Jeremy Green With the Bank of England signalling an impending interest rate rise, monetary policy has returned to centre stage. Since 2008 we have lived through a period of extremely unorthodox monetary policy characterised by unprecedentedly low interest rates. This era of ‘cheap money’ may now be about to end and a return to ‘normality’ […]

Continue ReadingThe Story of Machines vs. Labour

DT Cochrane The replacement of labour by machines has brought many improvements in social well-being. New machines have made a wide variety jobs safer and less physically debilitating. Yet, the process is far from decisively good, with many attendant ills. Consider the mechanization of fishing boats. Fishing is a dangerous activity and having fewer workers […]

Continue ReadingThe Geopolitical Economy of the Ethanol Boom

Joseph Baines The corn-ethanol boom represents one of the most dramatic changes in the world food system in recent decades. The ethanol sector now absorbs around 40% of the corn produced in the US. Surging biofuels production (of which US corn-ethanol production accounts for about half) is widely considered to have played a key role […]

Continue ReadingThe Business of FIFA and Our Love of Football

James McMahon John Oliver, a former correspondent for The Daily Show with Jon Stewart, now has his own HBO show. Like what he did on The Daily Show, Oliver’s Last Week Tonight brings irreverence and wit to politics, business and other news of the day. Recently, he did a funny and sarcastic piece on FIFA, […]

Continue ReadingA Price for Everything

DT Cochrane What is a tree worth? Is this a question you’ve ever pondered? Does it seem like an odd question? Perhaps it seems like an inappropriate question? How could someone possibly attach a financial quantity to a tree? Don’t trees transcend monetary values? Trees are more the things of poetry than finance, aren’t they? […]

Continue ReadingBichler & Nitzan, ‘How Capitalists Learned to Stop Worrying and Love the Crisis’

Abstract Do capitalists really want a recovery? Can they afford it? On the face of it, the question sounds silly: of course capitalists want a recovery; how else can they prosper? According to the textbooks, both mainstream and heterodox, capital accumulation and economic growth are two sides of the same process. Accumulation generates growth and […]

Continue ReadingThe Weekly Sabotage: Week 7

Tim Di Muzio The Privatization of Money: The Greatest Sabotage in Human History? Part II Last time we found out that modern money is created when commercial banks make loans to people and businesses. They are not loaning out other people’s money at all, but effectively creating it by entering numbers into a computer. Between […]

