The Forum on Capital as Power presents a panel series at the Montreal 2018 Great Transition Conference, May 17-20. The panels include the following papers: 1. ‘What is Capital as Power?’ Shimshon Bichler, Israel and Jonathan Nitzan, Canada 2. ‘Capitalization, Capital Goods and the State of Capital: The Boundaries of Accumulation’ DT Cochrane, Ryerson University […]

Continue ReadingNo. 2017/02: Bichler & Nitzan, ‘Growing through Sabotage’

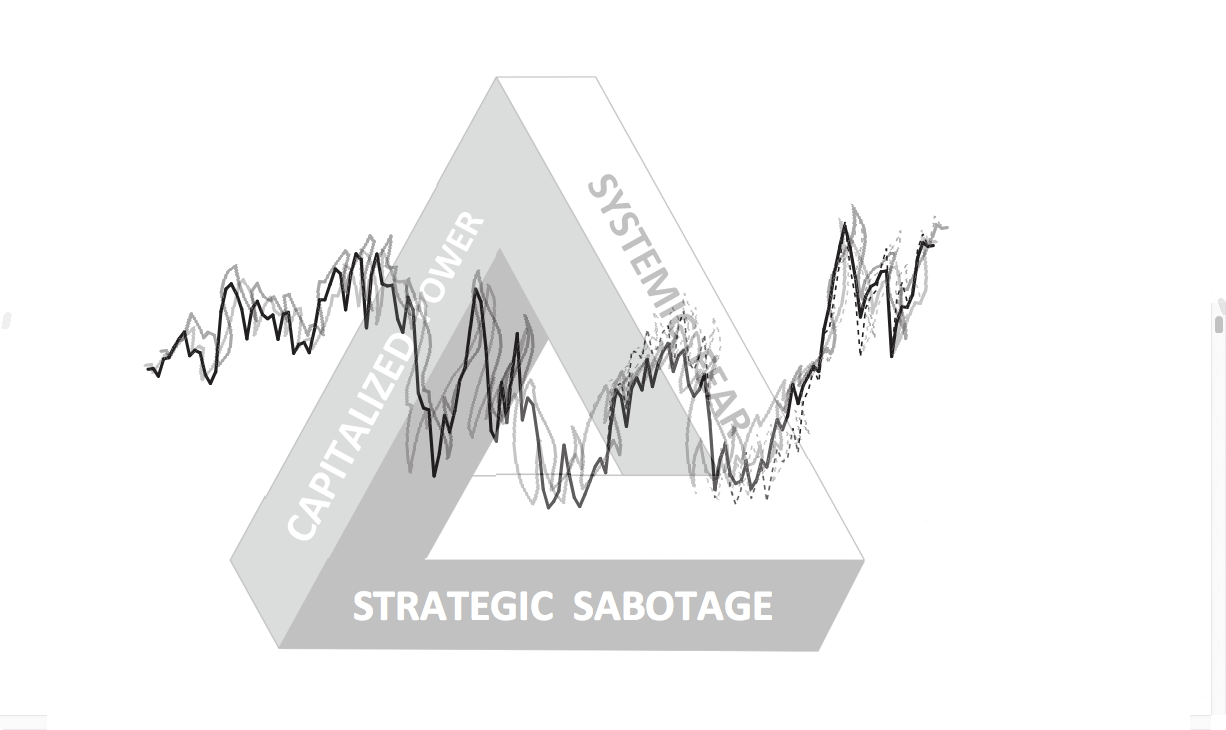

Abstract According to the theory of capital as power, capitalism, like any other mode of power, is born through sabotage and lives in chains – and yet everywhere we look we see it grow and expand. What explains this apparent puzzle of ‘growth in the midst of sabotage’? The answer, we argue, begins with the […]

Continue ReadingDiMuzio & Dow, ‘Uneven and Combined Confusion’

Abstract This article offers a critique of Alexander Anievas and Kerem Nişancioğlu’s “How the West came to rule: the geopolitical origins of capitalism”. We argue that while all historiography features a number of silences, shortcomings or omissions, the omissions in How the West came to rule lead to a mistaken view of the emergence of […]

