Abstract Las teorías convencionales del capitalismo están sumidas en una profunda crisis: tras siglos de debates todavía son incapaces de decirnos qué es el capital. Tanto liberales como marxistas se refieren al capital como una entidad ‘económica’ que puede ser contabilizada en unidades universales de ‘utilidad’ o de ‘trabajo abstracto’. Pero estas unidades son totalmente […]

Continue ReadingDebailleul, and Bichler & Nitzan, ‘Theory and Praxis, Theory and Practice, Practical Theory’

Abstract In their paper ‘The CasP Project: Past, Present and Future’, Shimshon Bichler and Jonathan Nitzan invite readers to engage critically with their theoretical framework, known as capital as power (CasP). This call for further research, reactions and critiques is the perfect occasion to raise a few questions that have grown in my mind in […]

Continue ReadingBichler & Nitzan, ‘The CasP Project: Past, Present, Future’

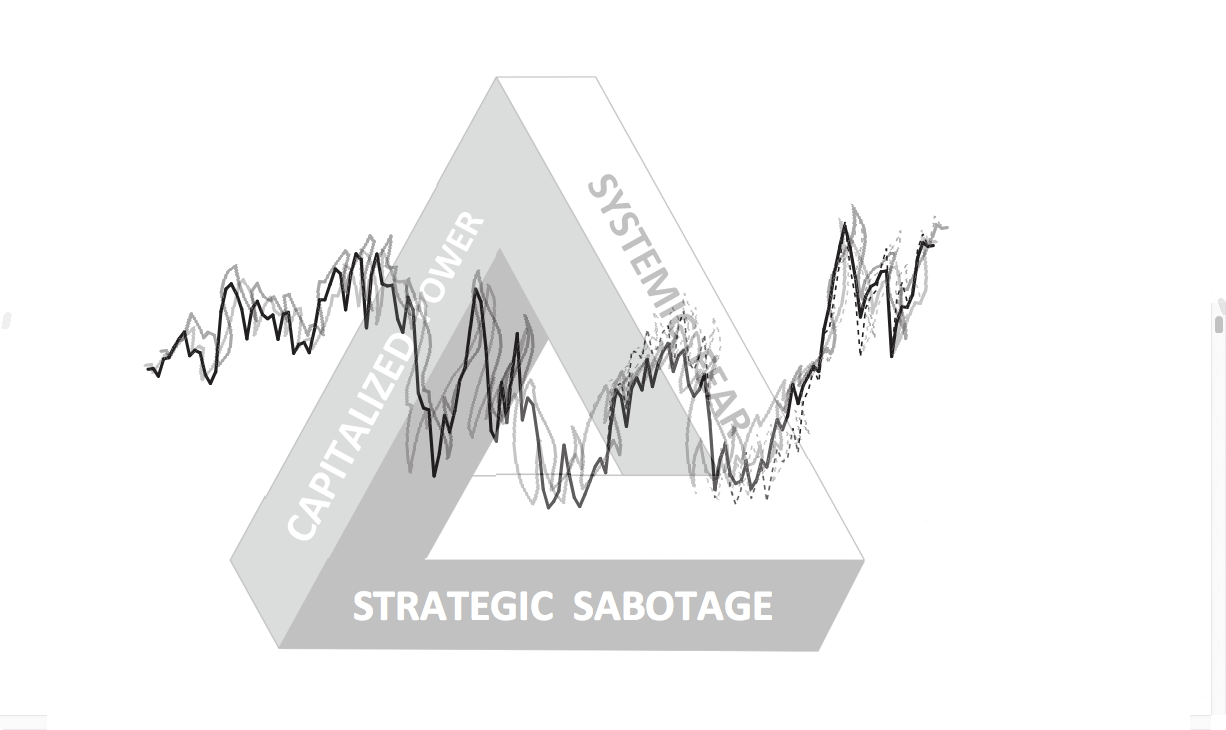

Abstract The study of capital as power (CasP) began when we were students in the 1980s and has since expanded into a broader project involving a growing number of researchers and new areas of inquiry. This paper provides a bird’s-eye view of the CasP journey. It explores what we have learned so far, reviews ongoing […]

