Abstract The study of energy transition is crucial to confronting the risks of climate change. However, it lacks a methodical approach to understanding relations of capitalist power, energy regime, and transitional dynamics. This study offers a systematic analysis of how business power shapes and controls socio-technical change under varying energy capture and power accumulation conditions. […]

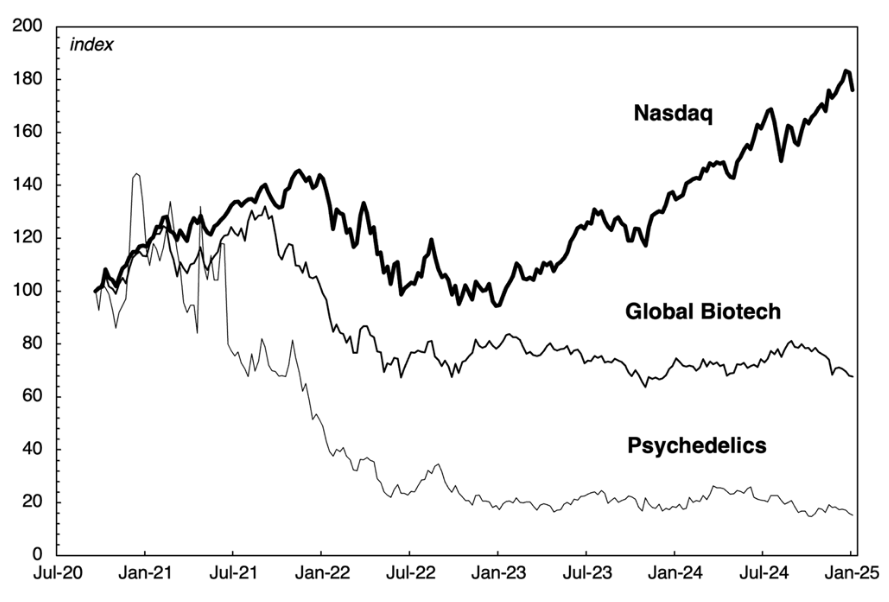

Continue ReadingHager, ‘The Shifting Fortunes of Corporate Psychedelia’

Abstract This article traces the shifting fortunes of for-profit psychedelic medicine through two phases: a boom from 2016 to late 2021, followed by a bust that continued through late 2024. It argues that the forces driving this cycle are best understood through the concept of capitalization, which links present valuations to investor expectations about future […]

Continue ReadingNetflix’s Crisis of Accumulation: chart book for my SCMS2025 presentation

Originally published at notes on cinema James McMahon I will be presenting at the Society for Cinema and Media Studies (SCMS) conference on Friday, April 4 at 6PM. Here is the chart book for the presentation, which contains sources and notes on all of the figures: [ PDF of SCMS2025 Chart Book ] Here is […]

