Max Ajl A review of Jonathan Nitzan and Shimshon Bickler’s The Scientist and the Church. Originally published at Jadaliyya Howard Page, a director at what was then Exxon, was once asked, “What would have happened if Iraq production had also surged during the 1960’s,” like that of Saudi Arabia and Iran. He responded, “I admit […]

Continue ReadingNo. 2015/04: Bichler & Nitzan, ‘The CasP Project: Past, Present, Future

Abstract The study of capital as power (CasP) began when we were students in the 1980s and has since expanded into a broader project involving a growing number of researchers and new areas of inquiry. This paper provides a bird’s-eye view of the CasP journey. It explores what we have learned so far, reviews ongoing […]

Continue ReadingVideo of Jonathan Nitzan's Presentation – The CasP Project: Past, Present, Future

Bichler, Shimshon and Nitzan, Jonathan. (2015). Presentation at York University. 20. October. 2015. The study of capital as power began when we were students in the 1980s and has since expanded into a broader project, involving a growing number of researchers and new areas of inquiry. The presentation explores what we have learned so far, […]

Continue ReadingThe Renminbi on the World Stage

DT Cochrane The IMF recently announced that China’s currency, the CYN (Chinese Yuan Renminbi), would be included in the IMF’s basket of currencies, known as the SRD (special drawing rights). The designation comes after China adopted certain reforms in accordance with International Monetary Fund (IMF) policies. The CYN will comprise 11% of the basket, with […]

Continue ReadingCochrane, ‘What’s Love Got to Do with It? Diamonds and the Accumulation of De Beers, 1935-55’

Abstract What is accumulation? Visibly, accumulation is a quantitative process, demarcated in financial quantities. However, what is the meaning of those quantities? This question has been the subject of great debate within political economic thought. A new theory of accumulation, capital as power (CasP), argues that the financial quantities of accumulation express the distribution of […]

Continue ReadingIs Hollywood running out of risk?

Shimshon Bichler and Jonathan Nitzan Repost from Real-World Economics Review Blog If we are to believe the conventional creed, Hollywood films are highly risky investments. According to De Vany, revenue forecasts have zero precision, which is just a way of saying that ‘anything can happen’. . . . The ‘nobody knows’ principle . . . […]

Continue ReadingSpeaker Series on Capital as Power (October-November, 2015)

Organized by the Forum on Capital as Power and sponsored by the York Department of Political Science and Graduate Program in Social and Political Thought (open to all, with refreshments) Existing theories of capitalism, mainstream as well as heterodox, view capitalism as a mode of production and consumption. This speaker series interrogates capitalism as a […]

Continue ReadingThe Enduring Power of GE The Enduring Power of GE (Tuesday Nov . 17. 3-5pm)

Abstract or Brief Description General Electric (GE) has demonstrated extraordinary longevity in the upper echelon of U.S. corporations. From 1925 to 2013, the company has never fallen below 10th in the rankings of firms by market capitalization. The only other firm to match this feat is the oil giant ExxonMobil. GE’s durability is remarkable given […]

Continue ReadingBlockbuster Cinema: Hollywood’s Obsession with Low Risk (Tuesday, Nov 3, 3-5pm)

Blockbuster Cinema: Hollywood’s Obsession with Low Risk York University presentation by James McMahon ABSTRACT: Hollywood is obsessed with blockbusters – for 20 years the major studios have been making them, and it appears that blockbuster cinema will be with us for many years to come. This presentation will theoretically and empirically explain how blockbusters, and […]

Continue ReadingMcMahon, ‘What Makes Hollywood Run? Capitalist Power, Risk and the Control of Social Creativity’

Abstract This dissertation combines an interest in political economy, political theory and cinema to offer an answer about the pace of the Hollywood film business and its general modes of behaviour. More specifically, this dissertation seeks to find out how the largest Hollywood firms attempt to control social creativity such that the art of filmmaking […]