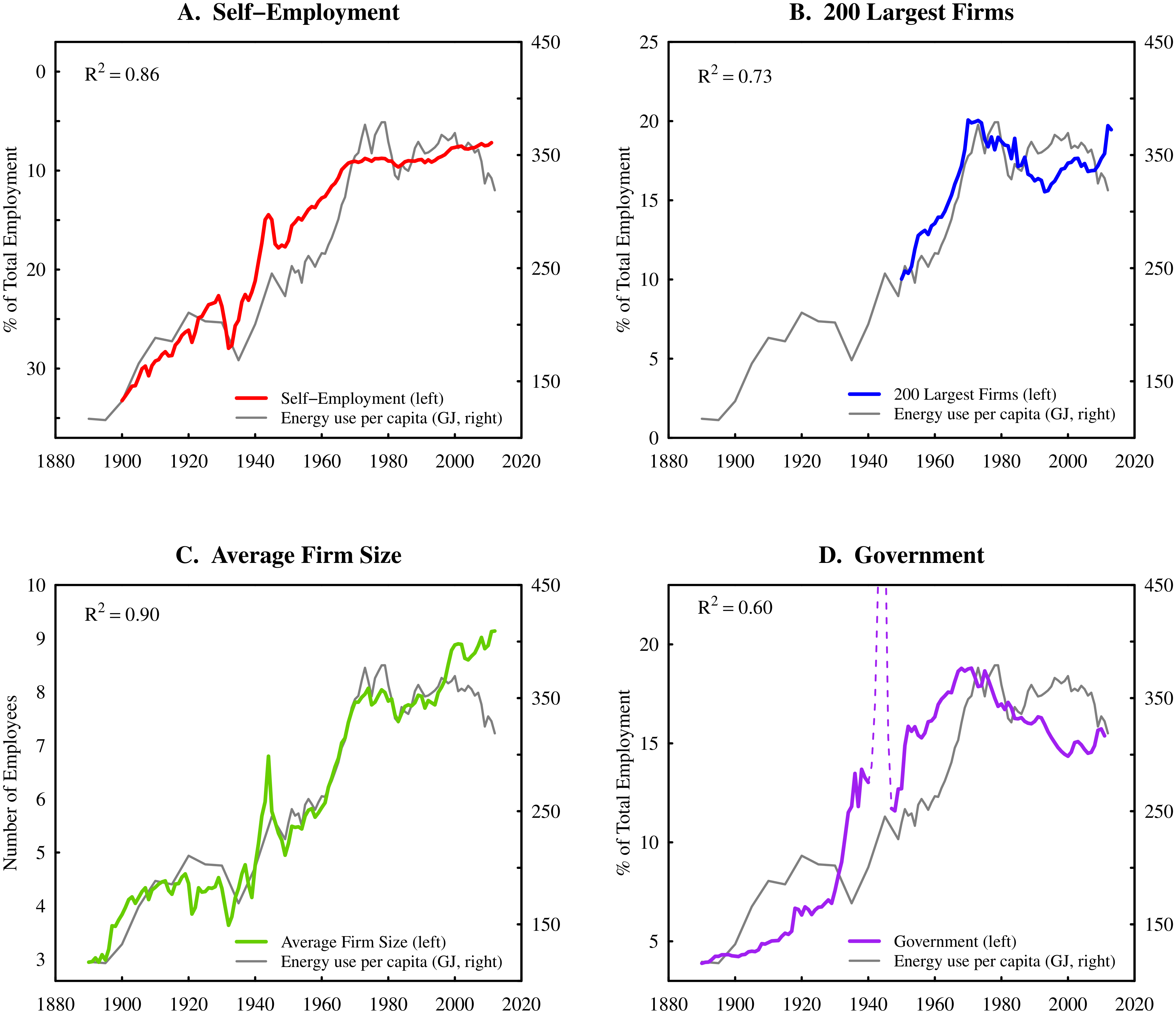

Continue ReadingFix, ‘Energy and Institution Size’

