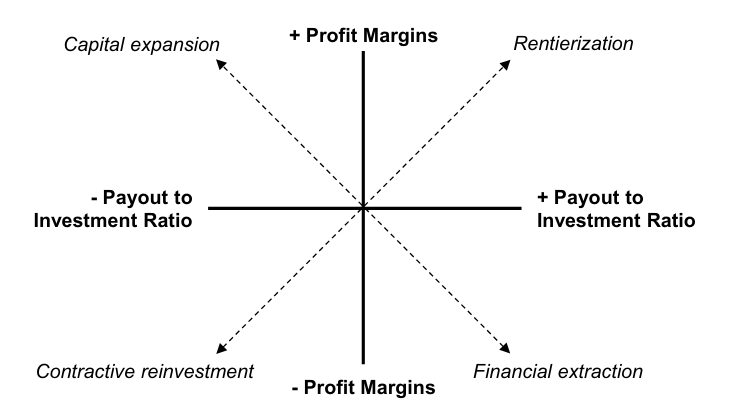

Abstract The concepts of rentiership and intellectual monopoly have gained increased prominence in discussions about the transformation of global capitalism in recent years. However, there have been few if any attempts to construct measures for rentiership and intellectual monopoly using firm-level financial data. The absence of such work, we argue, is symptomatic of conceptual challenges […]

Continue ReadingBichler & Nitzan, ‘The Business of Strategic Sabotage’

Abstract Marxists love to hate the theory of capital as power, or CasP for short. And they have two good reasons. First, CasP criticizes the logical and empirical validity of the labour theory of value on which Marxism rests. And second, it offers the young at heart a radical, non-Marxist alternative with which to research, […]

