The CasP Project Past, Present and Future SHIMSHON BICHLER and JONATHAN NITZAN April 2018 Abstract The study of capital as power (CasP) began when we were students in the 1980s and has since expanded into a broader project involving a growing number of researchers and new areas of inquiry. This paper provides a bird’s-eye view […]

Continue ReadingGuillem, ‘Análisis de conflictos y Relaciones Internacionales, una elaboración teórica de Sociología del Poder. Causas de la Guerra del Líbano de 2006’

Abstract SPANISH Si observamos la literatura sobre la Guerra del Líbano del 2006, llama la atención la ausencia de un marco teórico claro en la mayoría de los análisis. Igualmente se perciben notables discrepancias en algo tan básico como las causas de la guerra y encontramos destacadas diferencias en la explicación de la conducta de […]

Continue ReadingSharp, ‘Corporate Urbanization: Between the Future and Survival in Lebanon’

Abstract If you look today at the skyline of downtowns throughout the Middle East and beyond, the joint-stock corporation has transformed the urban landscape. The corporation makes itself present through the proliferation of its urban mega-projects, including skyscrapers, downtown developments and gated communities; retail malls and artificial islands; airports and ports; and highways. Built into […]

Continue ReadingFix, ‘Economics from the Top Down: Does Hierarchy Unify Economic Theory?’

Abstract What is the unit of analysis in economics? The prevailing orthodoxy in mainstream economic theory is that the individual is the ‘ultimate’ unit of analysis. The implicit goal of mainstream economics is to root macro-level social structure in the micro-level actions of individuals. But there is a simple problem with this approach: our knowledge […]

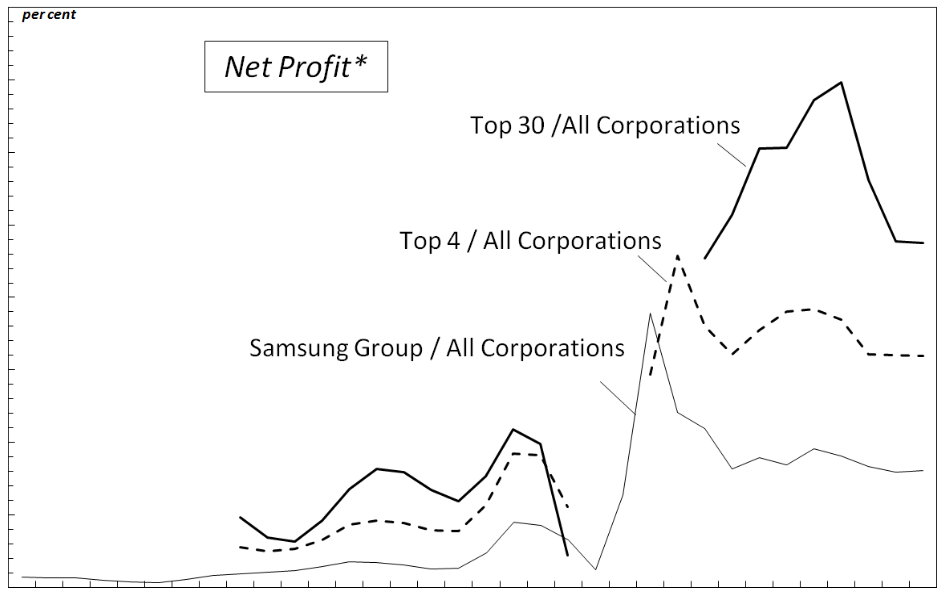

Continue ReadingPark, ‘Korea’s Post-1997 Restructuring: An Analysis of Capital as Power’

Abstract Winner of the RRPE Annual Best Paper Award for 2016 This paper aims to transcend current debates on Korea’s post-1997 restructuring, which rely on a dichotomy between domestic industrial capital and foreign financial capital, by adopting Nitzan and Bichler’s capital-as-power perspective. Based on this approach, the paper analyzes Korea’s recent political economic restructuring as […]

Continue ReadingCochrane, ‘What’s Love Got to Do with It? Diamonds and the Accumulation of De Beers, 1935-55’

