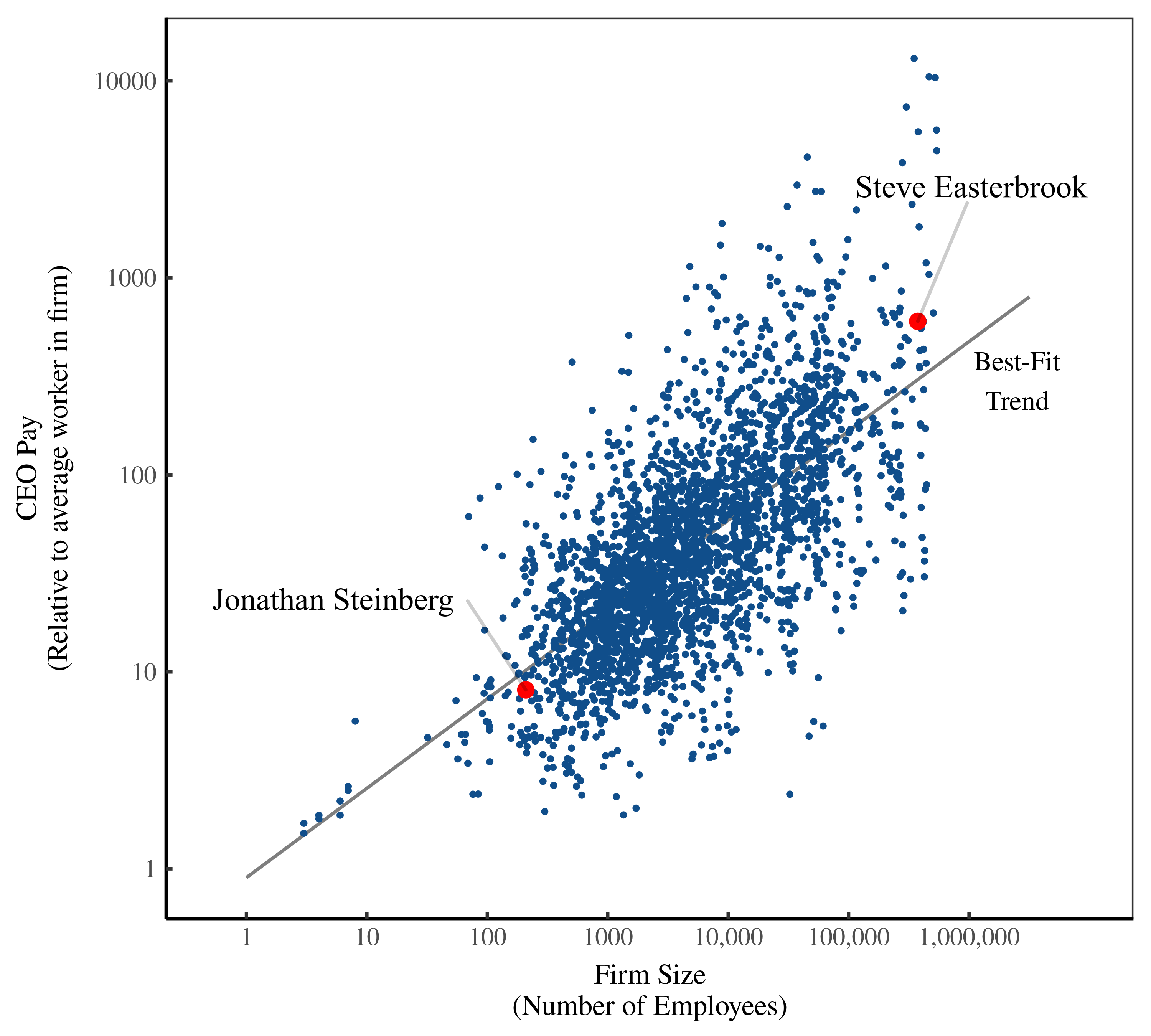

Originally published on Economics from the Top Down Blair Fix Last fall, I wrote a short article for The Mint Magazine about how income relates to hierarchy. The Mint, if you’re not familiar, does great work promoting pluralist thinking in economics. Check out their on-going Festival for Change — a festival devoted to building a […]