Continue ReadingWoodley, ‘Globalization and Capitalist Geopolitics: Sovereignty and State Power in a Multipolar World’

Abstract Globalization and Capitalist Geopolitics is concerned with the growth of transnational corporate power against the backdrop of the decline of the West and the struggle by non-Western states to challenge and overcome domination of the rest of the world by the West. At the centre of the study is the problematic status of the […]

Continue ReadingDi Muzio, ‘The Tragedy of Human Development: A Genealogy of Capital as Power’

Abstract How might an objective observer conceive of what humans have accomplished as a species over its brief history? Benjamin argues that history can be judged as one giant catastrophe. Liberals suggest that this is to sombre an assessment and that human history can be read as a story of greater and greater progress in […]

Continue ReadingHoward, ‘Craftwashing in the U.S. Beer Industry’

Abstract Background: Big brewers, which have experienced declining sales for their beer brands in the last decade, have been accused of “craftwashing” by some craft brewers and their aficionados—they define craftwashing as big brewers (>6 million barrels per year) taking advantage of the increasing sales of craft beer by emulating these products or by acquiring […]

Continue ReadingHolman & McMahon, ‘From Power over Creation to the Power of Creation: Cornelius Castoriadis on Democratic Cultural Creation and the Case of Hollywood’

Abstract This article is a critical investigation and application of the aesthetic theory of Cornelius Castoriadis, one of the most important 20th-century theorists of radical democracy. We outline Castoriadis’s thoughts on autonomy, the social-historical nature of Being, and creation — key elements that inform his model of democratic culture. We then develop a Castoriadian critique […]

Continue ReadingPark, ‘Korea’s Post-1997 Restructuring: An Analysis of Capital as Power’