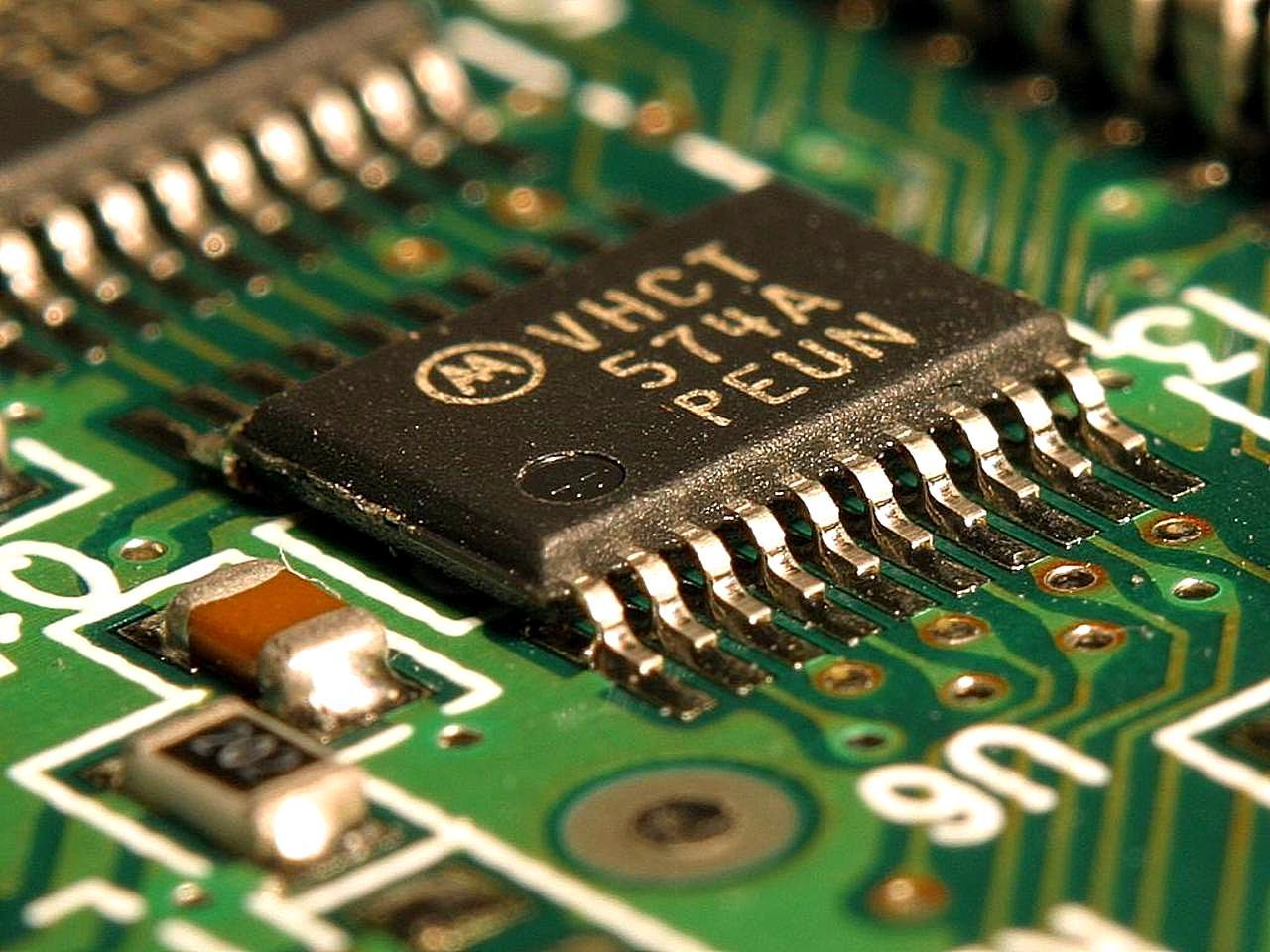

Continue ReadingNo Shortage of Profit: Semiconductor firms and the differential effects of chip shortages

Chris Mouré Note: this is the manuscript version of an article now featured in The Mint Magazine. Few will argue with the claim that shortages are socially harmful. Shortages, by definition, imply a lack of something – not enough stuff to go around. A shortage of food implies hunger; a shortage of electricity implies darkness. […]

Continue ReadingMouré, ‘No Shortage of Profit: Technological Change, Chip ‘Shortages’, and Capital Accumulation in the Semiconductor Business’

Abstract Rapid technological change is often touted as a fundamental reality of capitalist societies. It is also often presented as concrete evidence for the supposed progressive improvement of material well-being that characterises the capitalist system of social order. Since its emergence in the mid-20th century, semiconductor technology in many ways exemplifies this reality. Yet the […]

Continue ReadingMouré, ‘Costly Efficiencies: Healthcare Spending, COVID-19, and the Public/Private Healthcare Debate’

