Capital as Power in the 21st Century A Conversation MICHAEL HUDSON, JONATHAN NITZAN, TIM DI MUZIO, and BLAIR FIX February 2025 Abstract On December 3, 2024, Michael Hudson met with capital-as-power researchers Jonathan Nitzan, Tim Di Muzio, and Blair Fix to discuss the intersections between their two lines of research. What follows is a transcript […]

Continue ReadingBichler & Nitzan, ‘הדרך לעזה: על משטרי הכוח וכנסיות האל העליון היחיד (The Road to Gaza: On Modes of Power and Supreme-God Churches)’

Abstract מלחמת הקודש המתנהלת בין המיליציות הרבניות לבין המיליציות האיסלמיות הינה מסוג חדש. אבל הדרך למלחמה בעזה נסללה עוד לפני כששת אלפים שנה, בעת שקמו לראשונה משטרי המלוכה-כהונה במסופוטמיה. אוליגרכיות אלה היו הראשונות שיצקו תשלובת חזקה של מלך עריץ בארמון וכוהני אל-עליון במקדש. ילידי המזרח התיכון היו הראשונים בהיסטוריה האנושית שזכו בכבוד להתקיים כנתינים כנועים […]

Continue ReadingBichler & Nitzan, ‘The Road to Gaza’

Abstract The war that started in 2023 between Hamas and Israel is driven by various long-lasting processes, but it also brings to the fore a new cause that hitherto seemed marginal: the armed militias of the Rabbinate and Islamic churches. The Rabbinate militias, embodied in Jewish settler organizations, have taken over not only Palestinian lands, […]

Continue ReadingNoble, ‘Follow the Money: The Political Economy of Petrodollar Accumulation and Recycling’

Abstract This thesis makes two unique contributions to the International Political Economy literature. It presents the first comprehensive, empirical investigation of petrodollar accumulation and recycling spanning the period 1980-2021. It also corrects the misconception that petrodollar recycling in the 1970s and 1980s involved the extension of loans to developing countries using fractional reserve banking and […]

Continue ReadingVastenaekels, ‘Degrowth and Capital: Assembling a Power-Centred Theory of Change’

Abstract In the context of contemporary socio-environmental shifts, the concept of “degrowth” advocates for transforming societies to ensure environmental justice and a well-being for all within planetary boundaries. This PhD thesis, positioned within degrowth studies, provides a processual, holistic and interdisciplinary exploration of the dynamics between degrowth transformations and capital accumulation, understood as an all-encompassing […]

