Abstract An early analysis of the imperialist implications of the surge of global commodity prices was conducted in 2014 by Jonathan Nitzan and Shimshon Bichler. However, their analysis did not consider how the US monetary and fiscal expansionist policies have contributed to the rise of global commodity prices. This article fills this gap. Arguably, under […]

Continue ReadingHudson, Nitzan, Di Muzio & Fix, ‘El capital como poder en el siglo XXI: Una conversación’

Abstract El 3 de diciembre de 2024, Michael Hudson se reunió con los investigadores del capital como poder Jonathan Nitzan, Tim Di Muzio y Blair Fix para discutir las intersecciones entre sus dos líneas de investigación. Lo que sigue es una transcripción de la conversación. Vídeo de YouTube (inglés): https://www.youtube.com/watch?v=tBOU4xBg2pA Citation El capital como poder […]

Continue ReadingMarshall, ‘Rethinking the Political Economy of Environmental Conflict: Lessons from the UK Fracking Controversy’

Abstract As governments and corporations have intensified their efforts to locate, extract, and capitalise oil, gas, and various other biophysical materials, the world has simultaneously witnessed a proliferation of social resistance to these efforts. While taking many forms, such resistance, and concomitant ecological distribution conflicts (EDCs), are invariably motivated by a diverse range of objections […]

Continue ReadingSuaste Cherizola, ‘Estudiar el precio, olvidar el valor. Una alternativa al pensamiento económico tradicional’

Abstract Este artículo intenta sentar las bases para una comprensión de los precios radicalmente diferente a como los entiende el pensamiento económico tradicional. Tras revisar algunos aspectos relevantes de la crítica a la teoría del dinero como mercancía, se muestra que el pensamiento tradicional es incapaz de captar las propiedades irreductibles de los precios y […]

Continue ReadingGlobal Capital: Political Economy of Capitalist Power (YorkU, GS/POLS 6285 3.0, Graduate, Fall Term, 2022-23)

Jonathan Nitzan What is capital? Despite centuries of debate, there is no clear answer to this question – and for a good reason. Capital is a polemic term. The way we define it attests our theoretical biases, ideological disposition, view of politics, class consciousness, social position, and more. Is capital the same as machines, or […]

Continue ReadingPietryka, ‘Kapitał, by rządzić, musi sabotować postęp’

Abstract Od głodu i biedy po zwykłe marnotrawstwo i nawracające fale przeróżnych kryzysów – to nie niepożądane skutki uboczne kapitalizmu, ale przejawy sabotażu. Bo nic nie utrwala władzy kapitału skuteczniej niż istnienie szerokiej rzeszy ludzi, którzy ani na chwilę nie mogą przestać pracować, by przeżyć. Capital, in order to rule, must sabotage progress From hunger […]

Continue ReadingBichler & Nitzan, ‘ההון ושברו (Capital and its Crisis)’

Abstract הקפיטליזם שולט בעולם. דיונים סוערים מתנהלים בין המלומדים הממסדיים לבין “הביקורתיים” על טיבו של הקפיטליזם הגלובלי. הבעיה היא שטיבו של המוסד המרכזי בקפיטליזם — ההון — אינו ידוע. לאחר יותר ממאתיים שנה של התפתחות קפיטליסטית נמרצת לא קיימת תיאוריית הון הגיונית אמפירית — לא במדע הכלכלה, לא בכלכלה הפוליטית המרקסיסטית ולא במדעי החברה בכלל, […]

Continue ReadingThe Ritual of Capitalization

Originally published at Economics from the Top Down Blair Fix There’s something mysterious about finance. The symbols are arcane. The math is complex. The practitioners are impressively educated. And the stakes are high. All of this gives finance the veneer of higher truth — as if quants are uncovering a reality not accessible to the […]

