Capital as Power in the 21st Century A Conversation MICHAEL HUDSON, JONATHAN NITZAN, TIM DI MUZIO, and BLAIR FIX February 2025 Abstract On December 3, 2024, Michael Hudson met with capital-as-power researchers Jonathan Nitzan, Tim Di Muzio, and Blair Fix to discuss the intersections between their two lines of research. What follows is a transcript […]

Continue ReadingNoble, ‘Follow the Money: The Political Economy of Petrodollar Accumulation and Recycling’

Abstract This thesis makes two unique contributions to the International Political Economy literature. It presents the first comprehensive, empirical investigation of petrodollar accumulation and recycling spanning the period 1980-2021. It also corrects the misconception that petrodollar recycling in the 1970s and 1980s involved the extension of loans to developing countries using fractional reserve banking and […]

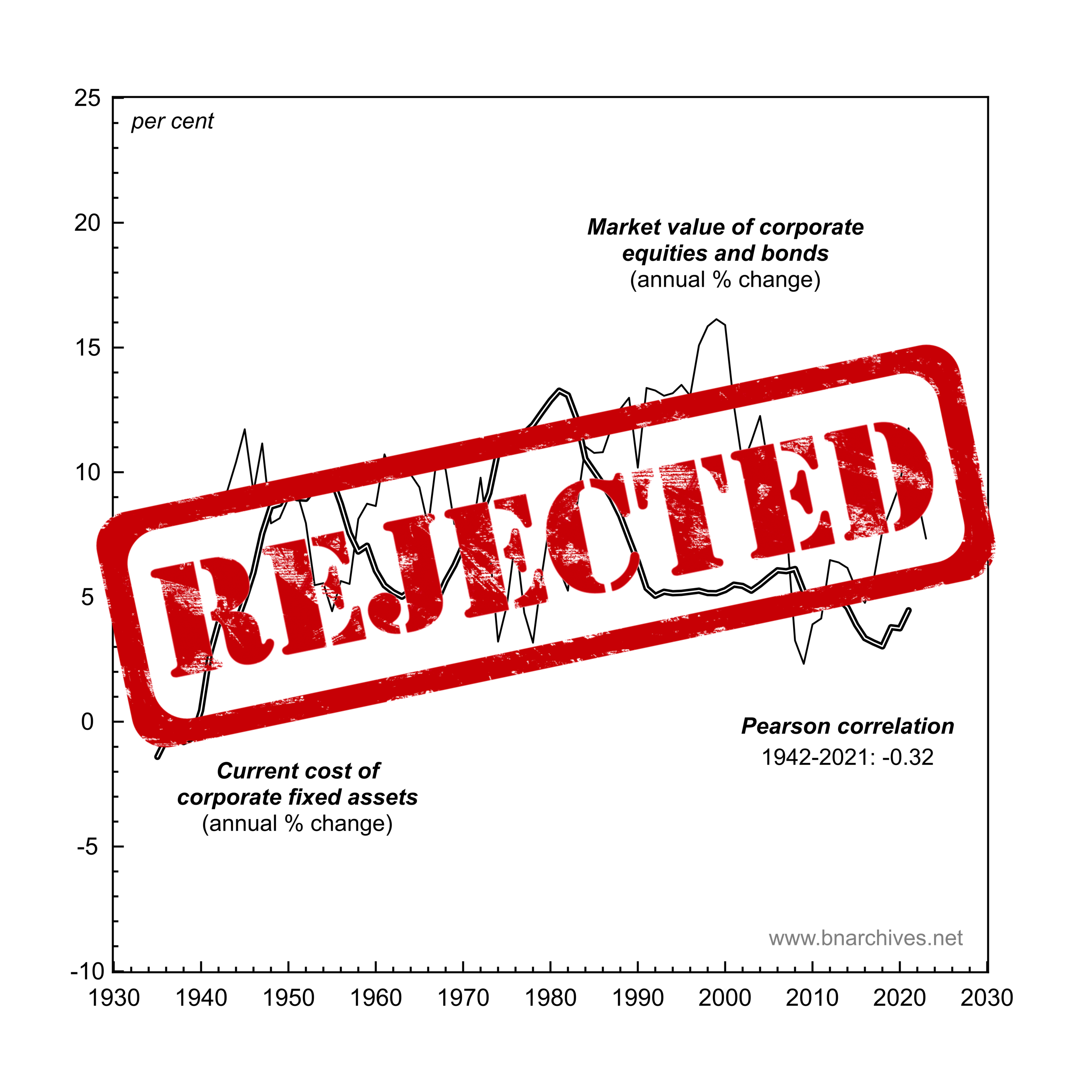

Continue ReadingBichler & Nitzan, ‘The Capital as Power Approach: An Invited-then-Rejected Interview’

