Originally published on Economics from the Top Down Blair Fix Do you believe in free markets? Do you think that unfettered competition is the best way to organize society? If so, this post is intended to shake your faith. No, I’m not going to argue that free markets are bad. Instead, I’m going to show […]

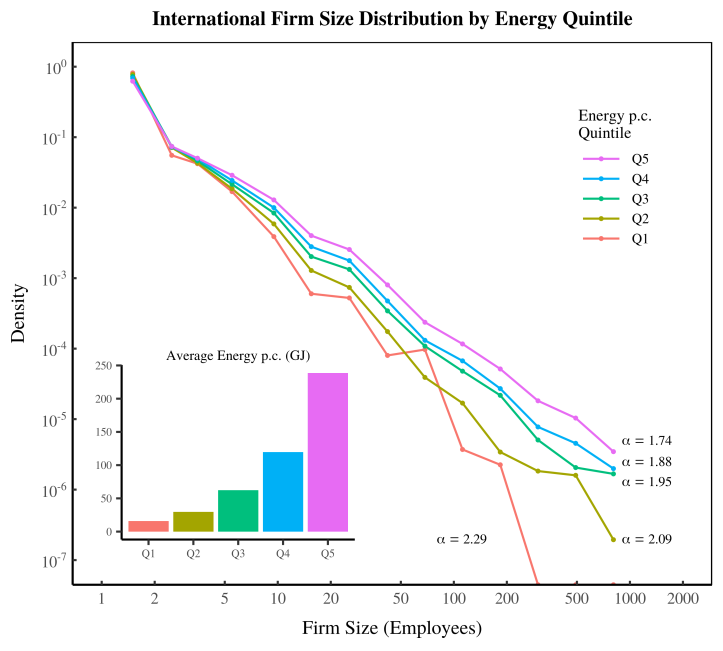

Continue ReadingEnergy and the Size Distribution of Firms

Originally published on Economics from the Top Down Blair Fix In this post, I’m going to return to the relation between energy and institution size. When we left off last time (in Groping in the Dark), I had described my struggle to understand how the size of firms and governments changes with energy use. It […]

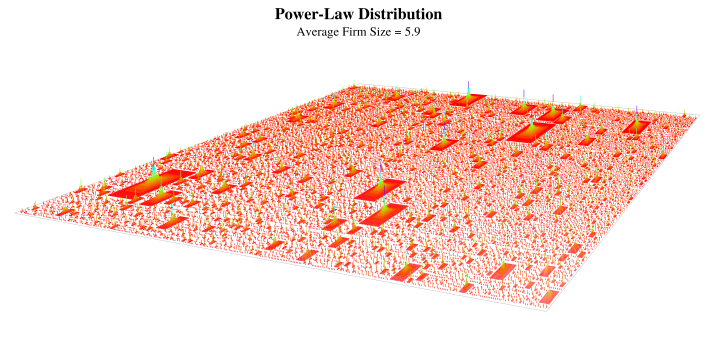

Continue ReadingVisualizing Power-Law Distributions

Originally published on Economics from the Top Down Blair Fix In this post we’re going to take a journey into the world of power-law distributions. Power laws pop up again and again in my research. But I’ve never taken the time to discuss what makes them so weird. This post will be a little ‘power-law […]

Continue ReadingThe Autocatalytic Sprawl of Pseudorational Mastery

The Autocatalytic Sprawl of Pseudorational Mastery ULF MARTIN May 2019 Abstract According to Jonathan Nitzan and Shimshon Bichler (2009), capital is not an economic quantity, but a mode of power. Their fundamental thesis could be summarized as follows: capital is power quantified in monetary terms. But what do we do when we quantify? What is […]

Continue ReadingAgent-Based Models and the Ghost in the Machine

Originally published on Economics from the Top Down Blair Fix In the opening post of this blog, I described my ‘top-down’ approach to studying society. This means studying groups of people without trying to reduce everything to the actions of individuals. It’s not that I think individual actions are unimportant. Of course they are important. […]

