Abstract Much of the economic analysis of banking crises focuses on the interplay between concentration and stability. A common theory is that concentration is associated with greater stability, whereas competition is associated with instability. In this view, there is a trade-off between, on the one hand, the higher prices and higher profits associated with a […]

Continue ReadingBichler & Nitzan, ‘Regime Change and Dominant Capital: Lessons from Israel’

Abstract Israel’s ongoing crisis – or ‘judicial coup’ in popular parlance – has elicited two opposite responses. The first comes from global rating agencies, economists and investment strategists who see Israel’s country risk rising. The opposite reaction, by Prime Minister Netanyahu and his acolytes, insists that the ‘coup’ is much ado about nothing, and that […]

Continue ReadingBichler & Nitzan, ‘Regime Change and Dominant Capital: Lessons from Israel’

Abstract Israel’s ongoing crisis – or ‘judicial coup’ in popular parlance – has elicited two opposite responses. The first comes from global rating agencies, economists and investment strategists who see Israel’s country risk rising. The opposite reaction, by Prime Minister Netanyahu and his acolytes, insists that the ‘coup’ is much ado about nothing, and that […]

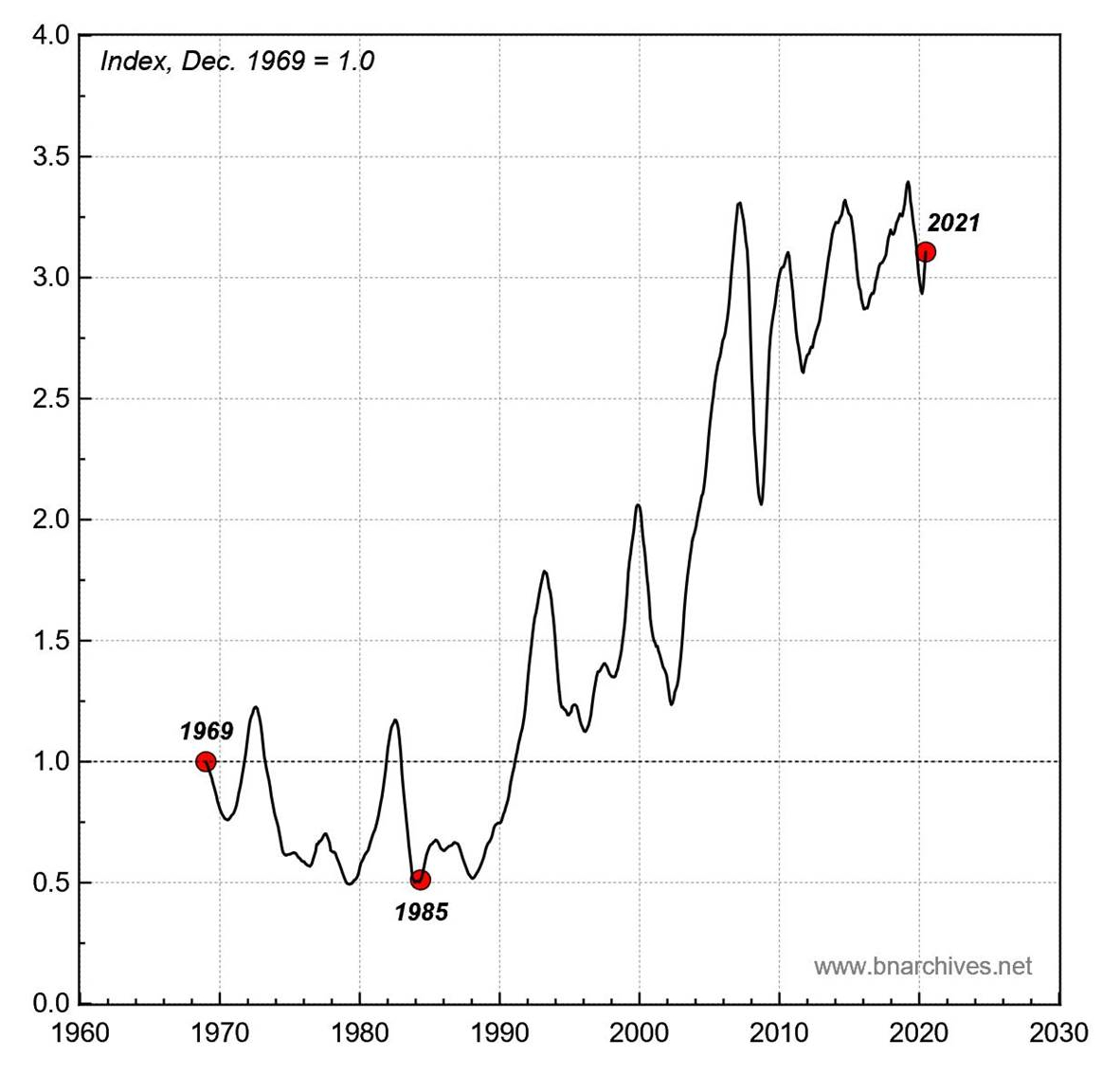

Continue ReadingNo Shortage of Profit: Semiconductor firms and the differential effects of chip shortages