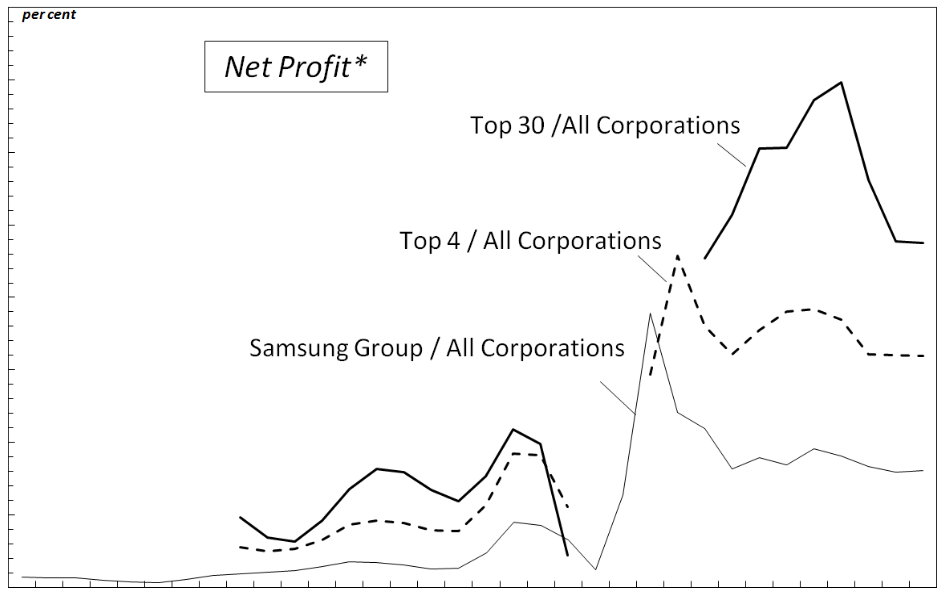

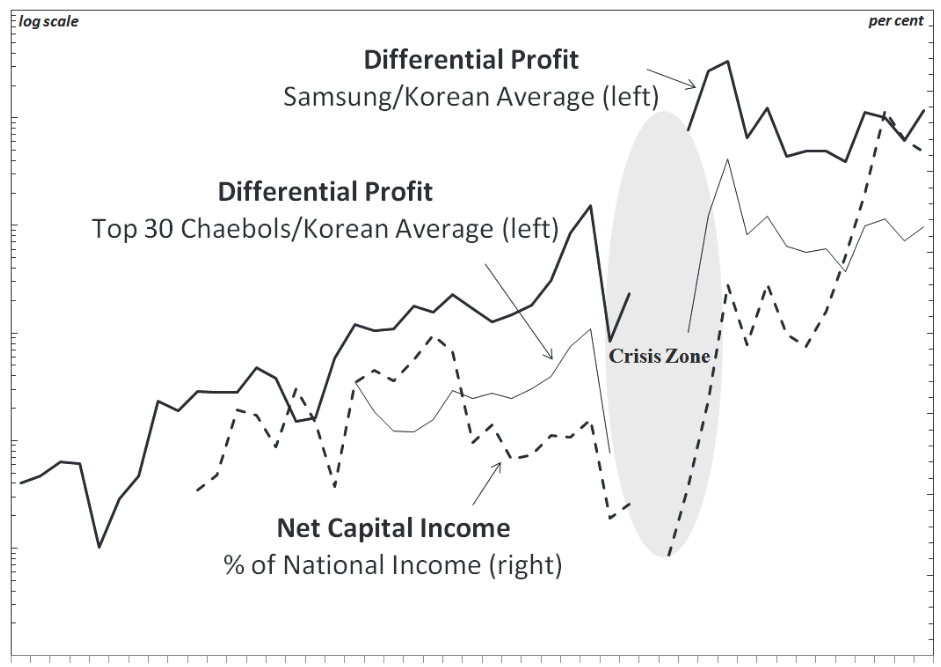

Abstract Winner of the RRPE Annual Best Paper Award for 2016 This paper aims to transcend current debates on Korea’s post-1997 restructuring, which rely on a dichotomy between domestic industrial capital and foreign financial capital, by adopting Nitzan and Bichler’s capital-as-power perspective. Based on this approach, the paper analyzes Korea’s recent political economic restructuring as […]

Continue ReadingBichler & Nitzan, ‘Un Modelo CcP Del Mercado De Valores’

Abstract La mayoría de las explicaciones de las alzas y bajas del mercado de valores se basan en la comparación de la lógica “fundamental” subyacente de la economía con los factores exógenos que supuestamente la distorsionan. Este artículo presenta un modelo radicalmente distinto, y examina el mercado de valores desde la perspectiva del poder capitalizado […]