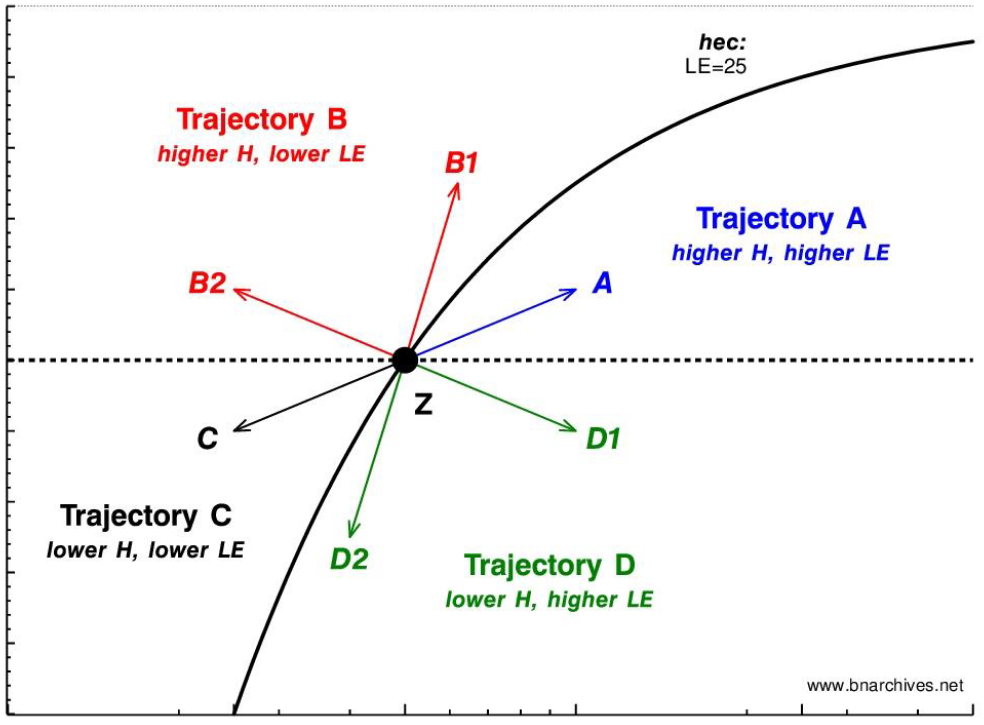

Abstract Why do institutions grow? Despite nearly a century of scientific effort, there remains little consensus on this topic. This paper offers a new approach that focuses on energy consumption. A systematic relation exists between institution size and energy consumption per capita: as energy consumption increases, institutions become larger. I hypothesize that this relation results […]

Continue ReadingBichler & Nitzan, ‘A CasP Model of the Stock Market’

