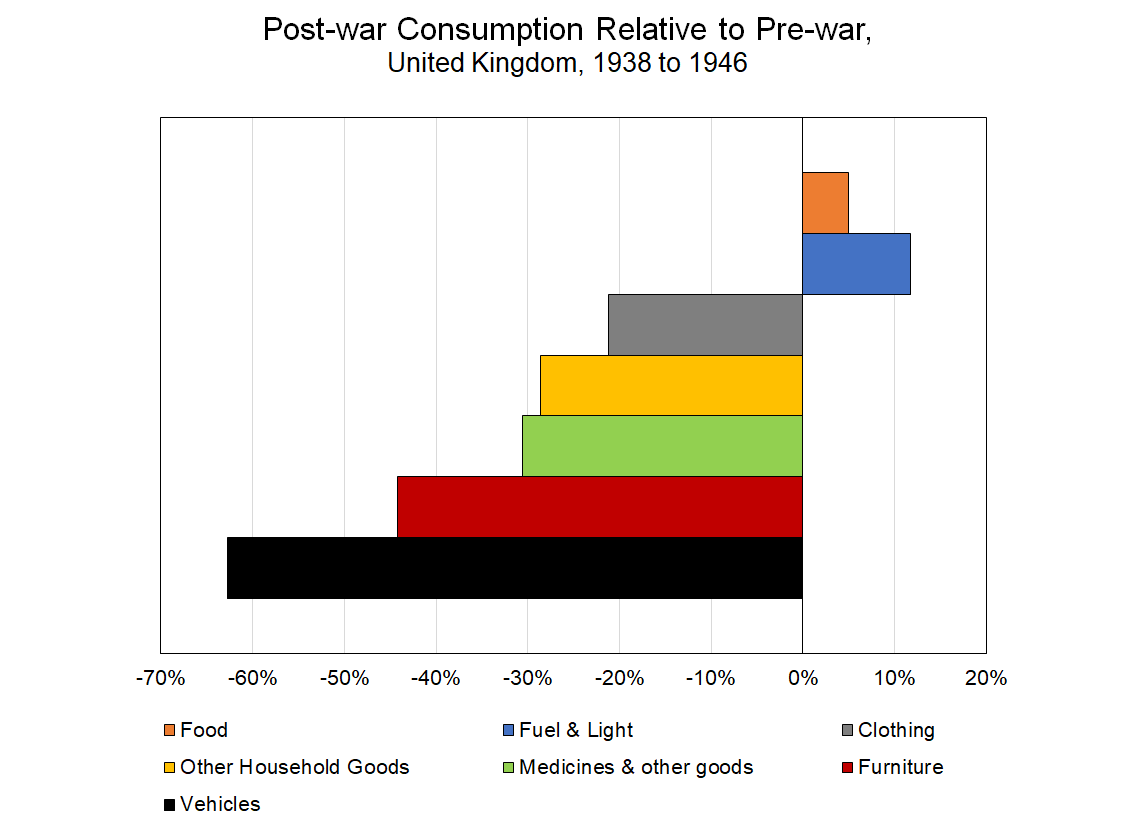

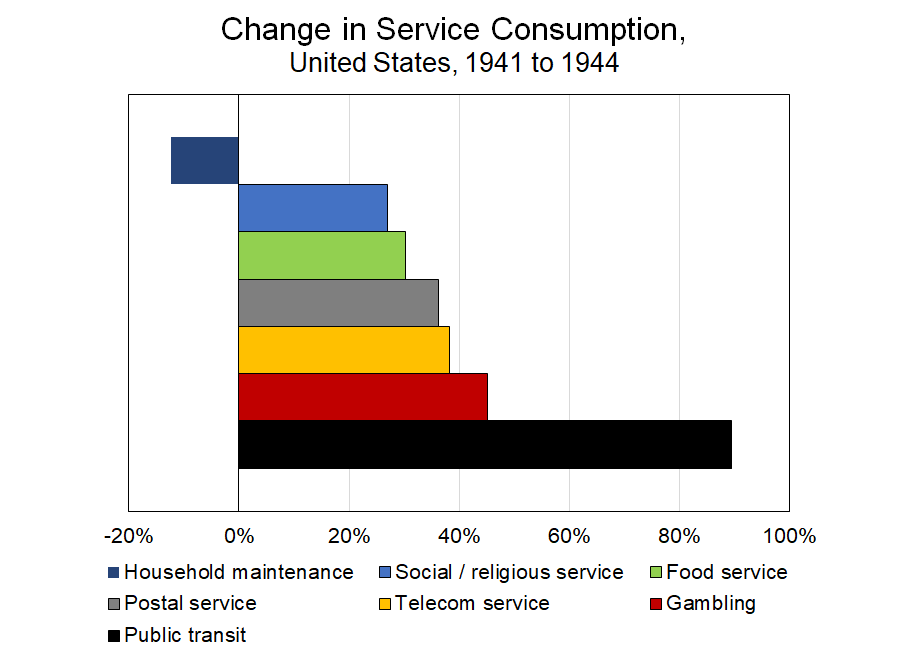

Originally published at dtcochrane.com DT Cochrane In Part 2, I looked at the shifts in U.S. household consumption that occurred during WWII. While aggregate consumption increased alongside massive government intervention, the qualitative mix of that consumption changed in some drastic ways. This analysis was intended to augment the analogy made by J.W. Mason and Mike […]

