The CasP Project Past, Present and Future SHIMSHON BICHLER and JONATHAN NITZAN April 2018 Abstract The study of capital as power (CasP) began when we were students in the 1980s and has since expanded into a broader project involving a growing number of researchers and new areas of inquiry. This paper provides a bird’s-eye view […]

Continue ReadingBichler & Nitzan, ‘With Their Back to the Future: Will Past Earnings Trigger the Next Crisis?’

Abstract As these lines are being written (April 2018), the The U.S. stock market is again in turmoil. After a two-year bull run in which share prices soared by nearly 50 per cent, the market is suddenly dropping. Since the beginning of 2018, it lost nearly 10 per cent of its value, threatening investors with […]

Continue ReadingKim, ‘Propertization: The Process by which Financial Corporate Power has Risen and Collapsed’

Abstract Elsewhere I argue that the legal concept of property was created in the image of money in the late Roman Republic. Since then, the division of property and contract has been an underlying structure of Western law. The paper argues that a main way of structuring financial corporate power, especially money market funds (MMFs), […]

Continue ReadingMcMahon, ‘Is Hollywood a Risky Business? A Political Economic Analysis of Risk and Creativity’

Abstract This paper seeks to explain why Hollywood’s dominant firms are narrowing the scope of creativity in the contemporary period (1980–2015). The largest distributors have sought to prevent the art of filmmaking and its related social relations from becoming financial risks in the pursuit of profit. Major filmed entertainment, my term for the six largest […]