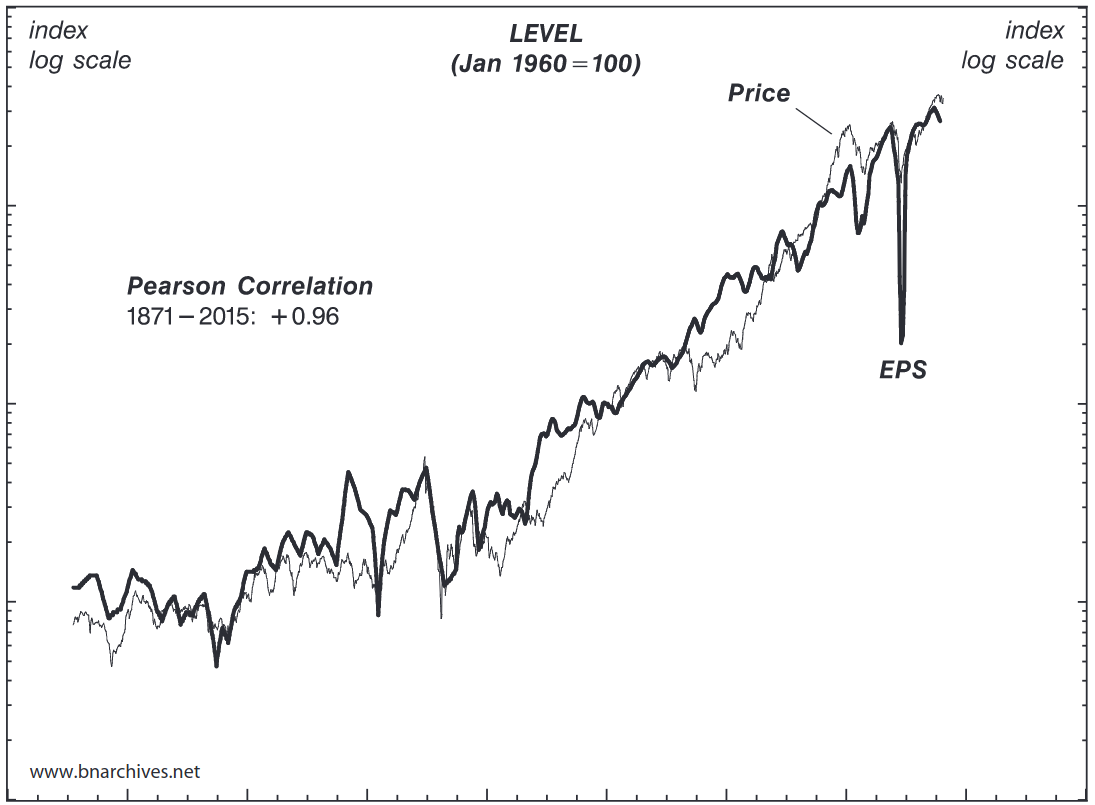

Abstract Most explanations of stock market booms and busts are based on contrasting the underlying ‘fundamental’ logic of the economy with the exogenous, non-economic factors that presumably distort it. Our paper offers a radically different model, examining the stock market not from the mechanical viewpoint of a distorted economy, but from the dialectical perspective of […]

Continue ReadingNo. 2016/07: Bichler & Nitzan, ‘A CasP Model of the Stock Market’

Abstract Most explanations of stock market booms and busts are based on contrasting the underlying ‘fundamental’ logic of the economy with the exogenous, non-economic factors that presumably distort it. Our paper offers a radically different model, examining the stock market not from the mechanical viewpoint of a distorted economy, but from the dialectical perspective of […]

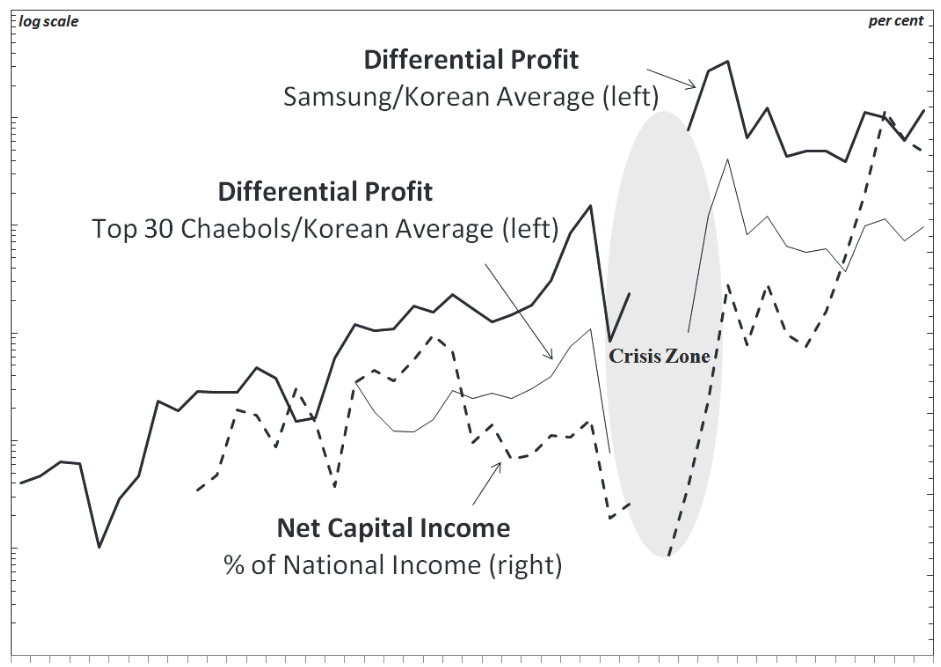

Continue ReadingPark & Doucette, ‘Financialization or Capitalization? Debating Capitalist Power in South Korea in the Context of Neoliberal Globalization’

