Abstract The relationship between inequality and financial instability has become a thriving topic of research in heterodox political economy. This article offers the first critical engagement with one framework within this wider literature: the Capital as Power (CasP) model of the stock market developed by Shimshon Bichler and Jonathan Nitzan. Specifically, we extend the CasP […]

Continue ReadingMartin, ‘The Autocatalytic Sprawl of Pseudorational Mastery ‘

Abstract Winner of the 2018 RECASP Essay Prize According to Jonathan Nitzan and Shimshon Bichler (2009), capital is not an economic quantity, but a mode of power. Their fundamental thesis could be summarized as follows: capital is power quantified in monetary terms. But what do we do when we quantify? What is the nature of […]

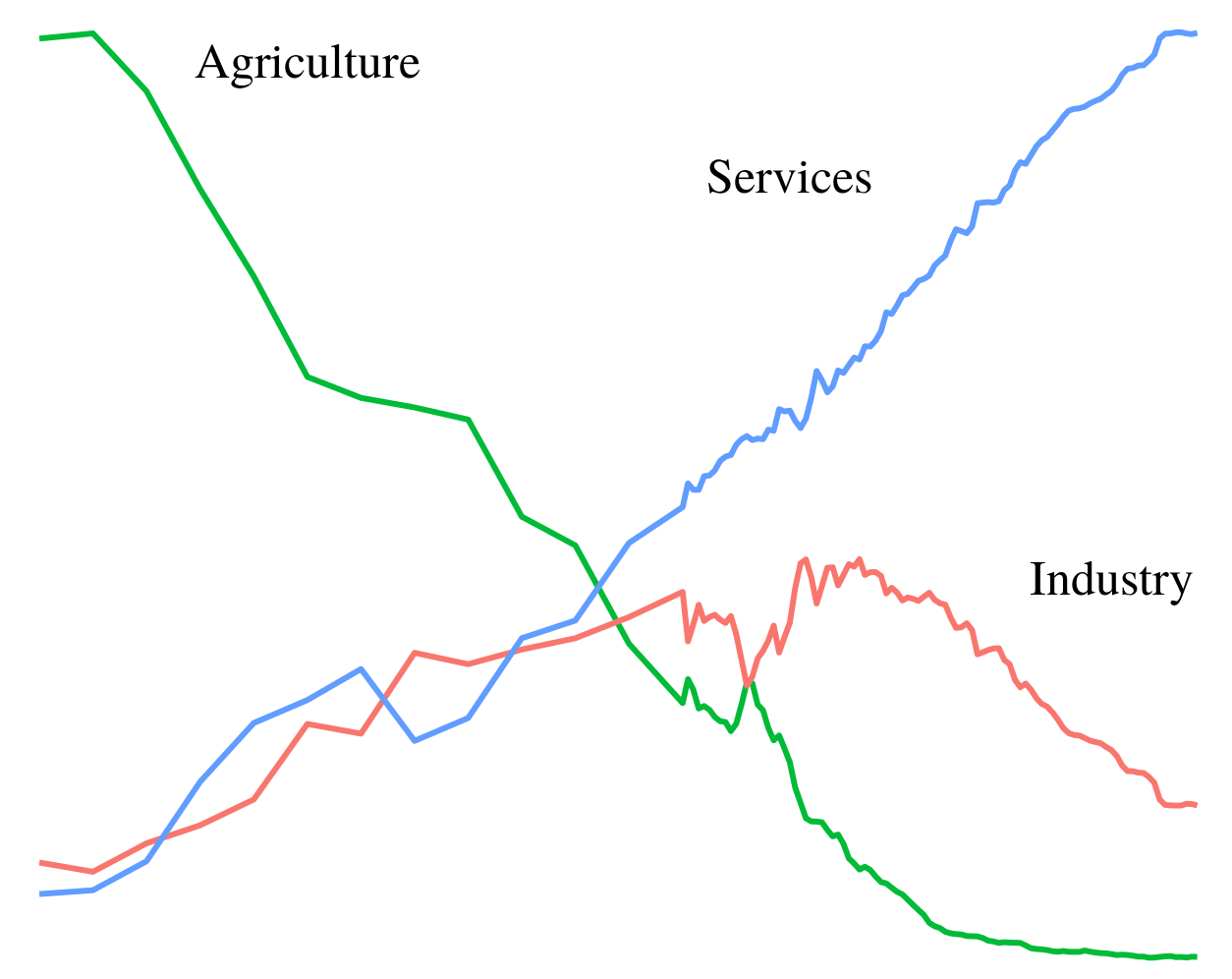

Continue ReadingFix, ‘Dematerialization Through Services: Evaluating the Evidence’

