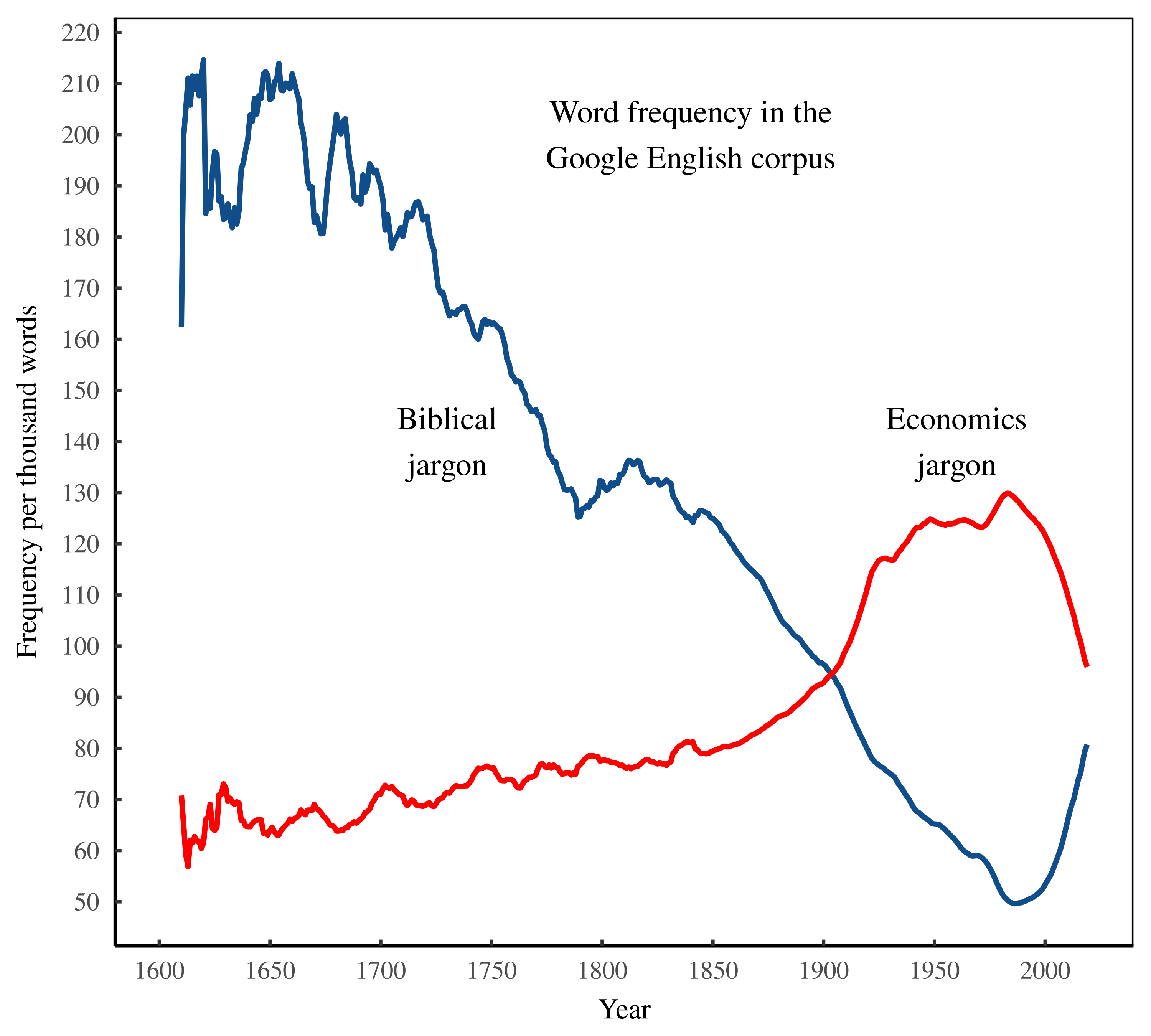

Abstract This paper uses word frequency to track the rise and potential peak of capitalist ideology. Using a sample of mainstream economics textbooks as my corpus of capitalist thinking, I isolate the jargon of these books and then track its frequency over time in the Google English corpus. I also measure the popularity of feudal […]