Continue ReadingJeffrey Williamson’s Terms of Trade

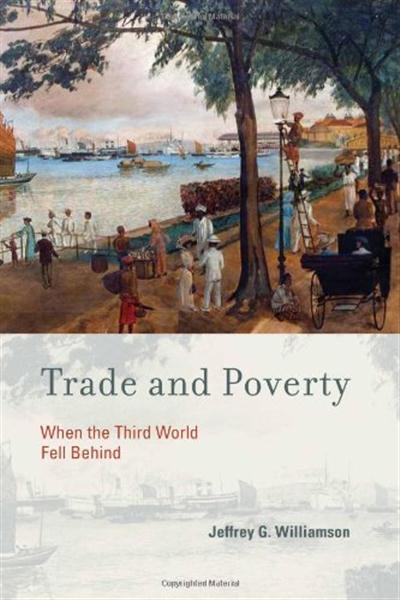

Originally published at joefrancis.info Joe Francis Jeffrey Williamson‘s (2011) book Trade and Poverty: When the Third World Fell Behind is one of the most interesting attempts to explain the ‘great divergence’ between rich and poor countries. It is a shame, then, that it is marred by his use of Mickey Mouse numbers. In simplified terms, Williamson argues that […]

Continue ReadingCapitalism without capitalists

Originally published at pluralistic.net Cory Doctorow One of the most exciting, eye-opening articles I’ve read in AGES. Showing how shareholder capitalism is a lie BY ITS PROPONENTS’ OWN TERMS…Genius. https://lpeblog.org/2020/02/18/privatizing-sovereignty-socializing-property-what-economics-doesnt-teach-you-about-the-corporation/ Marx thought individual property would end up being socialized, and he was right…but also wrong. The state hasn’t socialized property, corporations have. Corporatism is “capitalism […]

Continue ReadingWhat is (Global) Political Economy?

Originally published at sbhager.com Sandy Brian Hager For four years now I’ve been teaching a postgraduate module called Global Political Economy: Contemporary Approaches. This is one of two core modules for our MA programme in Global Political Economy at City. While my module deals with theoretical approaches, the other core module, taught by my colleague […]

Continue ReadingFrederick Soddy’s Debt Dynamics

Originally published on Economics from the Top Down Blair Fix In the field of ecological economics, Frederick Soddy looms large. Born in 1877, Soddy became a chemist and eventually won a Nobel prize for work on radioactive decay. Then he turned his attention to economics. Between 1921 and 1934, Soddy wrote four books that looked […]

Continue ReadingDid Andre Gunder Frank Know It All Already?

Originally published at joefrancis.info Joe Francis Andre Gunder Frank’s Lumpenbourgeoisie, Lumpendevelopment was published in 1972, almost half a century ago. Reading it now, it is surprising how contemporary it seems. Most notably, in a few pages Frank appears to provide a review of the ‘neo-institutionalist’ literature that is so prominent today in debates about the […]

Continue ReadingDi Muzio on ‘Sabotage’

Note from Blair Fix: In a series of essays published in 2013 and 2014 on capitaspower.com, political economist Tim Di Muzio explored the concept of ‘sabotage’ as it applies to capitalist power. I recently rediscovered these essays and was so impressed by them that I have reposted them here as a single piece. About the […]

Continue ReadingEnd of the line for Reaganomics

Originally published at pluralistic.net Cory Doctorow Reagan turned the country upside-down, in a very bad way. The “Reagan revolution” was indeed revolutionary (or, rather, counter-revolutionary), reversing a half-century of progress on social safety nets, workers’ rights, and environmental protections. When we take stock of the Reagan years, we tend to focus on the actions that […]

Continue ReadingDoing Public Debt: A Praxeology for the Bondholding Class?

