Forum Replies Created

-

AuthorReplies

-

This is part of a wider project that James McMahon and I are trying to get off the ground. We want to generalize CASP analysis to a big sample of countries to see what we can conclude, in general, about ‘sabotage’. So far James is doing the heavy lifting of compiling the data.

Hopefully I don’t screw up!

September 28, 2021 at 10:37 am in reply to: Cherizola’s “From Commodities to Assets” wins the 2021 RECASP Essay Prize #246872Your comments are not late at all. In fact, the revival of discussion about Jesús’ essay is welcome–it deserves it!

One extra nudge: please consider submitting something to RECasP.

True or false: The systemic fear thesis (“SFT”) is based on the assertion/assumption that a rational investor/capitalist does not consider current or past information in making investment decisions. I believe the sentence as written is “true” and the assertion/assumption is false and has been proven empirically to be so.

My concern is that the sentence, as written, is setting up an impossible situation, where any looking backwards in a period of low systemic fear cancels the thesis.

As I see it, systemic fear is a symptom of being able to see a future for differential accumulation. Benchmarking, rolling-averages, reading the Financial Times, teaching important ratios like CAPE3–the past is repeatedly incorporated into investor behavior. The systemic breakdown is when there is little to do with all of this information, other than pin price to past earnings (a rising correlation of P ~ E). A 1980s capitalist can use all sorts of methods to discount future expectations–this is not the direct issue–but they have the confidence to throw future expectations farther from the past.

Thanks, Blair!

