From Commodities to Assets Capital as Power and the Ontology of Finance JESÚS SUASTE CHERIZOLA May 2021 Abstract Assets are a crucial concept of the practice and mindset of the capitalist class. Critical analyses of capitalism, however, tend to admit that the exchange of commodities is the foundation of the analysis of capitalism. This article […]

Continue ReadingBaines & Hager, ‘Commodity Traders in a Storm: Financialization, Corporate Power and Ecological Crisis’

Abstract Commodity trading firms occupy a central position in global supply chains and their activities have been associated with financial instability, social upheaval and manifold forms of ecological devastation. This paper examines these companies in the context of debates regarding corporate financialization. We find that since the 2003–2011 commodity boom, trading firms have become less […]

Continue ReadingMcMahon, ‘Selling Hollywood to China’

Abstract From the 1980s to the present, Hollywood’s major distributors have been able to redistribute U.S. theatrical attendance to the advantage of their biggest blockbusters and franchises. At the global scale and during the same period, Hollywood has been leveraging U.S. foreign power to break ground in countries that have historically protected and supported their […]

Continue ReadingBaines & Hager, ‘The Great Debt Divergence and its Implications for the Covid-19 Crisis: Mapping Corporate Leverage as Power’

Abstract The COVID-19 pandemic has amplified longstanding concerns about mounting levels of corporate debt in the United States. This article places the current conjuncture in its historical context, analysing corporate indebtedness against the backdrop of increasing corporate concentration. Theorising leverage as a form of power, we find that the leverage of large non-financial firms increased […]

Continue ReadingDi Muzio & Robbins, ‘Capitalismo de deuda’

Abstract Capitalismo de deuda es un esfuerzo por descifrar cómo la tecnología de la deuda se ha convertido en uno de los mayores obstáculos para las aspiraciones democráticas y racionales de la sociedad moderna. Richard Robbins y Tim Di Muzio muestran que la deuda, entendida como una tecnología de poder, es un engranaje insertado en […]

