Abstract As these lines are being written (April 2018), the The U.S. stock market is again in turmoil. After a two-year bull run in which share prices soared by nearly 50 per cent, the market is suddenly dropping. Since the beginning of 2018, it lost nearly 10 per cent of its value, threatening investors with […]

Continue ReadingMcMahon, ‘Is Hollywood a Risky Business? A Political Economic Analysis of Risk and Creativity’

Abstract This paper seeks to explain why Hollywood’s dominant firms are narrowing the scope of creativity in the contemporary period (1980–2015). The largest distributors have sought to prevent the art of filmmaking and its related social relations from becoming financial risks in the pursuit of profit. Major filmed entertainment, my term for the six largest […]

Continue Reading2018/04: Martin, ‘The Autocatalytic Sprawl of Pseudorational Mastery’

Abstract According to Shimshon Bichler and Jonathan Nitzan capital is not an economic quantity but a mode of power; it could be sumarized as: “Capital is power quantified in monetary terms”. So, what do we do when we “quantify”? What is the nature of “money” in a capitalist society? And, indeed, what is “power” in […]

Continue ReadingDi Muzio, ‘The Tragedy of Human Development: A Genealogy of Capital as Power’

Abstract How might an objective observer conceive of what humans have accomplished as a species over its brief history? Benjamin argues that history can be judged as one giant catastrophe. Liberals suggest that this is to sombre an assessment and that human history can be read as a story of greater and greater progress in […]

Continue ReadingDiMuzio & Dow, ‘Uneven and Combined Confusion’

Abstract This article offers a critique of Alexander Anievas and Kerem Nişancioğlu’s “How the West came to rule: the geopolitical origins of capitalism”. We argue that while all historiography features a number of silences, shortcomings or omissions, the omissions in How the West came to rule lead to a mistaken view of the emergence of […]

