DT Cochrane An op-ed on the advocacy website Oil Change International examines the high levels of debt within the oil business and the consequences of that debt for extraction. It postulates a dangerous positive feedback mechanism between extraction levels, oil prices and oil company debt. The basic argument is that in order to service their […]

Continue ReadingHoward, ‘Concentration and Power in the Food System’

Abstract This book seeks to illuminate which firms have become the most dominant, and more importantly, how they shape and reshape society in their efforts to increase their control. These dynamics have received insufficient attention from academics and even critics of the current food system. The power of dominant firms extends far beyond narrow economic […]

Continue ReadingNo. 2016/01: Debailleul, Bichler & Nitzan, ‘Theory and Praxis, Theory and Practice, Practical Theory’

Abstract This working paper contains an intervention by Corentin Debailleul and an extended reply by Shimshon Bichler and Jonathan Nitzan. The exchange was first posted on the Capital as Power Forum in January 2016. Debailleul’s original questions are articulated at greater length here, while Bichler and Nitzan’s reply is reproduced as is. Citation Theory and […]

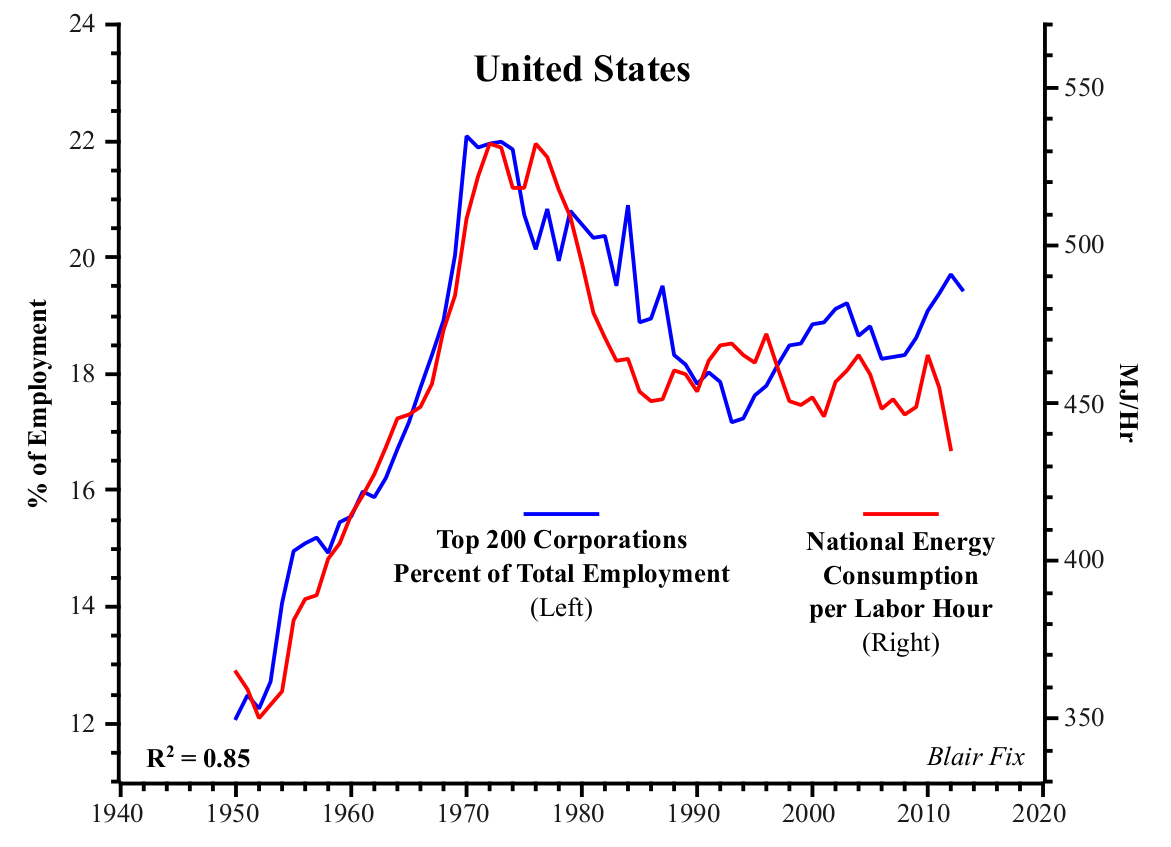

Continue ReadingVideo of Blair Fix's Presentation – Economic Growth as a Power Process

Is economic growth a miracle of the free market? According to mainstream theory, growth is best ensured through conditions of ‘perfect competition’. However, economic growth is tightly correlated with the concentration of power in the hands of large corporations. Why? The capital as power framework provides potential answers that turn mainstream theory on its head: […]