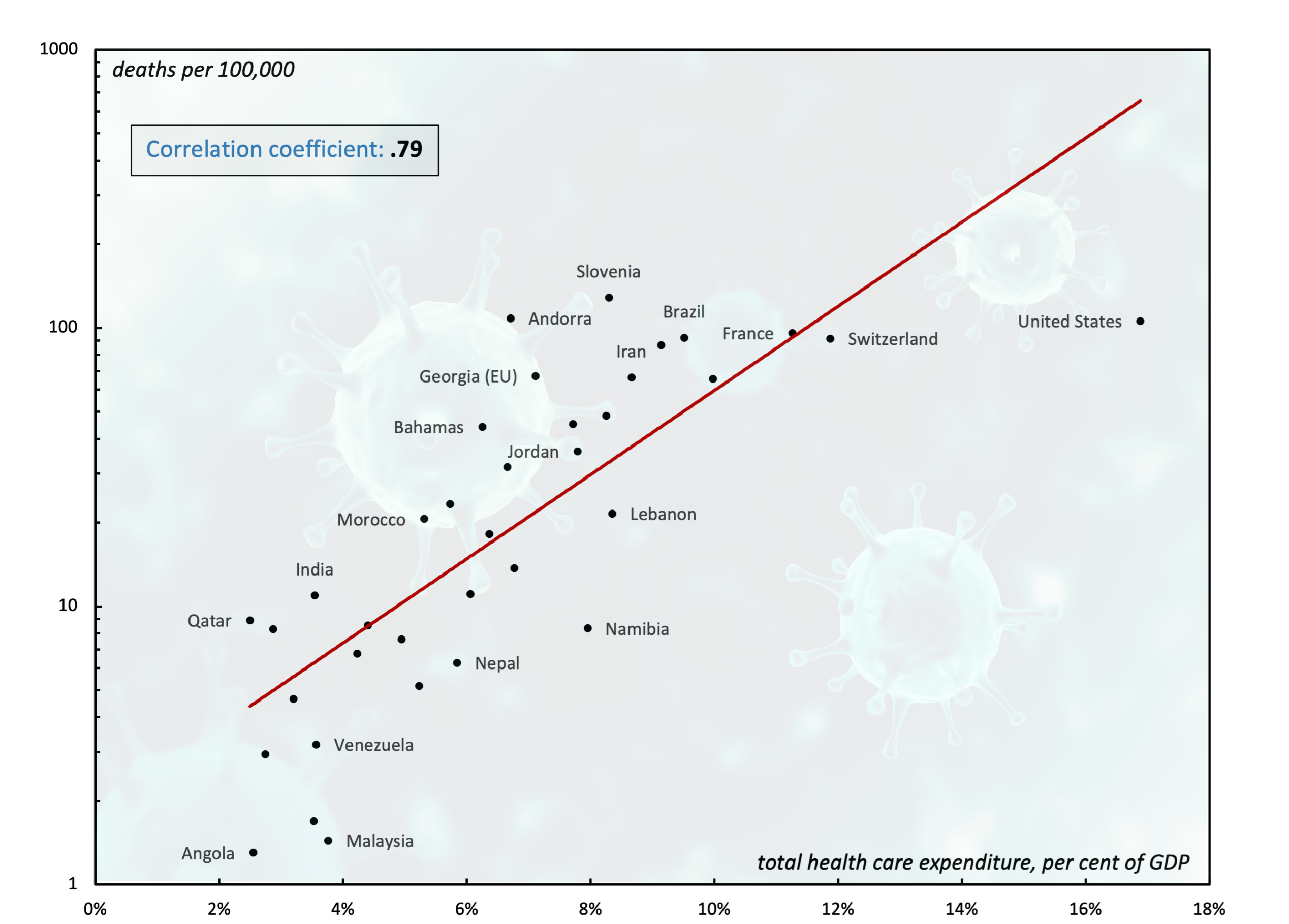

Continue ReadingMouré, ‘Costly Efficiencies: Healthcare Spending, COVID-19, and the Public/Private Healthcare Debate’

Costly Efficiencies Healthcare Spending, COVID-19, and the Public/Private Healthcare Debate CHRIS MOURÉ May 2022 Abstract Proponents of private healthcare often claim that the private sector is more ‘efficient’ at delivering healthcare services. This paper tests the privatization thesis in the context of the COVID-19 pandemic. Using a large sample of countries, I investigate how healthcare […]

Continue ReadingDi Liberto, ‘Hype: The Capitalist Degree of Induced Participation’

Hype The Capitalist Degree of Induced Participation YURI DI LIBERTO April 2022 Abstract Power is usually considered as either a ‘positive’ or ‘negative’ construct, as in the power to force action versus the power to forbid it. This paper explores a hybridized approach to power based on the idea of ‘induced participation’. Building on Bichler […]