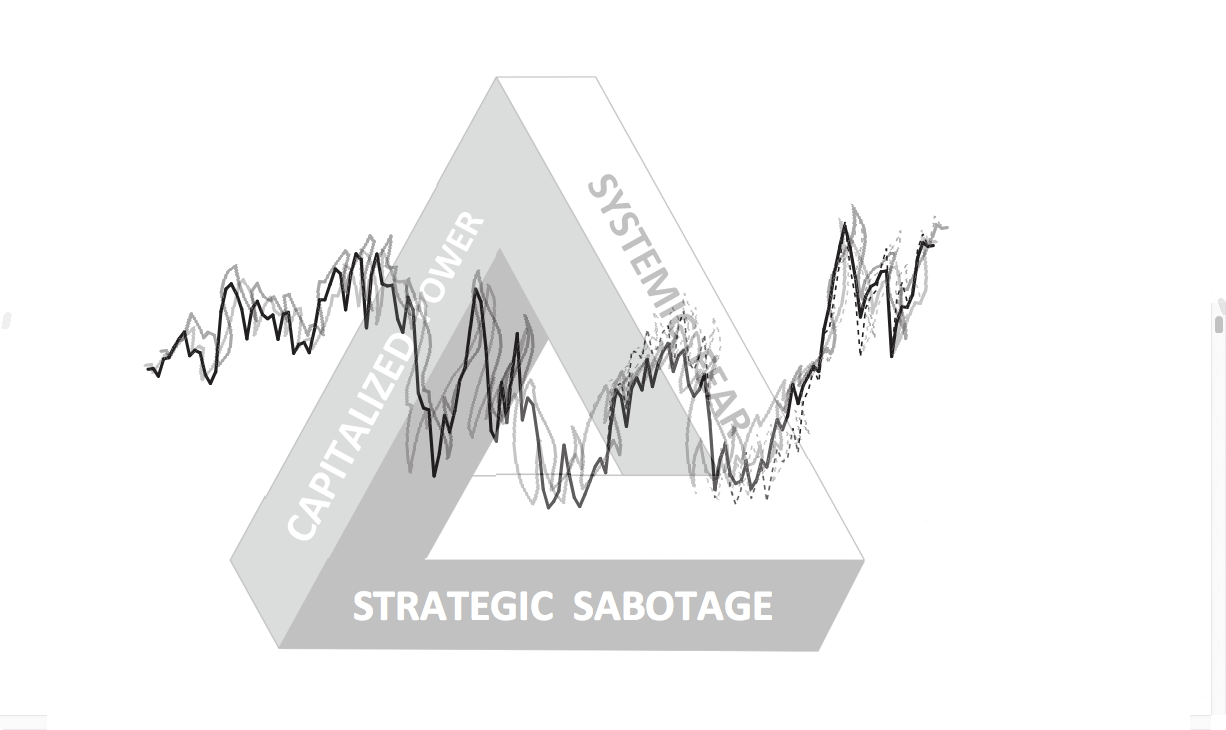

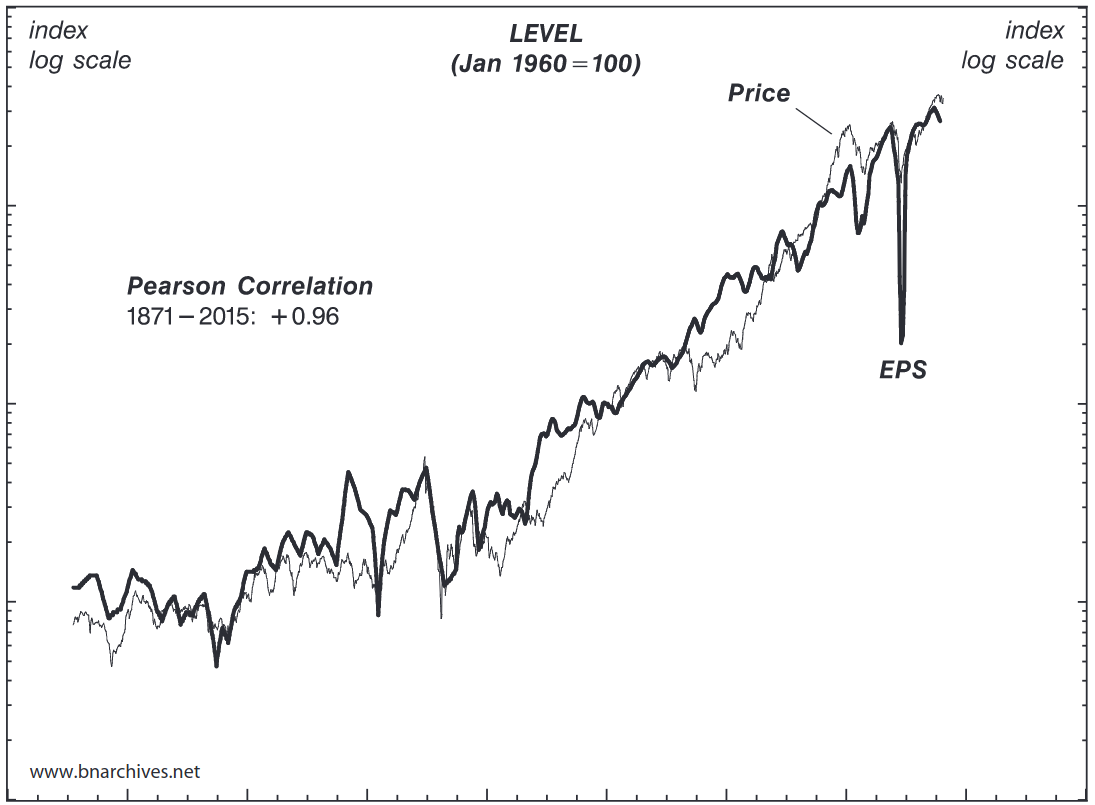

Continue ReadingBichler & Nitzan, ‘A CasP Model of the Stock Market’

