Abstract Hager’s project examines the historical development of US public debt ownership and its political implications. His main innovation is to approach the topic from the perspective of disaggregated social class and frame questions of public debt ownership in terms of social inequality and power. He tackles four questions: who are the owners of the […]

Continue ReadingDi Liberto, ‘Differential Harm: Patterns of Uneven Destruction’

Abstract This essay opposes the idea that contemporary critical events like pandemics, global warming, environmental deterioration, et cetera, are to be considered as affecting humanity in a uniform way. Instead of seeing these phenomena like abstract universal threats, I propose to look at them through the lens of my concept of differential harm. By drawing […]

Continue ReadingMouré, ‘No Shortage of Profit: Technological Change, Chip ‘Shortages’, and Capital Accumulation in the Semiconductor Business’

Abstract Rapid technological change is often touted as a fundamental reality of capitalist societies. It is also often presented as concrete evidence for the supposed progressive improvement of material well-being that characterises the capitalist system of social order. Since its emergence in the mid-20th century, semiconductor technology in many ways exemplifies this reality. Yet the […]

Continue ReadingPatent troll IP is more powerful than Apple’s

Originally published at pluralistic.net Cory Doctorow I was 12 years into my Locus Magazine column when I published the piece I’m most proud of, “IP,” from September 2020. It came after an epiphany, one that has profoundly shaped the way I talk and think about the issues I campaign on. https://locusmag.com/2020/09/cory-doctorow-ip/ That revelation was about […]

Continue ReadingDi Liberto, ‘Hype: The Capitalist Degree of Induced Participation’

Hype The Capitalist Degree of Induced Participation YURI DI LIBERTO April 2022 Abstract Power is usually considered as either a ‘positive’ or ‘negative’ construct, as in the power to force action versus the power to forbid it. This paper explores a hybridized approach to power based on the idea of ‘induced participation’. Building on Bichler […]

