Abstract The U.S. stock market is again in turmoil. After a two-year bull run in which share prices soared by nearly 50 per cent, the market is suddenly dropping. Since the beginning of 2018, it lost nearly 10 per cent of its value, threatening investors with an official ‘correction’ or worse. As always, there is […]

Continue ReadingAfrica and Capital as Power

Tim Di Muzio This post originally appeared on the website for Review of African Political Economy. Despite the fact that the ‘capital as power’ approach to critical political economy has been around for some time now, it is not very widely used and/or understood. Part of the reason for this, I believe, is that it […]

Continue ReadingPodcast Interview with Blair Fix on Capitalism, Hierarchy, and Energy

James McMahon Blair Fix, whose publications are available on this site, was interviewed by Post-Scarcity Anarchism. The interview covers his research on energy use and the relationship between hierarchy and personal income. Worth the listen!

Continue ReadingWoodley, ‘Globalization and Capitalist Geopolitics: Sovereignty and State Power in a Multipolar World’

Abstract Globalization and Capitalist Geopolitics is concerned with the growth of transnational corporate power against the backdrop of the decline of the West and the struggle by non-Western states to challenge and overcome domination of the rest of the world by the West. At the centre of the study is the problematic status of the […]

Continue Reading2017 Review of Capital as Power Essay Prize

The Review of Capital as Power (RECASP) announces an annual essay prize on the subject of capital as power. The best paper will receive a prize of $2000. A prize of $500 will be awarded to the second best contribution, while a $300 prize will be given to the third best article. Submitted articles should […]

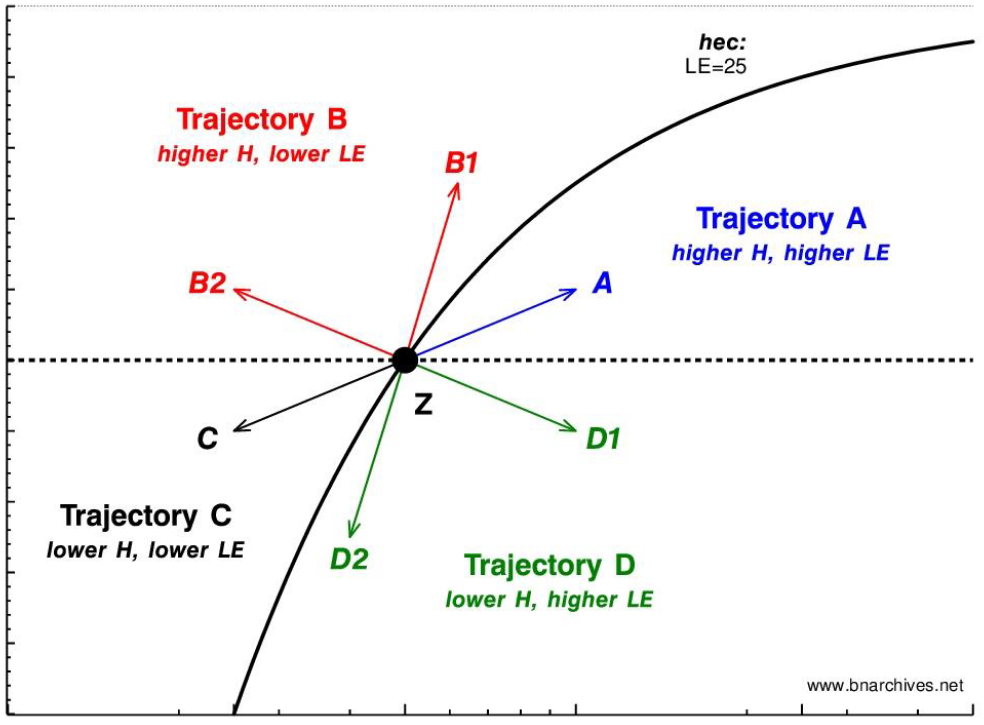

Continue ReadingDi Muzio, ‘The Tragedy of Human Development: A Genealogy of Capital as Power’

