Shimshom Bichler and Jonathan Nitzan The following research note first appeared on Real World Economics Review Blog. We have just updated the charts in our 2014 RWER paper ‘Still About Oil?’, and the picture they portray reads like a capitalist call for arms. Beginning in the late 1980s, we suggested that, since the late 1960s, […]

Continue ReadingThird Speaker Series on the Capitalist Mode of Power

ABSTRACT Existing theories of capitalism, mainstream as well as heterodox, view capitalism as a mode of production and consumption. The purpose of this ongoing speaker series is to interrogate capitalism as a mode of power. The presentations offer a power theory of personal income distribution (Blair Fix, 2:30-5:30pm, October 17, 2017), explore the power to […]

Continue ReadingHolman & McMahon, ‘From Power over Creation to the Power of Creation: Cornelius Castoriadis on Democratic Cultural Creation and the Case of Hollywood’

Abstract This article is a critical investigation and application of the aesthetic theory of Cornelius Castoriadis, one of the most important 20th-century theorists of radical democracy. We outline Castoriadis’s thoughts on autonomy, the social-historical nature of Being, and creation — key elements that inform his model of democratic culture. We then develop a Castoriadian critique […]

Continue Reading‘Is the Power of Mass Culture Profitable?’, Public Lecture by James McMahon

This presentation will examine how and why political economic theories of mass culture have accumulated, but not settled, methodological issues about the meaning of value and the nature of productivity. Labour is certainly an important factor to any comprehensive study of capitalist mass culture, but it is our assumptions about economic productivity and not the […]

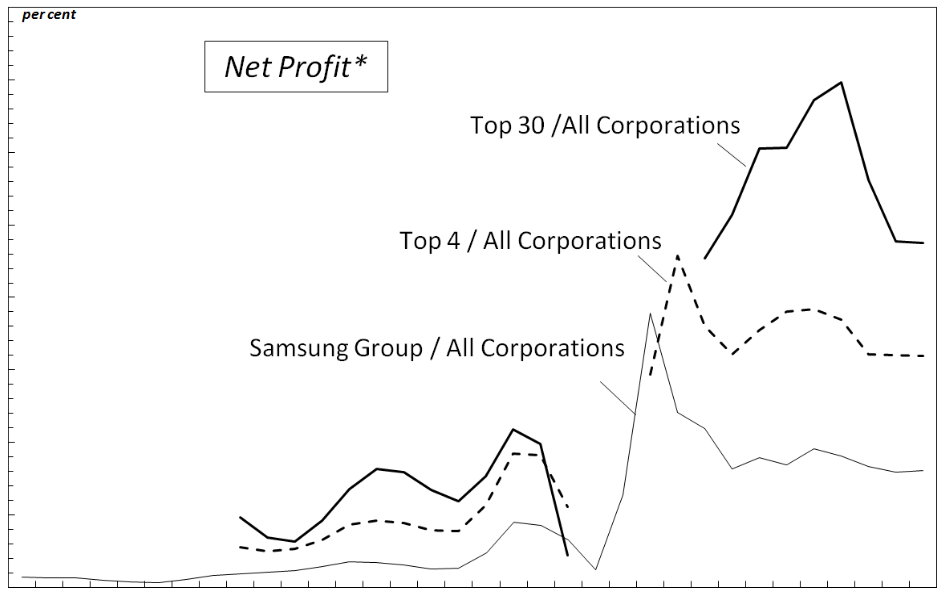

Continue ReadingPark, ‘Korea’s Post-1997 Restructuring: An Analysis of Capital as Power’

Abstract Winner of the RRPE Annual Best Paper Award for 2016 This paper aims to transcend current debates on Korea’s post-1997 restructuring, which rely on a dichotomy between domestic industrial capital and foreign financial capital, by adopting Nitzan and Bichler’s capital-as-power perspective. Based on this approach, the paper analyzes Korea’s recent political economic restructuring as […]

Continue Reading'From Colonialism to Climate Change: The Power to Externalize', Public Lecture by D.T. Cochrane