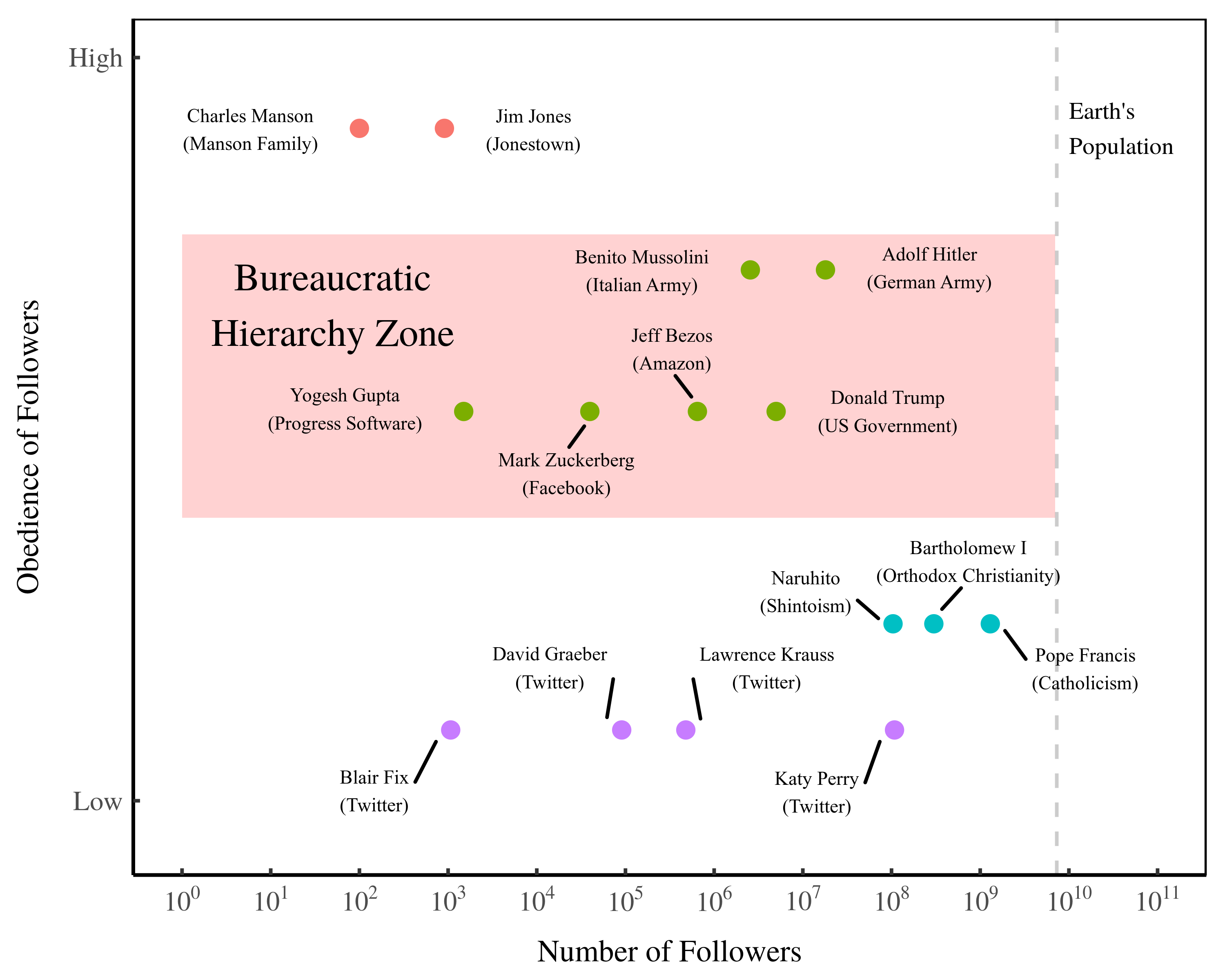

Continue ReadingThe Free Market as a Double Lie

Originally published on Economics from the Top Down Blair Fix As social animals, humans live and die by the success of our groups. This raises a dilemma. What’s best for the group is often not what’s best for individuals within the group. If you’re surrounded by a group of trusting individuals, it’s best for you […]

Continue ReadingPower and Price Construction in Capital as Power

D.T. Cochrane Abstract Perhaps the most contentious concept in Nitzan and Bichler’s power theory of value (CasP), is that of power itself. The contention is rightly placed. The concept has a long, complicated history and its widespread use within the social sciences is a problematic one, in part because its meaning is often taken for […]

