Originally published at notes on cinema James McMahon Ridley Scott’s Exodus: Gods and Kings is a telling example of Hollywood rationalizing its so-called inability to widen the boundaries of its creativity. In this case, the boundaries concern Hollywood’s tendency to reserve roles for its biggest stars, even when a big star appears unfit for the […]

Continue ReadingTeaching Income Inequality: Theory in Historical Perspective

Originally published at sbhager.com Sandy Brian Hager I’m spending some time during these summer months developing a new undergraduate course on wealth and income inequality. Branko Milanovic’s wonderful new book Global Inequality: A New Approach for the Age of Globalization will be the main text for the course. The first half of the course will […]

Continue ReadingHoward et al., ‘Protein Industry Convergence and Its Implications for Resilient and Equitable Food Systems’

Abstract Recent years have seen the convergence of industries that focus on higher protein foods, such as meat processing firms expanding into plant-based substitutes and/or cellular meat production, and fisheries firms expanding into aquaculture. A driving force behind these changes is dominant firms seeking to increase their power relative to close competitors, including by extending […]

Continue ReadingWhy Scorcese is right about corporate power, Part 1

Originally published at notes on cinema James McMahon What is more pleasurable: reading Martin Scorcese on cinema or reading reactions to Scorcese on cinema? The reactions compete for our pleasure because they reveal how easy it is for someone’s words to make us jump into a debate with two feet and eyes closed. In the […]

Continue ReadingStocks Are Up. Wages Are Down. What Does it Mean?

Originally published on Economics from the Top Down Blair Fix If you listen carefully, you can hear Jeff Bezos getting richer. There’s the sound again. Another billion in Bezos’ coffers. Let’s put some numbers to this sound of money. Since 2017, Bezos’ net worth has grown by about $4 million per hour — roughly 500,000 […]

