Abstract Corporate concentration in the United States has been on the rise in recent years, sparking a heated debate about its causes, consequences, and potential remedies. In this study, we examine a facet of public policy that has been largely neglected in current debates about concentration: corporate tax policy. As part of our analysis we […]

Continue ReadingFix, ‘Economics from the Top Down: Does Hierarchy Unify Economic Theory?’

Abstract What is the unit of analysis in economics? The prevailing orthodoxy in mainstream economic theory is that the individual is the ‘ultimate’ unit of analysis. The implicit goal of mainstream economics is to root macro-level social structure in the micro-level actions of individuals. But there is a simple problem with this approach: our knowledge […]

Continue ReadingHoward, ‘Craftwashing in the U.S. Beer Industry’

Abstract Background: Big brewers, which have experienced declining sales for their beer brands in the last decade, have been accused of “craftwashing” by some craft brewers and their aficionados—they define craftwashing as big brewers (>6 million barrels per year) taking advantage of the increasing sales of craft beer by emulating these products or by acquiring […]

Continue ReadingPark, ‘Korea’s Post-1997 Restructuring: An Analysis of Capital as Power’

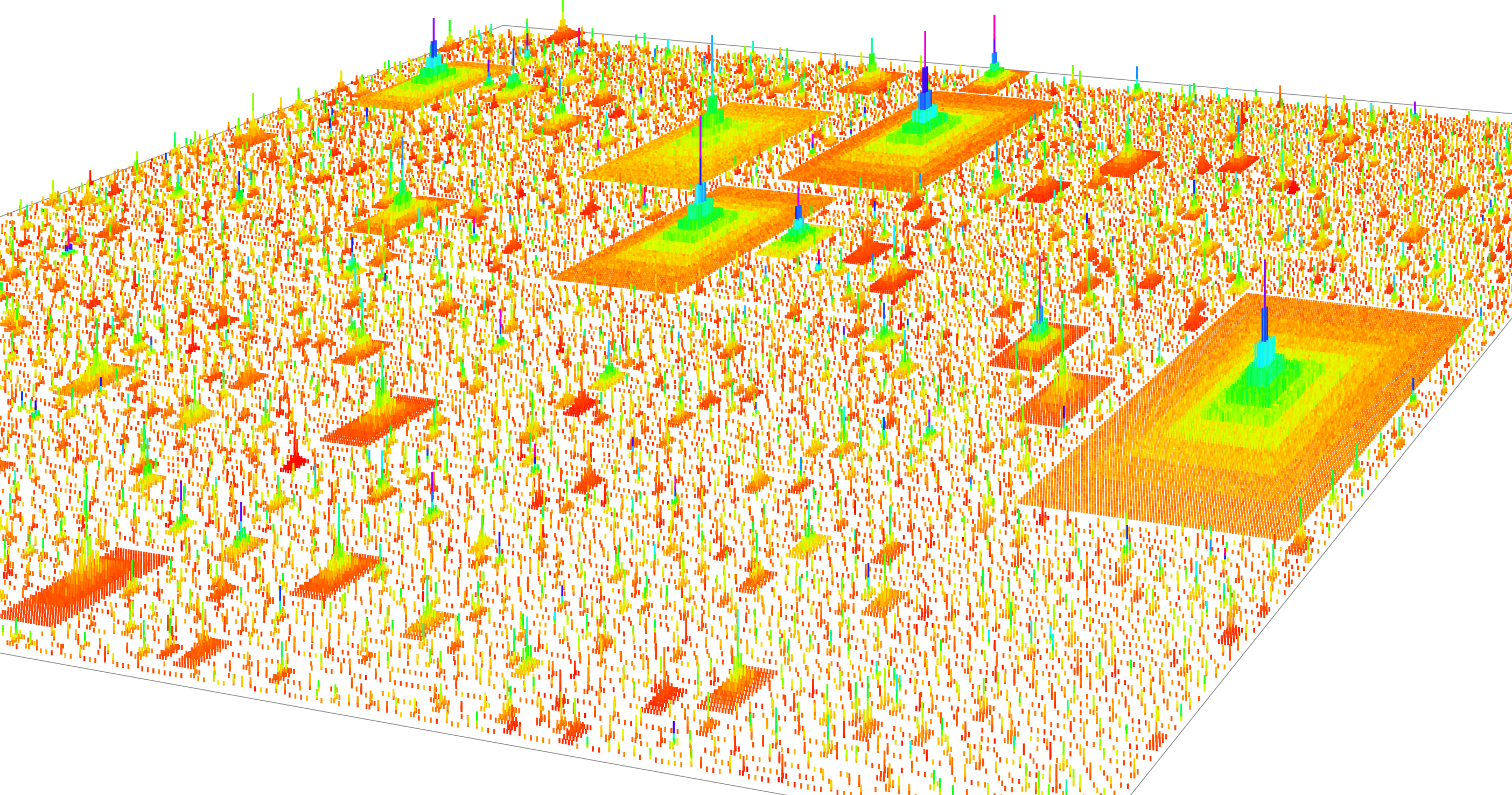

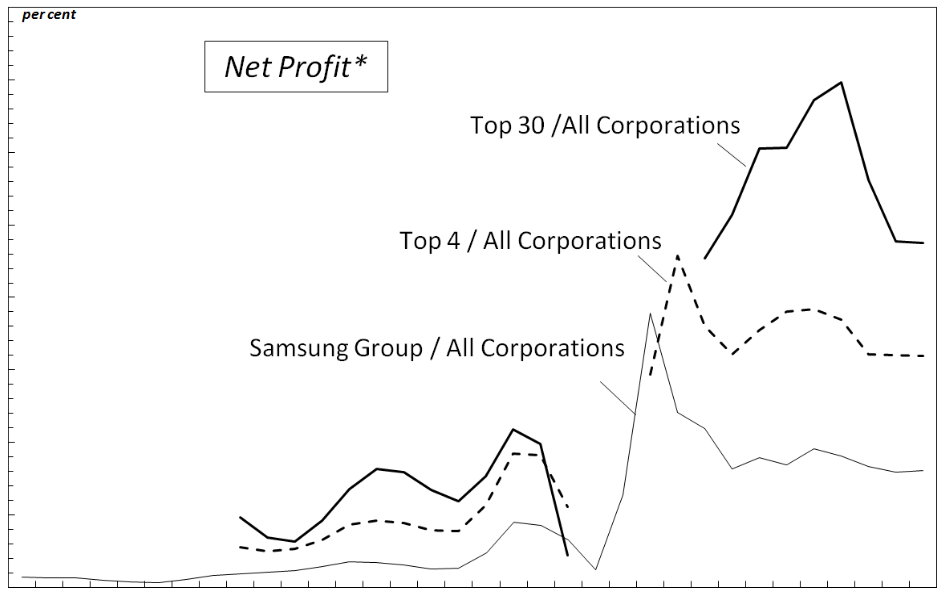

Abstract Winner of the RRPE Annual Best Paper Award for 2016 This paper aims to transcend current debates on Korea’s post-1997 restructuring, which rely on a dichotomy between domestic industrial capital and foreign financial capital, by adopting Nitzan and Bichler’s capital-as-power perspective. Based on this approach, the paper analyzes Korea’s recent political economic restructuring as […]

Continue ReadingHager, ‘A Global Bond: Explaining the Safe Haven Status of U.S. Treasury Securities’