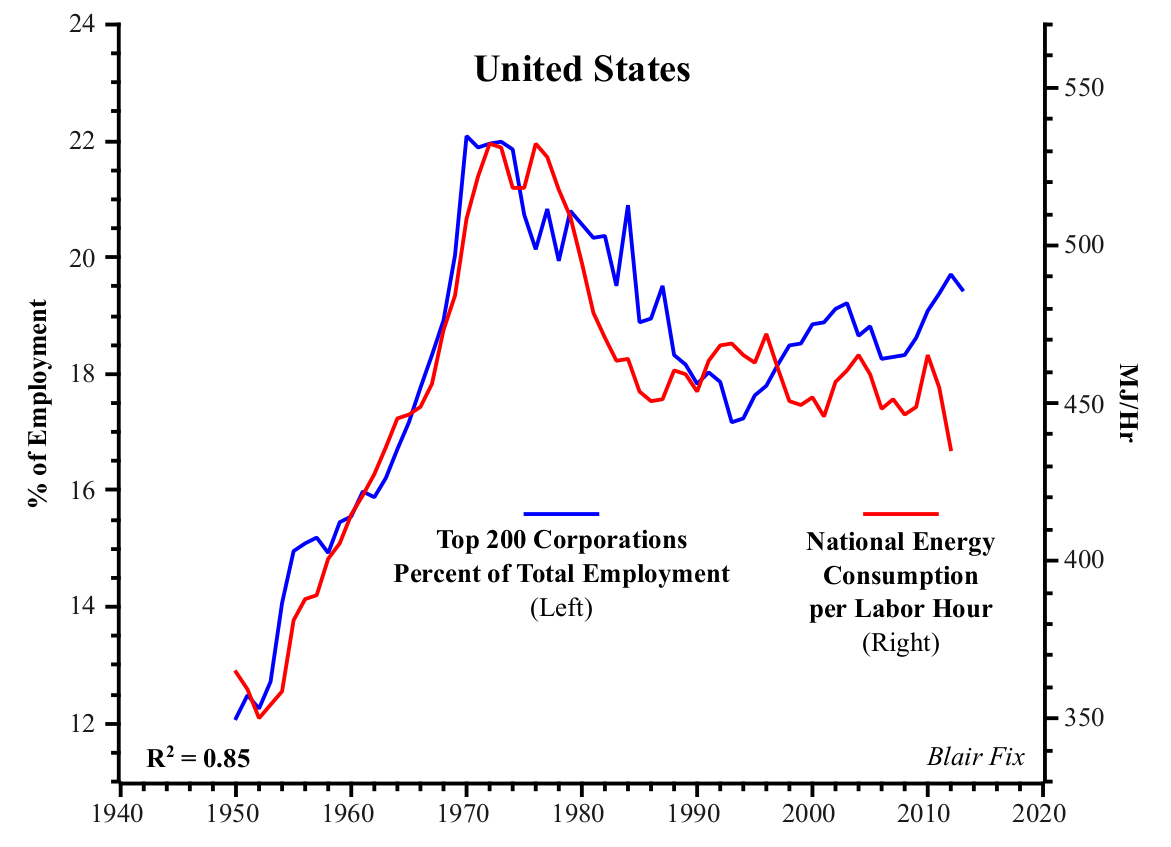

Continue ReadingPutting Power Back into Growth Theory

Putting Power Back Into Growth Theory BLAIR FIX June 2015 Abstract Neoclassical growth theory assumes that economic growth is an atomistic process in which changes in distribution play no role. Unfortunately, when this assumption is tested against real-world evidence, it is systematically violated. This paper argues that a reality-based growth theory must reject neoclassical principles […]