The history of capitalism is a history of externalization. While benefits were tallied, costs were routinely excluded from accounts. In this presentation I examine the history of externalization as a power process. A history of brutality and destruction marketed as innovation and efficiency, externalization has been the shadowy counterpart to accumulation. From colonialism to climate […]

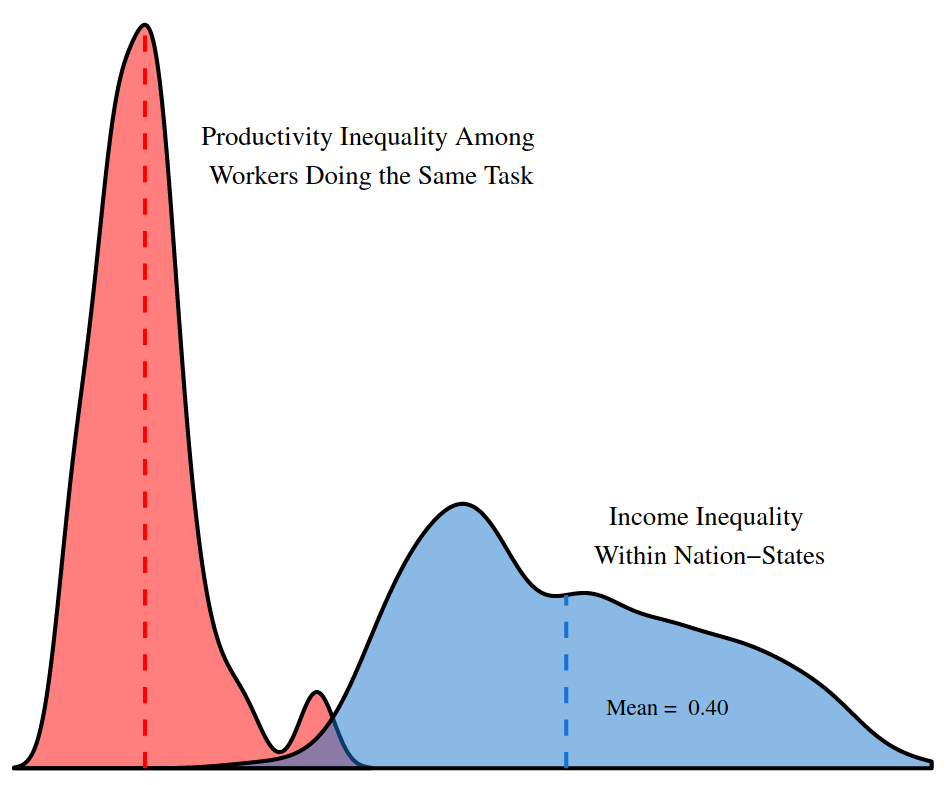

Continue Reading'A Power Theory of Personal Income Distribution', Public Lecture by Blair Fix

Due in no small part to the work of Thomas Piketty, the empirical study of income inequality has flourished in the last decade. But this plethora of new data has not led to a corresponding theoretical revolution. Why? The problem, I believe, is an unwillingness to question and test the basic assumptions on which current […]

