Abstract Elsewhere I argue that the legal concept of property was created in the image of money in the late Roman Republic. Since then, the division of property and contract has been an underlying structure of Western law. The paper argues that a main way of structuring financial corporate power, especially money market funds (MMFs), […]

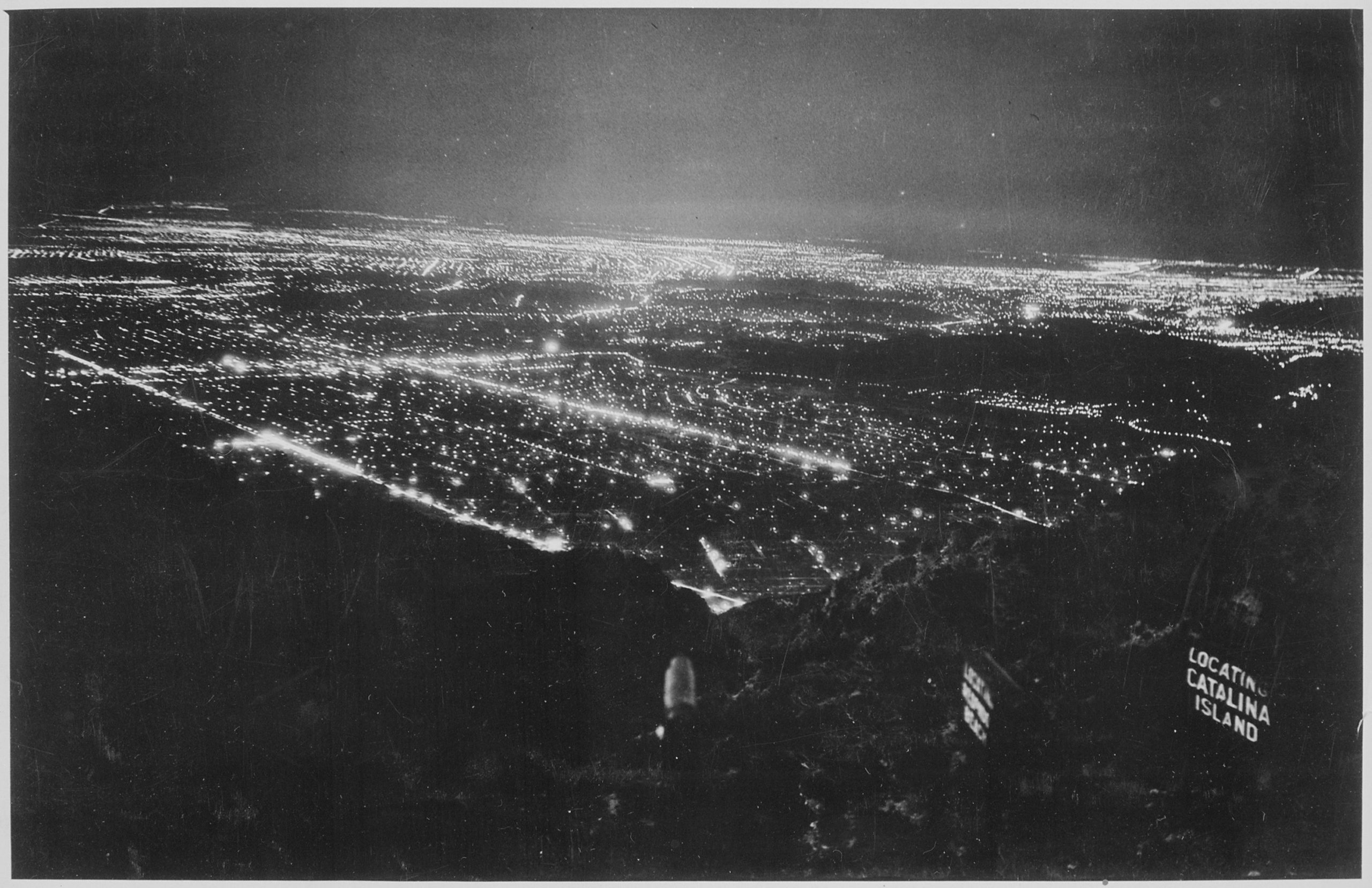

Continue ReadingMcMahon, ‘Is Hollywood a Risky Business? A Political Economic Analysis of Risk and Creativity’