Abstract How might an objective observer conceive of what humans have accomplished as a species over its brief history? Benjamin argues that history can be judged as one giant catastrophe. Liberals suggest that this is to sombre an assessment and that human history can be read as a story of greater and greater progress in […]

Continue ReadingHoward, ‘Craftwashing in the U.S. Beer Industry’

Abstract Background: Big brewers, which have experienced declining sales for their beer brands in the last decade, have been accused of “craftwashing” by some craft brewers and their aficionados—they define craftwashing as big brewers (>6 million barrels per year) taking advantage of the increasing sales of craft beer by emulating these products or by acquiring […]

Continue ReadingProfit warning: there will be blood

Shimshom Bichler and Jonathan Nitzan The following research note first appeared on Real World Economics Review Blog. We have just updated the charts in our 2014 RWER paper ‘Still About Oil?’, and the picture they portray reads like a capitalist call for arms. Beginning in the late 1980s, we suggested that, since the late 1960s, […]

Continue ReadingHolman & McMahon, ‘From Power over Creation to the Power of Creation: Cornelius Castoriadis on Democratic Cultural Creation and the Case of Hollywood’

Abstract This article is a critical investigation and application of the aesthetic theory of Cornelius Castoriadis, one of the most important 20th-century theorists of radical democracy. We outline Castoriadis’s thoughts on autonomy, the social-historical nature of Being, and creation — key elements that inform his model of democratic culture. We then develop a Castoriadian critique […]

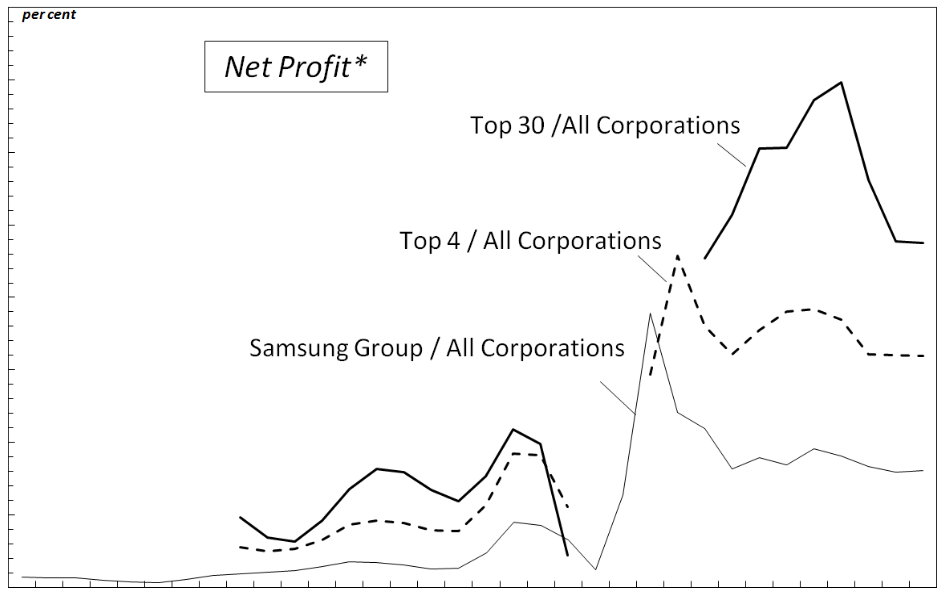

Continue ReadingPark, ‘Korea’s Post-1997 Restructuring: An Analysis of Capital as Power’

Abstract Winner of the RRPE Annual Best Paper Award for 2016 This paper aims to transcend current debates on Korea’s post-1997 restructuring, which rely on a dichotomy between domestic industrial capital and foreign financial capital, by adopting Nitzan and Bichler’s capital-as-power perspective. Based on this approach, the paper analyzes Korea’s recent political economic restructuring as […]