Continue ReadingBichler & Nitzan, ‘Book Review: Steve Keen (2021) The New Economics: A Manifesto’

Abstract Steve Keen’s book, The New Economics: A Manifesto (2021), offers a new path for economics, and for good reason. In his view, neoclassicism, the paradigm that rules modern-day economics, has become a serious menace: “I regard Neoclassical economics as not merely a bad methodology for economic analysis, but as an existential threat to the […]

Continue ReadingDi Muzio & Dow, ‘Covid-19 and the Global Political Economy. Crises in the 21st Century’

Abstract Covid-19 and the Global Political Economy investigates and explores how far and in what ways the Covid-19 pandemic is challenging, restructuring, and perhaps remaking aspects of the global political economy. Since the 1970s, neoliberal capitalism has been the guiding principle of global development: fiscal discipline, privatisations, deregulation, the liberalisation of trade and investment regimes, […]

Continue ReadingMcMahon, ‘Why Scorsese is Right About Corporate Power’

Abstract In the March 2021 issue of Harper’s, Scorsese wrote an essay to pay tribute to Federico Fellini, the Italian director who directed such great films as La Strada, 8 1/2, La Dolce Vita, Nights of Cabiria and Satyricon. Scorsese writing on Fellini is definitely newsworthy for cinephiles who want to know about Fellini’s beginnings […]

Continue ReadingMcMahon, ‘The Political Economy of Hollywood’

Abstract In Hollywood, the goals of art and business are entangled. Directors, writers, actors, and idealistic producers aspire to make the best films possible. These aspirations often interact with the dominant firms that control Hollywood film distribution. This control of distribution is crucial as it enables the firms and other large businesses involved, such as […]

Continue ReadingFix, ‘Das Ritual der Kapitalisierung (The Ritual of Capitalization)’

Abstract Wenn man genau hinhört, kann man zuhören, wie Jeff Bezos immer reicher wird. Da ist es schon wieder, dieses Geräusch. Eine weitere Milliarde in Bezos‘ Kassen. Lassen Sie uns diesen Klang des Geldes mit ein paar Zahlen belegen. Seit 2017 ist das Nettovermögen von Bezos um etwa 4 Millionen Dollar pro Stunde gewachsen – […]

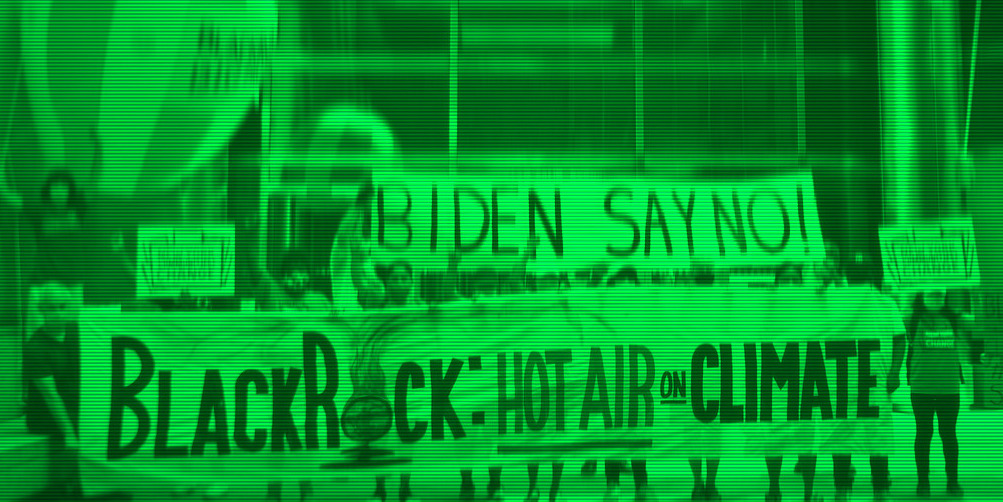

Continue ReadingBaines & Hager, ‘From Passive Owners to Planet Savers? Asset Managers, Carbon Majors and the Limits of Sustainable Finance’