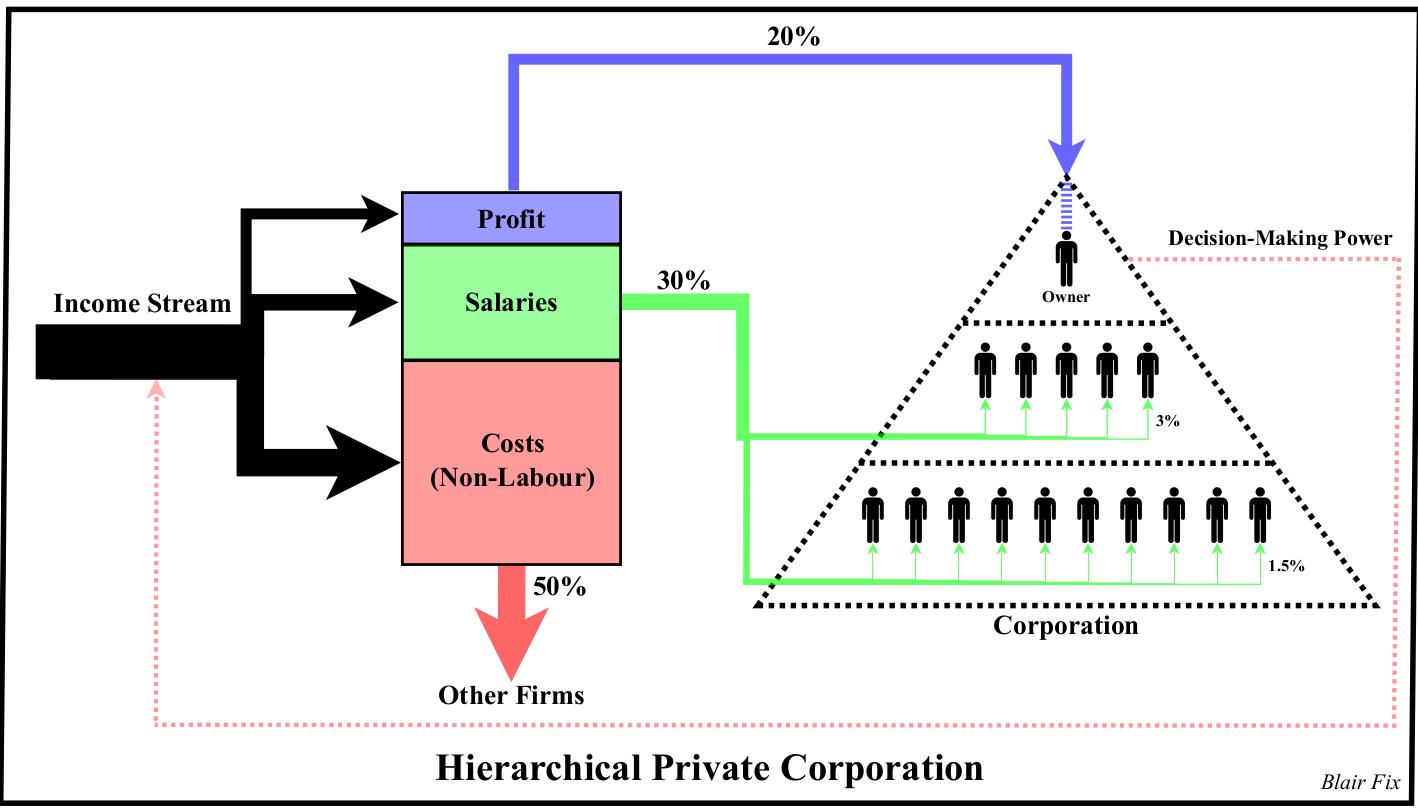

Continue ReadingNo. 2014/02: Fix, ‘Rethinking Profit: How Redistribution Drives Growth’

Abstract Using a combination of heterodox economics and biophysical analysis, this paper investigates the relationship between economic distribution and the growth of material throughput. Empirical results show that the growth of “useful work” correlates with redistribution towards profit. Furthermore, increases in energy consumption are correlated with increases in the largest corporations’ share of total employment. […]

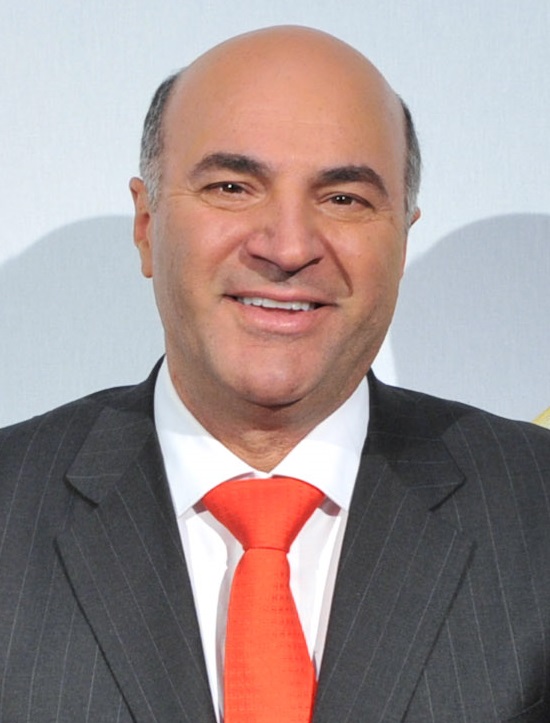

Continue ReadingKevin O’Leary, the Distillation of Capital

DT Cochrane Television personality Kevin O’Leary is best known as the ‘asshole’ on the investment reality shows Dragon’s Den, in Canada, and Shark Tank, in the United States. The shows have self-styled entrepreneurs bring forth their inventions or business ideas in hopes of attracting investment from a panel of capitalists, which includes O’Leary. He has […]

Continue ReadingNo. 2014/01: McMahon, ‘Capitalist Power, Distribution and the Order of Cinema’

Abstract In this paper, the structure of Hollywood film distribution will be analyzed through the lens of risk. In both its technical and conceptual senses, risk is relevant to the study of Hollywood’s dominant firms. In the interest of lowering risk, the business interests of Hollywood look to predetermine how new films will function in […]

Continue ReadingBaines, ‘Wal-Mart’s Power Trajectory: A Contribution to the Political Economy of the Firm’

Abstract This article offers a power theory of value analysis of Wal-Mart’s contested expansion in the retail business. More specifically, it draws on, and develops, some aspects of the capital as power framework so as to provide the first clear quantitative explication of the company’s power trajectory to date. After rapid growth in the first […]

Continue ReadingThe Weekly Sabotage: Week 6

Tim Di Muzio The Capitalization of Money Creation: The Greatest Sabotage in Human History? Every year in my course on Political Economy in the New Millennium I ask my students to do an exercise. The task is for them to ask three members of their friends or family how money is created. As you can […]

Continue ReadingHow sincere is Mr. Kerry about climate change?