Abstract The article reviews debates concerning financialization in South Korea, with a focus on ongoing arguments between liberal, post-Keynesian, institutionalist and Marxist economists. It argues that post-Keynesian and institutionalist perspectives in particular neglect important class processes through which the financial circuit operates within the Korean economy, especially the power of Korea’s large, family-led conglomerates, or […]

Continue ReadingDi Muzio, ‘Energy, Capital as Power and World Order’

Abstract Until late, the subject of energy and its importance for capitalism and the constitution and reconstitution of world order has been sorely overlooked in the international political economy (IPE) literature. Indeed, only two of the major textbooks in IPE have chapters on energy. This is also true of the literature known as classical political […]

Continue ReadingNo. 2016/03: Di Muzio & Dow, ‘Uneven and Combined Confusion: On the Geopolitical Origins of Capitalism and the Rise of the West’

Abstract This article offers a critique of Alexander Anievas and Kerem Nişancioğlu’s How the West Came to Rule: The Geopolitical Origins of Capitalism. We argue that while all historiography features a number of silences, shortcomings or omissions, the omissions in How the West Came to Rule lead to a mistaken view of the emergence of […]

Continue ReadingProtecting the Game from the Players

DT Cochrane In certain circles, Charlie Munger is a demi-god. He is the vice-chairman of Berkshire Hathaway, the holding company controlled by the god of markets himself, or rather, Warren Buffett. The words spoken and written by both Buffett and Munger are treated as divine insights on the way the world works or ought to […]

Continue ReadingCapital as Power and Freelance Creative Work 4

Frederick H. Pitts Resonance and dissonance in the rhythms of freelance creative work In the last blog, I applied some of Nitzan and Bichler’s ideas to freelance work in the creative industries. I utilised their conceptualisation of the distinction between creativity and power, and of the sabotage of the former by the latter. Nitzan and […]

Continue ReadingCapital as Power and Freelance Creative Work 3

Frederick H. Pitts Creativity, sabotage and the management of risk and responsibility in freelance creative work Nitzan and Bichler theorise a dissonant relation of sabotage between power and creativity, business and industry. What they show is that the control of creative processes of production is not antithetical to their success. Rather, it is constitutive of […]

Continue ReadingCapital as Power and Freelance Creative Work 2

Frederick H. Pitts Capital as Power, risk-aversion and the avoidance of uncertainty Mainstream critiques of contemporary capitalism conducted in the wake of the Great Recession tend to indict a number of factors. Perceived short-termism. The dangerous compulsion to speculate. An attraction to growth for growth’s sake. The propensity towards the greedy and rapid accumulation of […]

Continue ReadingCapital as Power and Freelance Creative Work 1

Frederick H. Pitts Rhythms of Risk and Responsibility in Freelance Creative Work This series of blogs applies Nitzan and Bichler’s theory of capital as power to the empirical concern of freelance work in the creative industries. It reports some findings from a research project I conducted earlier this year. The research was part of a […]

Continue ReadingNo. 2014/01: McMahon, ‘Capitalist Power, Distribution and the Order of Cinema’

Abstract In this paper, the structure of Hollywood film distribution will be analyzed through the lens of risk. In both its technical and conceptual senses, risk is relevant to the study of Hollywood’s dominant firms. In the interest of lowering risk, the business interests of Hollywood look to predetermine how new films will function in […]

Continue ReadingBichler & Nitzan, ‘No Way Out: Crime, Punishment and the Capitalization of Power’

Abstract The United States is often hailed as the world’s largest ‘free market’. But this ‘free market’ is also the world’s largest penal colony. It holds over seven million adults – roughly five per cent of the labour force – in jail, in prison, on parole and on probation. Is this an anomaly, or does […]