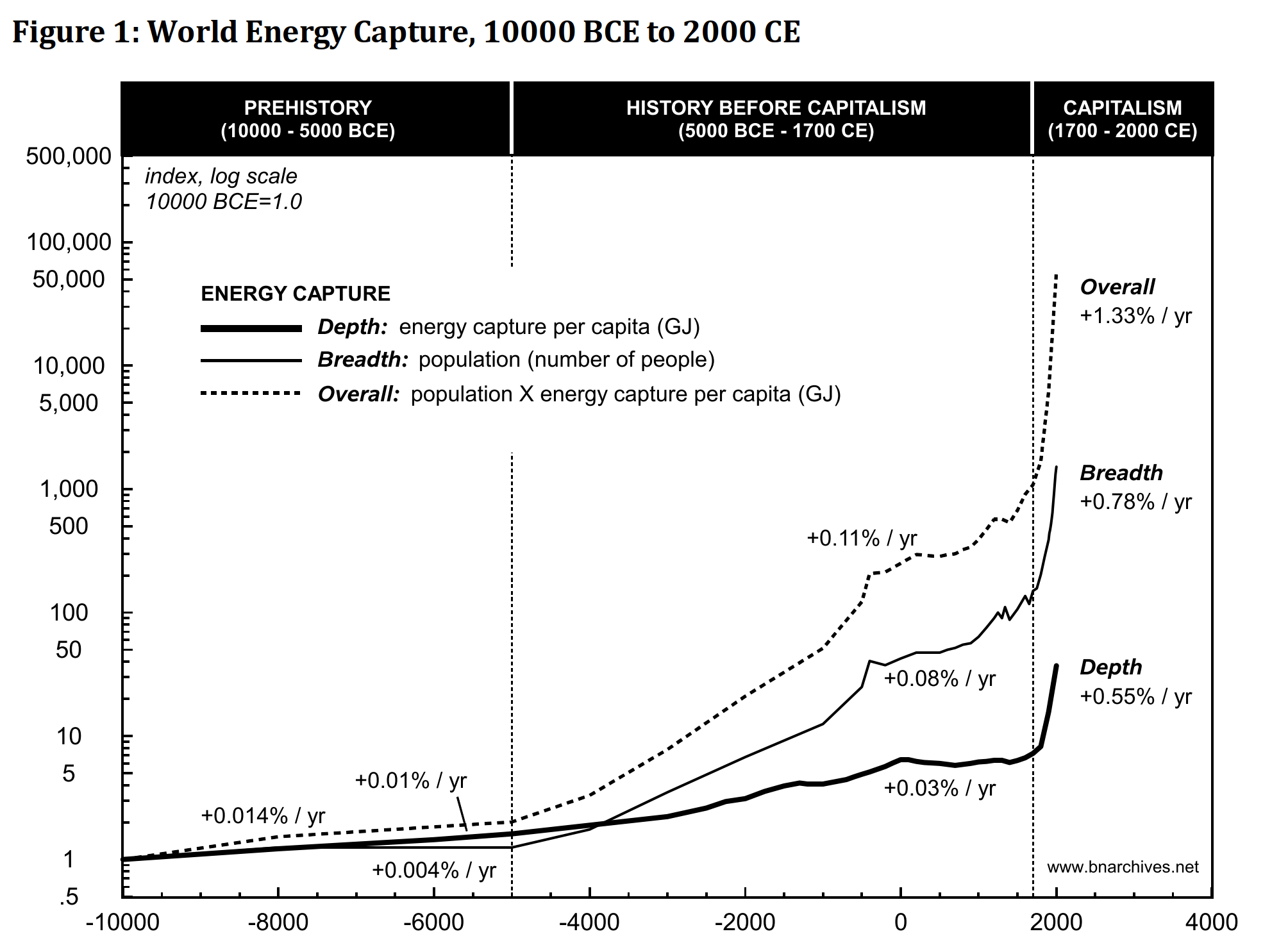

Continue ReadingBichler and Nitzan, ‘Growing Through Sabotage’

Growing Through Sabotage Energizing Hierarchical Power SHIMSHON BICHLER and JONATHAN NITZAN June 2020 Abstract According to the theory of capital as power, capitalism, like any other mode of power, is born through sabotage and lives in chains — and yet everywhere we look we see it grow and expand. What explains this apparent puzzle of […]

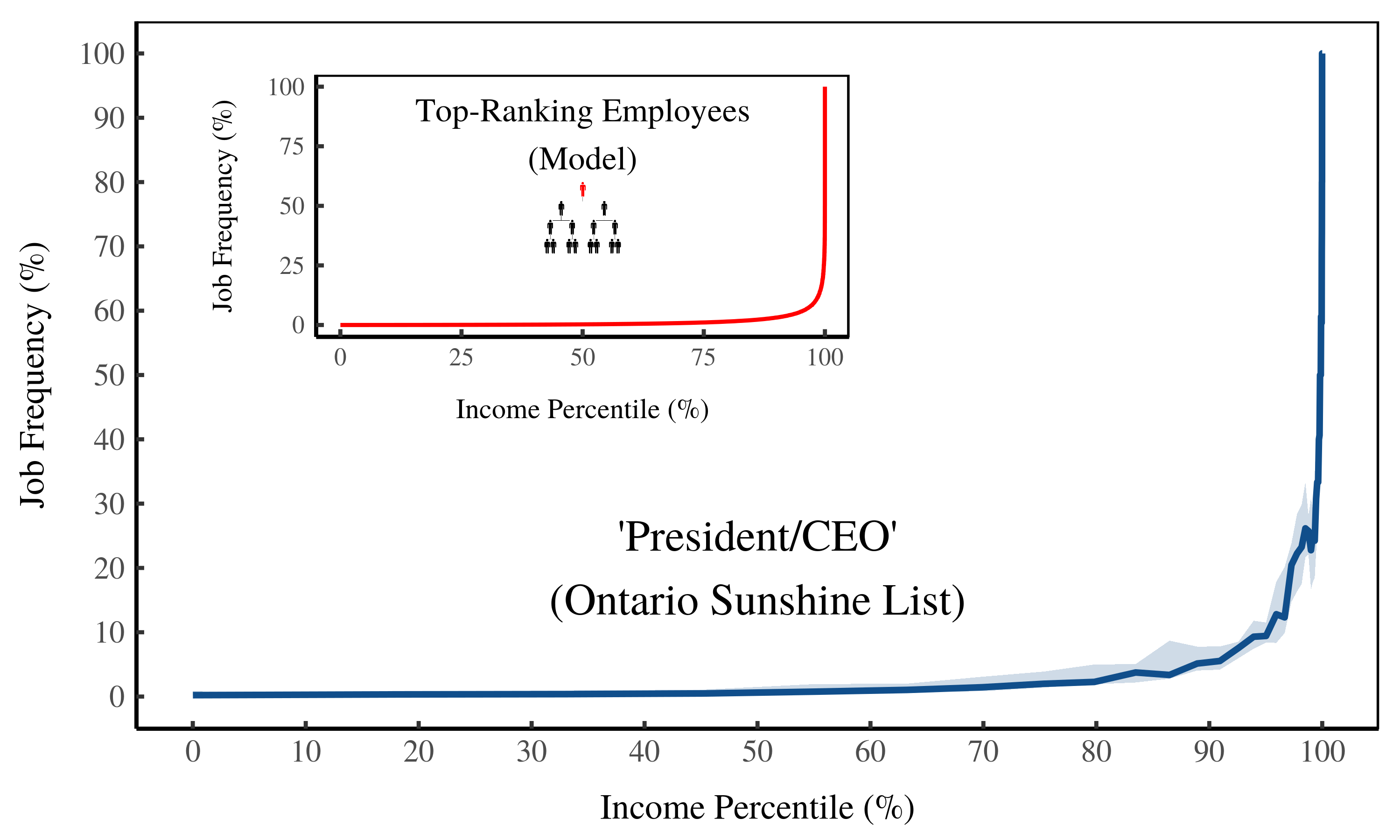

Continue ReadingSome Sunshine on the Ontario Job Hierarchy

Originally published on Economics from the Top Down Blair Fix Income, I’ve come to believe, is shaped largely by rank within a hierarchy. If you’re at the top of a hierarchy, you’ll earn a handsome sum. But if you’re at the bottom of a hierarchy, you’ll earn a pittance. As a hard-nosed scientist, I’m always […]