Abstract What is accumulation? Visibly, accumulation is a quantitative process, demarcated in financial quantities. However, what is the meaning of those quantities? This question has been the subject of great debate within political economic thought. A new theory of accumulation, capital as power (CasP), argues that the financial quantities of accumulation express the distribution of […]

Continue ReadingMcMahon, ‘What Makes Hollywood Run? Capitalist Power, Risk and the Control of Social Creativity’

Abstract This dissertation combines an interest in political economy, political theory and cinema to offer an answer about the pace of the Hollywood film business and its general modes of behaviour. More specifically, this dissertation seeks to find out how the largest Hollywood firms attempt to control social creativity such that the art of filmmaking […]

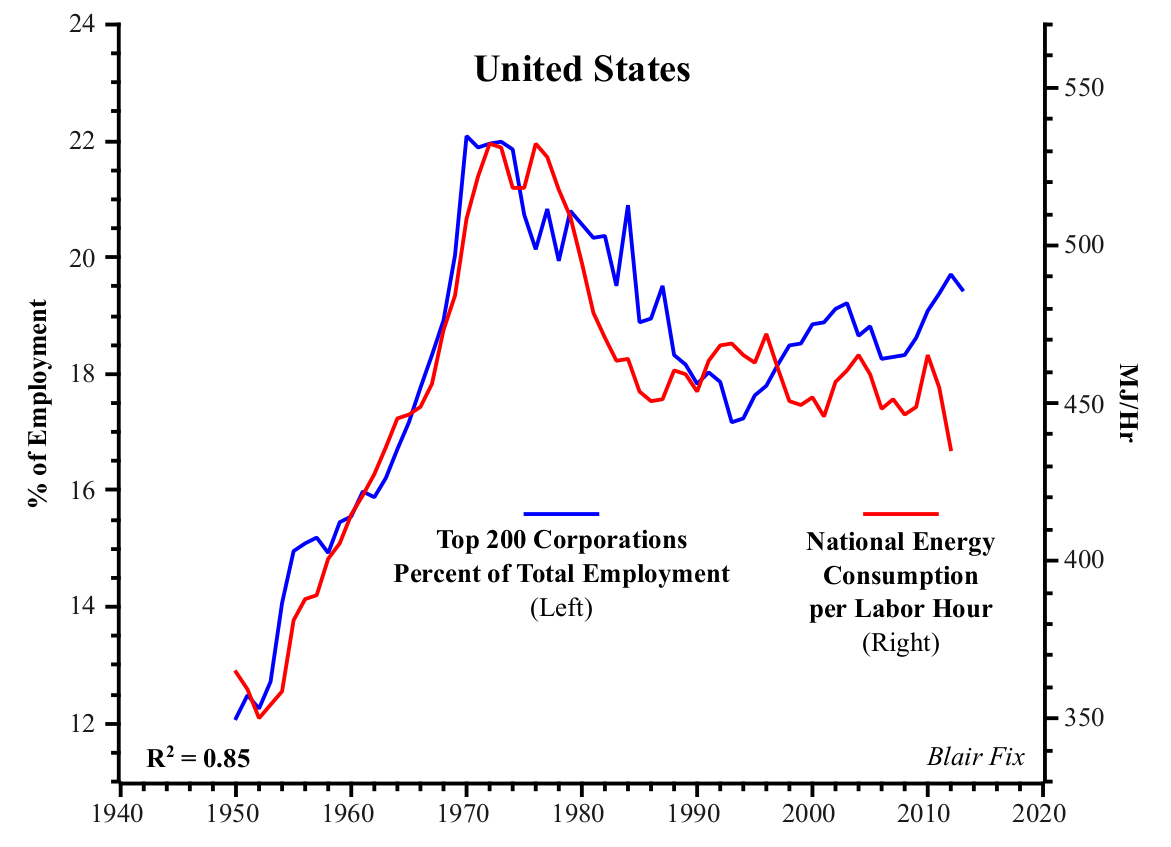

Continue ReadingPutting Power Back into Growth Theory

Putting Power Back Into Growth Theory BLAIR FIX June 2015 Abstract Neoclassical growth theory assumes that economic growth is an atomistic process in which changes in distribution play no role. Unfortunately, when this assumption is tested against real-world evidence, it is systematically violated. This paper argues that a reality-based growth theory must reject neoclassical principles […]

