Ken Zimmerman This piece was originally posted on the Real-World Economics Review Blog here and here. Shimshon Bichler and Jonathan Nitzan are Israeli political economists. Together they’ve created a thought-provoking power theory of capitalism and theory of differential accumulation. The theory is not “pie-in-the-sky,” but is based in their analysis of the political economy of […]

Continue ReadingCapitalism’s Deniers

Shimshon Bichler and Jonathan Nitzan Originally published at Real World Economics Review Blog. A new, capitalism-denying book is on the shelves, and it makes a stunning discovery: ‘Capitalism without competition is not capitalism’! Distortions: Capitalism Denied Capitalist crisis, like climate change, tends to breed ‘capitalism deniers’. The problem, argue the deniers, lies not in capitalism […]

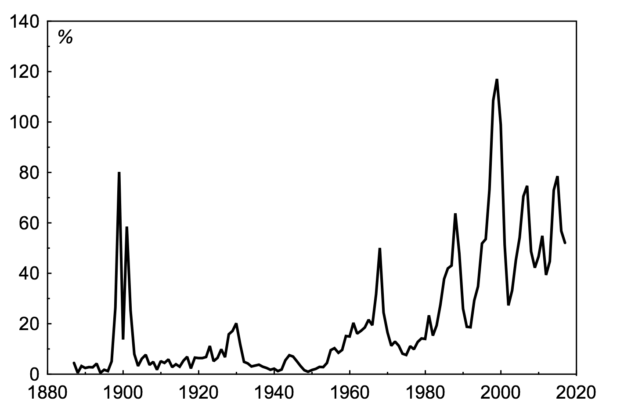

Continue ReadingFrancis’ Updated Buy-to-Build Indicator

Joe Francis The tendency toward buying other companies more than building new productive capacity continues in the United States In a past life I had access to expensive databases of corporate statistics, which I used to calculate the buy-to-build indicator for the United States from the 1880s until 2012. In short, the buy-to-build indicator shows […]

Continue ReadingAfrica and Capital as Power

Tim Di Muzio This post originally appeared on the website for Review of African Political Economy. Despite the fact that the ‘capital as power’ approach to critical political economy has been around for some time now, it is not very widely used and/or understood. Part of the reason for this, I believe, is that it […]

Continue ReadingPodcast Interview with Blair Fix on Capitalism, Hierarchy, and Energy

James McMahon Blair Fix, whose publications are available on this site, was interviewed by Post-Scarcity Anarchism. The interview covers his research on energy use and the relationship between hierarchy and personal income. Worth the listen!

Continue ReadingProfit warning: there will be blood

Shimshom Bichler and Jonathan Nitzan The following research note first appeared on Real World Economics Review Blog. We have just updated the charts in our 2014 RWER paper ‘Still About Oil?’, and the picture they portray reads like a capitalist call for arms. Beginning in the late 1980s, we suggested that, since the late 1960s, […]

Continue ReadingComment on Can Capitalists Afford a Trumped Recovery?

The following commentary on Nitzan and Bichler’s piece ‘Can Capitalist Afford a Trumped Recovery?’ first appeared on the blog Pension Pulse, written by Leo Kolivakis. Earlier this week, I hooked up for a lunch with George Archer and Jonathan Nitzan, two friends of mine who also had previous stints working at BCA Research. I enjoyed […]

Continue ReadingDid the Market Punish United Airlines?

DT Cochrane In the days following the wide-spread distribution of a video depicting Chicago transportation police officers violently removing Dr. David Dao from a United Airlines flight, there was celebration as the market pummelled the airlines shares (UAL). Or did it? Although the incident generated a great deal of outrage on Twitter, and early in […]

Continue ReadingSpiegel Online Analysis of Deutsche Bank’s Differential Misfortune

DT Cochrane Deutsche Bank was a central figure of the 2008 global financial crisis. While some of its compatriots, such as Goldman Sachs, have re-ascended to the commanding heights of global capital, Deutsche remains a shadow of its former self as seen in the graph below (screenshot from Yahoo! Finance). A comparison of Deutsche Bank […]