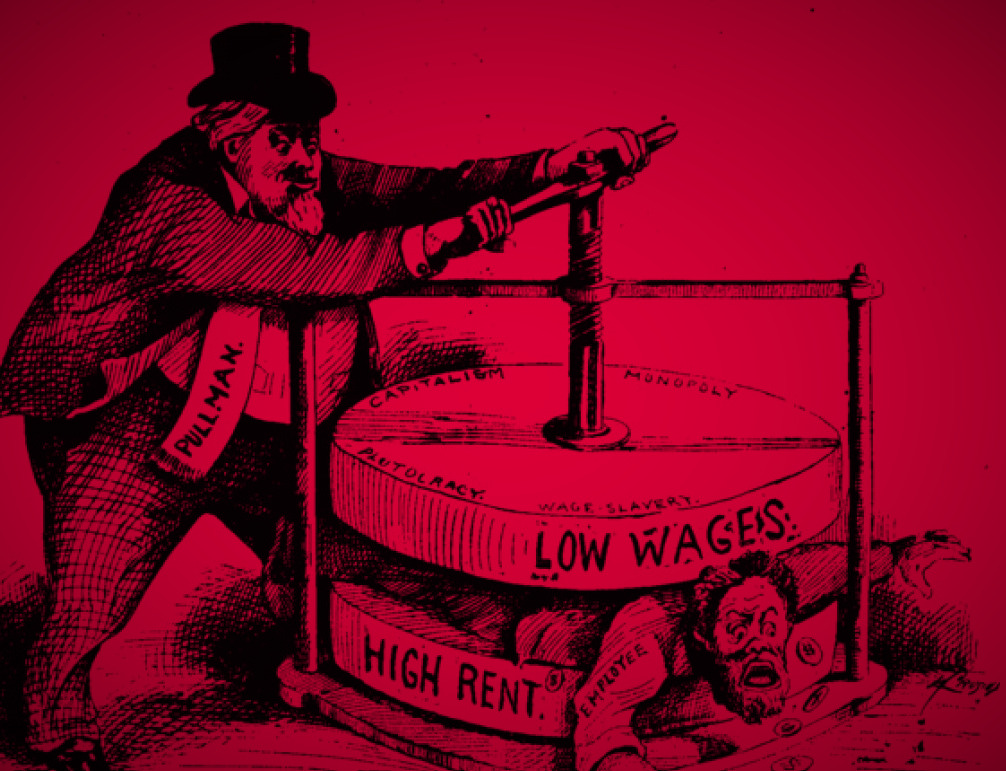

Continue ReadingDi Muzio, ‘Capitalism, Money and Inequality in the World’

Abstract There is little doubt that, in the last hundred years or so, progress has been made in lifting more people out of extreme poverty. Yet, considerable economic inequalities both within and between nations persists and, as recent work has shown, if the rate of return on capital surpasses the rate of growth, inherited wealth […]