Abstract This paper seeks to explain why Hollywood’s dominant firms are narrowing the scope of creativity in the contemporary period (1980–2015). The largest distributors have sought to prevent the art of filmmaking and its related social relations from becoming financial risks in the pursuit of profit. Major filmed entertainment, my term for the six largest […]

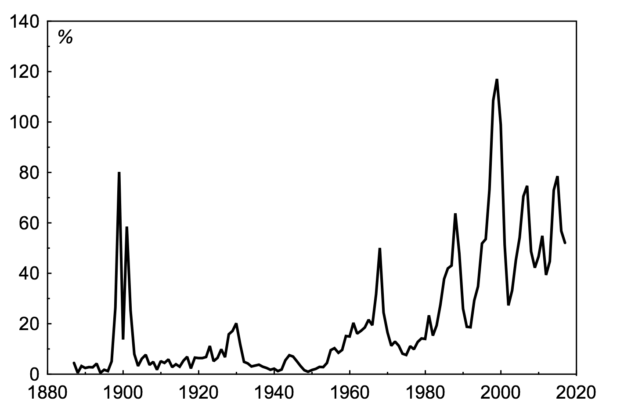

Continue ReadingFrancis’ Updated Buy-to-Build Indicator

Joe Francis The tendency toward buying other companies more than building new productive capacity continues in the United States In a past life I had access to expensive databases of corporate statistics, which I used to calculate the buy-to-build indicator for the United States from the 1880s until 2012. In short, the buy-to-build indicator shows […]

Continue Reading2018/07: Fix, ‘The Trouble with Human Capital Theory’

Abstract Human capital theory is the dominant approach for understanding personal income distribution. According to this theory, individual income is the result of ‘human capital’. The idea is that human capital makes people more productive, which leads to higher income. But is this really the case? This paper takes a critical look at human capital […]

Continue Reading2018/06: Fix, ‘Capitalist Income and Hierarchical Power: A Gradient Hypothesis’

Abstract This paper offers a new approach to the study of capitalist income. Building on the ‘capital as power’ framework, I propose that capitalists earn their income not from any productive asset, but from the legal right to command a corporate hierarchy. In short, I hypothesize that capitalist income stems from hierarchical power. Based on […]

Continue ReadingFix, ‘Economics from the Top Down: Does Hierarchy Unify Economic Theory?’

Abstract What is the unit of analysis in economics? The prevailing orthodoxy in mainstream economic theory is that the individual is the ‘ultimate’ unit of analysis. The implicit goal of mainstream economics is to root macro-level social structure in the micro-level actions of individuals. But there is a simple problem with this approach: our knowledge […]

Continue Reading2018/05: Fix, ‘The Growth of US Top Income Inequality: A Hierarchical Redistribution Hypothesis’