Originally published at sbhager.com Sandy Brian Hager Earlier this month in Berlin I participated in the third workshop of the “Doing Debt” research network. I received the invitation back in May and was asked by the organizers to present my research on ownership of the public debt and to think about how this research might […]

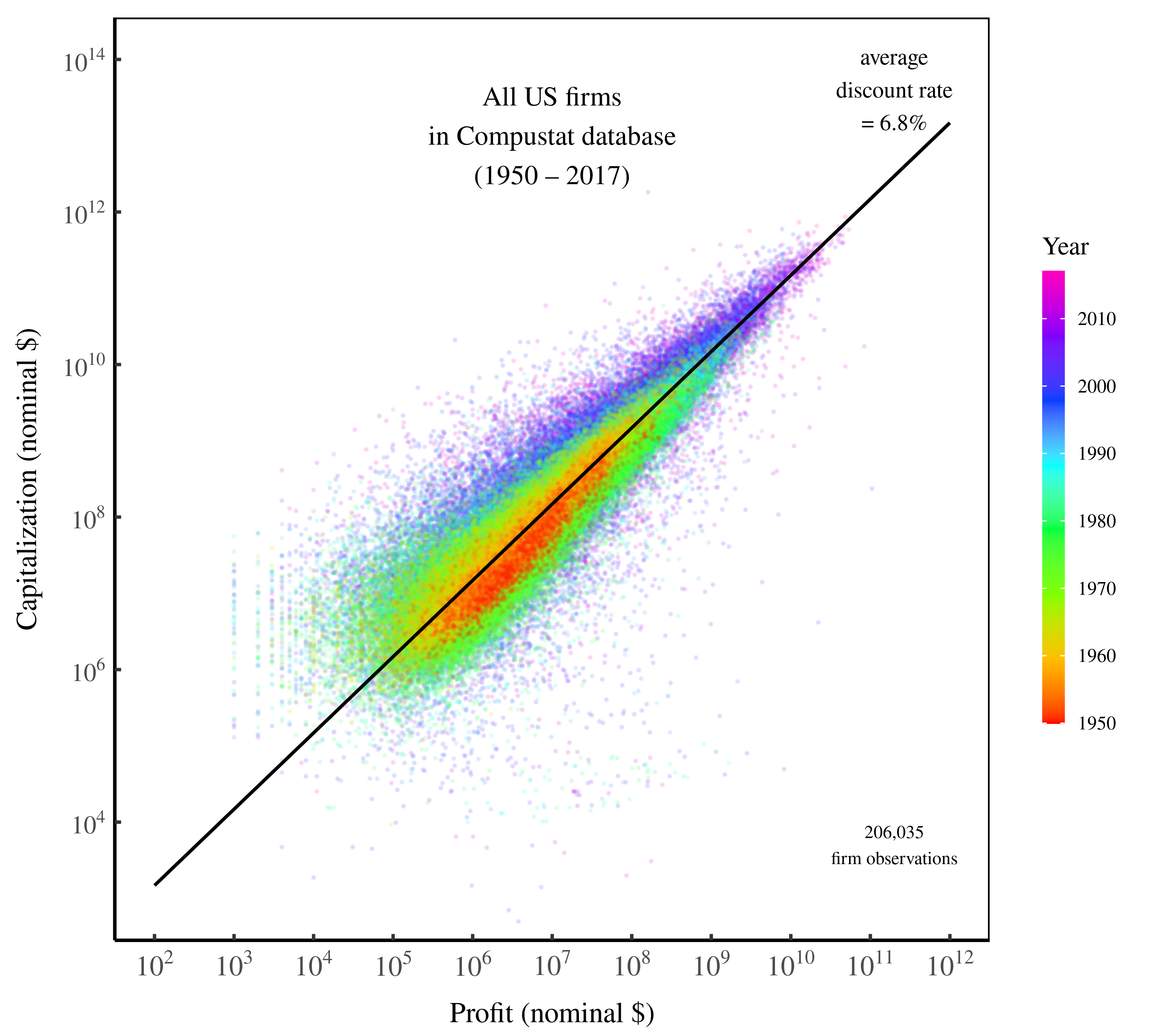

Continue ReadingFix, ‘The Ritual of Capitalization’

Abstract For more than a century, political economists have sought to understand the nature of capital. The prevailing wisdom is that there must be something ‘real’ — some productive capacity — that underpins capitalized values. This thinking, I argue, is a mistake. Building on Jonathan Nitzan and Shimshon Bichler’s theory of capital as power, I […]