Continue ReadingMcMahon, ‘The Political Economy of Hollywood’

Abstract In Hollywood, the goals of art and business are entangled. Directors, writers, actors, and idealistic producers aspire to make the best films possible. These aspirations often interact with the dominant firms that control Hollywood film distribution. This control of distribution is crucial as it enables the firms and other large businesses involved, such as […]

Continue ReadingThe Rise of Human Capital Theory

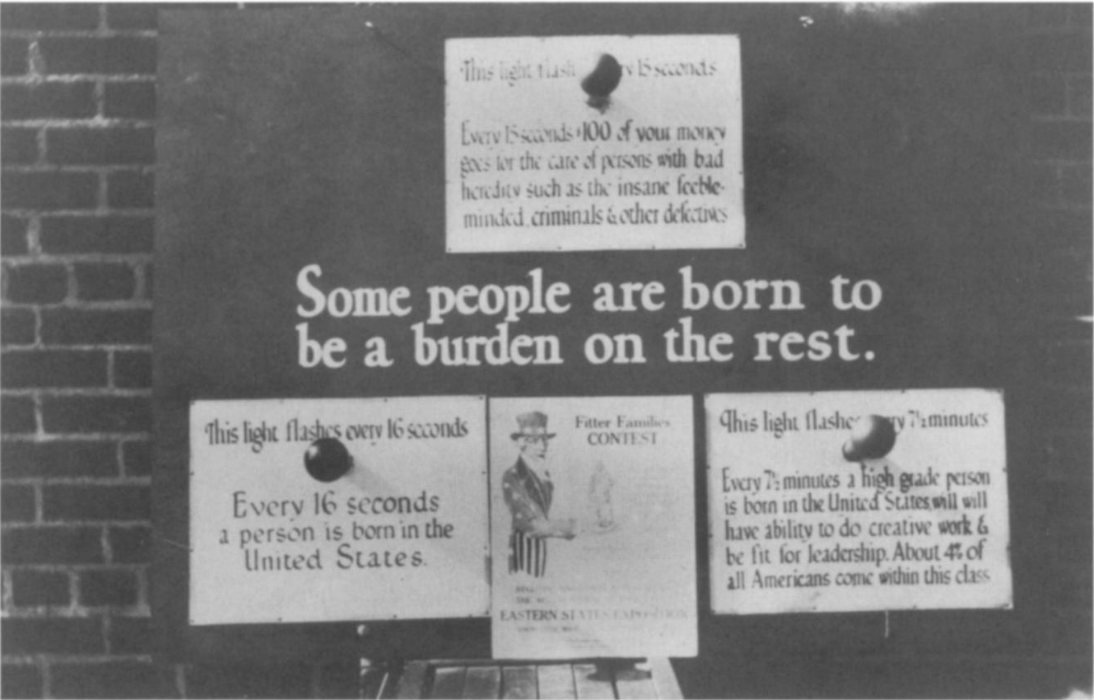

Originally published at Economics from the Top Down Blair Fix If there was an award for the most pernicious scientific idea ever, what theory should get first prize? I would vote for eugenics, a theory that claims we can ‘improve’ humanity through selective breeding. If there was a second prize, I’d give it to human […]

Continue ReadingOwen Lynch, ‘ Book Review: Capital as Power’

Originally published at ownlynch.org Owen Lynch Part A: Overview 1. A Need for Better Theory If you are a well-educated person in the 21st century, you probably have conflicted views. On the one hand, the grand socialist project has had… problems… over the last century. Serious problems. Problems that kill and hurt people, and are […]

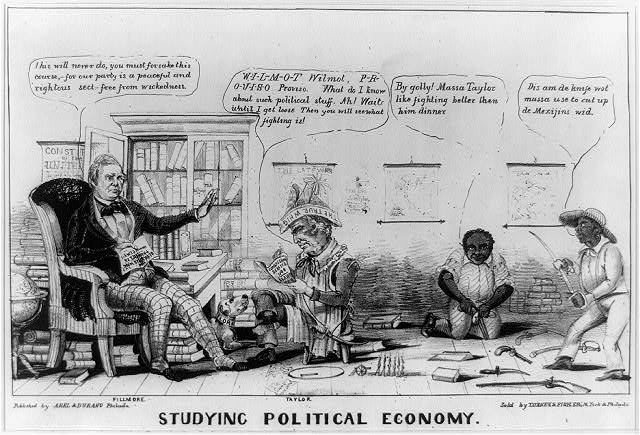

Continue ReadingWhat is (Global) Political Economy?