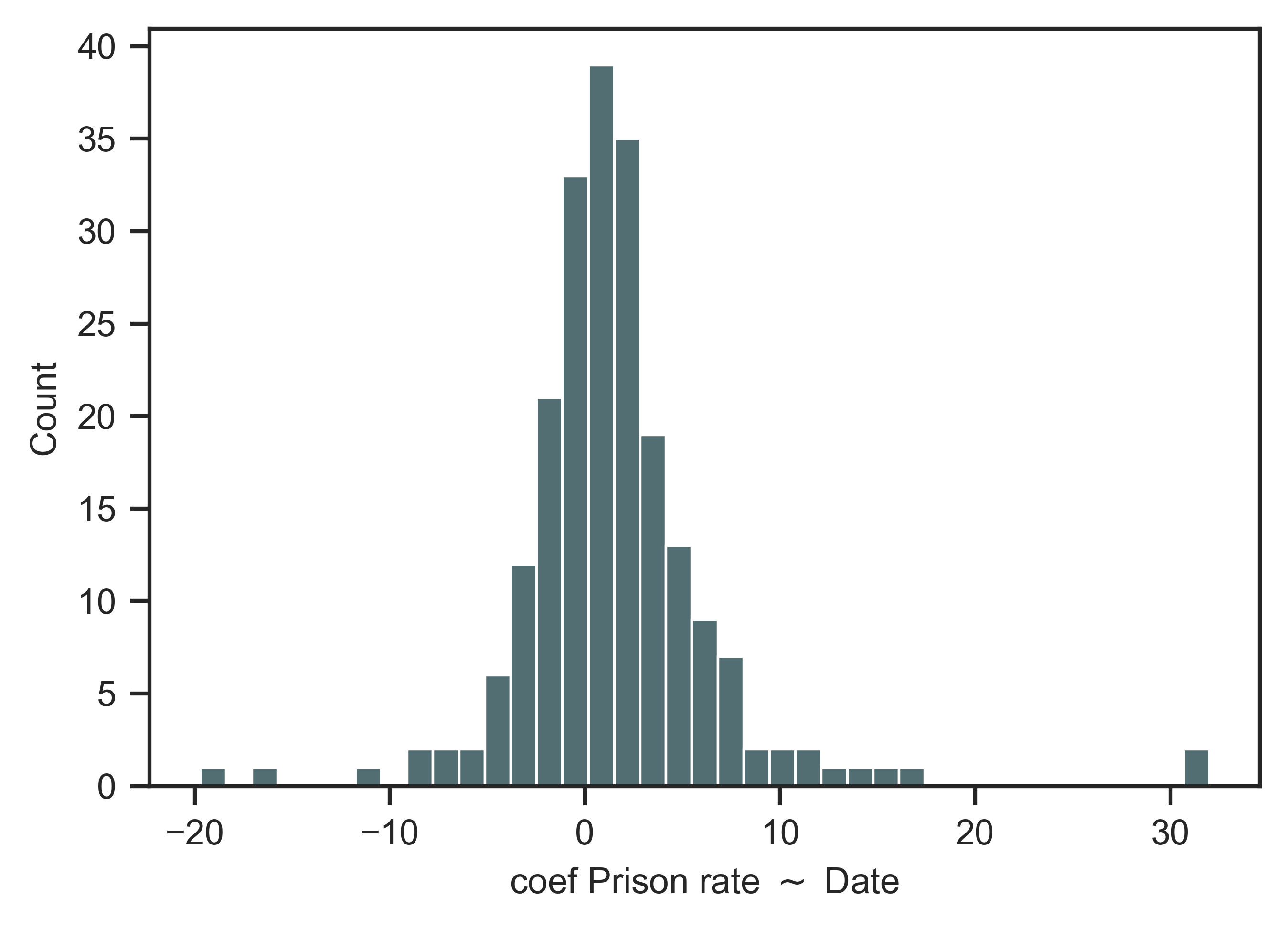

Done! Interesting that it appears normally distributed (have not analyzed skew).