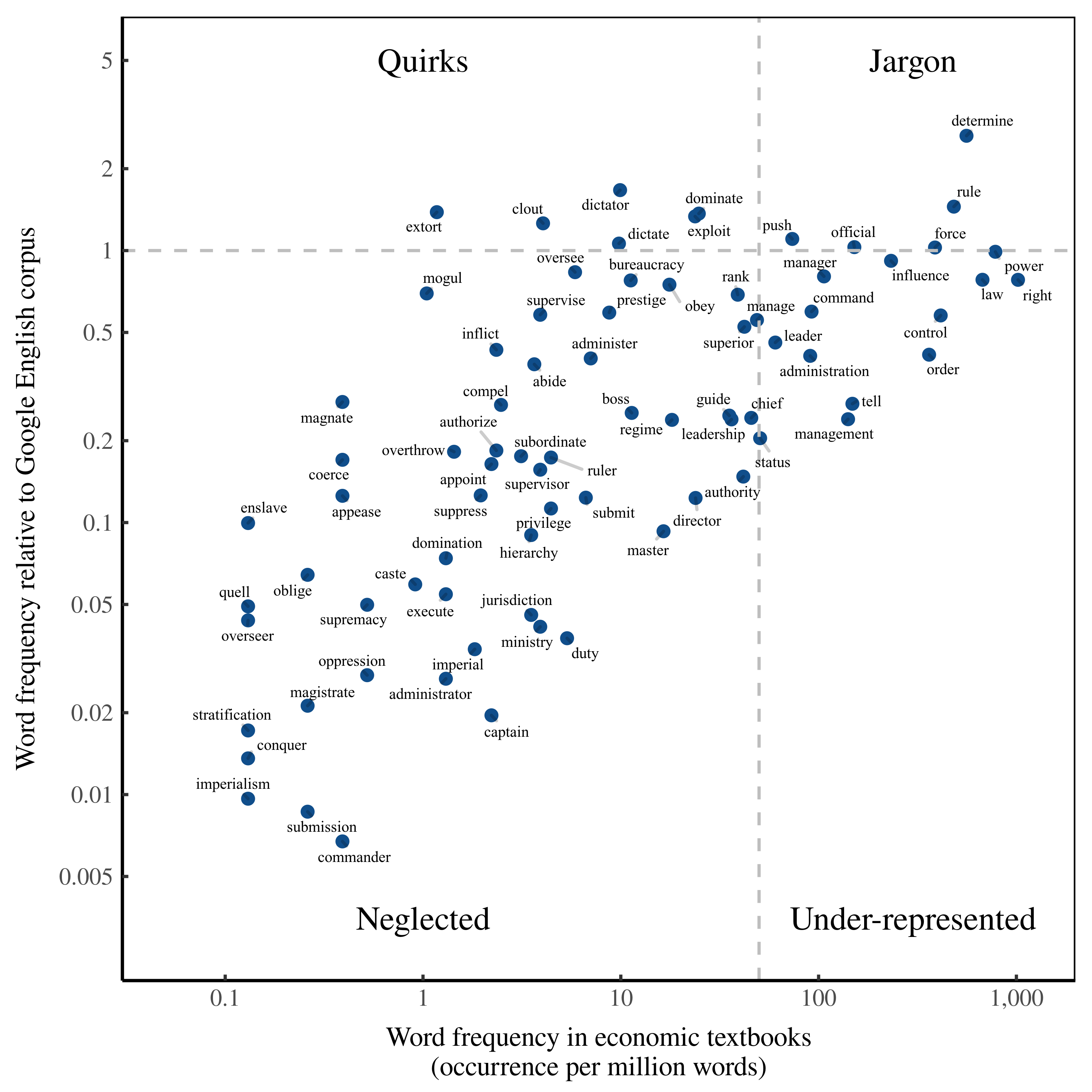

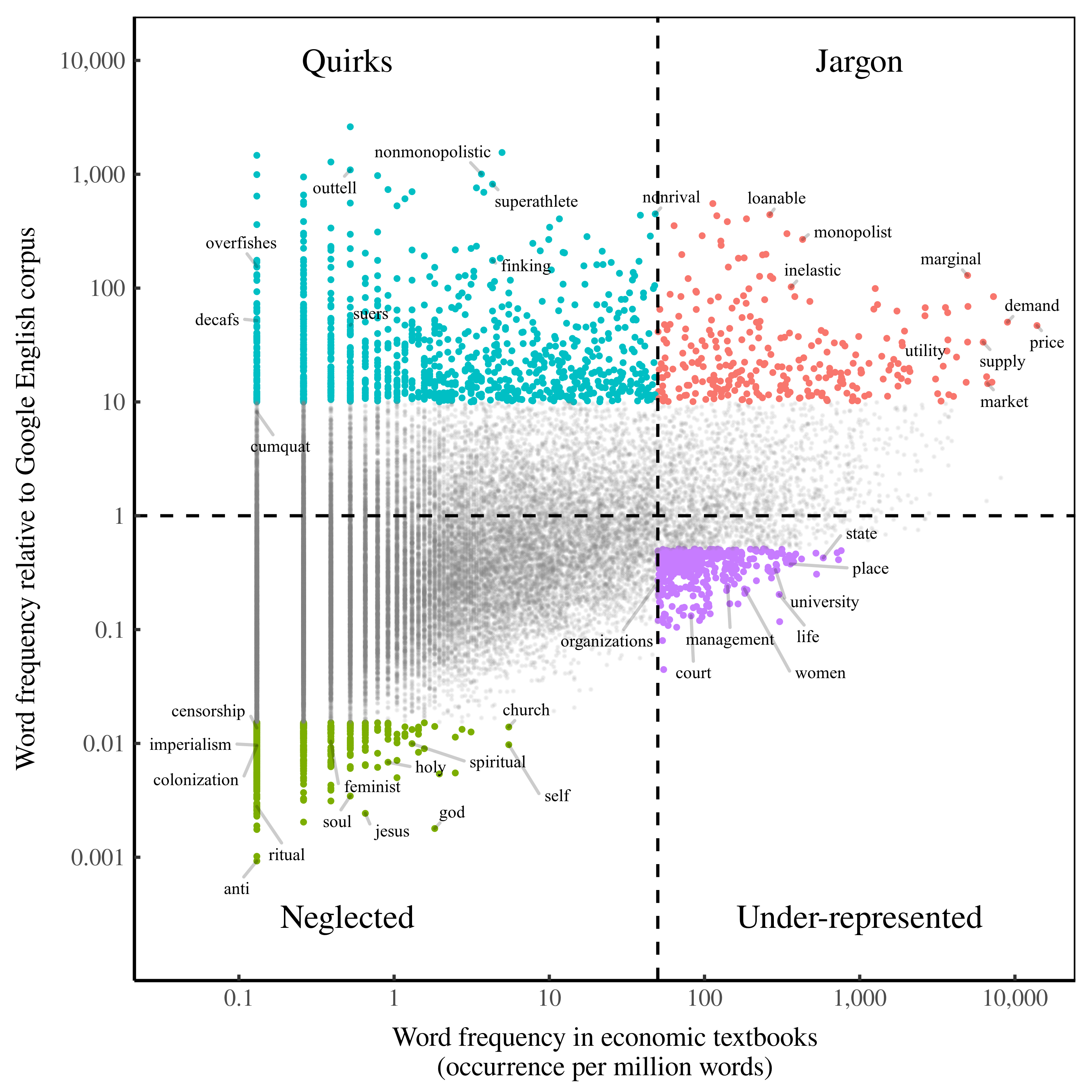

Continue ReadingPower … and the Dialect of Economics

Originally published at Economics from the Top Down Blair Fix A few months ago, I went down a rabbit hole analyzing word frequency in economics textbooks. Henry Leveson-Gower, editor of The Mint Magazine, thought the results were interesting and asked me to write up a short piece. The Mint article is now up, and is […]