Continue ReadingRemaking Our Economies with Wartime Analogies, Part 3

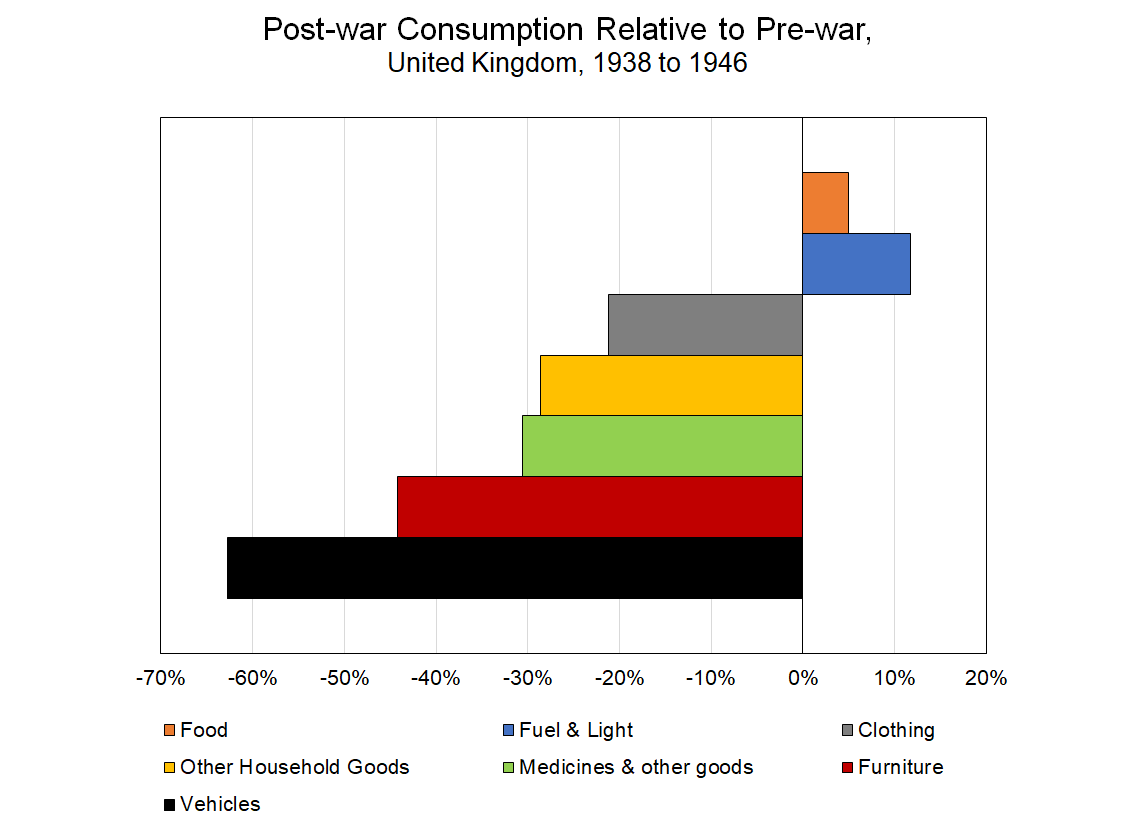

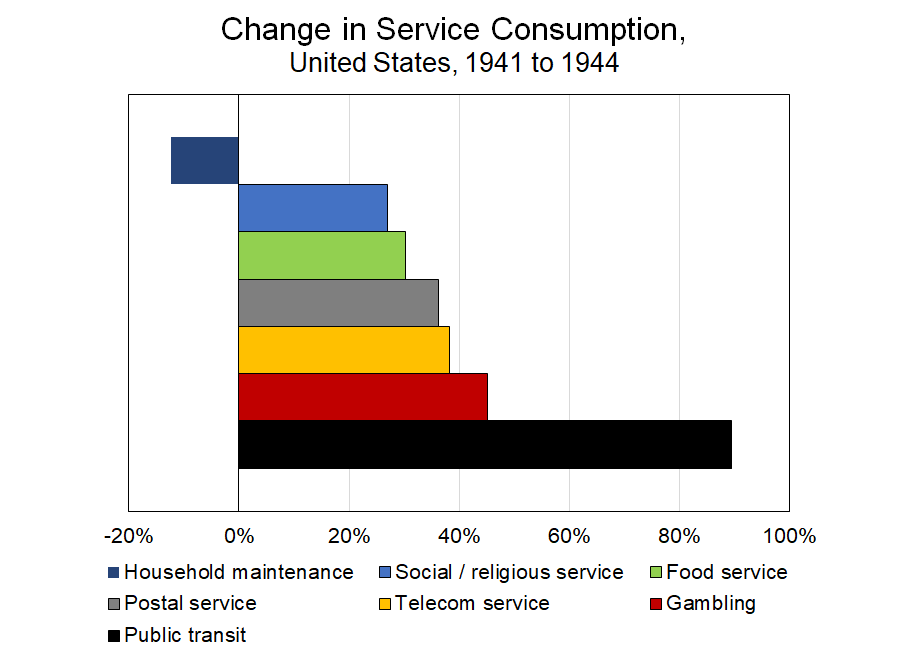

Originally published at dtcochrane.com DT Cochrane In Part 2, I looked at the shifts in U.S. household consumption that occurred during WWII. While aggregate consumption increased alongside massive government intervention, the qualitative mix of that consumption changed in some drastic ways. This analysis was intended to augment the analogy made by J.W. Mason and Mike […]

Continue ReadingRemaking Our Economies with Wartime Analogies, Part 2

Originally published at dtcochrane.com DT Cochrane In Part 1, I explained the motivation for this series. I want to use the analogy of WWII, as invoked by economists JW Mason and Mike Konczal in an NYT op-ed, to consider how we ought to manage a potential post-pandemic economic boom. In this post, I will look […]