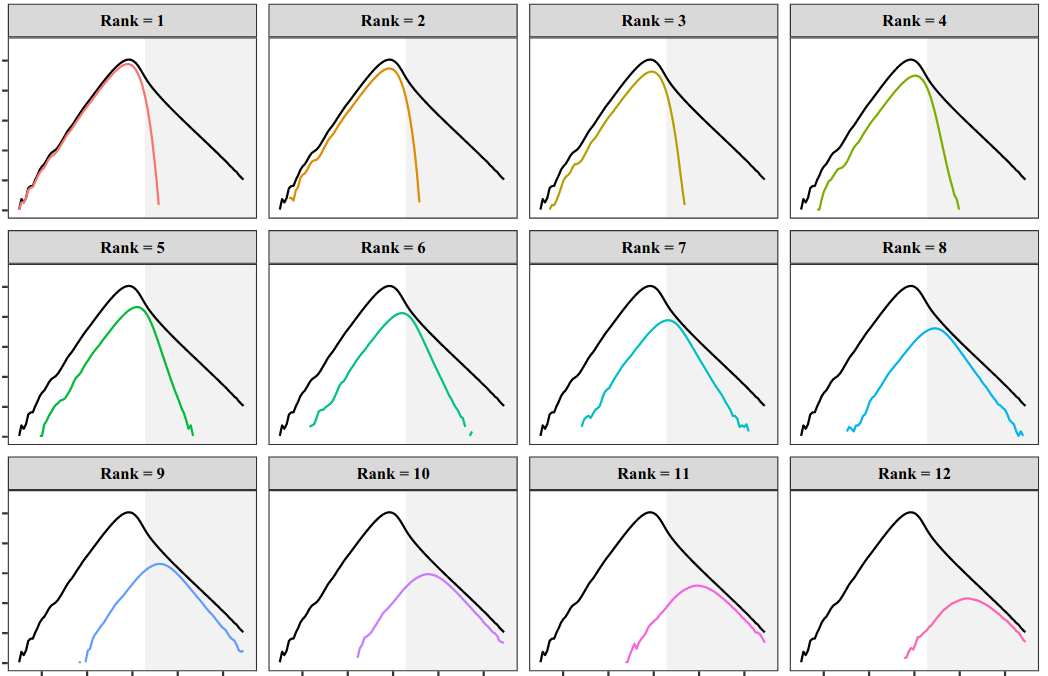

Abstract What accounts for the growth of US top income inequality? This paper proposes a hierarchical redistribution hypothesis. The idea is that US firms have systematically redistributed income to the top of the corporate hierarchy. I test this hypothesis using a large scale hierarchy model of the US private sector. My method is to vary […]

