DT Cochrane ‘Ask a Mortician‘ is a quirky and informative Youtube series with mortician Caitlin Doughty. The most recent video touches on the political economy of the funeral business. The question is based on an anti-funeral business rant on Reddit and asks: “Is the Funeral Industry a Pyramid Scheme?” Doughty quickly sets aside the misleading […]

Continue ReadingDi Muzio, ‘The Capitalist Mode of Power: Critical Engagements with the Power Theory of Value’

Abstract This edited volume offers the first critical engagement with one of the most provocative and controversial theories in political economy: the thesis that capital can be theorized as power and that capital is finance and only finance. The book also includes a detailed introduction to this novel thesis first put forward by Nitzan and […]

Continue ReadingLabouring in College Sports

DT Cochrane Sports writer Patrick Hruby offers a breakdown of recent turmoil over the possibility that Texas A&M football star Johnny Manziel broke college sports rules pertaining to the payment of athletes. The piece provides some insights into the complicated political economy of U.S. American college sports. Billions of dollars circulate around athletes who are […]

Continue ReadingPaying for attention

DT Cochrane The media company 21st Century Fox has purchased a five percent share of the website Vice for $70 million. The website produces a wide range of content. However, much of what it currently does is rabble rousing investigative reporting, like a recent half hour report on Sarnia’s ‘Chemical Valley’ and the effect of […]

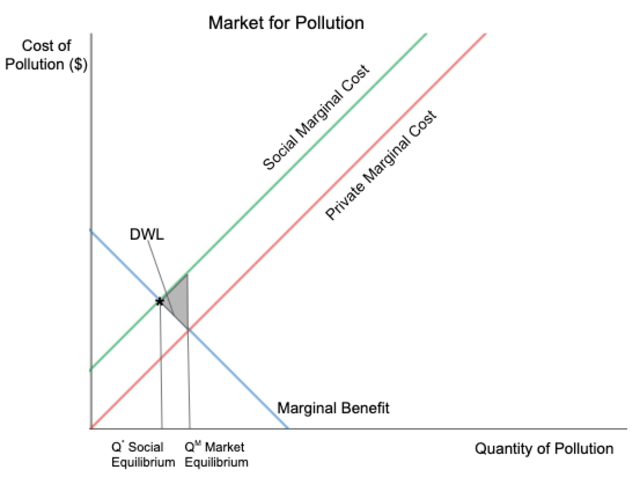

Continue ReadingTransportation, Markets and Externalities

DT Cochrane The Brazilian government is due to spend R$200 billion (US$84 billion) on its ports, airports, railroads and roads over the next two years. This spending highlights the impossibility of separating ‘politics’ from the ‘economy,’ as it is meant to reduce transportation costs, an important – and often overlooked – component of production, distribution […]

Continue ReadingThe Price of Human Life

DT Cochrane This American Life is a great public radio show based out of Chicago. They just hit their 500th episode and to celebrate, Ira Glass talked with his other producers about favourite past episodes. Alex Blumberg, one of the producers of Planet Money, reflected on a particular co-production with This American Life. All the […]