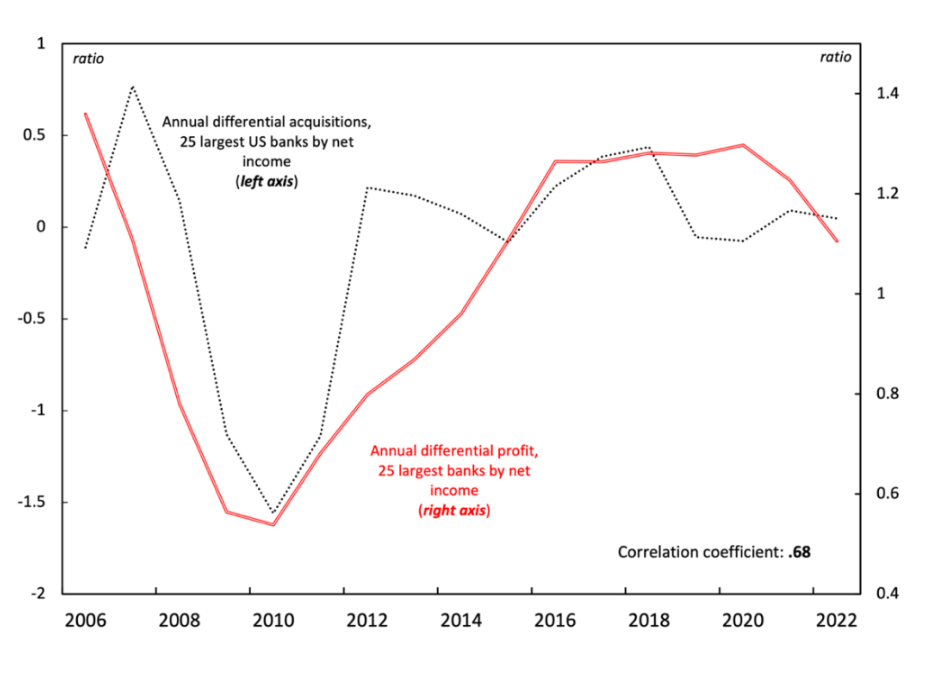

Continue ReadingMouré, ‘Consolidation and Crisis in the US Banking Sector 1980-2022’

Abstract Much of the economic analysis of banking crises focuses on the interplay between concentration and stability. A common theory is that concentration is associated with greater stability, whereas competition is associated with instability. In this view, there is a trade-off between, on the one hand, the higher prices and higher profits associated with a […]

Continue ReadingAnderson, ‘From Operation Warp Speed to TRIPS. Vaccines as Assets’

Abstract This chapter examines the political economy of biopharmaceutical innovation, focusing primarily on vaccines in the Covid-19 pandemic. This analysis aims to make visible the deep entanglements that entrench an extractive and dysfunctional innovation ecosystem, calcifying inequities in global access to essential medicines. The chapter argues that the current inequities in vaccine access are not […]

Continue ReadingBichler & Nitzan, ‘Blood and Oil in the Orient: A 2023 Update’

Abstract The 2023 war between Hamas and Israel elicits many different explanations. As with previous regional hostilities, here too, the pundits and commentators have numerous overlapping processes to draw on – from the struggle between the Zionist and Palestinian national movements, to the deep hostility between the Rabbinate and Islamic churches, to the many conflicts […]

Continue ReadingBichler & Nitzan, ‘Regime Change and Dominant Capital: Lessons from Israel’

Abstract Israel’s ongoing crisis – or ‘judicial coup’ in popular parlance – has elicited two opposite responses. The first comes from global rating agencies, economists and investment strategists who see Israel’s country risk rising. The opposite reaction, by Prime Minister Netanyahu and his acolytes, insists that the ‘coup’ is much ado about nothing, and that […]

Continue ReadingBichler & Nitzan, ‘Regime Change and Dominant Capital: Lessons from Israel’

Abstract Israel’s ongoing crisis – or ‘judicial coup’ in popular parlance – has elicited two opposite responses. The first comes from global rating agencies, economists and investment strategists who see Israel’s country risk rising. The opposite reaction, by Prime Minister Netanyahu and his acolytes, insists that the ‘coup’ is much ado about nothing, and that […]