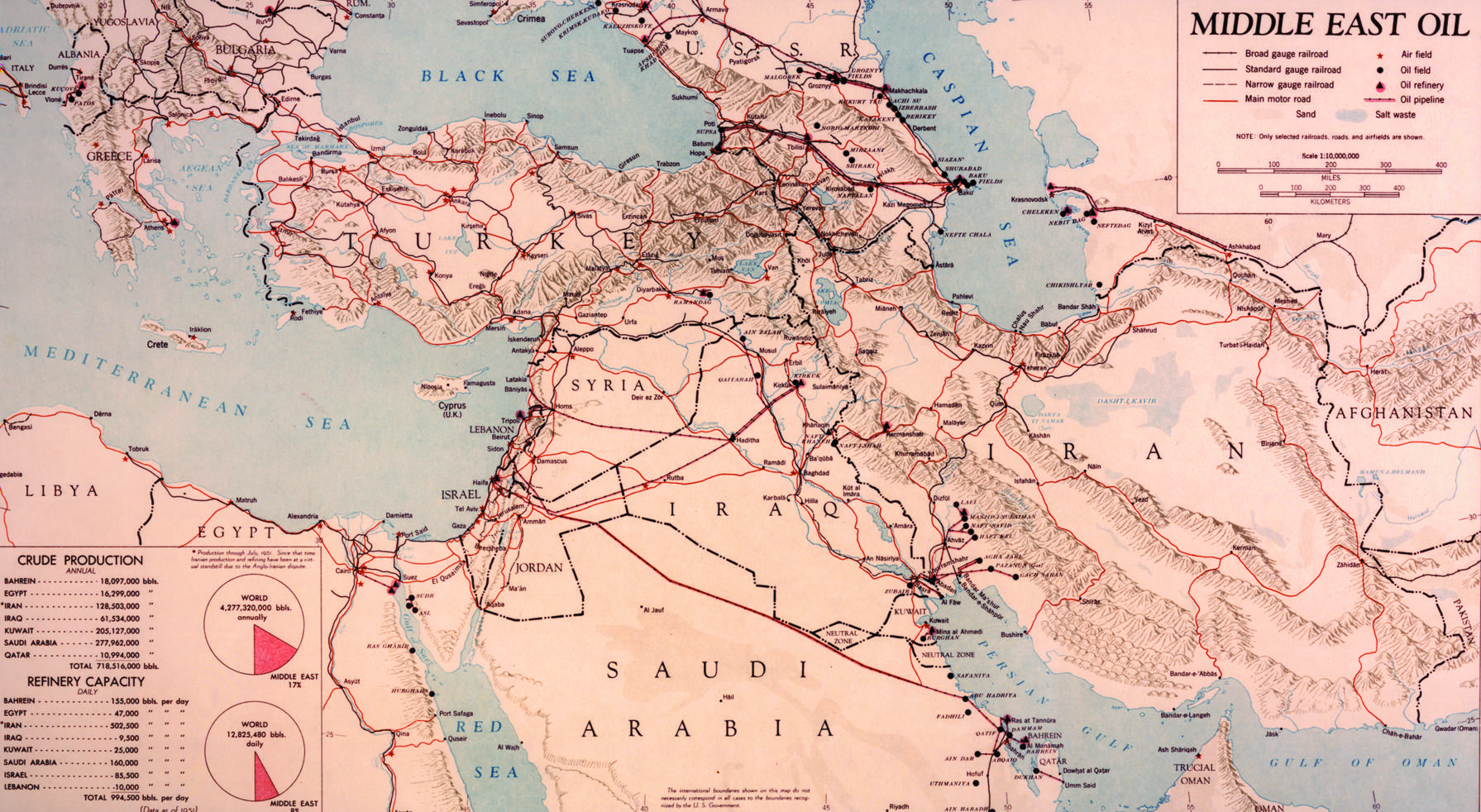

Continue ReadingNo. 2017/04: Bichler & Nitzan, ‘Arms and Oil in the Middle East: A Biography of Research’

Abstract During the late 1980s, we printed a series of working papers, offering a new approach to the political economy of Israel and wars in the Middle East. Our approach in these papers rested on three new concepts. It started by identifying the Weapondollar-Petrodollar Coalition – an alliance of armament firms, oil companies and financial […]

Continue ReadingNo. 2017/03: Fix, ‘Evidence for a Power Theory of Personal Income Distribution’

Abstract This paper proposes a new ‘power theory’ of personal income distribution. Contrary to the standard assumption that income is proportional to productivity, I hypothesize that income is most strongly determined by social power, as indicated by one’s position within an institutional hierarchy. While many theorists have proposed a connection between personal income and power, […]

Continue ReadingNo. 2017/02: Bichler & Nitzan, ‘Growing through Sabotage’