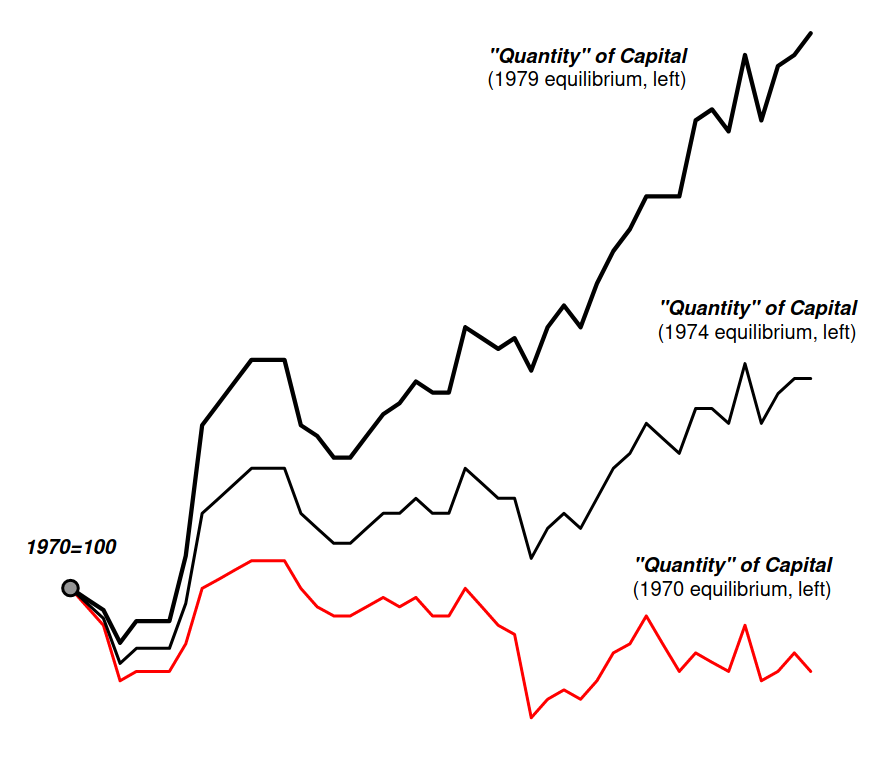

Continue ReadingBichler & Nitzan, ‘Capital Accumulation: Fiction and Reality’

Abstract What do economists mean when they talk about “capital accumulation”? Surprisingly, the answer to this question is anything but clear, and it seems the most unclear in times of turmoil. Consider the “financial crisis” of the late 2000s. The very term already attests to the presumed nature and causes of the crisis, which most […]

Continue ReadingDi Muzio, ‘Carbon Capitalism: Energy, Social Reproduction and World Order’

Abstract Modern civilization and the social reproduction of capitalism are bound inextricably with fossil fuel consumption. But as carbon energy resources become scarcer, what implications will this have for energy-intensive modes of life? Can renewable energy sustain high levels of accumulation? Or will we witness the end of existing capitalist economies? This book provides an […]

Continue ReadingCapital as Power: Broadening the Vista – (Conference Postponed to 2016)

(Conference Postponed to 2016) The theory of capital as power (CasP) offers a radical alternative to mainstream and Marxist theories of capitalism. It argues that capital symbolizes and quantifies not utility or labour but organized power writ large, and that capitalism is best understood and challenged not as a mode of consumption and production, but […]