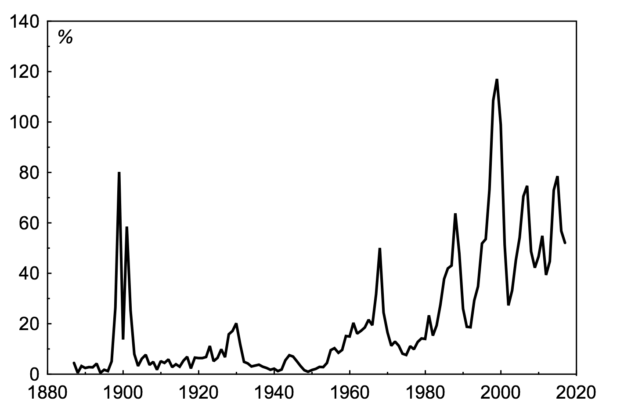

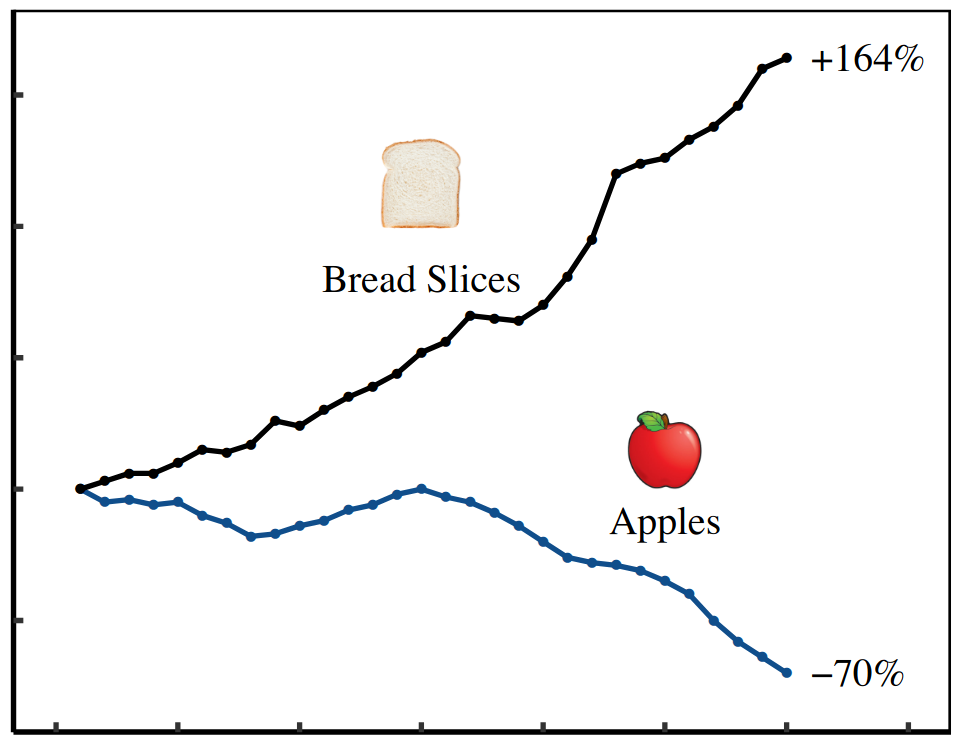

Continue ReadingFrancis’ Updated Buy-to-Build Indicator

Joe Francis The tendency toward buying other companies more than building new productive capacity continues in the United States In a past life I had access to expensive databases of corporate statistics, which I used to calculate the buy-to-build indicator for the United States from the 1880s until 2012. In short, the buy-to-build indicator shows […]

Continue Reading2018/07: Fix, ‘The Trouble with Human Capital Theory’

Abstract Human capital theory is the dominant approach for understanding personal income distribution. According to this theory, individual income is the result of ‘human capital’. The idea is that human capital makes people more productive, which leads to higher income. But is this really the case? This paper takes a critical look at human capital […]

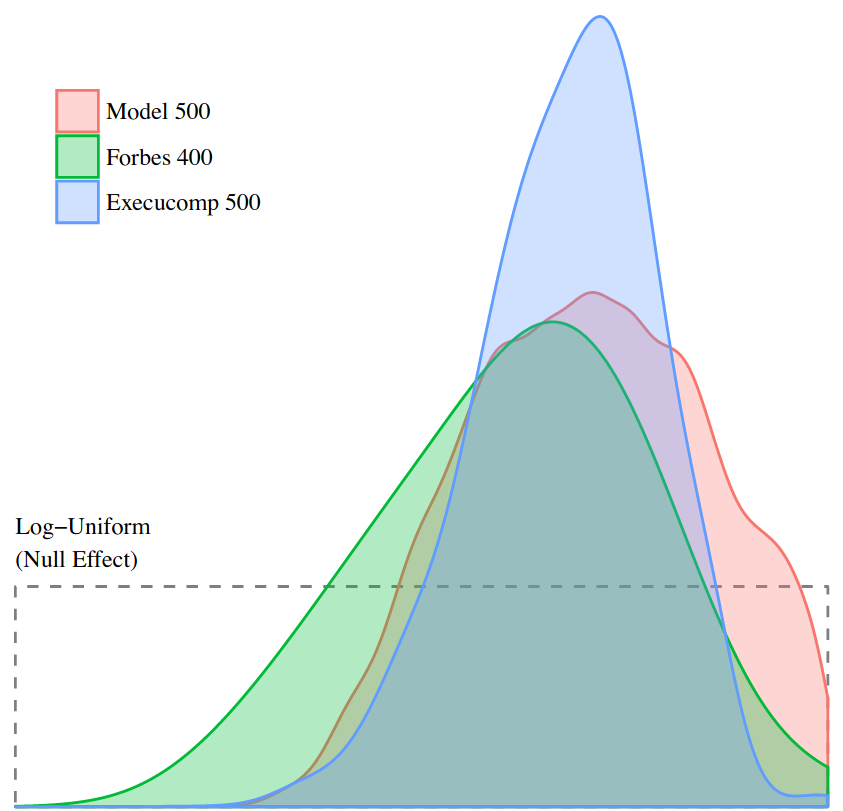

Continue Reading2018/06: Fix, ‘Capitalist Income and Hierarchical Power: A Gradient Hypothesis’

Abstract This paper offers a new approach to the study of capitalist income. Building on the ‘capital as power’ framework, I propose that capitalists earn their income not from any productive asset, but from the legal right to command a corporate hierarchy. In short, I hypothesize that capitalist income stems from hierarchical power. Based on […]

Continue ReadingFix, ‘Economics from the Top Down: Does Hierarchy Unify Economic Theory?’