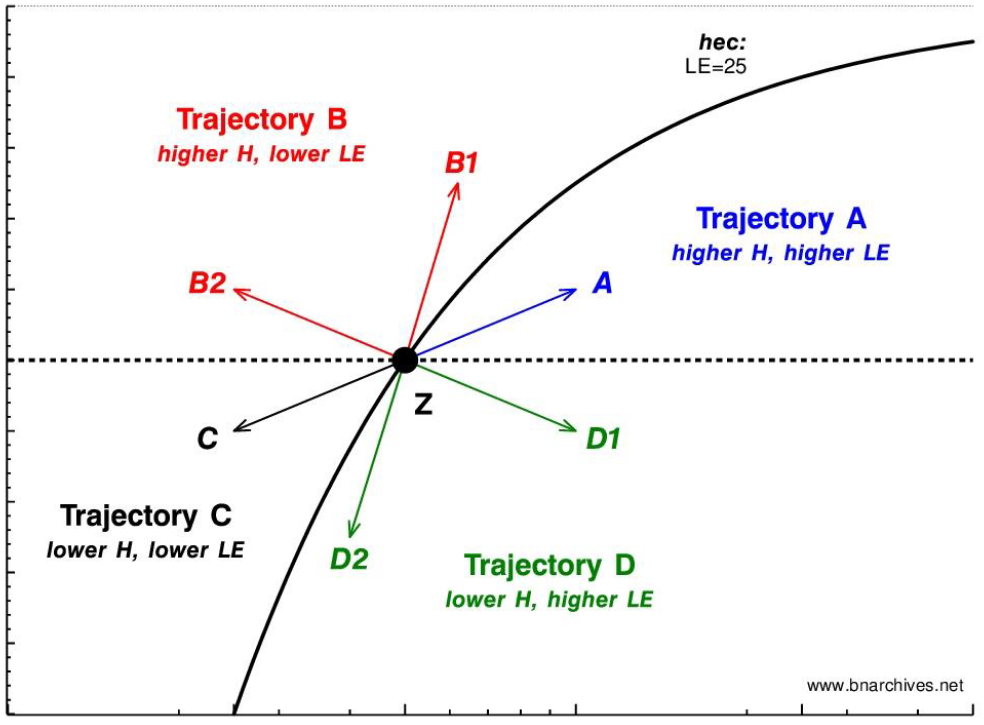

Abstract According to the theory of capital as power, capitalism, like any other mode of power, is born through sabotage and lives in chains – and yet everywhere we look we see it grow and expand. What explains this apparent puzzle of ‘growth in the midst of sabotage’? The answer, we argue, begins with the […]

Continue ReadingBichler & Nitzan, ‘Un Modelo CcP Del Mercado De Valores’

Abstract La mayoría de las explicaciones de las alzas y bajas del mercado de valores se basan en la comparación de la lógica “fundamental” subyacente de la economía con los factores exógenos que supuestamente la distorsionan. Este artículo presenta un modelo radicalmente distinto, y examina el mercado de valores desde la perspectiva del poder capitalizado […]

Continue ReadingComment on Can Capitalists Afford a Trumped Recovery?

The following commentary on Nitzan and Bichler’s piece ‘Can Capitalist Afford a Trumped Recovery?’ first appeared on the blog Pension Pulse, written by Leo Kolivakis. Earlier this week, I hooked up for a lunch with George Archer and Jonathan Nitzan, two friends of mine who also had previous stints working at BCA Research. I enjoyed […]