The Capital as Power Approach An Invited-then-Rejected Interview with Shimshon Bichler and Jonathan Nitzan SHIMSHON BICHLER and JONATHAN NITZAN September 2023 Keywords capital accumulation, capitalization, interview, Marxism, modes of power, stagflation, systemic fear, value theory Citation Bichler, Shimshon, and Nitzan, Jonathan. 2023. ‘The Capital as Power Approach: An Invited-then-Rejected Interview with Shimshon Bichler and Jonathan […]

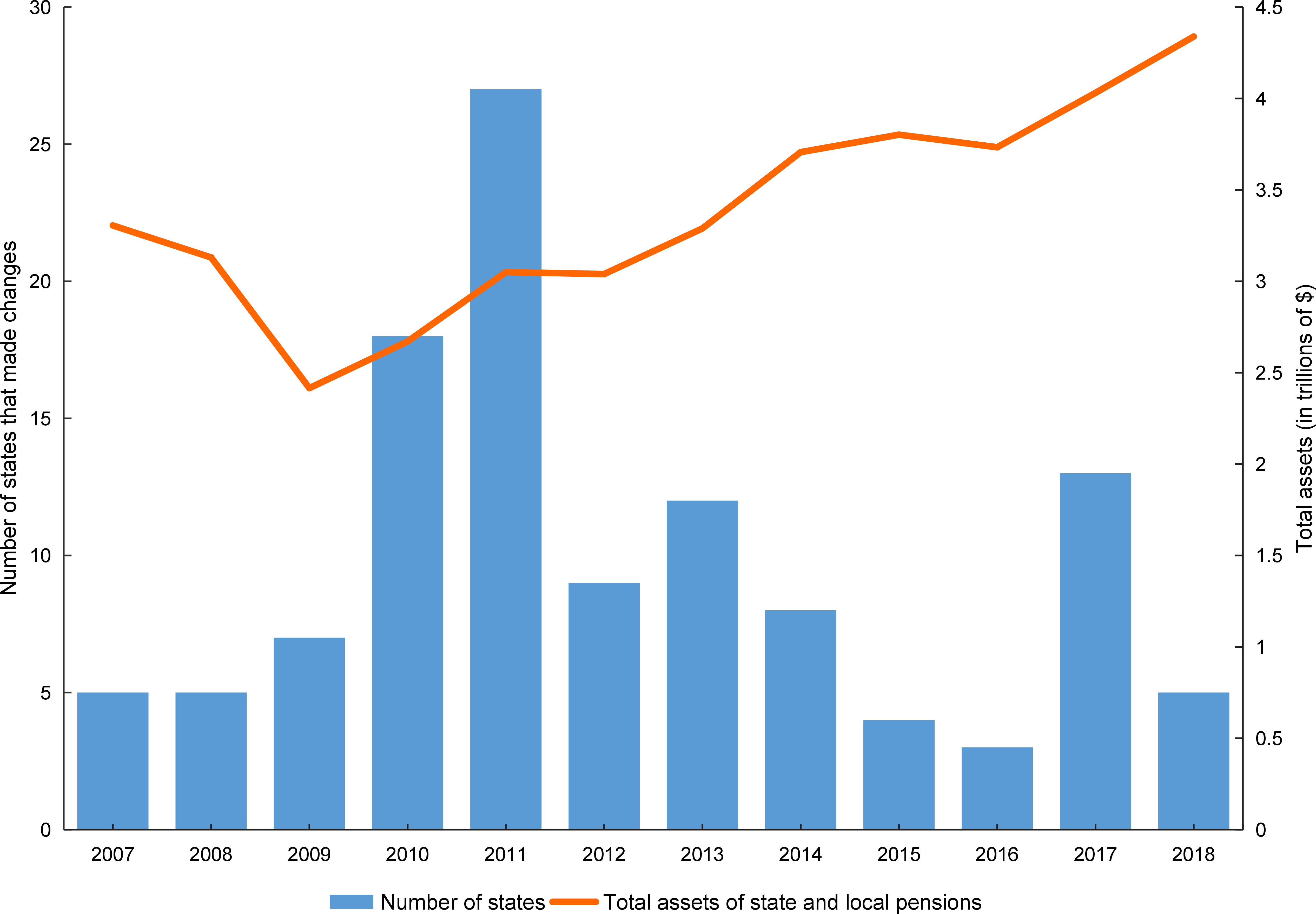

Continue ReadingKolasi, ‘Pensions and Power: The Political and Market Dynamics of Public Pension Plans’