Continue ReadingGroping in the Dark: The Untold Side of Research

Originally published on Economics from the Top Down Blair Fix There is an exciting side of blogging that I want to explore here. Blogging can tell the story behind research. This is something you don’t get in journals. Most scientific articles obey a formula that goes like this: Here is the question I asked. Here […]

Continue ReadingVideo: Can Capitalists Afford Economic Growth? An Animation

Elvire Thouvenot has produced an animated video that summarizes the key points of Bichler and Nitzan’s 2014 paper “Can Capitalists Afford Recovery? Three Views on Economic Policy in Times of Crisis.” This paper was first printed in Review of Capital as Power. It was reprinted in Philosophers for Change. Watch the video below:

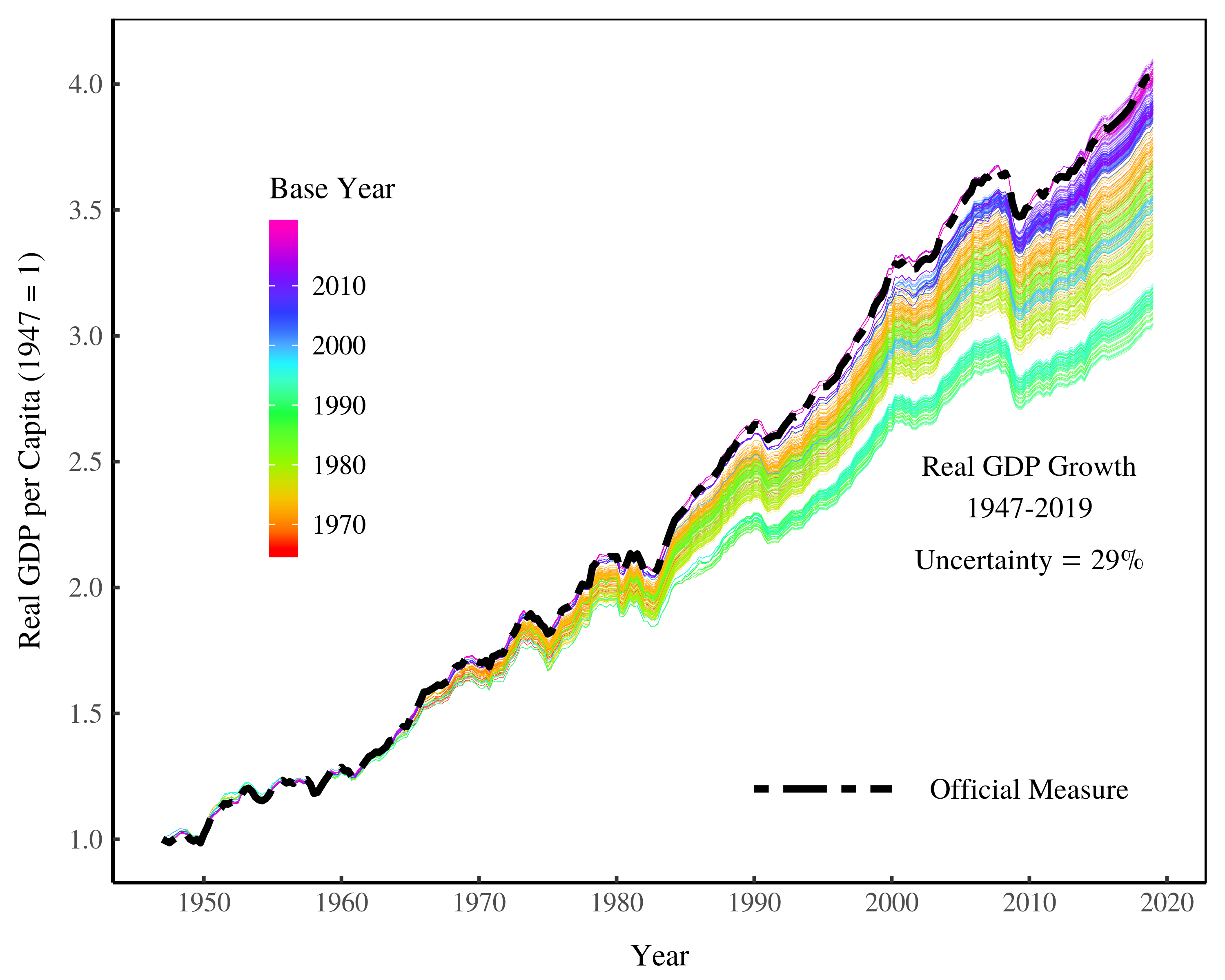

Continue ReadingFix, Nitzan & Bichler, ‘Real GDP: The Flawed Metric at the Heart of Macroeconomics’

Abstract The study of economic growth is central to macroeconomics. More than anything else, macroeconomists are concerned with finding policies that encourage growth. And by ‘growth’, they mean the growth of real GDP. This measure has become so central to macroeconomics that few economists question its validity. Our intention here is to do just that. […]

Continue ReadingBaines & Hager, ‘Financial Crisis, Inequality, and Capitalist Diversity: A Critique of the Capital as Power Model of the Stock Market’

Abstract The relationship between inequality and financial instability has become a thriving topic of research in heterodox political economy. This article offers the first critical engagement with one framework within this wider literature: the Capital as Power (CasP) model of the stock market developed by Shimshon Bichler and Jonathan Nitzan. Specifically, we extend the CasP […]

Continue ReadingMartin, ‘The Autocatalytic Sprawl of Pseudorational Mastery ‘

Abstract Winner of the 2018 RECASP Essay Prize According to Jonathan Nitzan and Shimshon Bichler (2009), capital is not an economic quantity, but a mode of power. Their fundamental thesis could be summarized as follows: capital is power quantified in monetary terms. But what do we do when we quantify? What is the nature of […]