Continue ReadingRemaking Our Economies with Wartime Analogies, Part 2

Originally published at dtcochrane.com DT Cochrane In Part 1, I explained the motivation for this series. I want to use the analogy of WWII, as invoked by economists JW Mason and Mike Konczal in an NYT op-ed, to consider how we ought to manage a potential post-pandemic economic boom. In this post, I will look […]

Continue ReadingRemaking Our Economies with Wartime Analogies, Part 1

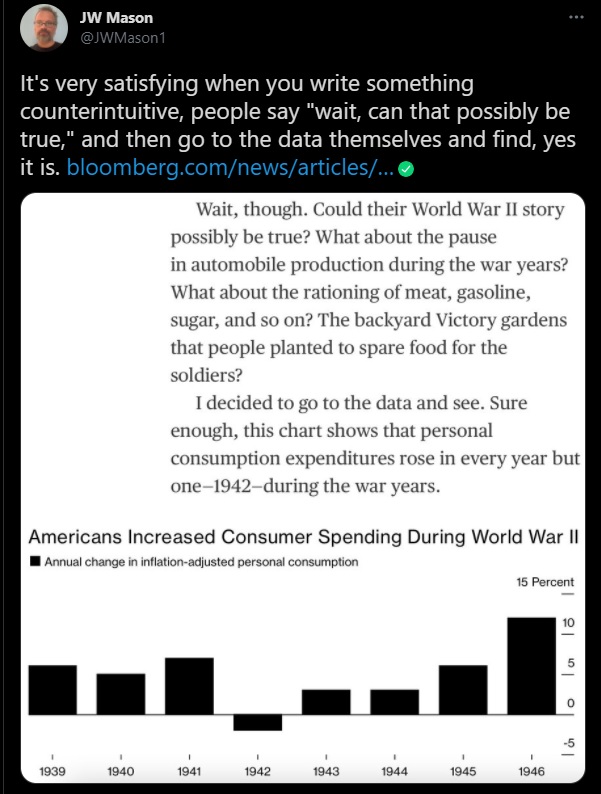

Originally published at dtcochrane.com DT Cochrane Economist JW Mason recently tweeted the following: Bloomberg writer Peter Coy was motived to perform this research by an NYT op-ed from Mason and Mike Konczal. Mason and Konczal’s primary argument is that we can have a post-pandemic economic boom, but that it needs to be properly managed. They […]

Continue ReadingWhy ‘General Intelligence’ Doesn’t Exist

Originally published on Economics from the Top Down Blair Fix Donald Trump took an IQ test … you’ll never guess what he scored! Apologies. That was my attempt at clickbait.1 Now that I’ve hooked you, let’s talk about the elephant in the room. No, not Donald Trump. Let’s talk about IQ. For as long as […]

