Originally published at Economics from the Top Down Blair Fix According to behavioral economics, most human decisions are mired in ‘bias’. It muddles our actions from the mundane to the monumental. Human behavior, it seems, is hopelessly subpar.1 Or is it? You see, the way that behavioral economists define ‘bias’ is rather peculiar. It involves […]

Continue ReadingBichler & Nitzan, ‘ההון ושברו (Capital and its Crisis)’

Abstract הקפיטליזם שולט בעולם. דיונים סוערים מתנהלים בין המלומדים הממסדיים לבין “הביקורתיים” על טיבו של הקפיטליזם הגלובלי. הבעיה היא שטיבו של המוסד המרכזי בקפיטליזם — ההון — אינו ידוע. לאחר יותר ממאתיים שנה של התפתחות קפיטליסטית נמרצת לא קיימת תיאוריית הון הגיונית אמפירית — לא במדע הכלכלה, לא בכלכלה הפוליטית המרקסיסטית ולא במדעי החברה בכלל, […]

Continue ReadingBichler & Nitzan, ‘The Business of Strategic Sabotage’

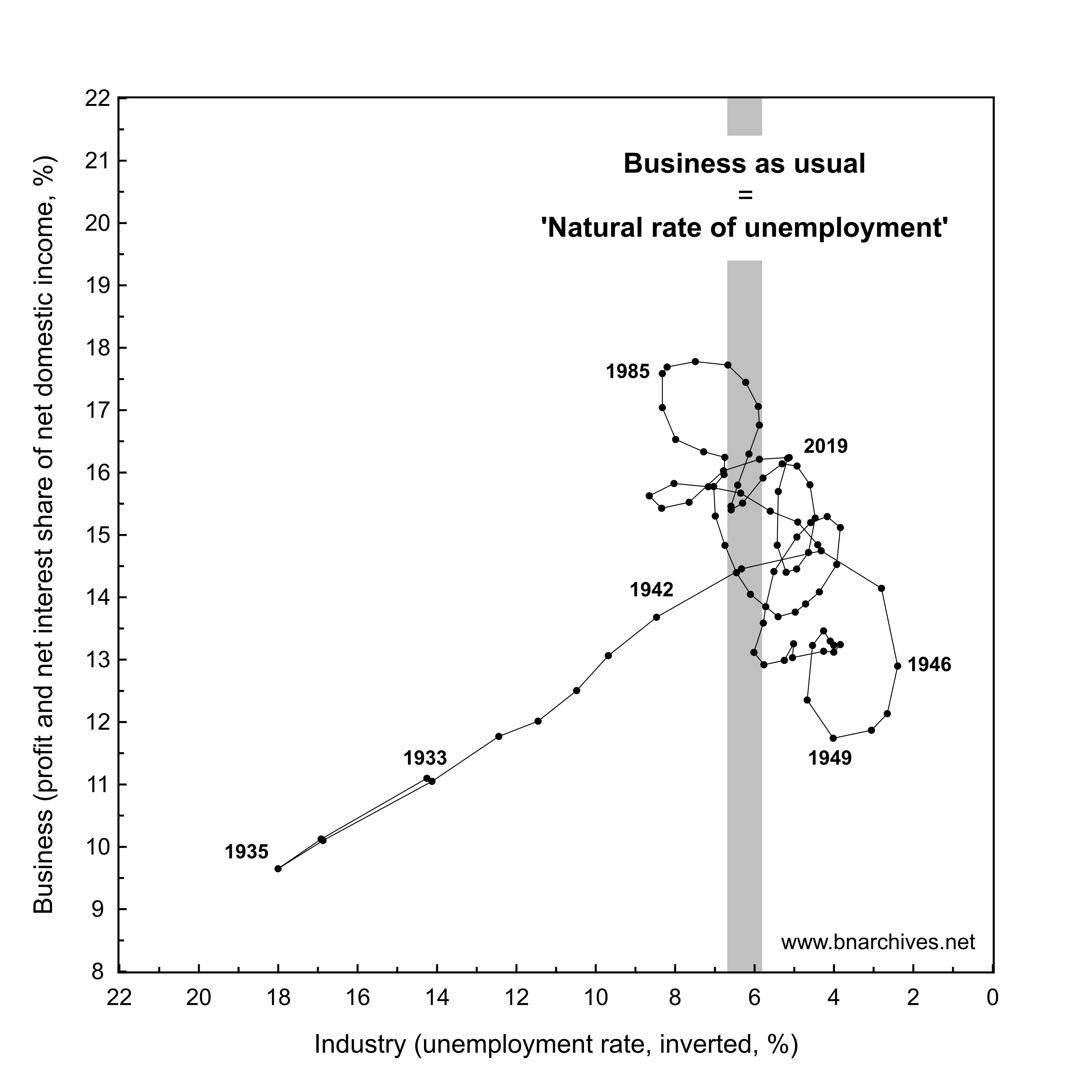

The Business of Strategic Sabotage SHIMSHON BICHLER and JONATHAN NITZAN January 2023 Abstract In a recent article, Nicolas D. Villarreal claims that our empirical analysis of the relation between business power and industrial sabotage in the United States is unpersuasive, if not deliberately misleading. Specifically, he argues that we cherry-pick specific data definitions and smoothing […]

Continue ReadingProximity to Power: The oilpatch & Alberta’s major dailies

Regan Boychuk The bias of Alberta’s media in favour of our dominant industry is both pervasive and obvious to any careful observer. But how to prove it? Studies of media bias are notoriously difficult and significant media analysis can easily become a gargantuan and subjective task. This novel study uses a small sample size while […]