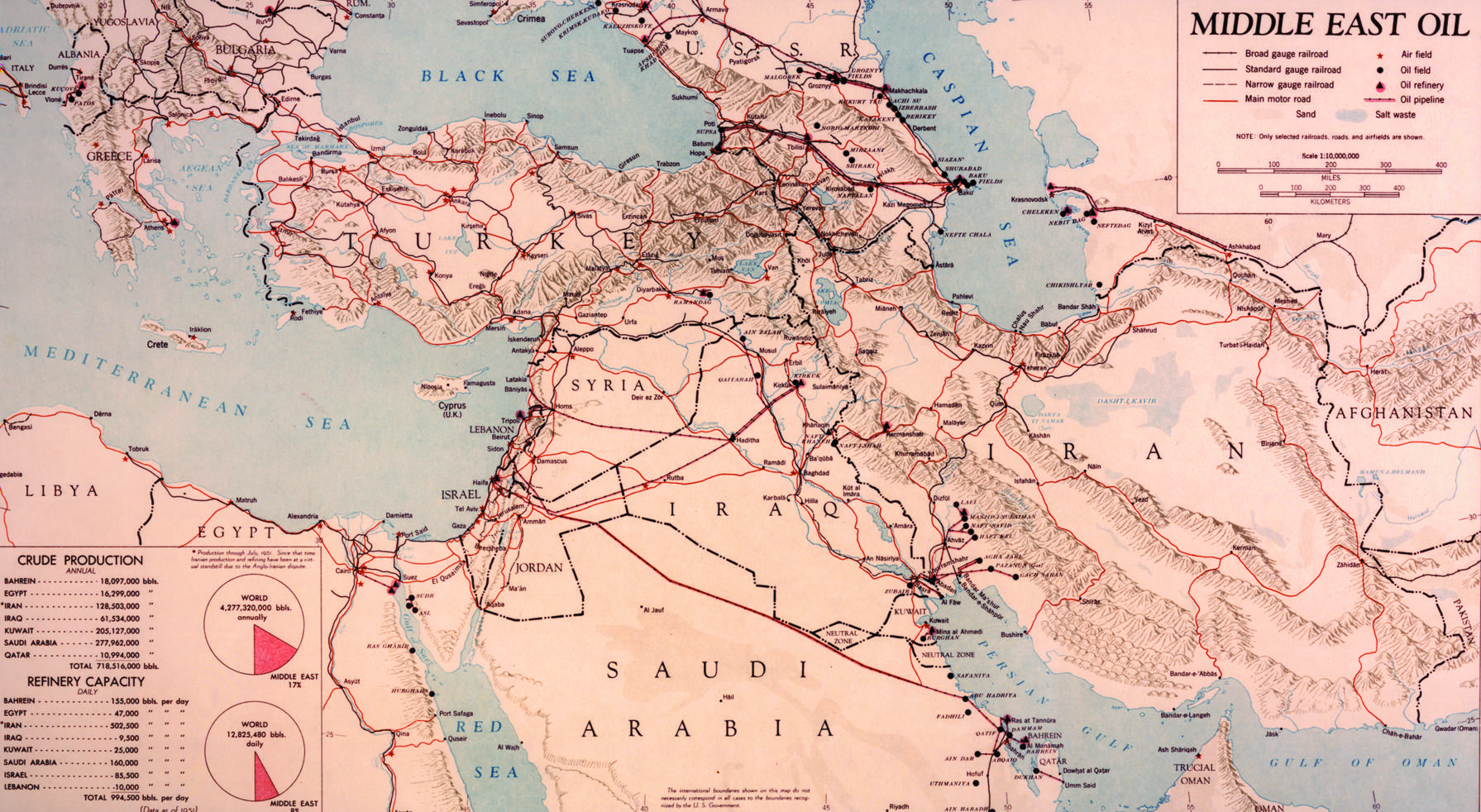

Continue ReadingNo. 2017/04: Bichler & Nitzan, ‘Arms and Oil in the Middle East: A Biography of Research’

Abstract During the late 1980s, we printed a series of working papers, offering a new approach to the political economy of Israel and wars in the Middle East. Our approach in these papers rested on three new concepts. It started by identifying the Weapondollar-Petrodollar Coalition – an alliance of armament firms, oil companies and financial […]