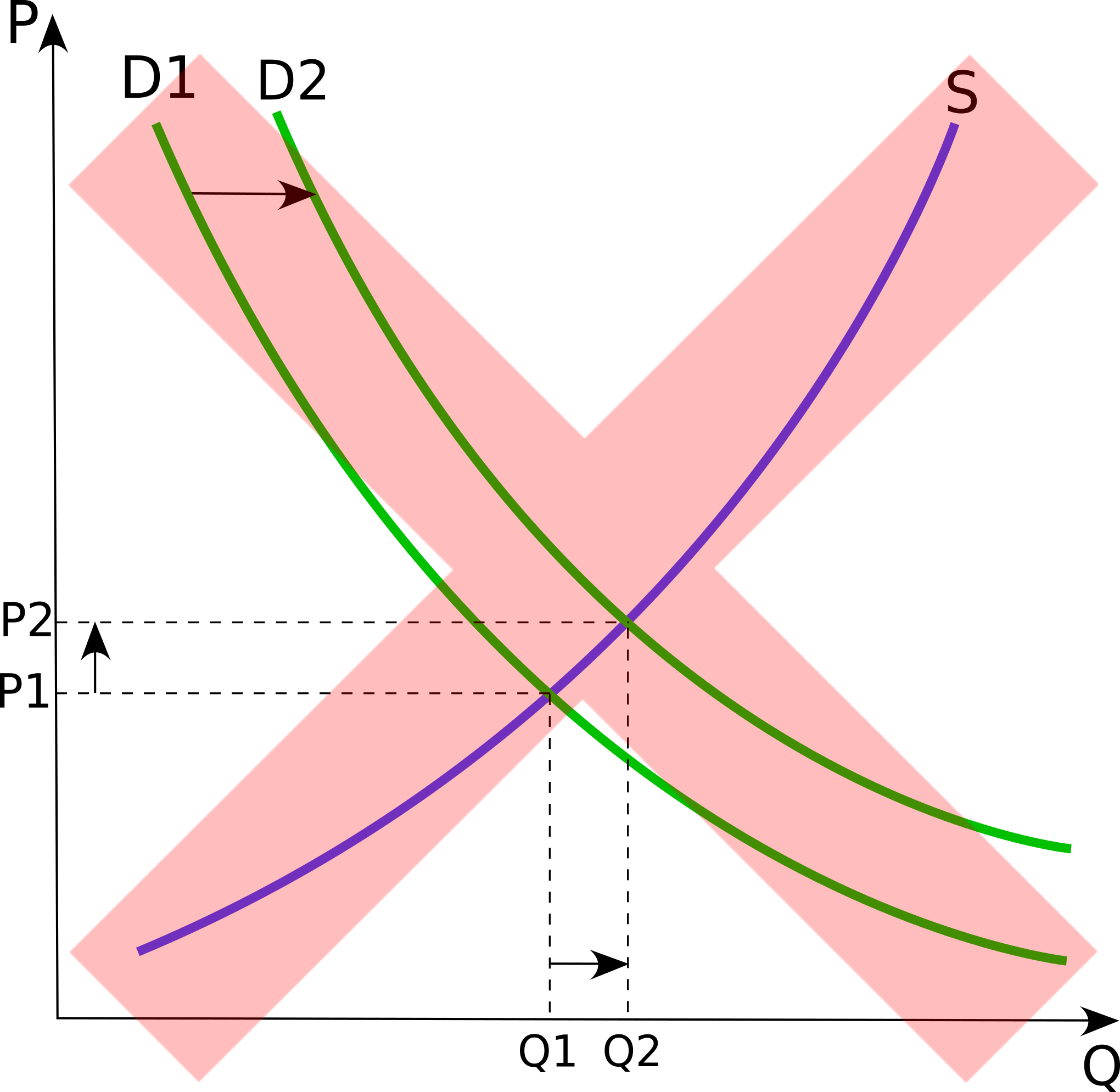

Continue ReadingSupply and Demand Deconstructed

Originally published on Economics from the Top Down Blair Fix Prices are caused by supply and demand, right? So say neoclassical economists. If you’ve bought their fairy tale, I recommend you watch the video below. In it, Jonathan Nitzan demolishes the neoclassical theory of prices. It’s a master lesson in how to deconstruct a theory. […]