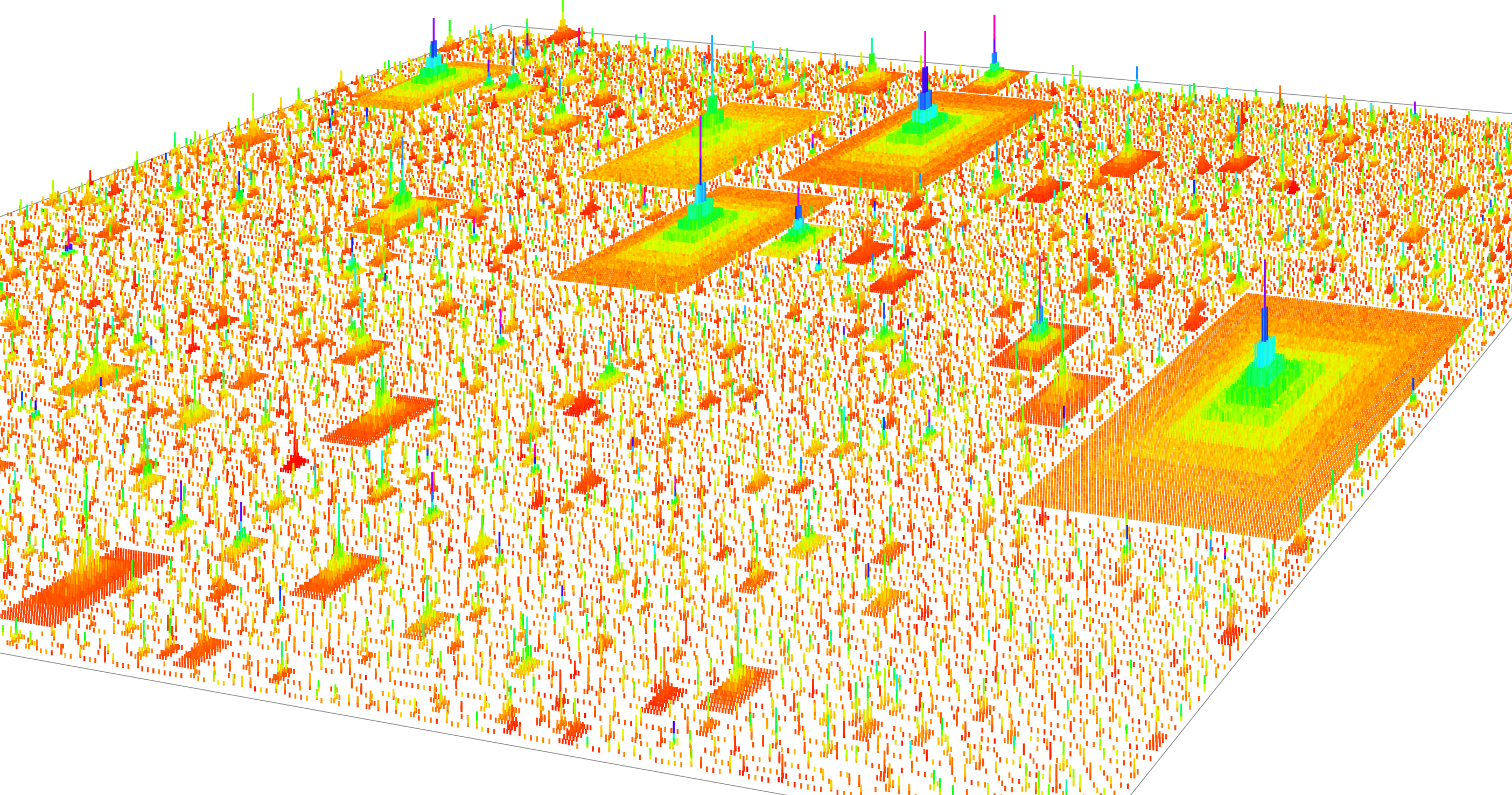

Continue ReadingFix, ‘Hierarchy and the power-law income distribution tail’

Abstract What explains the power-law distribution of top incomes? This paper tests the hypothesis that it is firm hierarchy that creates the power-law income distribution tail. Using the available case-study evidence on firm hierarchy, I create the first large-scale simulation of the hierarchical structure of the US private sector. Although not tuned to do so, […]

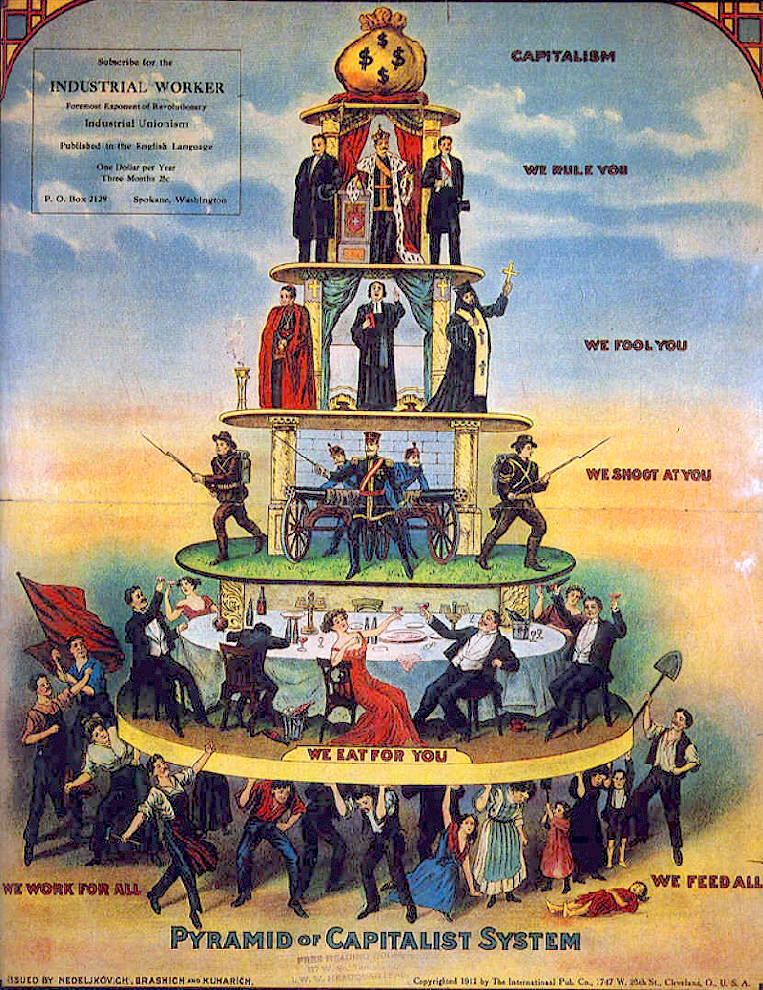

Continue Reading2018/04: Martin, ‘The Autocatalytic Sprawl of Pseudorational Mastery’

Abstract According to Shimshon Bichler and Jonathan Nitzan capital is not an economic quantity but a mode of power; it could be sumarized as: “Capital is power quantified in monetary terms”. So, what do we do when we “quantify”? What is the nature of “money” in a capitalist society? And, indeed, what is “power” in […]