Ilirjan Shehu Speaking to students in Jakarta, Indonesia, US Secretary of State, John Kerry, declared a few days ago that climate change is the world’s “most fearsome” weapon of mass destruction. Likening climate change to terrorism, Kerry stated that “It doesn’t keep us safe if the United States secures its nuclear arsenal while other countries […]

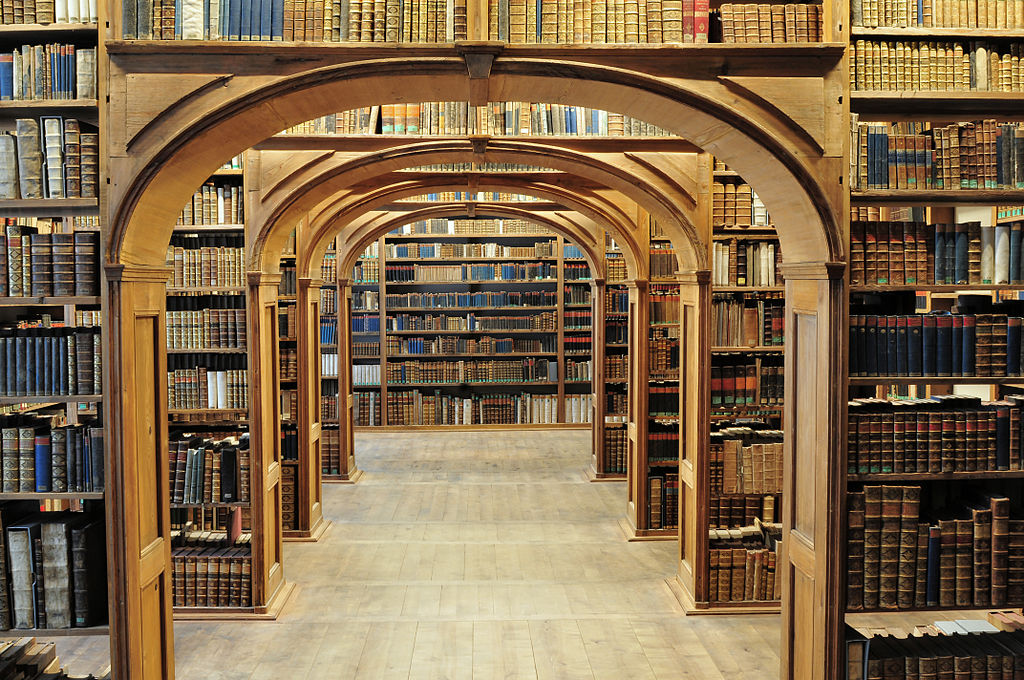

Continue ReadingWhat Should I Read?

James McMahon Over at Heterodox Microeconomics Research Network they have a thorough list of academic publications that are relevant to heterodox theories of capitalism. The list covers the following subjects: History and Methodology of Heterodox Microeconomics Critiques of Mainstream Microeconomics Principles of Heterodox Microeconomic Theory Theory of the Business Enterprise Structure of Production and Costs […]

Continue ReadingUS Department of Justice Increasingly Resorts to “Private” Negotiations

Eric George Since 2012, the U.S Department of Justice has launched a series of private negotiations with Wall Street banks relating to their involvement in the 2008 financial crisis. The DoJ made headlines this November when it struck a record $13b settlement with JP Morgan for allegations of fraud in the sale of mortgage-backed securities. […]

Continue ReadingThe President and the Tech Giants

Sandy Hager In an interesting piece for the Financial Times, Christopher Caldwell assesses Obama’s declaration to ‘go it alone’ in light of the ‘obstructionist Republican agenda’ in the US Congress. In a recent State of the Union address, Obama pledged a year of action, one that would see the president push for major policy reforms […]

Continue ReadingThe Weekly Sabotage: Week 5

Tim Di Muzio The Constitution of the United States of America It is by now fairly clear that the Congress of the United States is a ‘do-nothing’ Congress populated by 268 millionaires (out of 534 lawmakers). The job approval rating, depending on which poll we consider, hovers around 9-14%. This is perhaps hardly surprising given […]

Continue ReadingBichler & Nitzan, ‘No Way Out: Crime, Punishment and the Capitalization of Power’

Abstract The United States is often hailed as the world’s largest ‘free market’. But this ‘free market’ is also the world’s largest penal colony. It holds over seven million adults – roughly five per cent of the labour force – in jail, in prison, on parole and on probation. Is this an anomaly, or does […]

Continue ReadingThe facade of smooth operations

DT Cochrane Toronto’s Pearson Airport was recently thrown into chaos when bad weather forced it to suspend ground operations. For eight hours, hundreds of flights scheduled to land and take-off were unable to do so. Condemnation of the airport authority was swift and harsh. The event revealed two facts about the airport as a productive […]

Continue ReadingThe discipline of capital

DT Cochrane The title of this piece might make readers think of capitalist power over the masses. However, in this case, I’m thinking of how capital serves to discipline the decision-makers of capitalism. A recent Globe & Mail article discussed the desire of Canadian banks to keep the corporate bond market going. The banks serve […]

Continue Reading