Continue ReadingThe Paradox of Individualism and Hierarchy

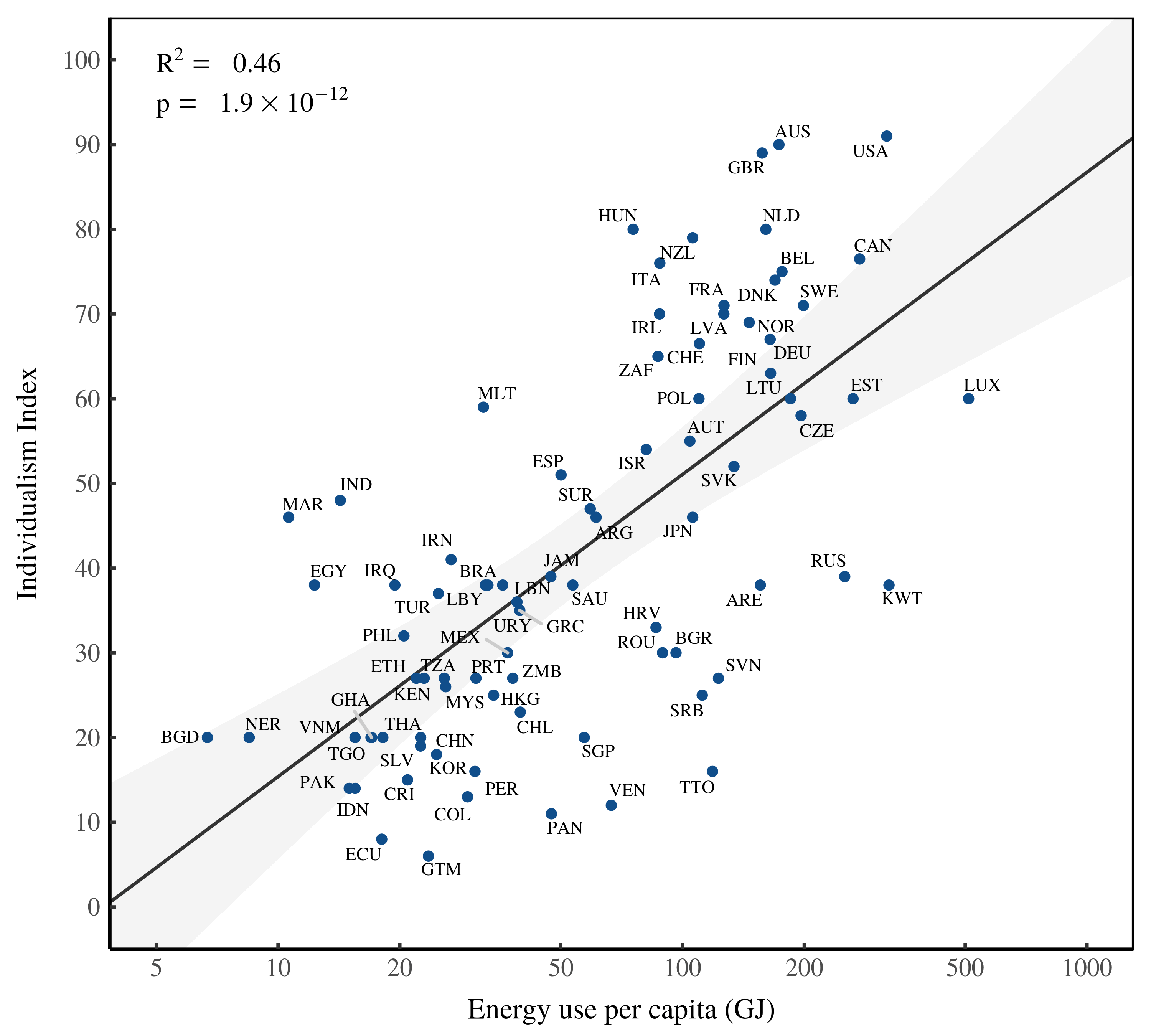

Originally published on Economics from the Top Down Blair Fix In the early 1970s, Geert Hofstede discovered something interesting. While analyzing a work-attitude survey that had been given to thousands of IBM employees around the world, Hofstede found that responses clustered by country. In some countries, for instance, employees tended to prefer an autocratic style […]

Continue Reading10 Tips for Making Beautiful Charts

Originally published on Economics from the Top Down Blair Fix They say that a picture is worth a thousand words. In science, the corollary is that a good chart is worth a whole article. Okay, that’s probably an exaggeration … but only slightly. Millions of words are spilled each day communicating science. Yet people have […]