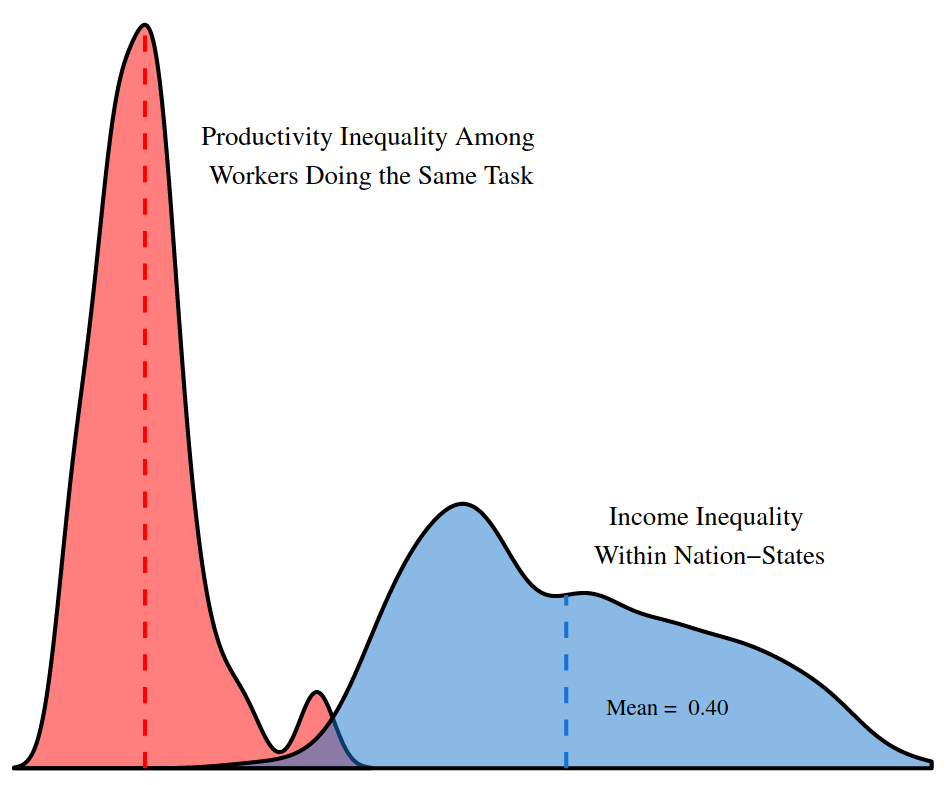

Continue ReadingNo. 2017/03: Fix, ‘Evidence for a Power Theory of Personal Income Distribution’

Abstract This paper proposes a new ‘power theory’ of personal income distribution. Contrary to the standard assumption that income is proportional to productivity, I hypothesize that income is most strongly determined by social power, as indicated by one’s position within an institutional hierarchy. While many theorists have proposed a connection between personal income and power, […]

Continue ReadingNo. 2017/02: Bichler & Nitzan, ‘Growing through Sabotage’

Abstract According to the theory of capital as power, capitalism, like any other mode of power, is born through sabotage and lives in chains – and yet everywhere we look we see it grow and expand. What explains this apparent puzzle of ‘growth in the midst of sabotage’? The answer, we argue, begins with the […]

Continue ReadingBichler & Nitzan, ‘Un Modelo CcP Del Mercado De Valores’

Abstract La mayoría de las explicaciones de las alzas y bajas del mercado de valores se basan en la comparación de la lógica “fundamental” subyacente de la economía con los factores exógenos que supuestamente la distorsionan. Este artículo presenta un modelo radicalmente distinto, y examina el mercado de valores desde la perspectiva del poder capitalizado […]

Continue ReadingComment on Can Capitalists Afford a Trumped Recovery?