Continue ReadingFix, ‘Putting Power Back Into Growth Theory’

Abstract Neoclassical growth theory assumes that economic growth is an atomistic process in which changes in distribution play no role. Unfortunately, when this assumption is tested against real-world evidence, it is systematically violated. This paper argues that a reality-based growth theory must reject neoclassical principles in favour of a power-centered approach. Building on Nitzan and […]

Continue ReadingOstojić, ‘Differential Taxation: The Case of American Banking’

Abstract This paper maps an empirical history of corporate profit and taxation in the United States, with a special focus on the differential profit and taxation of banks relative to other corporations. An examination of these trends reveals a striking anomaly within the American banking sector: from the early 1980s until the financial crisis of […]

Continue ReadingBaines, ‘Price and Income Dynamics in the Agri-Food System: A Disaggregate Perspective’

Abstract This dissertation seeks to illuminate contemporary processes of redistribution in the agri-food sector, with particular reference to the US. It addresses the following questions: How has the rapid rise in food price instability since the turn of the twenty-first century impacted income shifts within the agri-food system? Which groups within agriculture and agribusiness benefit […]

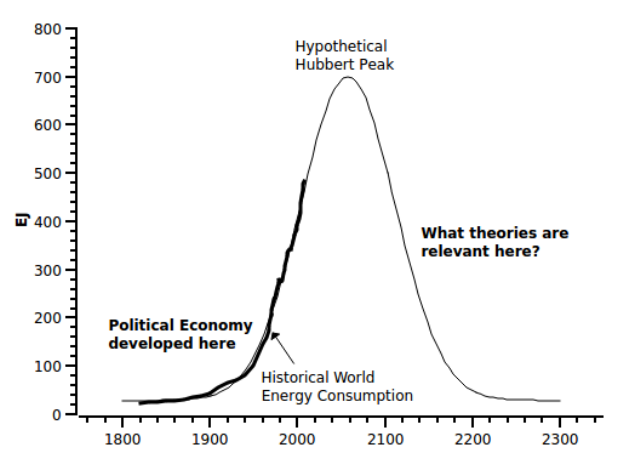

Continue ReadingFix, ‘Rethinking Economic Growth Theory From a Biophysical Perspective’