Abstract This article examines the role of the Big Three asset management firms — BlackRock, Vanguard and State Street — in corporate environmental governance. Specifically, it charts the Big Three’s relationships with the public–owned Carbon Majors: a small group of fossil fuels, cement and mining companies responsible for the bulk of industrial greenhouse gas emissions. […]

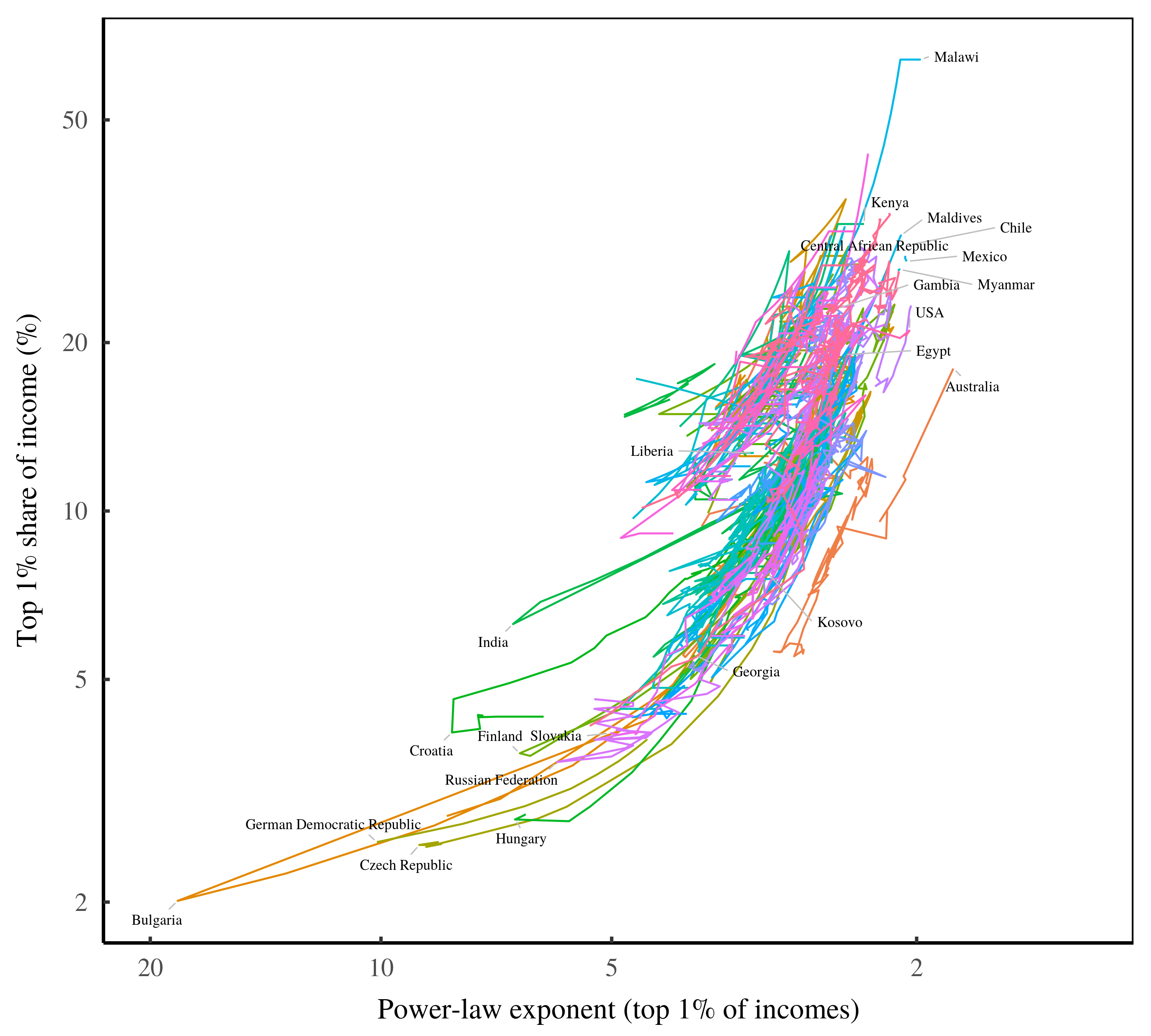

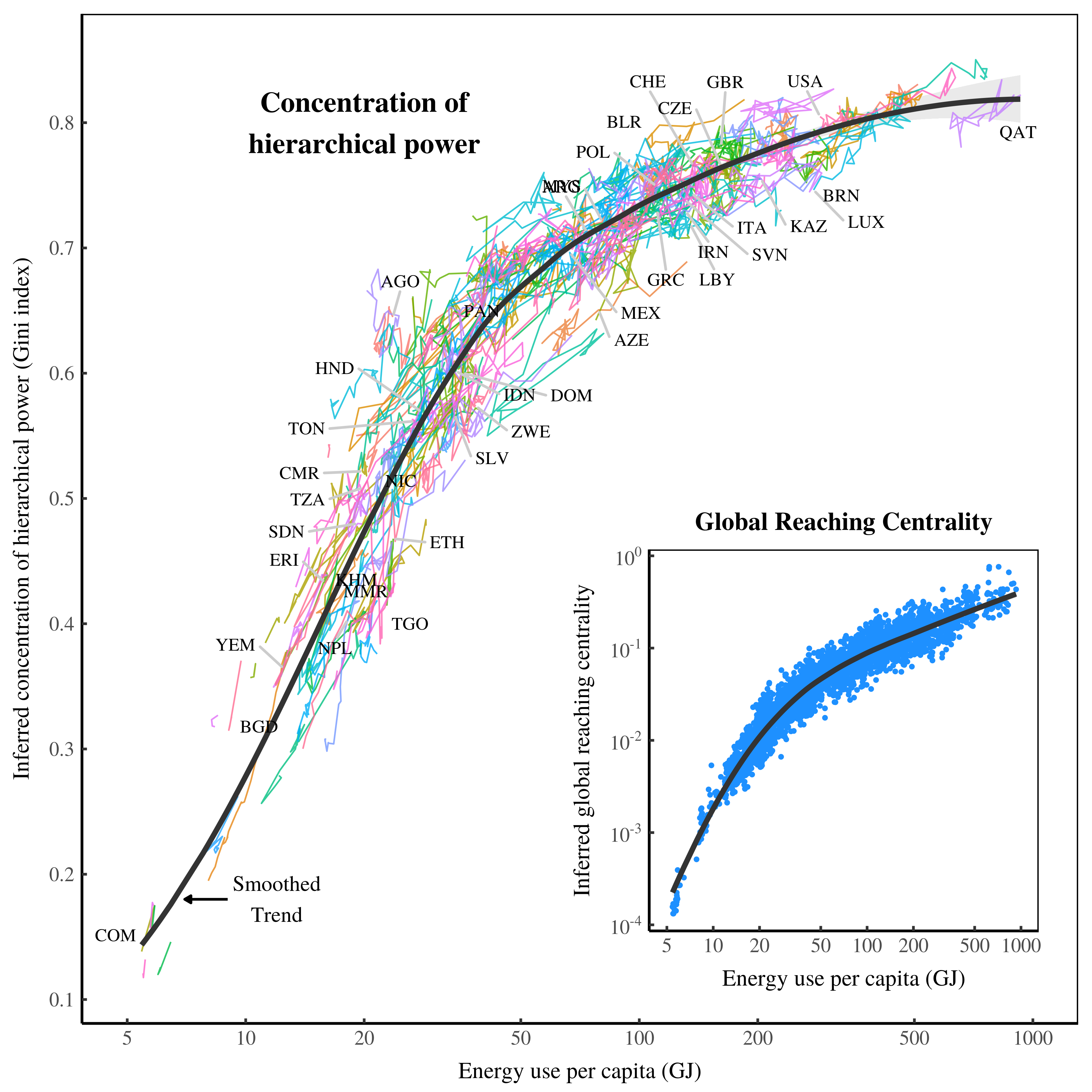

Continue ReadingFix, ‘Redistributing Income Through Hierarchy’