The following commentary on Nitzan and Bichler’s piece ‘Can Capitalist Afford a Trumped Recovery?’ first appeared on the blog Pension Pulse, written by Leo Kolivakis. Earlier this week, I hooked up for a lunch with George Archer and Jonathan Nitzan, two friends of mine who also had previous stints working at BCA Research. I enjoyed […]

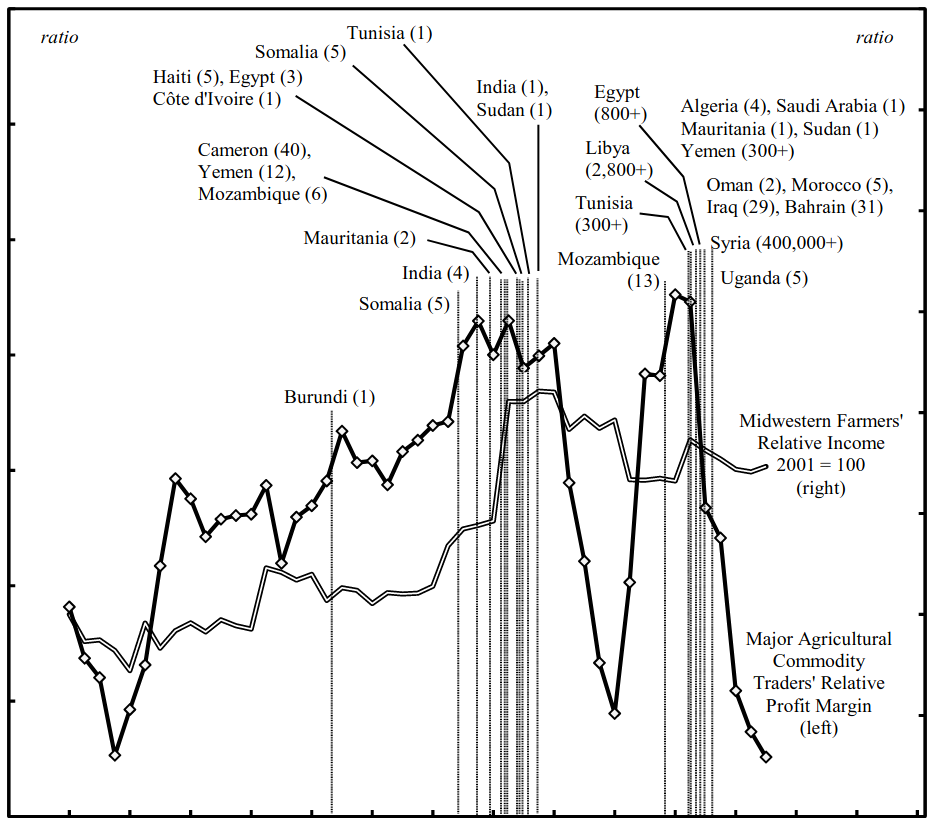

Continue ReadingBaines, ‘Accumulating through Food Crisis? Farmers, Commodity Traders and the Distributional Politics of Food Crisis’

Abstract This paper considers the domestic and international ramifications of financialization and grain price instability in the US agri-food sector. It finds that during the recent period of high and volatile prices, the average income of large-scale farms reached the earnings threshold of the top percentile of US households, and agricultural commodity traders markedly outperformed […]

Continue ReadingDid the Market Punish United Airlines?

DT Cochrane In the days following the wide-spread distribution of a video depicting Chicago transportation police officers violently removing Dr. David Dao from a United Airlines flight, there was celebration as the market pummelled the airlines shares (UAL). Or did it? Although the incident generated a great deal of outrage on Twitter, and early in […]

Continue ReadingDiMuzio & Dow, ‘Uneven and Combined Confusion’

Abstract This article offers a critique of Alexander Anievas and Kerem Nişancioğlu’s “How the West came to rule: the geopolitical origins of capitalism”. We argue that while all historiography features a number of silences, shortcomings or omissions, the omissions in How the West came to rule lead to a mistaken view of the emergence of […]