Continue ReadingRemaking Our Economies with Wartime Analogies, Part 1

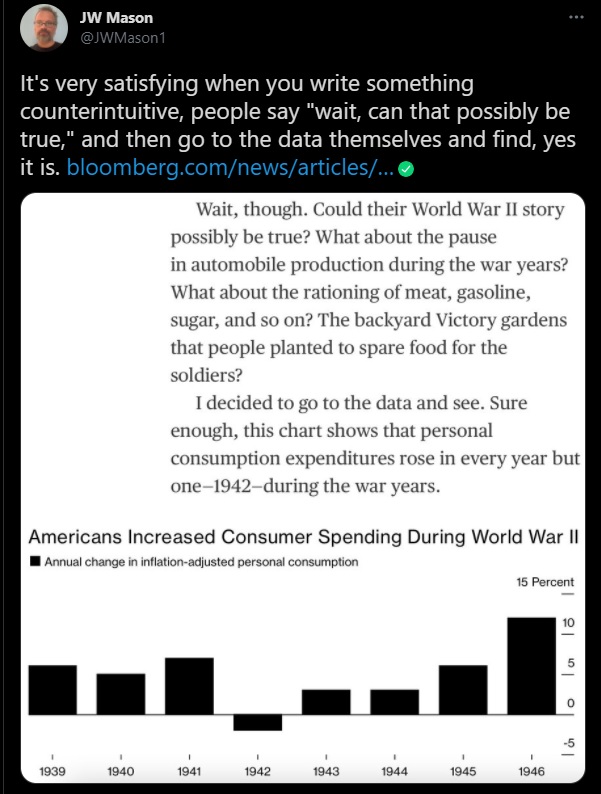

Originally published at dtcochrane.com DT Cochrane Economist JW Mason recently tweeted the following: Bloomberg writer Peter Coy was motived to perform this research by an NYT op-ed from Mason and Mike Konczal. Mason and Konczal’s primary argument is that we can have a post-pandemic economic boom, but that it needs to be properly managed. They […]