Continue ReadingThe Weekly Sabotage: Week 4

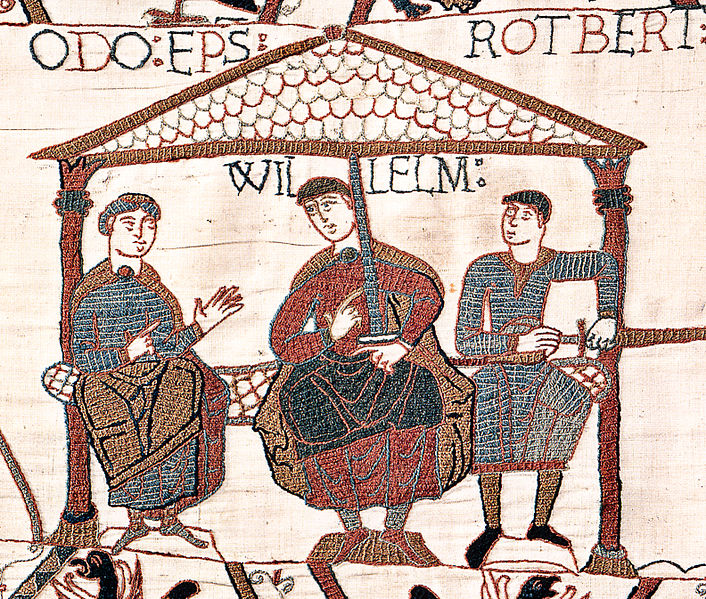

Tim Di Muzio Royal Authority and Private Property Last week we considered the concept of ownership though the work of Veblen and Marx. We noted that the establishment and protection of private property involved the dispossession of the many by the few and that this tendency begins with the appropriation of humans (slavery) and land […]

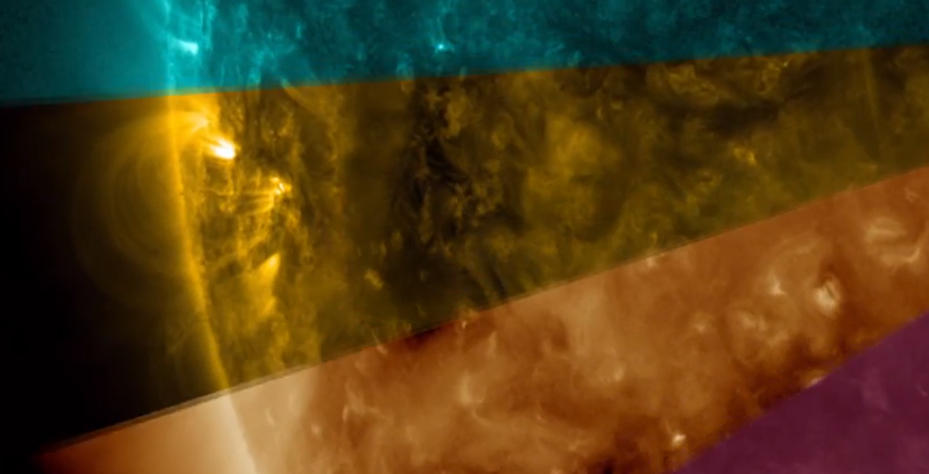

Continue ReadingThe Colour of the Sun: A Metaphor for Methodology?

James McMahon Found this video when browsing Boing Boing. Originally posted by NASA, this video is fascinating. It may also stand as a metaphor for the methodological problems in political economic theory. Consider part of the explanation behind the video: “As the colors sweep around the sun in the movie, viewers should note how different […]

Continue ReadingDiscussion: The Ups and Downs of Empirical Research

DT Cochrane It is exciting to see this website grow. Content is being added here and there, and our Working Paper Series has its first paper. What already stands out on this website, in my opinion, is the strength of the empirical research. With our feet planted in society itself, we have before us a […]

Continue ReadingDi Muzio, ‘The Capitalist Mode of Power: Critical Engagements with the Power Theory of Value’

Abstract This edited volume offers the first critical engagement with one of the most provocative and controversial theories in political economy: the thesis that capital can be theorized as power and that capital is finance and only finance. The book also includes a detailed introduction to this novel thesis first put forward by Nitzan and […]

Continue Reading