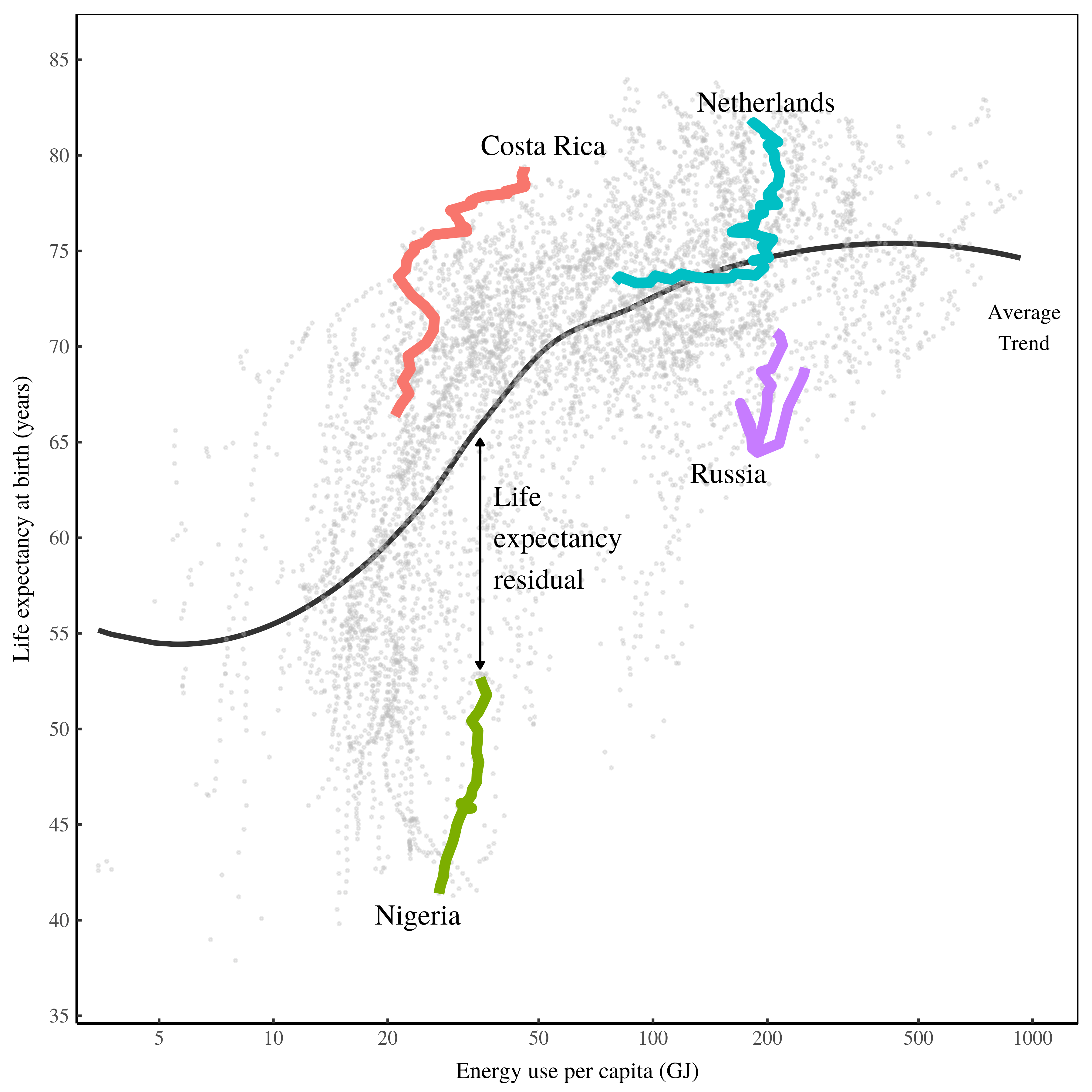

Continue ReadingLiving the Good Life … Without Killing the Planet

Originally published on Economics from the Top Down Blair Fix How can we live the ‘good life’ without killing the planet? My last post on energy and empire got me thinking about this question. We know that human welfare improves as we use more resources. But it’s suicidal for all of humanity to pursue this […]

Continue ReadingWhy America Won’t Be ‘Great’ Again

Originally published on Economics from the Top Down Blair Fix They called him the ‘Little Emperor’. Romulus Augustus — better known as Romulus ‘Augustulus’ (‘Little Augustus’) — was the last Western Roman Emperor. He assumed the throne at the age of 16 during a period of unprecedented strife. There had been 8 emperors in the […]

Continue ReadingWhy Isn’t Modern Monetary Theory Common Knowledge?

Originally published on Economics from the Top Down Blair Fix I’ve always been baffled why ‘modern monetary theory’ is called a theory. I don’t mean this in a disparaging way. As far as theories of money go, I think modern monetary theory (MMT for short) is the correct one. But having a correct theory of […]

Continue ReadingJesús Suaste Cherizola Wins the 2021 CASP Essay Prize

Originally published on Economics from the Top Down Blair Fix As some of you may know, I recently became the editor of the Review of Capital as Power (RECASP), a journal that publishes research on the power underpinnings of capitalism. Each year, RECASP hosts an essay competition. I’m proud to announce that the winner of […]

Continue ReadingSuaste Cherizola, ‘From Commodities to Assets’

From Commodities to Assets Capital as Power and the Ontology of Finance JESÚS SUASTE CHERIZOLA May 2021 Abstract Assets are a crucial concept of the practice and mindset of the capitalist class. Critical analyses of capitalism, however, tend to admit that the exchange of commodities is the foundation of the analysis of capitalism. This article […]

Continue ReadingFix, ‘The Rise of Human Capital Theory’

Abstract Today, human capital theory dominates the study of personal income. But this has not always been so. In this essay, I chart the rise of human capital theory, and compare it to the rise (and fall) of eugenics. The comparison, I argue, is an apt one. Eugenics and human capital theory both focus on […]

Continue ReadingCan the World Get Along Without Natural Resources?

Originally published on Economics from the Top Down Blair Fix If it is very easy to substitute other factors for natural resources, then there is in principle no “problem”. The world can, in effect, get along without natural resources. — Robert Solow, 1974 In the distant future, aliens come to Earth. They find a planet […]

Continue ReadingBig money, nuclear subsidies, and systemic corruption

By Cassandra Jeffery1 and M. V. Ramana2 The “largest bribery, money-laundering scheme ever perpetrated against the people and the state of Ohio” came to light during an unexpected press conference in July 2020 in Columbus. Speaking haltingly and carefully, US Attorney for the Southern District of Ohio David DeVillers announced “the arrest of Larry Householder, […]

Continue Reading2021/02: Fix, ‘Living the good life in a non-growth world: Investigating the role of hierarchy’