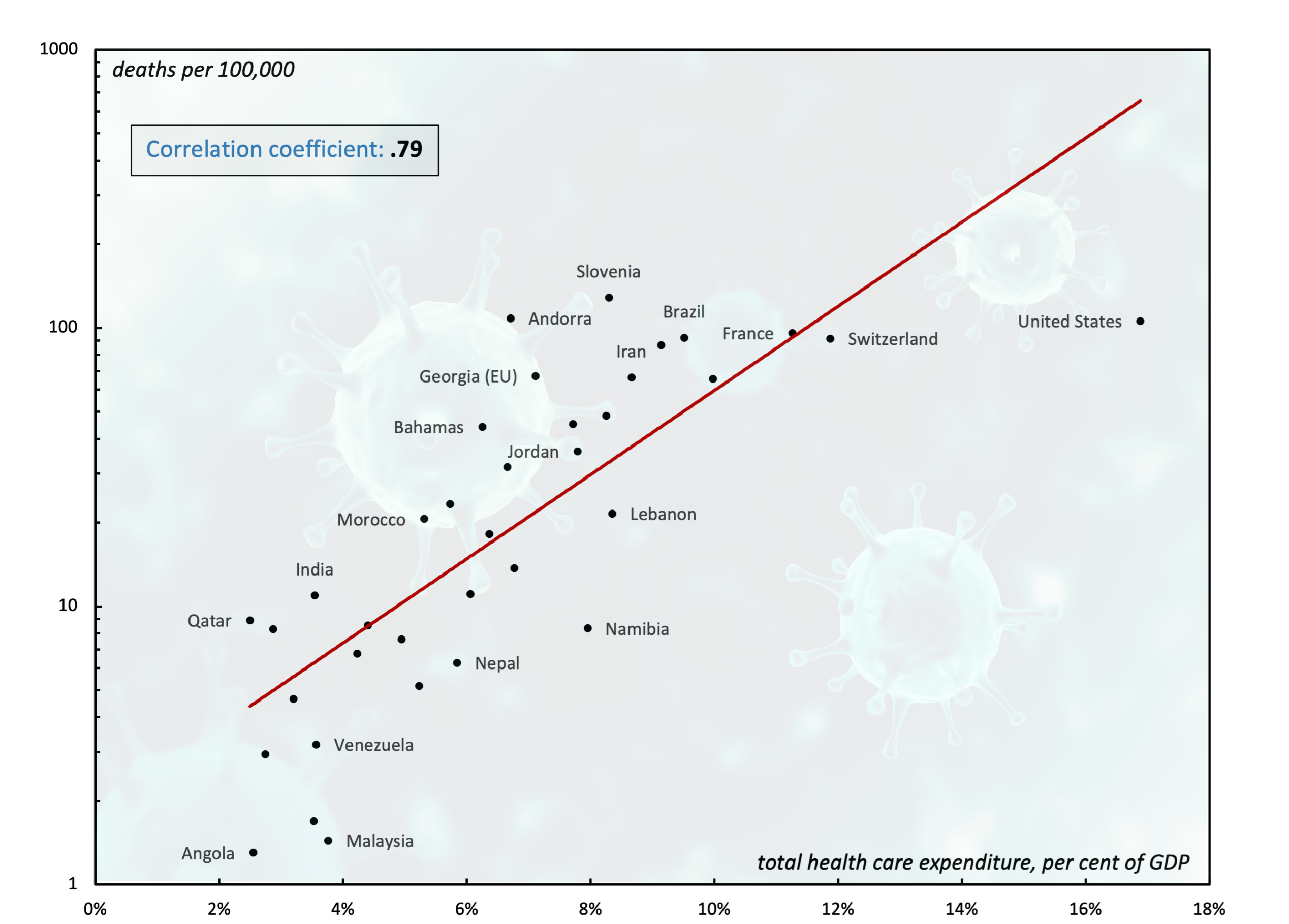

Costly Efficiencies Healthcare Spending, COVID-19, and the Public/Private Healthcare Debate CHRIS MOURÉ May 2022 Abstract Proponents of private healthcare often claim that the private sector is more ‘efficient’ at delivering healthcare services. This paper tests the privatization thesis in the context of the COVID-19 pandemic. Using a large sample of countries, I investigate how healthcare […]

Continue ReadingA Requiem for Carbon Capitalism?

