Sandy Hager In an interesting piece for the Financial Times, Christopher Caldwell assesses Obama’s declaration to ‘go it alone’ in light of the ‘obstructionist Republican agenda’ in the US Congress. In a recent State of the Union address, Obama pledged a year of action, one that would see the president push for major policy reforms […]

Continue ReadingThe Weekly Sabotage: Week 5

Tim Di Muzio The Constitution of the United States of America It is by now fairly clear that the Congress of the United States is a ‘do-nothing’ Congress populated by 268 millionaires (out of 534 lawmakers). The job approval rating, depending on which poll we consider, hovers around 9-14%. This is perhaps hardly surprising given […]

Continue ReadingBichler & Nitzan, ‘No Way Out: Crime, Punishment and the Capitalization of Power’

Abstract The United States is often hailed as the world’s largest ‘free market’. But this ‘free market’ is also the world’s largest penal colony. It holds over seven million adults – roughly five per cent of the labour force – in jail, in prison, on parole and on probation. Is this an anomaly, or does […]

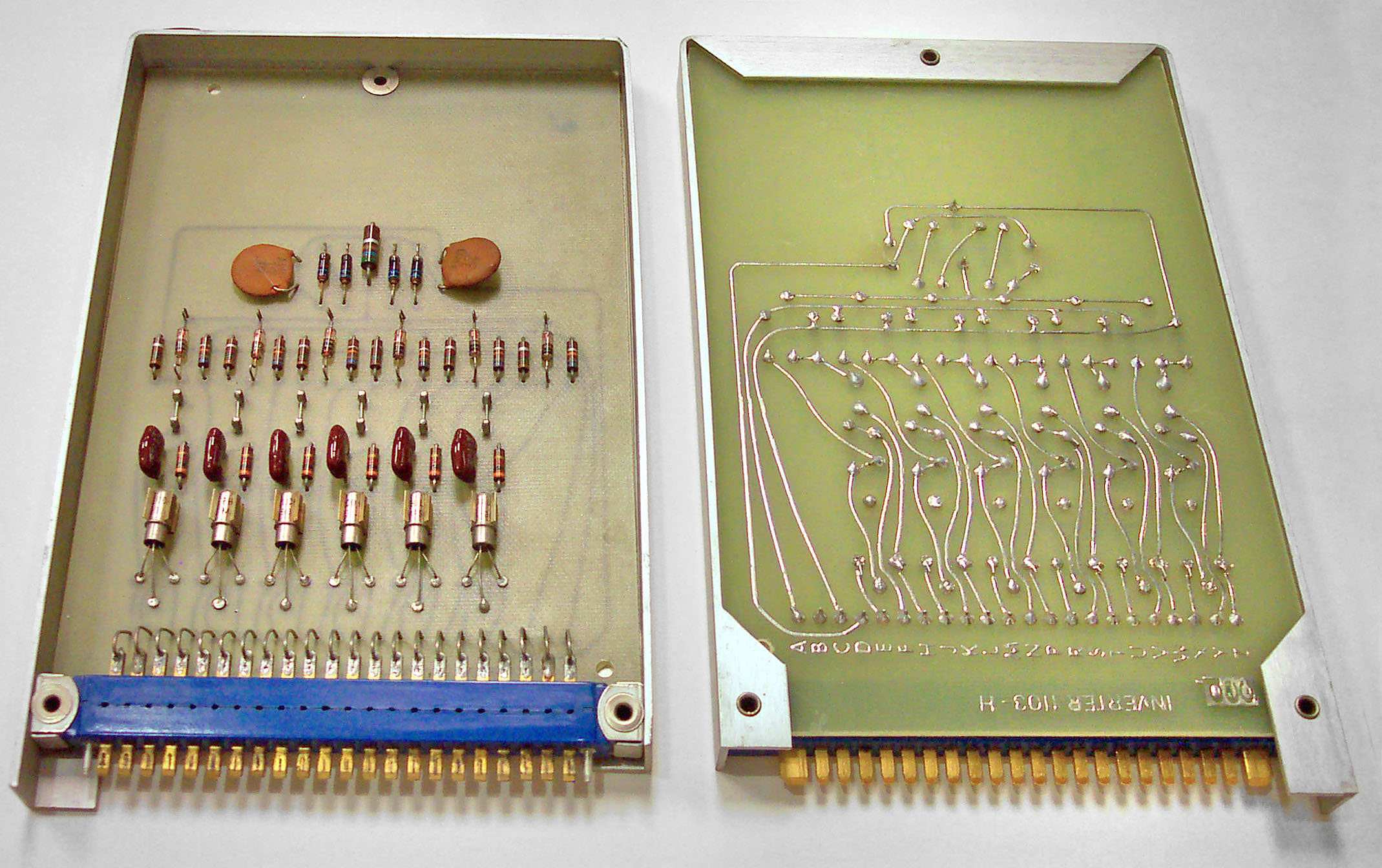

Continue ReadingThe facade of smooth operations

DT Cochrane Toronto’s Pearson Airport was recently thrown into chaos when bad weather forced it to suspend ground operations. For eight hours, hundreds of flights scheduled to land and take-off were unable to do so. Condemnation of the airport authority was swift and harsh. The event revealed two facts about the airport as a productive […]