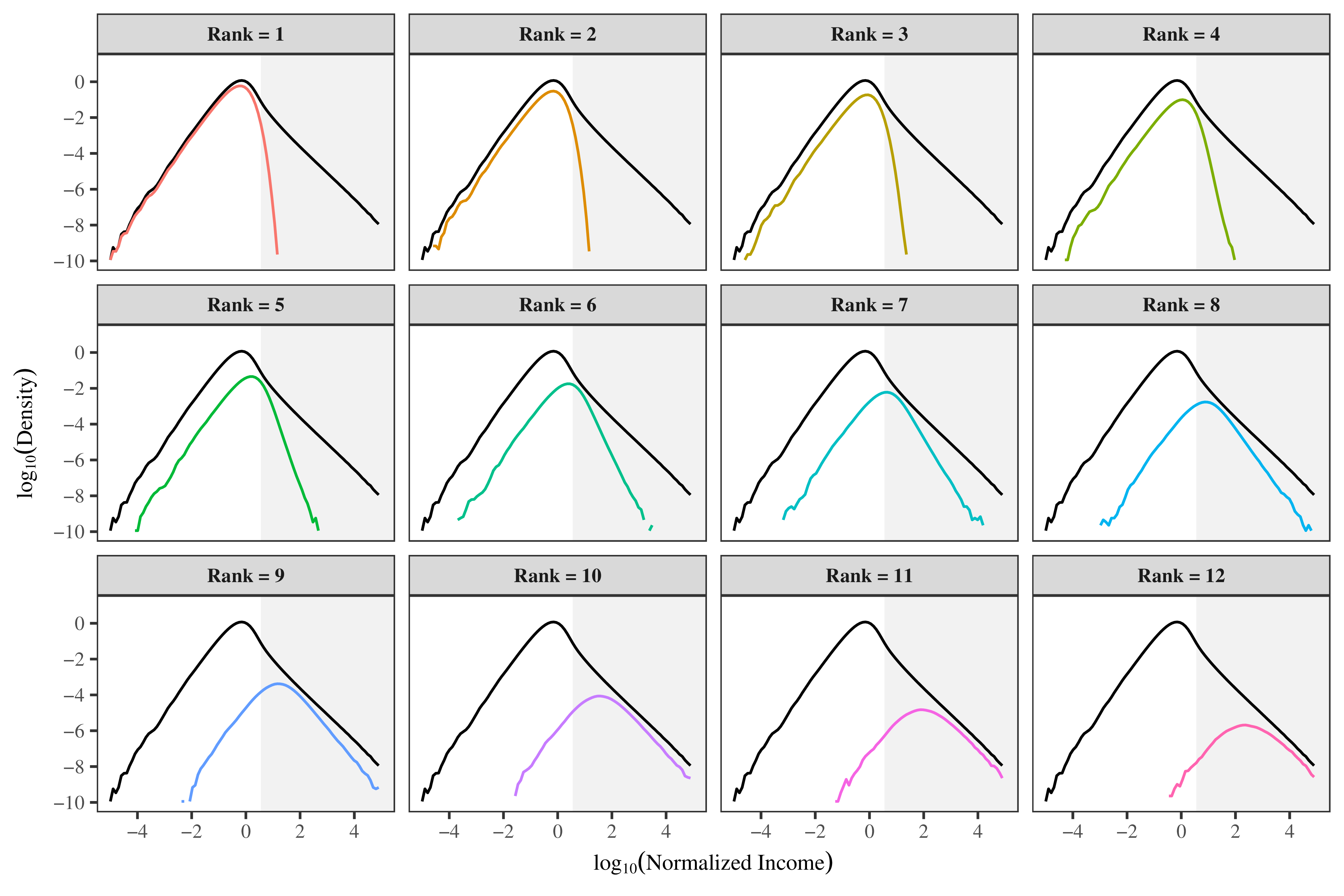

Continue ReadingWhy ‘General Intelligence’ Doesn’t Exist

Originally published on Economics from the Top Down Blair Fix Donald Trump took an IQ test … you’ll never guess what he scored! Apologies. That was my attempt at clickbait.1 Now that I’ve hooked you, let’s talk about the elephant in the room. No, not Donald Trump. Let’s talk about IQ. For as long as […]