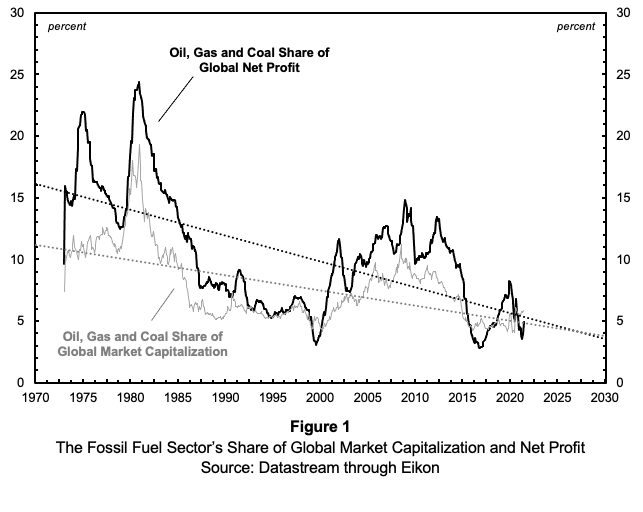

Originally published at sbhager.com Sandy Brian Hager News of the immanent demise of companies responsible for a significant portion of global greenhouse gas emissions might sound like a boon for efforts to avert climate breakdown. But just how bad is the outlook for fossil fuels? In this research note, I offer a preview of findings […]

Continue ReadingFix, ‘The Ritual of Capitalization’