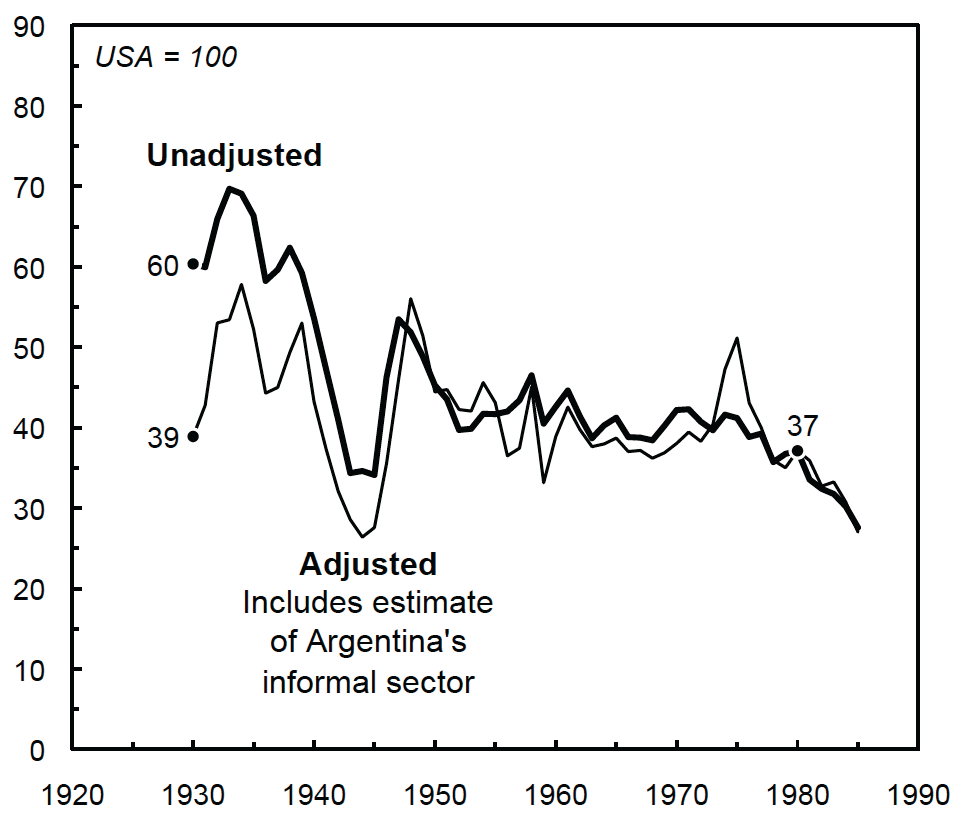

Continue ReadingArgentina: Decline or Urbanisation?

Originally published at joefrancis.info Joe Francis Recently the Economist published a front-page feature on ‘The Tragedy of Argentina: A Century of Decline‘. By summarising the current scholarship on the ‘Argentine paradox’, the article demonstrates why the study of the country’s history remains so necessary. The article begins with the standard claim that Argentina was rich at the beginning […]

Continue ReadingInequality Looks Very Different in Denmark and the US. Why?