Pensions and Power The Political and Market Dynamics of Public Pension Plans ERALD KOLASI June 2022 Abstract This paper uses the theory of ‘capital as power’ to analyze the struggle over public pensions in the United States. While mainstream commentators claim that public pensions must be ‘reformed’ because they are ‘under funded’, I argue that […]

Continue ReadingMcMahon, ‘Why Scorsese is Right About Corporate Power’

Abstract In the March 2021 issue of Harper’s, Scorsese wrote an essay to pay tribute to Federico Fellini, the Italian director who directed such great films as La Strada, 8 1/2, La Dolce Vita, Nights of Cabiria and Satyricon. Scorsese writing on Fellini is definitely newsworthy for cinephiles who want to know about Fellini’s beginnings […]

Continue ReadingMcMahon, ‘Selling Hollywood to China’

Abstract From the 1980s to the present, Hollywood’s major distributors have been able to redistribute U.S. theatrical attendance to the advantage of their biggest blockbusters and franchises. At the global scale and during the same period, Hollywood has been leveraging U.S. foreign power to break ground in countries that have historically protected and supported their […]

Continue ReadingBaines & Hager, ‘The Great Debt Divergence and its Implications for the Covid-19 Crisis: Mapping Corporate Leverage as Power’

Abstract The COVID-19 pandemic has amplified longstanding concerns about mounting levels of corporate debt in the United States. This article places the current conjuncture in its historical context, analysing corporate indebtedness against the backdrop of increasing corporate concentration. Theorising leverage as a form of power, we find that the leverage of large non-financial firms increased […]

Continue ReadingKvachev, ‘Unflat Ontology: Essay on the Poverty of Democratic Materialism’

Abstract The paper is dedicated to the problem of flat ontology in philosophy and its relation to the practice in economy. The author argues that flat economy is based on a marginal utility theory of value and presents hierarchical value chains with concentration of power-capital as if they were flat and all the actors involved […]

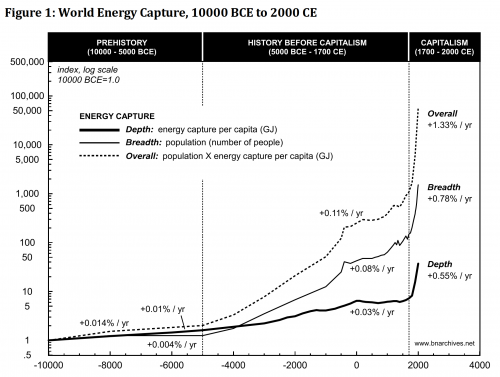

Continue ReadingBichler & Nitzan, ‘Growing through Sabotage: Energizing Hierarchical Power’

Abstract According to the theory of capital as power, capitalism, like any other mode of power, is born through sabotage and lives in chains – and yet everywhere we look we see it grow and expand. What explains this apparent puzzle of ‘growth in the midst of sabotage’? The answer, we argue, begins with the […]

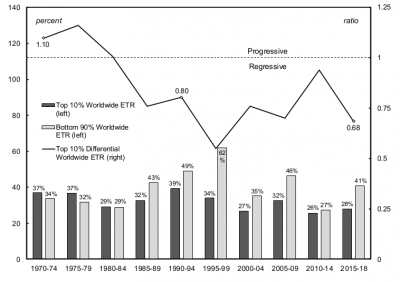

Continue ReadingHager & Baines, ‘The Tax Advantage of Big Business’

Abstract Corporate concentration in the United States has been on the rise in recent years, sparking a heated debate about its causes, consequences, and potential remedies. In this study, we examine a facet of public policy that has been largely neglected in current debates about concentration: corporate taxation. As part of our analysis we develop […]