Continue ReadingThe discipline of capital

DT Cochrane The title of this piece might make readers think of capitalist power over the masses. However, in this case, I’m thinking of how capital serves to discipline the decision-makers of capitalism. A recent Globe & Mail article discussed the desire of Canadian banks to keep the corporate bond market going. The banks serve […]

Continue ReadingBrussels Business – A documentary about dominant capital and sabotage in the EU

Ilirjan Shehu Brussels Business is a documentary about the important role dominant capital has played in the shaping of the European Union from its early days. It explores the secretive activity of big business and lobbying organizations and the role they play in the origination and circulation of ideas and plans for the advancement of […]

Continue ReadingThe Weekly Sabotage: Week 4

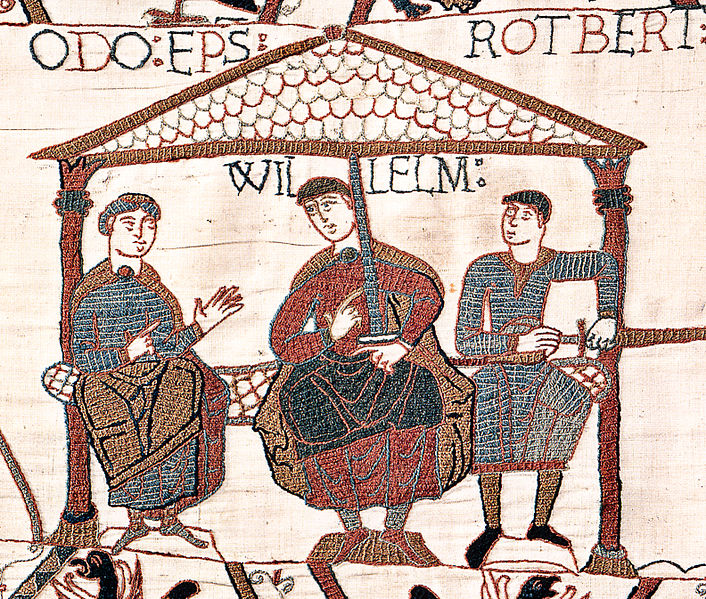

Tim Di Muzio Royal Authority and Private Property Last week we considered the concept of ownership though the work of Veblen and Marx. We noted that the establishment and protection of private property involved the dispossession of the many by the few and that this tendency begins with the appropriation of humans (slavery) and land […]