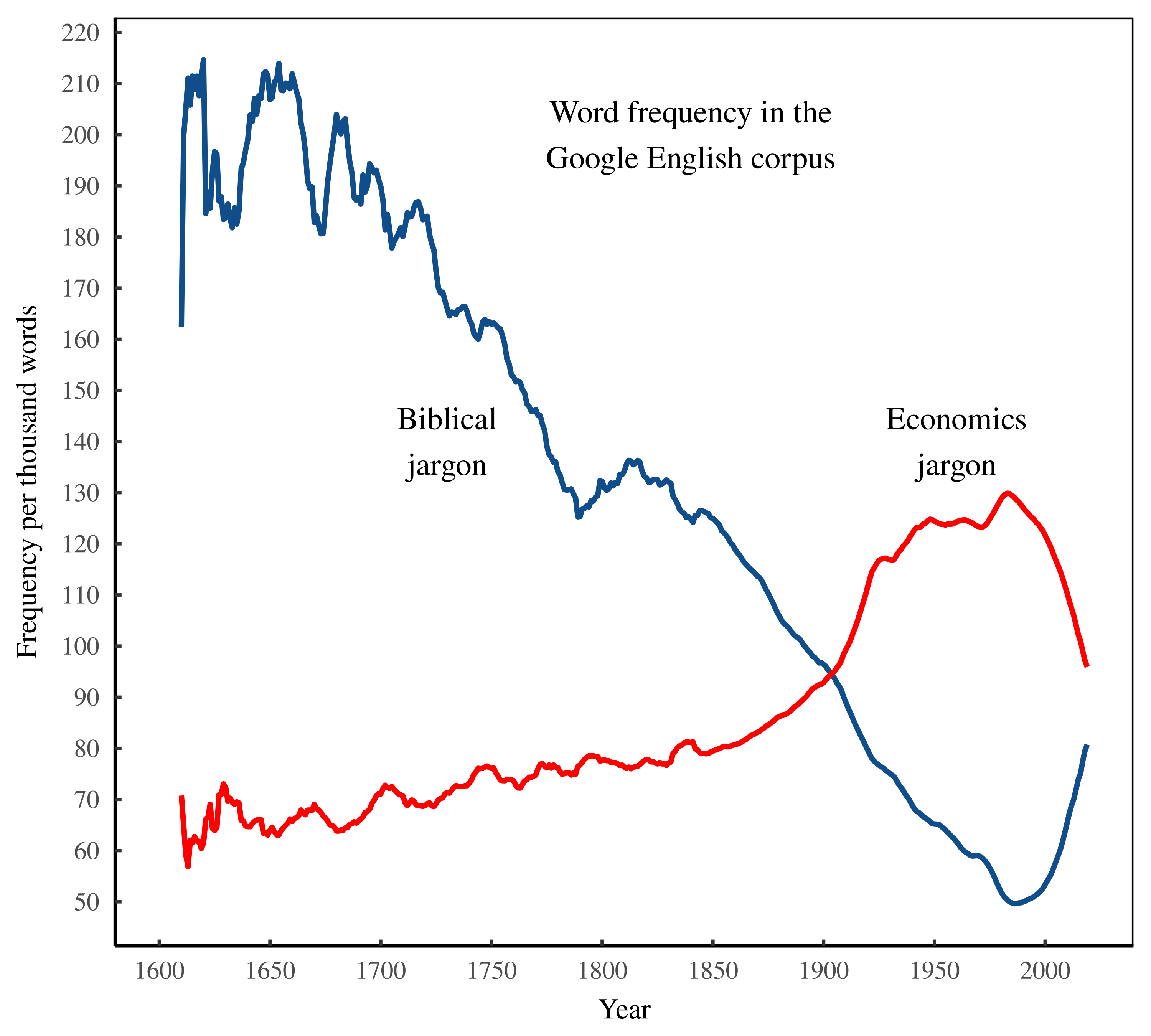

Continue ReadingFix, ‘Have We Passed Peak Capitalism?’

Abstract This paper uses word frequency to track the rise and potential peak of capitalist ideology. Using a sample of mainstream economics textbooks as my corpus of capitalist thinking, I isolate the jargon of these books and then track its frequency over time in the Google English corpus. I also measure the popularity of feudal […]

Continue ReadingBichler & Nitzan, ‘Book Review: Steve Keen (2021) The New Economics: A Manifesto’

Abstract Steve Keen’s book, The New Economics: A Manifesto (2021), offers a new path for economics, and for good reason. In his view, neoclassicism, the paradigm that rules modern-day economics, has become a serious menace: “I regard Neoclassical economics as not merely a bad methodology for economic analysis, but as an existential threat to the […]

Continue ReadingAlberta’s Rockefeller Coups, Part 3: Who Would Do This To Themselves?