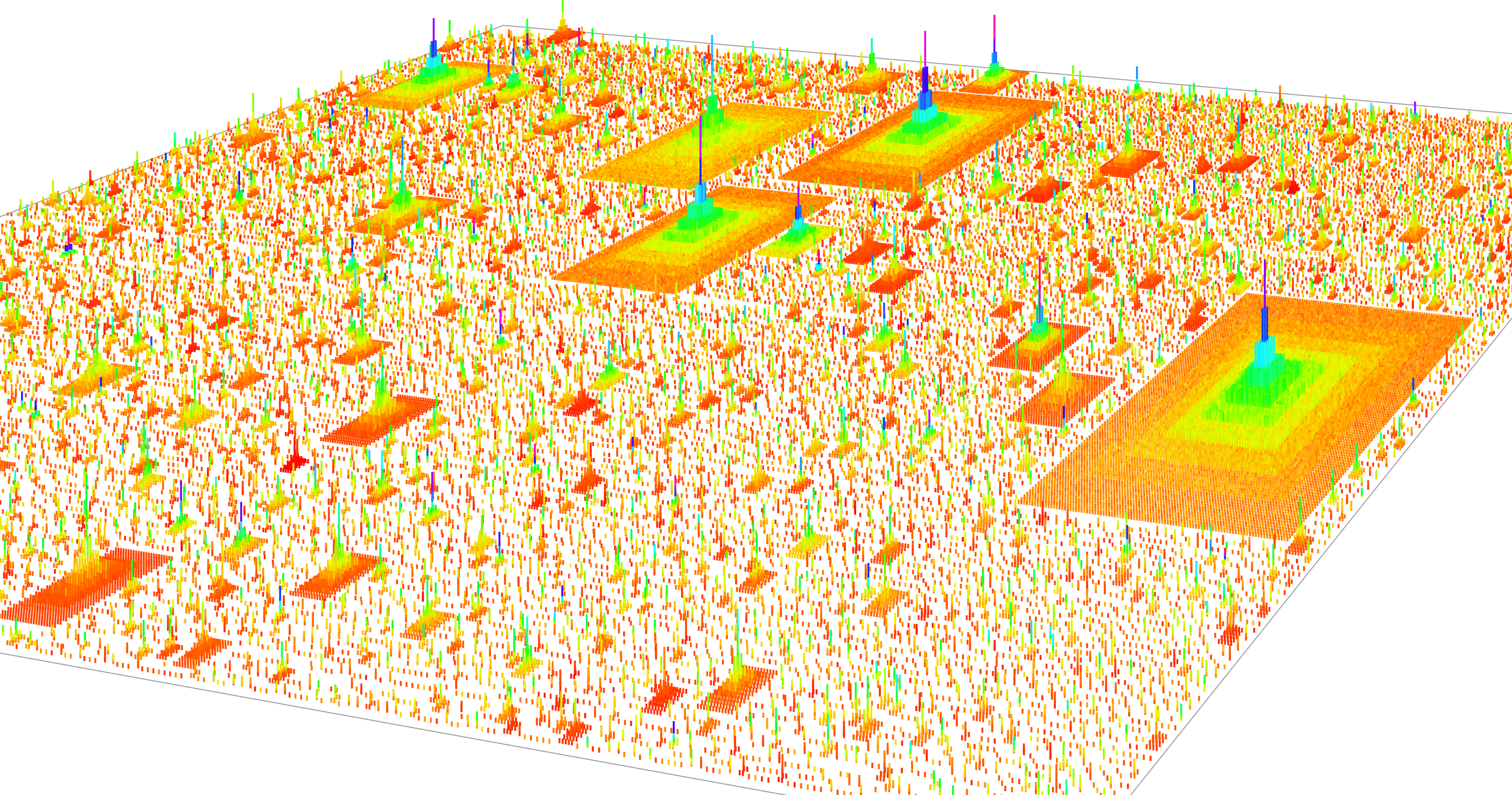

Abstract Neoclassical growth theory is the dominant perspective for explaining economic growth. At its core are four implicit assumptions: 1) economic output can become decoupled from energy consumption; 2) economic distribution is unrelated to growth; 3) large institutions are not important for growth; and 4) labor force structure is not important for growth. Drawing on […]

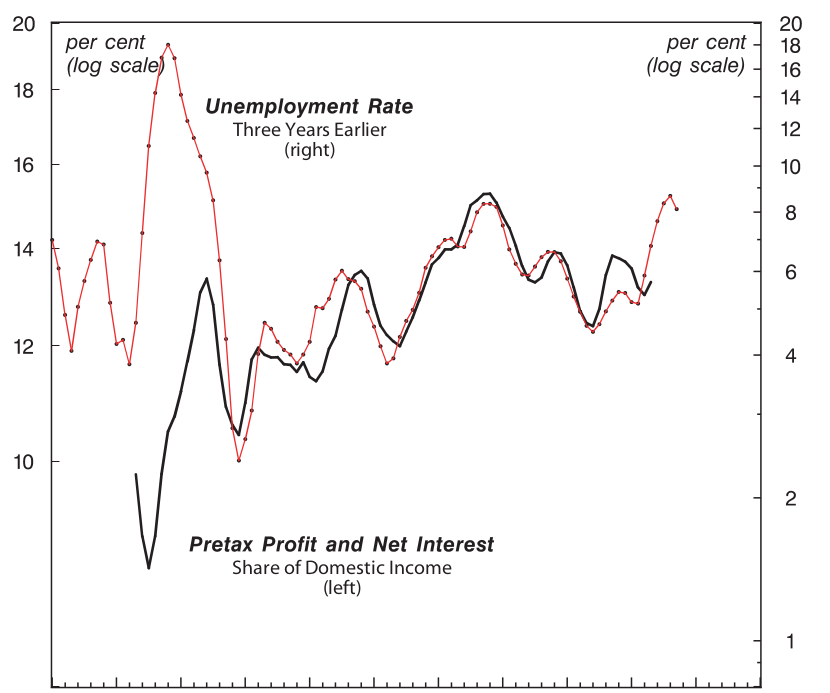

Continue ReadingCan Capitalists Afford Recovery?