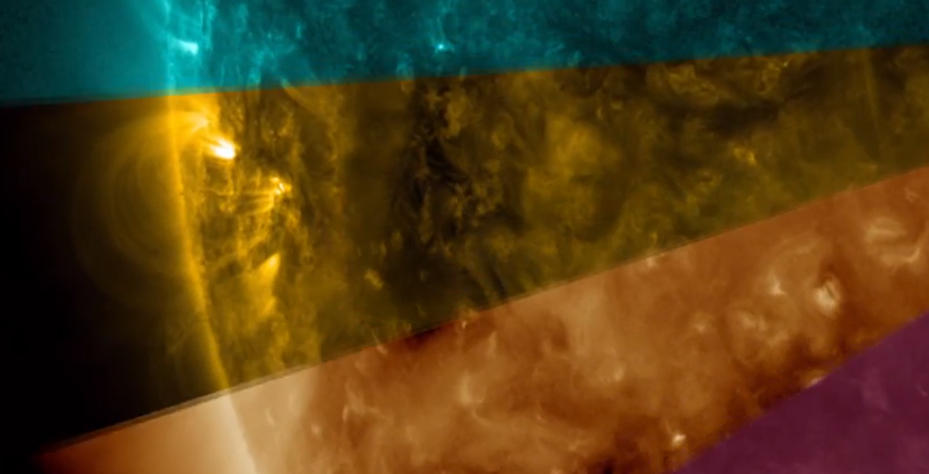

Continue ReadingThe Colour of the Sun: A Metaphor for Methodology?

James McMahon Found this video when browsing Boing Boing. Originally posted by NASA, this video is fascinating. It may also stand as a metaphor for the methodological problems in political economic theory. Consider part of the explanation behind the video: “As the colors sweep around the sun in the movie, viewers should note how different […]

Continue Reading‘Rigging’ the market for fun and profit

DT Cochrane The EU has fined a selection of European and U.S. American banks €1.7 billion for rigging major interest-rate benchmarks. The article notes that the benchmarks – Libor, and the Tokyo and euro area interbank – are used in the pricing of hundreds of trillions of assets. The problem, according to the prosecutors, is […]

Continue ReadingThe Weekly Sabotage: Week 1

Tim Di Muzio Welcome to a weekly investigation into the fascinating world of corporate sabotage where human creativity, cooperation, mutual aid and well-being are all held ransom for the profit and power of dominant owners. Every week this column will explore various aspects of what Veblen called ‘strategic sabotage’. But first, a bit of context. […]

Continue ReadingThe Market Disapproves of Rob Ford

DT Cochrane The market has spoken: it disapproves of Rob Ford. A Bloomberg article notes that Toronto’s borrowing costs have risen relative to those of other Canadian municipalities. The determinants of bond prices are complex. Broadly, they translate the confidence of market participants in the ability of the borrower to service their debt. This is […]

Continue ReadingDiscussion: The Ups and Downs of Empirical Research

DT Cochrane It is exciting to see this website grow. Content is being added here and there, and our Working Paper Series has its first paper. What already stands out on this website, in my opinion, is the strength of the empirical research. With our feet planted in society itself, we have before us a […]

Continue ReadingNo. 2013/01: Bichler & Nitzan, ‘Can Capitalists Afford Recovery?’