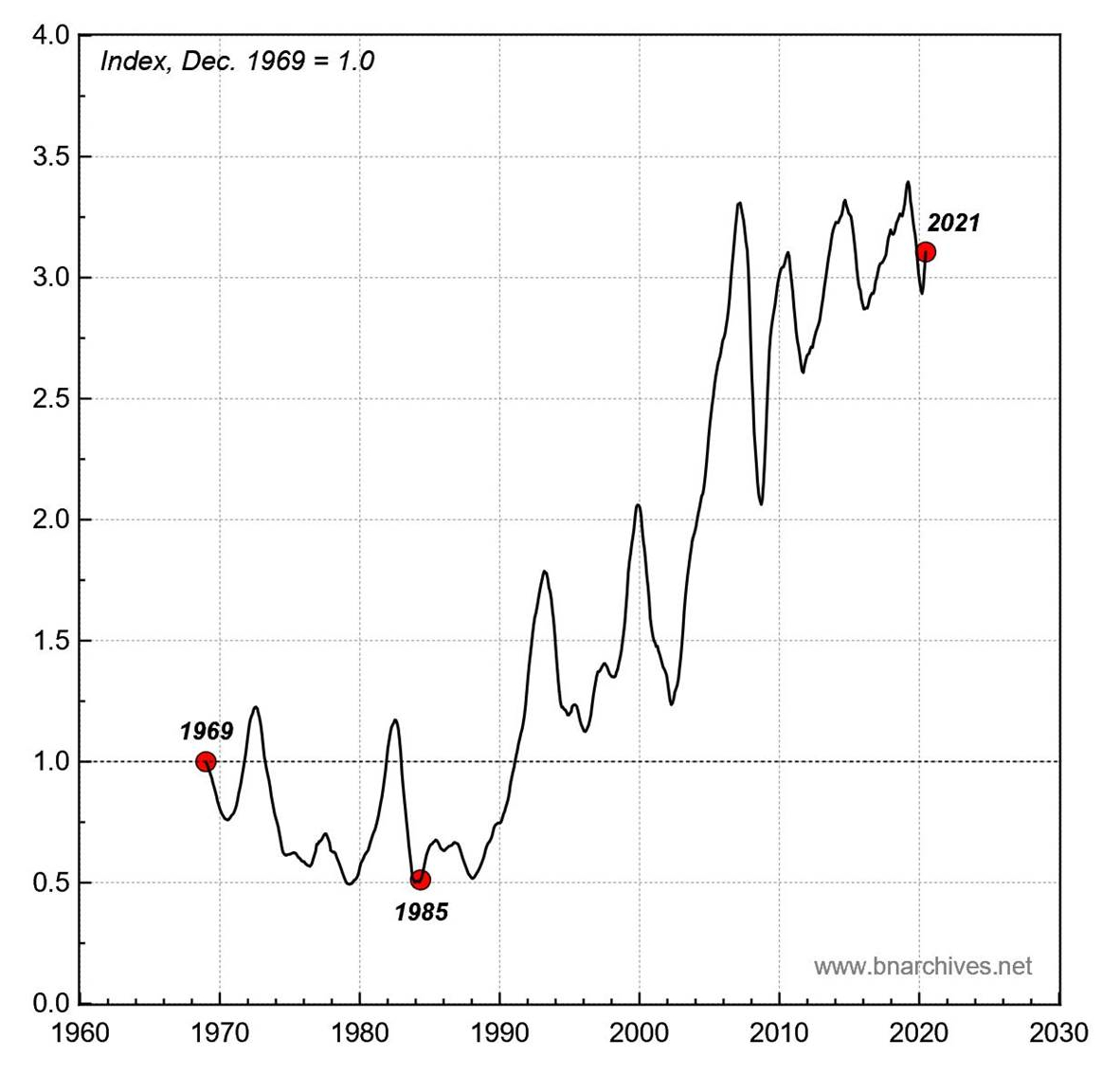

Continue ReadingMouré, ‘No Shortage of Profit: Technological Change, Chip ‘Shortages’, and Capital Accumulation in the Semiconductor Business’

Abstract Rapid technological change is often touted as a fundamental reality of capitalist societies. It is also often presented as concrete evidence for the supposed progressive improvement of material well-being that characterises the capitalist system of social order. Since its emergence in the mid-20th century, semiconductor technology in many ways exemplifies this reality. Yet the […]

Continue ReadingMcMahon, ‘The Political Economy of Hollywood’

Abstract In Hollywood, the goals of art and business are entangled. Directors, writers, actors, and idealistic producers aspire to make the best films possible. These aspirations often interact with the dominant firms that control Hollywood film distribution. This control of distribution is crucial as it enables the firms and other large businesses involved, such as […]

Continue ReadingMouré, ‘Soft-wars: A Capital-as-Power Analysis of Google’s Differential Power Trajectory’