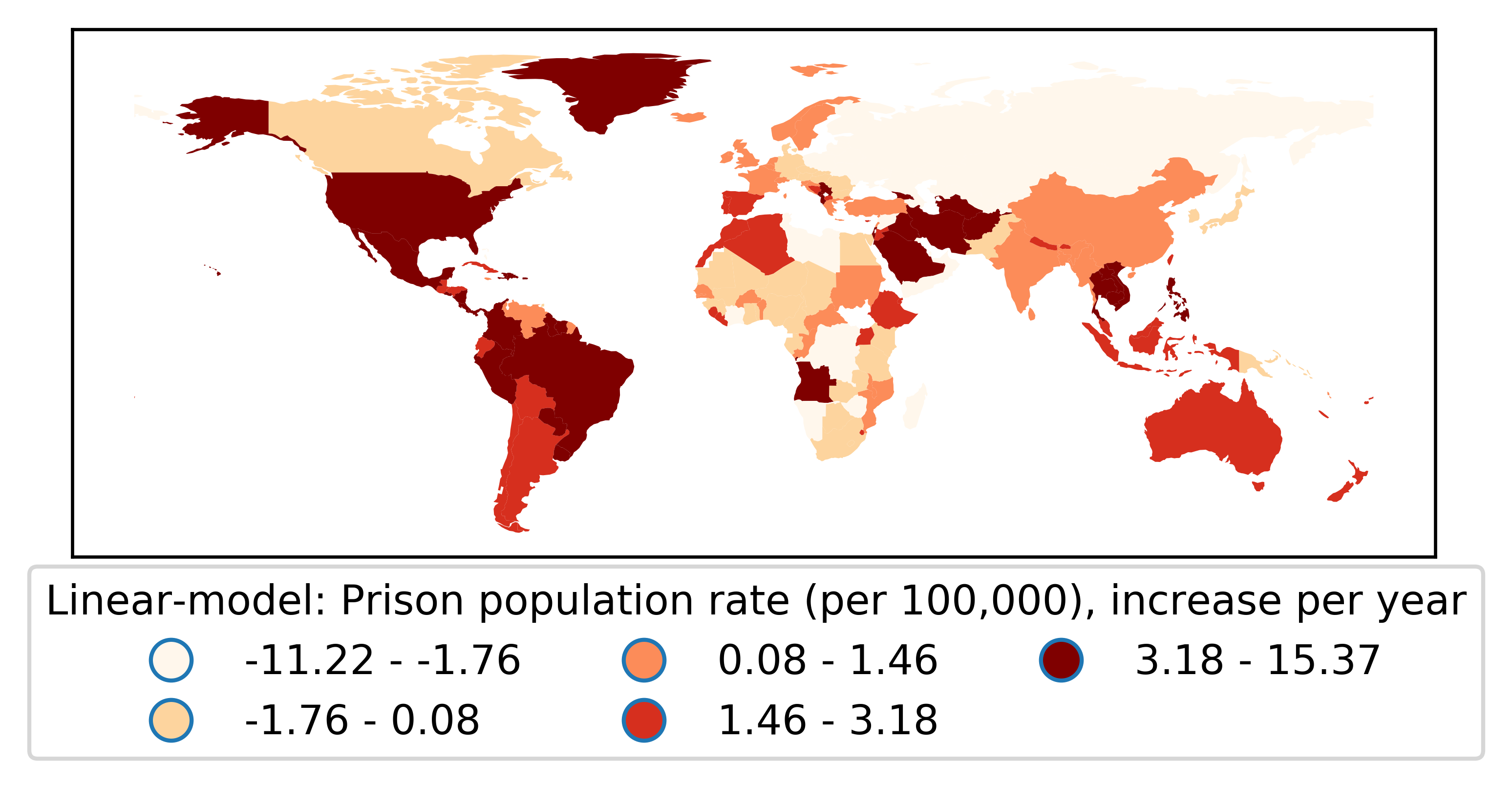

For fun, I plotted the results on a world map. Colors are discrete quantiles. The United States, as always, is similar to some brutal regimes.

In a previous post, I used prison population data to demonstrate the benefits of web-scraping.