Originally published at sbhager.com Sandy Brian Hager For four years now I’ve been teaching a postgraduate module called Global Political Economy: Contemporary Approaches. This is one of two core modules for our MA programme in Global Political Economy at City. While my module deals with theoretical approaches, the other core module, taught by my colleague […]

Continue ReadingDi Muzio on ‘Sabotage’

Note from Blair Fix: In a series of essays published in 2013 and 2014 on capitaspower.com, political economist Tim Di Muzio explored the concept of ‘sabotage’ as it applies to capitalist power. I recently rediscovered these essays and was so impressed by them that I have reposted them here as a single piece. About the […]

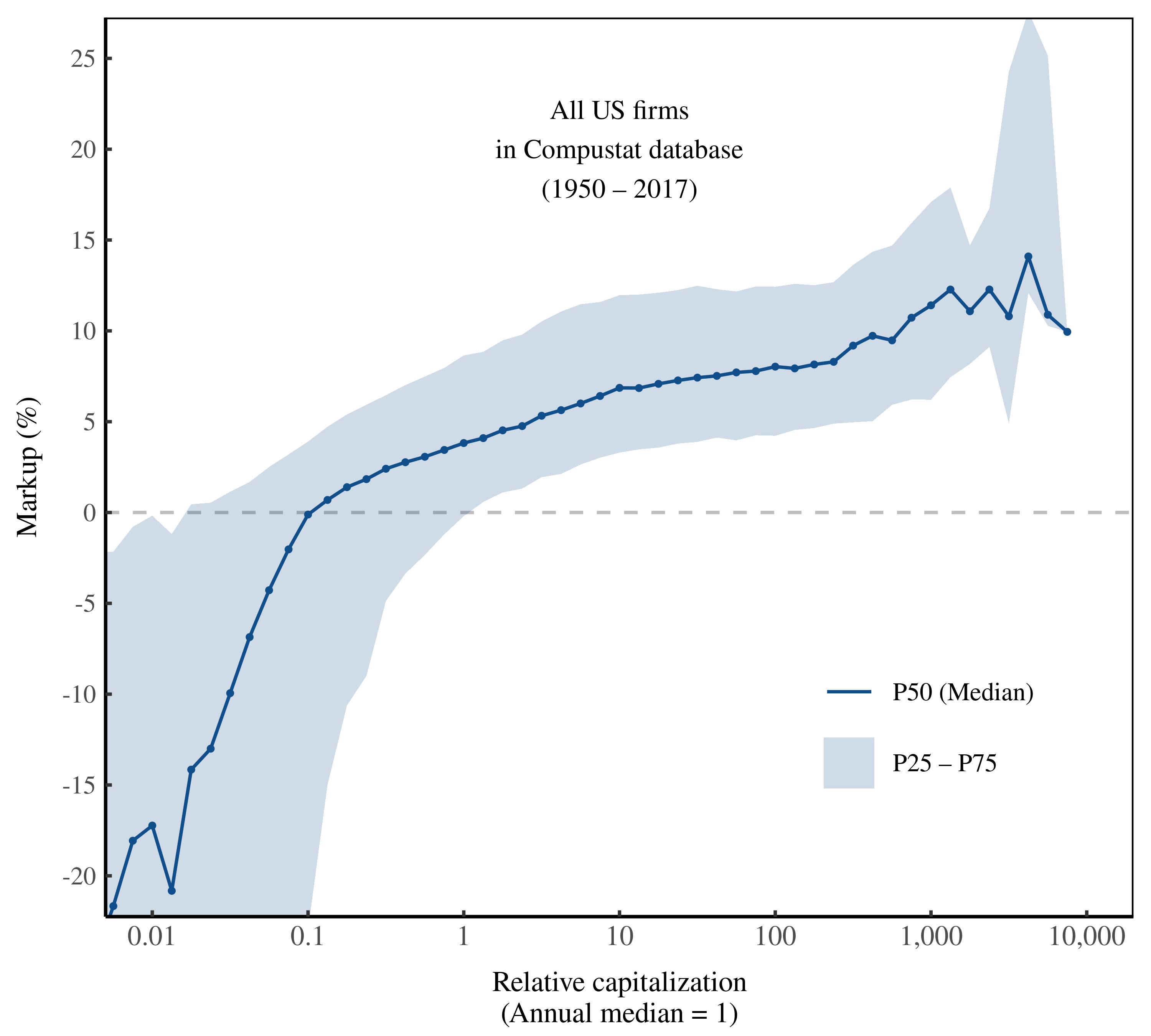

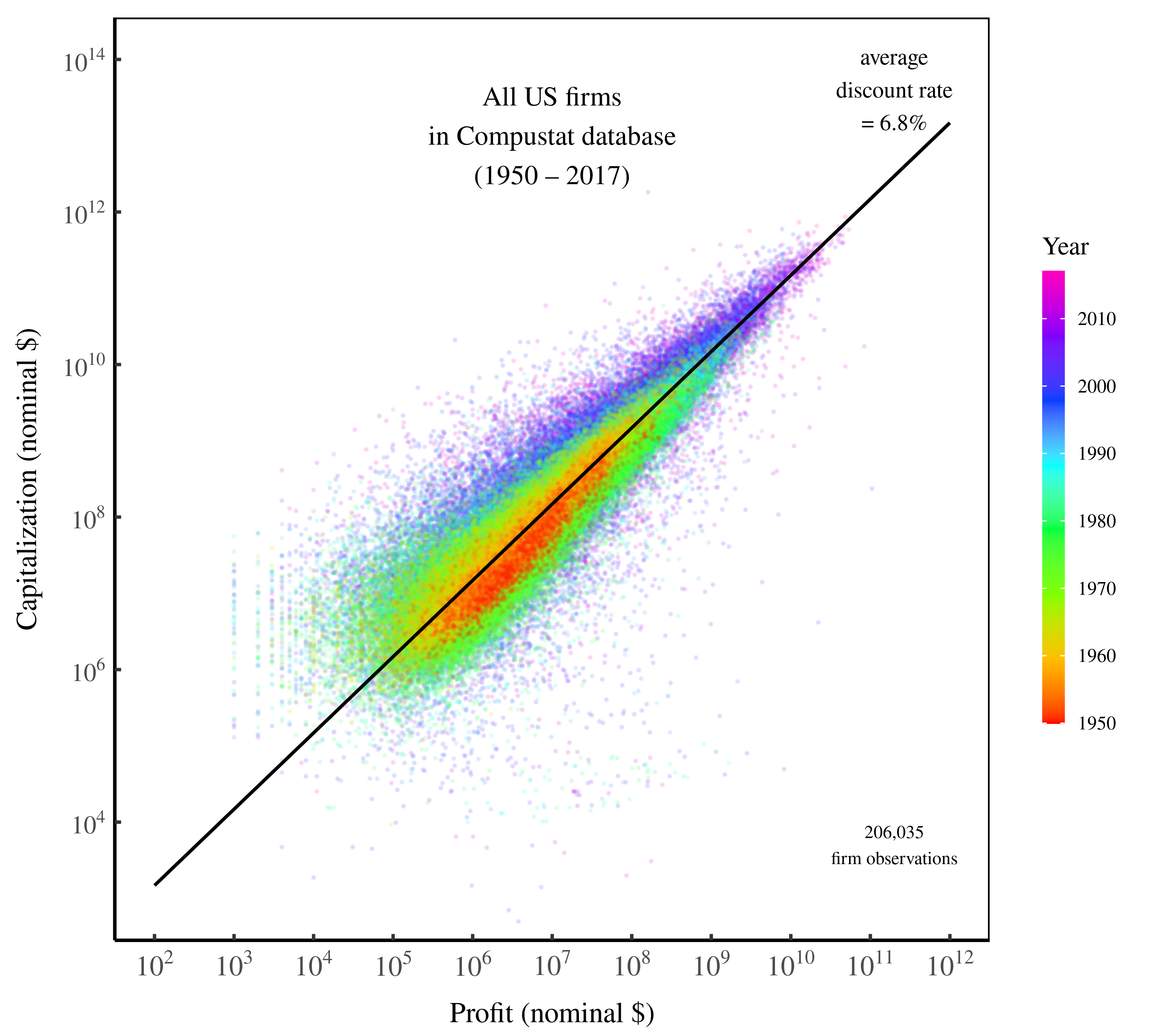

Continue ReadingFix, ‘The Ritual of Capitalization’