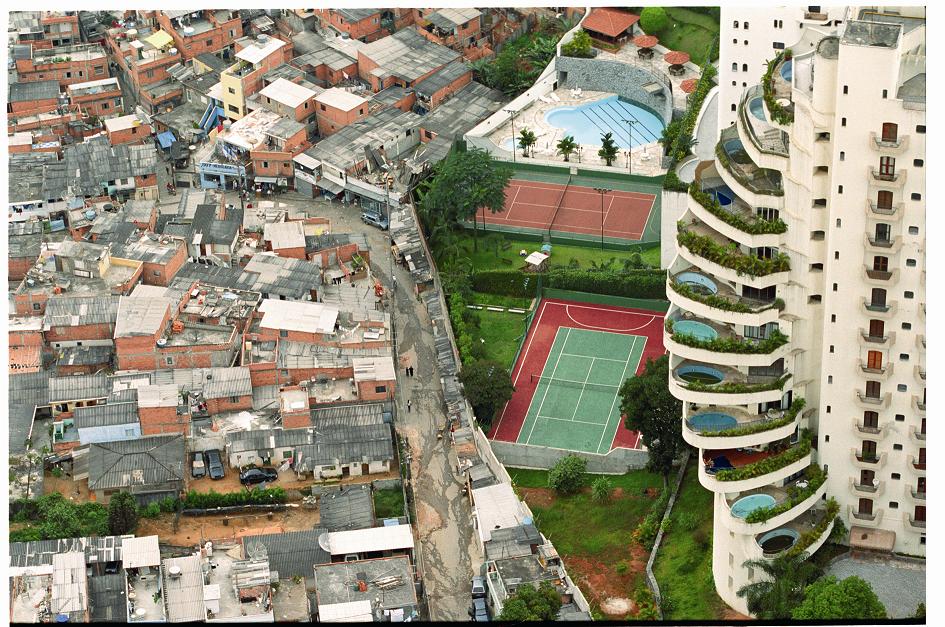

Continue ReadingMarkets and Inequality

DT Cochrane In the August 16 issue of The Financial Times, popularizing economics writer Tim Harford joined the chorus of voices raising the issue of income inequality. He asked whether or not we should care that the income gap is widening. He suggested there are two reasons we might care: process and outcome. On the […]

Continue ReadingMediating the Intra-capitalist Struggle

DT Cochrane U.S. regulators have subpoenaed powerhouses of financial intermediation, Goldman Sachs and JPMorgan Chase, as part of a probe into metal warehousing. Two companies identified with the supposedly ephemeral world of finance are being called to answer questions as owners of the decidedly concrete warehouses used to store aluminum. The investigation is being conducted […]

Continue Reading3rd Annual Conference – Capitalizing Power: The qualities and quantities of accumulation

Power from Above, Power from Below — Tim Di Muzio & Jonathan Nitzan No Way Out: Crime, Punishment & the Capitalization of Power — by Jonathan Nitzan New Dynamics of Power — Jeffrey Harrod & Herman Schwartz Restructuring Against Resistance — Joseph Baines https://www.youtube.com/watch?v=96zCLv25yNM What Happened to the Bondholding Class? — Sandy Hager Capitalist Power, […]

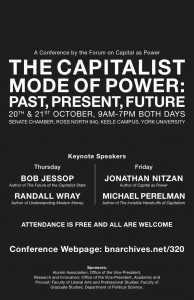

Continue Reading2nd Annual Conference – The Capitalist Mode of Power: Past, Present, Future

Session I: STATE POWER, Forum on Capital as Power 2011 Session II: BANKING, MONEY, FINANCE (Part 1), Forum on Capital as Power 2011 SESSION III: KEYNOTE ADDRESSES, Bob Jessop & Randall Wray, Forum on Capital as Power 2011 SESSION IV: BUSINESS POWER, Forum on Capital as Power 2011 SESSION V: BANKING, MONEY, FINANCE (Part 2), […]

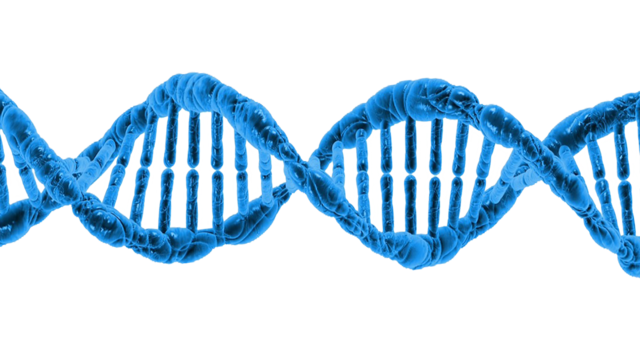

Continue ReadingDecapitalization of the human genome

DT Cochrane The U.S. Supreme Court has ruled that pieces of the human gene cannot be patented. The ruling invalidated two high profile cancer detection patents awarded to Myriad Genetics (MYGN). The ruling upheld the patenting of synthetic DNA. This partial decapitalization of the human genome showed up as decumulation by the company. Compared to […]

Continue ReadingThe language of capitalism

DT Cochrane In a Guardian op-ed, Doreen Massey explains how neoliberalism has altered the way we think and talk about the economy. While the general point is correct, the issue is much more fundamental than neoliberal ideology. The extent of the problem can be seen in the essay’s slugline: We should scrutinise the everyday language […]

Continue ReadingRadiolab: Nanoseconds on the Market

DT Cochrane The second part of this episode of Radiolab talks about the importance of nanoseconds when it comes to profitably making trades. The importance of this small difference led to a land grab as traders tried to get as close to the NYSE’s physical trading floor, since each foot of fiber optic cable between […]