Continue ReadingCapital as Power @ Historical Materialism 2018: Panel Series at The Great Transition Conference, Montreal, May 17-20, 2018

The Forum on Capital as Power presents a panel series at the Montreal 2018 Great Transition Conference, May 17-20. The panels include the following papers: 1. ‘What is Capital as Power?’ Shimshon Bichler, Israel and Jonathan Nitzan, Canada 2. ‘Capitalization, Capital Goods and the State of Capital: The Boundaries of Accumulation’ DT Cochrane, Ryerson University […]

Continue ReadingDiMuzio & Dow, ‘Uneven and Combined Confusion’

Abstract This article offers a critique of Alexander Anievas and Kerem Nişancioğlu’s “How the West came to rule: the geopolitical origins of capitalism”. We argue that while all historiography features a number of silences, shortcomings or omissions, the omissions in How the West came to rule lead to a mistaken view of the emergence of […]

Continue ReadingFix, ‘Energy and Institution Size’

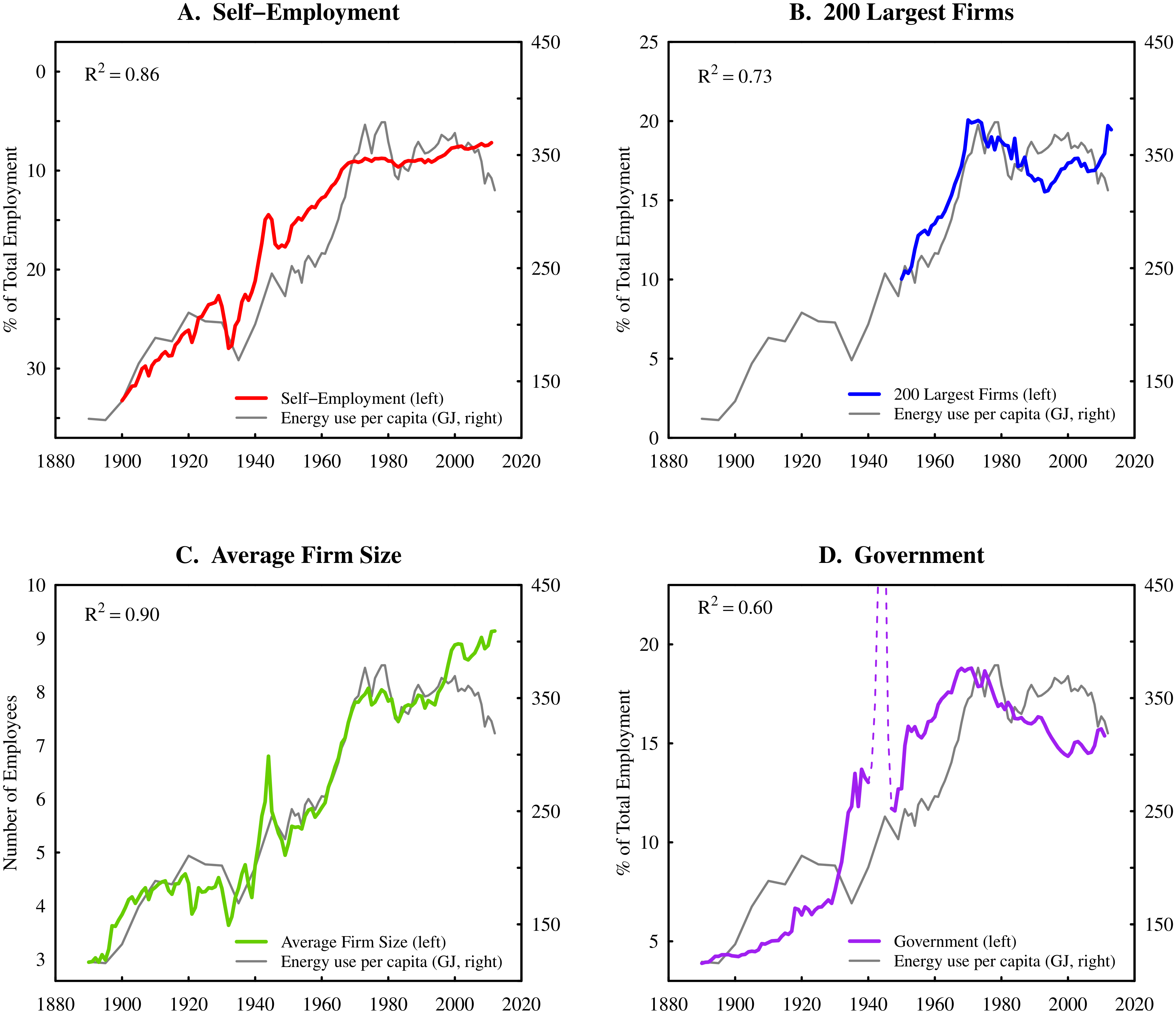

Abstract Why do institutions grow? Despite nearly a century of scientific effort, there remains little consensus on this topic. This paper offers a new approach that focuses on energy consumption. A systematic relation exists between institution size and energy consumption per capita: as energy consumption increases, institutions become larger. I hypothesize that this relation results […]

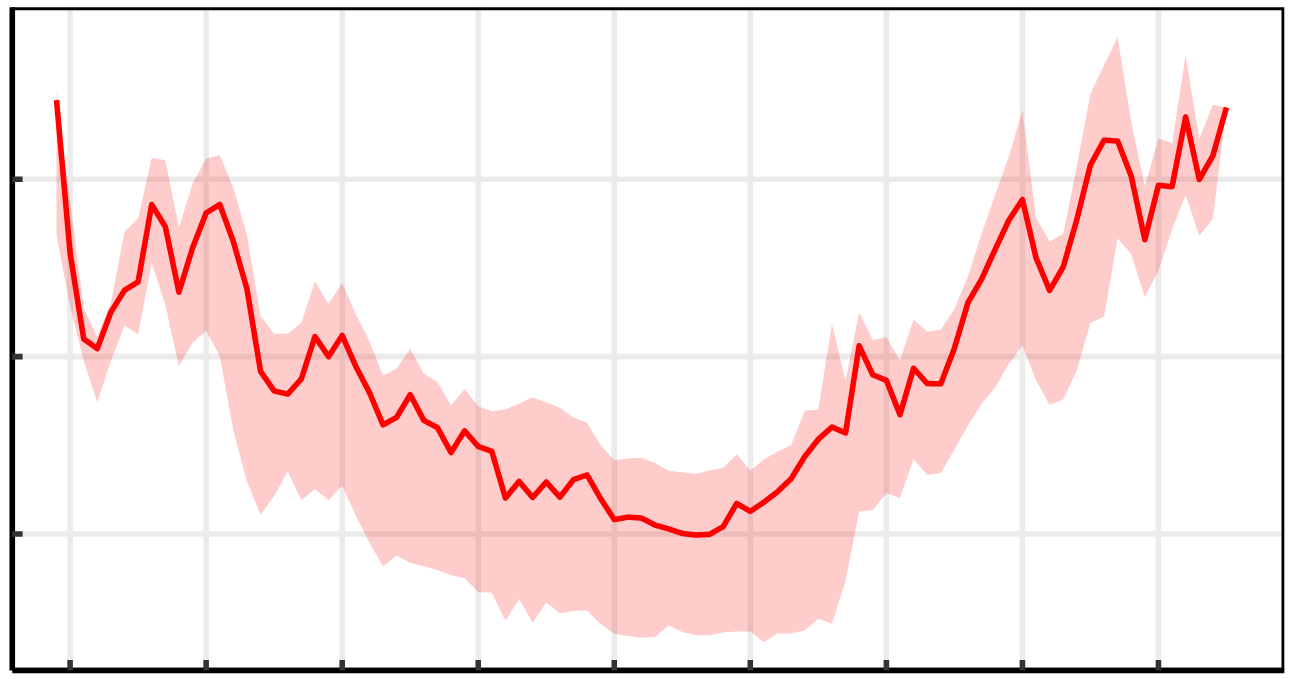

Continue ReadingBichler & Nitzan, ‘A CasP Model of the Stock Market’