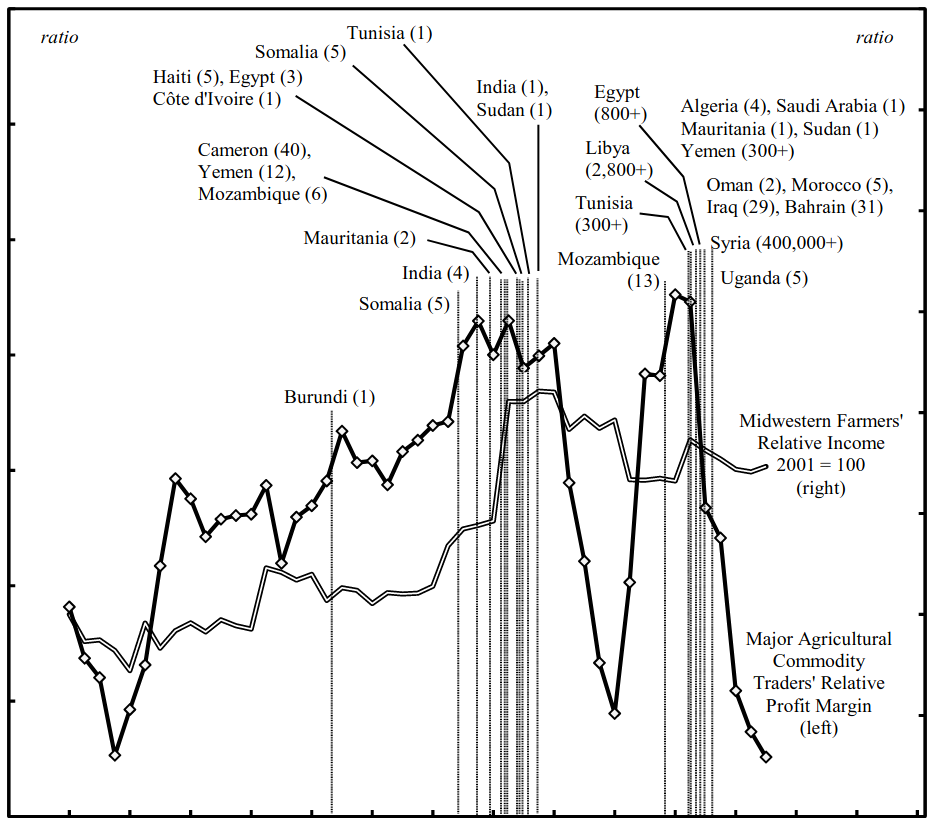

Continue ReadingBaines, ‘Accumulating through Food Crisis? Farmers, Commodity Traders and the Distributional Politics of Food Crisis’

Abstract This paper considers the domestic and international ramifications of financialization and grain price instability in the US agri-food sector. It finds that during the recent period of high and volatile prices, the average income of large-scale farms reached the earnings threshold of the top percentile of US households, and agricultural commodity traders markedly outperformed […]

Continue ReadingDiMuzio & Dow, ‘Uneven and Combined Confusion’

Abstract This article offers a critique of Alexander Anievas and Kerem Nişancioğlu’s “How the West came to rule: the geopolitical origins of capitalism”. We argue that while all historiography features a number of silences, shortcomings or omissions, the omissions in How the West came to rule lead to a mistaken view of the emergence of […]

Continue ReadingFix, ‘Energy and Institution Size’