Abstract What is the unit of analysis in economics? The prevailing orthodoxy in mainstream economic theory is that the individual is the ‘ultimate’ unit of analysis. The implicit goal of mainstream economics is to root macro-level social structure in the micro-level actions of individuals. But there is a simple problem with this approach: our knowledge […]

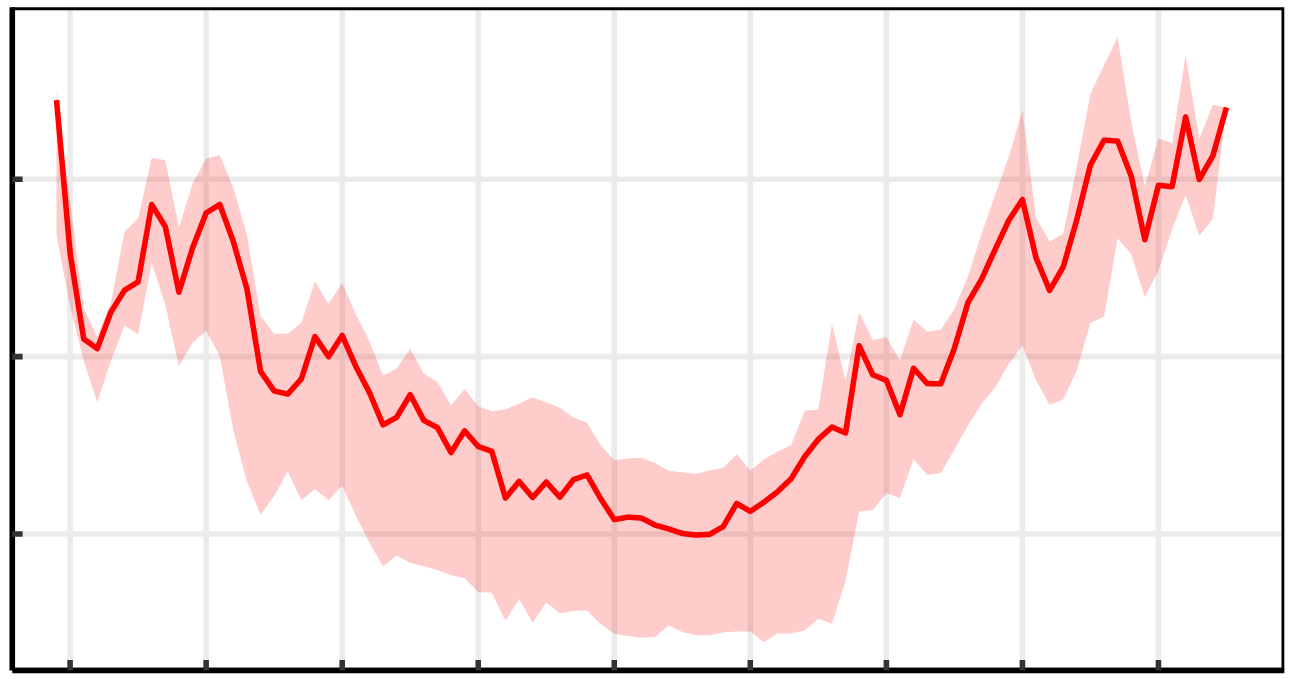

Continue Reading2018/05: Fix, ‘The Growth of US Top Income Inequality: A Hierarchical Redistribution Hypothesis’

Abstract What accounts for the growth of US top income inequality? This paper proposes a hierarchical redistribution hypothesis. The idea is that US firms have systematically redistributed income to the top of the corporate hierarchy. I test this hypothesis using a large scale hierarchy model of the US private sector. My method is to vary […]