Continue ReadingDeath Anxiety and the Political Economy of Power

Originally published at sbhager.com Sandy Hager THINKING ABOUT DEATH I’ve been thinking a lot about death recently. No, it’s not something that came about because of the global pandemic and my new daily ritual of checking graphs on COVID-19 death tolls around the world. It started a few years back when I became interested in […]

Continue ReadingHow Hierarchy Can Mediate the Returns to Education

Originally published on Economics from the Top Down Blair Fix In The Social Environment as a Cause in Economics I argued that human behavior has two parts: Individual variation An environment that acts on this variation To illustrate these two parts, I used the example of the peppered moth. This species comes in two colors […]

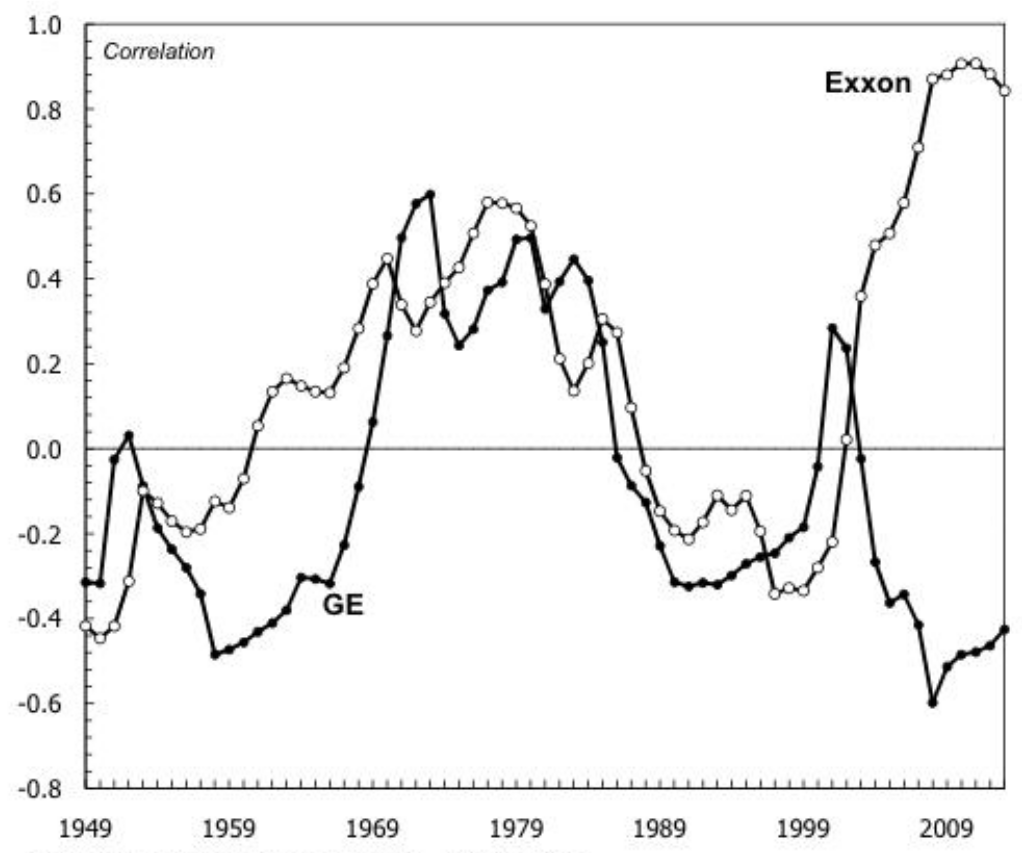

Continue Reading2020/04: McMahon, ‘Reconsidering Systemic Fear and the Stock Market: A Reply to Baines and Hager’

Abstract A recent New Political Economy article by Baines and Hager (2020) critiqued Shimshon Bichler and Jonathan Nitzan’s capital-as-power (CasP) model of the stock market (Bichler & Nitzan, 2016). Bichler and Nitzan’s model of the stock market seeks to explain how financial crises are tied to the (upper) limits of redistributing income through power. Bichler […]