Can Capitalists Afford Recovery? Three Views on Economic Policy in Times of Crisis JONATHAN NITZAN and SHIMSHON BICHLER October 2014 Abstract Economic, financial and social commentators from all directions and of various persuasions are obsessed with the prospect of recovery. The world remains mired in a deep, prolonged crisis, and the key question seems to […]

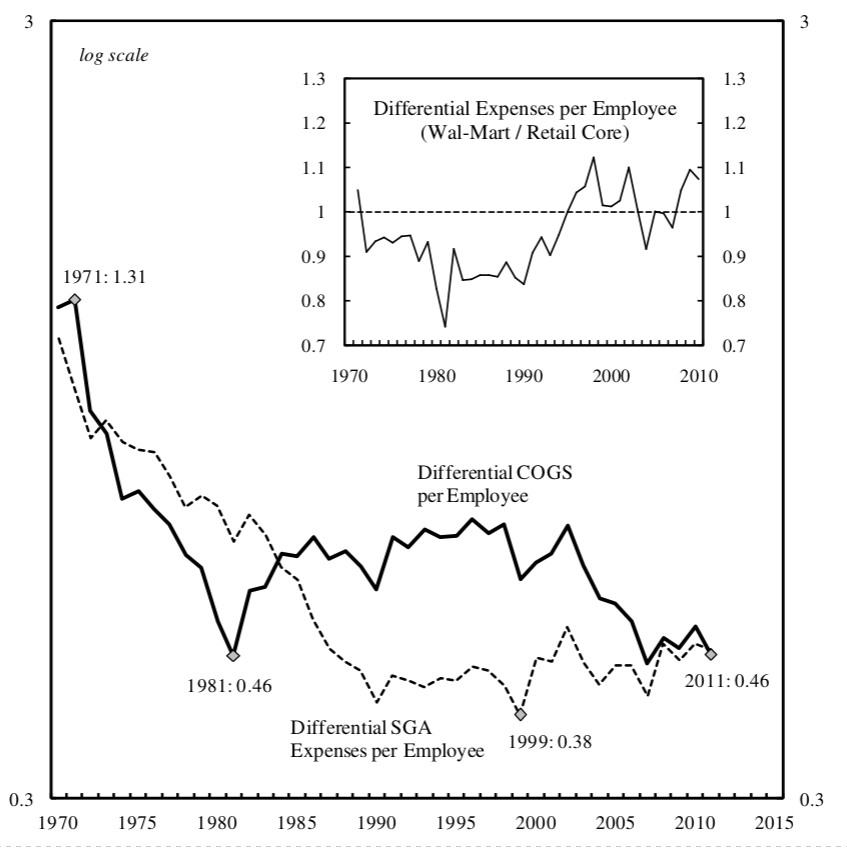

Continue ReadingWal-Mart’s Power Trajectory: A Contribution to the Political Economy of the Firm

Wal-Mart’s Power Trajectory A Contribution to the Political Economy of the Firm JOSEPH BAINES March 2014 Abstract This article offers a power theory of value analysis of Wal-Mart’s contested expansion in the retail business. More specifically, it draws on, and develops, some aspects of the capital as power framework so as to provide the first […]