Abstract Dematerialization through services is a popular proposal for reducing environmental impact. The idea is that by shifting from the production of goods to the provision of services, a society can reduce its material demands. But do societies with a larger service sector actually dematerialize? I test the ‘dematerialization through services’ hypothesis with a focus […]

Continue Reading2019/01: Bichler & Nitzan, ‘CasP’s Differential Accumulation versus Veblen’s Differential Advantage (Revised and Expanded)’

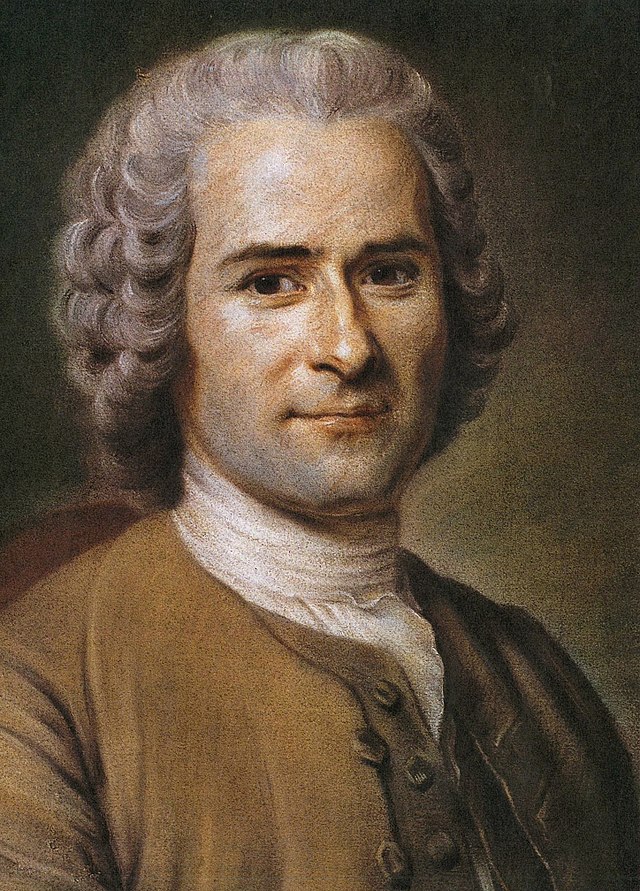

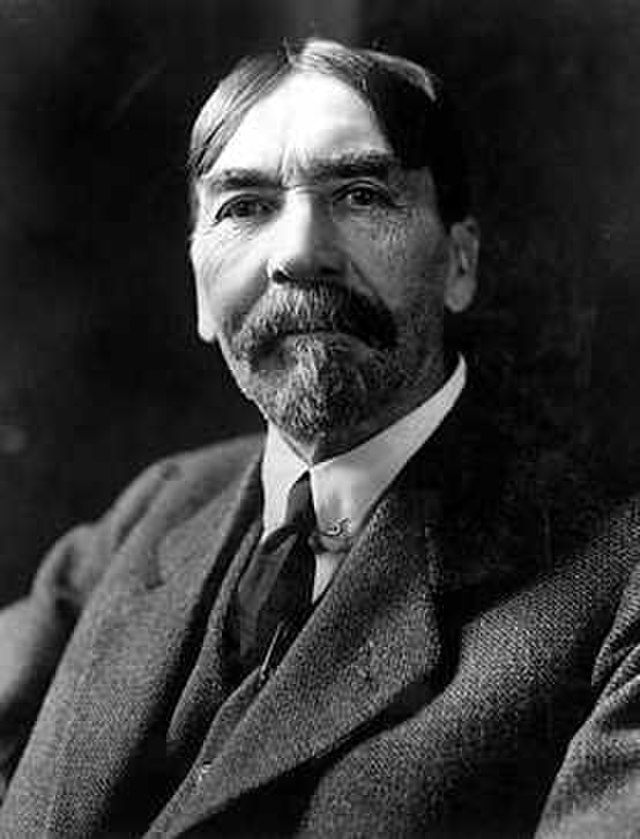

Abstract This paper clarifies a common misrepresentation of our theory of capital as power, or CasP. Many observers tend to box CasP as an ‘institutionalist’ theory, tracing its central process of ‘differential accumulation’ to Thorstein Veblen’s notion of ‘differential advantage’. This view, we argue, betrays a misunderstanding of CasP, Veblen or both. First, we are […]