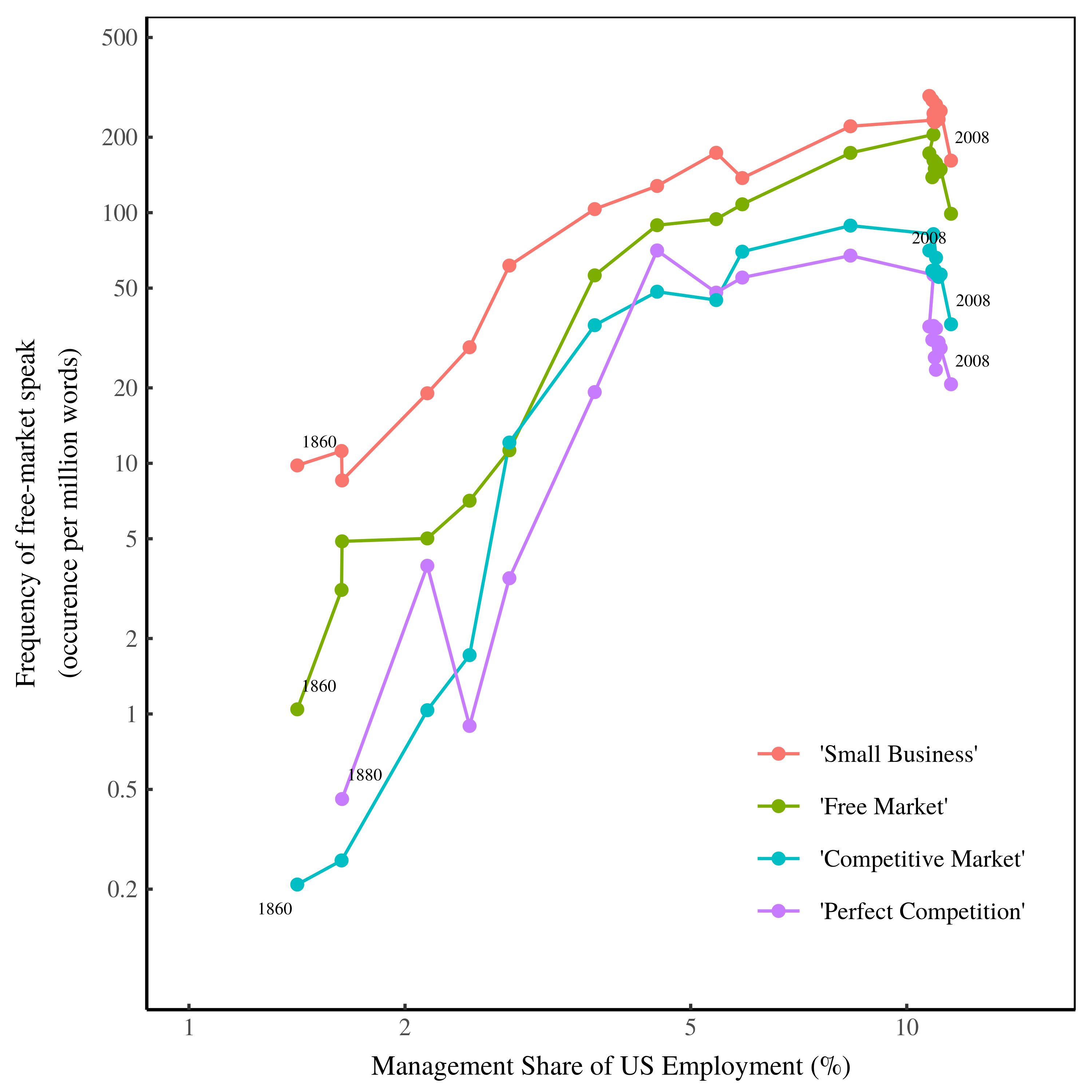

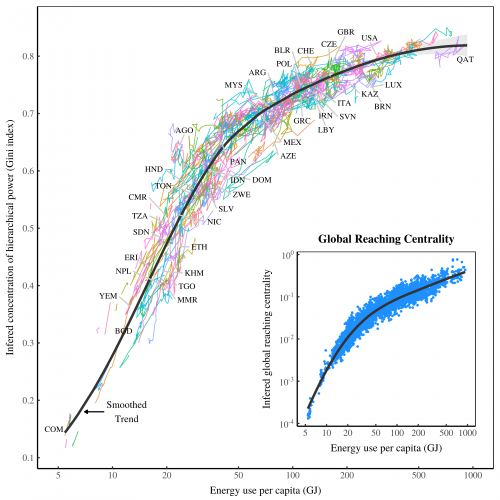

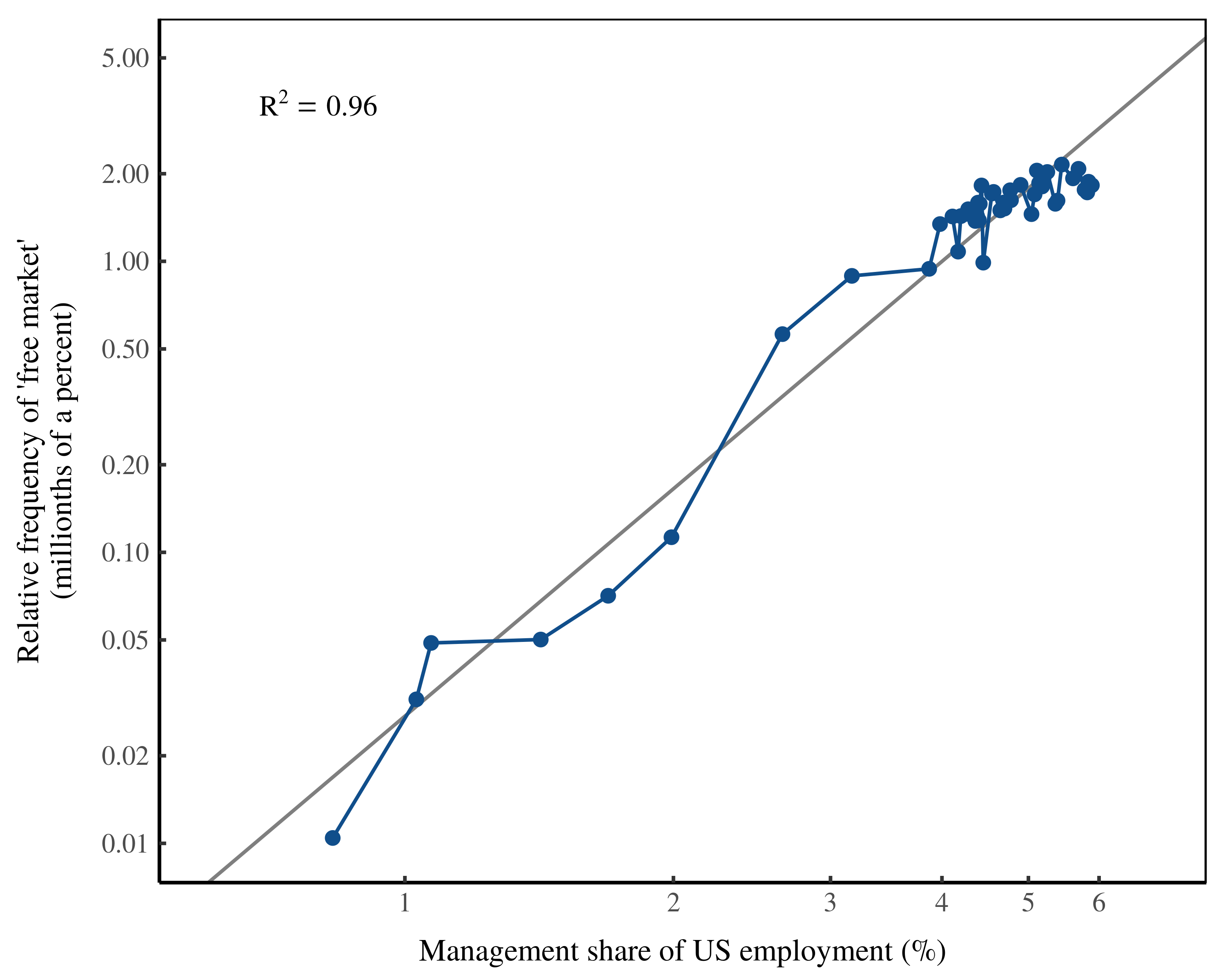

Continue Reading2020/01: Fix, ‘Economic Development and the Death of the Free Market’

Abstract Free markets are, according to neoclassical economic theory, the most efficient way of organizing human activity. The claim is that individuals can benefit society by acting only in their self interest. In contrast, the evolutionary theory of multilevel selection proposes that groups must suppress the self interest of individuals. They often do so, the […]

Continue ReadingAn Evolutionary Theory of Resource Distribution (Part 3)