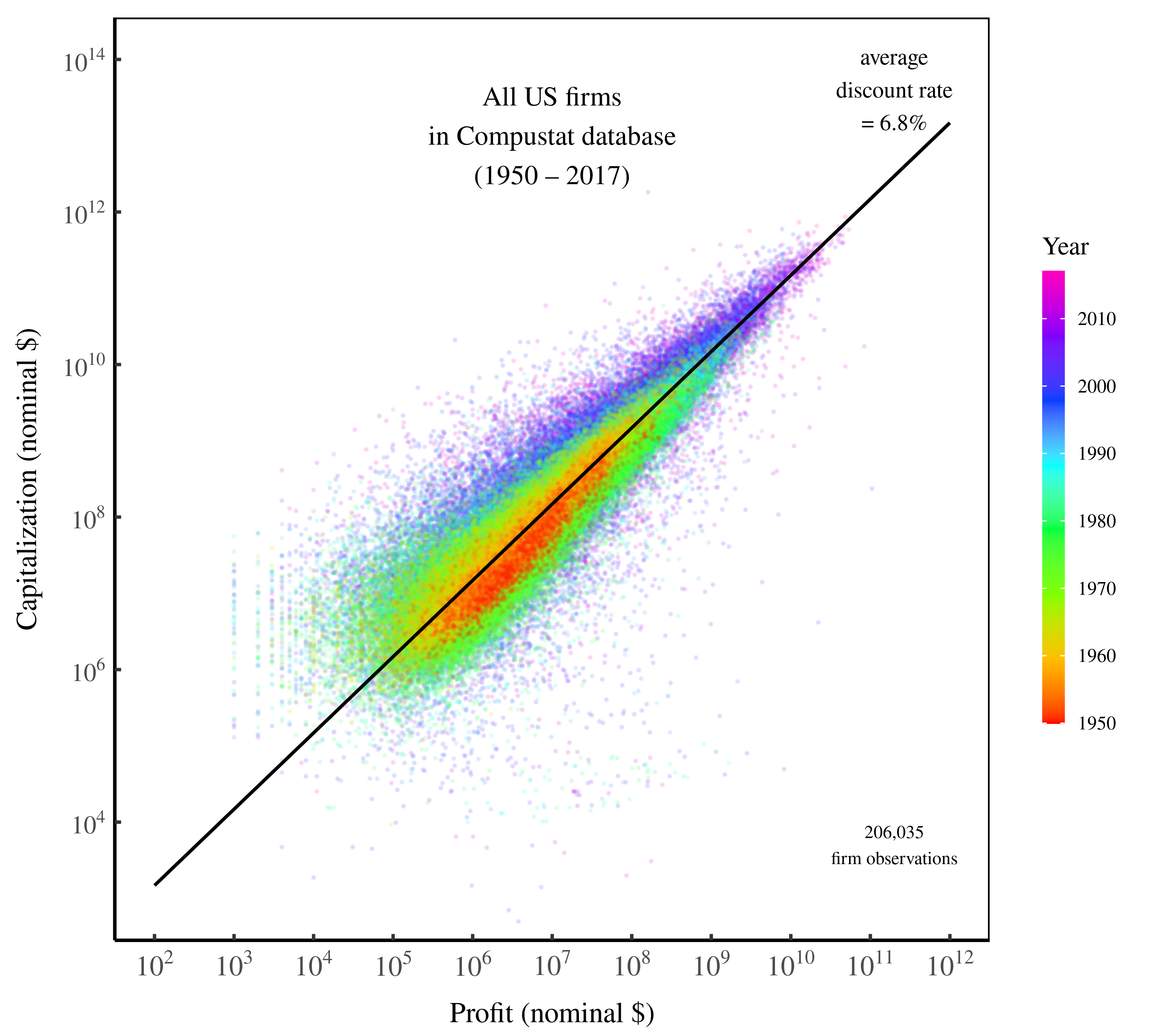

Abstract For more than a century, political economists have sought to understand the nature of capital. The prevailing wisdom is that there must be something ‘real’ — some productive capacity — that underpins capitalized values. This thinking, I argue, is a mistake. Building on Jonathan Nitzan and Shimshon Bichler’s theory of capital as power, I […]

Continue ReadingHollywood’s mantra: “Nobody knows anything”