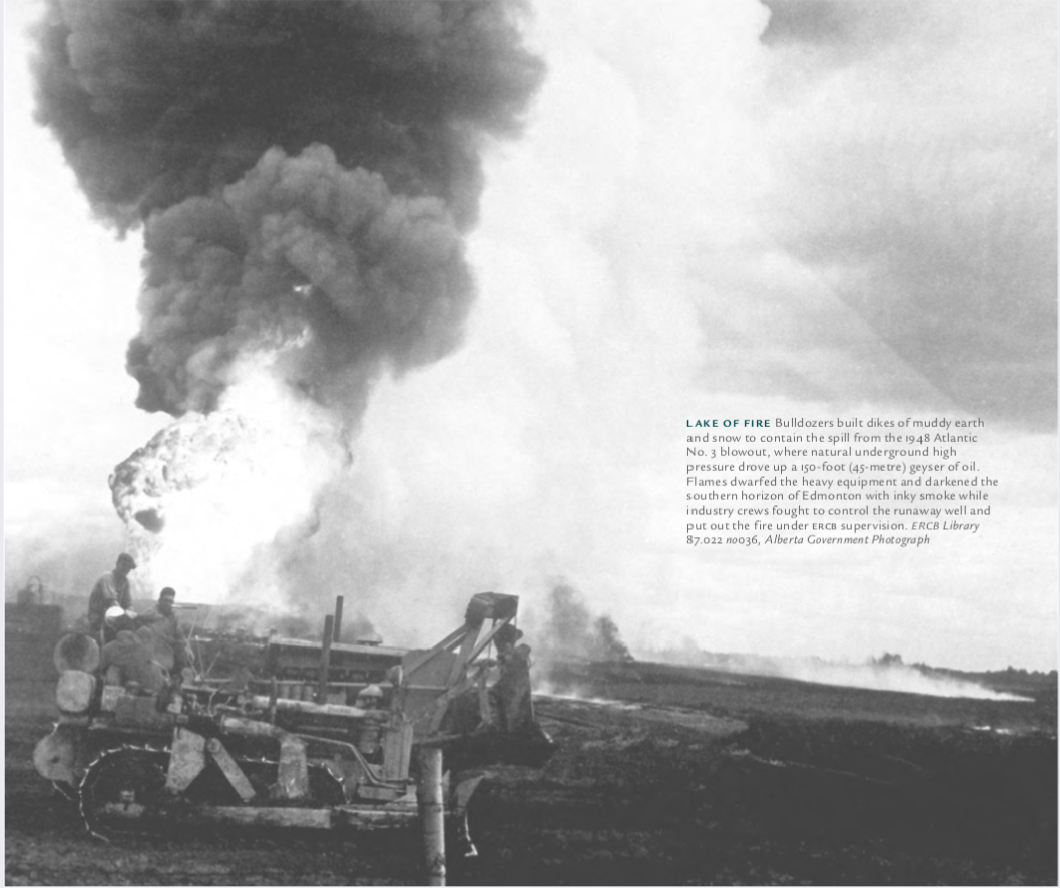

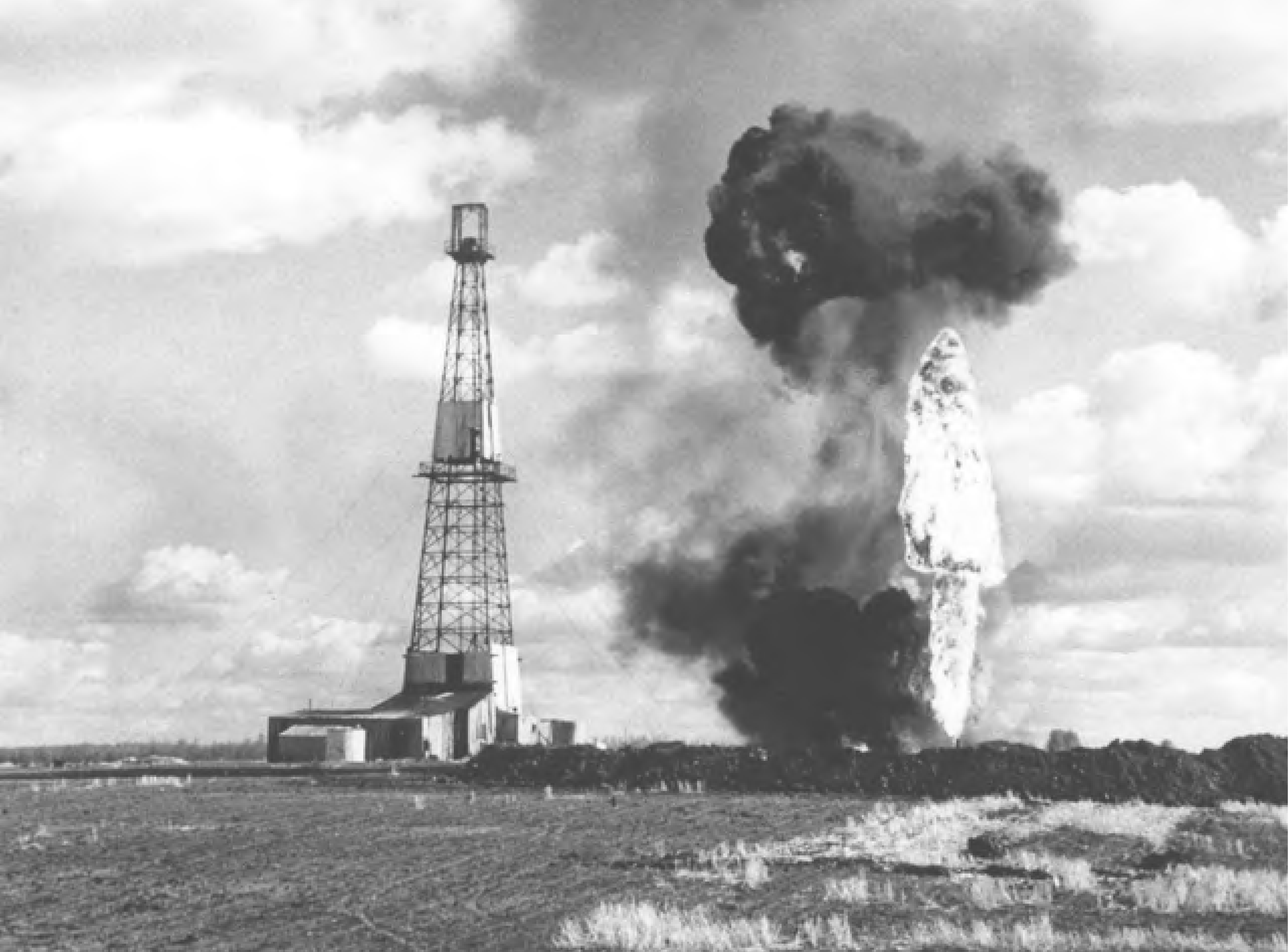

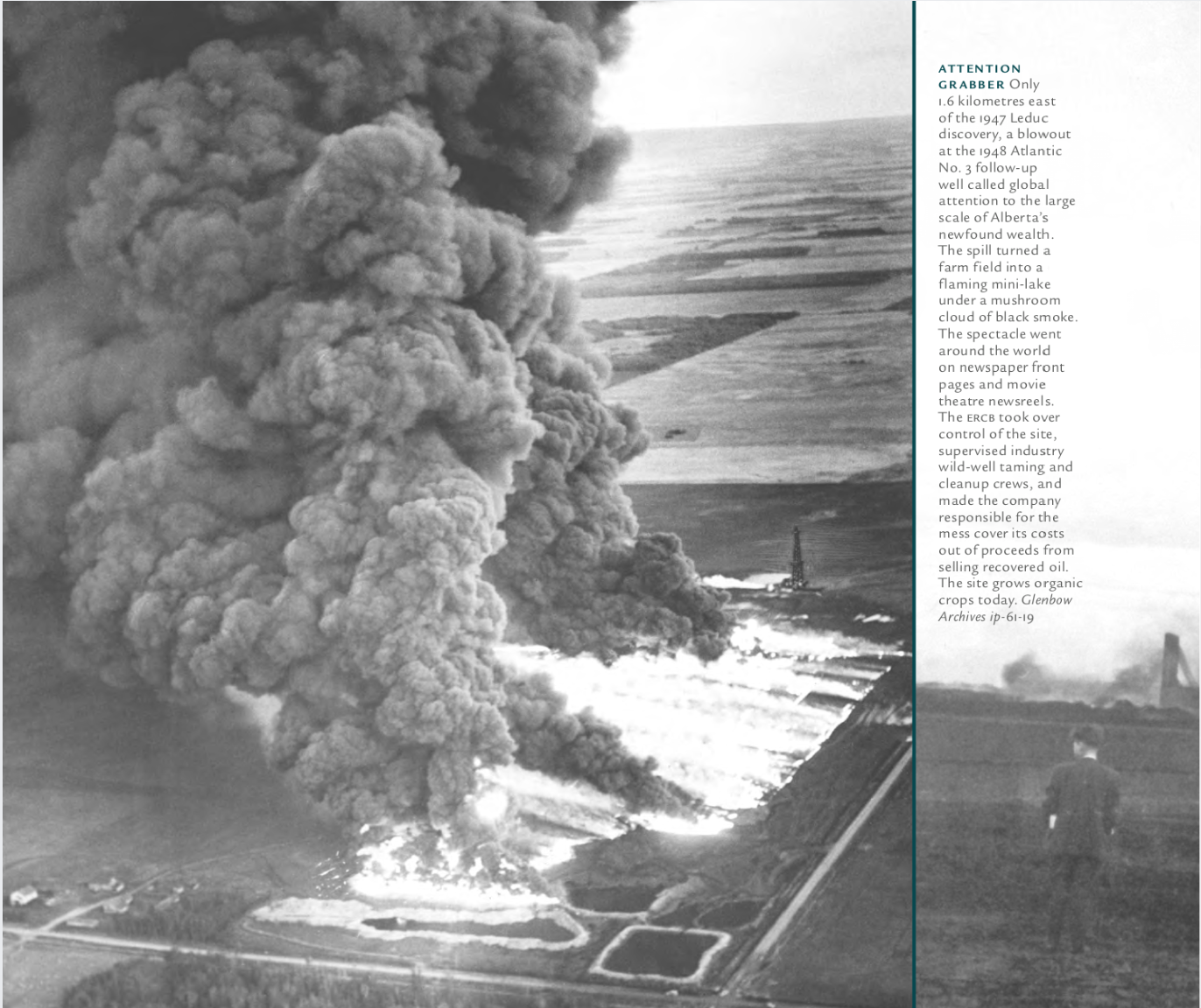

Regan Boychuk Author’s note: At the end of the First Cold War, Canada tried to make the polluter pay. This resulted in the United States launching an unknown, but successful coup in Alberta over the course of 1991-92. And the results of that coup are the single biggest threat to a liveable future. This three-part […]