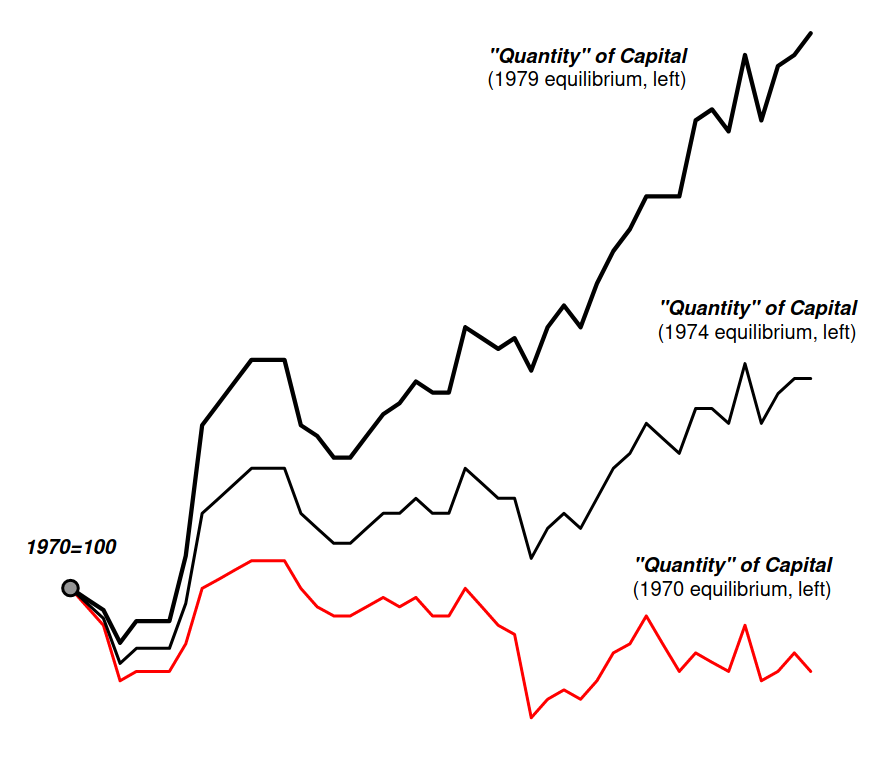

Abstract Most explanations of stock market booms and busts are based on contrasting the underlying ‘fundamental’ logic of the economy with the exogenous, non-economic factors that presumably distort it. Our paper offers a radically different model, examining the stock market not from the mechanical viewpoint of a distorted economy, but from the dialectical perspective of […]

Continue ReadingNo. 2016/07: Bichler & Nitzan, ‘A CasP Model of the Stock Market’

Abstract Most explanations of stock market booms and busts are based on contrasting the underlying ‘fundamental’ logic of the economy with the exogenous, non-economic factors that presumably distort it. Our paper offers a radically different model, examining the stock market not from the mechanical viewpoint of a distorted economy, but from the dialectical perspective of […]

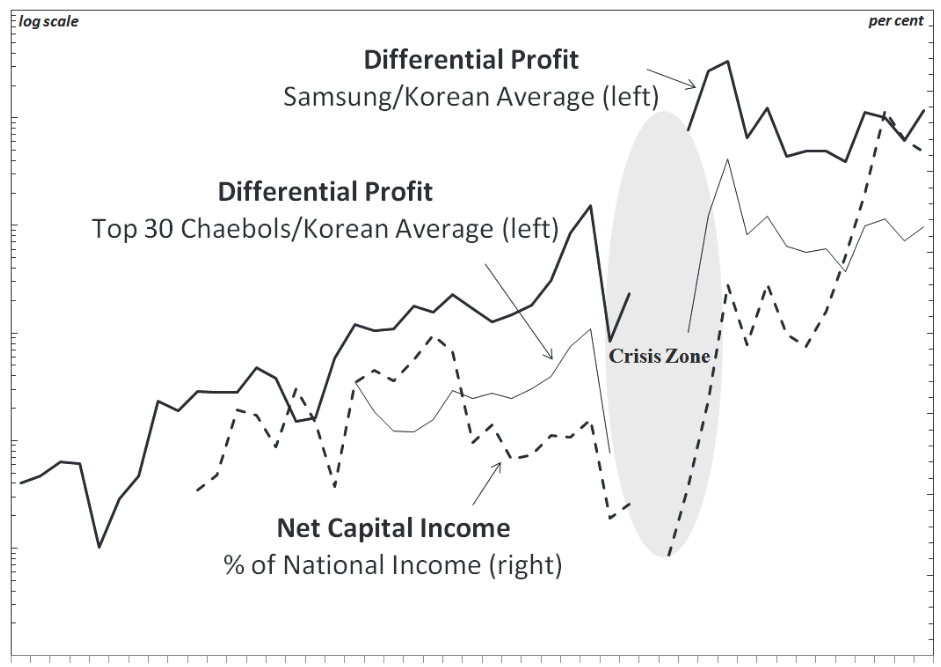

Continue ReadingPark & Doucette, ‘Financialization or Capitalization? Debating Capitalist Power in South Korea in the Context of Neoliberal Globalization’

Abstract The article reviews debates concerning financialization in South Korea, with a focus on ongoing arguments between liberal, post-Keynesian, institutionalist and Marxist economists. It argues that post-Keynesian and institutionalist perspectives in particular neglect important class processes through which the financial circuit operates within the Korean economy, especially the power of Korea’s large, family-led conglomerates, or […]

Continue ReadingNo. 2016/5: Cochrane, ‘Disobedient Things: The Deepwater Horizon oil spill and accounting for disaster’