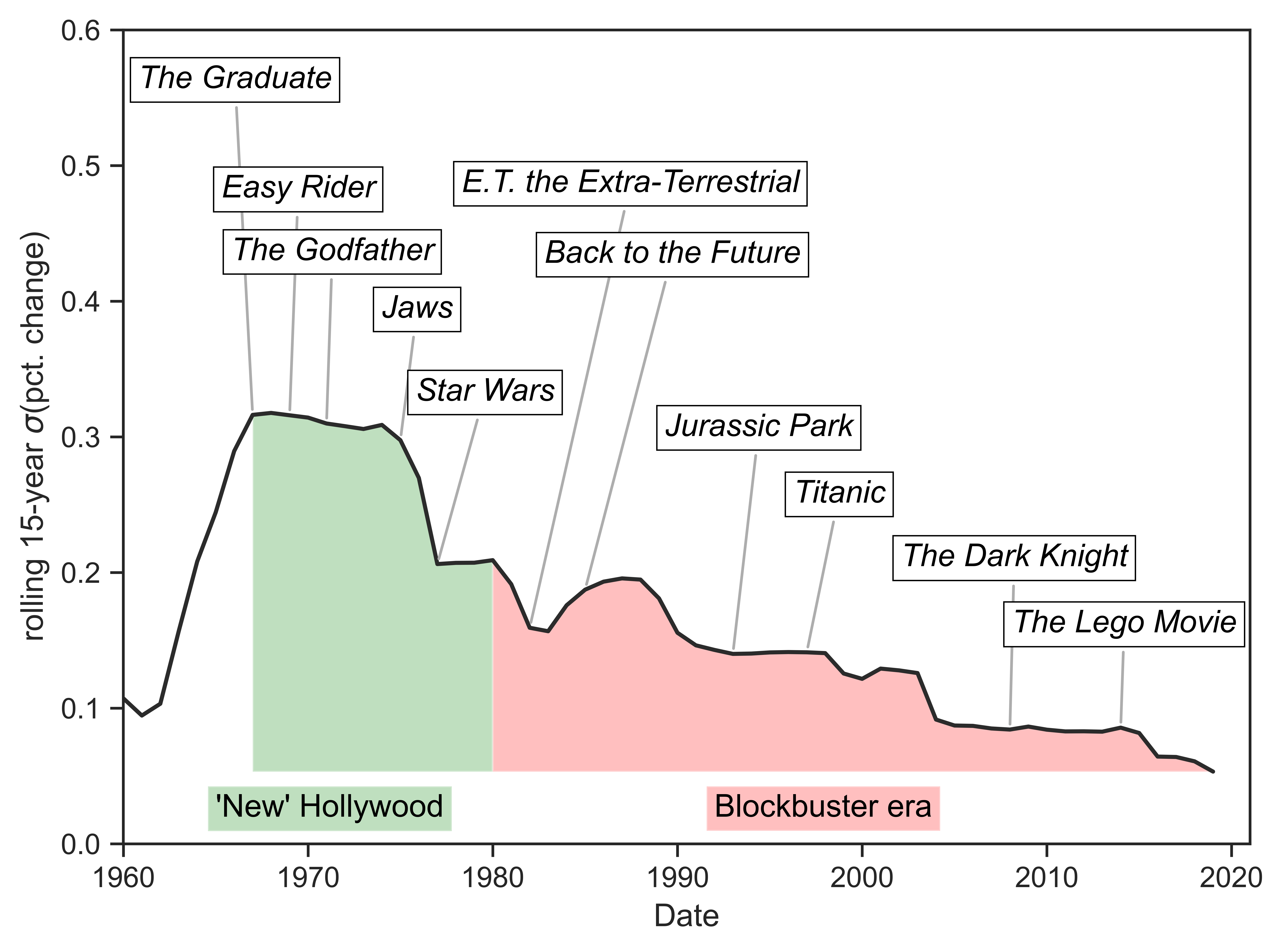

Originally published at notes on cinema James McMahon Your movie turned out the be a flop? “Nobody knows anything”. You mistakenly believed consumers wanted to see a movie set in the 1920s? “Nobody knows anything”. You thought your casting decisions were going to be loved by all? “Nobody knows anything”. “Nobody knows anything”–this was the […]

Continue ReadingWhy Scorcese is right about corporate power, Part 2

Originally published at notes on cinema James McMahon Part 1 introduced Scorcese’s argument in his Harper’s essay, which was about much more than Fellini. The first part also explained how we can connect Scorcese’s essay to the drive in the Hollywood film business for major film distributors to differentially accumulate, i.e., beat a benchmark that […]

Continue ReadingMcMahon, ‘Is Hollywood a Risky Business? A Political Economic Analysis of Risk and Creativity’

Abstract This paper seeks to explain why Hollywood’s dominant firms are narrowing the scope of creativity in the contemporary period (1980–2015). The largest distributors have sought to prevent the art of filmmaking and its related social relations from becoming financial risks in the pursuit of profit. Major filmed entertainment, my term for the six largest […]

Continue ReadingNo. 2016/5: Cochrane, ‘Disobedient Things: The Deepwater Horizon oil spill and accounting for disaster’

Abstract Analysis of the Deepwater Horizon disaster and the accumulatory decline of BP demonstrates both the analytical efficacy of the capital-as-power (CasP) approach to value theory, and the irreducible role of objects in the process of accumulation. Rather than productivity per se, accumulation depends on control of productivity. Owners’ control is over both the human […]