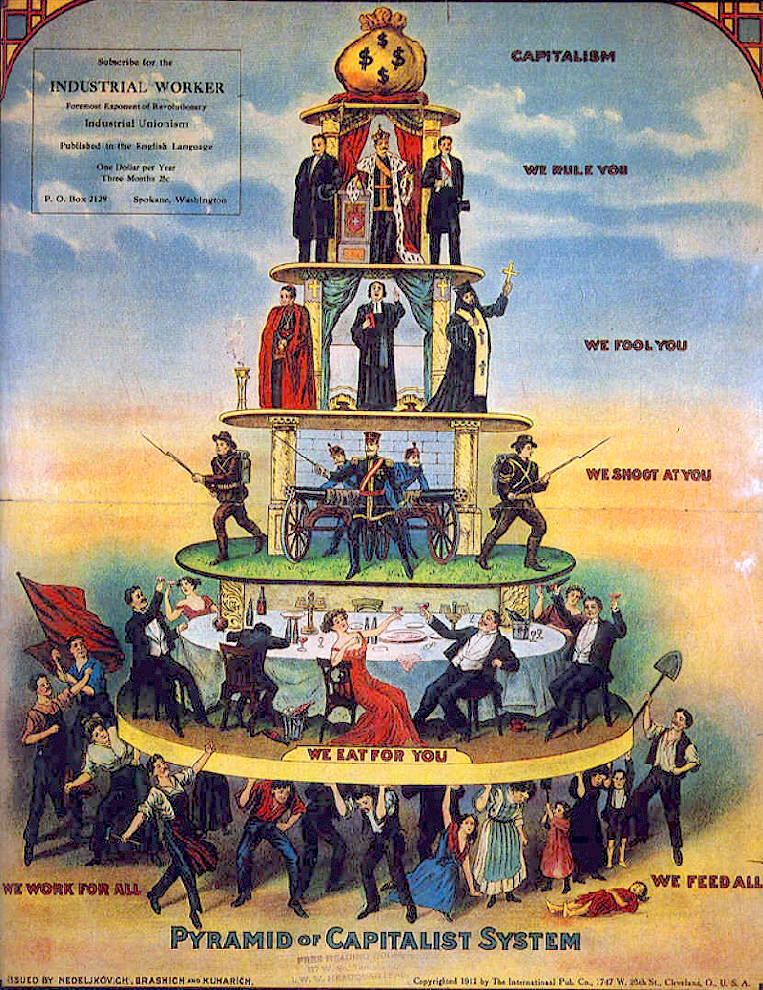

Continue ReadingCapitalism’s Deniers

Shimshon Bichler and Jonathan Nitzan Originally published at Real World Economics Review Blog. A new, capitalism-denying book is on the shelves, and it makes a stunning discovery: ‘Capitalism without competition is not capitalism’! Distortions: Capitalism Denied Capitalist crisis, like climate change, tends to breed ‘capitalism deniers’. The problem, argue the deniers, lies not in capitalism […]

Continue ReadingFix, ‘The Aggregation Problem: Implications for Ecological and Biophysical Economics’