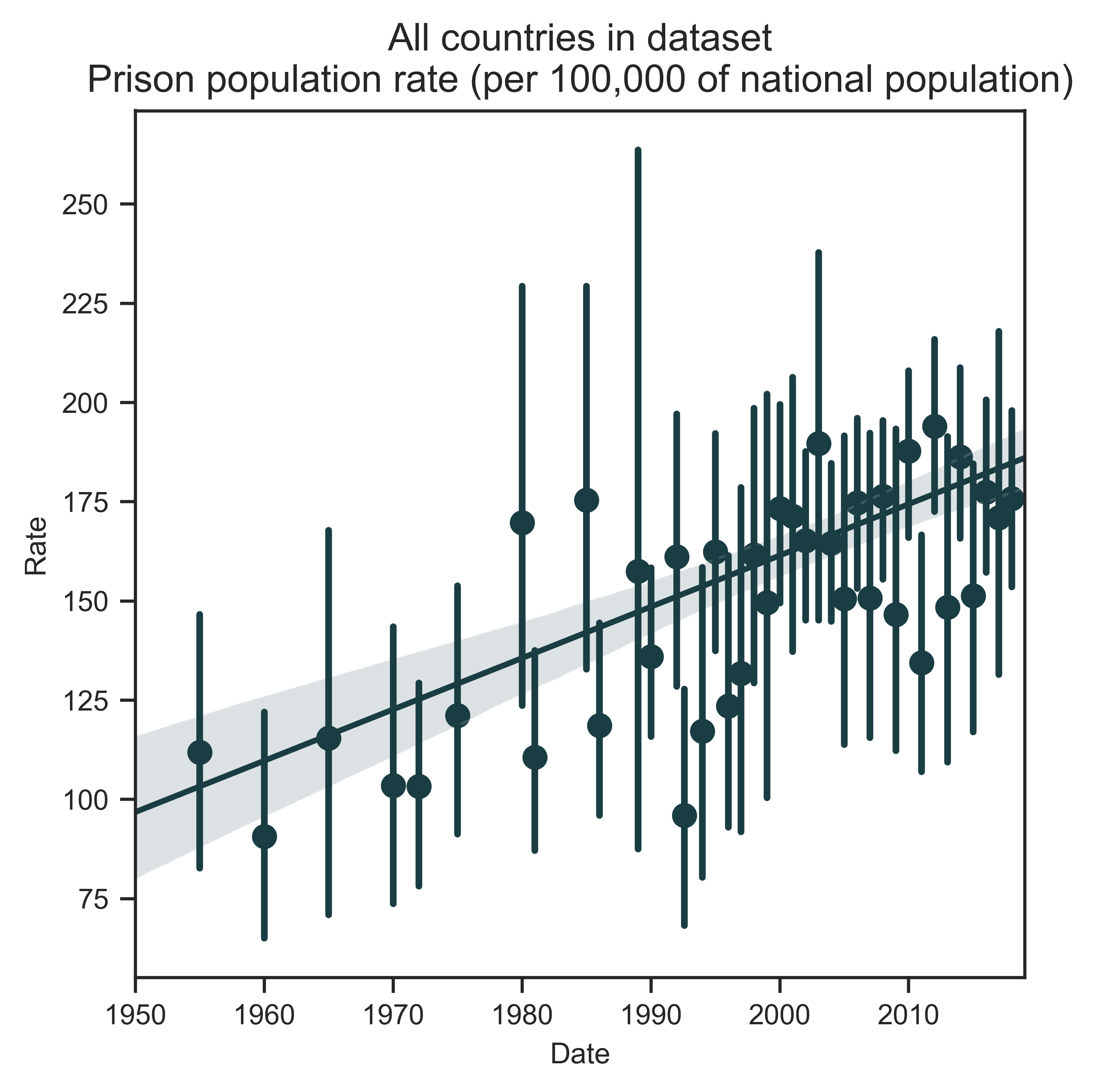

Jonathan, your post inspired me to run my script again. The update did not add much data, but is the rising global trend a portend of BN’s argument about the redistribution of income share?