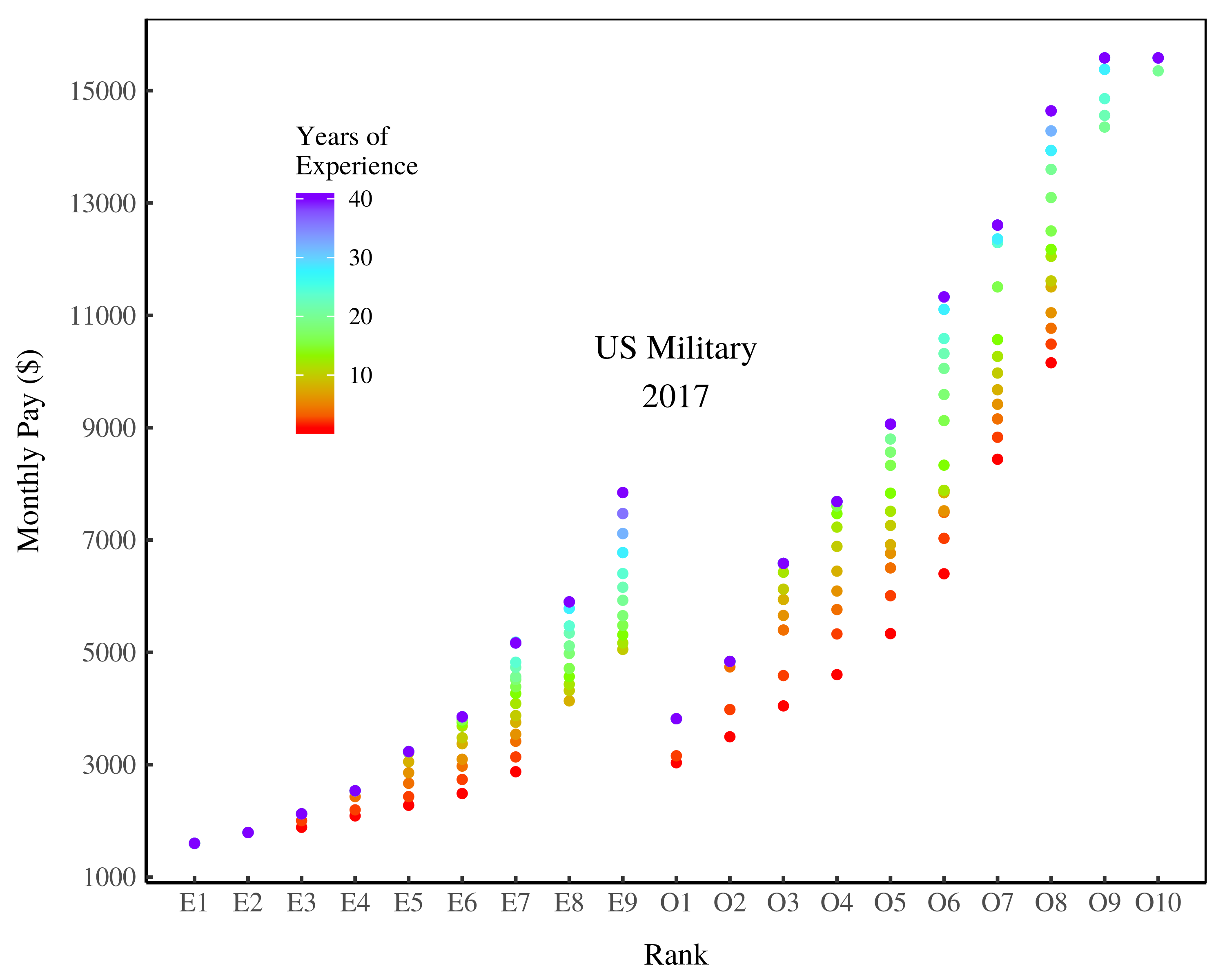

Originally published on Economics from the Top Down Blair Fix When it comes to earning income in a hierarchy, it’s not what you know that matters. It’s who you control. This was the provocative idea that I proposed in Part 2 of this series on an evolutionary theory of resource distribution. In this post, I […]

Continue ReadingAn Evolutionary Theory of Resource Distribution (Part 2)

Originally published on Economics from the Top Down Blair Fix A 25% chance. That’s the likelihood that when I tell someone I’m searching for a job, they’ll say: Remember, Blair … to land a job, it’s not what you know that matters. It’s who you know. OK, maybe I’m exaggerating this chance. Still, it’s an […]