Continue ReadingBichler & Nitzan, ‘Acumulación de capital: ficción y realidad’

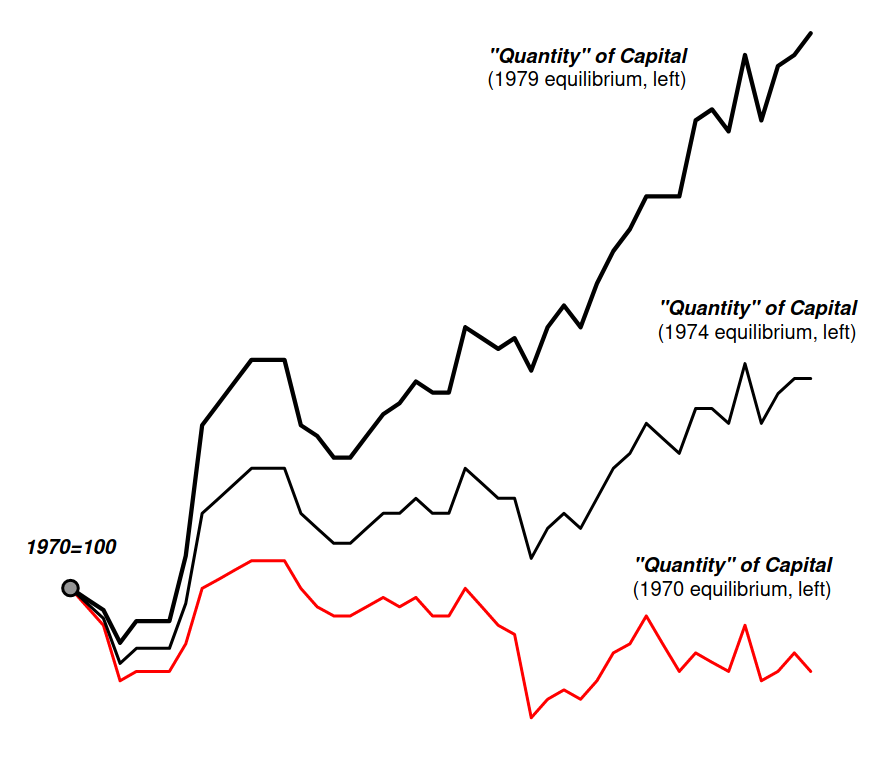

Abstract ¿Qué quieren decir los economistas cuando hablan de “acumulación de capital’? La respuesta es todo, menos clara. La opinión convencional es que hay dos tipos de capital: real y financiero, que deben guardar correspondencia y que, infortunadamente, la mayoría de las veces no se corresponden, pues el crecimiento del capital financiero tiende a desajustarse […]

Continue ReadingPetrodollars and Profit: Rethinking Political Economy through the Middle East

Max Ajl A review of Jonathan Nitzan and Shimshon Bickler’s The Scientist and the Church. Originally published at Jadaliyya Howard Page, a director at what was then Exxon, was once asked, “What would have happened if Iraq production had also surged during the 1960’s,” like that of Saudi Arabia and Iran. He responded, “I admit […]

Continue ReadingNo. 2015/04: Bichler & Nitzan, ‘The CasP Project: Past, Present, Future

Abstract The study of capital as power (CasP) began when we were students in the 1980s and has since expanded into a broader project involving a growing number of researchers and new areas of inquiry. This paper provides a bird’s-eye view of the CasP journey. It explores what we have learned so far, reviews ongoing […]

Continue ReadingVideo of Jonathan Nitzan’s Presentation – The CasP Project: Past, Present, Future

Bichler, Shimshon and Nitzan, Jonathan. (2015). Presentation at York University. 20. October. 2015. The study of capital as power began when we were students in the 1980s and has since expanded into a broader project, involving a growing number of researchers and new areas of inquiry. The presentation explores what we have learned so far, […]

Continue ReadingThe Renminbi on the World Stage

DT Cochrane The IMF recently announced that China’s currency, the CYN (Chinese Yuan Renminbi), would be included in the IMF’s basket of currencies, known as the SRD (special drawing rights). The designation comes after China adopted certain reforms in accordance with International Monetary Fund (IMF) policies. The CYN will comprise 11% of the basket, with […]

Continue ReadingIs Hollywood running out of risk?