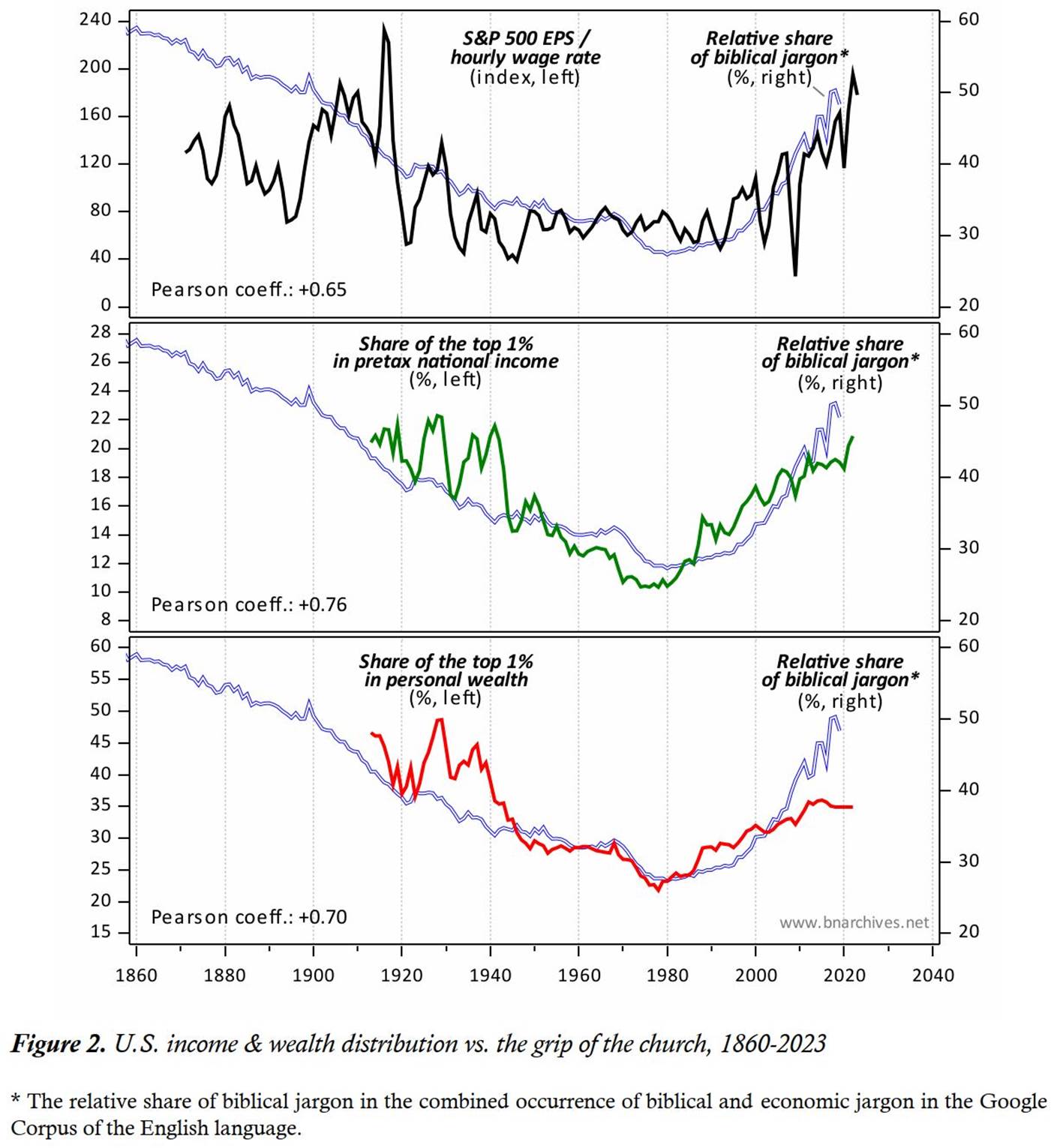

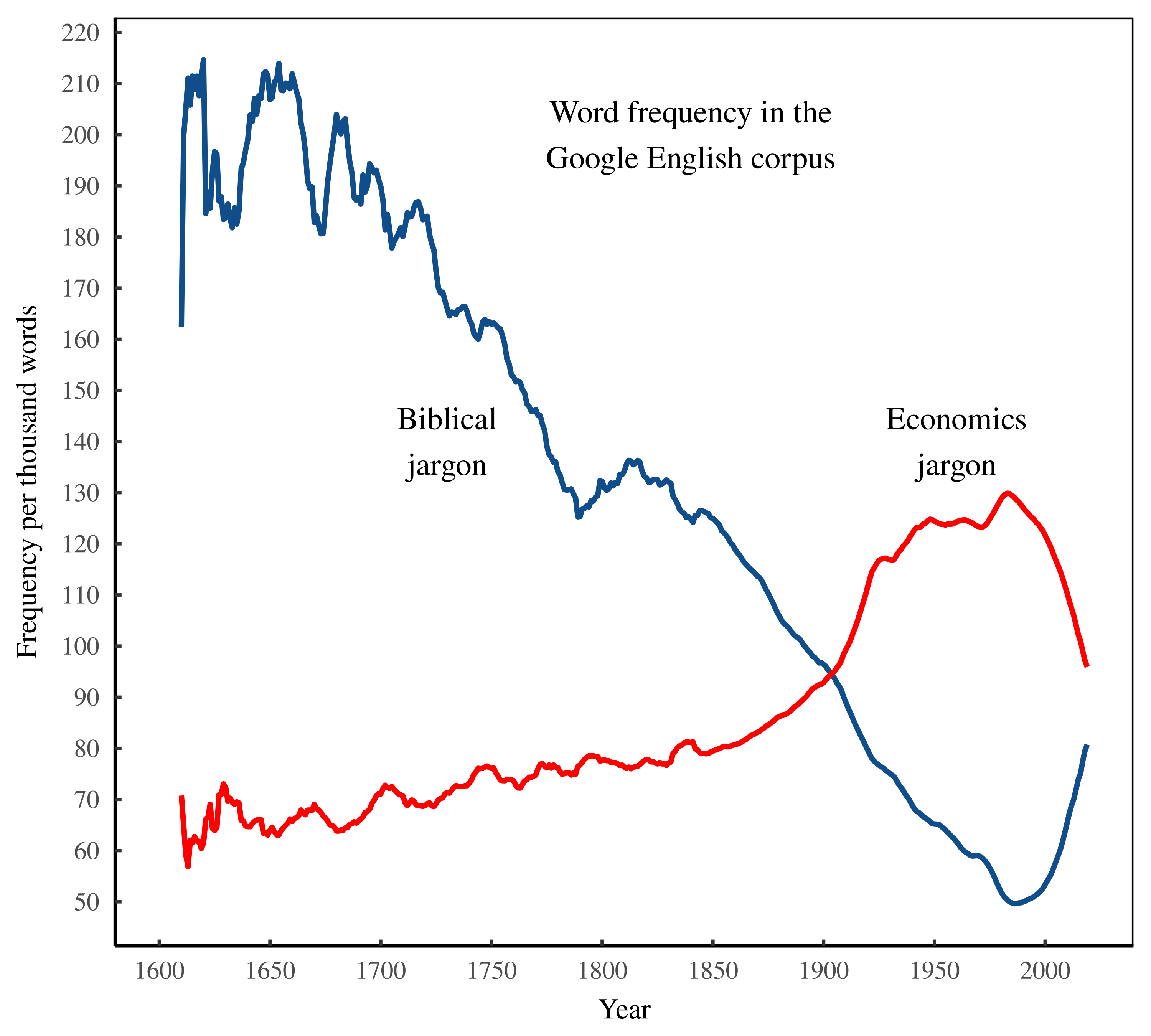

Continue ReadingFix, ‘Have We Passed Peak Capitalism?’

Abstract This paper uses word frequency to track the rise and potential peak of capitalist ideology. Using a sample of mainstream economics textbooks as my corpus of capitalist thinking, I isolate the jargon of these books and then track its frequency over time in the Google English corpus. I also measure the popularity of feudal […]

Continue ReadingDi Muzio & Dow, ‘Covid-19 and the Global Political Economy. Crises in the 21st Century’

Abstract Covid-19 and the Global Political Economy investigates and explores how far and in what ways the Covid-19 pandemic is challenging, restructuring, and perhaps remaking aspects of the global political economy. Since the 1970s, neoliberal capitalism has been the guiding principle of global development: fiscal discipline, privatisations, deregulation, the liberalisation of trade and investment regimes, […]

Continue ReadingWhy should we teach the history of political-economic thought?

Originally published at sbhager.com Sandy Brian Hager With the academic term winding down, I thought it would be useful to post some reflections on my teaching experiences this past year. In total, I taught three courses. Two of these courses were inherited from previous lecturers: a second-year undergraduate course on the history of political-economic thought, […]