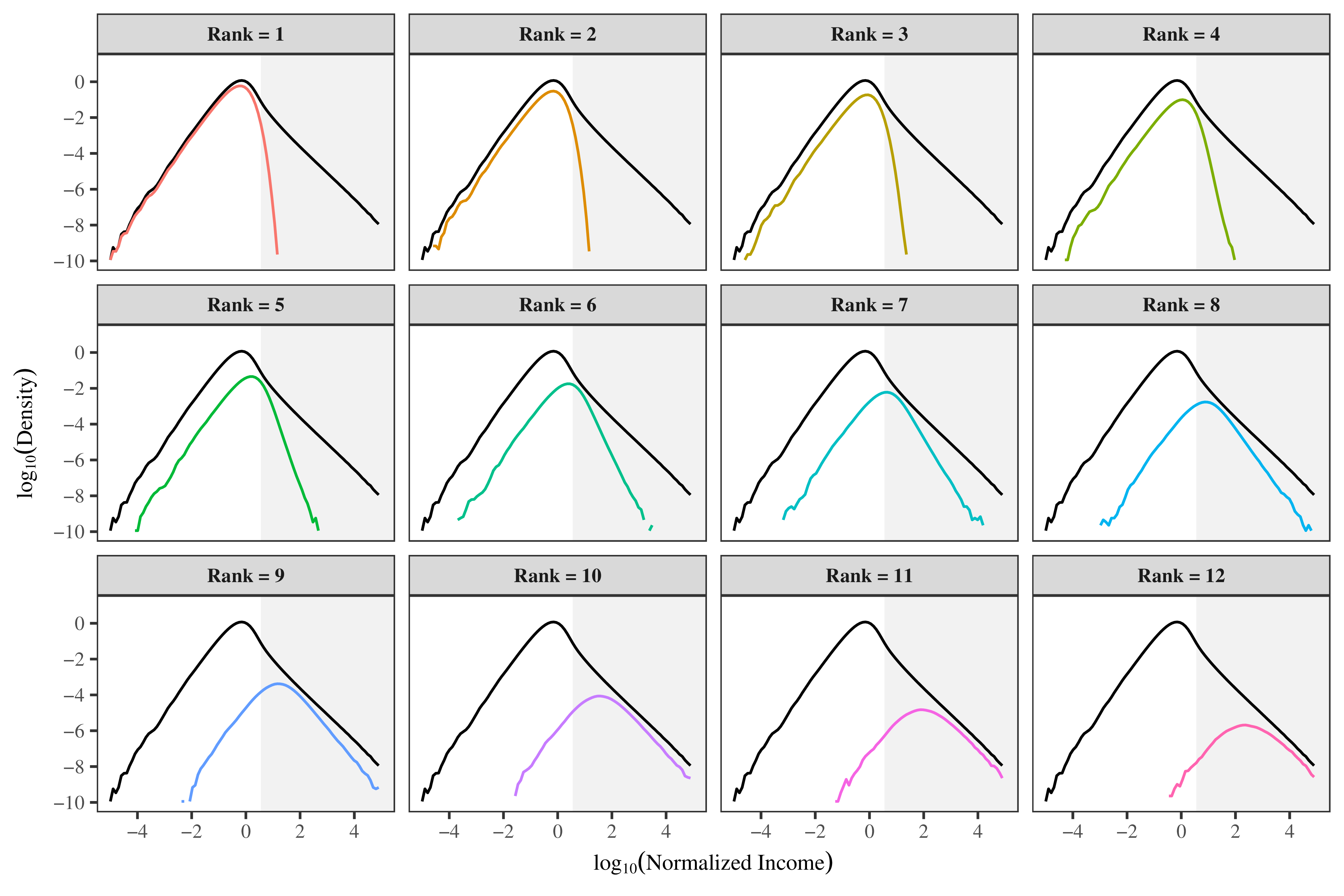

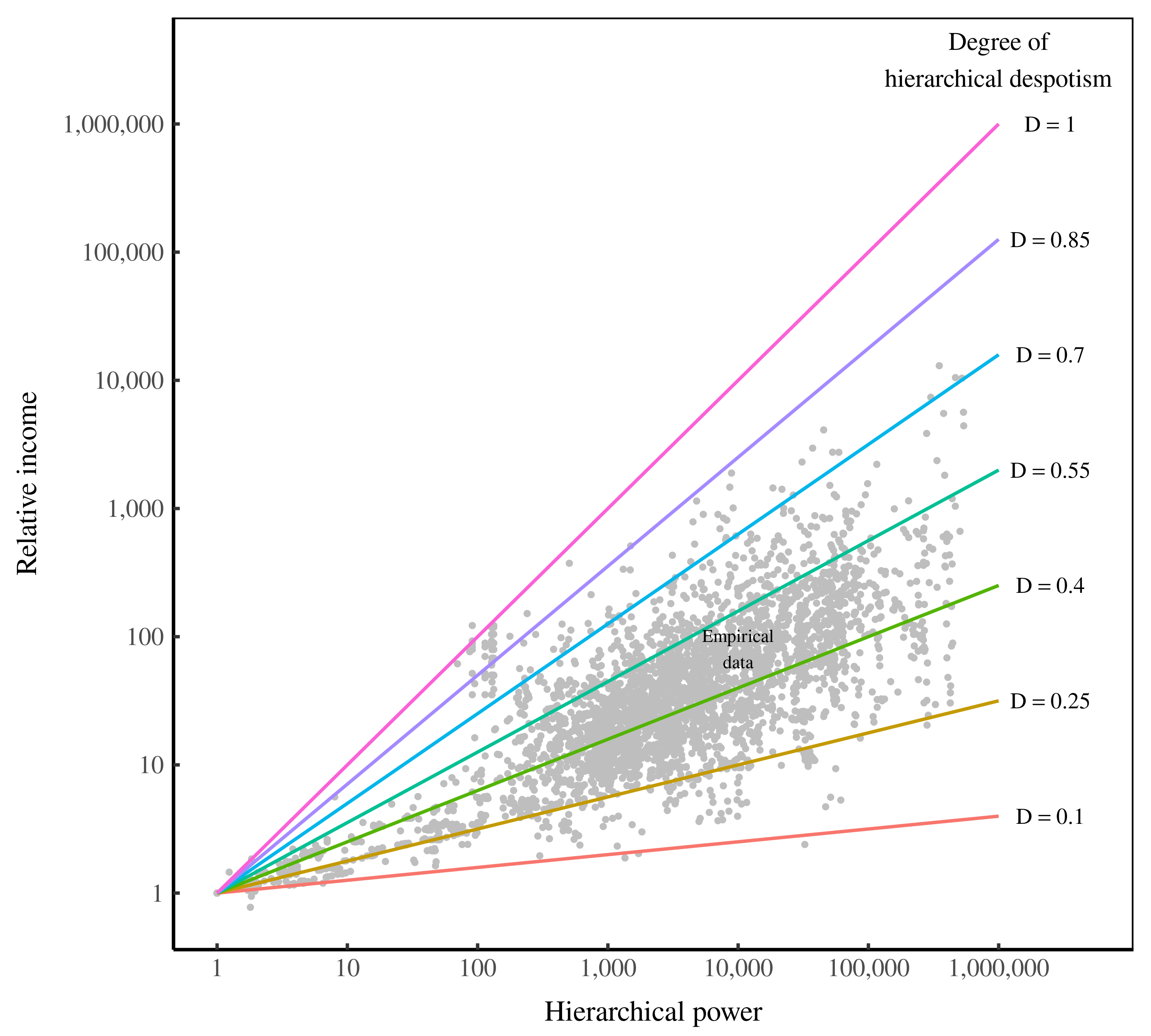

Abstract Humanity’s most pressing need is to learn how to live within our planet’s boundaries — something that likely means doing without economic growth. How, then, can we create a non-growth society that is both just and equitable? I attempt to address this question by looking at an aspect of sustainability (and equity) that is […]

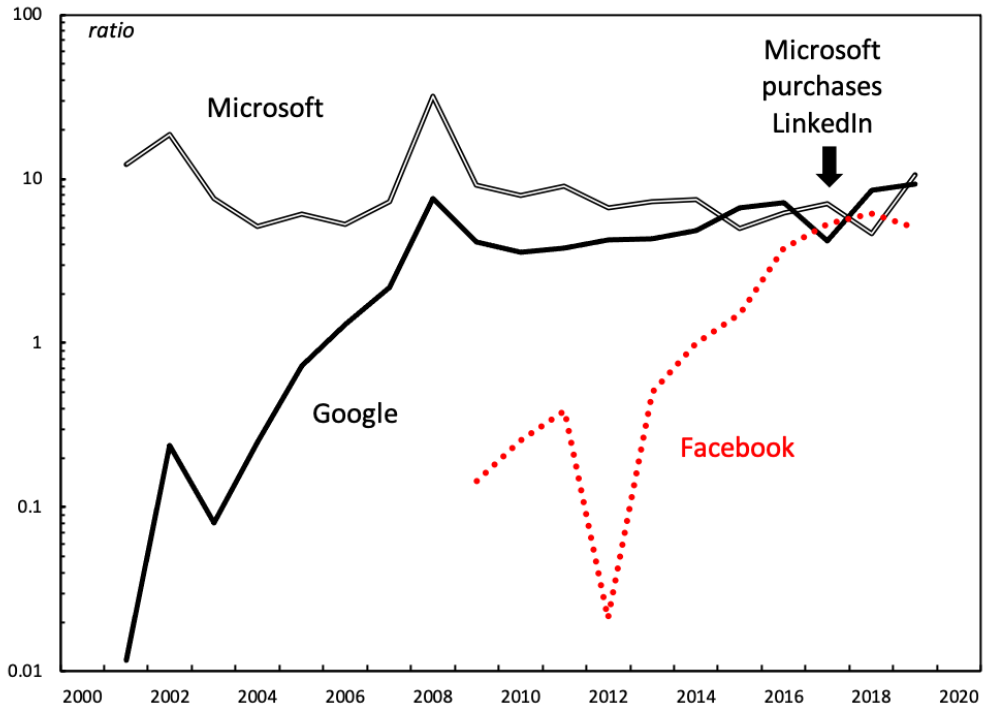

Continue Reading2021/01: Mouré, ‘Soft-wars: The Differential Trajectories of Google and Microsoft – a Capital as Power Analysis’

Abstract According to the capital as power framework, pecuniary earnings, or profits, are a symbolic representation of the struggle for power between different capitalist groups. In this struggle, capitalists measure their own power differentially – that is, relative to other capitalist entities. The focus on differential power, expressed in differential earnings, leads firms to try […]

Continue ReadingGameStop Capitalism: Wall Street vs. The Reddit Rally (Part 1)

Tim Di Muzio1 PDF version available here The phrase, ‘there’s a sucker born every minute’ is typically attributed to the American showman, P.T. Barnum and was made infamous since the mid-19th century by gamblers, hucksters and confidence artists (con men). On Wall Street, the ‘sucker’ is supposed to be the ‘dumb money’ retail traders who […]

Continue ReadingEconomic Growth Theory … Bah Humbug!