Chris Mouré Note: this is the manuscript version of an article now featured in The Mint Magazine. Few will argue with the claim that shortages are socially harmful. Shortages, by definition, imply a lack of something – not enough stuff to go around. A shortage of food implies hunger; a shortage of electricity implies darkness. […]

Continue ReadingMcMahon, ‘Reconsidering Systemic Fear and the Stock Market’

Reconsidering Systemic Fear and the Stock Market A Reply to Baines and Hager JAMES MCMAHON August 2021 Abstract This article responds to Baines and Hager’s recent critique of the capital-as-power model of the stock market. Proposed by Bichler and Nitzan, this model seeks to explain how financial crises are tied to the concept of ‘systemic […]

Continue ReadingBaines & Hager, ‘Financial Crisis, Inequality, and Capitalist Diversity: A Critique of the Capital as Power Model of the Stock Market’

Abstract The relationship between inequality and financial instability has become a thriving topic of research in heterodox political economy. This article offers the first critical engagement with one framework within this wider literature: the Capital as Power (CasP) model of the stock market developed by Shimshon Bichler and Jonathan Nitzan. Specifically, we extend the CasP […]

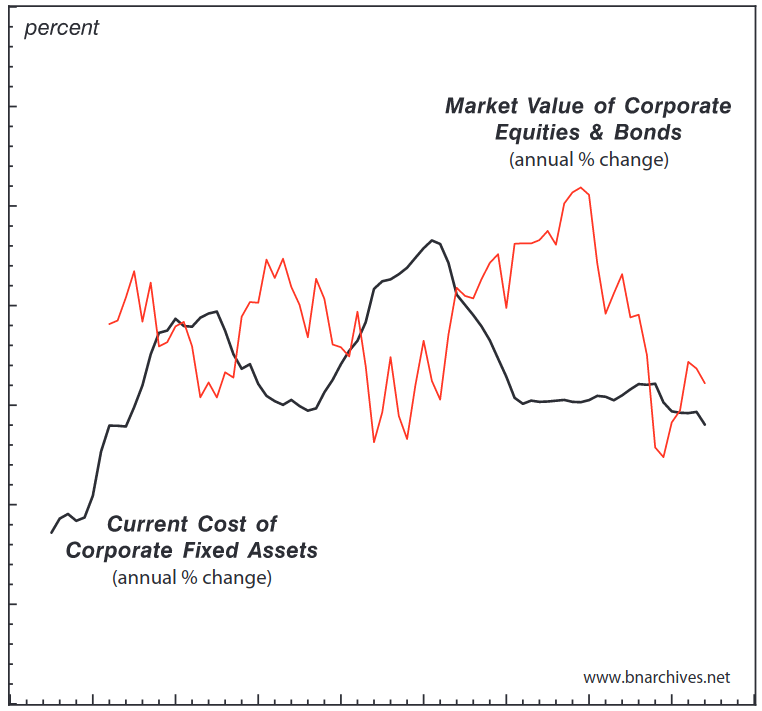

Continue ReadingNo. 2015/03: Bichler & Nitzan, ‘Capital Accumulation: Fiction and Reality’