Continue ReadingBichler & Nitzan, ‘Unbridgeable: why political economists cannot accept capital as power’

Abstract The theory of capital as power (CasP) is radically different from conventional political economy. In the conventional view, mainstream as well as heterodox, capital is seen a ‘real’ economic entity engaged in the production of goods and services, and capitalism is thought of as a mode of production and consumption. Finance in this approach […]

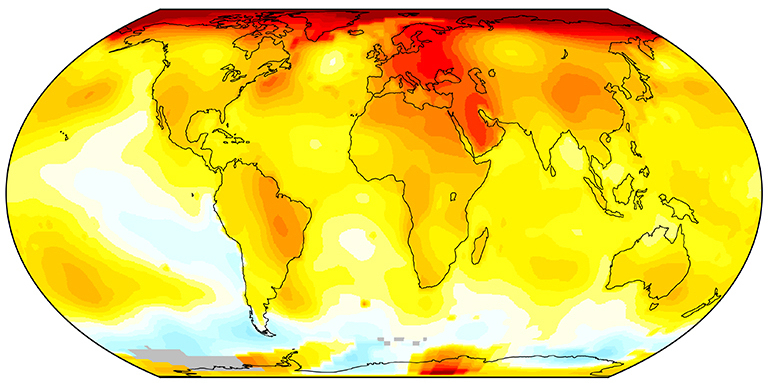

Continue ReadingLucas, ‘Risking the earth, parts 1 and 2’

Abstract This two-part paper details the arguments and evidence that have been marshalled by both climate scientists and social scientists to critique the current procedures and methodologies deployed by the Intergovernmental Panel on Climate Change (IPCC) and the United Nations Framework Convention on Climate Change (UNFCCC) to represent the risks of anthropogenic forcing and a […]

Continue ReadingBaines & Hager, ‘Commodity Traders in a Storm: Financialization, Corporate Power and Ecological Crisis’

Abstract Commodity trading firms occupy a central position in global supply chains and their activities have been associated with financial instability, social upheaval and manifold forms of ecological devastation. This paper examines these companies in the context of debates regarding corporate financialization. We find that since the 2003–2011 commodity boom, trading firms have become less […]

Continue ReadingMcMahon, ‘Selling Hollywood to China’