Abstract Most explanations of stock market booms and busts are based on contrasting the underlying ‘fundamental’ logic of the economy with the exogenous, non-economic factors that presumably distort it. Our paper offers a radically different model, examining the stock market not from the mechanical viewpoint of a distorted economy, but from the dialectical perspective of […]

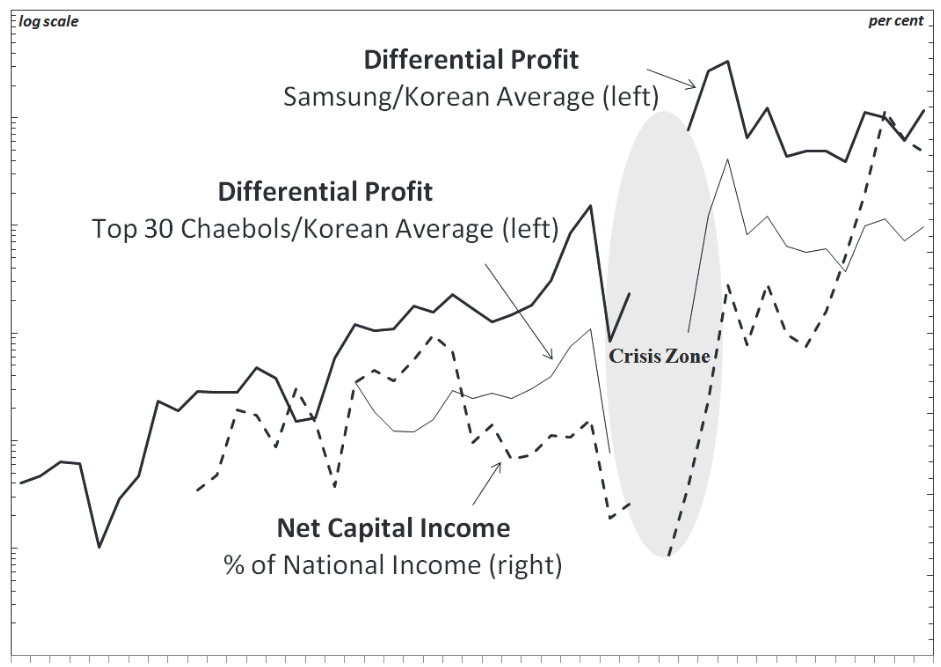

Continue ReadingPark & Doucette, ‘Financialization or Capitalization? Debating Capitalist Power in South Korea in the Context of Neoliberal Globalization’

Abstract The article reviews debates concerning financialization in South Korea, with a focus on ongoing arguments between liberal, post-Keynesian, institutionalist and Marxist economists. It argues that post-Keynesian and institutionalist perspectives in particular neglect important class processes through which the financial circuit operates within the Korean economy, especially the power of Korea’s large, family-led conglomerates, or […]

Continue ReadingMcMahon, ‘What Makes Hollywood Run? Capitalist Power, Risk and the Control of Social Creativity’

Abstract This dissertation combines an interest in political economy, political theory and cinema to offer an answer about the pace of the Hollywood film business and its general modes of behaviour. More specifically, this dissertation seeks to find out how the largest Hollywood firms attempt to control social creativity such that the art of filmmaking […]