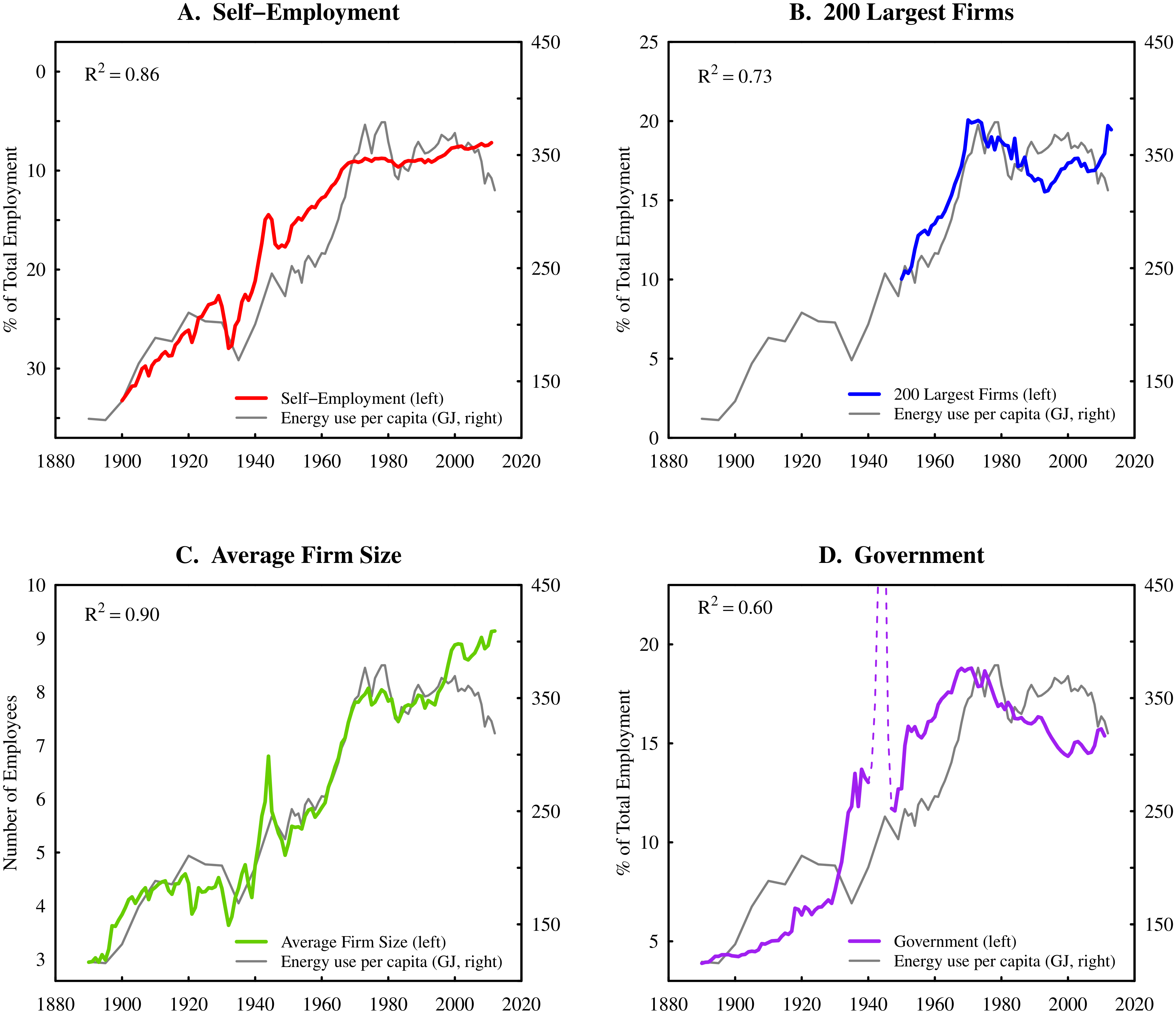

Abstract Why do institutions grow? Despite nearly a century of scientific effort, there remains little consensus on this topic. This paper offers a new approach that focuses on energy consumption. A systematic relation exists between institution size and energy consumption per capita: as energy consumption increases, institutions become larger. I hypothesize that this relation results […]

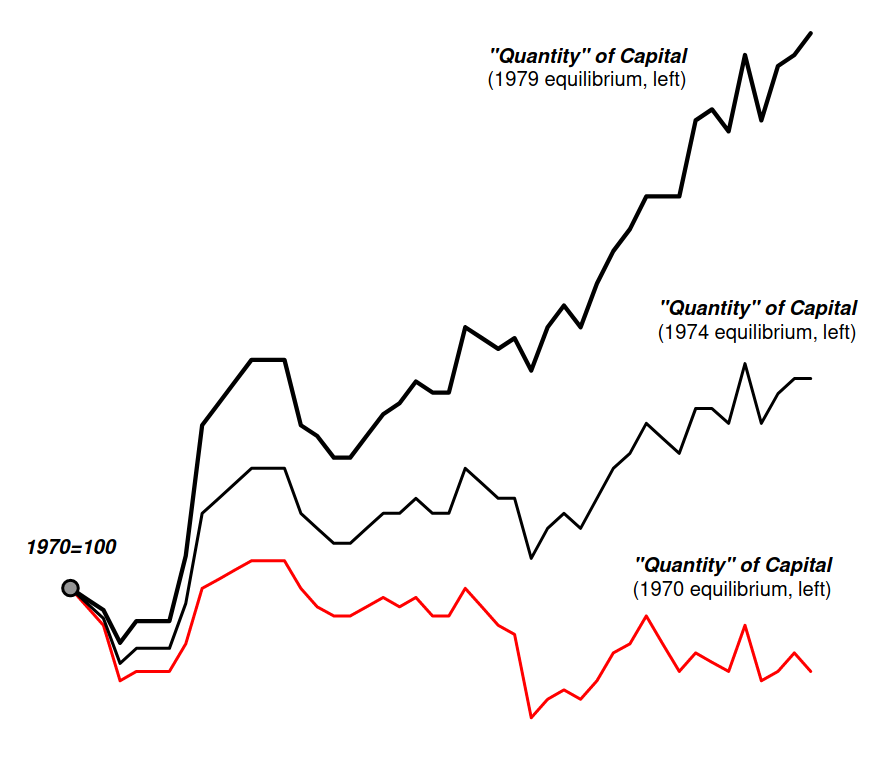

Continue ReadingBichler & Nitzan, ‘A CasP Model of the Stock Market’