Abstract For more than a century, political economists have sought to understand the nature of capital. The prevailing wisdom is that there must be something ‘real’ — some productive capacity — that underpins capitalized values. This thinking, I argue, is a mistake. Building on Jonathan Nitzan and Shimshon Bichler’s theory of capital as power, I […]

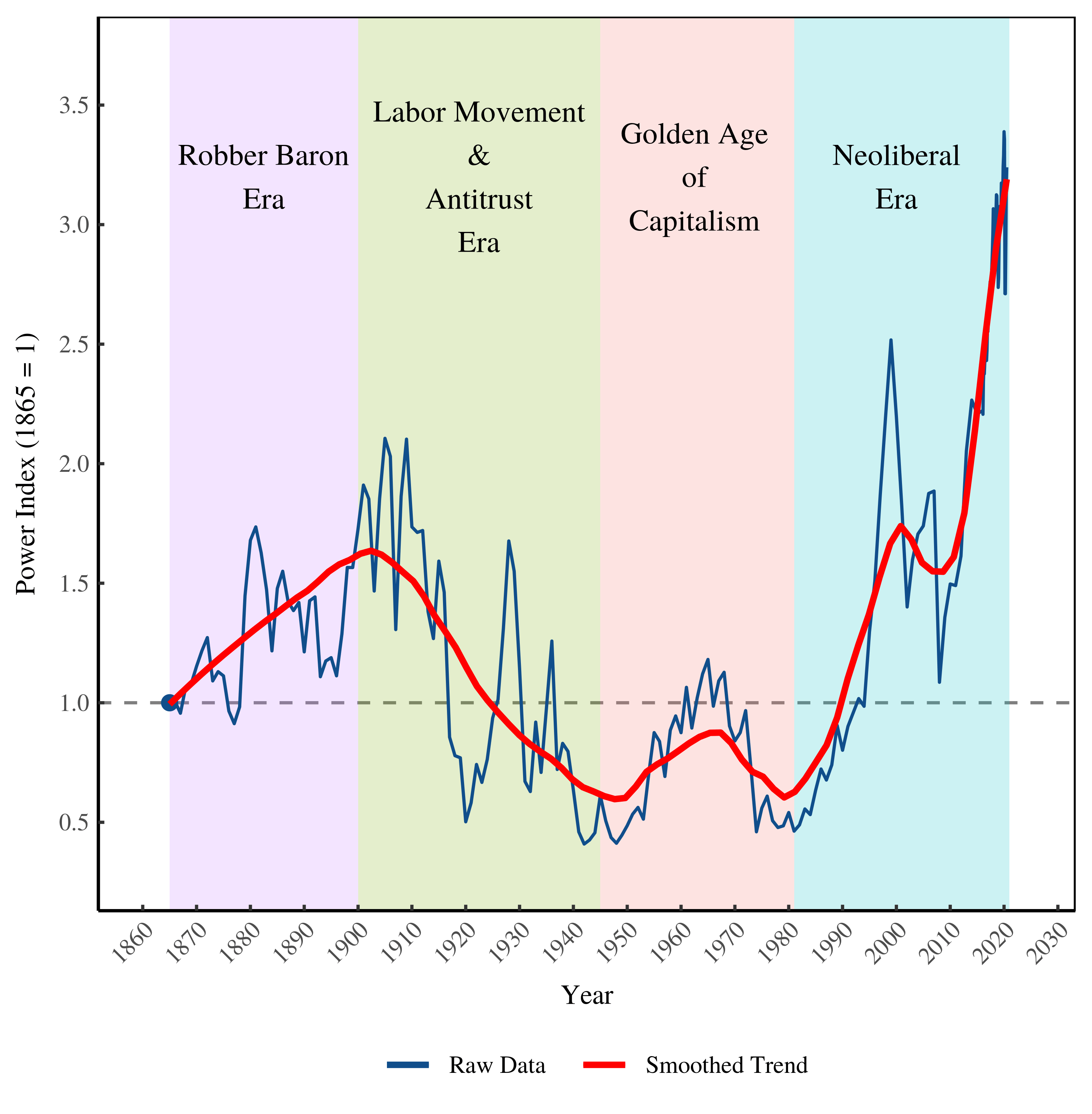

Continue ReadingStocks Are Up. Wages Are Down. What Does it Mean?