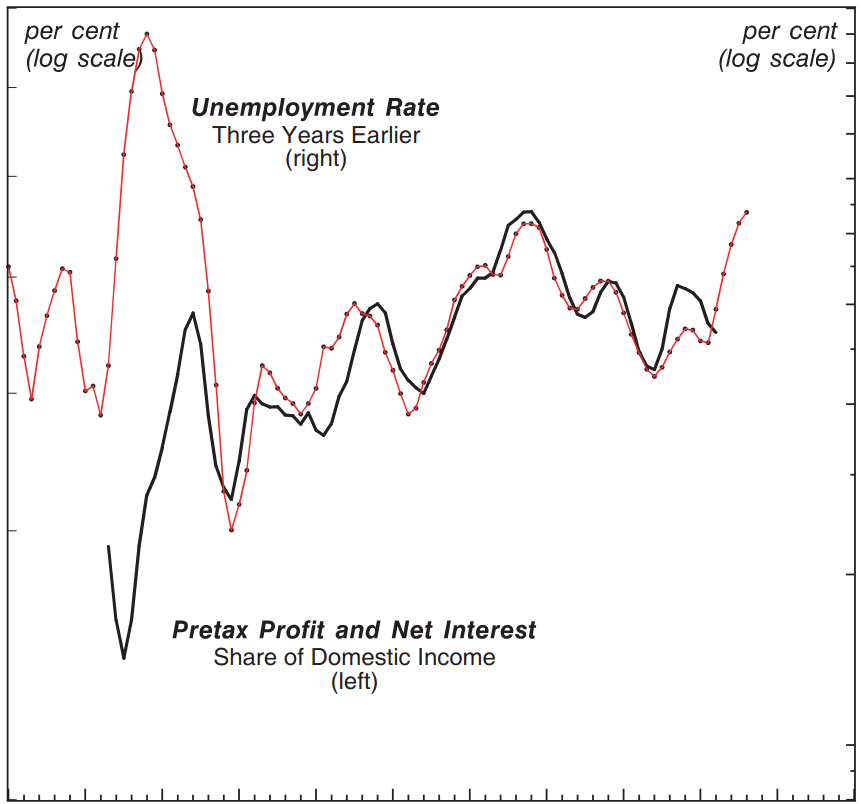

Abstract Economic, financial and social commentators from all directions and persuasion are obsessed with the prospect of recovery. The world remains mired in a deep, prolonged crisis, and the key question seems to be how to get out of it. The purpose of our paper is to ask a very different question that few if […]

Continue ReadingNeither here nor there, both here and there

DT Cochrane The media is notoriously short sighted. Its reports on recent events are largely devoid of any historical consideration. This is equally true of market reports. Despite not putting market events into a historical setting, the journalists do not hesitate to offer reasons for the day’s price movements. Usually, some high profile event over […]

Continue ReadingThe Rise of a Confident Hollywood: Risk and the Capitalization of Cinema