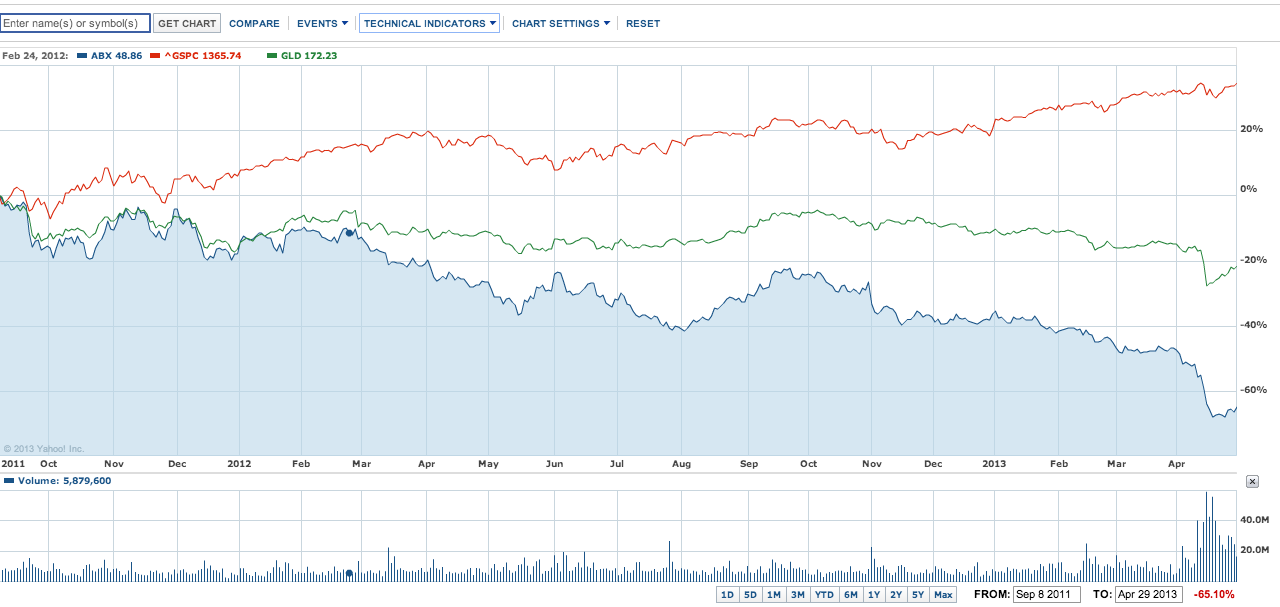

Continue ReadingProtest and gold deccumulation

DT Cochrane Activists confronted Barrick Gold CEO Peter Monk and shareholders at the company’s annual meeting. A Globe & Mail article suggested: “The long term outlook for Barrick shares hinges on many factors: the gold price is obviously the biggest driver, but the company also faces vociferous opposition from environmentalists and many residents around its […]

Continue ReadingPark, ‘Dominant Capital and the Transformation of Korean Capitalism: From Cold War to Globalization’

Abstract After the 1997 financial crisis, the neo-liberal restructuring of the Korean political economy accelerated dramatically. While there is a general consensus that the reform has had negative consequences for Korean society, heated debates continue over the culprits of the 1997 crisis and the changes that followed in its wake. Major opinions have largely coalesced […]

Continue Reading1st Annual Conference – Crisis of Capital, Crisis of Theory

Session I: THE VALUE CONTROVERSY, Forum on Capital as Power 2011 Session II: CRISIS OF CAPITAL, CRISIS OF THEORY, Forum on Capital as Power 2010 Session III: SYSTEMIC FEAR, MODERN FINANCE AND THE FUTURE OF CAPITALISM, Forum on Capital as Power 2010 Session IV: CRISIS, Forum on Capital as Power 2010 Session V: METHODS AND INSTITUTIONS, Forum on Capital as Power […]