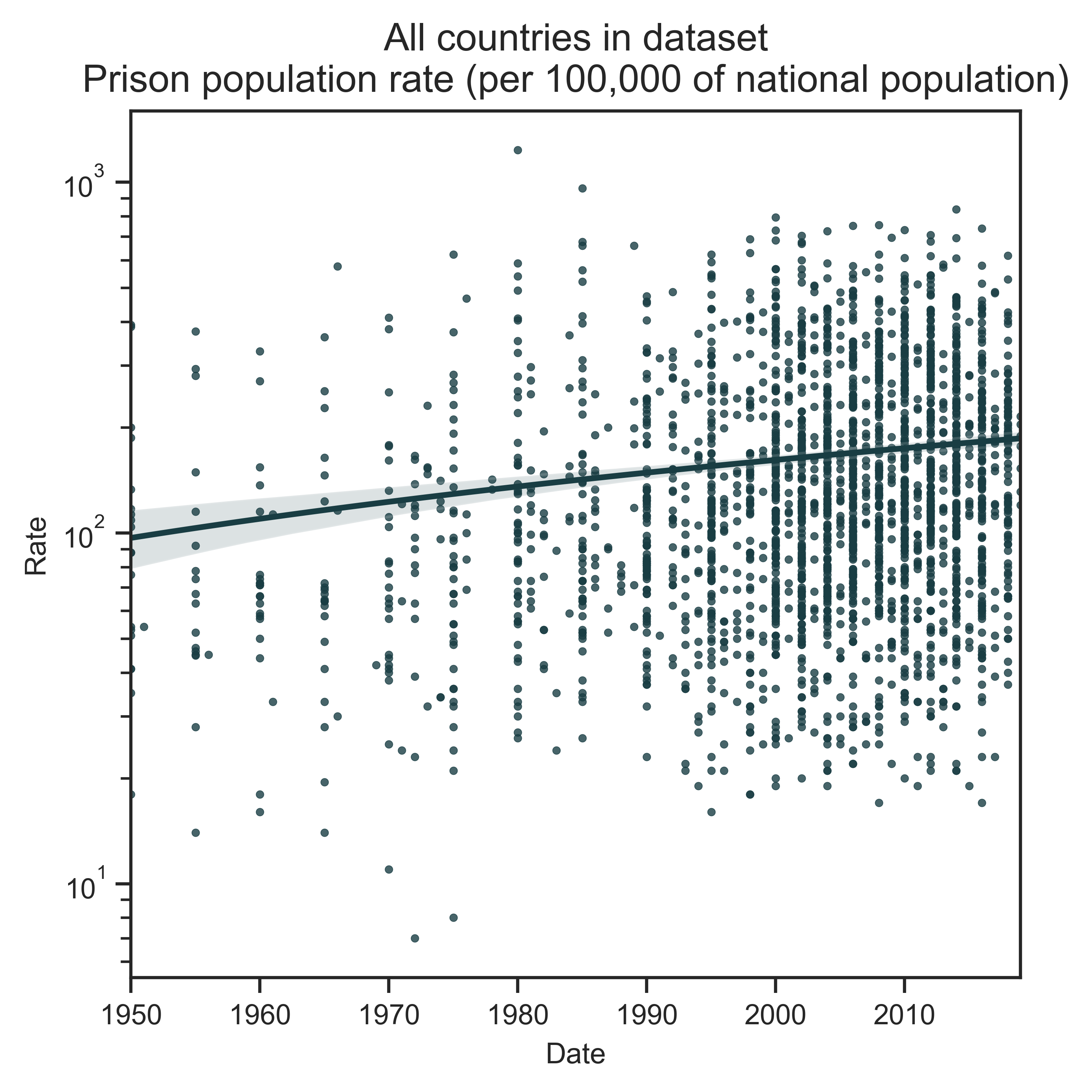

In the figure above we have the data binned across the x-axis. For each bin, the dot is the mean and the error bar is the confidence interval. For those interested, here is a log-normal plot of data without binning. On the log scale the upwards trend looks flatter, but I would have to leave it to an expert or interested researcher to speak to the significance of increasing the prison population by even a few percent (which would require a massive coordination of lots of states agencies).

Data is from https://www.prisonstudies.org and the dataset has 215 countries.

- This reply was modified 4 years, 8 months ago by jmc.

When I first read Jose Saramago, I started with Blindness and could only make it about 60 pages. Saramago’s style is beautifully poetic, but you have to give his writing your complete attention. If infinite regress is described with “turtles all the way down”, Saramago’s sentences are sub-clauses all the way down. The Double might be my best personal entry to Saramago’s novels. Its philosophical exploration of the self is, at least for me, a page turner (except that a page turner, for Saramago, is me re-reading the same paragraph over and over).

* For those who have read Blindness, I will definitely return to it. I actually think about that novel a lot, even if I never completed it. Something about its premise, I guess …

i’d mention the films eraserhead (john waters), ‘metropolis’ (fritz lang) , and aguirre the wrath of god (herzog) as other semi-fictional accounts of capitalist development — and also maybe Matewan (film about a labor rebellion in coal country—w va.).

ishi, can’t help myself:

Eraserhead is directed by David Lynch. Funny fact, it was actually funded by the American Film Institute. Eraserhead is lovely, but if anyone finds it slow and weird, Lynch does not care:

Matewan, directed by John Sayles. Great pick. Another would be a film that people know infamously: Michael Cimino’s Heaven’s Gate, a film about a cattle conglomerate crushing cattle rustling in a poverty stricken county.

- This reply was modified 4 years, 9 months ago by jmc.

Thanks, David, for the email!

What is the main thesis of the book [Nitzan and Bichler, Capital as Power (2009)]?

Are you trying to show that

1_ The capitalist regime will one day be overthrown as “the masses” become enlightened? (If so, hopefully something better than the communism of the Soviet Union will replace it.)

2_ The capitalist regime should one day be overthrown ?

3_ “The capitalists” will continue to grow in power until they own — and control — everything. And there is nothing that “we, the people” can do to prevent this.

Any help you can give me to understand your book would be appreciated.

PS. I am also having trouble understanding the term “capitalization”. Do you mean by this term just the “total value” in a corporation (as in the market capitalization of Microsoft is US$ 50 billion).

And yes, people like Cochrane, Di Muzio, Fix and Hager have tried to breathe value and meaning into CasP, but despite their best efforts it remains obscure. With the notable exception of Tim Di Muzio’s The Tragedy of Human Development, most CasP efforts seem focused on finding new ways to show capital’s power in this industry or that industry, using this new metric or that new metric. Why should we care if capital is power? How would our lives be different if capital was not power? Why should we care about power at all? (To me, the answer is none of us should be subject to the arbitrary coercive power of another without our consent, which is implied in the case of states but not for private actors.) Eventually, someone will have to declare CasP’s purpose, and if that goal is not to constrain the power of capital, I don’t see the point.

There are lots of important discussion points here. Perhaps some of the discussion can build on Jonathan’s curiosity about the future of CasP, found here: https://capitalaspower.com/casp-forum/topic/the-future-of-casp-and-beyond/

I do want to comment about the noticeable pattern of industry/sector level research. Focus on the particular, rather than the universal, partly stems from how much academic theory speaks about power. Combine political economy with political theory, Continental philosophy, anthropology and history, and you have endless opportunities to find articles, books and presentations that critique a power process in capitalism.