Continue ReadingCapital as Power and Freelance Creative Work 4

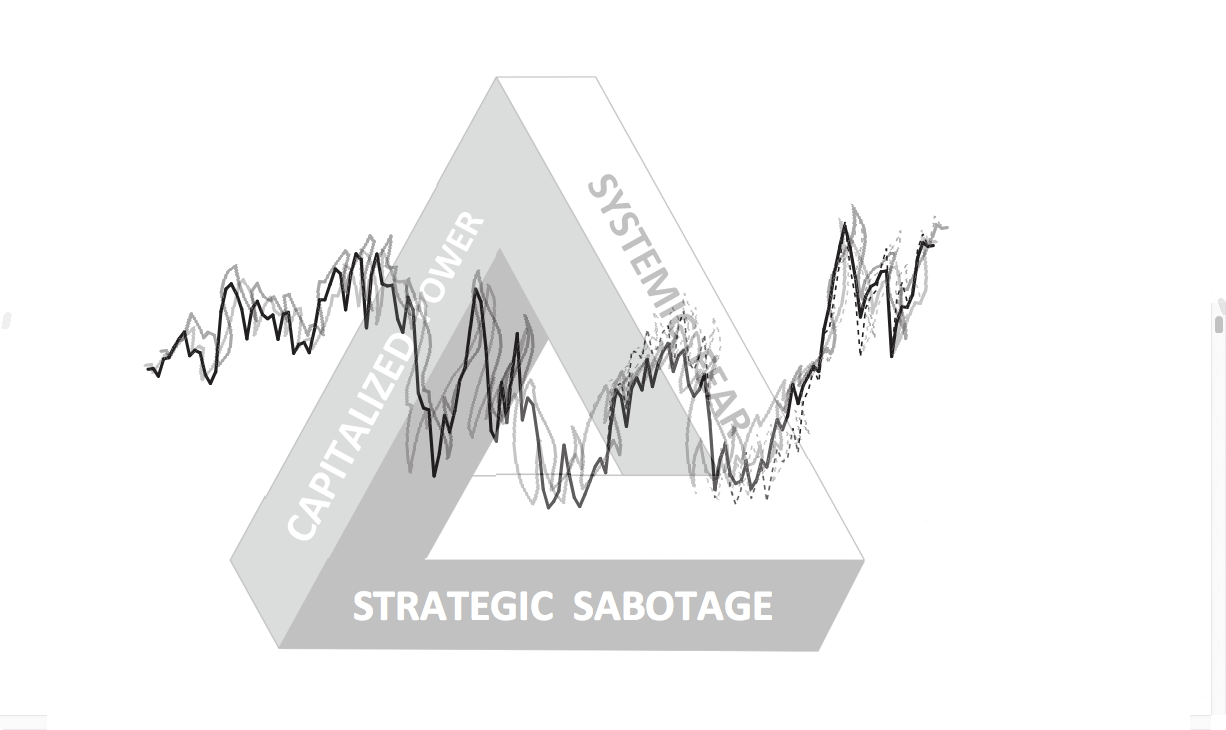

Frederick H. Pitts Resonance and dissonance in the rhythms of freelance creative work In the last blog, I applied some of Nitzan and Bichler’s ideas to freelance work in the creative industries. I utilised their conceptualisation of the distinction between creativity and power, and of the sabotage of the former by the latter. Nitzan and […]

Continue ReadingCapital as Power and Freelance Creative Work 3

Frederick H. Pitts Creativity, sabotage and the management of risk and responsibility in freelance creative work Nitzan and Bichler theorise a dissonant relation of sabotage between power and creativity, business and industry. What they show is that the control of creative processes of production is not antithetical to their success. Rather, it is constitutive of […]

Continue ReadingCapital as Power and Freelance Creative Work 2

Frederick H. Pitts Capital as Power, risk-aversion and the avoidance of uncertainty Mainstream critiques of contemporary capitalism conducted in the wake of the Great Recession tend to indict a number of factors. Perceived short-termism. The dangerous compulsion to speculate. An attraction to growth for growth’s sake. The propensity towards the greedy and rapid accumulation of […]

Continue ReadingCapital as Power and Freelance Creative Work 1

Frederick H. Pitts Rhythms of Risk and Responsibility in Freelance Creative Work This series of blogs applies Nitzan and Bichler’s theory of capital as power to the empirical concern of freelance work in the creative industries. It reports some findings from a research project I conducted earlier this year. The research was part of a […]

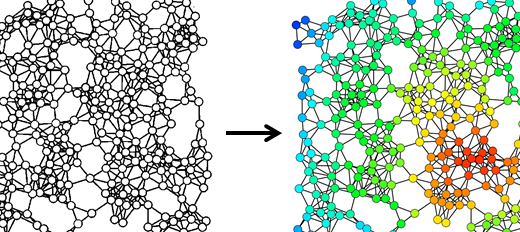

Continue ReadingComplexity Science and Political-Economy: Post 1 – Networks

Shai Gorsky This series of posts will explore some contemporary fields in “complexity science”. They summarize experiences from the Santa-Fe Institute Complex Systems Summer School 2014, with the hope of suggesting to readers useful research tools for political-economy. Please feel free to contact the author if you are interested in discussing or utilizing any of […]

Continue Reading