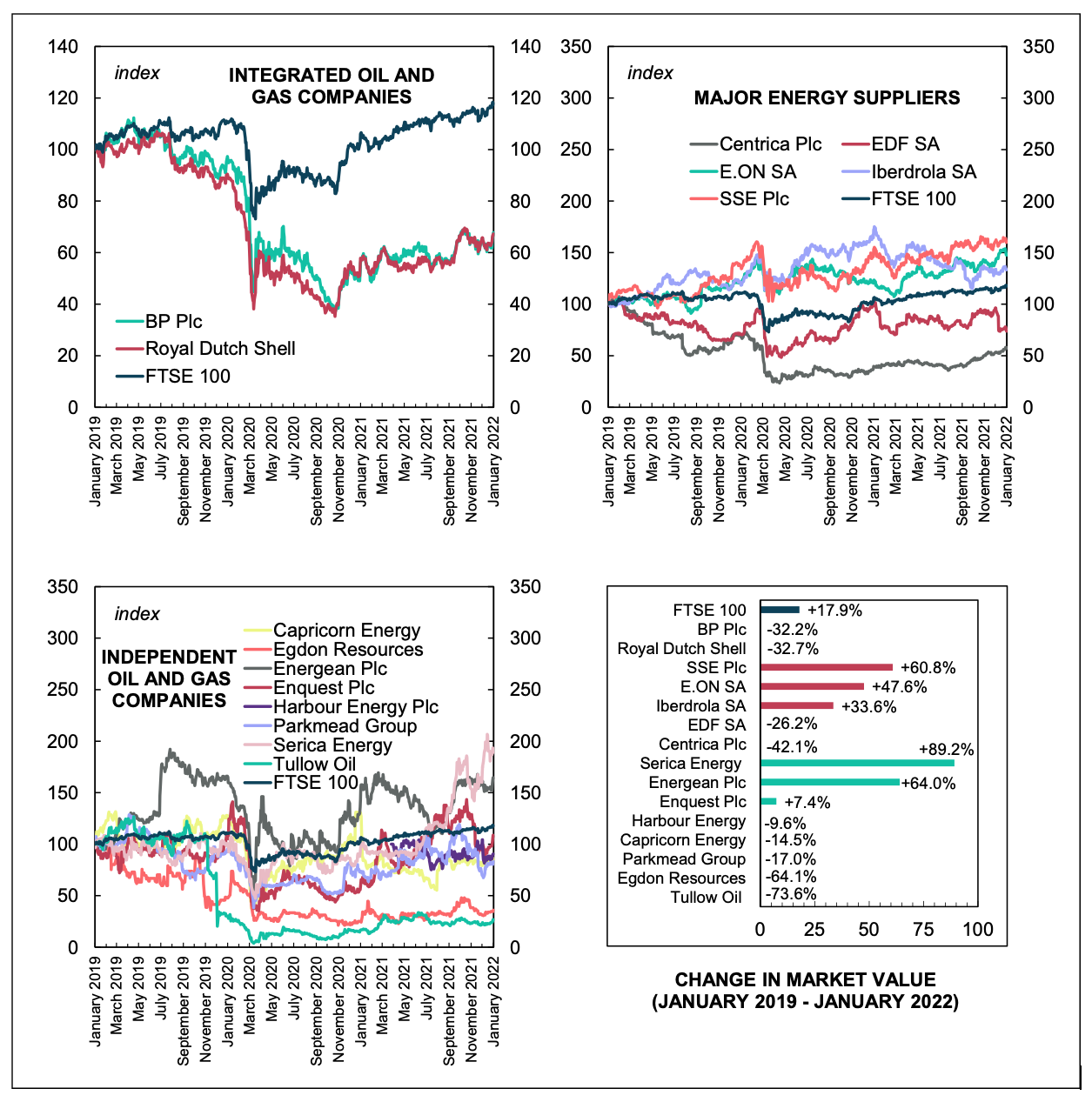

Continue ReadingNew Briefing – Drilling Down: UK Oil and Gas Financial Performance

Originally published at sbhager.com Sandy Brian Hager Joseph Baines and I have a new briefing with Common Wealth examining the financial performance of UK oil and gas producers and energy suppliers. Some of the key findings include: The two UK-headquartered supermajors – BP and Royal Dutch Shell – have remained profitable over the past decade, […]