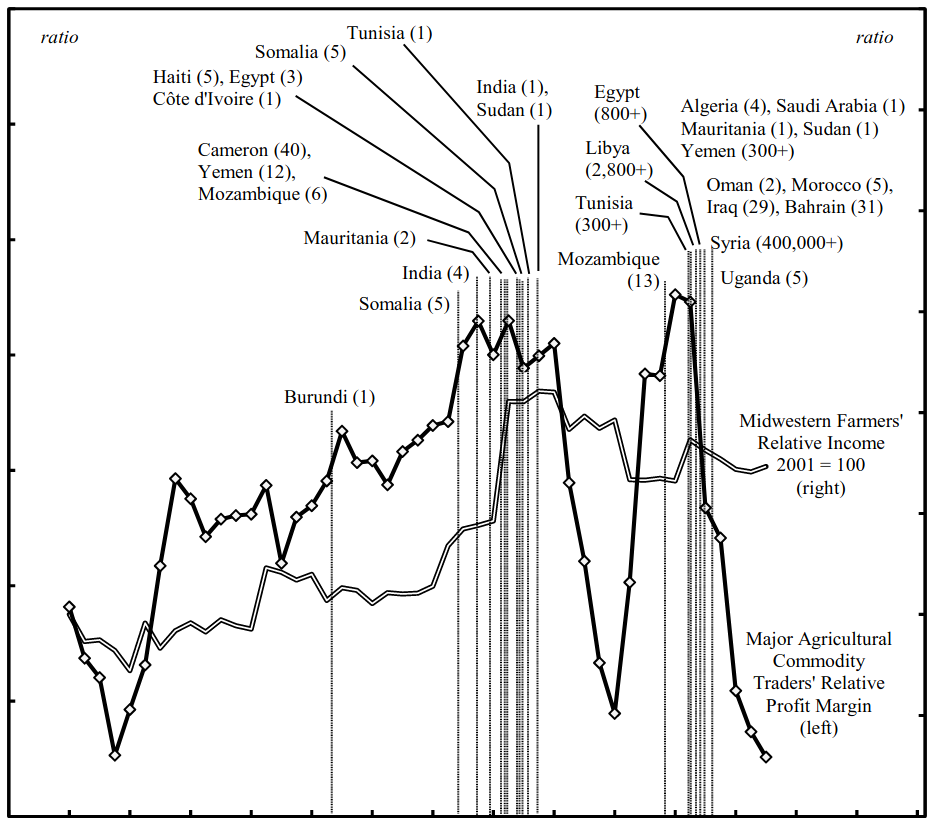

Continue ReadingBaines, ‘Accumulating through Food Crisis? Farmers, Commodity Traders and the Distributional Politics of Food Crisis’

Abstract This paper considers the domestic and international ramifications of financialization and grain price instability in the US agri-food sector. It finds that during the recent period of high and volatile prices, the average income of large-scale farms reached the earnings threshold of the top percentile of US households, and agricultural commodity traders markedly outperformed […]

Continue ReadingDid the Market Punish United Airlines?

DT Cochrane In the days following the wide-spread distribution of a video depicting Chicago transportation police officers violently removing Dr. David Dao from a United Airlines flight, there was celebration as the market pummelled the airlines shares (UAL). Or did it? Although the incident generated a great deal of outrage on Twitter, and early in […]

Continue ReadingDiMuzio & Dow, ‘Uneven and Combined Confusion’

Abstract This article offers a critique of Alexander Anievas and Kerem Nişancioğlu’s “How the West came to rule: the geopolitical origins of capitalism”. We argue that while all historiography features a number of silences, shortcomings or omissions, the omissions in How the West came to rule lead to a mistaken view of the emergence of […]