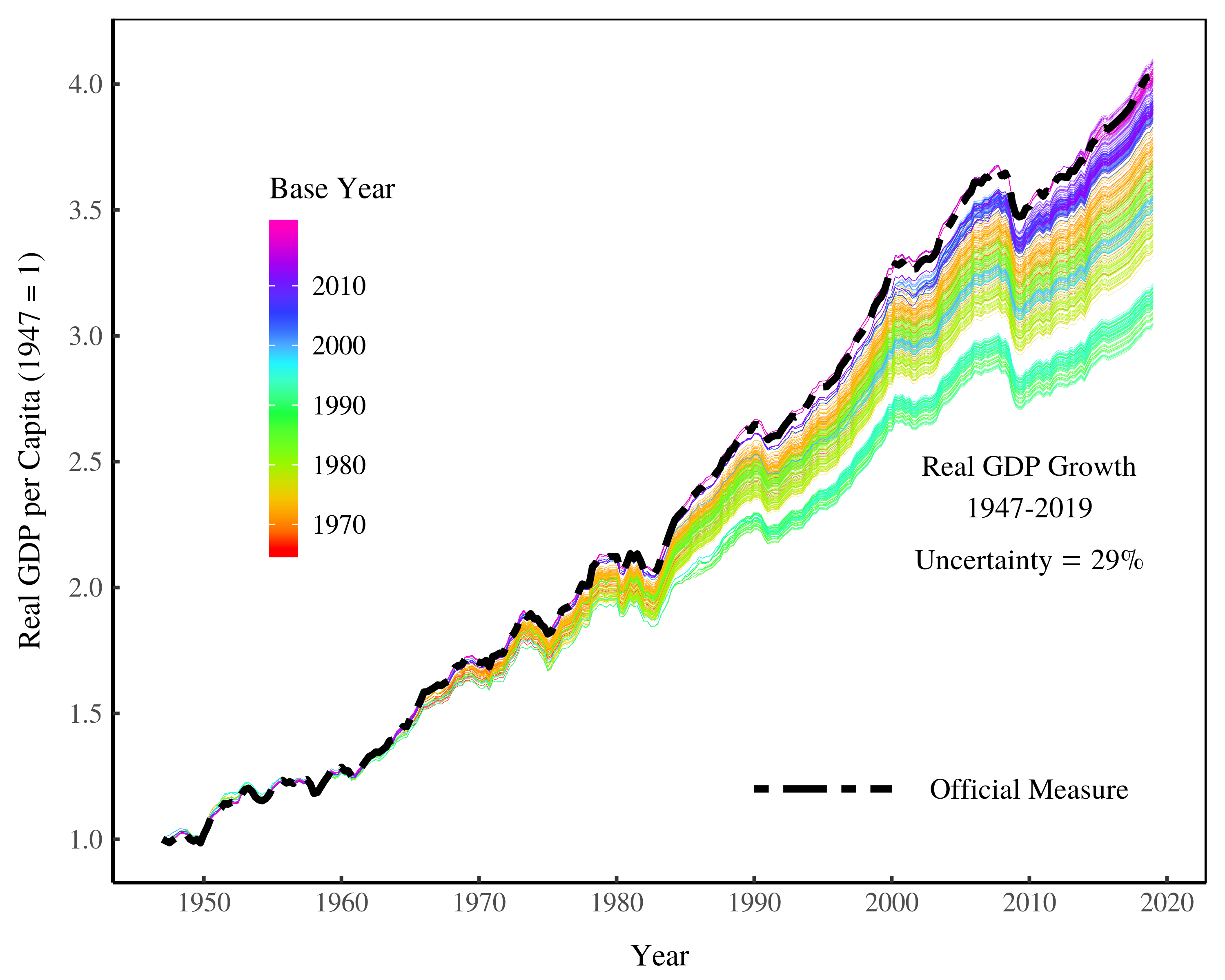

Abstract This paper discusses the dimension problem in economic aggregation, as it relates to ecological and biophysical economics. The dimension problem consists of a simple dilemma: when we aggregate, the observer must choose the dimension of analysis. The dilemma is that this choice affects the resulting measurement. This means that aggregate measurements are dependent on […]

Continue ReadingFix, ‘The Trouble With Human Capital Theory’

Abstract Human capital theory is the dominant approach for understanding personal income distribution. According to this theory, individual income is the result of ‘human capital’. The idea is that human capital makes people more productive, which leads to higher income. But is this really the case? This paper takes a critical look at human capital […]

Continue Reading2018/09: Fix, ‘Energy, Hierarchy and the Origin of Inequality’

Abstract Where should we look to understand the origin of inequality? Most research focuses on three windows of evidence: (1) the archaeological record; (2) existing traditional societies; and (3) the historical record. I propose a fourth window of evidence — modern society itself. I hypothesize that we can infer the origin of inequality from the […]