Originally published on Economics from the Top Down Blair Fix I’ve written a lot on this blog about the absurdity of marginal productivity theory. But I haven’t said much about the other pillar of mainstream economics: neoclassical growth theory. Today I’ll break that silence. Neoclassical growth theory is a textbook example of Murphy’s law. Everything […]

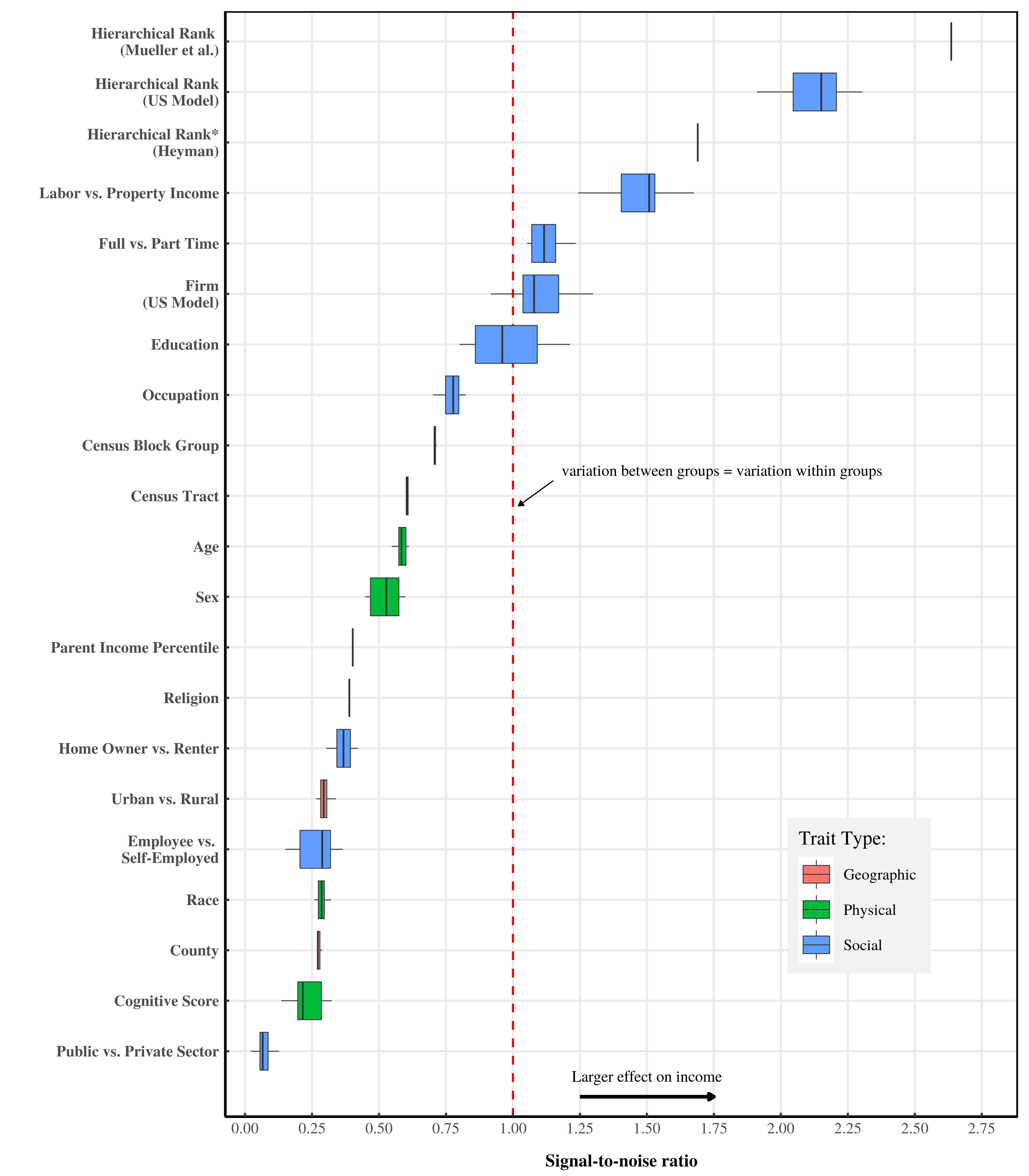

Continue ReadingWhat Trait Affects Income the Most?

Originally published on Economics from the Top Down Blair Fix If the history of science has taught us anything, it’s that we can’t trust our preconceptions about how the world works. All human societies have developed stories about their place in the cosmos. Almost without exception, these stories were wrong. True, we’ve killed many of […]

Continue Reading