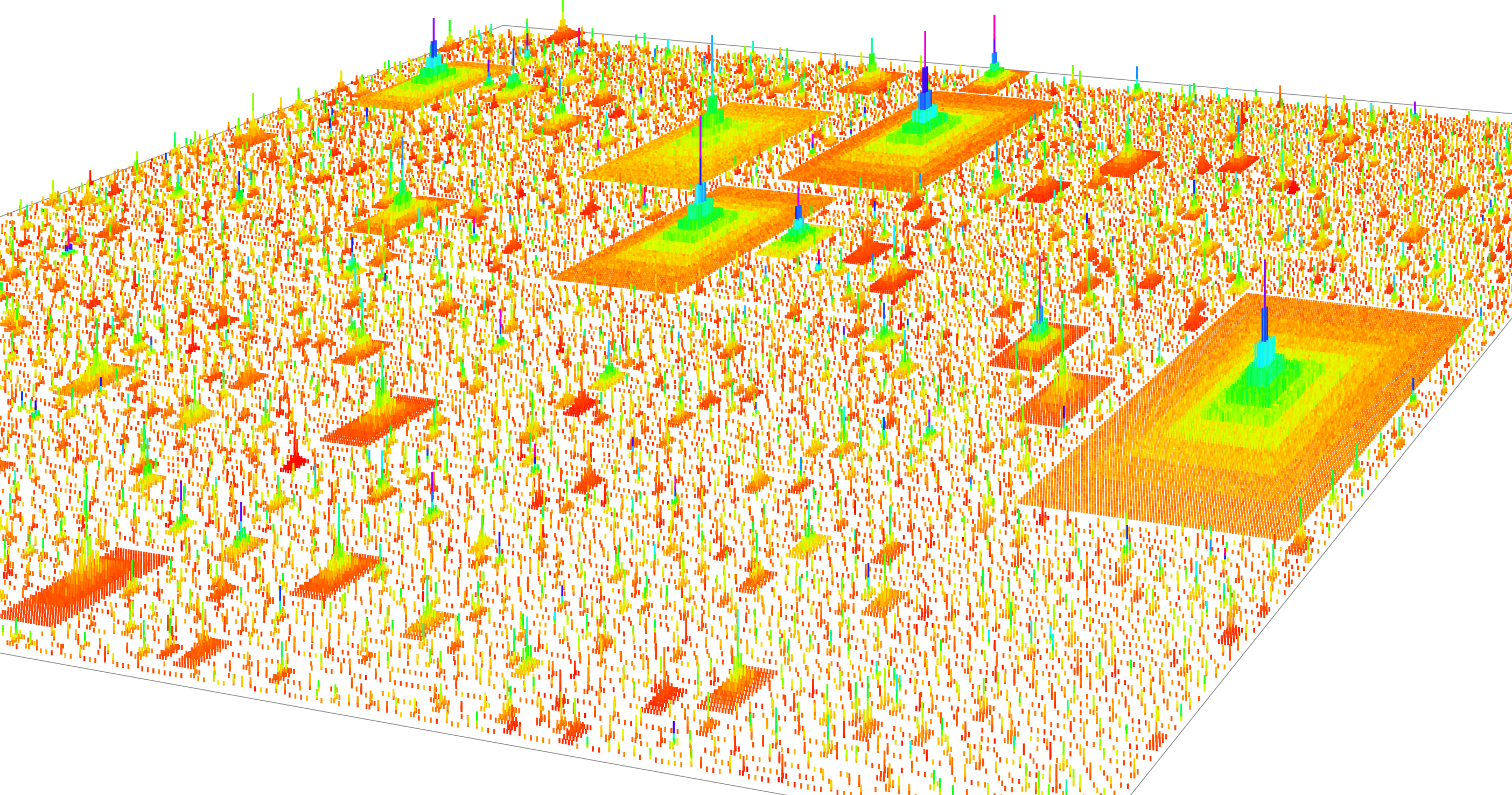

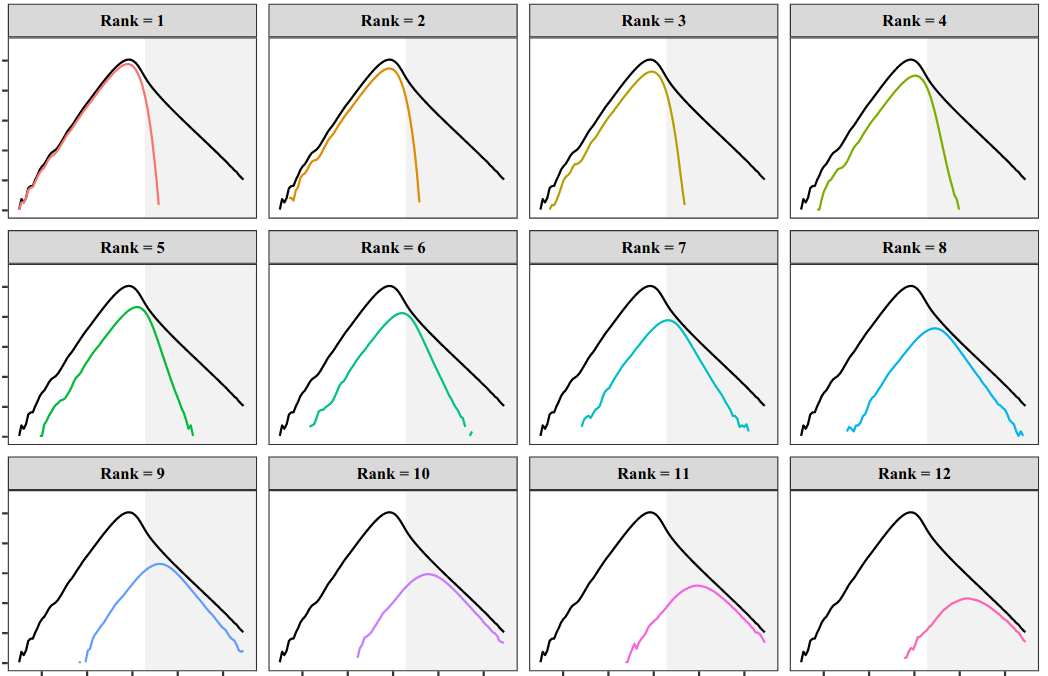

Continue ReadingFix, ‘Hierarchy and the power-law income distribution tail’

Abstract What explains the power-law distribution of top incomes? This paper tests the hypothesis that it is firm hierarchy that creates the power-law income distribution tail. Using the available case-study evidence on firm hierarchy, I create the first large-scale simulation of the hierarchical structure of the US private sector. Although not tuned to do so, […]

Continue Reading2018/04: Martin, ‘The Autocatalytic Sprawl of Pseudorational Mastery’

Abstract According to Shimshon Bichler and Jonathan Nitzan capital is not an economic quantity but a mode of power; it could be sumarized as: “Capital is power quantified in monetary terms”. So, what do we do when we “quantify”? What is the nature of “money” in a capitalist society? And, indeed, what is “power” in […]

Continue Reading2018/03: Fix, ‘The Aggregation Problem’

Abstract This article discusses the aggregation problem and its implications for ecological economics. The aggregation problem consists of a simple dilemma: when adding heterogeneous phenomena together, the observer must choose the unit of analysis. The dilemma is that this choice affects the resulting measurement. This means that aggregate measurements are dependent on one’s goals, and […]

Continue ReadingNitzan & Bichler, ‘El capital como poder. Un estudio del orden y el creorden’

Abstract Las teorías convencionales del capitalismo están sumidas en una profunda crisis: tras siglos de debates todavía son incapaces de decirnos qué es el capital. Tanto liberales como marxistas se refieren al capital como una entidad ‘económica’ que puede ser contabilizada en unidades universales de ‘utilidad’ o de ‘trabajo abstracto’. Pero estas unidades son totalmente […]