Continue ReadingBichler & Nitzan, ‘Arms and Oil in the Middle East: A Biography of Research’

Abstract This essay interweaves two stories—one theoretical and empirical, the other autobiographical. The first story embeds the Israeli-Palestinian conflict in the broader political economy of the Middle East and the global accumulation of “capital as power.” The second story narrates the authors’ personal journey to uncover, theorize, and research this enfoldment. The essay explores and […]

Continue Reading2018/08: Bichler & Nitzan, ‘CasP’s Differential Accumulation versus Veblen’s Differential Advantage’

Abstract This paper clarifies a common misrepresentation of our theory of capital as power, or CasP. Many observers tend to box CasP as an ‘institutionalist’ theory, tracing its central process of ‘differential accumulation’ to Thorstein Veblen’s notion of ‘differential advantage’. This view, we argue, betrays a misunderstanding of CasP, Veblen or both. As we show, […]

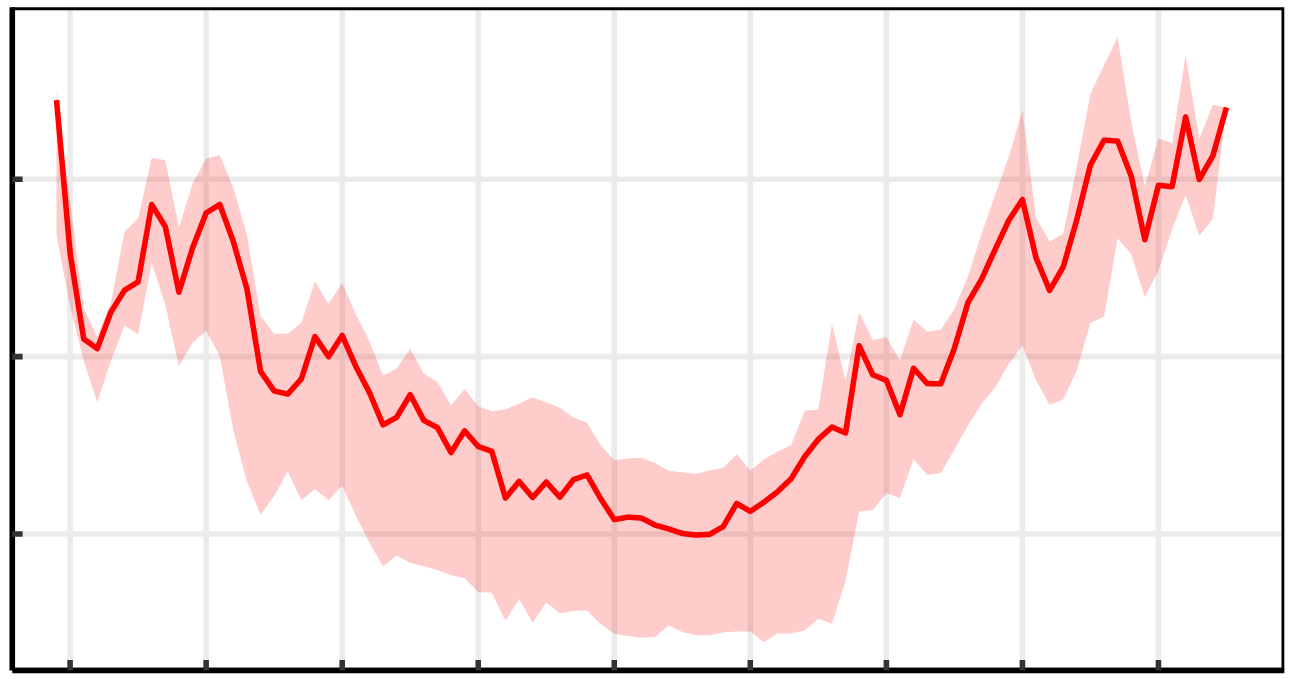

Continue ReadingBichler & Nitzan, ‘With Their Back to the Future: Will Past Earnings Trigger the Next Crisis?’