Abstract Although the determinants of income are complex, the results are surprisingly uniform. To a first approximation, top incomes follow a power-law distribution, and the redistribution of income corresponds to a change in the power-law exponent. Given the messiness of the struggle for resources, why is the outcome so simple? This paper explores the idea […]

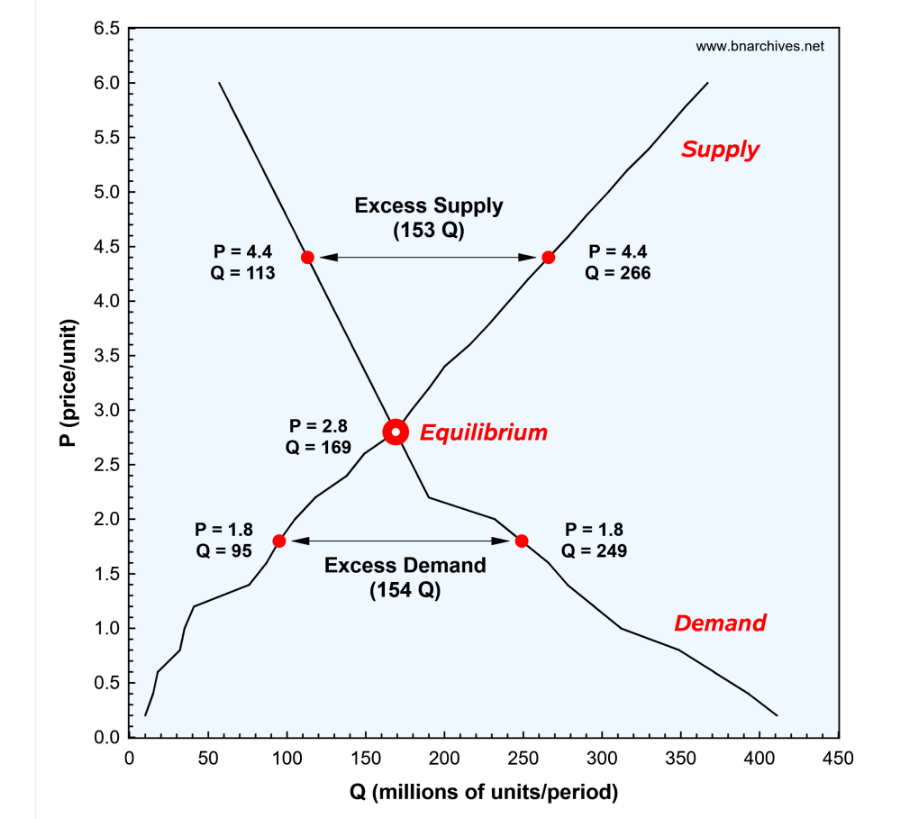

Continue ReadingBichler & Nitzan, ‘The 1-2-3 Toolbox of Mainstream Economics: Promising Everything, Delivering Nothing’

Abstract We write this essay for both lay readers and scientists, though mainstream economists are welcome to enjoy it too. Our subject is the basic toolbox of mainstream economics. The most important tools in this box are demand, supply and equilibrium. All mainstream economists – as well as many heterodox ones – use these tools, […]