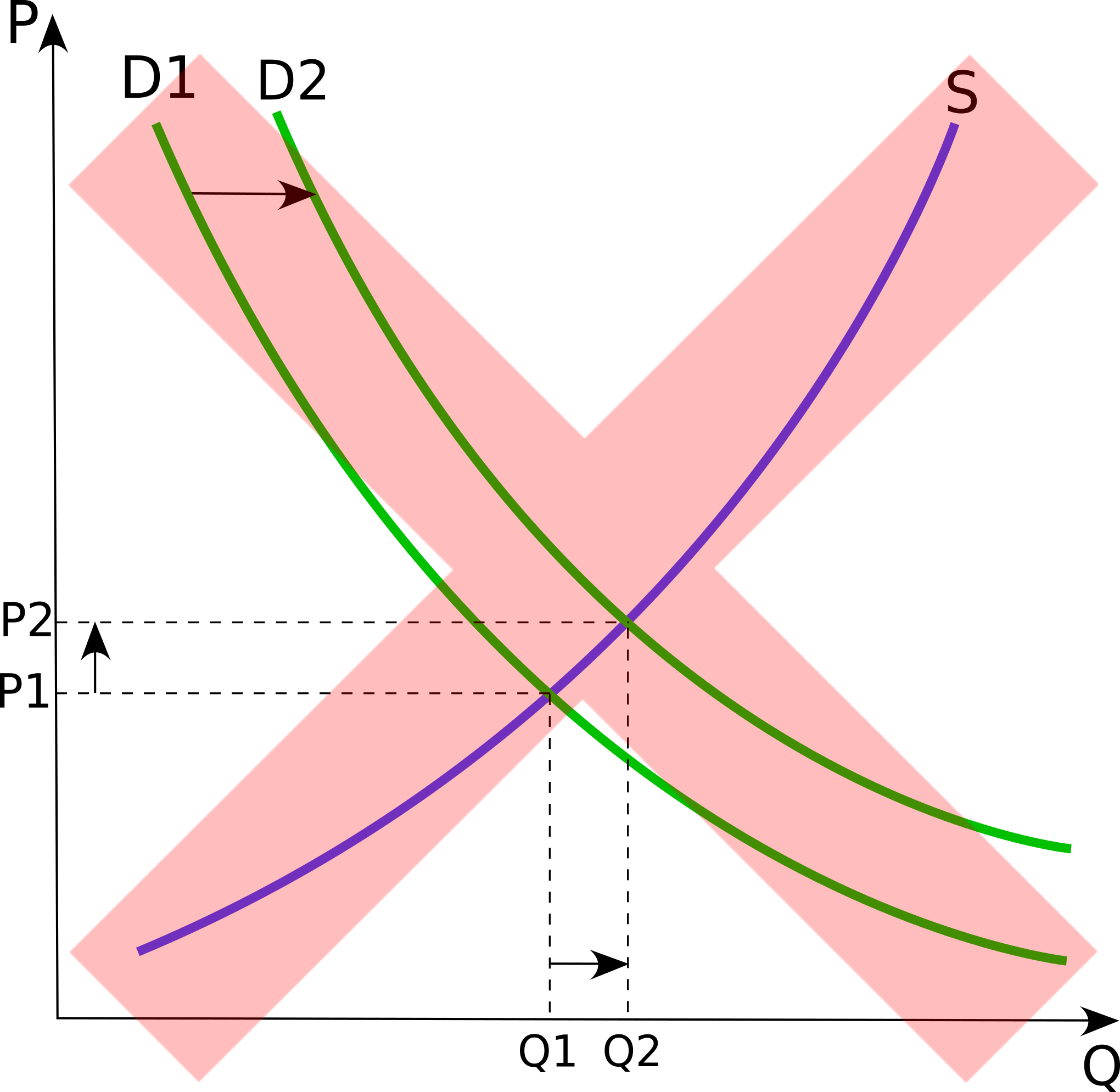

Continue ReadingSupply and Demand Deconstructed

Originally published on Economics from the Top Down Blair Fix Prices are caused by supply and demand, right? So say neoclassical economists. If you’ve bought their fairy tale, I recommend you watch the video below. In it, Jonathan Nitzan demolishes the neoclassical theory of prices. It’s a master lesson in how to deconstruct a theory. […]

