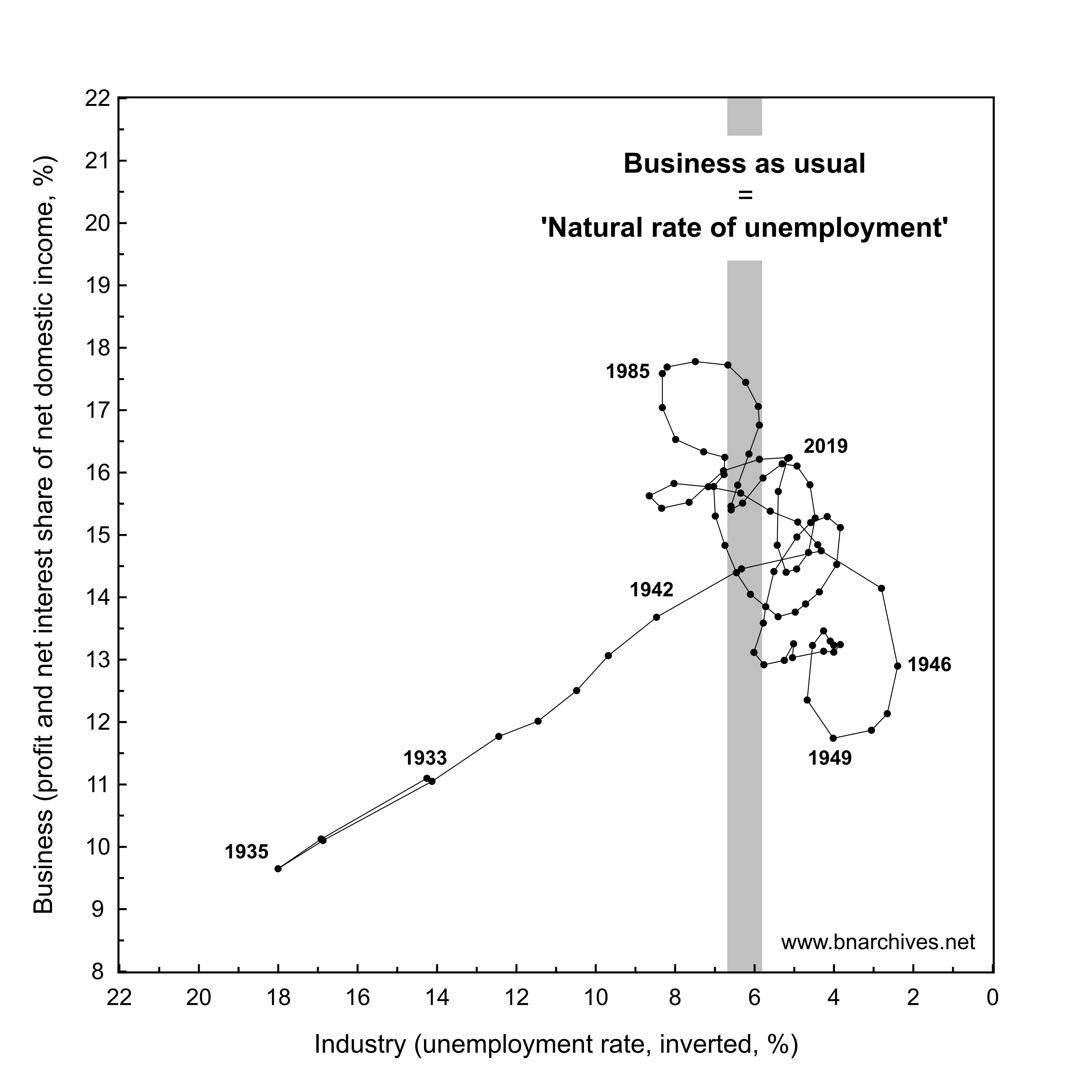

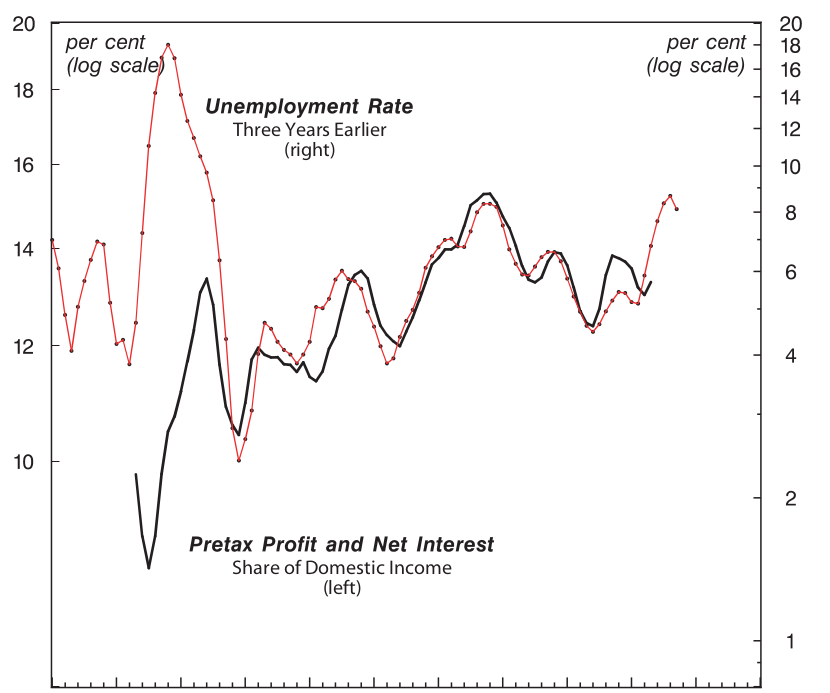

The Business of Strategic Sabotage SHIMSHON BICHLER and JONATHAN NITZAN January 2023 Abstract In a recent article, Nicolas D. Villarreal claims that our empirical analysis of the relation between business power and industrial sabotage in the United States is unpersuasive, if not deliberately misleading. Specifically, he argues that we cherry-pick specific data definitions and smoothing […]