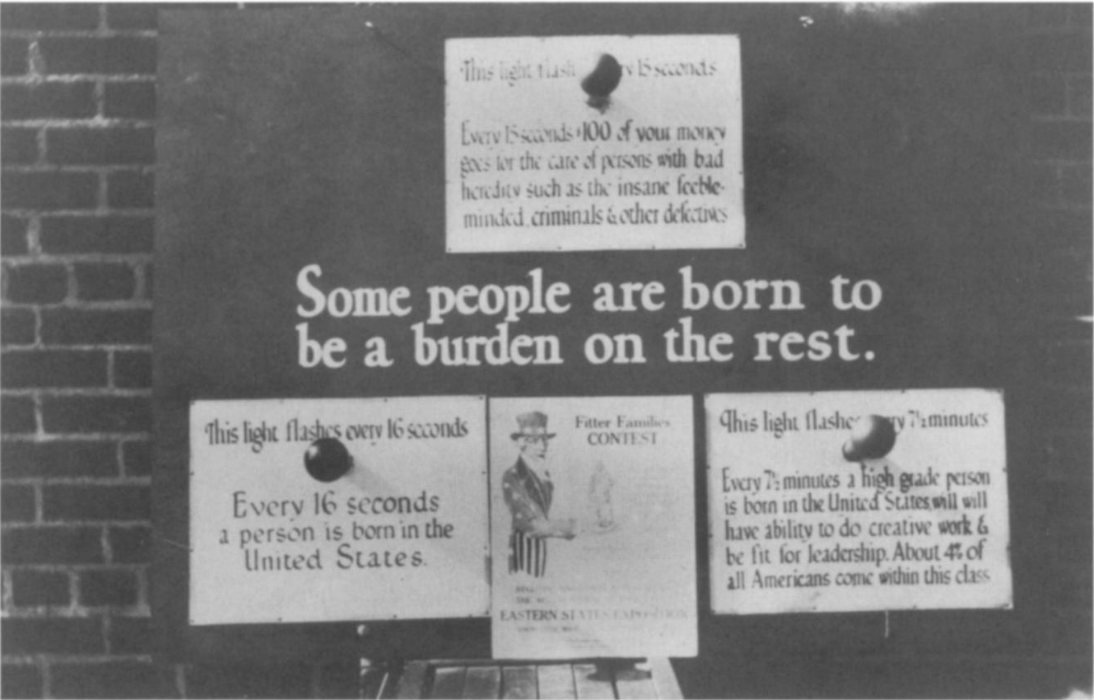

Continue ReadingThe Rise of Human Capital Theory

Originally published at Economics from the Top Down Blair Fix If there was an award for the most pernicious scientific idea ever, what theory should get first prize? I would vote for eugenics, a theory that claims we can ‘improve’ humanity through selective breeding. If there was a second prize, I’d give it to human […]