Continue ReadingDebailleul, and Bichler & Nitzan, ‘Theory and Praxis, Theory and Practice, Practical Theory’

Abstract In their paper ‘The CasP Project: Past, Present and Future’, Shimshon Bichler and Jonathan Nitzan invite readers to engage critically with their theoretical framework, known as capital as power (CasP). This call for further research, reactions and critiques is the perfect occasion to raise a few questions that have grown in my mind in […]

Continue ReadingBichler & Nitzan, ‘The CasP Project: Past, Present, Future’

Abstract The study of capital as power (CasP) began when we were students in the 1980s and has since expanded into a broader project involving a growing number of researchers and new areas of inquiry. This paper provides a bird’s-eye view of the CasP journey. It explores what we have learned so far, reviews ongoing […]

Continue Reading2018/02: Fix, ‘A Hierarchy Model of Income Distribution’

Abstract Based on worldly experience, most people would agree that firms are hierarchically organized, and that pay tends to increase as one moves up the hierarchy. But how this hierarchical structure affects income distribution has not been widely studied. To remedy this situation, this paper presents a new model of income distribution that explores the […]

Continue Reading2018/01: Bichler & Nitzan, ‘With their Back to the Future: Will Past Earnings Trigger the Next Crisis?’

Abstract The U.S. stock market is again in turmoil. After a two-year bull run in which share prices soared by nearly 50 per cent, the market is suddenly dropping. Since the beginning of 2018, it lost nearly 10 per cent of its value, threatening investors with an official ‘correction’ or worse. As always, there is […]