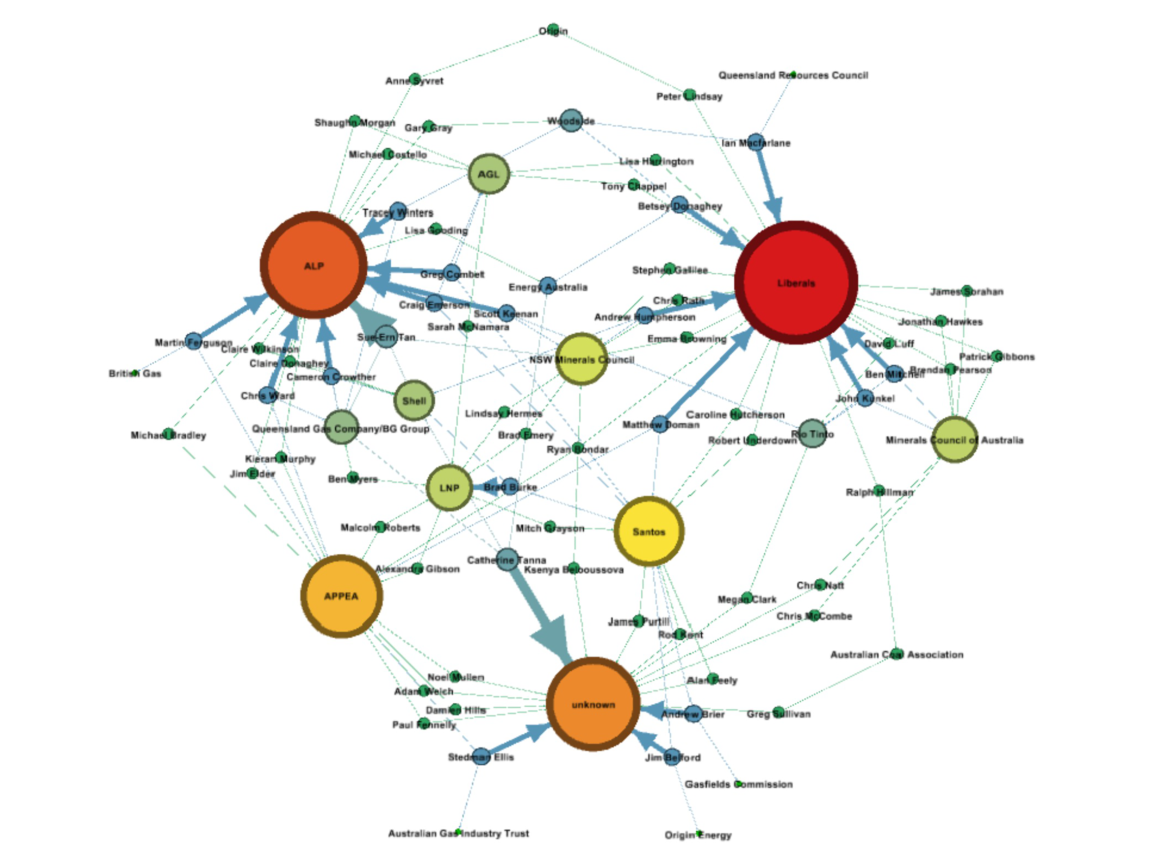

Continue ReadingLucas, ‘Investigating networks of corporate influence on government decision-making: The case of Australia’s climate change and energy policies’

Abstract This paper argues that the ability of dominant corporations in the fossil fuel and other polluting industries to shape government policy on climate change and energy issues is directly related to their financial interests in particular countries, and emblematic of the crippling effect which they have exercised on the ability of nation states to […]