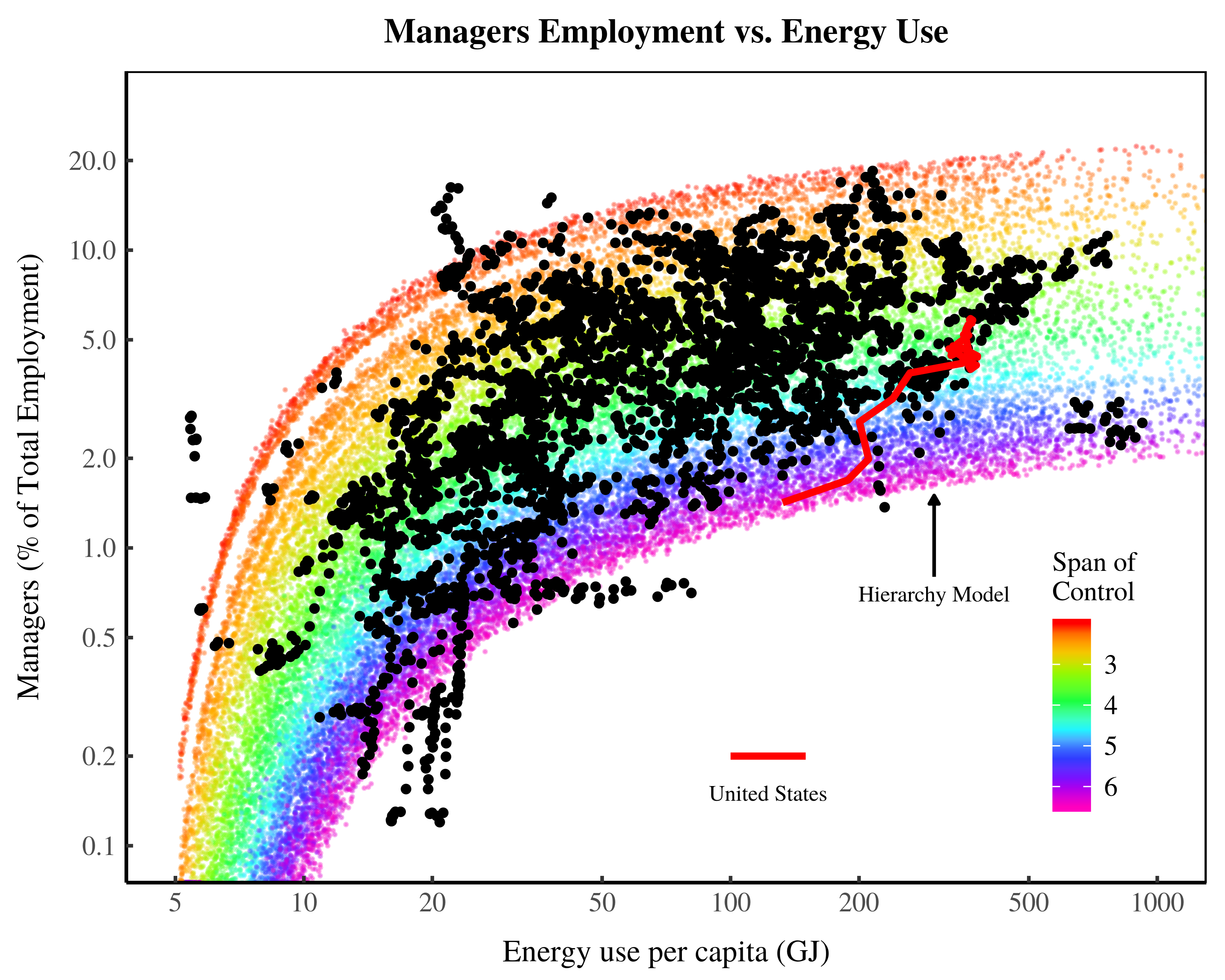

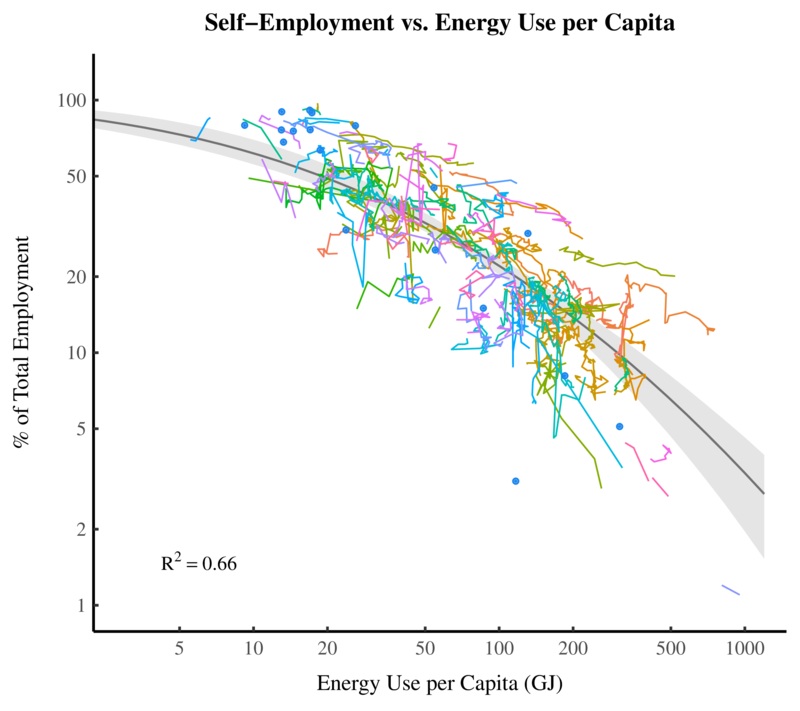

Continue ReadingFix, ‘Energy, Hierarchy and the Origin of Inequality’