CasP does not make this literature irrelevant, but I would say that it challenges empirical research to come to terms with a problem that is still growing: when you say “power”, what does it actually mean for capital accumulation? How would one know if it is 20%, 50% or 100% of capital value?

This problem is methodological and I think that it makes industry/sector research a better starting point to build CasP (not to say that we can’t do more with what we build). For example, when I worked on my dissertation I had an acute fear that I could not put my finger on how Hollywood accumulated through power–hence the metrics, proxies, triangulation. Because if I could not measure how Hollywood accumulated through power, how would I know if my reference to power was more metaphorical than literal?

I came to political economy via political theory and my journey has taught me there is a recurring pitfall to theorizing: abstract ideas that are camouflaged as concrete, empirical claims. Herbert Marcuse came to this realization about the philosophy of his first mentor, Martin Heidegger:

To me and my friends, Heidegger’s work appeared as a new beginning: we experienced his book … as, at long last, a concrete philosophy: here there was talk of existence, of our existence, of fear and care and boredom, and so forth …. Only gradually did we begin to observe that the concreteness of Heidegger’s philosophy was to a large extent deceptive–that we were once again confronted with a variant of transcendental philosophy (on a higher plane), in which existential categories had lost their sharpness, been neutralized, and in the end were dissipated amid greater abstractions. That remained the case later on when the “question of Being” was replaced by the “question of technology”: merely another instance in which apparent concreteness was subsumed by abstraction–bad abstraction, in which the concrete was not genuinely superseded but instead merely squandered.

You have to fight against this pitfall all the time. Case in point: here is Moishe Postone, a Marxist theorist who inverts the labour theory of value to the “value theory of labour”, purportedly addressing his interviewer’s concern that speaking about the dual-form of the commodity easily slips into a kind of “metaphorics”:

Marx grounds the form of production in capitalism as well as its trajectory of growth with reference to his analysis of the dynamic nature of capital. I tried to work out the general character of the dynamic as a treadmill dialectic. It’s this treadmill dialectic that generates the historical possibility for the abolition of proletariat labor. It renders such labor anachronistic while, at the same time, reaffirming its necessity. This historical dialectic entails processes of ongoing transformation, as well as the ongoing reproduction of the underlying conditions of the whole. As capital develops, however, the necessity imposed by the forms that underlie this dialectic increasingly remains a necessity for capital alone; it becomes less and less a necessity for human life. In other words, capital and human life become historically separated.

Much like the abstractness of metaphysics, here we have truth claims stacked on top of truth claims about a historical process that should have concrete, observable details.

April 25, 2021 at 9:25 pm in reply to: Blair Fix’s Postdoctoral Proposal: Does Hierarchy Drive Income Inequality? #245476Congrats, Blair!

Interesting find! From a quick look, an analytical separation between economics and politics lurks at the bottom of the argument. In my opinion, I find this is what bothers me with papers that look at lobbying and the wealthy’s effect in Washington: there is a two-stage argument that wealth is achieved (in the economy) and this buys a seat at the table in places of power (government).

This is all from a quick scan, so I could be wrong.

Coincidentally, I was scanning this paper when I came across an article that Bill Gates is now the largest landowner in the United States. Below is the cover photo of The Land Report, a magazine for the “American landowner”.

- This reply was modified 4 years, 11 months ago by jmc.

ishi crew,

As you can see, our forum is open to the critique of ideas. But please try to be conscious of what some of your tangential comments imply. I can take responsibility for the edit above–the race and sexual orientation of the economist is not relevant to them using neo-classical economics.

