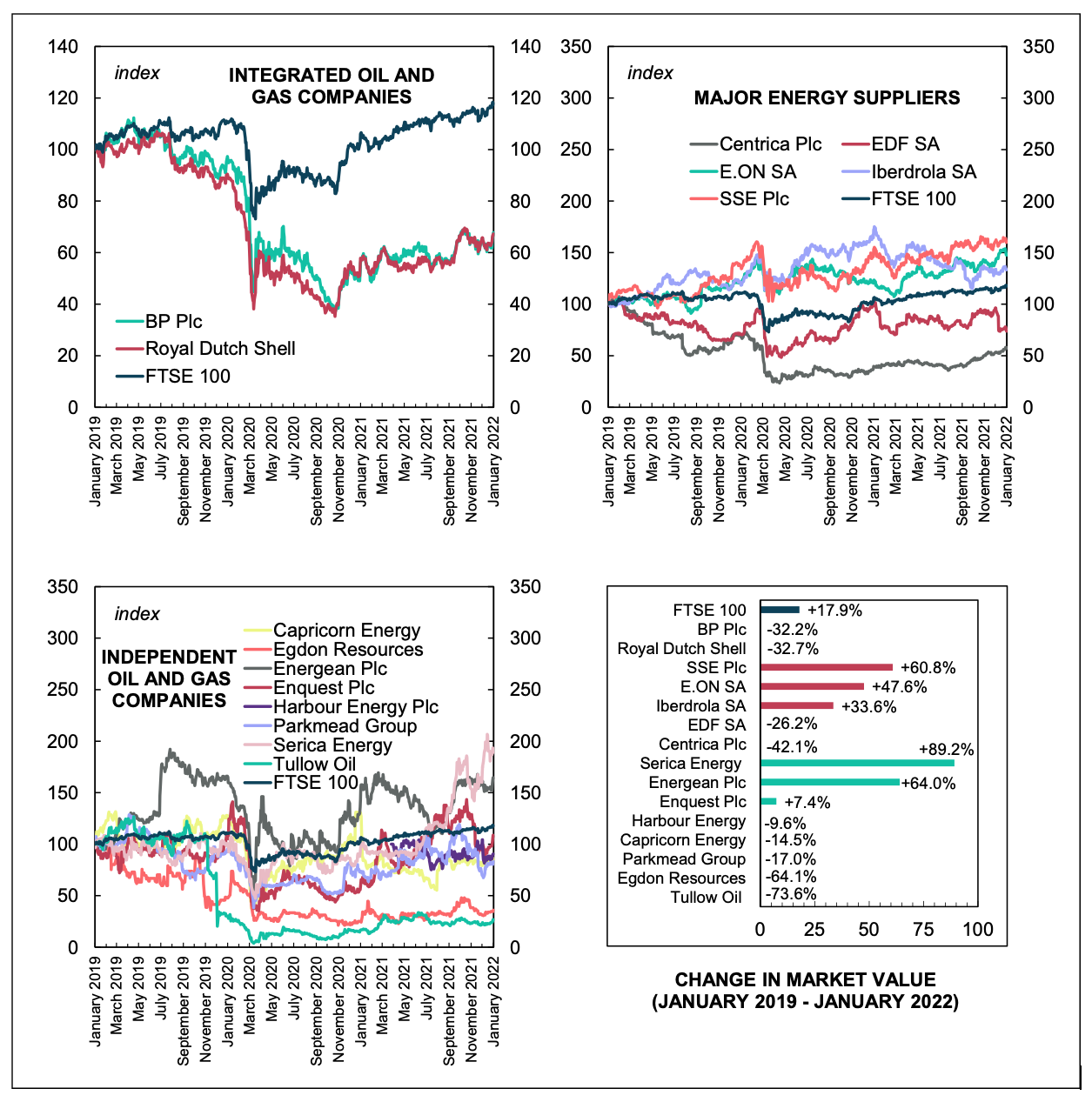

Continue ReadingNew Briefing – Drilling Down: UK Oil and Gas Financial Performance

Originally published at sbhager.com Sandy Brian Hager Joseph Baines and I have a new briefing with Common Wealth examining the financial performance of UK oil and gas producers and energy suppliers. Some of the key findings include: The two UK-headquartered supermajors – BP and Royal Dutch Shell – have remained profitable over the past decade, […]

Continue ReadingNew Report – Power Ahead: An Energy System Fit For The Future

Originally published at sbhager.com Sandy Brian Hager In a new briefing with Common Wealth, Miriam Brett, Joseph Baines and I examine ownership and financial data for the “Big Six” UK energy companies: Centrica (British Gas), EDF Energy, E.ON UK, NPower, Scottish Power and SSE. We found that: Privatisation since the late-1980s transferred wealth from the […]

Continue ReadingA Requiem for Carbon Capitalism?