Abstract Where should we look to understand the origin of inequality? I propose an unusual window of evidence — modern societies. I hypothesize that evidence for the origin of inequality is encoded in the institutional structure of industrial societies. To test this idea, I use a model to project modern trends into the past. This […]

Continue ReadingOn the Power Theory of Capitalism and Differential Accumulation

Ken Zimmerman This piece was originally posted on the Real-World Economics Review Blog here and here. Shimshon Bichler and Jonathan Nitzan are Israeli political economists. Together they’ve created a thought-provoking power theory of capitalism and theory of differential accumulation. The theory is not “pie-in-the-sky,” but is based in their analysis of the political economy of […]

Continue Reading2019/03: McMahon, ‘Selling Hollywood to China’

Abstract From the 1980s to the present, Hollywood’s major distributors have been able to redistribute U.S. theatrical attendance to the advantage of their biggest blockbusters and franchises. At the global scale and during the same period, Hollywood has been leveraging U.S. foreign power to break ground in countries that have historically protected and supported their […]

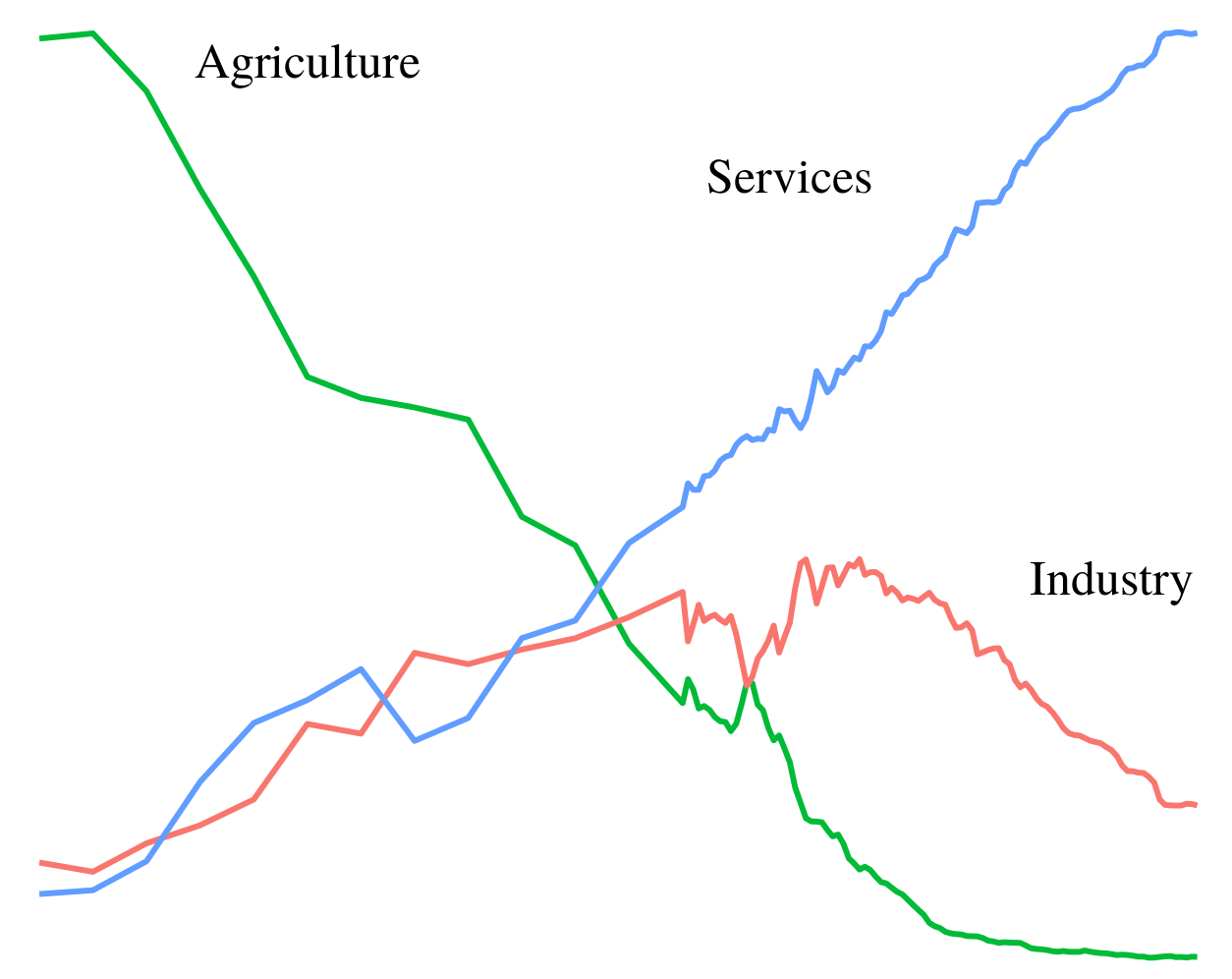

Continue ReadingFix, ‘Dematerialization Through Services: Evaluating the Evidence’

Abstract Dematerialization through services is a popular proposal for reducing environmental impact. The idea is that by shifting from the production of goods to the provision of services, a society can reduce its material demands. But do societies with a larger service sector actually dematerialize? I test the ‘dematerialization through services’ hypothesis with a focus […]

Continue Reading2019/01: Bichler & Nitzan, ‘CasP’s Differential Accumulation versus Veblen’s Differential Advantage (Revised and Expanded)’

Abstract This paper clarifies a common misrepresentation of our theory of capital as power, or CasP. Many observers tend to box CasP as an ‘institutionalist’ theory, tracing its central process of ‘differential accumulation’ to Thorstein Veblen’s notion of ‘differential advantage’. This view, we argue, betrays a misunderstanding of CasP, Veblen or both. First, we are […]