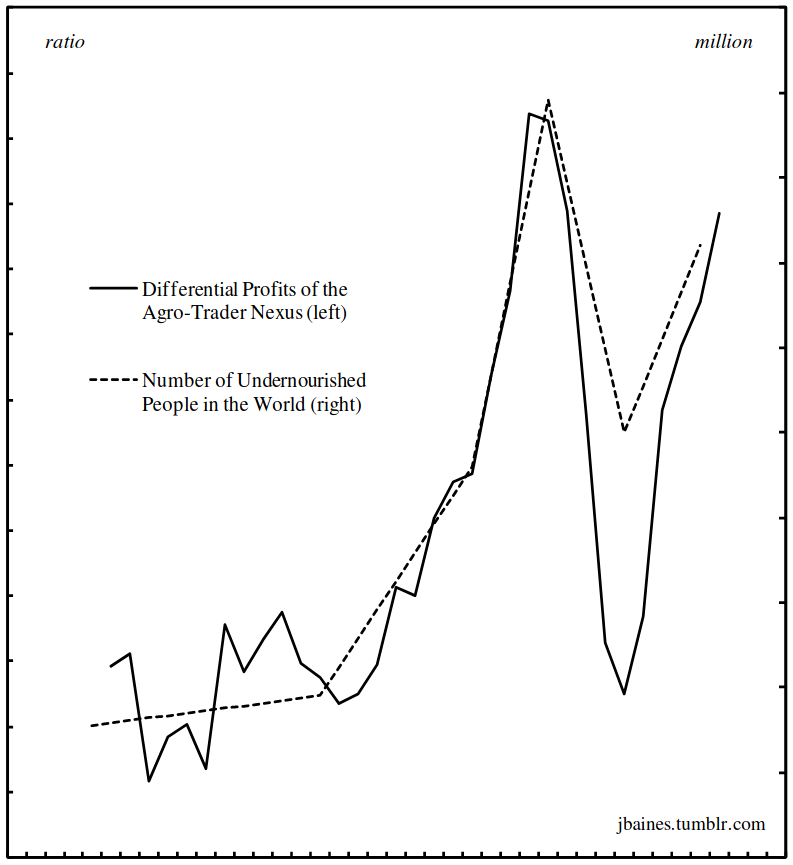

Continue ReadingBaines, ‘Food Price Inflation as Redistribution: Towards a New Analysis of Corporate Power in the World Food System’

Abstract This paper outlines the contours of a new research agenda for the analysis of food price crises. By weaving together a detailed quantitative examination of changes in corporate profit shares with a qualitative appraisal of the restructuring in business control over the organisation of society and nature, the paper points to the rapid ascendance […]

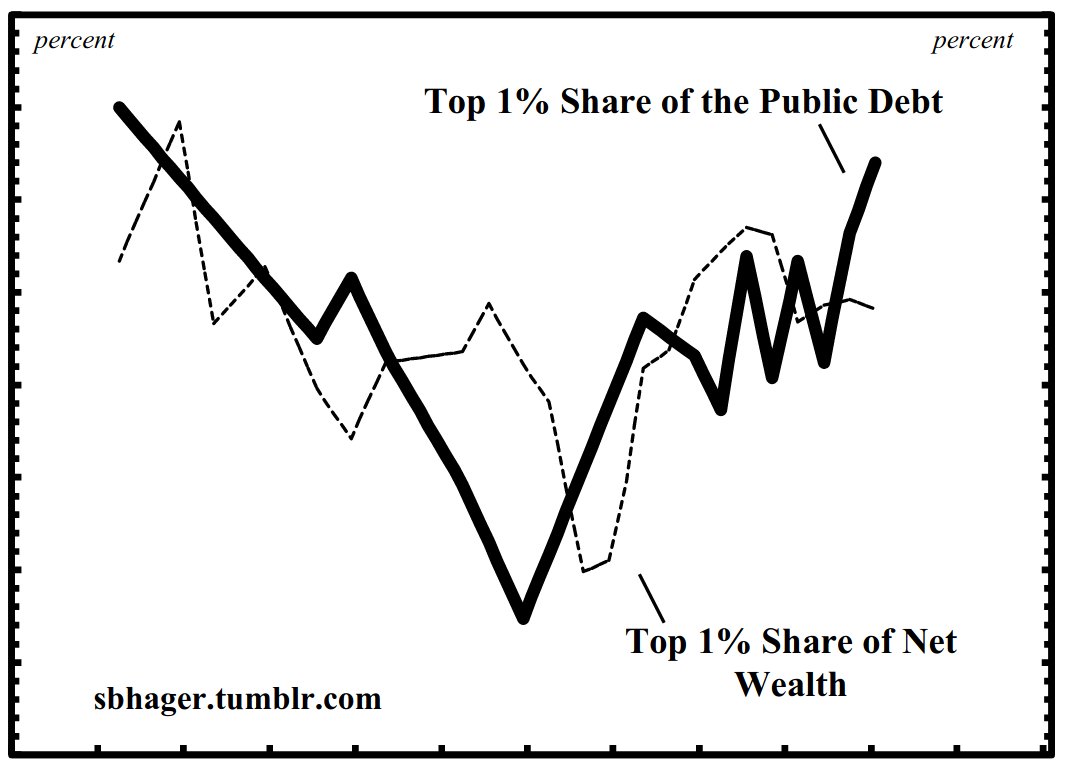

Continue ReadingHager, ‘What Happened to the Bondholding Class? Public Debt, Power and the Top One Per Cent’