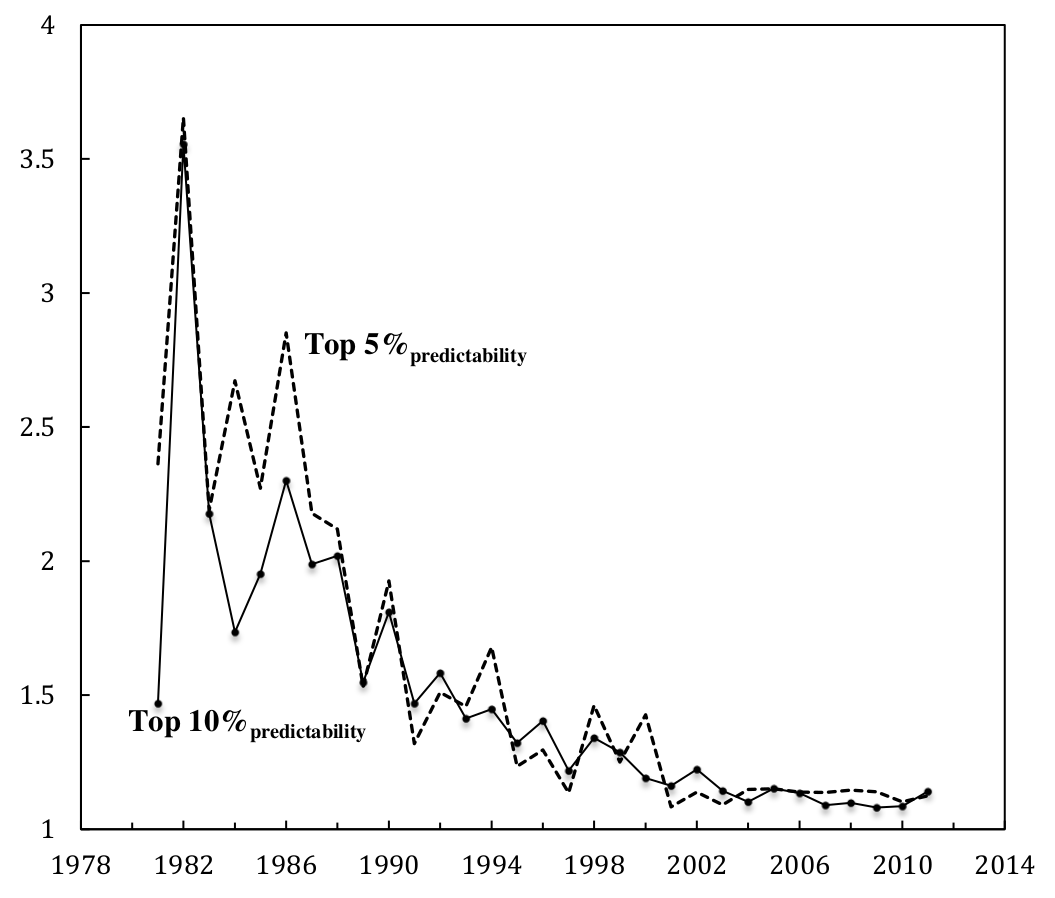

The Rise of a Confident Hollywood Risk and the Capitalization of Cinema JAMES MCMAHON February 2013 Abstract This paper investigates the historical development of risk in the Hollywood film business. Using opening theatres as a proxy for future expectations, the paper demonstrates how, from 1981 to 2011, Hollywood has improved its ability to predict the […]

Continue ReadingAmerica’s Real ‘Debt Dilemma’

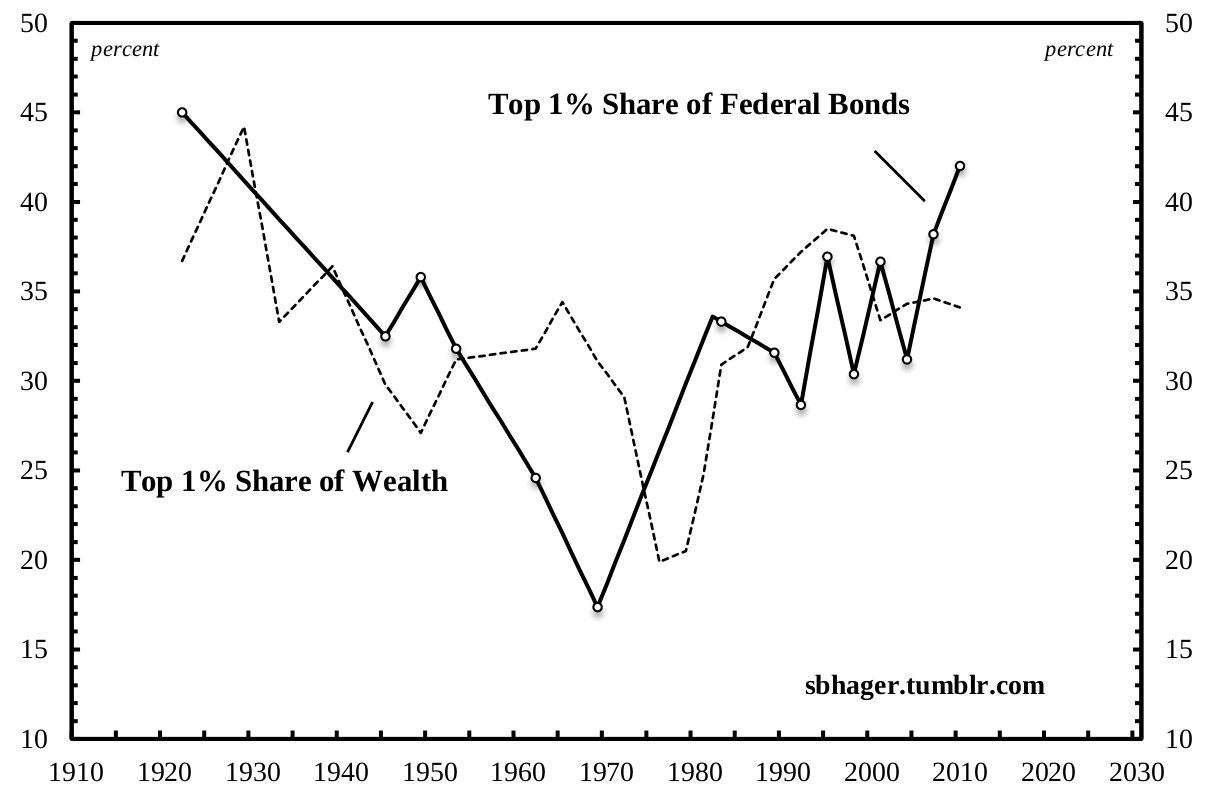

America’s Real ‘Debt Dilemma’ SANDY BRIAN HAGER July 2013 Abstract In the wake of the current crisis there has been an explosive rise in the level of the US public debt. These massive levels of public indebtedness are expected to keep growing unless there are drastic changes to existing budgetary policies. According to a recent […]