Abstract Most explanations of stock market booms and busts are based on contrasting the underlying ‘fundamental’ logic of the economy with the exogenous, non-economic factors that presumably distort it. Our paper offers a radically different model, examining the stock market not from the mechanical viewpoint of a distorted economy, but from the dialectical perspective of […]

Continue ReadingPark & Doucette, ‘Financialization or Capitalization? Debating Capitalist Power in South Korea in the Context of Neoliberal Globalization’

Abstract The article reviews debates concerning financialization in South Korea, with a focus on ongoing arguments between liberal, post-Keynesian, institutionalist and Marxist economists. It argues that post-Keynesian and institutionalist perspectives in particular neglect important class processes through which the financial circuit operates within the Korean economy, especially the power of Korea’s large, family-led conglomerates, or […]

Continue ReadingDi Muzio, ‘Energy, Capital as Power and World Order’

Abstract Until late, the subject of energy and its importance for capitalism and the constitution and reconstitution of world order has been sorely overlooked in the international political economy (IPE) literature. Indeed, only two of the major textbooks in IPE have chapters on energy. This is also true of the literature known as classical political […]

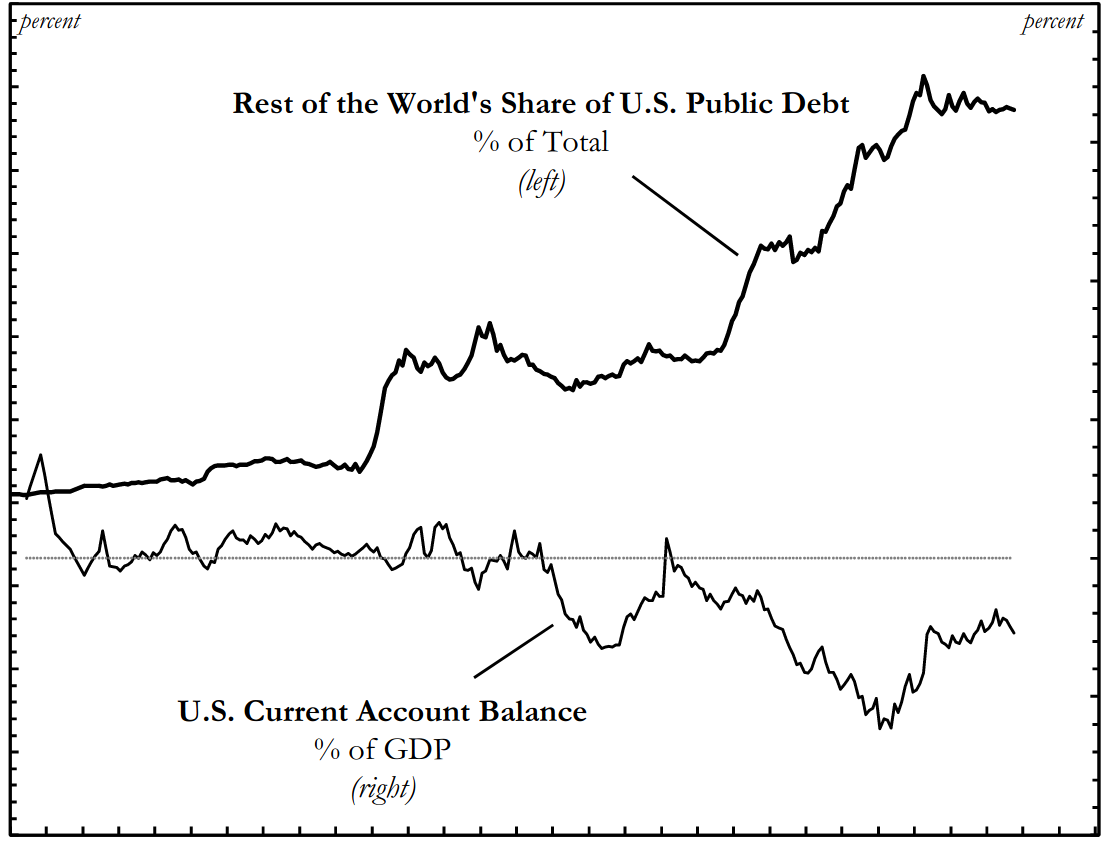

Continue ReadingHager, ‘A Global Bond: Explaining the Safe Haven Status of U.S. Treasury Securities’

Abstract This article offers new theoretical and empirical insights to explain the resilience of U.S. Treasury securities as the world’s premier safe or “risk free” asset. The standard explanation of resilience emphasizes the relative safety of U.S. Treasuries due to a shortage of safe assets in the global political economy. The analysis here goes beyond […]