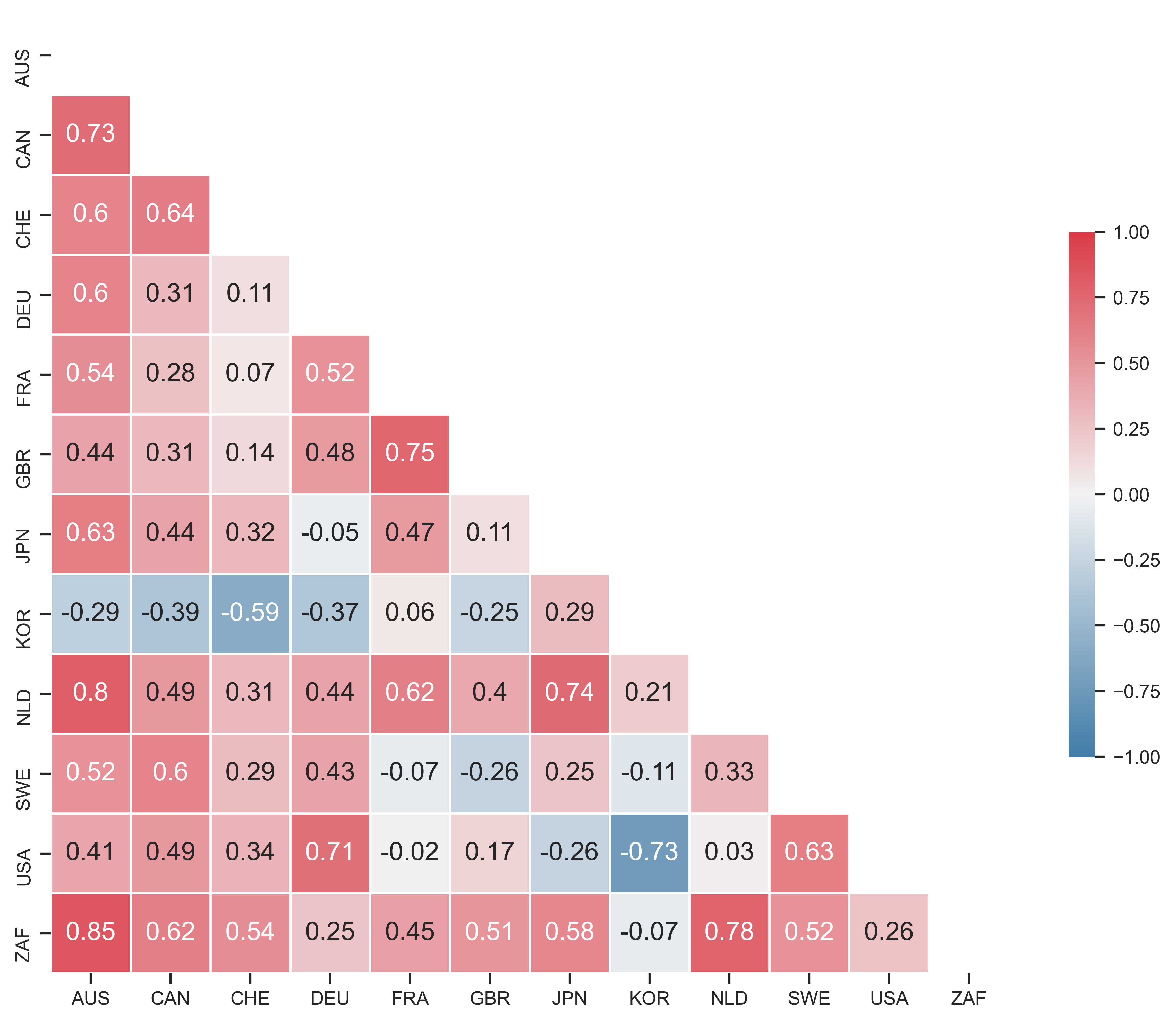

Originally published at sbhager.com Sandy Brian Hager The following piece is based on my State of the Art article in Socio-Economic Review. It was originally published for The Conversation and the World Economic Forum Global Agenda. A Spanish translation can be found here. Why do the richest 1% of Americans take 20% of national income, […]

Continue ReadingThe Mickey Mouse Number Problem

Originally published at joefrancis.info Joe Francis I never met my grandsupervisor (the PhD supervisor of my PhD supervisor), but I have enjoyed reading his rants. One in particular made a major impression upon me. In Mickey Mouse Numbers in World History: The Short View D.C.M. Platt (1989) outlined what he believed to be a major malady that […]