Continue ReadingCapitalism’s Deniers

Shimshon Bichler and Jonathan Nitzan Originally published at Real World Economics Review Blog. A new, capitalism-denying book is on the shelves, and it makes a stunning discovery: ‘Capitalism without competition is not capitalism’! Distortions: Capitalism Denied Capitalist crisis, like climate change, tends to breed ‘capitalism deniers’. The problem, argue the deniers, lies not in capitalism […]

Continue ReadingFix, ‘The Aggregation Problem: Implications for Ecological and Biophysical Economics’

Abstract This paper discusses the dimension problem in economic aggregation, as it relates to ecological and biophysical economics. The dimension problem consists of a simple dilemma: when we aggregate, the observer must choose the dimension of analysis. The dilemma is that this choice affects the resulting measurement. This means that aggregate measurements are dependent on […]

Continue ReadingFix, ‘The Trouble With Human Capital Theory’

Abstract Human capital theory is the dominant approach for understanding personal income distribution. According to this theory, individual income is the result of ‘human capital’. The idea is that human capital makes people more productive, which leads to higher income. But is this really the case? This paper takes a critical look at human capital […]

Continue Reading2018/09: Fix, ‘Energy, Hierarchy and the Origin of Inequality’

Abstract Where should we look to understand the origin of inequality? Most research focuses on three windows of evidence: (1) the archaeological record; (2) existing traditional societies; and (3) the historical record. I propose a fourth window of evidence — modern society itself. I hypothesize that we can infer the origin of inequality from the […]

Continue ReadingBichler & Nitzan, ‘Arms and Oil in the Middle East: A Biography of Research’

Abstract This essay interweaves two stories—one theoretical and empirical, the other autobiographical. The first story embeds the Israeli-Palestinian conflict in the broader political economy of the Middle East and the global accumulation of “capital as power.” The second story narrates the authors’ personal journey to uncover, theorize, and research this enfoldment. The essay explores and […]

Continue Reading