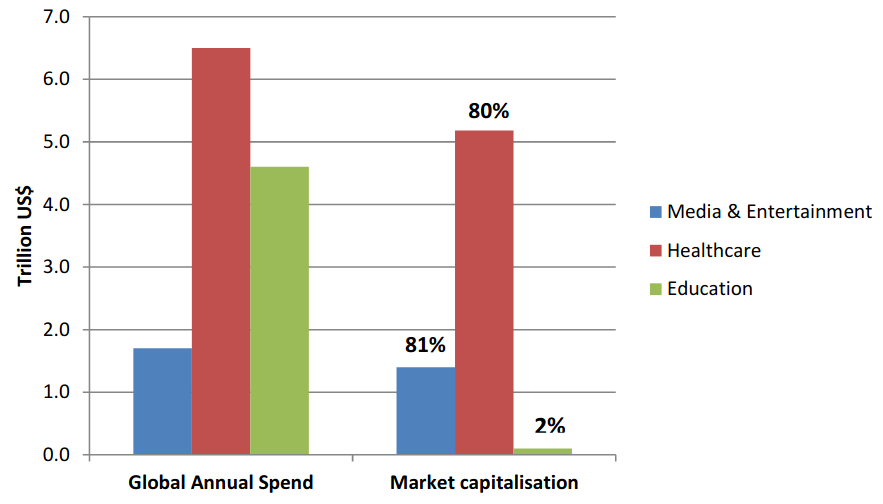

Continue ReadingKivisto, ‘Capital as Power and the Corporatization of Education’

Abstract Building on the definition of critical education residing in the crossroads of cultural politics and political economy, this theoretical article offers an inquiry into the intersection between critical education research and the central ritual of contemporary capitalism – capitalisation. This article outlines four current approaches in education research literature to the corporatisation of education. […]

Continue ReadingHager, ‘Public Debt, Inequality, and Power: The Making of a Modern Debt State’

Abstract Who are the dominant owners of US public debt? Is it widely held, or concentrated in the hands of a few? Does ownership of public debt give these bondholders power over our government? What do we make of the fact that foreign-owned debt has ballooned to nearly 50 percent today? Until now, we have […]

Continue ReadingHoward, ‘Concentration and Power in the Food System’

Abstract This book seeks to illuminate which firms have become the most dominant, and more importantly, how they shape and reshape society in their efforts to increase their control. These dynamics have received insufficient attention from academics and even critics of the current food system. The power of dominant firms extends far beyond narrow economic […]

Continue ReadingBichler & Nitzan, ‘Acumulación de capital: ficción y realidad’

Abstract ¿Qué quieren decir los economistas cuando hablan de “acumulación de capital’? La respuesta es todo, menos clara. La opinión convencional es que hay dos tipos de capital: real y financiero, que deben guardar correspondencia y que, infortunadamente, la mayoría de las veces no se corresponden, pues el crecimiento del capital financiero tiende a desajustarse […]

Continue Reading