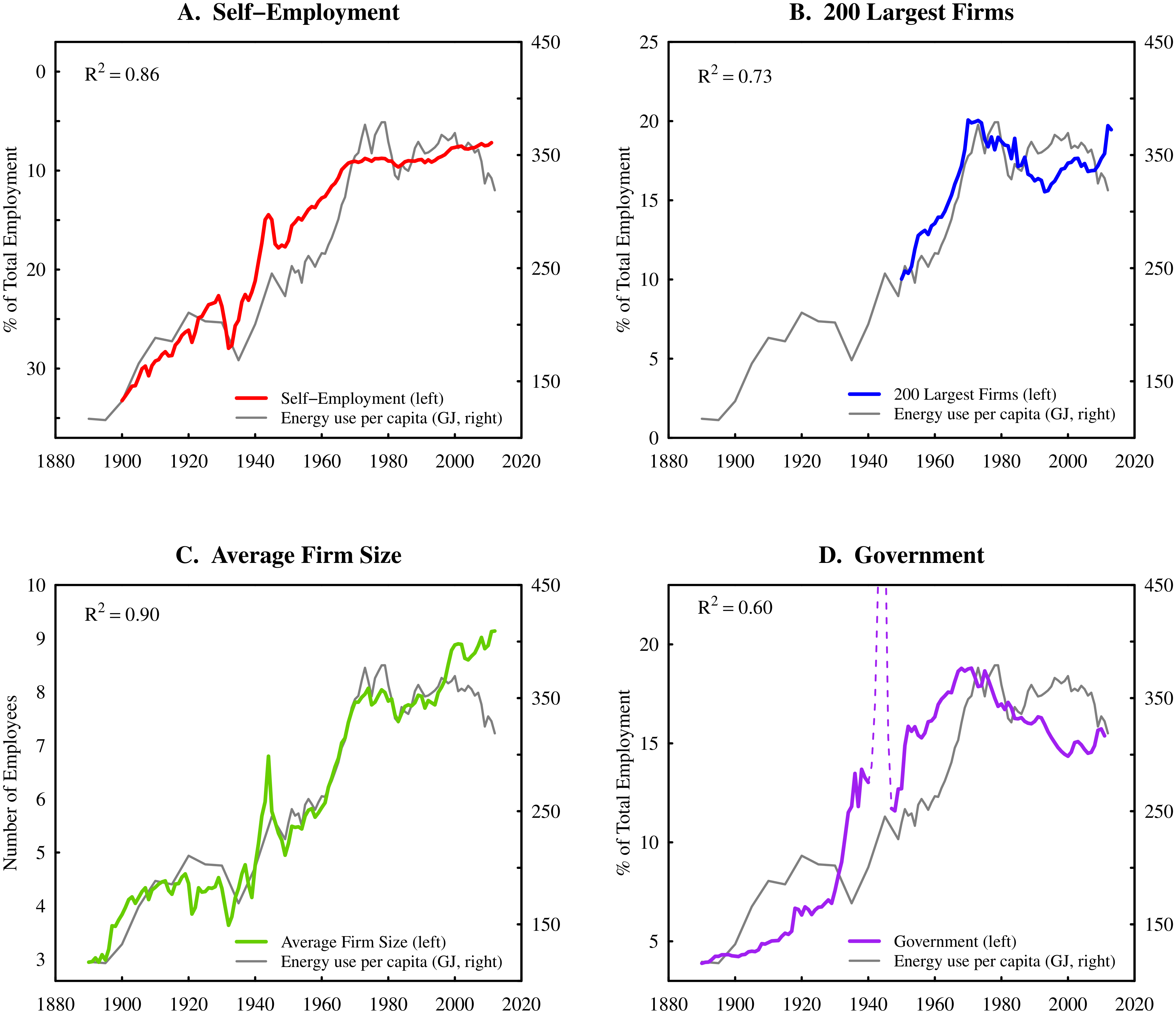

Continue ReadingFix, ‘Energy and Institution Size’

Abstract Why do institutions grow? Despite nearly a century of scientific effort, there remains little consensus on this topic. This paper offers a new approach that focuses on energy consumption. A systematic relation exists between institution size and energy consumption per capita: as energy consumption increases, institutions become larger. I hypothesize that this relation results […]

Continue ReadingCapital as Power Essay Prize, 2016

First Prize $2000 Second Prize $500 Third Prize $300 The Review of Capital as Power (RECASP) announces an annual essay prize on the subject of capital as power. The best paper will receive a prize of $2000. A prize of $500 will be awarded to the second best contribution, while a $300 prize will be […]