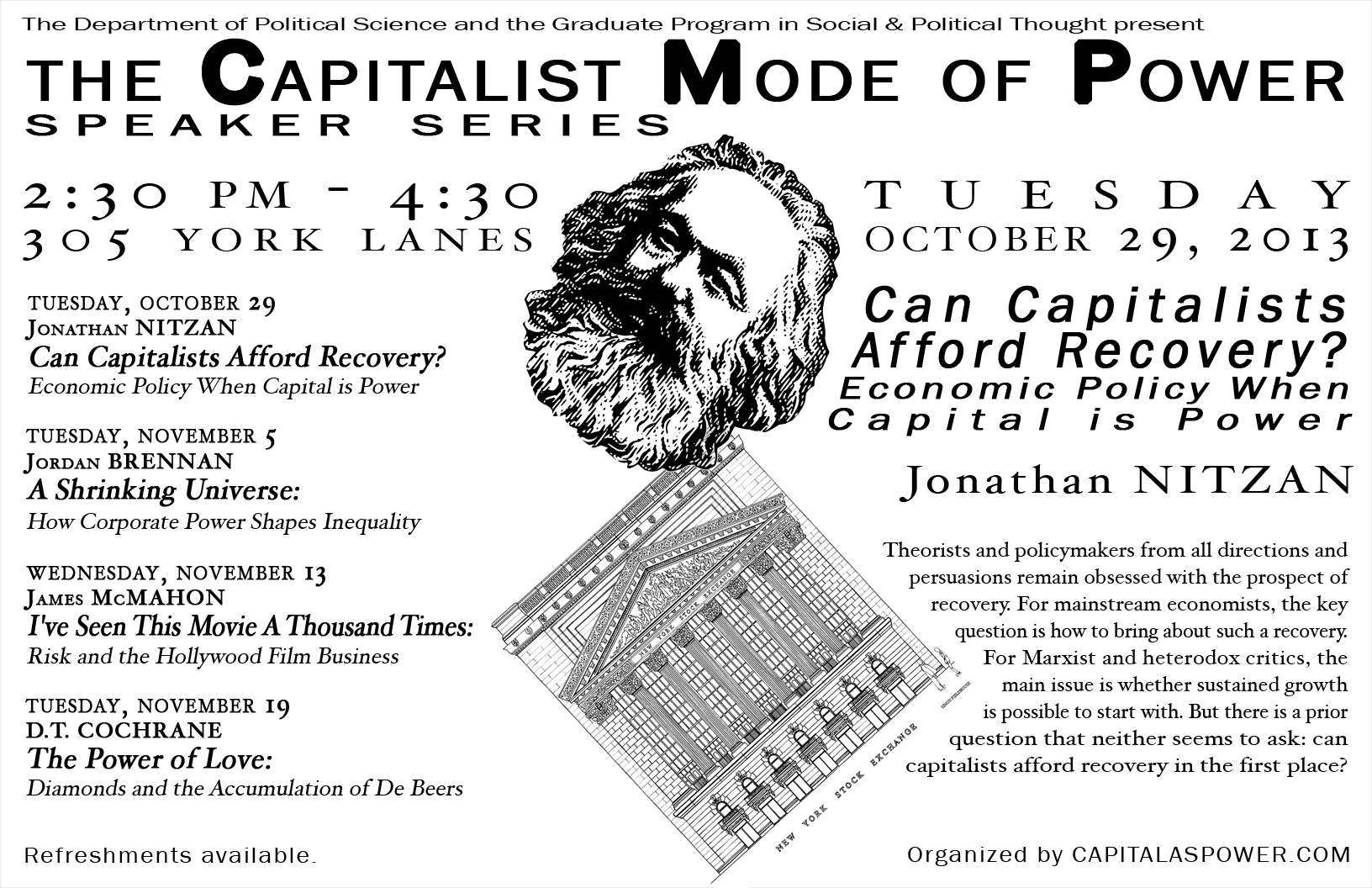

Continue ReadingFirst Speaker Series on the Capitalist Mode of Power

The First Speaker Series on the Capitalist Mode of Power was sponsored by the York Department of Political Science and the Graduate Programme in Social and Political Thought. Talks were held at York University, Toronto, Canada and the series ran from October to November 2013. Tuesday, Oct 29, 2013 Can Capitalists Afford Recovery? Economic Policy […]