Continue ReadingAlberta’s Rockefeller Coups, Part 2: American Style Democracy

Regan Boychuk Author’s note: At the end of the First Cold War, Canada tried to make the polluter pay. This resulted in the United States launching an unknown, but successful coup in Alberta over the course of 1991-92. And the results of that coup are the single biggest threat to a liveable future. This three-part […]

Continue ReadingAlberta’s Rockefeller Coups, Part 1: The ‘No-Lookback’ Deal

Regan Boychuk Author’s note: At the end of the First Cold War, Canada tried to make the polluter pay. This resulted in the United States launching an unknown, but successful coup in Alberta over the course of 1991-92. And the results of that coup are the single biggest threat to a liveable future. This three-part […]

Continue ReadingAt last, a new Econ 101 textbook

Originally published at pluralistic.net Cory Doctorow Neoclassical economics is a hell of a drug. It has no theory of prices, no account of inflation, and its models all presume the existence of a perfectly rational “homo economicus” who is a “utility maximizer” with perfect information. Even the Queen is wise to the scam, grilling Bank […]

Continue ReadingBichler & Nitzan, ‘The Business of Strategic Sabotage’

Abstract Marxists love to hate the theory of capital as power, or CasP for short. And they have two good reasons. First, CasP criticizes the logical and empirical validity of the labour theory of value on which Marxism rests. And second, it offers the young at heart a radical, non-Marxist alternative with which to research, […]