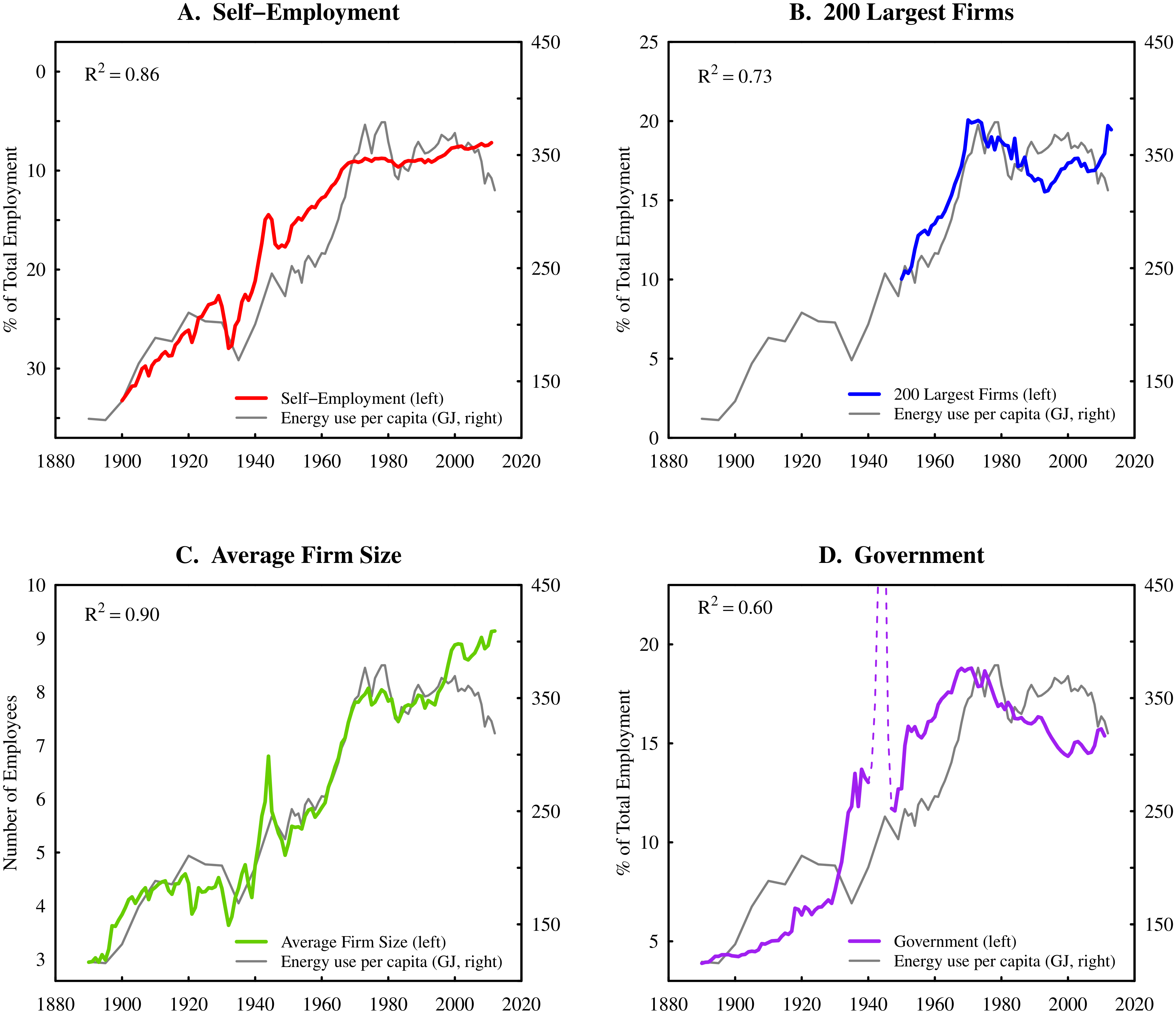

Continue ReadingFix, ‘Energy and Institution Size’

Abstract Why do institutions grow? Despite nearly a century of scientific effort, there remains little consensus on this topic. This paper offers a new approach that focuses on energy consumption. A systematic relation exists between institution size and energy consumption per capita: as energy consumption increases, institutions become larger. I hypothesize that this relation results […]