Abstract As these lines are being written (April 2018), the The U.S. stock market is again in turmoil. After a two-year bull run in which share prices soared by nearly 50 per cent, the market is suddenly dropping. Since the beginning of 2018, it lost nearly 10 per cent of its value, threatening investors with […]

Continue ReadingKim, ‘Propertization: The Process by which Financial Corporate Power has Risen and Collapsed’

Abstract Elsewhere I argue that the legal concept of property was created in the image of money in the late Roman Republic. Since then, the division of property and contract has been an underlying structure of Western law. The paper argues that a main way of structuring financial corporate power, especially money market funds (MMFs), […]

Continue ReadingMcMahon, ‘Is Hollywood a Risky Business? A Political Economic Analysis of Risk and Creativity’

Abstract This paper seeks to explain why Hollywood’s dominant firms are narrowing the scope of creativity in the contemporary period (1980–2015). The largest distributors have sought to prevent the art of filmmaking and its related social relations from becoming financial risks in the pursuit of profit. Major filmed entertainment, my term for the six largest […]

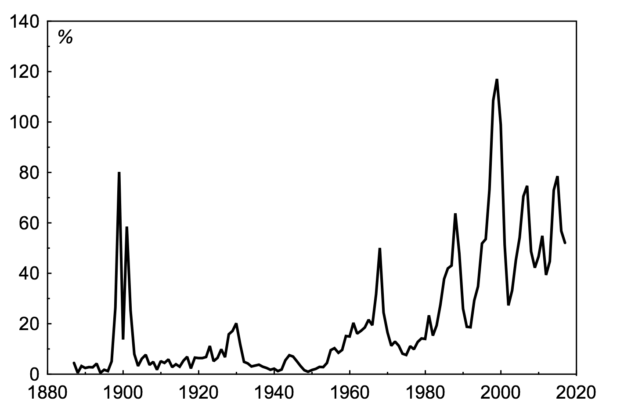

Continue ReadingFrancis’ Updated Buy-to-Build Indicator

Joe Francis The tendency toward buying other companies more than building new productive capacity continues in the United States In a past life I had access to expensive databases of corporate statistics, which I used to calculate the buy-to-build indicator for the United States from the 1880s until 2012. In short, the buy-to-build indicator shows […]

Continue Reading2018/07: Fix, ‘The Trouble with Human Capital Theory’

Abstract Human capital theory is the dominant approach for understanding personal income distribution. According to this theory, individual income is the result of ‘human capital’. The idea is that human capital makes people more productive, which leads to higher income. But is this really the case? This paper takes a critical look at human capital […]

Continue Reading2018/06: Fix, ‘Capitalist Income and Hierarchical Power: A Gradient Hypothesis’

Abstract This paper offers a new approach to the study of capitalist income. Building on the ‘capital as power’ framework, I propose that capitalists earn their income not from any productive asset, but from the legal right to command a corporate hierarchy. In short, I hypothesize that capitalist income stems from hierarchical power. Based on […]

Continue ReadingFix, ‘Economics from the Top Down: Does Hierarchy Unify Economic Theory?’

Abstract What is the unit of analysis in economics? The prevailing orthodoxy in mainstream economic theory is that the individual is the ‘ultimate’ unit of analysis. The implicit goal of mainstream economics is to root macro-level social structure in the micro-level actions of individuals. But there is a simple problem with this approach: our knowledge […]