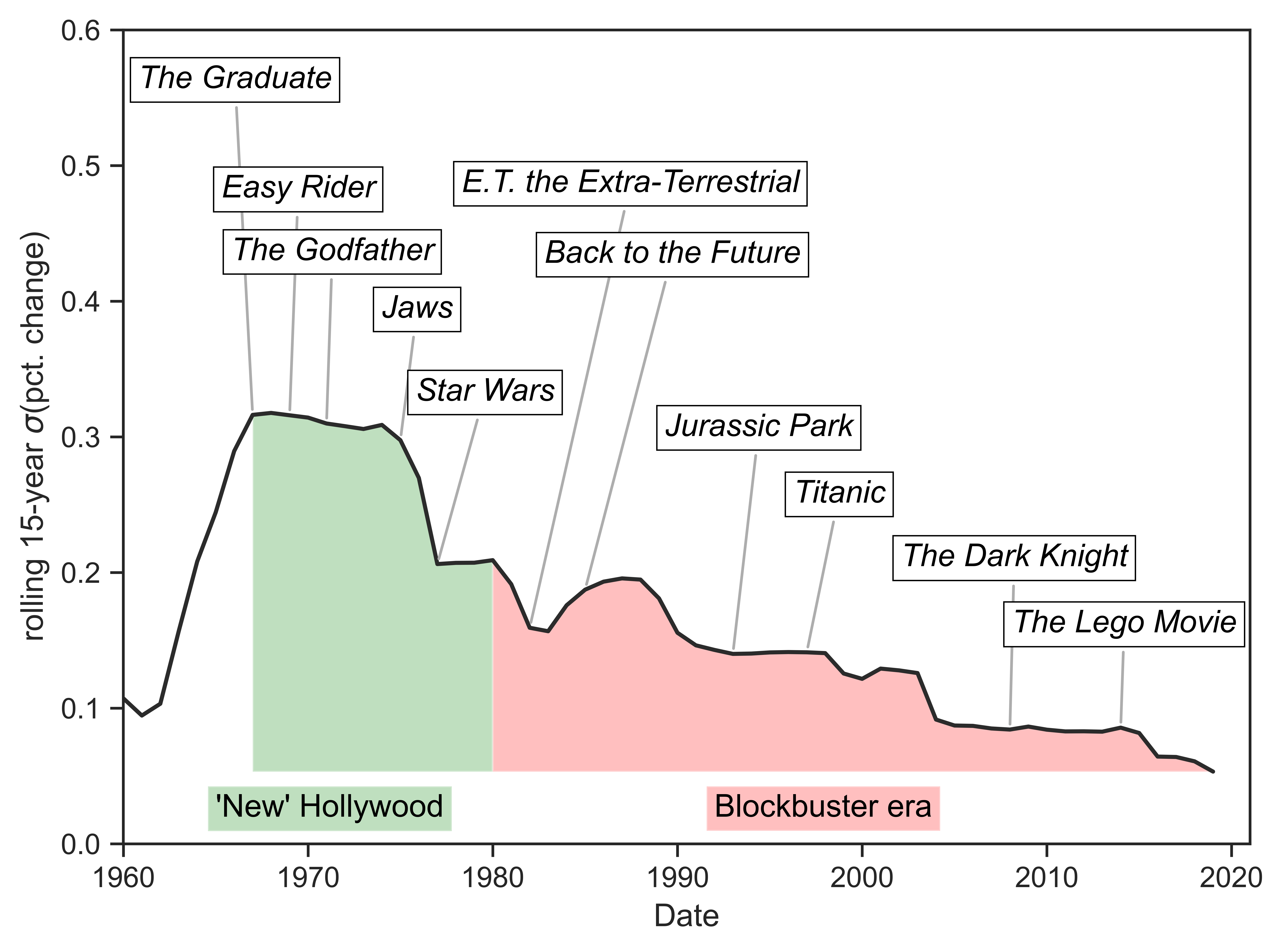

Continue ReadingHollywood’s mantra: “Nobody knows anything”

Originally published at notes on cinema James McMahon Your movie turned out the be a flop? “Nobody knows anything”. You mistakenly believed consumers wanted to see a movie set in the 1920s? “Nobody knows anything”. You thought your casting decisions were going to be loved by all? “Nobody knows anything”. “Nobody knows anything”–this was the […]