Abstract What do economists mean when they talk about ‘capital accumulation’? Surprisingly, the answer to this question is anything but clear, and it seems the most unclear in times of turmoil. Consider the recent ‘financial crisis’. The very term already attests to the presumed nature and causes of the crisis, which most observers indeed believe […]

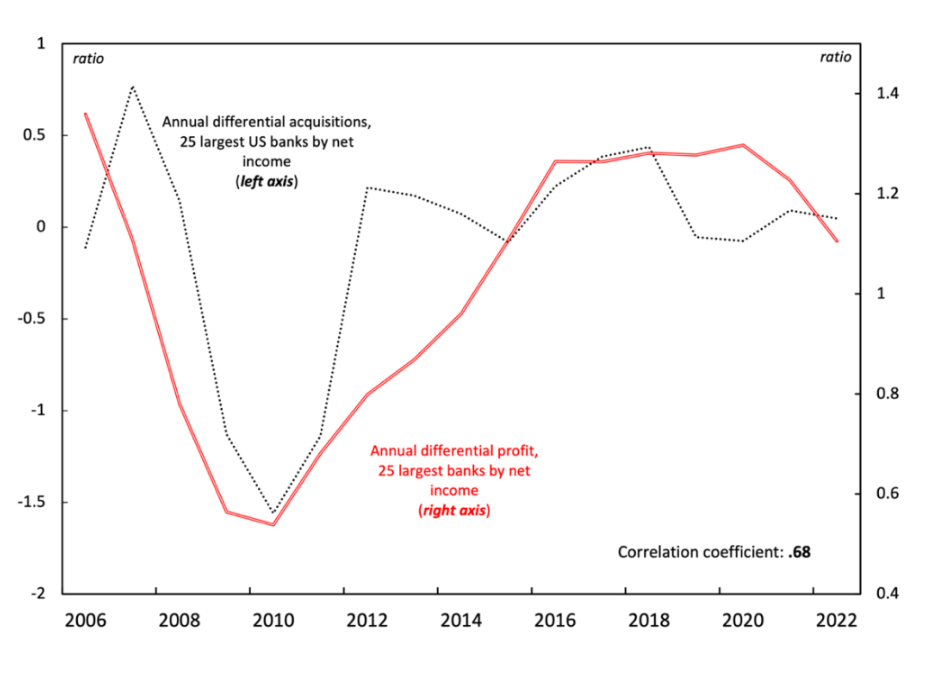

Continue ReadingOstojić, ‘Differential Taxation: The Case of American Banking’

Abstract This paper maps an empirical history of corporate profit and taxation in the United States, with a special focus on the differential profit and taxation of banks relative to other corporations. An examination of these trends reveals a striking anomaly within the American banking sector: from the early 1980s until the financial crisis of […]

Continue ReadingNo. 2015/01: Hager, ‘Public Debt as Corporate Power’

Abstract In various writings Karl Marx made references to an ‘aristocracy of finance’ in Western Europe and the United States that dominated ownership of the public debt. Drawing on original research, this paper offers the first comprehensive analysis of the pattern of public debt ownership within the US corporate sector. The research shows that over […]