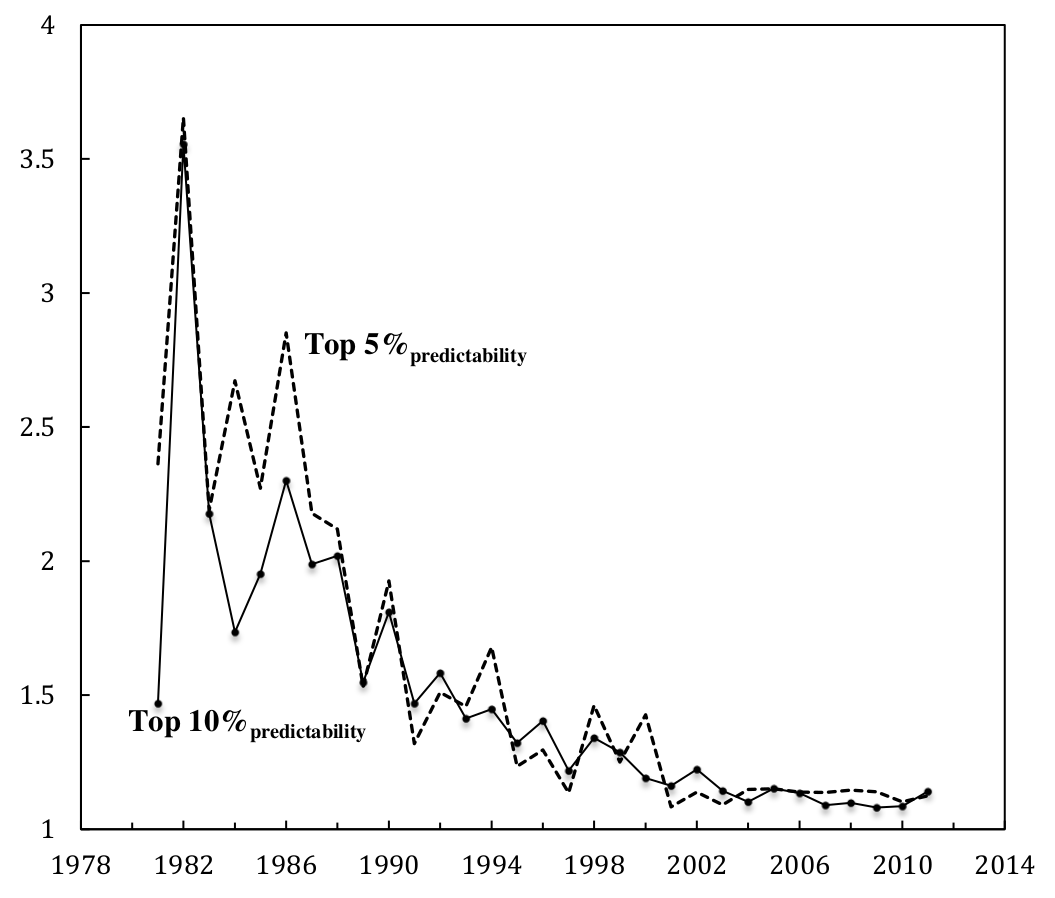

Continue ReadingThe Rise of a Confident Hollywood: Risk and the Capitalization of Cinema

The Rise of a Confident Hollywood Risk and the Capitalization of Cinema JAMES MCMAHON February 2013 Abstract This paper investigates the historical development of risk in the Hollywood film business. Using opening theatres as a proxy for future expectations, the paper demonstrates how, from 1981 to 2011, Hollywood has improved its ability to predict the […]

Continue ReadingAmerica’s Real ‘Debt Dilemma’