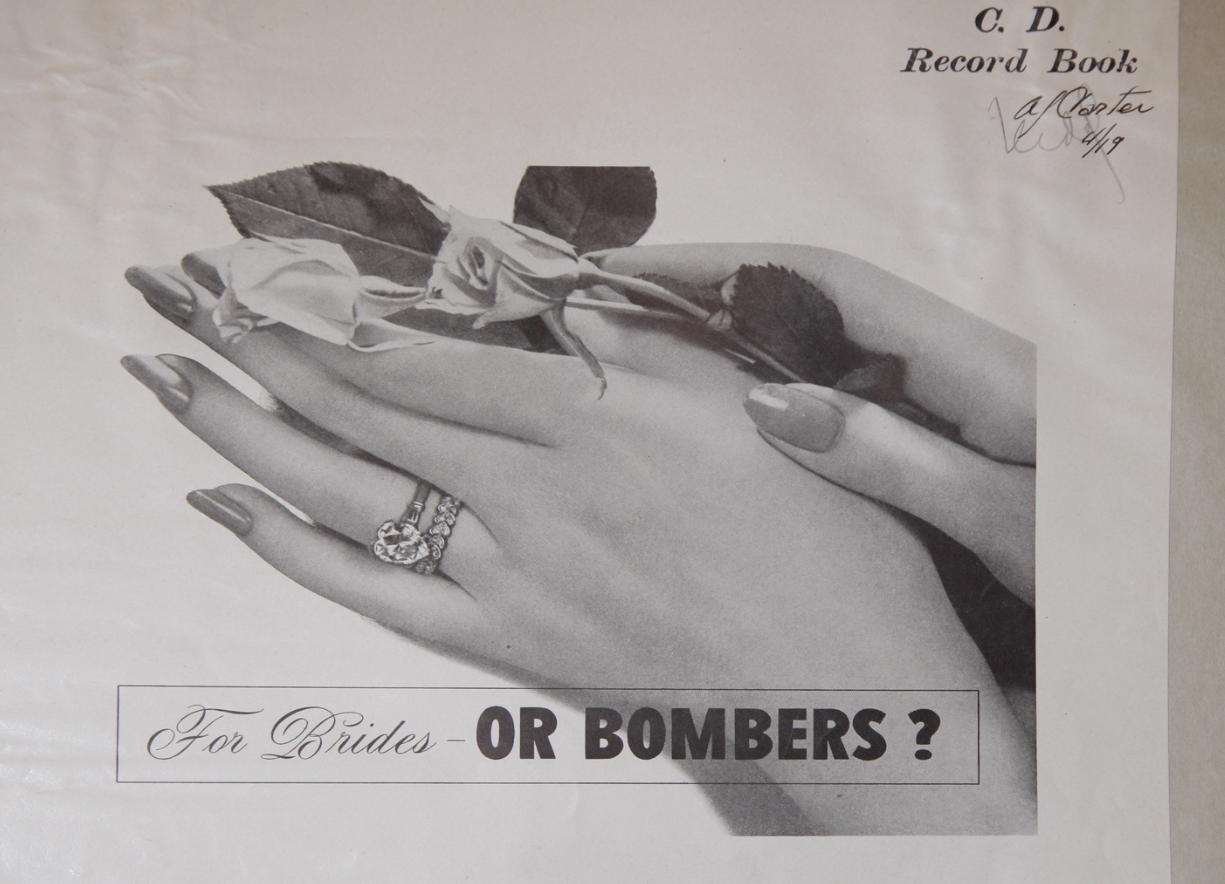

Continue ReadingNo. 2017/01: Cochrane, ‘Differentiating Diamonds: Transforming Knowledge and the Accumulation of De Beers’

Abstract In 1939, the De Beers diamond company faced a dire situation. The company’s accumulation had been dwindling for decades. The Great Depression not only pushed diamond sales to historic lows, it shifted American attitudes around consumption and thriftiness to the detriment of the luxury object. In this article, I bring together Liz McFall’s assertion […]

Continue ReadingSpiegel Online Analysis of Deutsche Bank’s Differential Misfortune

DT Cochrane Deutsche Bank was a central figure of the 2008 global financial crisis. While some of its compatriots, such as Goldman Sachs, have re-ascended to the commanding heights of global capital, Deutsche remains a shadow of its former self as seen in the graph below (screenshot from Yahoo! Finance). A comparison of Deutsche Bank […]

Continue Reading