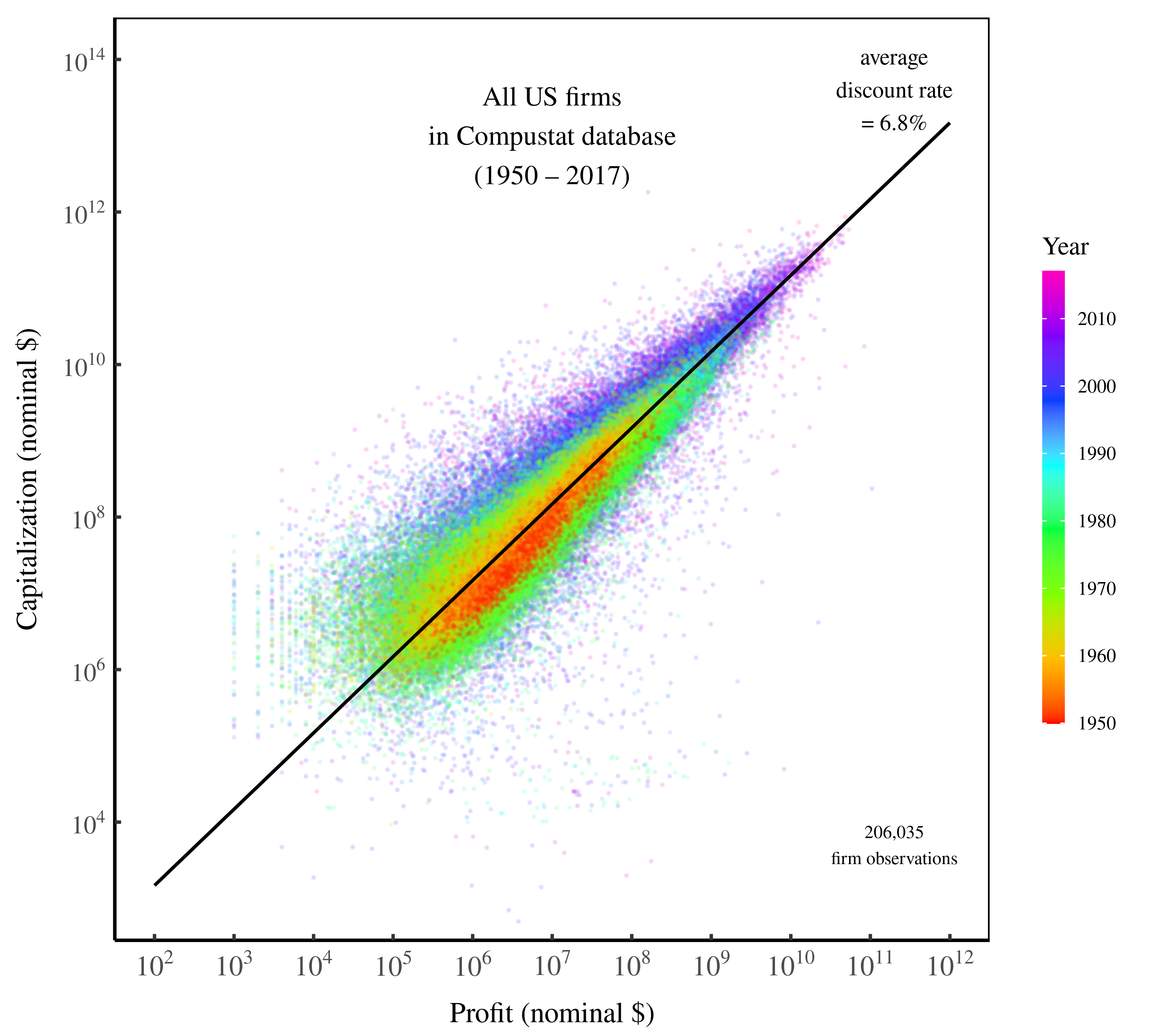

Continue ReadingFix, ‘The Ritual of Capitalization’

Abstract For more than a century, political economists have sought to understand the nature of capital. The prevailing wisdom is that there must be something ‘real’ — some productive capacity — that underpins capitalized values. This thinking, I argue, is a mistake. Building on Jonathan Nitzan and Shimshon Bichler’s theory of capital as power, I […]

Continue ReadingFix, ‘Economic Development and the Death of the Free Market’

Abstract According to neoclassical economics, the most efficient way to organize human activity is to use the free market. By stoking self interest, the theory claims, individuals can benefit society. This idea, however, conflicts with the evolutionary theory of multilevel selection, which proposes that rather than stoke individual self interest, successful groups must suppress it. […]

Continue ReadingHoward et al., ‘Protein Industry Convergence and Its Implications for Resilient and Equitable Food Systems’