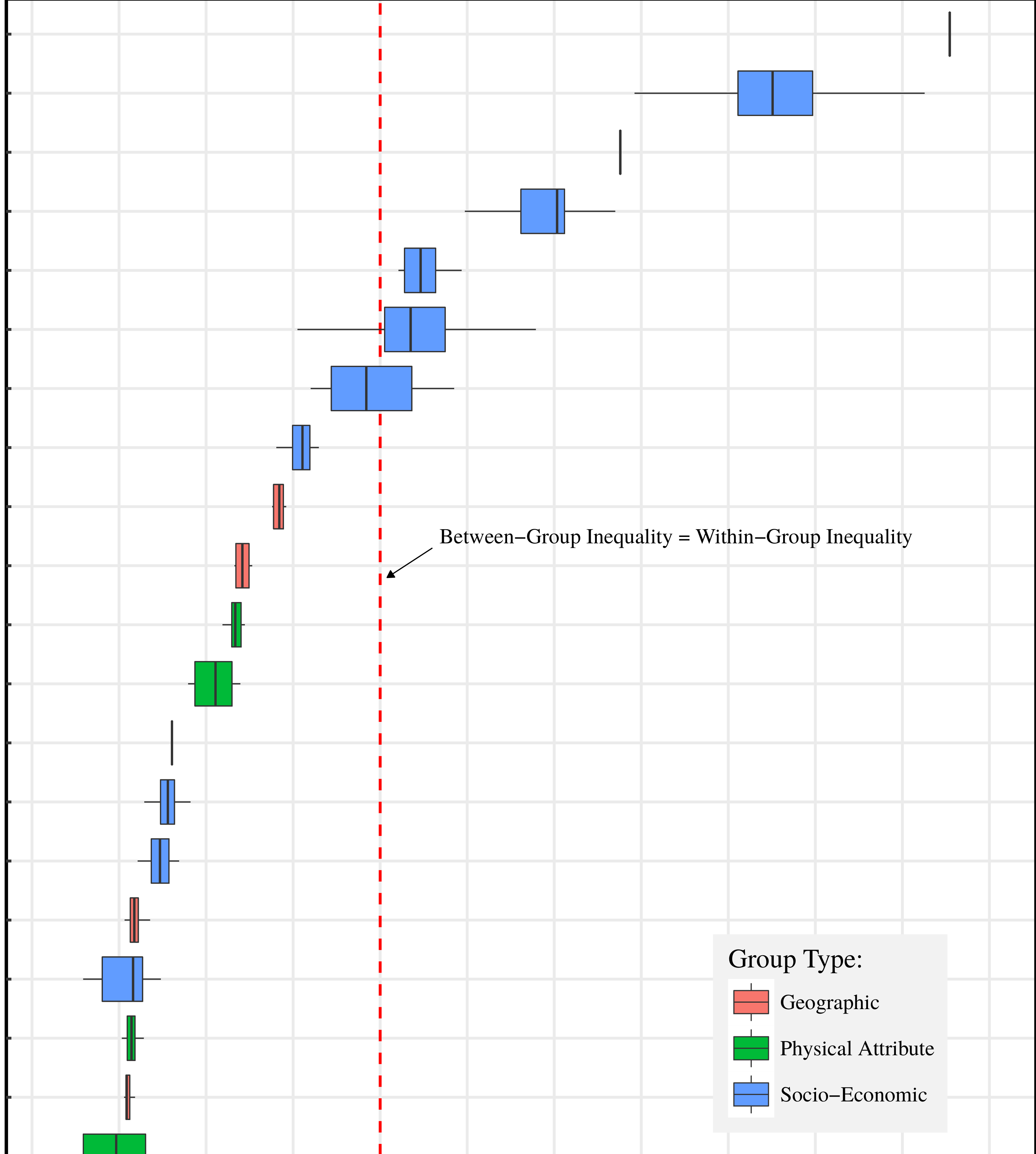

Continue ReadingFix, ‘An Evolutionary Theory of Resource Distribution’

Abstract This paper explores how the evolution of human sociality can help us understand how we distribute resources. Using ideas from sociobiology, I argue that resource distribution is marked by a tension between two levels of natural selection. At the group level, selfless behavior is advantageous. But at the individual level, selfish behavior is advantageous. […]

Continue ReadingFix, ‘Personal Income and Hierarchical Power’

Abstract This article examines the relation between personal income and hierarchical power. In the context of a firm hierarchy, I define hierarchical power as the number of subordinates under an individual’s control. Using the available case-study evidence, I find that relative income within firms scales strongly with hierarchical power. I also find that hierarchical power […]

Continue ReadingThe Allure of Marxism … And Why It’s a Mistake

Originally published on Economics from the Top Down Blair Fix Karl Marx is probably the most important social scientist in history. But while his influence is beyond compare, Marx’s legacy is, in many ways, disastrous. Few thinkers have inspired so many people to commit crimes against humanity. Think of Stalinist gulags. Think of the Ukrainian […]

Continue ReadingAs it Dies, We Talk About the ‘Free Market’ More

Originally published on Economics from the Top Down Blair Fix In The Growth of Hierarchy and the Death of the Free Market, I argued that economic development involves killing the free market. What was the evidence? As energy use increases, so does the relative number of managers. This growth of managers, I argued, indicates that […]

Continue Reading2019/04: Hager and Baines, ‘Jurisdictional Tax Rates: How the Corporate Tax System Fuels Concentration and Inequality’

Abstract Corporate concentration in the United States has been on the rise in recent years, sparking a heated debate about its causes, consequences, and potential remedies. In this study, we examine a facet of public policy that has been largely neglected in current debates about concentration: corporate tax policy. As part of our analysis we […]

Continue Reading