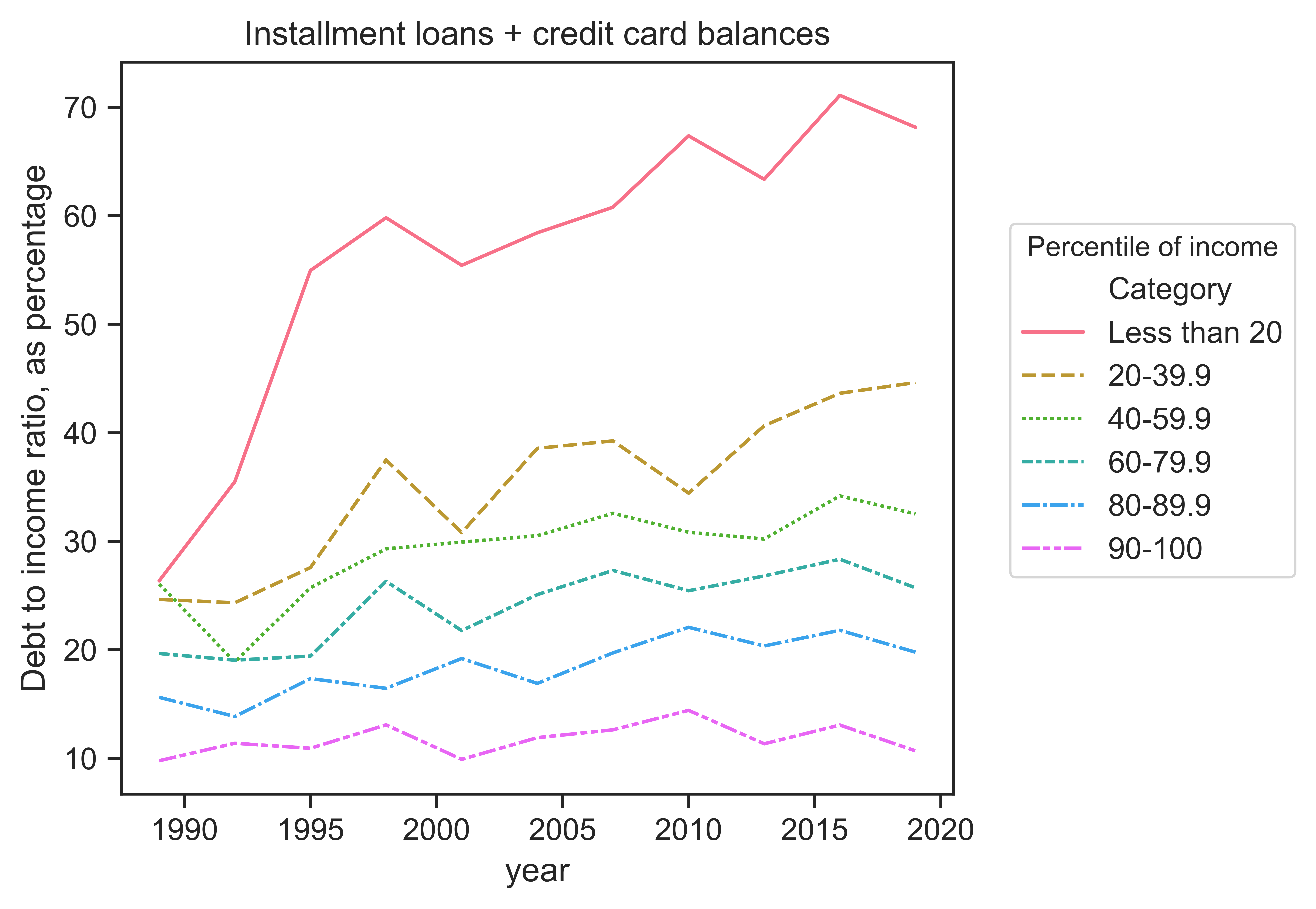

March 2, 2021 at 2:44 pm in reply to: GameStop, hedge funds, and the “reality” of the stock market #245399That link is great, Jonathan. The breakdown of consumer finance by percentiles of income or wealth can help dispel assumptions about our collective investment in capitalist systems of retirement or debt. For example, I curiously plotted the ratio of credit card and installment debt to income. The impact of this type of debt is far from evenly distributed across income bands. Moreover, this debt is difficult to get out of through asset liquidation; often the things we buy on credit cards and installment plans (cars) depreciate in value.

February 16, 2021 at 10:40 am in reply to: Links, tid-bits, or snippets of interesting research #245350

February 16, 2021 at 10:40 am in reply to: Links, tid-bits, or snippets of interesting research #245350Hi Dominic,

Thanks for the recommendation! I moved it to this page so it can be the next item in a list of recommendations. I’ll be checking it out.

-

AuthorReplies