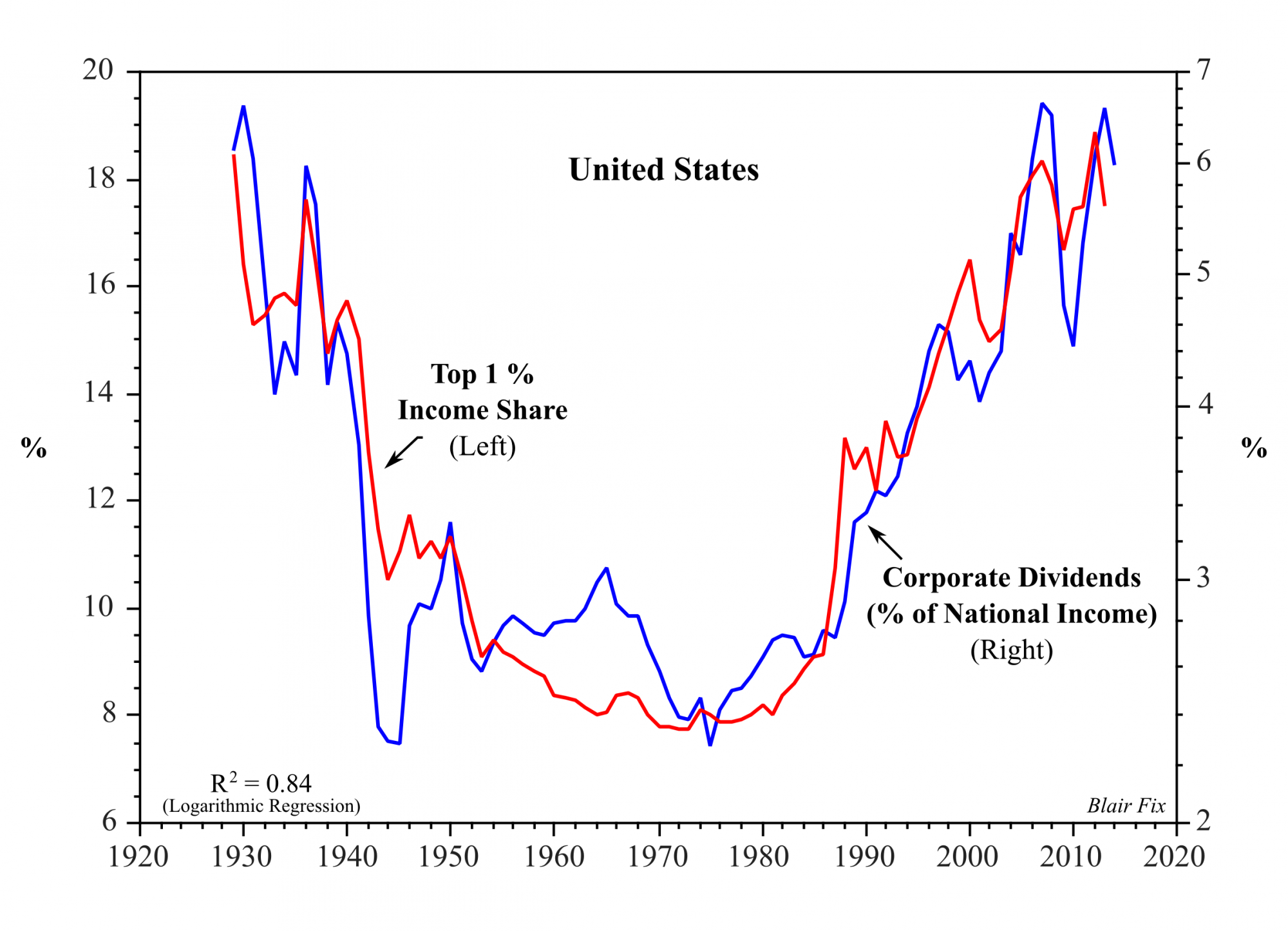

Continue ReadingSome Important Limitations of Income Inequality Data

Jonathan Nitzan Blair Fix, a PhD student in the Faculty of Environmental Studies at York University in Toronto, points to some important limitations of income inequality data. In a recent posting on capitalaspower.com, Fix shows that, in the case of the U.S., the Top 1% income share correlates not with the share of capitalists in […]

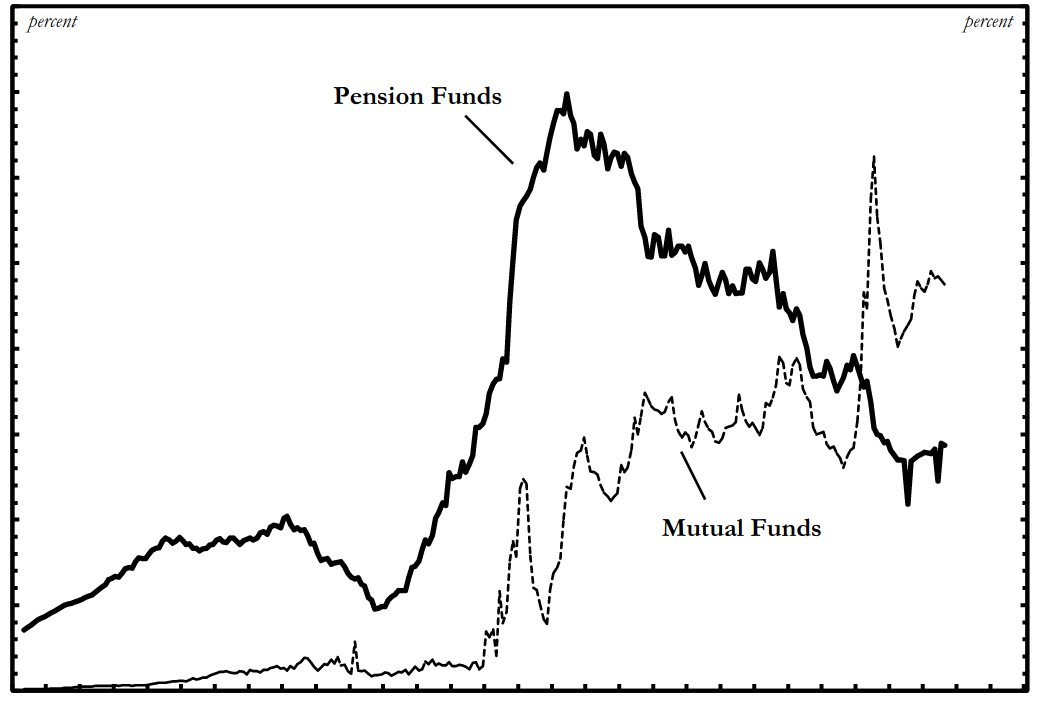

Continue ReadingHager, ‘Corporate Ownership of the Public Debt’

Abstract In various writings Karl Marx made references to an ‘aristocracy of finance’ in Western Europe and the United States that dominated ownership of the public debt. Drawing on original research, this article offers the first comprehensive analysis of public debt ownership within the US corporate sector. The research shows that over the past three […]

Continue Reading