Continue ReadingColour Coded Gender

DT Cochrane Girls wear pink. Boys wear blue. This seemingly universal gender dichotomy is actually a very recent invention, as this post on smithsonian.com makes clear. At the end of the 19th century, most boys and girls were dressed in ‘gender neutral’ white dresses. These were considered a practical option, convenient for play and easily […]

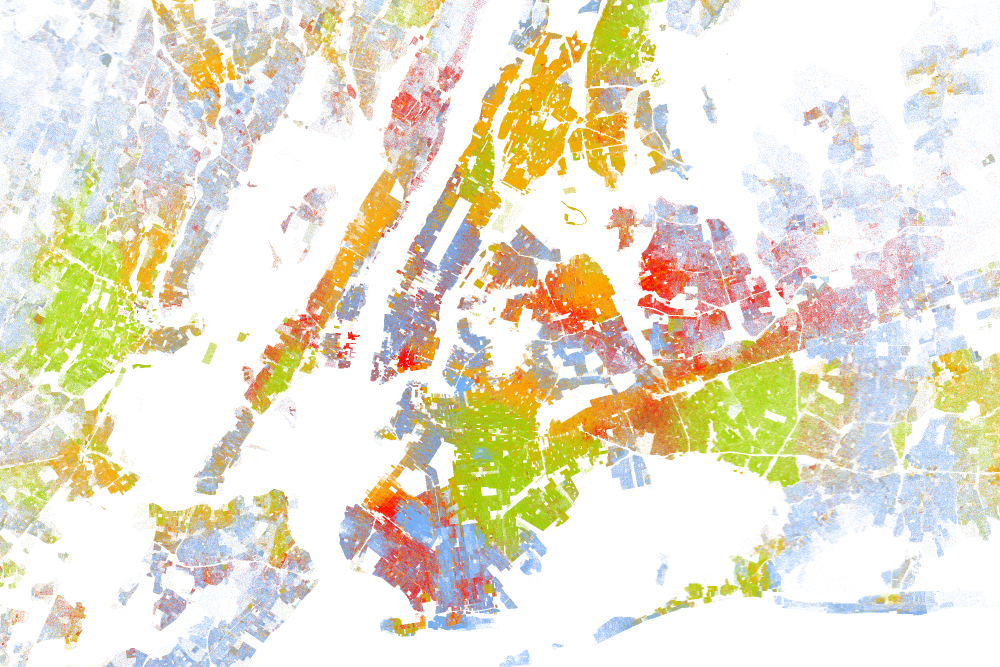

Continue ReadingVisualizing Racial Segregation in America

DT Cochrane Wired has published a series of maps that try to visualize racial segregation in many of America’s biggest cities. From Wired: “The [maps], created by Dustin Cable at University of Virginia’s Weldon Cooper Center for Public Service, is stunningly comprehensive. Drawing on data from the 2010 U.S. Census, it shows one dot per […]

Continue ReadingBig Business, small businesses, Death & Profits

DT Cochrane ‘Ask a Mortician‘ is a quirky and informative Youtube series with mortician Caitlin Doughty. The most recent video touches on the political economy of the funeral business. The question is based on an anti-funeral business rant on Reddit and asks: “Is the Funeral Industry a Pyramid Scheme?” Doughty quickly sets aside the misleading […]

Continue ReadingDi Muzio, ‘The Capitalist Mode of Power: Critical Engagements with the Power Theory of Value’

Abstract This edited volume offers the first critical engagement with one of the most provocative and controversial theories in political economy: the thesis that capital can be theorized as power and that capital is finance and only finance. The book also includes a detailed introduction to this novel thesis first put forward by Nitzan and […]

Continue Reading