Continue ReadingThe Paradox of Individualism and Hierarchy

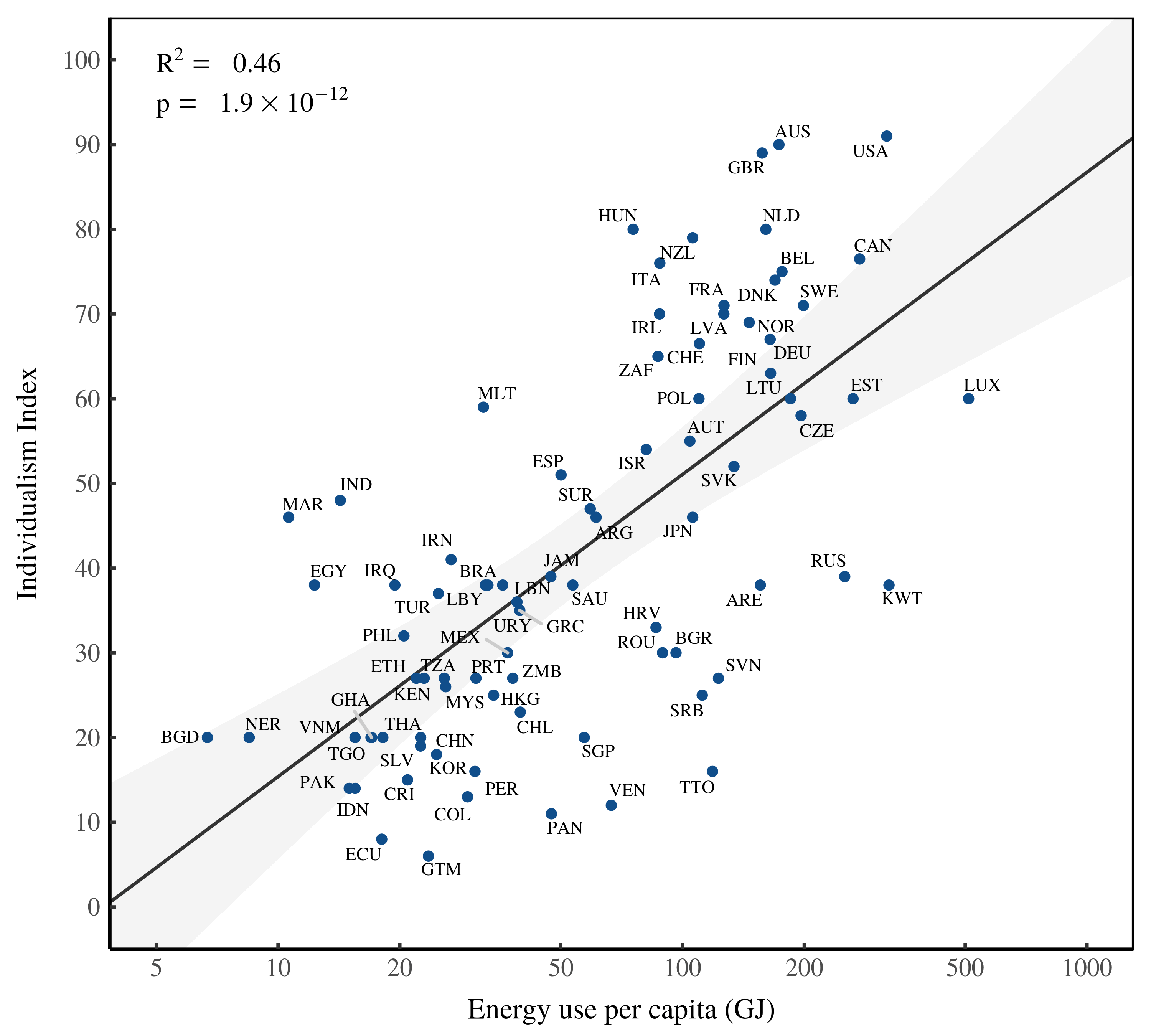

Originally published on Economics from the Top Down Blair Fix In the early 1970s, Geert Hofstede discovered something interesting. While analyzing a work-attitude survey that had been given to thousands of IBM employees around the world, Hofstede found that responses clustered by country. In some countries, for instance, employees tended to prefer an autocratic style […]

Continue Reading10 Tips for Making Beautiful Charts

Originally published on Economics from the Top Down Blair Fix They say that a picture is worth a thousand words. In science, the corollary is that a good chart is worth a whole article. Okay, that’s probably an exaggeration … but only slightly. Millions of words are spilled each day communicating science. Yet people have […]