Abstract Analysis of the Deepwater Horizon disaster and the accumulatory decline of BP demonstrates both the analytical efficacy of the capital-as-power (CasP) approach to value theory, and the irreducible role of objects in the process of accumulation. Rather than productivity per se, accumulation depends on control of productivity. Owners’ control is over both the human […]

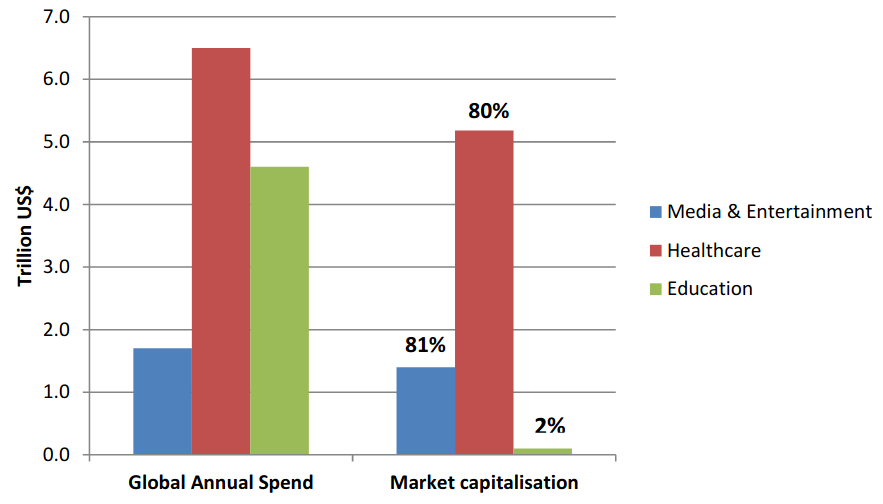

Continue ReadingKivisto, ‘Capital as Power and the Corporatization of Education’

Abstract Building on the definition of critical education residing in the crossroads of cultural politics and political economy, this theoretical article offers an inquiry into the intersection between critical education research and the central ritual of contemporary capitalism – capitalisation. This article outlines four current approaches in education research literature to the corporatisation of education. […]

Continue ReadingCorporate Taxation and the Power Theory of Value

Sandy Hager This is a (longer) draft version of an article that is under consideration for the newsletter of the Tax Justice Network: Tax Justice Focus. Taxation is all about power. We are constantly reminded of this when flipping through any newspaper (or browsing any news website). The Panama Papers, the stuff of which front […]

Continue ReadingBichler & Nitzan, ‘Acumulación de capital: ficción y realidad’

Abstract ¿Qué quieren decir los economistas cuando hablan de “acumulación de capital’? La respuesta es todo, menos clara. La opinión convencional es que hay dos tipos de capital: real y financiero, que deben guardar correspondencia y que, infortunadamente, la mayoría de las veces no se corresponden, pues el crecimiento del capital financiero tiende a desajustarse […]

Continue ReadingBaines, ‘Encumbered Behemoth: Wal-Mart, Differential Accumulation and International Retail Restructuring’

Abstract This chapter draws on, and develops, some aspects of the capital as power framework so as to provide the first clear quantitative explication of the company’s power trajectory to date. After rapid growth in the first four decades of its existence, the power of Wal-Mart appears to be flat-lining relative to dominant capital as […]

Continue ReadingBichler & Nitzan, ‘How Capitalists Learned to Stop Worrying and Love the Crisis’

Abstract Do capitalists really want a recovery? Can they afford it? On the face of it, the question sounds silly: of course capitalists want a recovery; how else can they prosper? According to the textbooks, both mainstream and heterodox, capital accumulation and economic growth are two sides of the same process. Accumulation generates growth and […]

Continue ReadingNo. 2014/01: McMahon, ‘Capitalist Power, Distribution and the Order of Cinema’

Abstract In this paper, the structure of Hollywood film distribution will be analyzed through the lens of risk. In both its technical and conceptual senses, risk is relevant to the study of Hollywood’s dominant firms. In the interest of lowering risk, the business interests of Hollywood look to predetermine how new films will function in […]

Continue ReadingBichler & Nitzan, ‘No Way Out: Crime, Punishment and the Capitalization of Power’

Abstract The United States is often hailed as the world’s largest ‘free market’. But this ‘free market’ is also the world’s largest penal colony. It holds over seven million adults – roughly five per cent of the labour force – in jail, in prison, on parole and on probation. Is this an anomaly, or does […]