Continue ReadingTrump, US Public Debt, and the Future of Global Financial Power

Sandy Hager The following post is based loosely on my presentation at the first annual Thammasat University-Conference for Asia Pacific Studies in Phuket, Thailand (8-9 December 2016). What a difference a few months makes. This past summer I published a piece in the European Journal of International Relations on the role of US Treasury securities […]

Continue ReadingLogics AND the Logic of Accumulation

DT Cochrane The presiding logic of capitalism is that of accumulation. CasP re-emphasizes and re-theorizes accumulation as ‘Moses & the Prophets’ of capitalism. However, Nitzan and Bichler’s theorization severs the link between accumulation and productivity that grounds both mainstream and critical value theory. Instead, they emphasize the meaning of the nominal quantities of capital as […]

Continue ReadingProtecting the Game from the Players

DT Cochrane In certain circles, Charlie Munger is a demi-god. He is the vice-chairman of Berkshire Hathaway, the holding company controlled by the god of markets himself, or rather, Warren Buffett. The words spoken and written by both Buffett and Munger are treated as divine insights on the way the world works or ought to […]

Continue ReadingCorporate Taxation and the Power Theory of Value

Sandy Hager This is a (longer) draft version of an article that is under consideration for the newsletter of the Tax Justice Network: Tax Justice Focus. Taxation is all about power. We are constantly reminded of this when flipping through any newspaper (or browsing any news website). The Panama Papers, the stuff of which front […]

Continue ReadingWhy Diamonds and De Beers?, or The Need for Accumulation Studies

DT Cochrane Preface. I successfully defended my dissertation in December. This served as the introductory presentation for the defence. In it, I explain what I tried to do with the dissertation, the methods I used, and the larger project I hope it is initiating. Specifically, I suggest there is a need for accumulation studies as […]

Continue ReadingSocial Change and the Bottom Line

DT Cochrane The North Carolina legislature recently passed a law, widely known as the ‘Bathroom Bill,’ that bans anti-discrimination protections for gay and transgender people. The law has generated a lot of backlash from the general public and several high-profile musicians have cancelled scheduled appearances in the state. However, it is not just activists or […]

Continue ReadingFrom Global Oil Politics to Desire via Gas Prices

DT Cochrane The Globe & Mail is reporting that the average fuel efficiency of new vehicles sold in 2014 dropped for the first time since 2011. The coverage suggests this is a response to falling prices at the gas pump. First, without access to the relevant data for a longer time period, it is difficult […]

Continue ReadingThe Panama Papers and the Topology of Power

DT Cochrane Reportage of the Panama Papers, leaked documents from the Panama-based law firm Mossack Fonseca, is getting intense attention. The papers reveal the use of shell companies to shelter wealth on behalf of many high profile political figures. Debates have erupted about the meaning of the documents and what they reveal about the global […]

Continue ReadingOil, Debt & Power: A New Crisis?

DT Cochrane An op-ed on the advocacy website Oil Change International examines the high levels of debt within the oil business and the consequences of that debt for extraction. It postulates a dangerous positive feedback mechanism between extraction levels, oil prices and oil company debt. The basic argument is that in order to service their […]

Continue ReadingPetrodollars and Profit: Rethinking Political Economy through the Middle East

Max Ajl A review of Jonathan Nitzan and Shimshon Bickler’s The Scientist and the Church. Originally published at Jadaliyya Howard Page, a director at what was then Exxon, was once asked, “What would have happened if Iraq production had also surged during the 1960’s,” like that of Saudi Arabia and Iran. He responded, “I admit […]

Continue ReadingThe Renminbi on the World Stage

DT Cochrane The IMF recently announced that China’s currency, the CYN (Chinese Yuan Renminbi), would be included in the IMF’s basket of currencies, known as the SRD (special drawing rights). The designation comes after China adopted certain reforms in accordance with International Monetary Fund (IMF) policies. The CYN will comprise 11% of the basket, with […]

Continue Reading