Continue Reading2022/01: McMahon, ‘Star power and risk: A political economic study of casting trends in Hollywood’

Abstract This paper builds an empirical and theoretical model to analyze how the financial goal of risk reduction changed the insides of Hollywood’s star system. For the moviegoer looking at Hollywood cinema from the outside, the function of the star system has remained the same since the 1920s: to have recognizable actors attract large audiences […]

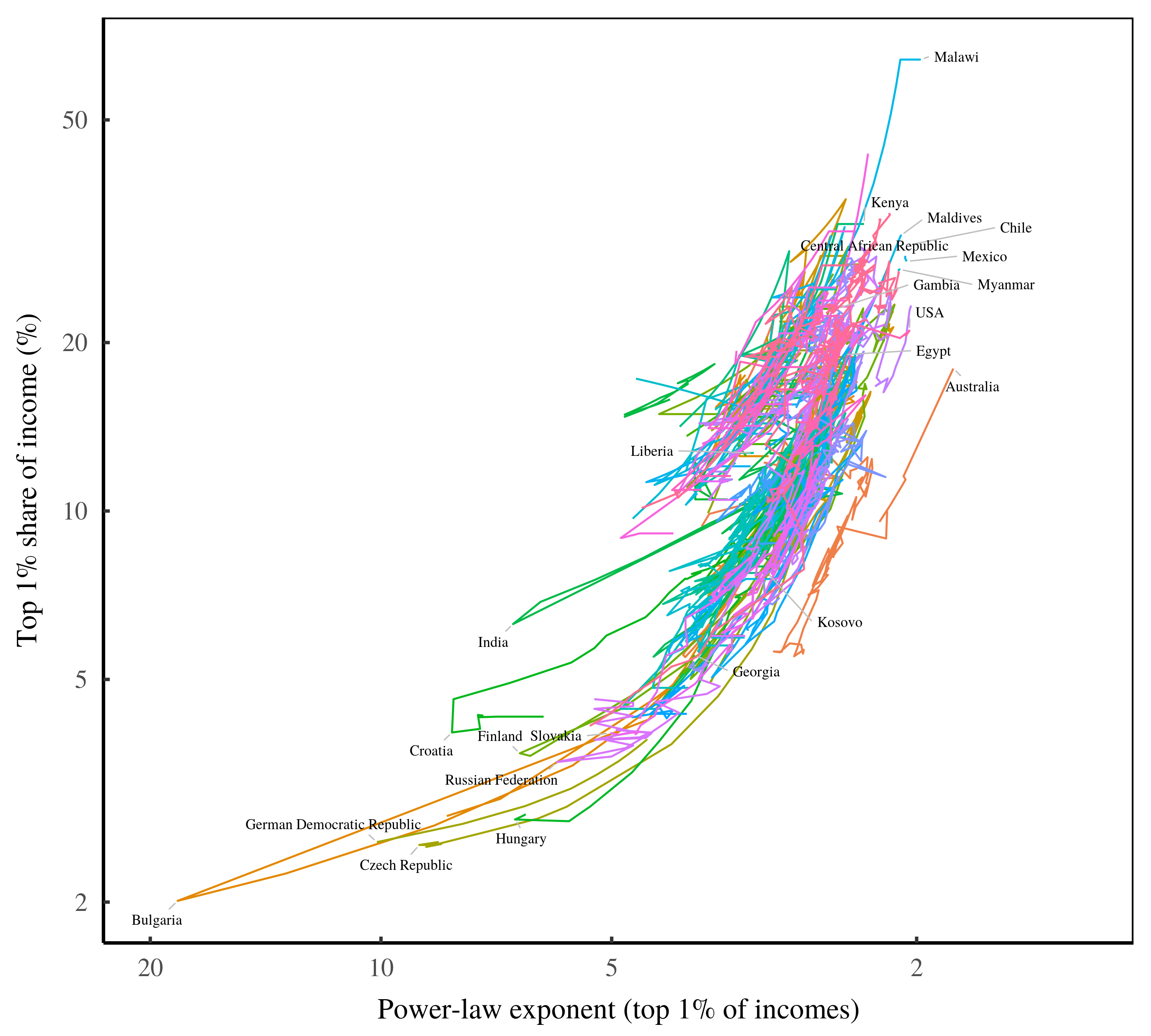

Continue ReadingFix, ‘Redistributing Income Through Hierarchy’