Shimshon Bichler and Jonathan Nitzan Repost from Real-World Economics Review Blog If we are to believe the conventional creed, Hollywood films are highly risky investments. According to De Vany, revenue forecasts have zero precision, which is just a way of saying that ‘anything can happen’. . . . The ‘nobody knows’ principle . . . […]

Continue ReadingPutting Power Back into Growth Theory

Putting Power Back Into Growth Theory BLAIR FIX June 2015 Abstract Neoclassical growth theory assumes that economic growth is an atomistic process in which changes in distribution play no role. Unfortunately, when this assumption is tested against real-world evidence, it is systematically violated. This paper argues that a reality-based growth theory must reject neoclassical principles […]

Continue ReadingDi Muzio, ‘Carbon Capitalism: Energy, Social Reproduction and World Order’

Abstract Modern civilization and the social reproduction of capitalism are bound inextricably with fossil fuel consumption. But as carbon energy resources become scarcer, what implications will this have for energy-intensive modes of life? Can renewable energy sustain high levels of accumulation? Or will we witness the end of existing capitalist economies? This book provides an […]

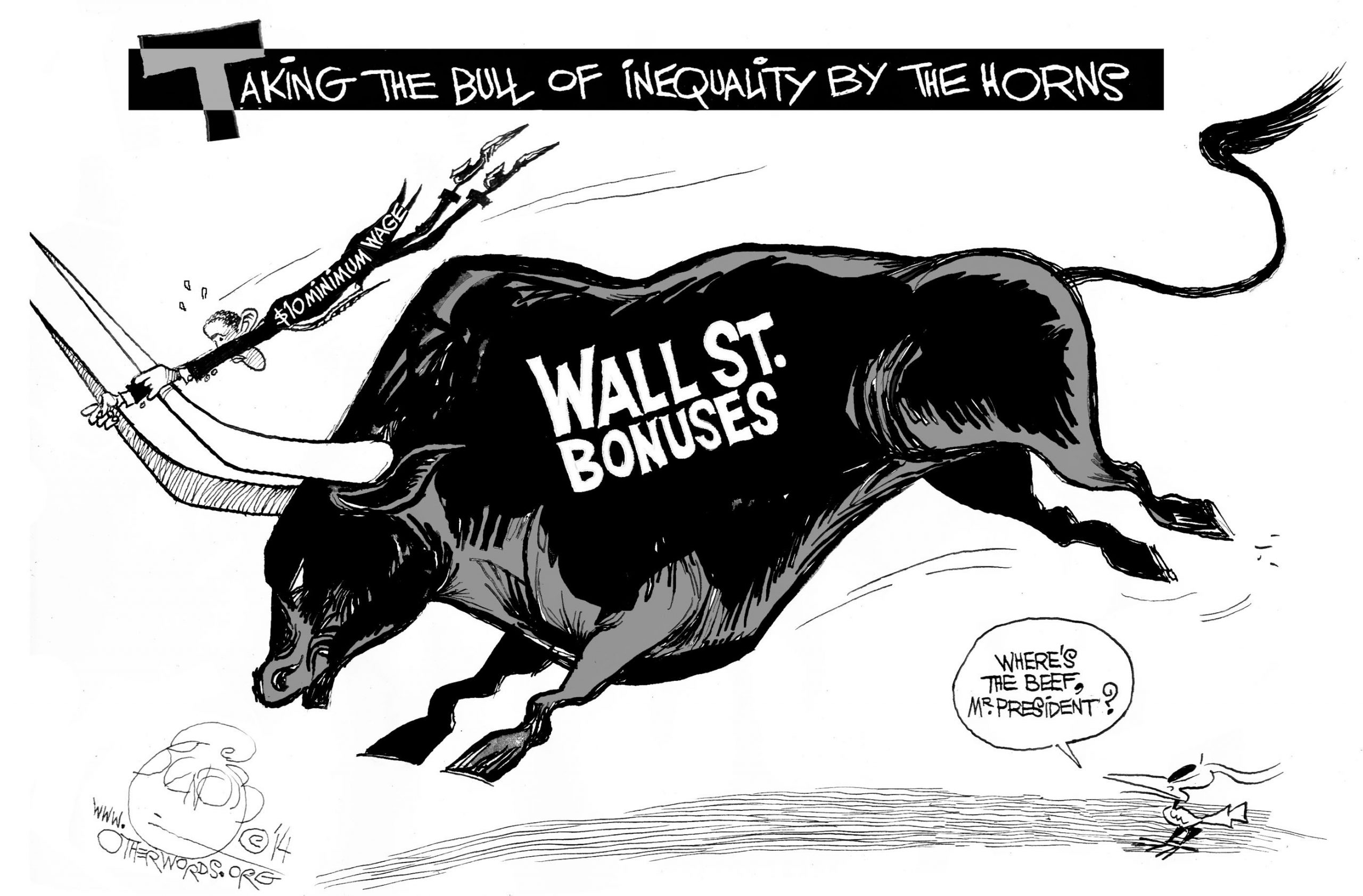

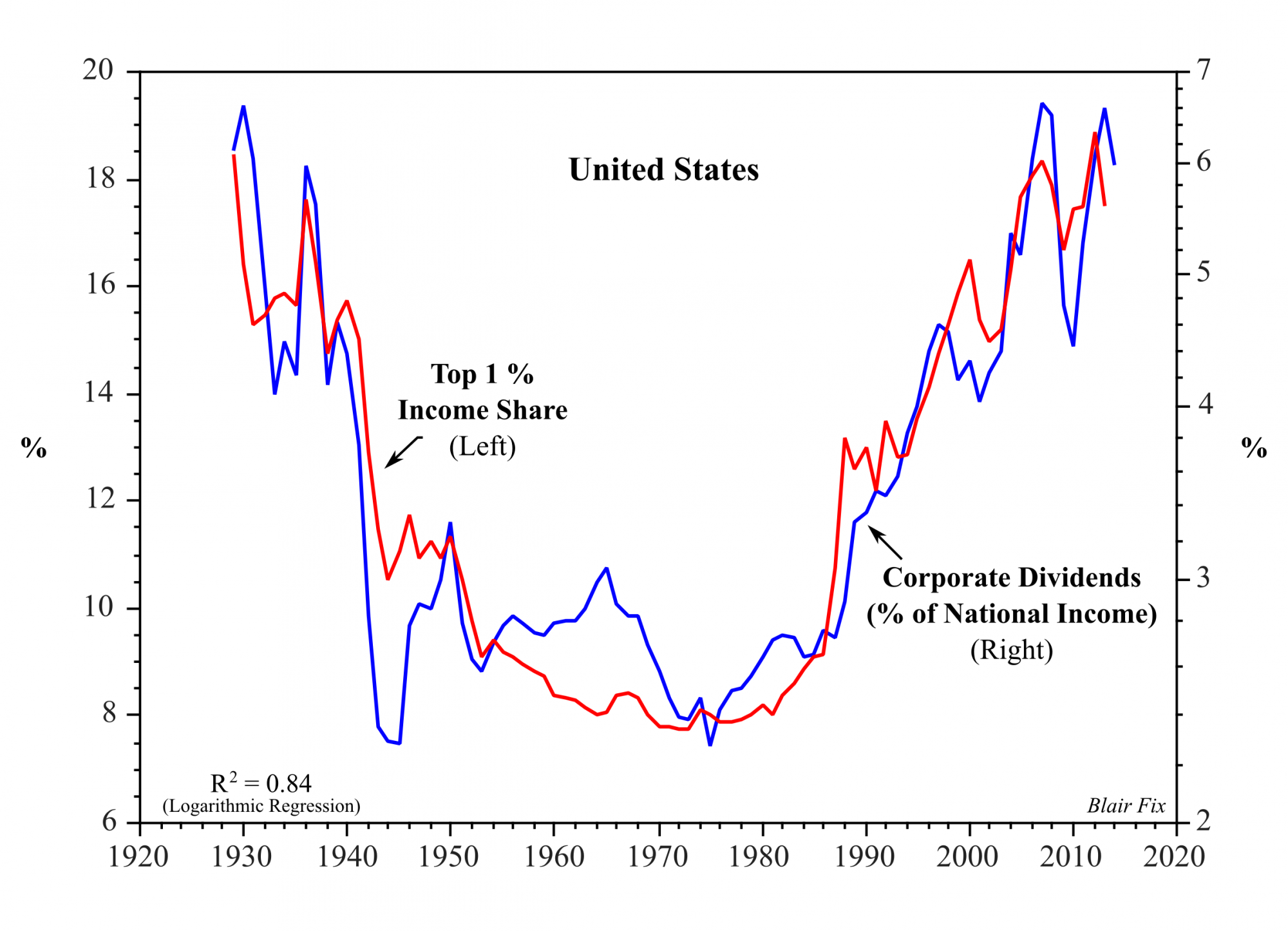

Continue ReadingSome Important Limitations of Income Inequality Data

Jonathan Nitzan Blair Fix, a PhD student in the Faculty of Environmental Studies at York University in Toronto, points to some important limitations of income inequality data. In a recent posting on capitalaspower.com, Fix shows that, in the case of the U.S., the Top 1% income share correlates not with the share of capitalists in […]

Continue Reading