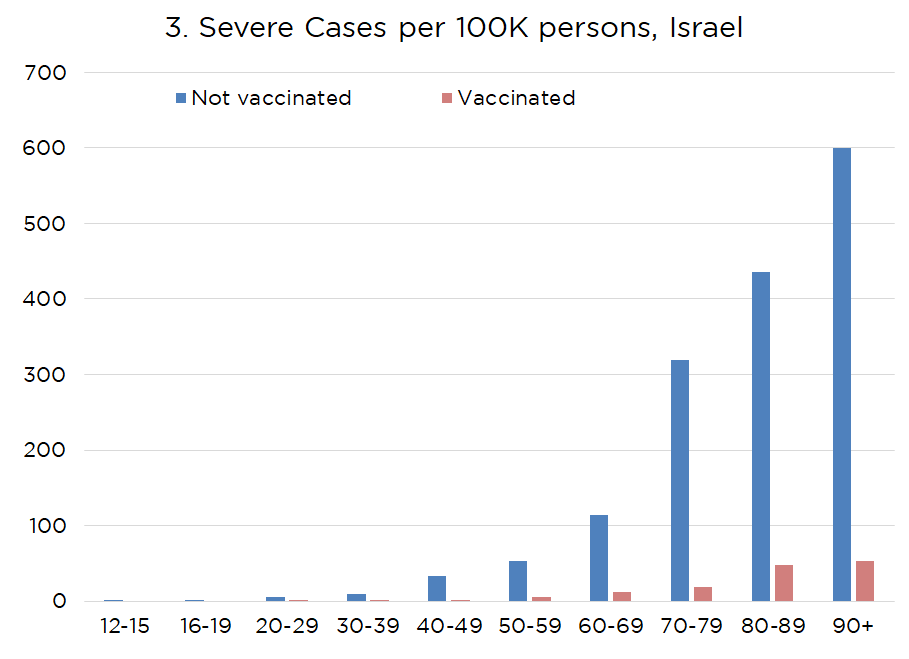

Continue ReadingIsraeli Data Demonstrates the Importance, and the Limits, of Vaccination

Originally published at dtcochrane.com DT Cochrane I recently saw a misleading presentation of COVID data pertaining to Israel. In this post I’m sharing several graphs that I made to counter this misleading image. Israel is currently a popular object of those committed to an anti-vax narrative because a high proportion of the population is fully […]