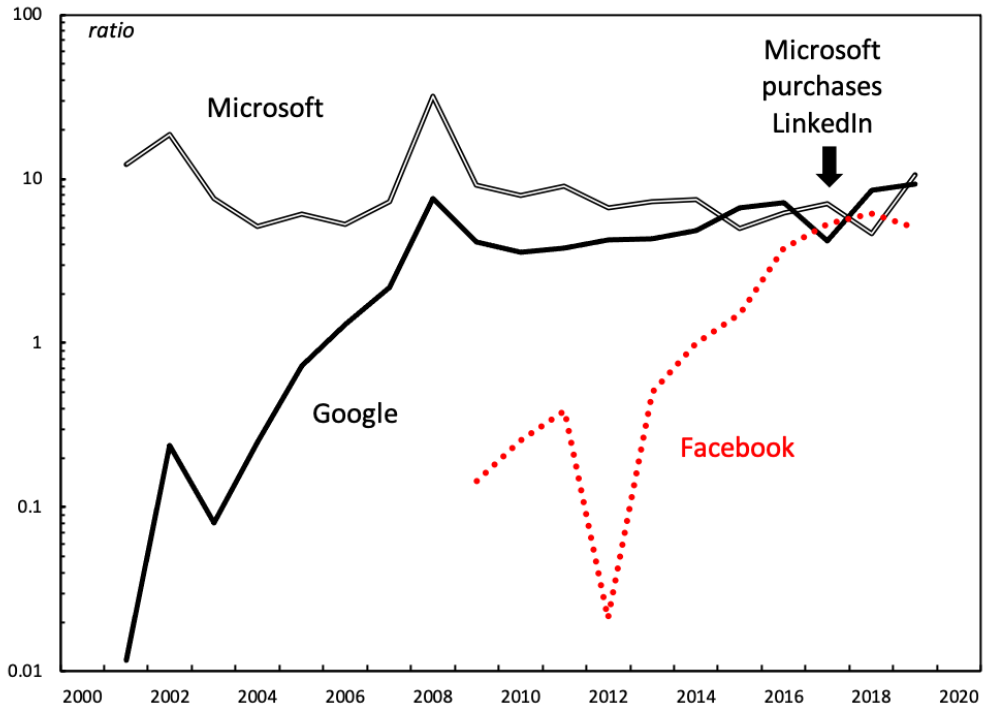

Soft-wars A Capital-as-Power Analysis of Google’s Differential Power Trajectory CHRIS MOURÉ October 2021 Abstract The capital as power framework, developed by Jonathan Nitzan and Shimshon Bichler, argues that the aim of business is not ‘profit maximization’ but the differential accumulation of social power. Using this framework as a theoretical starting point, I analyze the differential […]