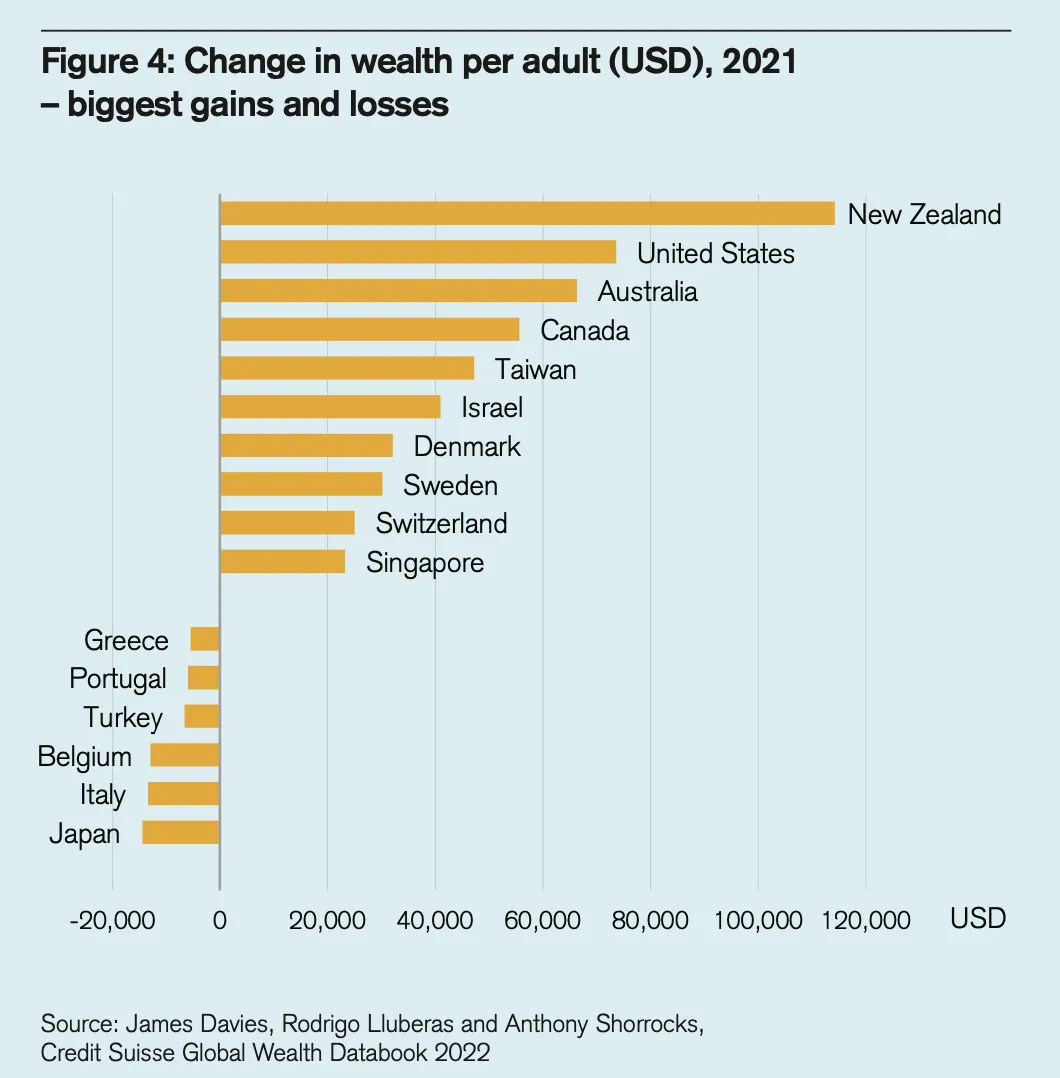

Continue ReadingDo we believe that the average Chinese adult is “wealthier” than the average European?

Originally published at Fresh Economic Thinking Cameron Murray Do you believe this headline? I don’t. The many problems with measuring a country’s wealth are on full display in this Credit Suisse report. But let’s start a little closer to home. When I married my wife I promised to look after her financial and material needs. […]

Continue ReadingWhat does the growing divide on Rotten Tomatoes mean?

Originally published at notes on cinema James McMahon Rotten Tomatoes (RT) found a way to get every last drop from the well of convenience. Film criticism is already pressured, tacitly by convention, or explicitly by editors and bosses, to give bite-size scores with thumbs (up or down), stars (out of 4 or 5), letter grades […]

Continue ReadingNo Shortage of Profit: Semiconductor firms and the differential effects of chip shortages

Chris Mouré Note: this is the manuscript version of an article now featured in The Mint Magazine. Few will argue with the claim that shortages are socially harmful. Shortages, by definition, imply a lack of something – not enough stuff to go around. A shortage of food implies hunger; a shortage of electricity implies darkness. […]

Continue ReadingEssentialism and Traditionalism in Academic Research

Originally published at Economics from the Top Down Ryan Kyger1 and Blair Fix Philosophy of science is about as useful to scientists as ornithology is to birds. — attributed to Richard Feynman2 Most scientists don’t worry much about philosophy; they just get on with doing ‘science’. They run experiments, analyze data, and report results. And […]

Continue ReadingThe antitrust case against Prime

Originally published at pluralistic.net Cory Doctorow The starting gun on Big Tech trustbusting was fired in 2017, when Lina Khan, then a law student (now an FTC trustbuster!) published “Amazon’s Antitrust Paradox,” a law-review article showing how Amazon formed a monopoly without legal trouble. https://www.yalelawjournal.org/note/amazons-antitrust-paradox The key was a Reagan-era shift in antitrust policy, based […]