Continue ReadingLiving the Good Life … Without Killing the Planet

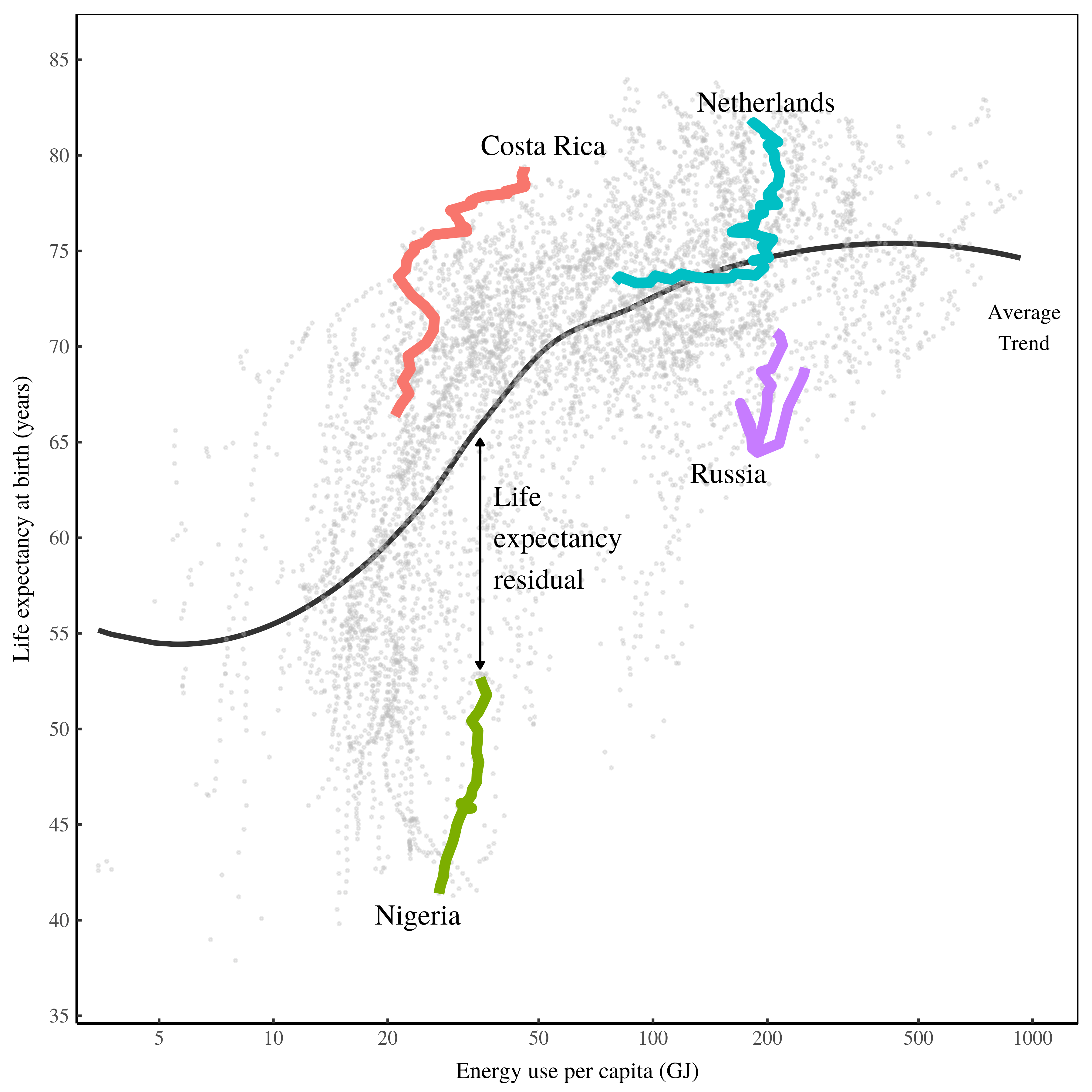

Originally published on Economics from the Top Down Blair Fix How can we live the ‘good life’ without killing the planet? My last post on energy and empire got me thinking about this question. We know that human welfare improves as we use more resources. But it’s suicidal for all of humanity to pursue this […]

Continue ReadingWhy America Won’t Be ‘Great’ Again

Originally published on Economics from the Top Down Blair Fix They called him the ‘Little Emperor’. Romulus Augustus — better known as Romulus ‘Augustulus’ (‘Little Augustus’) — was the last Western Roman Emperor. He assumed the throne at the age of 16 during a period of unprecedented strife. There had been 8 emperors in the […]

Continue ReadingWhy Isn’t Modern Monetary Theory Common Knowledge?

Originally published on Economics from the Top Down Blair Fix I’ve always been baffled why ‘modern monetary theory’ is called a theory. I don’t mean this in a disparaging way. As far as theories of money go, I think modern monetary theory (MMT for short) is the correct one. But having a correct theory of […]

Continue ReadingJesús Suaste Cherizola Wins the 2021 CASP Essay Prize

Originally published on Economics from the Top Down Blair Fix As some of you may know, I recently became the editor of the Review of Capital as Power (RECASP), a journal that publishes research on the power underpinnings of capitalism. Each year, RECASP hosts an essay competition. I’m proud to announce that the winner of […]

Continue ReadingSuaste Cherizola, ‘From Commodities to Assets’

From Commodities to Assets Capital as Power and the Ontology of Finance JESÚS SUASTE CHERIZOLA May 2021 Abstract Assets are a crucial concept of the practice and mindset of the capitalist class. Critical analyses of capitalism, however, tend to admit that the exchange of commodities is the foundation of the analysis of capitalism. This article […]

Continue ReadingFix, ‘The Rise of Human Capital Theory’

Abstract Today, human capital theory dominates the study of personal income. But this has not always been so. In this essay, I chart the rise of human capital theory, and compare it to the rise (and fall) of eugenics. The comparison, I argue, is an apt one. Eugenics and human capital theory both focus on […]

Continue ReadingCan the World Get Along Without Natural Resources?

Originally published on Economics from the Top Down Blair Fix If it is very easy to substitute other factors for natural resources, then there is in principle no “problem”. The world can, in effect, get along without natural resources. — Robert Solow, 1974 In the distant future, aliens come to Earth. They find a planet […]

Continue ReadingBichler & Nitzan, ‘Unbridgeable: why political economists cannot accept capital as power’

Abstract The theory of capital as power (CasP) is radically different from conventional political economy. In the conventional view, mainstream as well as heterodox, capital is seen a ‘real’ economic entity engaged in the production of goods and services, and capitalism is thought of as a mode of production and consumption. Finance in this approach […]

Continue Reading