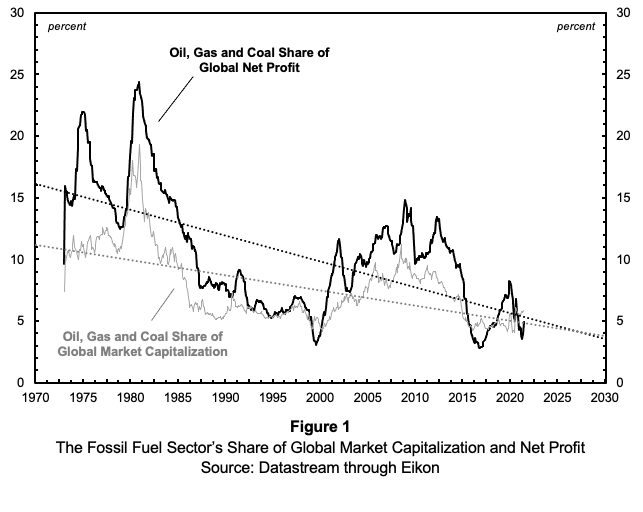

Originally published at sbhager.com Sandy Brian Hager News of the immanent demise of companies responsible for a significant portion of global greenhouse gas emissions might sound like a boon for efforts to avert climate breakdown. But just how bad is the outlook for fossil fuels? In this research note, I offer a preview of findings […]

Continue ReadingTeaching IPE Theory

Originally published at sbhager.com Sandy Brian Hager Switching Things Up This year I am introducing a new second year undergraduate module on theories of international political economy. Modelled on the theory module I teach on our MA programme, it replaces the history of economic thought module I taught for the past four years. There are […]

Continue ReadingWhat is (Global) Political Economy?

Originally published at sbhager.com Sandy Brian Hager For four years now I’ve been teaching a postgraduate module called Global Political Economy: Contemporary Approaches. This is one of two core modules for our MA programme in Global Political Economy at City. While my module deals with theoretical approaches, the other core module, taught by my colleague […]

Continue Reading2020/04: McMahon, ‘Reconsidering Systemic Fear and the Stock Market: A Reply to Baines and Hager’

Abstract A recent New Political Economy article by Baines and Hager (2020) critiqued Shimshon Bichler and Jonathan Nitzan’s capital-as-power (CasP) model of the stock market (Bichler & Nitzan, 2016). Bichler and Nitzan’s model of the stock market seeks to explain how financial crises are tied to the (upper) limits of redistributing income through power. Bichler […]

Continue ReadingCorporate Taxation and the Power Theory of Value

Sandy Hager This is a (longer) draft version of an article that is under consideration for the newsletter of the Tax Justice Network: Tax Justice Focus. Taxation is all about power. We are constantly reminded of this when flipping through any newspaper (or browsing any news website). The Panama Papers, the stuff of which front […]

Continue ReadingHager, ‘Public Debt, Ownership and Power: The Political Economy of Distribution and Redistribution’

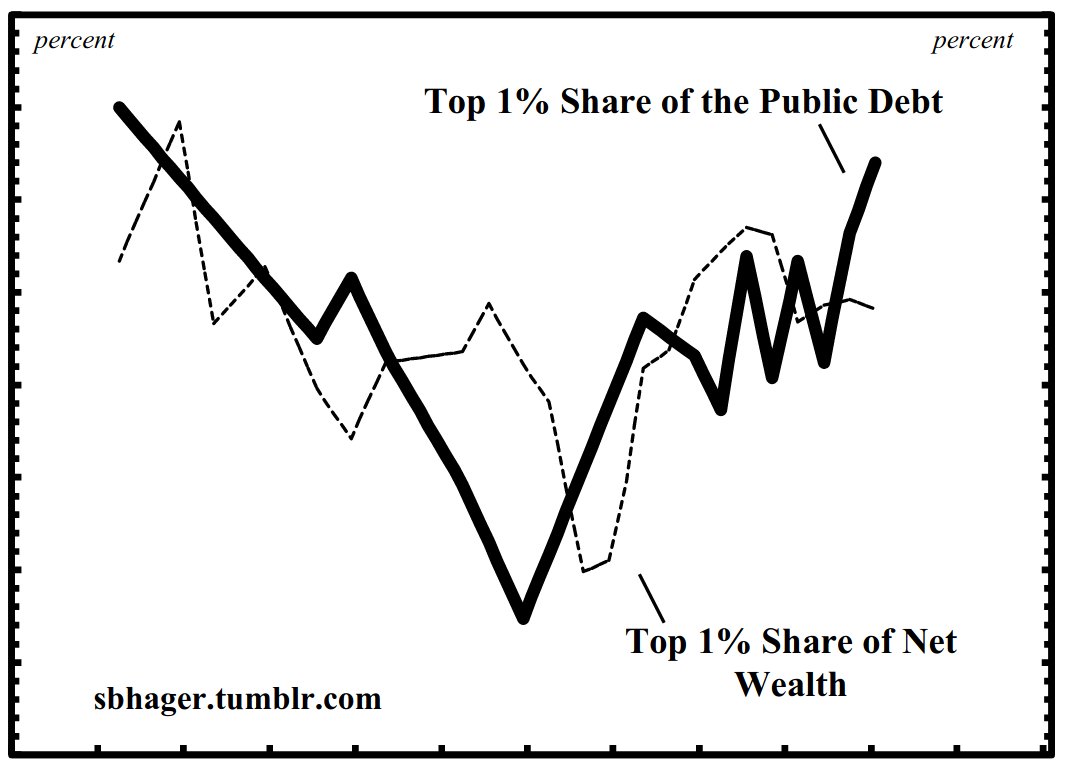

Abstract This dissertation offers the first comprehensive historical examination of the political economy of US public debt ownership. Specifically, the study addresses the following questions: Who owns the US public debt? Is the distribution of federal government bonds concentrated in the hands of a specific group or is it widely held? And what if the […]

Continue ReadingHager, ‘What Happened to the Bondholding Class? Public Debt, Power and the Top One Per Cent’

Abstract In 1887 Henry Carter Adams produced a study demonstrating that the ownership of government bonds was heavily concentrated in the hands of a ‘bondholding class’ that lent to and, in Adams’s view, controlled the government like dominant shareholders control a corporation. The interests of this bondholding class clashed with the interests of the masses, […]

Continue Reading