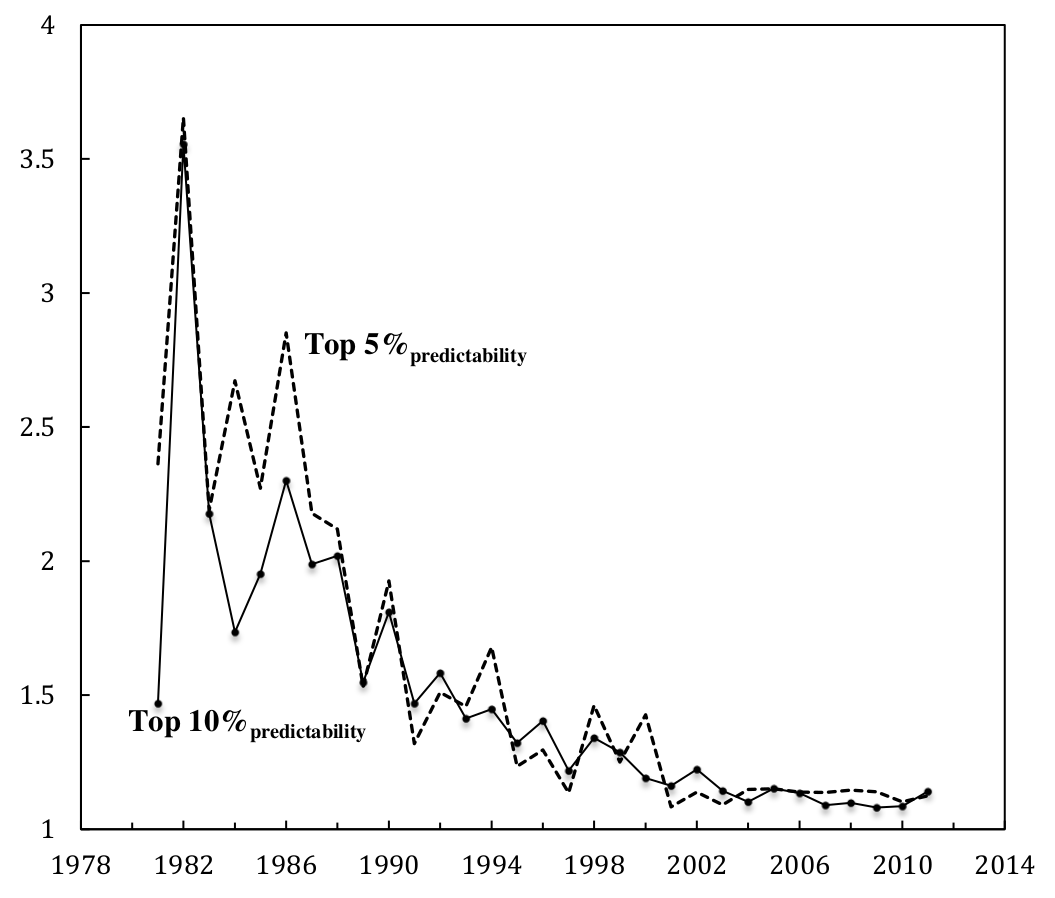

Continue ReadingThe Rise of a Confident Hollywood: Risk and the Capitalization of Cinema

The Rise of a Confident Hollywood Risk and the Capitalization of Cinema JAMES MCMAHON February 2013 Abstract This paper investigates the historical development of risk in the Hollywood film business. Using opening theatres as a proxy for future expectations, the paper demonstrates how, from 1981 to 2011, Hollywood has improved its ability to predict the […]

Continue ReadingThe Price of Human Life

DT Cochrane This American Life is a great public radio show based out of Chicago. They just hit their 500th episode and to celebrate, Ira Glass talked with his other producers about favourite past episodes. Alex Blumberg, one of the producers of Planet Money, reflected on a particular co-production with This American Life. All the […]

Continue ReadingPark, ‘Dominant Capital and the Transformation of Korean Capitalism: From Cold War to Globalization’

Abstract After the 1997 financial crisis, the neo-liberal restructuring of the Korean political economy accelerated dramatically. While there is a general consensus that the reform has had negative consequences for Korean society, heated debates continue over the culprits of the 1997 crisis and the changes that followed in its wake. Major opinions have largely coalesced […]

Continue ReadingMcMahon, ‘The Rise of a Confident Hollywood: Risk and the Capitalization of Cinema’

Abstract This paper investigates the historical development of risk in the Hollywood film business. Using opening theatres as a proxy for future expectations, the paper demonstrates how, from 1981 to 2011, Hollywood has improved its ability to predict the financial rankings of its films. More specifically, the Hollywood film business has become better at predicting […]

Continue Reading