Originally published on Economics from the Top Down Blair Fix If you listen carefully, you can hear Jeff Bezos getting richer. There’s the sound again. Another billion in Bezos’ coffers. Let’s put some numbers to this sound of money. Since 2017, Bezos’ net worth has grown by about $4 million per hour — roughly 500,000 […]

Continue ReadingFix, ‘The Rise of Human Capital Theory’

Abstract Today, human capital theory dominates the study of personal income. But this has not always been so. In this essay, I chart the rise of human capital theory, and compare it to the rise (and fall) of eugenics. The comparison, I argue, is an apt one. Eugenics and human capital theory both focus on […]

Continue ReadingBichler & Nitzan, ‘Unbridgeable: why political economists cannot accept capital as power’

Abstract The theory of capital as power (CasP) is radically different from conventional political economy. In the conventional view, mainstream as well as heterodox, capital is seen a ‘real’ economic entity engaged in the production of goods and services, and capitalism is thought of as a mode of production and consumption. Finance in this approach […]

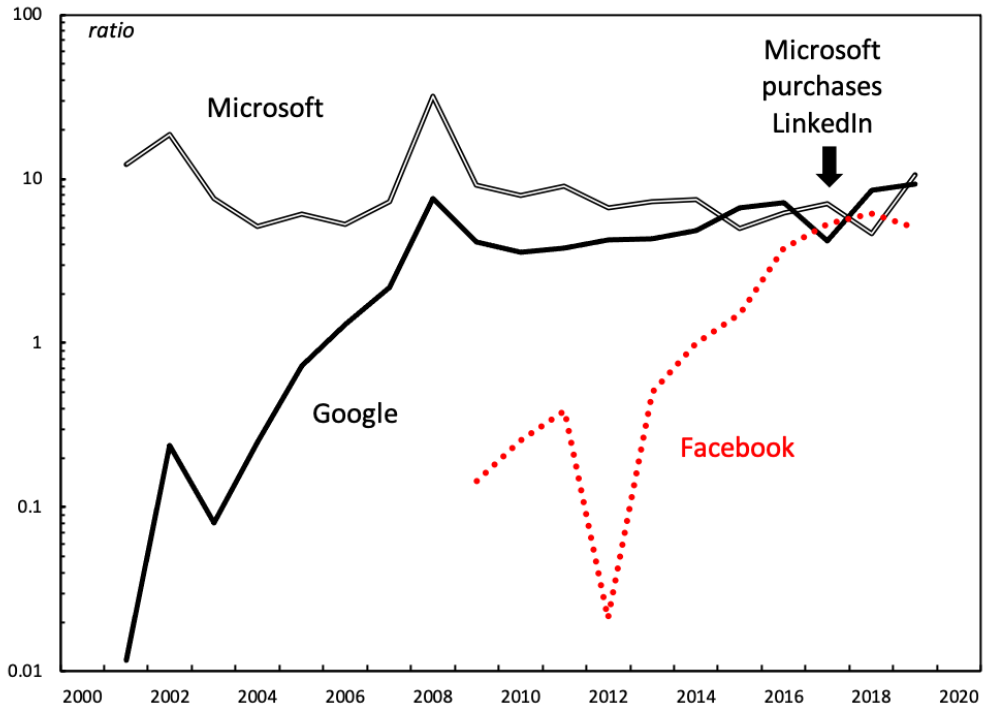

Continue Reading2021/01: Mouré, ‘Soft-wars: The Differential Trajectories of Google and Microsoft – a Capital as Power Analysis’

Abstract According to the capital as power framework, pecuniary earnings, or profits, are a symbolic representation of the struggle for power between different capitalist groups. In this struggle, capitalists measure their own power differentially – that is, relative to other capitalist entities. The focus on differential power, expressed in differential earnings, leads firms to try […]

Continue Reading