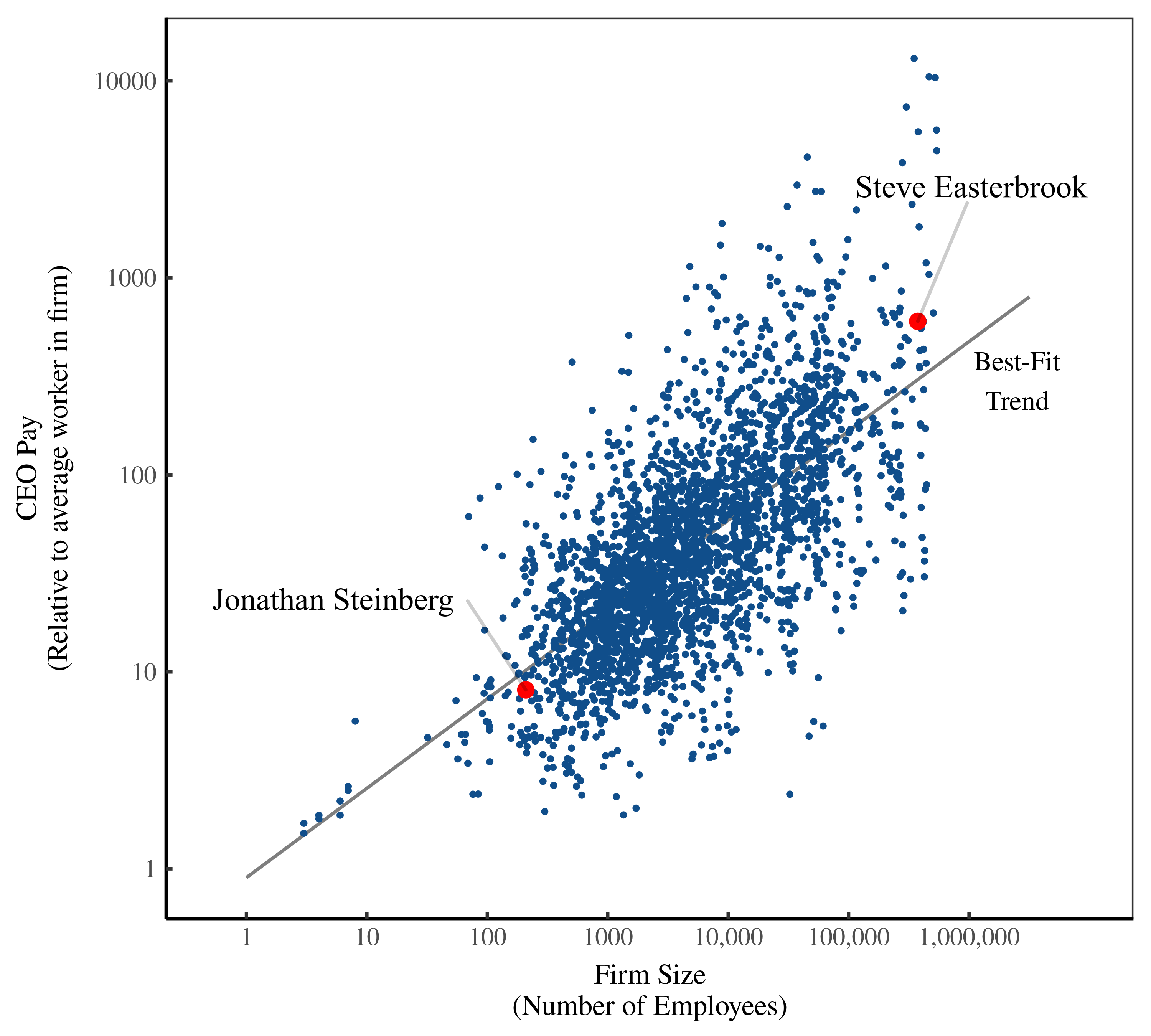

Abstract Although the determinants of income are complex, the results are surprisingly uniform. To a first approximation, top incomes follow a power-law distribution, and the redistribution of income corresponds to a change in the power-law exponent. Given the messiness of the struggle for resources, why is the outcome so simple? This paper explores the idea […]

Continue ReadingMaking culture rational … with power

Originally published at notes on cinema James McMahon A survey of academic writing on the business of culture will show that authors seldomly restrain themselves from making predictions or giving recommendations to the hypothetical economic actor. This offering of future-oriented arguments to an audience should not be surprising. The disciplines of economics, business, management studies […]

Continue ReadingDeconstructing Econospeak

Originally published at Economics from the Top Down Blair Fix It’s been 20 years, but I still remember the feeling. It was a mix of curiosity and unease. I was curious because I was learning something new. But I was uneasy because something didn’t sit right. The place was Edmonton, Alberta, circa the year 2000. […]

Continue ReadingAn evolving filmography about power

Originally published at notes on cinema James McMahon I have been fortunate enough to teach university classes on politics and film. I am certain few students in these classes could guess how stressful it was to assemble a list of films for each semester. The films I showed in class or assigned as homework have […]

Continue ReadingThe ideology of economics

Originally published at pluralistic.net Cory Doctorow Thomas Piketty’s “Capital in the 21st Century” advanced a simple, data-supported hypothesis: that markets left to their own will cause capital to grow faster than the economy as a whole, so over time, the rich always get richer. https://boingboing.net/2014/06/24/thomas-pikettys-capital-in-t.html He’s followed up Capital with the 1000-page “Capital and Ideology” […]

Continue ReadingA Second Look at Hierarchy

Originally published on Economics from the Top Down Blair Fix Last fall, I wrote a short article for The Mint Magazine about how income relates to hierarchy. The Mint, if you’re not familiar, does great work promoting pluralist thinking in economics. Check out their on-going Festival for Change — a festival devoted to building a […]