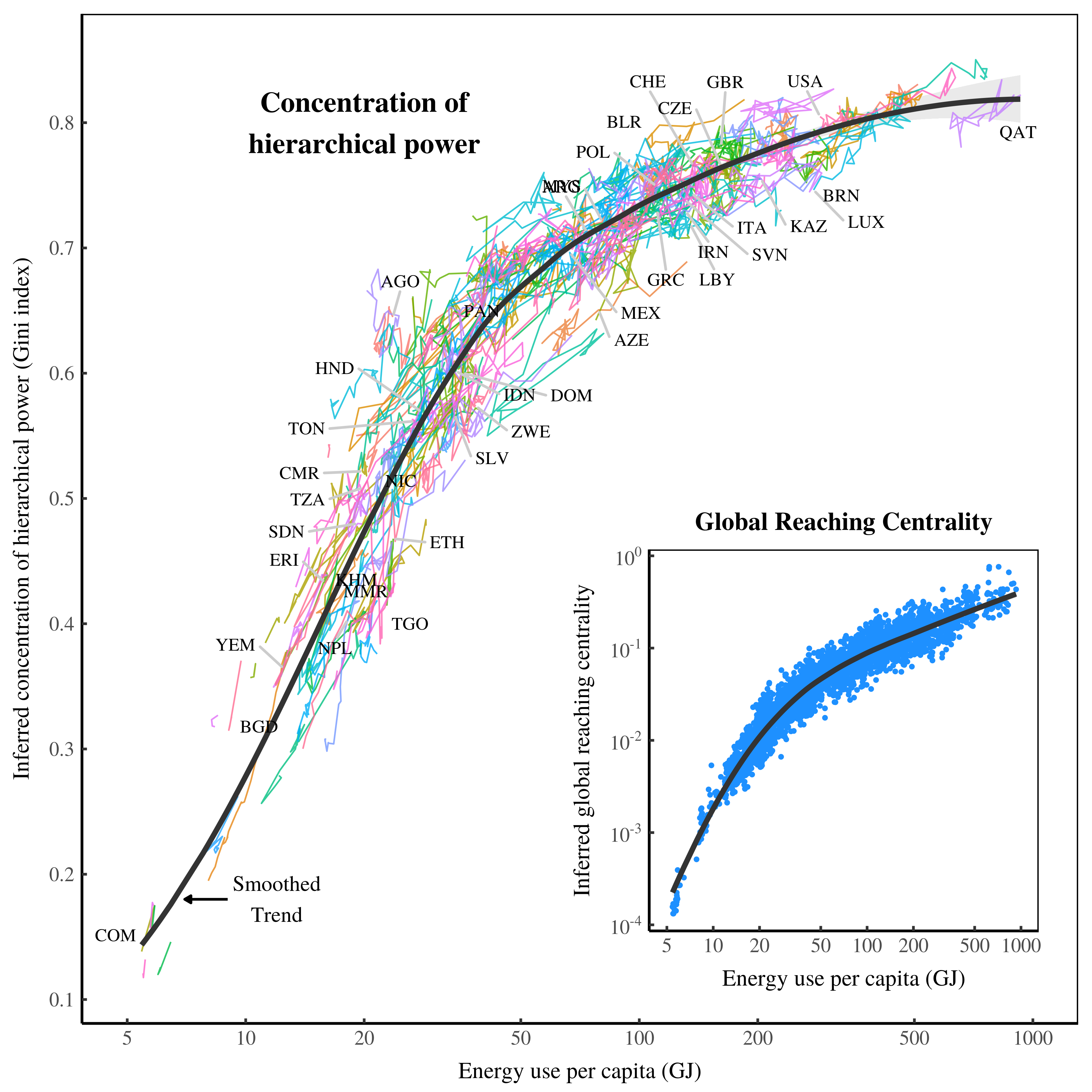

Continue ReadingFix, ‘Economic Development and the Death of the Free Market’

Abstract According to neoclassical economics, the most efficient way to organize human activity is to use the free market. By stoking self interest, the theory claims, individuals can benefit society. This idea, however, conflicts with the evolutionary theory of multilevel selection, which proposes that rather than stoke individual self interest, successful groups must suppress it. […]

Continue ReadingThe ‘Textbook Story’ of Inequality: How does it measure up?

Originally published at sbhager.com Sandy Brian Hager I put together Figure 1 for a paper I will be presenting at the 29th Annual Meeting of the Society for the Advancement of Socio-Economics in Lyon this summer. The chart captures the patterns of inequality found in the advanced capitalist countries over the past few decades. There are two […]

Continue ReadingWhy Scorcese is right about corporate power, Part 2

Originally published at notes on cinema James McMahon Part 1 introduced Scorcese’s argument in his Harper’s essay, which was about much more than Fellini. The first part also explained how we can connect Scorcese’s essay to the drive in the Hollywood film business for major film distributors to differentially accumulate, i.e., beat a benchmark that […]

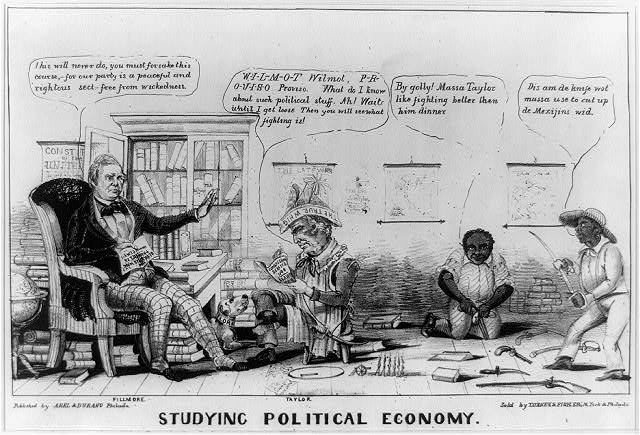

Continue ReadingWhy should we teach the history of political-economic thought?

Originally published at sbhager.com Sandy Brian Hager With the academic term winding down, I thought it would be useful to post some reflections on my teaching experiences this past year. In total, I taught three courses. Two of these courses were inherited from previous lecturers: a second-year undergraduate course on the history of political-economic thought, […]

Continue ReadingMcMahon, ‘Reconsidering Systemic Fear and the Stock Market’

Reconsidering Systemic Fear and the Stock Market A Reply to Baines and Hager JAMES MCMAHON August 2021 Abstract This article responds to Baines and Hager’s recent critique of the capital-as-power model of the stock market. Proposed by Bichler and Nitzan, this model seeks to explain how financial crises are tied to the concept of ‘systemic […]

Continue Reading