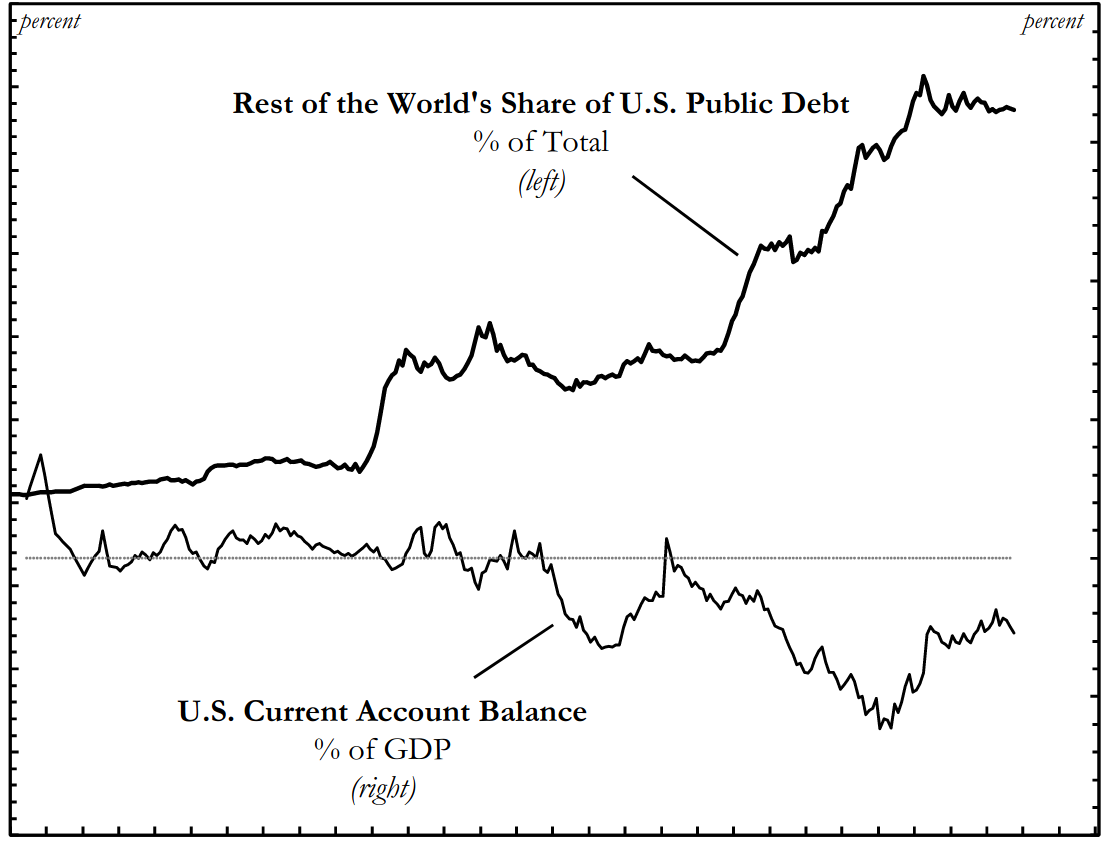

Abstract This article offers new theoretical and empirical insights to explain the resilience of U.S. Treasury securities as the world’s premier safe or “risk free” asset. The standard explanation of resilience emphasizes the relative safety of U.S. Treasuries due to a shortage of safe assets in the global political economy. The analysis here goes beyond […]

Continue ReadingFix, ‘Putting Power Back Into Growth Theory’

Abstract Neoclassical growth theory assumes that economic growth is an atomistic process in which changes in distribution play no role. Unfortunately, when this assumption is tested against real-world evidence, it is systematically violated. This paper argues that a reality-based growth theory must reject neoclassical principles in favour of a power-centered approach. Building on Nitzan and […]

Continue ReadingBrennan, ‘Ascent of Giants: NAFTA, Corporate Power and the Growing Income Gap’

Abstract There is growing awareness in Canada of how unequal society is becoming. It is probably most obvious in the gap between the compensation of Canada’s highest paid corporate executives and the average worker. The political pressure to do something to close this gap, for example by increasing taxes at the top of the income […]

Continue Reading