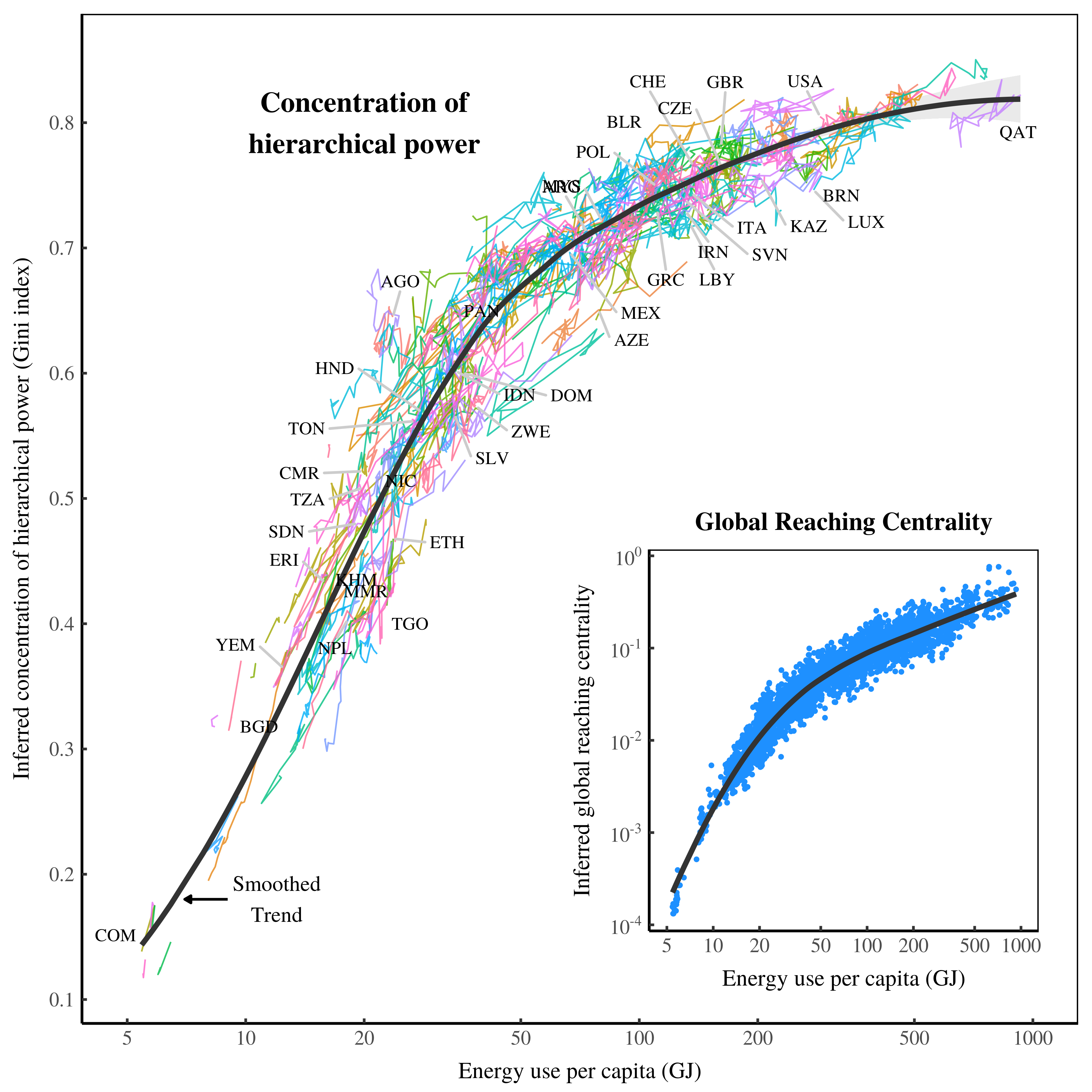

Continue ReadingFix, ‘Economic Development and the Death of the Free Market’

Abstract According to neoclassical economics, the most efficient way to organize human activity is to use the free market. By stoking self interest, the theory claims, individuals can benefit society. This idea, however, conflicts with the evolutionary theory of multilevel selection, which proposes that rather than stoke individual self interest, successful groups must suppress it. […]

Continue ReadingHoward et al., ‘Protein Industry Convergence and Its Implications for Resilient and Equitable Food Systems’

Abstract Recent years have seen the convergence of industries that focus on higher protein foods, such as meat processing firms expanding into plant-based substitutes and/or cellular meat production, and fisheries firms expanding into aquaculture. A driving force behind these changes is dominant firms seeking to increase their power relative to close competitors, including by extending […]

Continue ReadingWhy Isn’t Modern Monetary Theory Common Knowledge?

Originally published on Economics from the Top Down Blair Fix I’ve always been baffled why ‘modern monetary theory’ is called a theory. I don’t mean this in a disparaging way. As far as theories of money go, I think modern monetary theory (MMT for short) is the correct one. But having a correct theory of […]

Continue ReadingJesús Suaste Cherizola Wins the 2021 CASP Essay Prize

Originally published on Economics from the Top Down Blair Fix As some of you may know, I recently became the editor of the Review of Capital as Power (RECASP), a journal that publishes research on the power underpinnings of capitalism. Each year, RECASP hosts an essay competition. I’m proud to announce that the winner of […]

Continue ReadingSuaste Cherizola, ‘From Commodities to Assets’

From Commodities to Assets Capital as Power and the Ontology of Finance JESÚS SUASTE CHERIZOLA May 2021 Abstract Assets are a crucial concept of the practice and mindset of the capitalist class. Critical analyses of capitalism, however, tend to admit that the exchange of commodities is the foundation of the analysis of capitalism. This article […]

Continue Reading