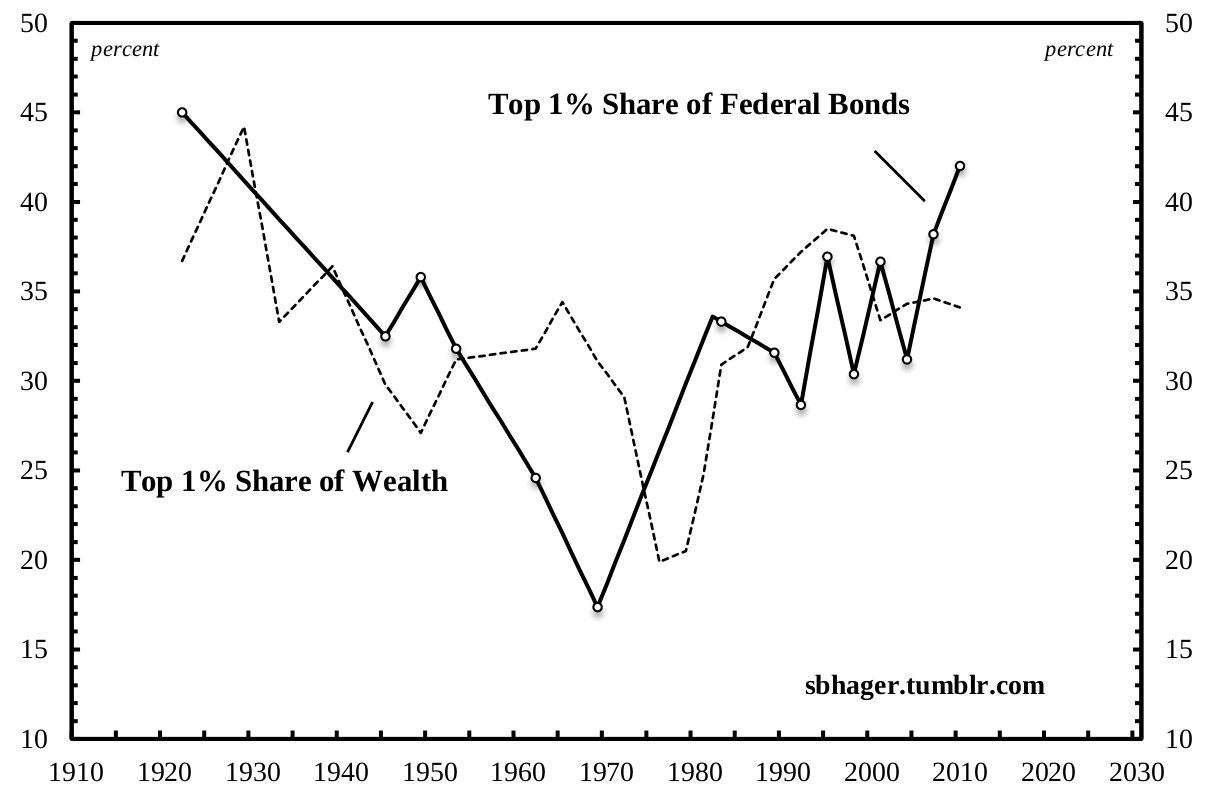

America’s Real ‘Debt Dilemma’ SANDY BRIAN HAGER July 2013 Abstract In the wake of the current crisis there has been an explosive rise in the level of the US public debt. These massive levels of public indebtedness are expected to keep growing unless there are drastic changes to existing budgetary policies. According to a recent […]

Continue ReadingHager, ‘Public Debt, Ownership and Power: The Political Economy of Distribution and Redistribution’

Abstract This dissertation offers the first comprehensive historical examination of the political economy of US public debt ownership. Specifically, the study addresses the following questions: Who owns the US public debt? Is the distribution of federal government bonds concentrated in the hands of a specific group or is it widely held? And what if the […]

Continue ReadingFix, ‘Human Activity, Energy & Money in the United States’

Abstract There is no consensus, in political economy, about the exact relationship between the biophysical and the pecuniary spheres. This paper enters into the debate by asking the following question: how can a biophysical approach to political economy be used to gain insight into the complex interrelationship between the biophysical sphere of economic activity and […]

Continue ReadingPark, ‘Dominant Capital and the Transformation of Korean Capitalism: From Cold War to Globalization’

Abstract After the 1997 financial crisis, the neo-liberal restructuring of the Korean political economy accelerated dramatically. While there is a general consensus that the reform has had negative consequences for Korean society, heated debates continue over the culprits of the 1997 crisis and the changes that followed in its wake. Major opinions have largely coalesced […]

Continue Reading