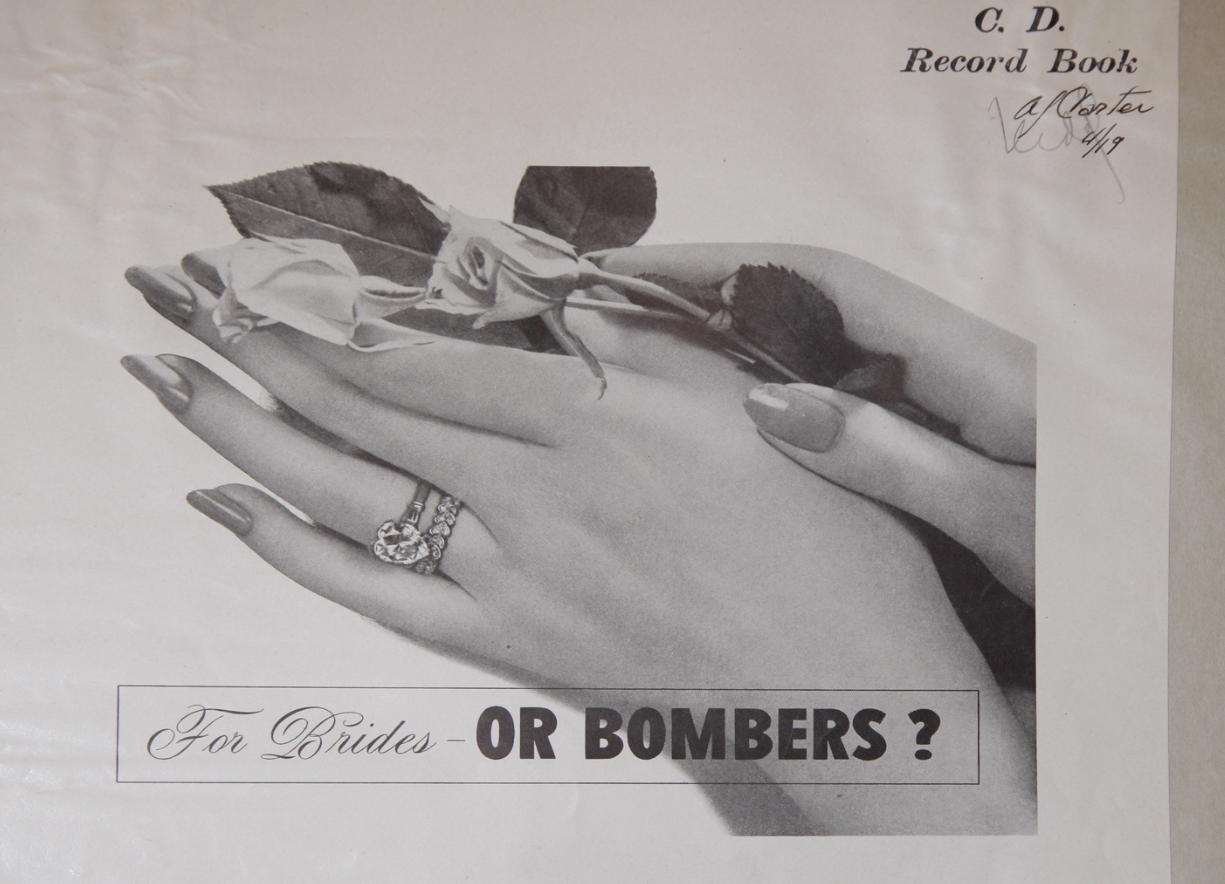

Continue ReadingNo. 2017/01: Cochrane, ‘Differentiating Diamonds: Transforming Knowledge and the Accumulation of De Beers’

Abstract In 1939, the De Beers diamond company faced a dire situation. The company’s accumulation had been dwindling for decades. The Great Depression not only pushed diamond sales to historic lows, it shifted American attitudes around consumption and thriftiness to the detriment of the luxury object. In this article, I bring together Liz McFall’s assertion […]

Continue Reading