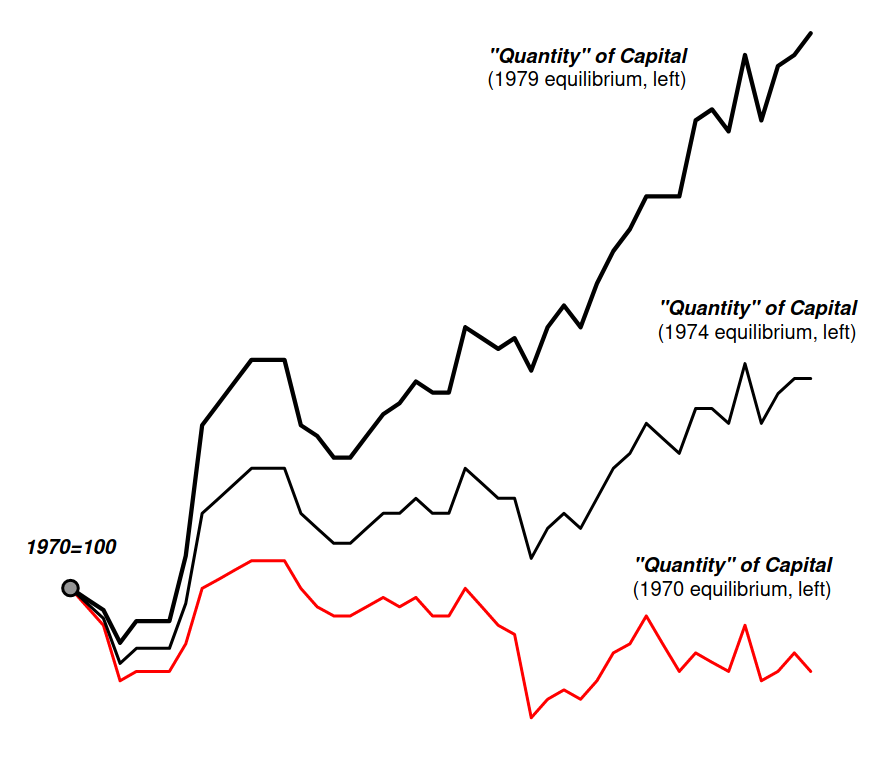

Continue ReadingBaines & Hager, ‘Financial Crisis, Inequality, and Capitalist Diversity: A Critique of the Capital as Power Model of the Stock Market’

Abstract The relationship between inequality and financial instability has become a thriving topic of research in heterodox political economy. This article offers the first critical engagement with one framework within this wider literature: the Capital as Power (CasP) model of the stock market developed by Shimshon Bichler and Jonathan Nitzan. Specifically, we extend the CasP […]

Continue ReadingMartin, ‘The Autocatalytic Sprawl of Pseudorational Mastery ‘

Abstract Winner of the 2018 RECASP Essay Prize According to Jonathan Nitzan and Shimshon Bichler (2009), capital is not an economic quantity, but a mode of power. Their fundamental thesis could be summarized as follows: capital is power quantified in monetary terms. But what do we do when we quantify? What is the nature of […]

Continue ReadingBichler & Nitzan, ‘Acumulación de capital: ficción y realidad’

Abstract ¿Qué quieren decir los economistas cuando hablan de “acumulación de capital’? La respuesta es todo, menos clara. La opinión convencional es que hay dos tipos de capital: real y financiero, que deben guardar correspondencia y que, infortunadamente, la mayoría de las veces no se corresponden, pues el crecimiento del capital financiero tiende a desajustarse […]

Continue ReadingCochrane, ‘What’s Love Got to Do with It? Diamonds and the Accumulation of De Beers, 1935-55’

Abstract What is accumulation? Visibly, accumulation is a quantitative process, demarcated in financial quantities. However, what is the meaning of those quantities? This question has been the subject of great debate within political economic thought. A new theory of accumulation, capital as power (CasP), argues that the financial quantities of accumulation express the distribution of […]

Continue ReadingBichler & Nitzan, ‘Capital Accumulation: Fiction and Reality’

Abstract What do economists mean when they talk about “capital accumulation”? Surprisingly, the answer to this question is anything but clear, and it seems the most unclear in times of turmoil. Consider the “financial crisis” of the late 2000s. The very term already attests to the presumed nature and causes of the crisis, which most […]

Continue ReadingNo. 2015/03: Bichler & Nitzan, ‘Capital Accumulation: Fiction and Reality’

Abstract What do economists mean when they talk about ‘capital accumulation’? Surprisingly, the answer to this question is anything but clear, and it seems the most unclear in times of turmoil. Consider the recent ‘financial crisis’. The very term already attests to the presumed nature and causes of the crisis, which most observers indeed believe […]

Continue ReadingBaines, ‘Price and Income Dynamics in the Agri-Food System: A Disaggregate Perspective’

Abstract This dissertation seeks to illuminate contemporary processes of redistribution in the agri-food sector, with particular reference to the US. It addresses the following questions: How has the rapid rise in food price instability since the turn of the twenty-first century impacted income shifts within the agri-food system? Which groups within agriculture and agribusiness benefit […]

Continue Reading