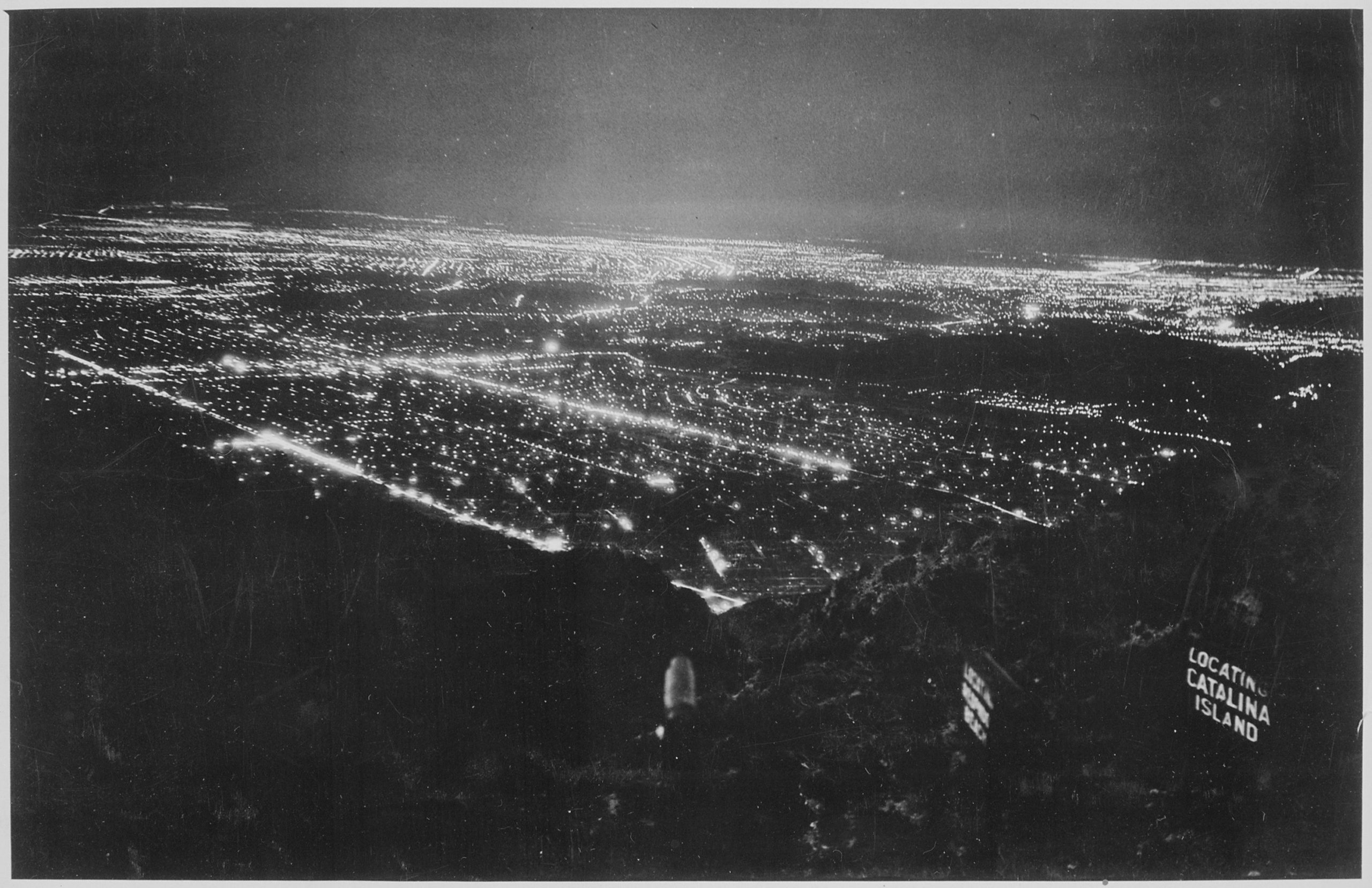

Continue ReadingAfrica and Capital as Power

Tim Di Muzio This post originally appeared on the website for Review of African Political Economy. Despite the fact that the ‘capital as power’ approach to critical political economy has been around for some time now, it is not very widely used and/or understood. Part of the reason for this, I believe, is that it […]

Continue ReadingPodcast Interview with Blair Fix on Capitalism, Hierarchy, and Energy

James McMahon Blair Fix, whose publications are available on this site, was interviewed by Post-Scarcity Anarchism. The interview covers his research on energy use and the relationship between hierarchy and personal income. Worth the listen!

Continue ReadingWoodley, ‘Globalization and Capitalist Geopolitics: Sovereignty and State Power in a Multipolar World’

Abstract Globalization and Capitalist Geopolitics is concerned with the growth of transnational corporate power against the backdrop of the decline of the West and the struggle by non-Western states to challenge and overcome domination of the rest of the world by the West. At the centre of the study is the problematic status of the […]

Continue Reading