Continue ReadingThe Half Life of a Spotify Hit

Originally published at Economics from the Top Down Blair Fix The music business is a cruel and shallow money trench, a long plastic hallway where thieves and pimps run free, and good men die like dogs. — Hunter S. Thompson meme1 Browse the internet long enough and you’ll eventually run across Hunter S. Thompson’s meme […]

Continue ReadingThe habits of Netflix’s users

Originally published at notes on cinema James McMahon Like other streaming services, Netflix does not make its user data public. To date, there are two exceptions to this privacy. Netflix released a large dataset of anonymized user activity when it offered a one million dollar prize for the best AI model that could predict user […]

Continue ReadingDi Muzio & Dow, ‘Covid-19 and the Global Political Economy. Crises in the 21st Century’

Abstract Covid-19 and the Global Political Economy investigates and explores how far and in what ways the Covid-19 pandemic is challenging, restructuring, and perhaps remaking aspects of the global political economy. Since the 1970s, neoliberal capitalism has been the guiding principle of global development: fiscal discipline, privatisations, deregulation, the liberalisation of trade and investment regimes, […]

Continue ReadingMouré, ‘No Shortage of Profit: Technological Change, Chip ‘Shortages’, and Capital Accumulation in the Semiconductor Business’

Abstract Rapid technological change is often touted as a fundamental reality of capitalist societies. It is also often presented as concrete evidence for the supposed progressive improvement of material well-being that characterises the capitalist system of social order. Since its emergence in the mid-20th century, semiconductor technology in many ways exemplifies this reality. Yet the […]

Continue Reading