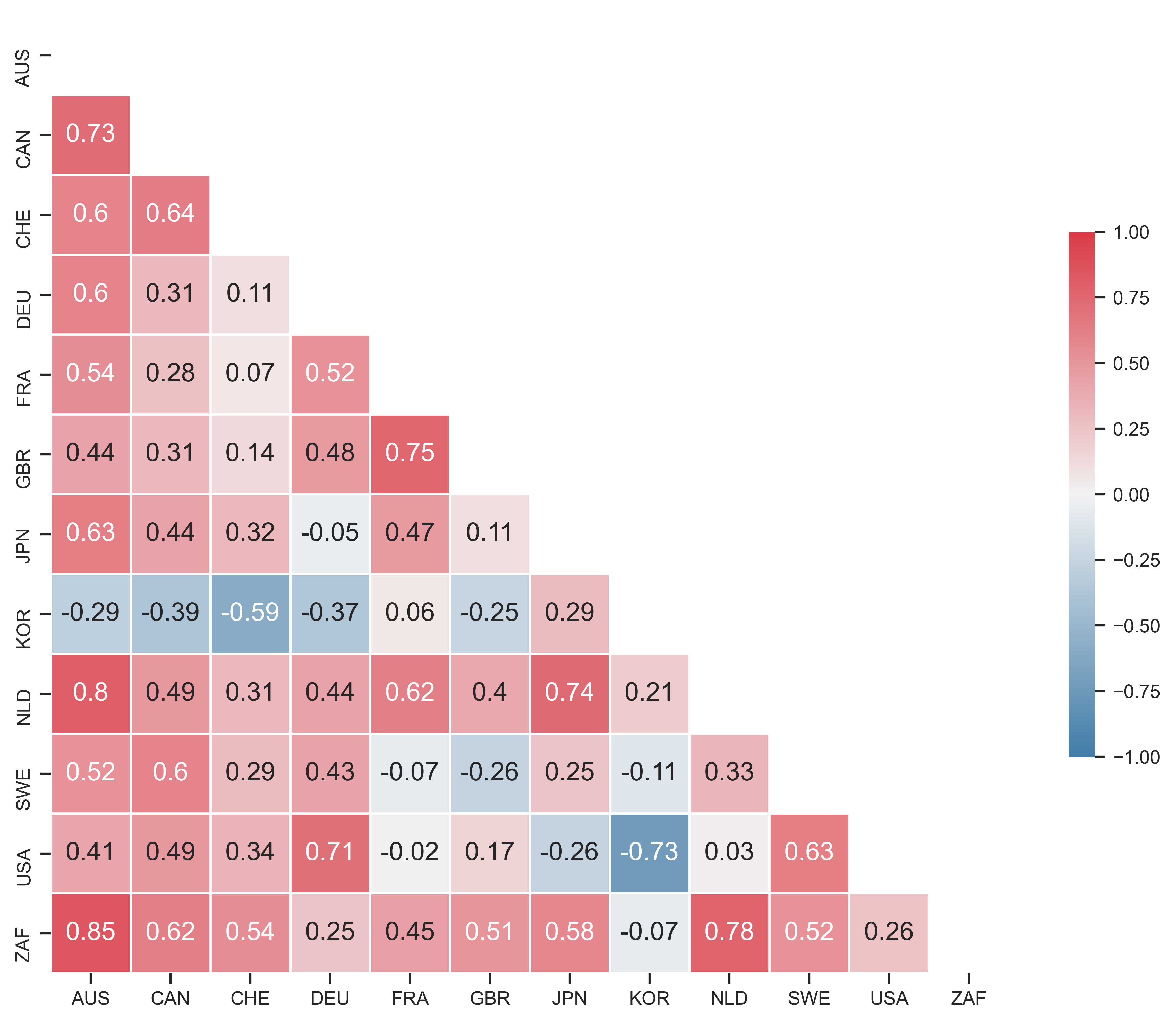

Continue ReadingPark, ‘Dominant Capital and the Transformation of Korean Capitalism: From Cold War to Globalization’

Abstract After the 1997 financial crisis, the neo-liberal restructuring of the Korean political economy accelerated dramatically. While there is a general consensus that the reform has had negative consequences for Korean society, heated debates continue over the culprits of the 1997 crisis and the changes that followed in its wake. Major opinions have largely coalesced […]

Continue Reading