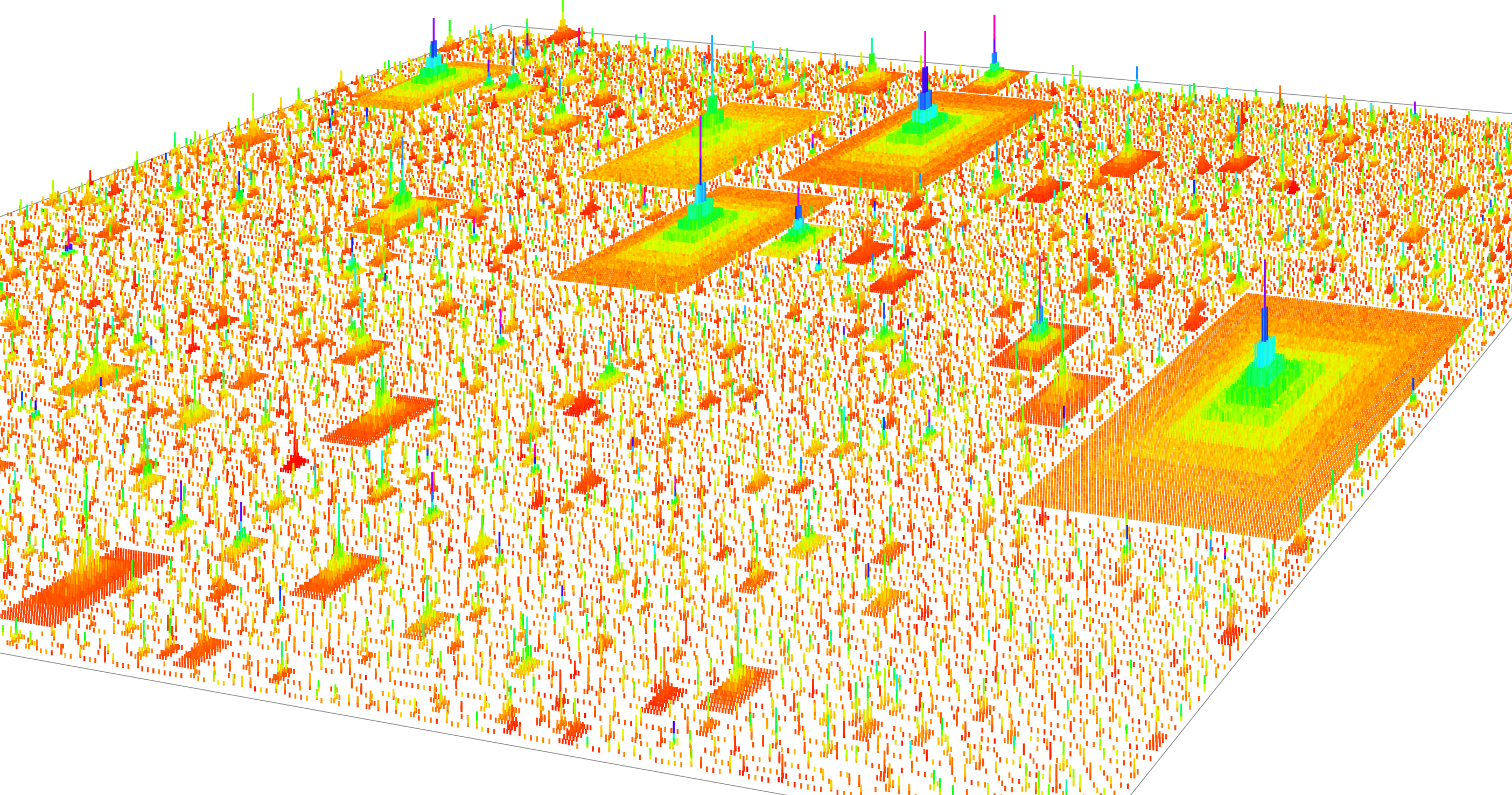

Continue Reading2018/05: Fix, ‘The Growth of US Top Income Inequality: A Hierarchical Redistribution Hypothesis’

Abstract What accounts for the growth of US top income inequality? This paper proposes a hierarchical redistribution hypothesis. The idea is that US firms have systematically redistributed income to the top of the corporate hierarchy. I test this hypothesis using a large scale hierarchy model of the US private sector. My method is to vary […]

Continue ReadingFix, ‘Hierarchy and the power-law income distribution tail’

Abstract What explains the power-law distribution of top incomes? This paper tests the hypothesis that it is firm hierarchy that creates the power-law income distribution tail. Using the available case-study evidence on firm hierarchy, I create the first large-scale simulation of the hierarchical structure of the US private sector. Although not tuned to do so, […]

Continue Reading2018/04: Martin, ‘The Autocatalytic Sprawl of Pseudorational Mastery’

Abstract According to Shimshon Bichler and Jonathan Nitzan capital is not an economic quantity but a mode of power; it could be sumarized as: “Capital is power quantified in monetary terms”. So, what do we do when we “quantify”? What is the nature of “money” in a capitalist society? And, indeed, what is “power” in […]

Continue Reading