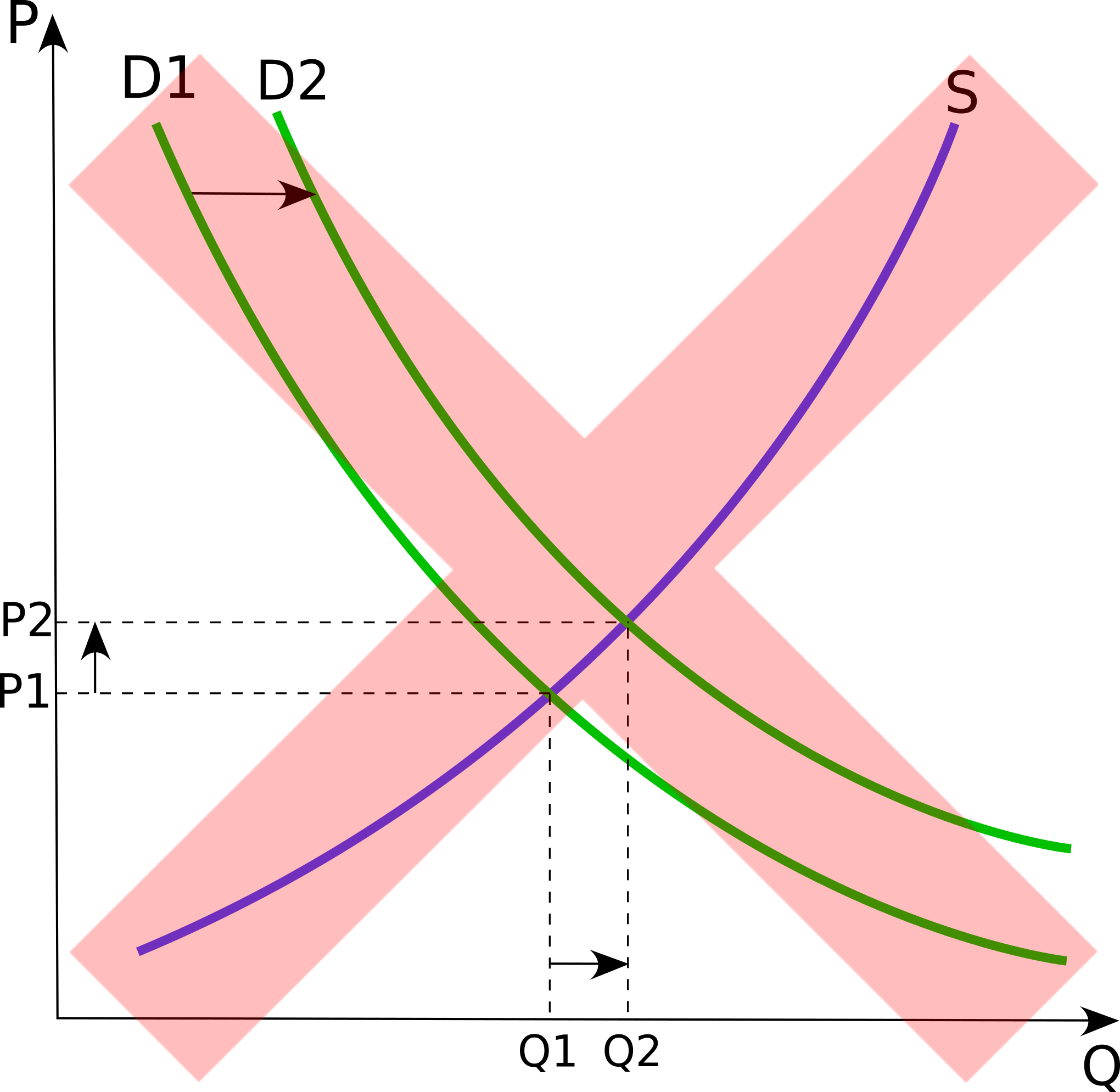

Continue ReadingSupply and Demand Deconstructed

Originally published on Economics from the Top Down Blair Fix Prices are caused by supply and demand, right? So say neoclassical economists. If you’ve bought their fairy tale, I recommend you watch the video below. In it, Jonathan Nitzan demolishes the neoclassical theory of prices. It’s a master lesson in how to deconstruct a theory. […]

Continue Reading2021/01: Mouré, ‘Soft-wars: The Differential Trajectories of Google and Microsoft – a Capital as Power Analysis’

Abstract According to the capital as power framework, pecuniary earnings, or profits, are a symbolic representation of the struggle for power between different capitalist groups. In this struggle, capitalists measure their own power differentially – that is, relative to other capitalist entities. The focus on differential power, expressed in differential earnings, leads firms to try […]

Continue ReadingDow, ‘Canada’s Carbon Capitalism: In the Age of Climate Change’

Abstract This historically and critically informed dissertation investigates the question why Canada has become one of the world’s leaders in promoting fossil fuels through its unconventional hydrocarbon industry in spite of the science and growing awareness of climate change. Using a critical historical political economy approach that encompasses both ecological or biophysical scientific realities and […]

Continue Reading2019/01: Bichler & Nitzan, ‘CasP’s Differential Accumulation versus Veblen’s Differential Advantage (Revised and Expanded)’

Abstract This paper clarifies a common misrepresentation of our theory of capital as power, or CasP. Many observers tend to box CasP as an ‘institutionalist’ theory, tracing its central process of ‘differential accumulation’ to Thorstein Veblen’s notion of ‘differential advantage’. This view, we argue, betrays a misunderstanding of CasP, Veblen or both. First, we are […]

Continue Reading2018/08: Bichler & Nitzan, ‘CasP’s Differential Accumulation versus Veblen’s Differential Advantage’

Abstract This paper clarifies a common misrepresentation of our theory of capital as power, or CasP. Many observers tend to box CasP as an ‘institutionalist’ theory, tracing its central process of ‘differential accumulation’ to Thorstein Veblen’s notion of ‘differential advantage’. This view, we argue, betrays a misunderstanding of CasP, Veblen or both. As we show, […]

Continue ReadingThe CasP Project Past, Present, Future

The CasP Project Past, Present and Future SHIMSHON BICHLER and JONATHAN NITZAN April 2018 Abstract The study of capital as power (CasP) began when we were students in the 1980s and has since expanded into a broader project involving a growing number of researchers and new areas of inquiry. This paper provides a bird’s-eye view […]