Abstract From the 1980s to the present, Hollywood’s major distributors have been able to redistribute U.S. theatrical attendance to the advantage of their biggest blockbusters and franchises. At the global scale and during the same period, Hollywood has been leveraging U.S. foreign power to break ground in countries that have historically protected and supported their […]

Continue ReadingBaines & Hager, ‘The Great Debt Divergence and its Implications for the Covid-19 Crisis: Mapping Corporate Leverage as Power’

Abstract The COVID-19 pandemic has amplified longstanding concerns about mounting levels of corporate debt in the United States. This article places the current conjuncture in its historical context, analysing corporate indebtedness against the backdrop of increasing corporate concentration. Theorising leverage as a form of power, we find that the leverage of large non-financial firms increased […]

Continue ReadingMonaghan & Cochrane, ‘Fight to Win! Tools for Confronting Capital’

Abstract Anarchists have generally rejected the idea that there is or ought to be a pure or inherently revolutionary strategy or tactic. In this chapter we make use of the capital-as-power theory of value and capital in a way that informs and supports the ad hoc perspective on struggle and fighting to win. Our primary […]

Continue ReadingDi Muzio & Robbins, ‘Capitalismo de deuda’

Abstract Capitalismo de deuda es un esfuerzo por descifrar cómo la tecnología de la deuda se ha convertido en uno de los mayores obstáculos para las aspiraciones democráticas y racionales de la sociedad moderna. Richard Robbins y Tim Di Muzio muestran que la deuda, entendida como una tecnología de poder, es un engranaje insertado en […]

Continue ReadingKvachev, ‘Unflat Ontology: Essay on the Poverty of Democratic Materialism’

Abstract The paper is dedicated to the problem of flat ontology in philosophy and its relation to the practice in economy. The author argues that flat economy is based on a marginal utility theory of value and presents hierarchical value chains with concentration of power-capital as if they were flat and all the actors involved […]

Continue Reading2020/04: McMahon, ‘Reconsidering Systemic Fear and the Stock Market: A Reply to Baines and Hager’

Abstract A recent New Political Economy article by Baines and Hager (2020) critiqued Shimshon Bichler and Jonathan Nitzan’s capital-as-power (CasP) model of the stock market (Bichler & Nitzan, 2016). Bichler and Nitzan’s model of the stock market seeks to explain how financial crises are tied to the (upper) limits of redistributing income through power. Bichler […]

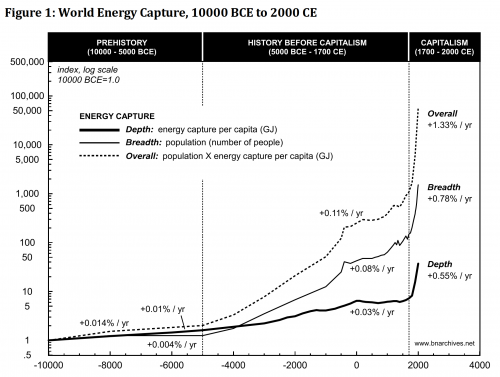

Continue ReadingBichler & Nitzan, ‘Growing through Sabotage: Energizing Hierarchical Power’

Abstract According to the theory of capital as power, capitalism, like any other mode of power, is born through sabotage and lives in chains – and yet everywhere we look we see it grow and expand. What explains this apparent puzzle of ‘growth in the midst of sabotage’? The answer, we argue, begins with the […]

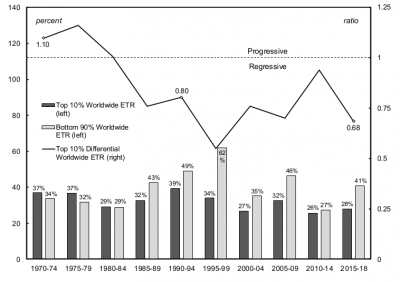

Continue ReadingHager & Baines, ‘The Tax Advantage of Big Business’

Abstract Corporate concentration in the United States has been on the rise in recent years, sparking a heated debate about its causes, consequences, and potential remedies. In this study, we examine a facet of public policy that has been largely neglected in current debates about concentration: corporate taxation. As part of our analysis we develop […]

Continue Reading