Abstract In 1887 Henry Carter Adams produced a study demonstrating that the ownership of government bonds was heavily concentrated in the hands of a ‘bondholding class’ that lent to and, in Adams’s view, controlled the government like dominant shareholders control a corporation. The interests of this bondholding class clashed with the interests of the masses, […]

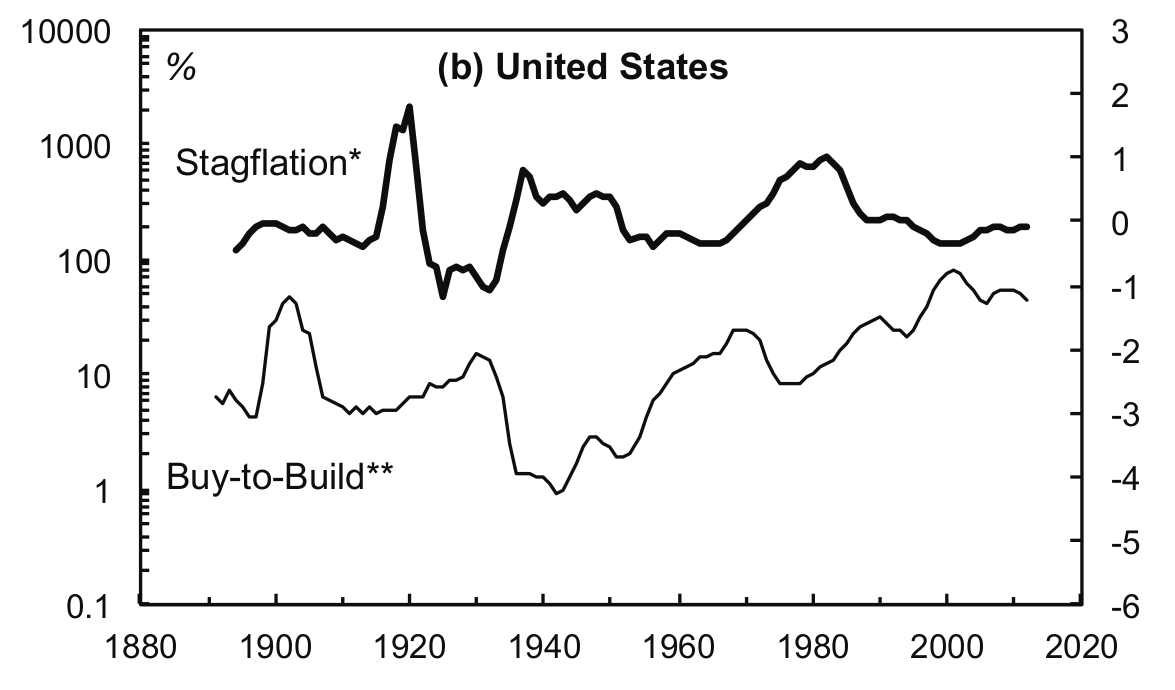

Continue ReadingThe Buy-to-Build Indicator: New Estimates for Britain and the United States

The Buy-to-Build Indicator New Estimates for Britain and the United States JOSEPH A. FRANCIS October 2013 Abstract This note presents new long-term estimates of what Jonathan Nitzan and Shimshon Bichler have named the ‘buy-to-build indicator’, which is calculated as the value of mergers and acquisitions as a percentage of gross capital formation. Keywords Britain, buy-to-build […]

Continue ReadingMcMahon, ‘The Rise of a Confident Hollywood: Risk and the Capitalization of Cinema’

Abstract This paper investigates the historical development of risk in the Hollywood film business. Using opening theatres as a proxy for future expectations, the paper demonstrates how, from 1981 to 2011, Hollywood has improved its ability to predict the financial rankings of its films. More specifically, the Hollywood film business has become better at predicting […]

Continue Reading