Continue ReadingCapital as Power Essay Prize Winners, 2022

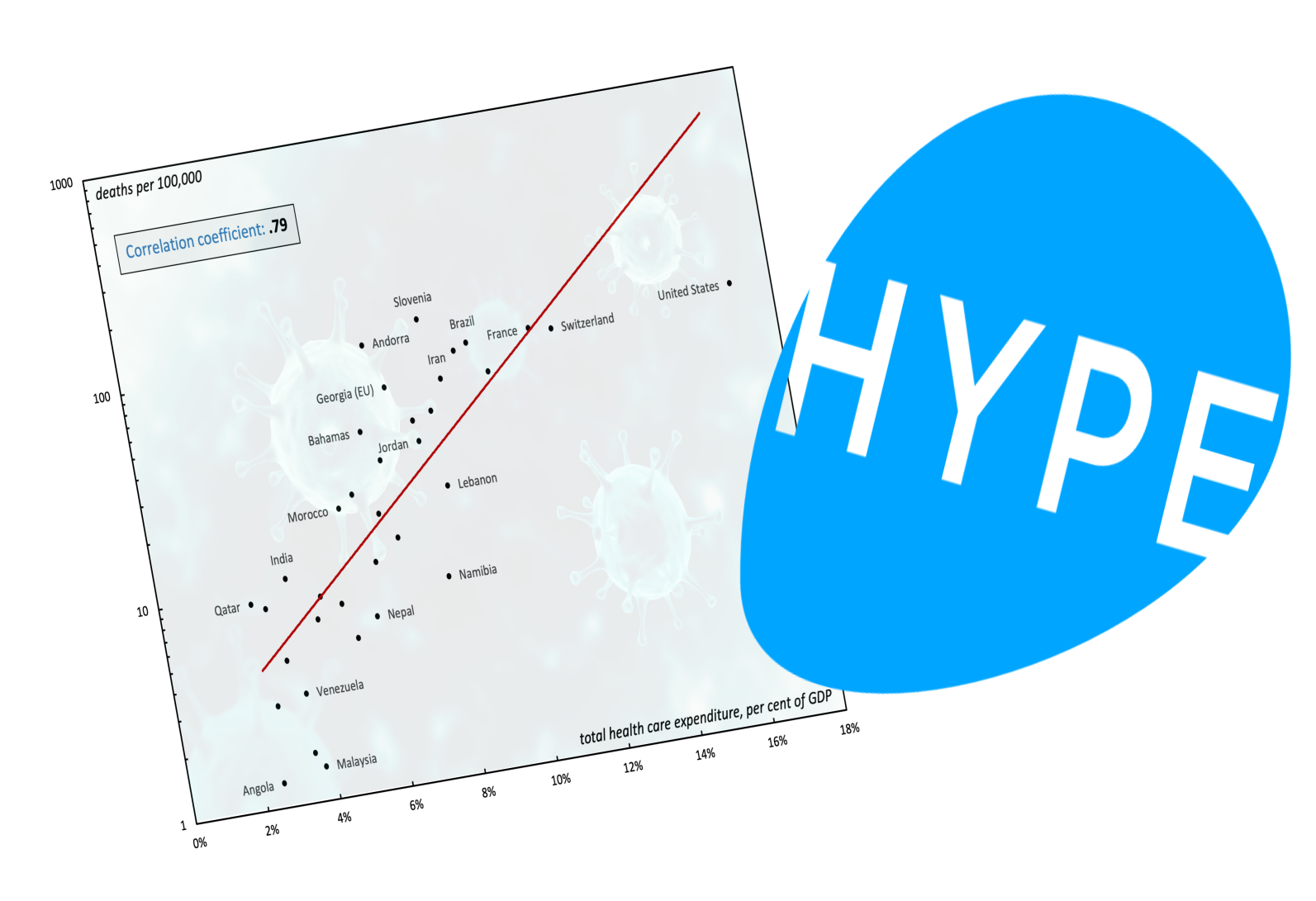

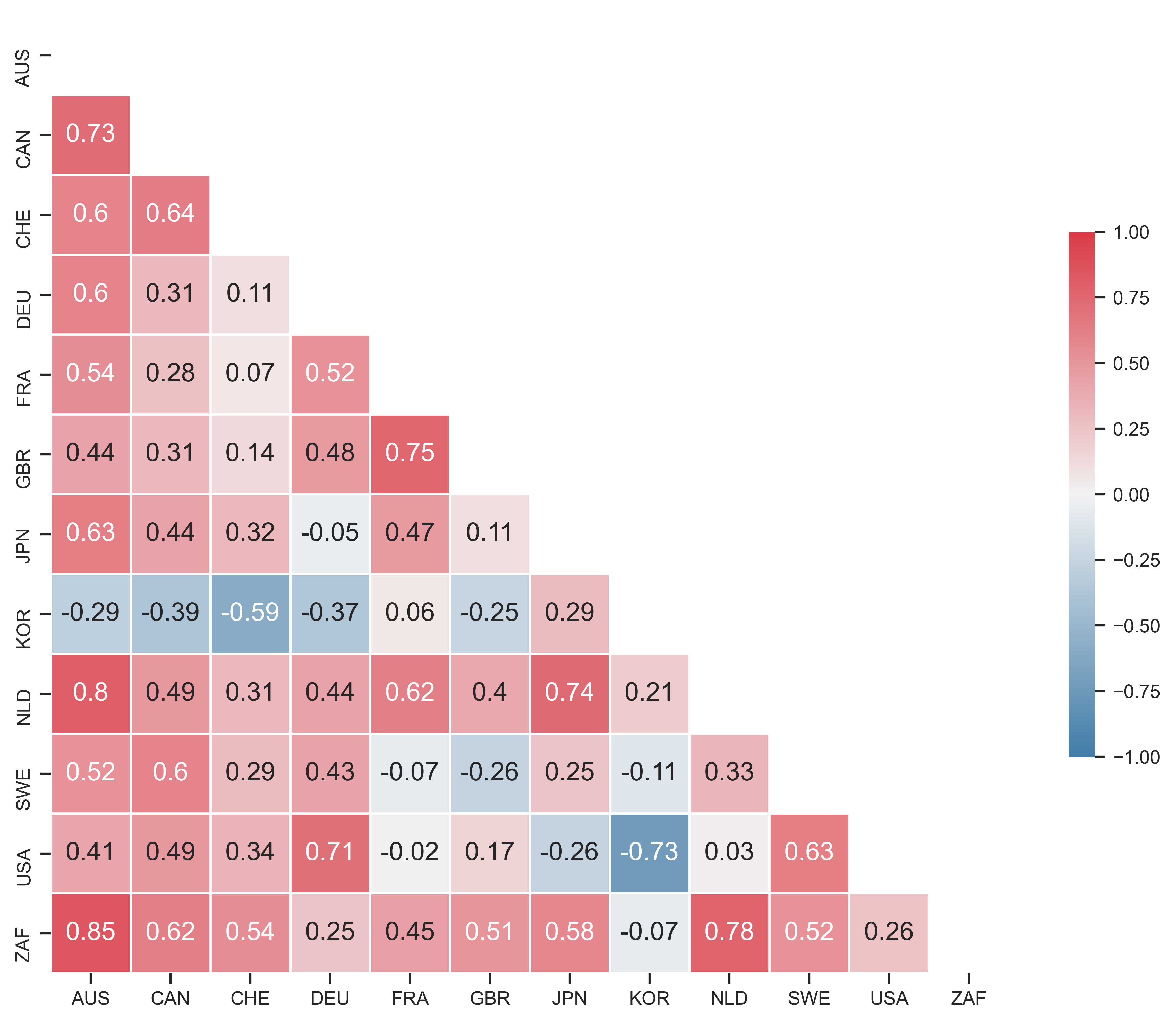

Blair Fix The Review of Capital as Power is pleased to announce the winners of the 2022 Capital as Power Essay Prize: First Prize: ‘Costly Efficiencies: Healthcare Spending, COVID-19, and the Public/Private Healthcare Debate’, by Chris Mouré. Second Prize: ‘Hype: The Capitalist Degree of Induced Participation’, by Yuri Di Liberto. Chris Mouré’s ‘Costly Efficiencies’ In […]

Continue ReadingMcMahon, ‘Reconsidering Systemic Fear and the Stock Market’

Reconsidering Systemic Fear and the Stock Market A Reply to Baines and Hager JAMES MCMAHON August 2021 Abstract This article responds to Baines and Hager’s recent critique of the capital-as-power model of the stock market. Proposed by Bichler and Nitzan, this model seeks to explain how financial crises are tied to the concept of ‘systemic […]