Continue ReadingPutting Power Back into Growth Theory

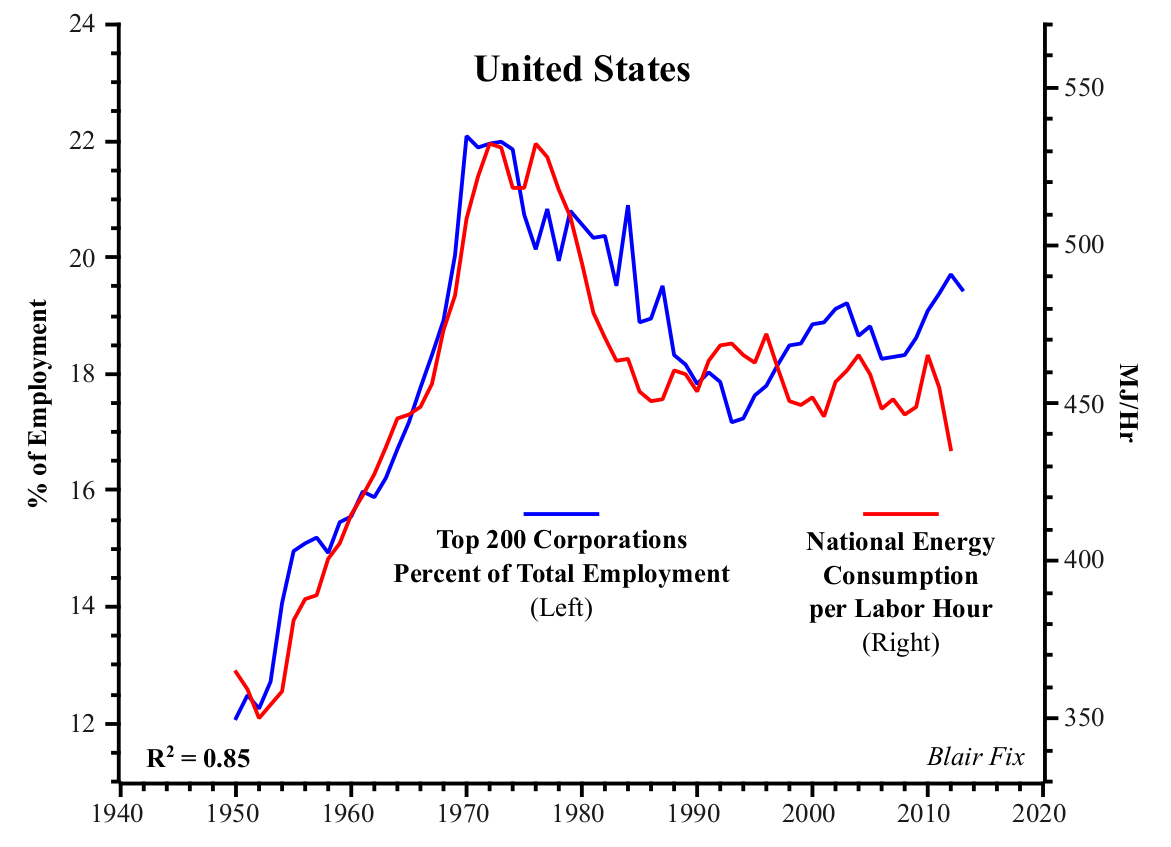

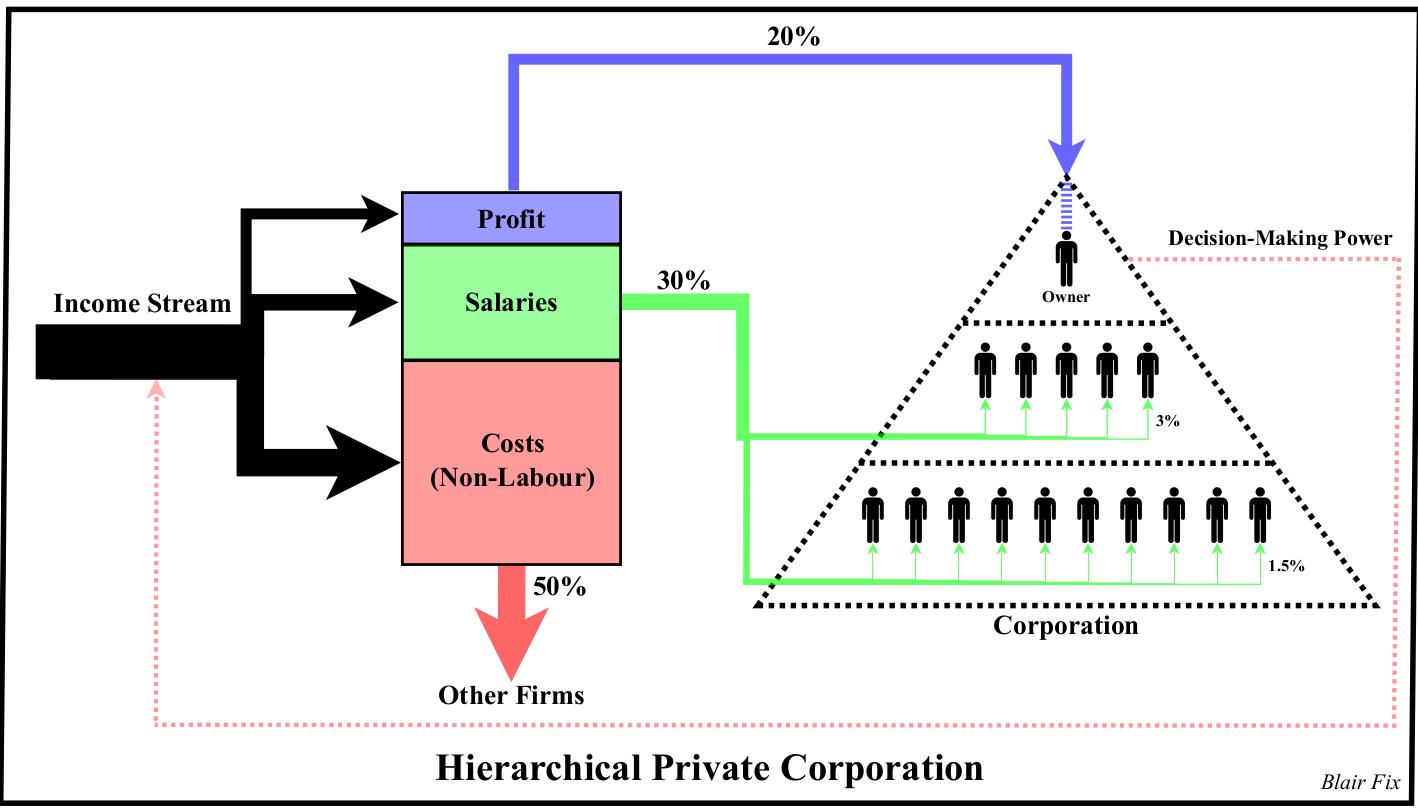

Putting Power Back Into Growth Theory BLAIR FIX June 2015 Abstract Neoclassical growth theory assumes that economic growth is an atomistic process in which changes in distribution play no role. Unfortunately, when this assumption is tested against real-world evidence, it is systematically violated. This paper argues that a reality-based growth theory must reject neoclassical principles […]

Continue ReadingFix, ‘Putting Power Back Into Growth Theory’

Abstract Neoclassical growth theory assumes that economic growth is an atomistic process in which changes in distribution play no role. Unfortunately, when this assumption is tested against real-world evidence, it is systematically violated. This paper argues that a reality-based growth theory must reject neoclassical principles in favour of a power-centered approach. Building on Nitzan and […]

Continue ReadingNo. 2014/05: Fix, ‘Putting Power Back Into Growth Theory’

Abstract Neoclassical growth theory assumes that economic growth is an atomistic process in which changes in distribution play no role. Unfortunately, when this assumption is tested against real-world evidence, it is systematically violated. This paper argues that a reality-based growth theory must reject neoclassical principles in favour of a power-centered approach. Building on Nitzan and […]

Continue ReadingNo. 2014/02: Fix, ‘Rethinking Profit: How Redistribution Drives Growth’

Abstract Using a combination of heterodox economics and biophysical analysis, this paper investigates the relationship between economic distribution and the growth of material throughput. Empirical results show that the growth of “useful work” correlates with redistribution towards profit. Furthermore, increases in energy consumption are correlated with increases in the largest corporations’ share of total employment. […]

Continue ReadingPark, ‘Dominant Capital and the Transformation of Korean Capitalism: From Cold War to Globalization’

Abstract After the 1997 financial crisis, the neo-liberal restructuring of the Korean political economy accelerated dramatically. While there is a general consensus that the reform has had negative consequences for Korean society, heated debates continue over the culprits of the 1997 crisis and the changes that followed in its wake. Major opinions have largely coalesced […]

Continue Reading