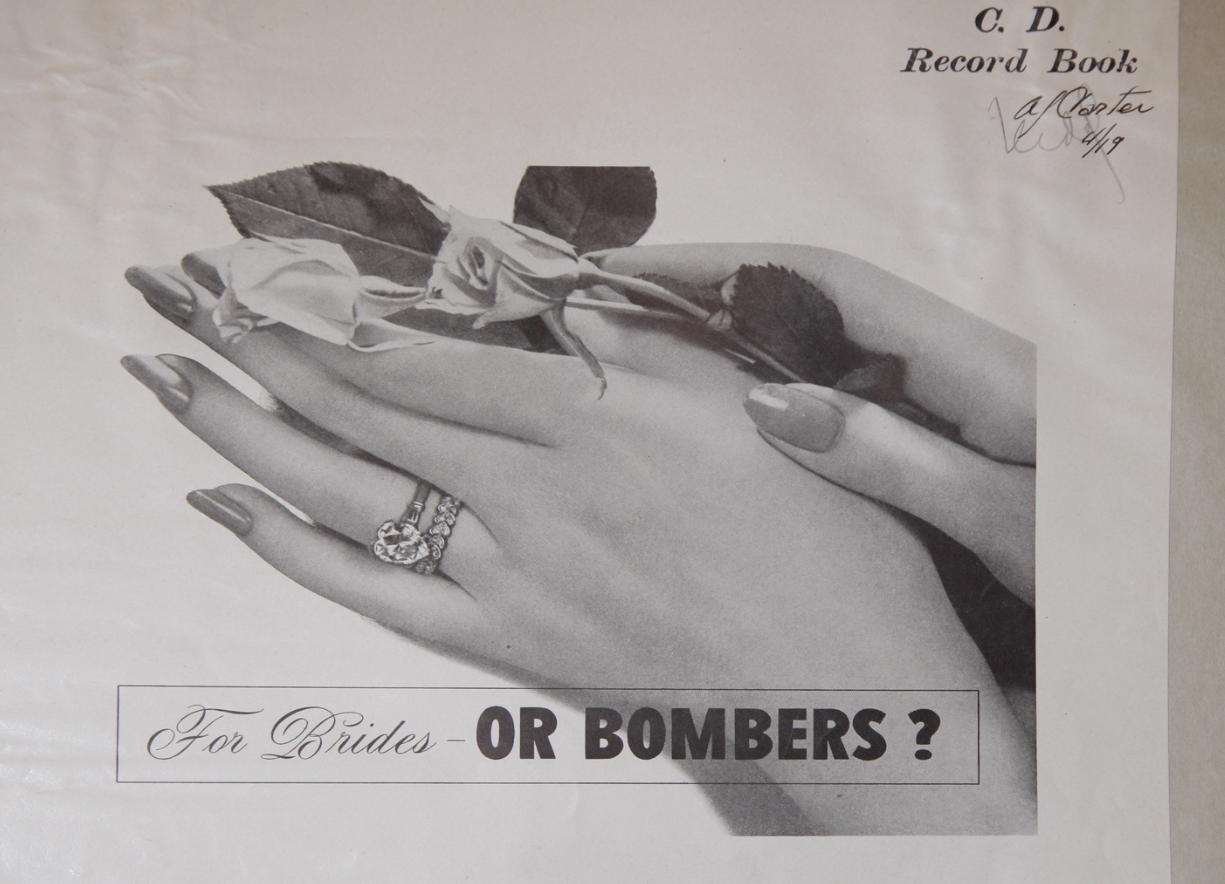

Continue ReadingNo. 2017/01: Cochrane, ‘Differentiating Diamonds: Transforming Knowledge and the Accumulation of De Beers’

Abstract In 1939, the De Beers diamond company faced a dire situation. The company’s accumulation had been dwindling for decades. The Great Depression not only pushed diamond sales to historic lows, it shifted American attitudes around consumption and thriftiness to the detriment of the luxury object. In this article, I bring together Liz McFall’s assertion […]

Continue ReadingNo. 2016/5: Cochrane, ‘Disobedient Things: The Deepwater Horizon oil spill and accounting for disaster’

Abstract Analysis of the Deepwater Horizon disaster and the accumulatory decline of BP demonstrates both the analytical efficacy of the capital-as-power (CasP) approach to value theory, and the irreducible role of objects in the process of accumulation. Rather than productivity per se, accumulation depends on control of productivity. Owners’ control is over both the human […]

Continue ReadingNo. 2016/02: Cochrane, ‘Why Diamonds and De Beers?, or The Need for Accumulation Studies’

Abstract I successfully defended my dissertation in December. This served as the introductory presentation for the defence. In it, I explain what I tried to do with the dissertation, the methods I used, and the larger project I hope it is initiating. Specifically, I suggest there is a need for accumulation studies as a field […]

Continue Reading