Abstract Recent years have seen the convergence of industries that focus on higher protein foods, such as meat processing firms expanding into plant-based substitutes and/or cellular meat production, and fisheries firms expanding into aquaculture. A driving force behind these changes is dominant firms seeking to increase their power relative to close competitors, including by extending […]

Continue ReadingFix, ‘The Rise of Human Capital Theory’

Abstract Today, human capital theory dominates the study of personal income. But this has not always been so. In this essay, I chart the rise of human capital theory, and compare it to the rise (and fall) of eugenics. The comparison, I argue, is an apt one. Eugenics and human capital theory both focus on […]

Continue ReadingBichler & Nitzan, ‘Unbridgeable: why political economists cannot accept capital as power’

Abstract The theory of capital as power (CasP) is radically different from conventional political economy. In the conventional view, mainstream as well as heterodox, capital is seen a ‘real’ economic entity engaged in the production of goods and services, and capitalism is thought of as a mode of production and consumption. Finance in this approach […]

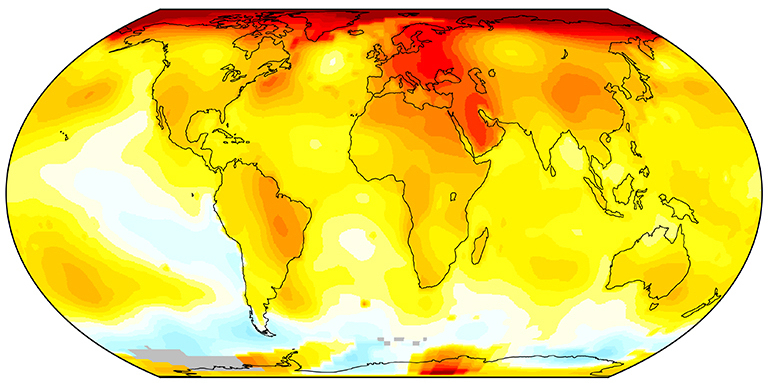

Continue ReadingLucas, ‘Risking the earth, parts 1 and 2’

Abstract This two-part paper details the arguments and evidence that have been marshalled by both climate scientists and social scientists to critique the current procedures and methodologies deployed by the Intergovernmental Panel on Climate Change (IPCC) and the United Nations Framework Convention on Climate Change (UNFCCC) to represent the risks of anthropogenic forcing and a […]

Continue ReadingBaines & Hager, ‘Commodity Traders in a Storm: Financialization, Corporate Power and Ecological Crisis’

Abstract Commodity trading firms occupy a central position in global supply chains and their activities have been associated with financial instability, social upheaval and manifold forms of ecological devastation. This paper examines these companies in the context of debates regarding corporate financialization. We find that since the 2003–2011 commodity boom, trading firms have become less […]

Continue ReadingMcMahon, ‘Selling Hollywood to China’

Abstract From the 1980s to the present, Hollywood’s major distributors have been able to redistribute U.S. theatrical attendance to the advantage of their biggest blockbusters and franchises. At the global scale and during the same period, Hollywood has been leveraging U.S. foreign power to break ground in countries that have historically protected and supported their […]

Continue ReadingBaines & Hager, ‘The Great Debt Divergence and its Implications for the Covid-19 Crisis: Mapping Corporate Leverage as Power’

Abstract The COVID-19 pandemic has amplified longstanding concerns about mounting levels of corporate debt in the United States. This article places the current conjuncture in its historical context, analysing corporate indebtedness against the backdrop of increasing corporate concentration. Theorising leverage as a form of power, we find that the leverage of large non-financial firms increased […]

Continue ReadingMonaghan & Cochrane, ‘Fight to Win! Tools for Confronting Capital’

Abstract Anarchists have generally rejected the idea that there is or ought to be a pure or inherently revolutionary strategy or tactic. In this chapter we make use of the capital-as-power theory of value and capital in a way that informs and supports the ad hoc perspective on struggle and fighting to win. Our primary […]

Continue Reading