Continue ReadingCan Capitalists Afford Recovery?

Can Capitalists Afford Recovery? Three Views on Economic Policy in Times of Crisis JONATHAN NITZAN and SHIMSHON BICHLER October 2014 Abstract Economic, financial and social commentators from all directions and of various persuasions are obsessed with the prospect of recovery. The world remains mired in a deep, prolonged crisis, and the key question seems to […]

Continue ReadingThe Weekly Sabotage: Week 4

Tim Di Muzio Royal Authority and Private Property Last week we considered the concept of ownership though the work of Veblen and Marx. We noted that the establishment and protection of private property involved the dispossession of the many by the few and that this tendency begins with the appropriation of humans (slavery) and land […]

Continue ReadingLow Capex, High Market Cap: A New High for Corporate Sabotage?

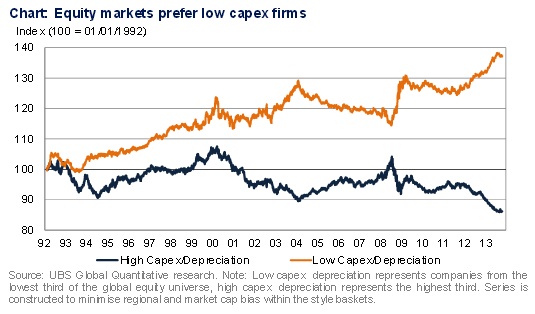

Edward Lam Found amongst some recent market commentary the chart above seems to be quite striking evidence in favour of the Capital as Power framework. The data series have been put together by the investment bank UBS, based on their broad (though not comprehensive) global stock coverage. UBS has charted two lines: a) the stock […]

Continue ReadingThe Weekly Sabotage: Week 1

Tim Di Muzio Welcome to a weekly investigation into the fascinating world of corporate sabotage where human creativity, cooperation, mutual aid and well-being are all held ransom for the profit and power of dominant owners. Every week this column will explore various aspects of what Veblen called ‘strategic sabotage’. But first, a bit of context. […]

Continue Reading